Form 26 QA

Diunggah oleh

himanshukathuria30Deskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Form 26 QA

Diunggah oleh

himanshukathuria30Hak Cipta:

Format Tersedia

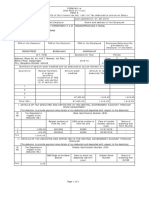

Form No.

26QA

[See section 206A and rule 31AC]

Particulars required to be maintained for furnishing quarterly return under section 206A

1. (a) Tax deduction and Collection Account No. (TAN) (c) Financial Year

(b) Permanent Account No. (PAN) (d) Assessment Year

2. Particulars of the payer :

(a) Name

(b) Branch/Division/Office/Unit

(c) BSR Code, if any

(d) Address :

(i) Flat/Premises No.

(ii) Name of the premises/building

(iii) Road/Street/Lane

(iv) Area/Location

(v) Town/City/District

(vi) State

(vii) Pin Code

(viii) Telephone No.

(ix) E-mail

3. Details of time deposits for the quarter ended of the Financial Year under section 206A.

Printed From Taxmann’s Income Tax Rules on CD Page 1 of 2

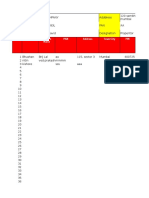

Particulars of the person Sl. No. Details of time deposit Details of time deposit Details of time deposits not to be Interest

on the first day of the made during the included in Form No. 26QA for next paid /

Quarter*** Quarter*** Quarter credited

during the

Quarter

Amount Reference Amount Reference Amount Reference Reasons****

No. No. No.

(301) (312) (313) (314) (315) (316) (317) (318) (319)

1. Name (302)

PAN* (303)

Date of Birth** (304)

Flat / Premises (305)

No.

Name of the (306)

premises

Road / Street / (307)

Lane

Area / Location (308)

Town / City / (309)

District

State (310)

Pin Code (311)

2.

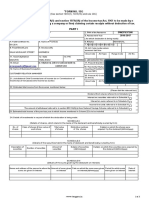

* Mention NA where PAN is not available. **Mention NA where Date of Birth is not available. *** Time deposits to be reported in Form No. 26Q

(rule 31A) not to be included in this Form.

**** Write 1 for encashment during the Quarter, 2 for renewal, 3 if interest likely to be payable to the person during the Financial Year exceeds Rs.

5,000/-, and 4 for any other reason.

Printed From Taxmann’s Income Tax Rules on CD Page 2 of 2

Anda mungkin juga menyukai

- Pan Card FormDokumen6 halamanPan Card FormAniruddha SamantaBelum ada peringkat

- As Approved by Income Tax DepartmentDokumen5 halamanAs Approved by Income Tax DepartmentRicha JoshiBelum ada peringkat

- 27eq 06062016Dokumen4 halaman27eq 06062016Manishtha SharmaBelum ada peringkat

- (See Sections 192A, 193, 194, 194A, 194B, 194BB, 194C, 194D, 194DA, 194EE, 194F, 194G, 194H, 194-I, 194J, 194K, 194LA, 194LBA, 194LBB, 194LBC, 194NDokumen6 halaman(See Sections 192A, 193, 194, 194A, 194B, 194BB, 194C, 194D, 194DA, 194EE, 194F, 194G, 194H, 194-I, 194J, 194K, 194LA, 194LBA, 194LBB, 194LBC, 194NRavi PrakashBelum ada peringkat

- Formno. 15G: Bar Code: PanDokumen2 halamanFormno. 15G: Bar Code: PanRajesh ManogaranBelum ada peringkat

- Notification No 73 2022Dokumen2 halamanNotification No 73 2022uslls visBelum ada peringkat

- Form No. 24Q: (See Section 192 and Rule 31A)Dokumen3 halamanForm No. 24Q: (See Section 192 and Rule 31A)Sajith Malappurath SasidharanBelum ada peringkat

- 26q DetailsDokumen3 halaman26q DetailsAmit TiwariBelum ada peringkat

- Ministry of Finance (Department of Revenue)Dokumen24 halamanMinistry of Finance (Department of Revenue)grameshchandraBelum ada peringkat

- 75 - 1 - 1 - Advt. No6.2018Dokumen6 halaman75 - 1 - 1 - Advt. No6.2018Umesh GuptaBelum ada peringkat

- Form No. 27Q (Dokumen7 halamanForm No. 27Q (11co249lovemylifeBelum ada peringkat

- 15g and H AutofillDokumen15 halaman15g and H AutofillAnonymous 6z7noS4fBelum ada peringkat

- Form 16 2019 20Dokumen4 halamanForm 16 2019 20Kishan SinghBelum ada peringkat

- Anspg5953f 2018-19Dokumen3 halamanAnspg5953f 2018-19virajv1Belum ada peringkat

- Excel Form16 Ay 2017 18Dokumen6 halamanExcel Form16 Ay 2017 18Tulsiram KumawatBelum ada peringkat

- Form No. 27A (See Rule 37B) Form For Furnishing Information With The Return or Statement of Deduction of Tax at Source Filed On Computer MediaDokumen2 halamanForm No. 27A (See Rule 37B) Form For Furnishing Information With The Return or Statement of Deduction of Tax at Source Filed On Computer Mediabestperson86Belum ada peringkat

- Law Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16Dokumen3 halamanLaw Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16api-247505461Belum ada peringkat

- "Form No. 15G: (See Section 197A (1), 197A (1A) and Rule 29C)Dokumen3 halaman"Form No. 15G: (See Section 197A (1), 197A (1A) and Rule 29C)Christopher Vinoth0% (2)

- Form NO 26Dokumen3 halamanForm NO 26Ayush gargBelum ada peringkat

- CA Audit Report Format-1Dokumen88 halamanCA Audit Report Format-1nuudmBelum ada peringkat

- Form2FandInstructions 06062006Dokumen11 halamanForm2FandInstructions 06062006Mnaoj PatelBelum ada peringkat

- Form No. 27Q ( (See Section 194E, 194LB, 194LBA, 194LBB, 194LBC, 194LC, 194N, 195, 196A, 196B, 196C, 196D, 197A, 206AA, 206AB and Rule 31A) )Dokumen6 halamanForm No. 27Q ( (See Section 194E, 194LB, 194LBA, 194LBB, 194LBC, 194LC, 194N, 195, 196A, 196B, 196C, 196D, 197A, 206AA, 206AB and Rule 31A) )Sophia RoseBelum ada peringkat

- Form 23ac: Form For Filing Balance Sheet and Other Documents With The RegistrarDokumen7 halamanForm 23ac: Form For Filing Balance Sheet and Other Documents With The Registrarcoolavi066628Belum ada peringkat

- Bank Account Number Name and Address of The DeductorDokumen2 halamanBank Account Number Name and Address of The DeductorAvinash KumarBelum ada peringkat

- rf9RgWUoLMY58namXBIiNpED PDFDokumen2 halamanrf9RgWUoLMY58namXBIiNpED PDFAvinash KumarBelum ada peringkat

- Income Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Dokumen5 halamanIncome Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Santosh Aditya Sharma ManthaBelum ada peringkat

- Form No. 15G: (Please Tick The Relevant Box)Dokumen4 halamanForm No. 15G: (Please Tick The Relevant Box)Santosh DasBelum ada peringkat

- 1.4 FORM NO 12 BB FinalDokumen2 halaman1.4 FORM NO 12 BB FinalVinit KayarkarBelum ada peringkat

- IT FormDokumen8 halamanIT Formapi-3829020Belum ada peringkat

- Notificaiton 5Dokumen3 halamanNotificaiton 5Parmeet NainBelum ada peringkat

- Form 15G PDFDokumen6 halamanForm 15G PDFSmitha GowdaBelum ada peringkat

- Form No. 15G: Part - IDokumen2 halamanForm No. 15G: Part - Ibalaji stationersBelum ada peringkat

- Form No. 15G: Part - IDokumen3 halamanForm No. 15G: Part - ImohanBelum ada peringkat

- Form NO 27Dokumen3 halamanForm NO 27Ayush gargBelum ada peringkat

- Somya Amritanshu - Arcpa1206b - Q3 - Ay202223Dokumen2 halamanSomya Amritanshu - Arcpa1206b - Q3 - Ay202223Sourabh PunshiBelum ada peringkat

- Form No. 16A: From ToDokumen2 halamanForm No. 16A: From ToShankara NarayananBelum ada peringkat

- A.P. (DIR Series) Circular No.84 Dated February 29, 2012 A.P. (DIR Series) Circular No.15 Dated July 28, 2014 A.P (Dir Series) Circular No.50 Dated February 11, 2016Dokumen4 halamanA.P. (DIR Series) Circular No.84 Dated February 29, 2012 A.P. (DIR Series) Circular No.15 Dated July 28, 2014 A.P (Dir Series) Circular No.50 Dated February 11, 2016Röhit NigamBelum ada peringkat

- Form 16 2020 21Dokumen6 halamanForm 16 2020 21Manoj MahimkarBelum ada peringkat

- New Form 16 AY 11 12Dokumen4 halamanNew Form 16 AY 11 12Sushma Kaza DuggarajuBelum ada peringkat

- (See Rule 31 (1) (A) ) : Form No. 16Dokumen8 halaman(See Rule 31 (1) (A) ) : Form No. 16Amol LokhandeBelum ada peringkat

- 15h PDFDokumen2 halaman15h PDFIndrasish BasuBelum ada peringkat

- Formst 1Dokumen3 halamanFormst 1arulantonyBelum ada peringkat

- BijayLata15G CompressedDokumen3 halamanBijayLata15G CompressedRishirajsinh JadejaBelum ada peringkat

- Form No 15GDokumen4 halamanForm No 15Graghu_kiranBelum ada peringkat

- Itrform12bb PDFDokumen3 halamanItrform12bb PDFSahil KumarBelum ada peringkat

- Itrform12bb PDFDokumen3 halamanItrform12bb PDFMeghana JoshiBelum ada peringkat

- Fabdd PDFDokumen3 halamanFabdd PDFSahil KumarBelum ada peringkat

- Itrform12bb PDFDokumen3 halamanItrform12bb PDFMuhammed RiyazBelum ada peringkat

- Itrform 12 BBDokumen3 halamanItrform 12 BBWater SpecBelum ada peringkat

- Itrform 12 BBDokumen3 halamanItrform 12 BBAnonymous DbmKEDxBelum ada peringkat

- Itrform 12 BBDokumen3 halamanItrform 12 BBPrAbHaS DarLiNgBelum ada peringkat

- Itrform 12 BBDokumen3 halamanItrform 12 BBAnonymous DbmKEDxBelum ada peringkat

- Itrform 12 BBDokumen3 halamanItrform 12 BBDedyTo'tedongBelum ada peringkat

- Itrform12bb PDFDokumen3 halamanItrform12bb PDFRudolph Antony ThomasBelum ada peringkat

- Form No 15GDokumen3 halamanForm No 15GSanjeeva ReddyBelum ada peringkat

- Form ST-1Dokumen4 halamanForm ST-1Suppy PBelum ada peringkat

- (2010-06-03) Form23AC-010610 For The FY Ending on-310308.OCTDokumen7 halaman(2010-06-03) Form23AC-010610 For The FY Ending on-310308.OCTtiger SBelum ada peringkat

- Form 3CDDokumen8 halamanForm 3CDmahi jainBelum ada peringkat

- Crane Life Cycle CostsDokumen3 halamanCrane Life Cycle CostsHenry Eduardo Cespedes CuellarBelum ada peringkat

- HTTP://WWW Bized Co UkDokumen23 halamanHTTP://WWW Bized Co UkSatyam mishra100% (1)

- World Deep PortsDokumen10 halamanWorld Deep Portshimanshukathuria30Belum ada peringkat

- Boston Consulting Group Matrix: Presented byDokumen19 halamanBoston Consulting Group Matrix: Presented byArshad AliBelum ada peringkat

- Swot MerckDokumen3 halamanSwot Mercktomassetya0% (1)

- Wendy in Kubricks The ShiningDokumen5 halamanWendy in Kubricks The Shiningapi-270111486Belum ada peringkat

- Philippine CuisineDokumen1 halamanPhilippine CuisineEvanFerrerBelum ada peringkat

- Aircraft FatigueDokumen1 halamanAircraft FatigueSharan RajBelum ada peringkat

- Aaron VanneyDokumen48 halamanAaron VanneyIvan KelamBelum ada peringkat

- Advanced Stock Trading Course + Strategies Course CatalogDokumen5 halamanAdvanced Stock Trading Course + Strategies Course Catalogmytemp_01Belum ada peringkat

- Viking Solid Cone Spray NozzleDokumen13 halamanViking Solid Cone Spray NozzlebalaBelum ada peringkat

- Department of Planning and Community Development: Organizational ChartDokumen5 halamanDepartment of Planning and Community Development: Organizational ChartkeithmontpvtBelum ada peringkat

- Evergreen Park Arrests 07-22 To 07-31-2016Dokumen5 halamanEvergreen Park Arrests 07-22 To 07-31-2016Lorraine SwansonBelum ada peringkat

- Rainiere Antonio de La Cruz Brito, A060 135 193 (BIA Nov. 26, 2013)Dokumen6 halamanRainiere Antonio de La Cruz Brito, A060 135 193 (BIA Nov. 26, 2013)Immigrant & Refugee Appellate Center, LLCBelum ada peringkat

- CIT Exercises - June 2020 - ACEDokumen16 halamanCIT Exercises - June 2020 - ACEKHUÊ TRẦN ÁIBelum ada peringkat

- LSG Statement of Support For Pride Week 2013Dokumen2 halamanLSG Statement of Support For Pride Week 2013Jelorie GallegoBelum ada peringkat

- LAW REFORMS COMMISSION KERALA Final Report Vol IDokumen211 halamanLAW REFORMS COMMISSION KERALA Final Report Vol ISampath BulusuBelum ada peringkat

- Price ReferenceDokumen2 halamanPrice Referencemay ann rodriguezBelum ada peringkat

- Travel Reservation August 18 For FREDI ISWANTODokumen2 halamanTravel Reservation August 18 For FREDI ISWANTOKasmi MinukBelum ada peringkat

- 45-TQM in Indian Service Sector PDFDokumen16 halaman45-TQM in Indian Service Sector PDFsharan chakravarthyBelum ada peringkat

- Project On Hospitality Industry: Customer Relationship ManagementDokumen36 halamanProject On Hospitality Industry: Customer Relationship ManagementShraddha TiwariBelum ada peringkat

- AKL - Pert 2-2Dokumen2 halamanAKL - Pert 2-2Astri Ririn ErnawatiBelum ada peringkat

- Ashish TPR AssignmentDokumen12 halamanAshish TPR Assignmentpriyesh20087913Belum ada peringkat

- Carl Rogers Written ReportsDokumen3 halamanCarl Rogers Written Reportskyla elpedangBelum ada peringkat

- AR 700-84 (Issue and Sale of Personal Clothing)Dokumen96 halamanAR 700-84 (Issue and Sale of Personal Clothing)ncfranklinBelum ada peringkat

- EZ 220 Songbook Web PDFDokumen152 halamanEZ 220 Songbook Web PDFOscar SpiritBelum ada peringkat

- Unit 1 PDFDokumen5 halamanUnit 1 PDFaadhithiyan nsBelum ada peringkat

- Standalone Statement On Impact of Audit Qualifications For The Period Ended March 31, 2016 (Company Update)Dokumen2 halamanStandalone Statement On Impact of Audit Qualifications For The Period Ended March 31, 2016 (Company Update)Shyam SunderBelum ada peringkat

- Profile Story On Survivor Contestant Trish DunnDokumen6 halamanProfile Story On Survivor Contestant Trish DunnMeganGraceLandauBelum ada peringkat

- About ArevaDokumen86 halamanAbout ArevaAbhinav TyagiBelum ada peringkat

- Schedules of Shared Day Companies - MITCOEDokumen1 halamanSchedules of Shared Day Companies - MITCOEKalpak ShahaneBelum ada peringkat

- Student Name: - : Question DetailsDokumen105 halamanStudent Name: - : Question Detailsyea okayBelum ada peringkat

- 3-16-16 IndyCar Boston / Boston Grand Prix Meeting SlidesDokumen30 halaman3-16-16 IndyCar Boston / Boston Grand Prix Meeting SlidesThe Fort PointerBelum ada peringkat

- 205 Radicals of Chinese Characters PDFDokumen7 halaman205 Radicals of Chinese Characters PDFNathan2013100% (1)