Syllabus Negotiable Instruments

Diunggah oleh

Magnolia Masangcay-Dalire100%(1)100% menganggap dokumen ini bermanfaat (1 suara)

3K tayangan7 halamanHak Cipta

© Attribution Non-Commercial (BY-NC)

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

100%(1)100% menganggap dokumen ini bermanfaat (1 suara)

3K tayangan7 halamanSyllabus Negotiable Instruments

Diunggah oleh

Magnolia Masangcay-DalireHak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 7

By:

College of Law JD Program

NEGOTIABLE INSTRUMENTSIMERCANTILE LAW

SYLLABUSIMETHOLOGY

HERi\lANDO B. PEREZ

I. Method of Instruction. - The Socratic method of instruction will be used i. e., recitation-lecture method. Each meeting, the students will be called to recite within the

assigned topic students.

1 1 " 1:.... ..,... I 1 l' 1- ., . ... _ -: -;:

ana the proressor snail ampurwsupptement \.'/11:1t nas oeen recitec oy the

1. Cases assigned. - All cases assigned must be read in the original and the students called to recite are expected to explain/recite the same.

2. Provisions to be memorized. - There are some provisions in the Negotiable fnslrnrnents Law that must be memorized and recited by all students, unless other-vise h'.·rl~inhf'loH' inn.icMerl, to \vit:

fa) First Batch: Sec.] (Form of Negotiable fnstnn11C:nt), Sec. 1 X4 (Promissory Note), Sec. 126 (Bill of Exchange) end Sec. ! 85 (C'h:;:;~:);

(b) Second Batch: Sec. 60 (Liability of the maker), Sec. 61 (Liability of the drawer), Sec. 62 (Liability of the acceptor), Sec. 65 (Warranties of a person negotiating by delivery or qualified indorsement and Sec. 66 (Warranties of a general indorser);

(c) Other provisions to be recited by the students called at random when /S,~~~d9Y the assignment: Sec. 9, Sec. 14, Sec. 15, Sec. 16, 23 and Sec. 5~. /

3. Grading: The final grades will be computed a<; follows: 30~;J recitation, 30°/;) mid-term exnmination and 40% final examination. All test papers shall be corrected and distributed in accordance with the policy of the Dean.

H. Prescribed book. _. The students may use any book on Negotiable Instruments. The professor will use the QUIZZER AND REVIEWER ON NEGOTIABLE INSTRUMENTS LAW AND RELATED LA \VS by HERNANDO B. PEREZ (distributed by Rex Book Store) and the codal provisions of Negotiable Instruments Law.

st/G " 4 - '2-

c-(1( ({

2

III. SyllAbus;

1. Introduction:

(a) Origin of the Negotiable Instruments Law and its applicability. Cases:

~ (i) Osmena vs. Citibank, N. A., 426 SCRA 159

i

() (ii) BPI Express Card Corporation vs. CA, 296 SCRA 260 I

~ (iii) Roman Catholic Bishop of Malolos vs. Intermediate Appellate Court, 191 SCRA 411

2. Requisites of negotiability. Cases:

'I (i) Caltex (phils.), Inc. vs. CA, G. R. 97753, Aug. 10, 1992 ~ (ii) Traders Royal Bank, 269 SCRA 15

C (iii) Consolidated Plywood vs, !Fe Leasing, 149 SCRA 448

'/'1

I (iv) Garcia vs. Llamas, 417 SeRA 292

(a) SUIP certain in money

(b) Unconditional promise or order to pay

(c) Determinable future time

(d) Act in addition to payment of money

(e) Matters that may be added or omitted

(1) Payable on demand

(g) Payable to order

(h) Payable to bearer.

(i) Ante-dated and post-dated instruments

(jjlncomplete instruments

(k)Mechanically incomplete but delivered instrument

- -

3

(h) Mechanically complete but undelivered instrument. Case:

~ (i) De la Victoria vs. Burgos, 245 SCRA 374

(m)Rules of construction

(n) Liability of person who did not sign the instrument

(0) Liability ofan agent. Case:

or (i) Francisco vs. Court of Appeals, G. R. 116320, Nov. 29, 1999.

(P) Forgery. Cases:

(,0 (i) San Carlos Milling Co. vs. BPI, 50 Phil. 59.

.t (ii) BPI vs. Casa Montessori, 430 SeRA 261.

I'}; (iii) Samsung Construction Co. vs. Far Ea<;t Bank, 436 SeRA 402.

12 (iv) PNB vs. National City Bank, 63 Phi!. 711.

If{ (v) PNB vs. Court of Appeals, 25 SCRA 693. ~ Republic vs. BPI, 10 SCRA 8 .

. ~Vii) Traders Royal Bank vs. Radio Phil., 390 SeRA 608. , ~Vii1}PCIB vs. Court of Appeals, 350 SCRA 4~

if (ix) Great Eastern Life Ins. vs. Hongkong & Shanghai Rank, 43 Phil. 679.

I C1 (x) Gernpesaw vs Court of Appeals, G. R. No. 92211), Feb. 9, 1993.

1.Jb (xi) Associated Bank VS. Court of Appeals, G. R. 89802, May 7, 1992.

,,@ii) Jai-Alai Corporation vs. BPI, 66 SCRA 29.

? 1 (xiii) Metrobank vs. Court of Appeals, 170 SCRA 169.

4

(i) Travel-On vs. Court of Appeals, G. R. 56169, June 26, 1992.

(ii) Yang vs. Court of Appeals, 409 SCRA 159.

(a) Absence or failure of consideration (b) Accommodation Party. Cases:

2~ (i) Lim vs. Saban, 447 SCRA 233.

(ii) Prudencio vs. Court of Appeals, 143 SCRA 7.

(iii) Maulini vs. Serrano, 28 Phil. 640. (iv) Sadaya vs. Sevilla. 19 SCRA 924.

4. Negotiation

(a) Indorsement, how made (b) Kinds of Indorsements

(1) Blank and special indorsements

(3) Qualified Indorsement (4) Conditional Indorsement

(c) How long negotiable character continues (d) Striking out an indorsement

(e) Delivery without indorsement of order instrument (f) Instrument renegotiated to prior party

" 5. Rights of the Holder

(il) Holder in due course. Case:

(i) Vicente R. de Ocampo vs. Gatchalian, 3 SCRA 596. (b) Rights of holder in due course

I. Personal defenses

11. Real defenses

Ill. Right to enforce full amount of the instrument (c) When the instrument is subject to original defenses

(d) When person not holder in due course has rights of holder in due

course

5

6. Liabilities of Parties

(a) Maker. Case:

(i) Astro Electronics vs. Phllguarantee, 411 SeRA 462. (b) Drawer

(c) Drawee

(d) Acceptor

(e) Irregular indorser

(f) Person negotiating by delivery or qualified indorsement (g) General Indorser

(h) Order of liability of indorsers

7. Presentment for Payment (a) When necessary

(b) Requisites of sufficient presentment ( c) Place of presentment

(d) When presentment is not required to charge the drawer

(e) When presentment is not required to charge the indorser

- . .._

(f) When delay in presentment is excused

(g) When presentment maybe dispensed with (h) Dishonorby non-payment

(i) Immediate right of recourse. Case

(i) Tuazon vs. Heirs of Bartolome Ramos, 463 SCRA 408. 0) Payment in due course

8 .. Notice of Dishonor

(a) Who must be given dishonor

(b) Who need not be given notice of dishonor

(c) Effect of failure to give notice of dishonor. Case: (i) Gullas vs. PNB, 62 PhiL 519.

(d) Who may give notice of dishonor

(e) Effect of notice of dishonor given by the holder

(f) Effect of notice of dishonor given by a party entitled 10 give notice

. ,

(a) Form ofnot;('p

'-0.1' -. ---_. - - ~-- ----

6

(il) Nmicc to au agent

(i) Time to give notice of dishonor

i. Parties residing at the same place

it Parties residing at different places

G) Where notice of dishonor must be sent

(k) Waiver of notice of dishonor

(1). Notice of dishonor dispensed with (m)Delay excused

(n) Notice of dishonor to drawer not required (0) Notice of dishonor to indorser not required

9. Discharge of Negotiable Instruments

(a) How negotiable instrument is discharged

(b) When person secondarily liable is discharged (c) Effects of payment by person secondarily liable (d) Alteration. Case:

(i) Montinola vs. Philippine National Bank, 88 Phil. 178.

1. Spoliation

ii. Material alterations

iii. Immaterial alterations

BILLS OF EXCHANGE

10. Form and Interpretation

(a) Bills of exchange defined

(b) Biil not an assignment of fund (c) Inland and foreign bills

(d) When a bill maybe treated as a note (e) Referee in case of need

11. Acceptance

(a) How made

(b) Time allotted to the drawee to accept

(c) Constructive and implied acceptance

8

(i) Effects of crossing a check. Cases:

(i) pcm vs. Court of Appeals, 350 SCRA 446.

(ii). Trader's Royal Bank vs. Radio Phil. 390 SCRA 608. (iii) Pio Barretto Realty vs. CA, 360 SeRA 126 .

. ' .

ii. Time of presentment

1. Effect of delay in presentment iii.Effect of certification

iv.Check not an assignment of fund .

;>

1. Liability of drawee to drawer "

v.NOW Accountt.Relationship between bank and Depositor Cases: (i) People vs. Reyes, 454 SCRA 636.

(ii) Associated Bank vs. Tan, 446 SeRA 282.

18. Definitions

WAREHOUSE RECEIPTS LA \V

1. Introduction

2. The Issue of Warehouse Receipts

3. Obligations and Rights of Warehousemen upon their receipts

4. Negotiation and Transfer of Receipts

5. Criminal Offenses

6. Interpretation

GENERAL BONDED WAREHOUSE ACT

1. General Bonded Warehouse Act

Anda mungkin juga menyukai

- SYLLABUS Negotiable Instruments LawDokumen5 halamanSYLLABUS Negotiable Instruments Lawkeithnavalta100% (1)

- Syllabus Negotiable Instruments Law NewDokumen8 halamanSyllabus Negotiable Instruments Law NewBryan CuaBelum ada peringkat

- Consti 2 Sections 14-21Dokumen143 halamanConsti 2 Sections 14-21Mark Kenneth CataquizBelum ada peringkat

- Syllabus On Obligations and ContractsDokumen1 halamanSyllabus On Obligations and ContractsKenneth Bryan Tegerero Tegio100% (1)

- Section 17. No Person Shall Be Compelled To Be A Witness Against HimselfDokumen4 halamanSection 17. No Person Shall Be Compelled To Be A Witness Against HimselfKim Laurente-AlibBelum ada peringkat

- Nachura OutlineDokumen18 halamanNachura Outlineboniglai5Belum ada peringkat

- Notes SSSDokumen5 halamanNotes SSSaquanesse21Belum ada peringkat

- Partnership Law SyllabusDokumen3 halamanPartnership Law Syllabusj2e1d3100% (1)

- Syllabus - ATAP 2nd Semester 2019-2020Dokumen8 halamanSyllabus - ATAP 2nd Semester 2019-2020gongsilog100% (1)

- Motion For Plea Bargain Manansala Et AlDokumen3 halamanMotion For Plea Bargain Manansala Et AlRaffy PangilinanBelum ada peringkat

- Ra 6557Dokumen14 halamanRa 6557April Ann Sapinoso Bigay-PanghulanBelum ada peringkat

- LAW 2 - Law On Partnership and Corporations and Credit TransactionDokumen19 halamanLAW 2 - Law On Partnership and Corporations and Credit TransactionMarianne67% (3)

- Guidelines For Term Paper 2019Dokumen3 halamanGuidelines For Term Paper 2019Novah Merill Comillor VenezuelaBelum ada peringkat

- Ortega Notes ReviewerDokumen106 halamanOrtega Notes ReviewerPhil Alkofero Lim AbrogarBelum ada peringkat

- Cases On ArraignmentDokumen69 halamanCases On ArraignmentMarlon BaltarBelum ada peringkat

- February 2018 Law Complex Publications PDFDokumen35 halamanFebruary 2018 Law Complex Publications PDFHottorney LimBelum ada peringkat

- Unreasonable Searches and Seizures Case DigestsDokumen19 halamanUnreasonable Searches and Seizures Case DigestsRia GabsBelum ada peringkat

- Law On Partnerships and CorporationDokumen12 halamanLaw On Partnerships and CorporationblahblahblueBelum ada peringkat

- Fraport II Vs PHDokumen15 halamanFraport II Vs PHCharm Agripa100% (1)

- Nuisance Abatement CasesDokumen3 halamanNuisance Abatement CasesNew York Daily News100% (1)

- Legal MemorandumDokumen7 halamanLegal MemorandumDiwa Rafael Bontuyan0% (2)

- Obligations and Contracts Prelim ReviewerDokumen4 halamanObligations and Contracts Prelim ReviewerMarcus AspacioBelum ada peringkat

- Nat Envi MT Reviewer MislangDokumen7 halamanNat Envi MT Reviewer MislangAleezah Gertrude RaymundoBelum ada peringkat

- Republic of The Philippines Regional Trial Court Fifth (5) Judicial Region Branch 24 XXXDokumen2 halamanRepublic of The Philippines Regional Trial Court Fifth (5) Judicial Region Branch 24 XXXPeasant MarieBelum ada peringkat

- POEA SEC - 2010 AmendmentsDokumen37 halamanPOEA SEC - 2010 AmendmentsMark YfjBelum ada peringkat

- Philippine Legal ProfessionDokumen48 halamanPhilippine Legal ProfessionLeizza Ni Gui Dula100% (2)

- Luz Farms vs. The Honorable Secretary of DarDokumen20 halamanLuz Farms vs. The Honorable Secretary of DarEmmanuel Enrico de VeraBelum ada peringkat

- Civil Law Review 2 Oblicon CasesDokumen22 halamanCivil Law Review 2 Oblicon CasesPaulitoPunongbayanBelum ada peringkat

- 13-G.profile - Professor Myrna S. Feliciano PDFDokumen1 halaman13-G.profile - Professor Myrna S. Feliciano PDFAP Aquino III100% (1)

- Order Denying Motion To QuashDokumen2 halamanOrder Denying Motion To QuashArjay Elnas0% (1)

- En Banc G.R. No. 227363, March 12, 2019 People of The Philippines, Plaintiff-Appellee, V. Salvador Tulagan, Accused-Appellant. Decision Peralta, J.Dokumen29 halamanEn Banc G.R. No. 227363, March 12, 2019 People of The Philippines, Plaintiff-Appellee, V. Salvador Tulagan, Accused-Appellant. Decision Peralta, J.Zusmitha SALCEDOBelum ada peringkat

- JurisprudenceDokumen2 halamanJurisprudencextinemaniegoBelum ada peringkat

- Oral ArgumentDokumen2 halamanOral ArgumentAlyza Montilla BurdeosBelum ada peringkat

- University of Santo Tomas: Faculty of Civil LawDokumen3 halamanUniversity of Santo Tomas: Faculty of Civil LawJustin TayabanBelum ada peringkat

- Nuisance Candidate in Election LawsDokumen3 halamanNuisance Candidate in Election LawsCiena MaeBelum ada peringkat

- Villavicencio vs. LukbanDokumen1 halamanVillavicencio vs. LukbanRoger John Caballero Fariñas IIBelum ada peringkat

- Right To Speedy, Impartial and Public Trial: Constitutional Law Ii Notes & DoctrinesDokumen6 halamanRight To Speedy, Impartial and Public Trial: Constitutional Law Ii Notes & DoctrinesJed SulitBelum ada peringkat

- TORTS 2 Mejo FinalDokumen490 halamanTORTS 2 Mejo FinalJon SnowBelum ada peringkat

- CLV Joint VenturesDokumen28 halamanCLV Joint VenturesleahtabsBelum ada peringkat

- Pab Resolution No. 001-10: Title and Construction Title of The RulesDokumen26 halamanPab Resolution No. 001-10: Title and Construction Title of The RulesMaddison YuBelum ada peringkat

- A Compendium ObligationsDokumen19 halamanA Compendium ObligationsCherry Ann Bawagan Astudillo-BalonggayBelum ada peringkat

- San Beda LLB Curriculum PDFDokumen2 halamanSan Beda LLB Curriculum PDFSbl IrvBelum ada peringkat

- Legal Techniques and Logic Study GuideDokumen53 halamanLegal Techniques and Logic Study GuideLoren Delos SantosBelum ada peringkat

- Jurado Reviewer, P. 997) : Last Minutes Tips - Sales - FinalsDokumen5 halamanJurado Reviewer, P. 997) : Last Minutes Tips - Sales - FinalsMarshan GualbertoBelum ada peringkat

- Chapter IDokumen20 halamanChapter IMary FlorBelum ada peringkat

- Cheng V GenatoDokumen5 halamanCheng V GenatoDonna IsubolBelum ada peringkat

- Republic of The Philippines Legal Education BoardDokumen25 halamanRepublic of The Philippines Legal Education BoardZed VilBelum ada peringkat

- Agency - LectureDokumen13 halamanAgency - LectureMiguel C. SollerBelum ada peringkat

- AW Ales: Ateneo Law School Utline D C L. V F S, SY 2015-2016 A - T V - T IDokumen51 halamanAW Ales: Ateneo Law School Utline D C L. V F S, SY 2015-2016 A - T V - T IBea CadornaBelum ada peringkat

- Right of AccessionDokumen14 halamanRight of AccessionJoy Laragan ChaclagBelum ada peringkat

- Land Titles and Deeds (Module 1)Dokumen8 halamanLand Titles and Deeds (Module 1)ichu73Belum ada peringkat

- 3.1 G.R. No. L-24732 Melliza v. Iloilo CityDokumen4 halaman3.1 G.R. No. L-24732 Melliza v. Iloilo CityIter MercatabantBelum ada peringkat

- C2020 SALES Digests PDFDokumen351 halamanC2020 SALES Digests PDFAndrew Nacita100% (1)

- 149 Query On The Exemption From Legal and Filing Fees of The Good Shepherd FoundationDokumen2 halaman149 Query On The Exemption From Legal and Filing Fees of The Good Shepherd FoundationPaolo SomeraBelum ada peringkat

- Notes On Philippine Criminal Justice SystemDokumen56 halamanNotes On Philippine Criminal Justice SystemLliana Marcel100% (2)

- Fria NotesDokumen6 halamanFria NotesRad IsnaniBelum ada peringkat

- Amla LectureDokumen11 halamanAmla LectureJolina AynganBelum ada peringkat

- Syllabus For Negotiable Instruments LawDokumen11 halamanSyllabus For Negotiable Instruments LawmickBelum ada peringkat

- Course Syllabus: Negotiable Instruments (Act 2031)Dokumen9 halamanCourse Syllabus: Negotiable Instruments (Act 2031)Jessamine OrioqueBelum ada peringkat

- Outline in Negotiable Instruments Law1Dokumen17 halamanOutline in Negotiable Instruments Law1Arvin AbyadangBelum ada peringkat

- Bangus LoafDokumen8 halamanBangus LoafMagnolia Masangcay-DalireBelum ada peringkat

- Request For SubpoenaDokumen2 halamanRequest For SubpoenaMagnolia Masangcay-DalireBelum ada peringkat

- Pre Trial Brief For Sum of MoneyDokumen2 halamanPre Trial Brief For Sum of MoneyMagnolia Masangcay-DalireBelum ada peringkat

- Motion For Execution - Collection of Sum of MoneyDokumen2 halamanMotion For Execution - Collection of Sum of MoneyMagnolia Masangcay-DalireBelum ada peringkat

- Demand Letter To Pay Guarantee FeesDokumen1 halamanDemand Letter To Pay Guarantee FeesMagnolia Masangcay-DalireBelum ada peringkat

- Motion To Publish Thru Publication SampleDokumen2 halamanMotion To Publish Thru Publication SampleMagnolia Masangcay-Dalire80% (5)

- CrimDokumen51 halamanCrimMagnolia Masangcay-DalireBelum ada peringkat

- Workout Sheet-21df Digital PDFDokumen3 halamanWorkout Sheet-21df Digital PDFSBambySBelum ada peringkat

- Consti 2 Cases 2 ND PartDokumen24 halamanConsti 2 Cases 2 ND PartMagnolia Masangcay-DalireBelum ada peringkat

- Affidavit of Attachment of SidecarDokumen1 halamanAffidavit of Attachment of Sidecarfreitz_09248167% (3)

- Corpo 2Dokumen135 halamanCorpo 2Magnolia Masangcay-DalireBelum ada peringkat

- Succession Memory Aid AteneoDokumen18 halamanSuccession Memory Aid AteneoMagnolia Masangcay-DalireBelum ada peringkat

- Domondon Taxation Notes 2010Dokumen79 halamanDomondon Taxation Notes 2010Charles de Vera100% (6)

- Petition For Admin ReconstitutionDokumen3 halamanPetition For Admin ReconstitutionMagnolia Masangcay-DalireBelum ada peringkat

- Primer On ICCDokumen36 halamanPrimer On ICCMagnolia Masangcay-DalireBelum ada peringkat

- Wills Paras Book Summary PDFDokumen61 halamanWills Paras Book Summary PDFMark Abragan88% (8)

- Dec4 DigestsDokumen5 halamanDec4 DigestsMagnolia Masangcay-DalireBelum ada peringkat

- Cam & JDR Admin RulesDokumen49 halamanCam & JDR Admin RulesMagnolia Masangcay-DalireBelum ada peringkat

- Designed It or Xmas TagsDokumen1 halamanDesigned It or Xmas TagsMagnolia Masangcay-DalireBelum ada peringkat

- International Economic LawDokumen42 halamanInternational Economic LawMagnolia Masangcay-DalireBelum ada peringkat

- Nego CodalDokumen3 halamanNego CodalMagnolia Masangcay-DalireBelum ada peringkat

- Detox PlansDokumen6 halamanDetox PlansMagnolia Masangcay-DalireBelum ada peringkat

- 2013 Syllabus Legal and Judicial EthicsDokumen5 halaman2013 Syllabus Legal and Judicial EthicsKathleen Catubay SamsonBelum ada peringkat

- Hacienda LuisitaDokumen92 halamanHacienda LuisitaMagnolia Masangcay-DalireBelum ada peringkat

- Germany Vs ItalyDokumen54 halamanGermany Vs ItalyMirriam EbreoBelum ada peringkat

- Century Tuna 6-Week Workout Challenge Calendar: Week 1 Day 1 Day 2 Day 3 Day 4 Day 5 Day 6 Day 7Dokumen6 halamanCentury Tuna 6-Week Workout Challenge Calendar: Week 1 Day 1 Day 2 Day 3 Day 4 Day 5 Day 6 Day 7Magnolia Masangcay-DalireBelum ada peringkat

- Rules 74-80Dokumen55 halamanRules 74-80pot420_aivanBelum ada peringkat

- Hacienda LuisitaDokumen92 halamanHacienda LuisitaMagnolia Masangcay-DalireBelum ada peringkat

- Simple Employment ContractDokumen2 halamanSimple Employment ContractMagnolia Masangcay-Dalire100% (6)

- ConstiDokumen10 halamanConstiMagnolia Masangcay-DalireBelum ada peringkat

- Art and OffenseDokumen2 halamanArt and OffenseKyle Eco Fostanes93% (14)

- Module 3 Readings Culture and Its Role in Moral Behavior What Is The Role of Culture in Shaping Moral Behavior?Dokumen9 halamanModule 3 Readings Culture and Its Role in Moral Behavior What Is The Role of Culture in Shaping Moral Behavior?MJ BauzonBelum ada peringkat

- Common Law Is Based On The Supremacy of God and The Rule of Law - More Specifically, The PrinciplesDokumen11 halamanCommon Law Is Based On The Supremacy of God and The Rule of Law - More Specifically, The PrinciplesGary KrimsonBelum ada peringkat

- Reading Exam Damian de La Cruz Carlos AlbertoDokumen2 halamanReading Exam Damian de La Cruz Carlos AlbertocarlosBelum ada peringkat

- Unit TestDokumen6 halamanUnit TestMajoy BantocBelum ada peringkat

- Fidic 1999 Red Book Subcontract OcrDokumen46 halamanFidic 1999 Red Book Subcontract OcrPhilipBelum ada peringkat

- 6 International Standby Practices - IsP98Dokumen9 halaman6 International Standby Practices - IsP98Md. Mehedi HasanBelum ada peringkat

- Caso 2 Performance AppraisalsDokumen2 halamanCaso 2 Performance Appraisalsjuanf132Belum ada peringkat

- D Asda Dasdas DaDokumen2 halamanD Asda Dasdas DaDhanushka PereraBelum ada peringkat

- 01 Worksheet 2 (7) Understanding Self1.Dokumen2 halaman01 Worksheet 2 (7) Understanding Self1.Shan EvangelistaBelum ada peringkat

- Writ Petition ProblemDokumen2 halamanWrit Petition ProblemNaveen PatilBelum ada peringkat

- Deviant Devoted Companion Final DownloadDokumen44 halamanDeviant Devoted Companion Final DownloadD20 Nat1100% (2)

- Zirakpur Escorts: You Have To Know About Our Escorts in ZirakpurDokumen6 halamanZirakpur Escorts: You Have To Know About Our Escorts in ZirakpurMia VermaBelum ada peringkat

- Bioethics Unit IiiDokumen4 halamanBioethics Unit IiiShannel J. DabalosBelum ada peringkat

- Rodriguez School Form 1 10Dokumen11 halamanRodriguez School Form 1 10Charisse DeirdreBelum ada peringkat

- Social Action TheoryDokumen3 halamanSocial Action TheoryJohn Rey Abad0% (2)

- FREEDOMDokumen23 halamanFREEDOMAngel Mae IturiagaBelum ada peringkat

- The General Systems TheoryDokumen5 halamanThe General Systems TheoryAnupam Gurung71% (7)

- An Open Letter To The New President Rodrigo DuterteDokumen4 halamanAn Open Letter To The New President Rodrigo DuterteERIKA JANE MARI ALICERBelum ada peringkat

- Toolbox&Actions - Eni Pak - Final - 24-10-19Dokumen18 halamanToolbox&Actions - Eni Pak - Final - 24-10-19saad_ur_rehman_ghouriBelum ada peringkat

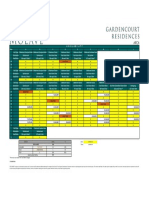

- Gardencourt Residences Molave Availability (July 19, 2022)Dokumen1 halamanGardencourt Residences Molave Availability (July 19, 2022)Nicolo MendozaBelum ada peringkat

- Cameron Mackay S5094241 3114IBA Assessment Two Problem Solving ReportDokumen35 halamanCameron Mackay S5094241 3114IBA Assessment Two Problem Solving Reportcameron mackayBelum ada peringkat

- Civil Services - The Steel Frame of India - CivilservicesiasDokumen11 halamanCivil Services - The Steel Frame of India - CivilservicesiasPratheep KalamBelum ada peringkat

- How Should We Live 2Dokumen2 halamanHow Should We Live 2Abegail SajoniaBelum ada peringkat

- Hume On TrustDokumen3 halamanHume On TrustWaldemar M. ReisBelum ada peringkat

- EPILOGUE1Dokumen11 halamanEPILOGUE1Verano Michelle M.Belum ada peringkat

- Mid Term Examination BS Communication Studies (4 Semester) Subject: Media Ethics & Law Student Name: Iqra Roll No: 1003 Submitted To: Sir AhmedDokumen11 halamanMid Term Examination BS Communication Studies (4 Semester) Subject: Media Ethics & Law Student Name: Iqra Roll No: 1003 Submitted To: Sir AhmedIqra ChBelum ada peringkat

- Global Citizen Essay 1Dokumen3 halamanGlobal Citizen Essay 1api-654549601Belum ada peringkat

- Payguides - MA000002 - 1 July 2023Dokumen44 halamanPayguides - MA000002 - 1 July 2023Jenny BarlowBelum ada peringkat

- Nature and Scope of HistoryDokumen3 halamanNature and Scope of HistoryVishal AnandBelum ada peringkat