Adani Wilmar Case Anaysis

Diunggah oleh

Chandrasekhar KotillilDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Adani Wilmar Case Anaysis

Diunggah oleh

Chandrasekhar KotillilHak Cipta:

Format Tersedia

ADANI WILMAR LIMITED GROUP G CASE ANALYSIS

Page 1 of 5

Subject MODELING FOR DECISIONS , TERM 1

Case ADANI WILMAR LIMITED

Group G : Members Kapil Tiwari , Karthik Srinivasan , Pramod Singh , Pratik Tamhane ,

Devendra Kale , Ashish Ahuja , Chandrasekhar Kotillil

Executive Summary

Adani Wilmar Limited is a 50-50 joint venture between the Adani Group and Wilmar Trading Private

Limited (WTPL) of Singapore for refining and marketing edible oil in western and northern India. The

company was planning to setup a refinery of capacity 600 tons per day at Mundra, on the coast of

Gujarat. The company had focussed on the north Indian market to realize competitive advantage in

its logistics operations, due to the proximity of Mundra to the edible oil markets in north India.

Mr. Pakarashi, Logistics manager at AWL, decided to evaluate different cost scenarios in setting up

warehouses in Uttar Pradesh (UP). From a strategic perspective, Mr. Pakarashi feels that the hub-

and-spoke model of distribution will suit the territory best. To this end, he has identified Bareilly,

Ghaziabad, Gorakhpur, Jhansi, Kanpur, Lucknow and Varanasi as the warehousing hubs.

The analysis if of the cases focuses on providing solutions to the 3 problem statements below:

1. Which cities/towns in UP are most suitable for setting up new warehouses, and what would

be the costs associated with shipment of refined oil to these warehouses?

2. What is the optimum way in which one can allocate dealers in different towns to

warehouses , so that the offtake by these dealers involves a minimum cost to AWL

3. Which are the optimum ways in which edible oil can be transported to the warehousing

hubs and should the oil be handled by the C&F agents

Our Recommendation to the AWL Management

1) Build two large capacity warehouses at Ghaziabad and Kanpur that are managed by AWL

and would be served by railroad through Concor from Mundra Port.

2) Establish a relationship with a C&F Agent at Jhansi for servicing dealers allocated to Jhansi.

In addition, supply oil to Jhansi by road (via Ahmedabad) from Mundra Port.

3) The total cost of the optimal transportation solution is Rs. 31,34,712 per Month.

4) The allocation of dealers to warehouses are provided in the attached exhibits (Spreadsheets)

5) The selected warehouses with their supplied capacity and the amount to be handled by CFA

is given in the table below

Allocation of Edible Oil Supplied to Warehouses (in Tons/Month)

Bareilly 0 (no warehouse required)

Ghaziabad 995 (Managed by AWL)

Gorakhpur 0 (no warehouse required)

Jhansi 67 (Managed by C&FA)

Kanpur 1164 (AWL)

Lucknow 0 (no warehouse required)

Varanasi 0 (no warehouse required)

ADANI WILMAR LIMITED GROUP G CASE ANALYSIS

Page 2 of 5

Analysis of the Situation

The objective of this step is to determine the combination of warehouses which will yield the lowest

cost per ton of oil shipped to the warehouse. Therefore there are 3 cost components to the logistics

cost

- Primary costs Cost of shipment of oil to the warehouses

- Secondary costs Cost of shipment of oil from warehouses to dealers

- Warehousing costs Cost inclusive of rent, labour and overheads

- Carry and Forwarding Agent handling costs In certain cases, it is cost effective to consider

C&FA for delivery of oil to dealers, rather than stocking the oil in the warehouse. C&FA cost is Rs.

150 per ton

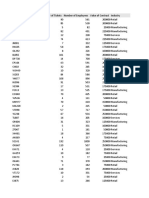

Primary Cost Analysis

The function is based on the data from the below table which shows the different freight rates

for shipping via rail and road to different warehouses. We will only consider the minimum cost

value in Rs. Per ton for each warehouse.

S

N

o

Modes of Shipment

(Figures in Rs per Ton)

Bareilly Ghazia

bad

Gorakhp

ur

Jhansi Kanpu

r

Luckno

w

Varan

asi

1 By ROAD : Mundra to 1550 1300 1900 1500 1600 1700 1800

2 By ROAD : Mundra- Ahmedabad

to WH

1600 1300 2000 1250 1500 1600 1900

3 By ROAD : Mundra -Indore to

WH

1600 1400 1850 1350 1500 1550 1750

4 By RAIL : Mundra - Ghaziabad

then by ROAD to WH

1250 950 1750 X 1400 x 1650

5 By RAIL : Mundra - Kanpur then

by ROAD to WH

X x 1535 x 1135 1260 1485

Secondary Cost Analysis

The secondary costs are calculated as Rs. 1.50 per ton per km. The costs per combination of

warehouse and dealer location are provided in the exhibit attached.

Cost of operating warehouses by AWL

Slab Rs/month

<200 tons/month 35000

200-400 tons/month 55000

400-600 tons/month 75000

>600 tons/month 85000

ADANI WILMAR LIMITED GROUP G CASE ANALYSIS

Page 3 of 5

Model - Formulation

The objective of the model is to minimize overall transportation cost from Mundra to all dealers of

UP. The following decision areas and inputs were incorporated in the model.

Warehouse decision areas

1. Location and capacity of warehouses

2. Allocation of dealers to respective warehouses

3. Own management or outsourcing it to a C&FA

Inputs

1. Primary transportation cost

2. Secondary transportation cost

3. Warehouse operating cost by AWL (depend on capacity of warehouse)

4. Cost of outsourcing warehouse to a C&FA ( Rs per ton)

Considering seven warehouse locations in the state (i = 1, 2, , 7) and 28 dealer locations (j = 1, 2,,

28)

Decision Variables

dij = tons of oil per month served to dealer j from Mundra via warehouse i

CFi = tons of oil per month supplied by C&FA from warehouse i

Pi = 1 if respective warehouse is handling <200 tons of oil per month

= 0 otherwise

Qi = 1 if respective warehouse is handling 200- 400 tons of oil per month

= 0 otherwise

Ri = 1 if respective warehouse is handling 400 - 600 tons of oil per month

= 0 otherwise

Si = 1 if respective warehouse is handling more than 600 tons of oil per month

= 0 otherwise

Inputs

Cij = Cost of transporting one ton of oil from Mundra to dealer j via warehouse i

Dj = Demand at dealer j (in tons per month)

M = a large number (conceptually at least 2200, to theoretically enable one of the warehouses (with

a capacity of more than 600) to handle all the dealers)

ADANI WILMAR LIMITED GROUP G CASE ANALYSIS

Page 4 of 5

The desirable routing on the primary element was analyzed using different model scenarios.

Formulation

The following formulation contains 136 +7 (dij + CFi) continuous and 28 (4 choices of capacity and

management for 7 locations) binary decision variables.

( ) ) 3 ( 1 , 0 , , , 0 ,

) 2 ( 7 .. ,......... 2 , 1 600 400 200

) 1 ( 28 ...... ,......... 2 , 1

* 150 85000 75000 55000 35000

28

1

7

1

7

1

7

1

28

1

7

1

e >

= + + + + s

= =

+ + + + +

=

=

= = = =

Si and Ri Qi Pi CFi dij

i every for Si M Ri Qi Pi CFi dij

j every for Dj dij

to Sub

CFi Si Ri Qi Pi Cij dij Min

j

i

i i j i

(1) --- Demand at every dealer must be satisfied.

(2) --- A warehouse of required capacity managed directly by AWL or C&FA must be opened for

dealers to be assigned. If that warehouse would be managed by C&F agents and in that case

Pi, Qi, Ri, Si will be zero. If that warehouse is managed by AWL, then we have a step function

that guides the maximum value of demand that can be satisfied by the warehouse.

(3) --- Nonegativity constraints and binary value constraints

Solution for LP problem using Premium Solver

The LP was solved using Premium Solver add-in for Excel and the results were calculated at both 0.05

tolerance (default) and 0.00 tolerance (to obtain the most optimal solution).

Assumptions :

1) We considered M as 9999 so as to force solver to treat the specific case of warehouse capacity

being larger than 600 to be considered only as a last option and when all other optimality

conditions fails.

2) All calculations are based on the assumption that the dealer demand and costs would remain

relatively constant in the period under study , in this case , 1 month.

3) Our optimal solution lies at Tolerance of 0.00

SOLUTION SUMMARY TABLE COMPARING TOLERANCES (0% Vs 5%)

Allocation of Edible Oil Supplied to

Warehouses at tolerance = 0.00

(in Tons/Month)

Allocation of Edible Oil Supplied to

Warehouses at tolerance = 0.05

(in Tons/Month)

ADANI WILMAR LIMITED GROUP G CASE ANALYSIS

Page 5 of 5

Bareilly 0 (no warehouse required) Bareilly 0 (no warehouse required)

Ghaziabad 995 (AWL) Ghaziabad 1054 (AWL)

Gorakhpur 0 (no warehouse required) Gorakhpur 197 (C&FA)

Jhansi 67 (C&FA) Jhansi 67 (C&FA)

Kanpur 1164 (AWL) Kanpur 568 (C&FA)

Lucknow 0 (no warehouse required) Lucknow 0 (no warehouse required)

Varanasi 0 (no warehouse required) Varanasi 340 (AWL)

Solution Alternatives

In addition to our recommendation , we would like to bring management attention to certain

scenarios that need to be considered. The recommendation provided takes into consideration that

the demand from UP will remain constant or that Concor will be operational by the time the Plant

goes live.

However, the more probable scenario is that the demand for oil (being an essential consumer good)

will increase and hence, we need to look at something less than the most optimal solution e.g. a 0.05

tolerance solution. In that case, our recommendations to the management are as follows:

Case Scenario Warehouse Selection Recommendations Costs

1 The demand

could

fluctuate , so

we consider

Tolerance of

0.05 as well

1) Build two large capacity warehouses at Ghaziabad and

Varanasi that are managed by AWL and served by railroad.

2) Establish a relationship with C&F Agents for warehouses at

Jhansi and Gorakhpur. Serve Jhansi by road and the rest by

a combination of railroad and road transport.

3) It should be noted that with further increase in demand

from the dealers being served by Kanpur warehouse, it will

be cheaper to manage the Kanpur warehouse ourselves

rather than using a C&FA. The C&FA cost keeps increasing

linearly while warehouse option becomes constant after a

certain capacity.

Rs.

32,16,290

Per

Month

2 Possibility

that Concor

services may

not start on

time.

1) Build three self-managed warehouses at Ghaziabad and

Lucknow

2) Establish a relationship with C&F Agents for warehouses at

Jhansi, Kanpur, Gorakhpur and Varanasi

3) Once Concor service is operational, we can convert the

Kanpur warehouse to a self-managed warehouse and

close/downgrade the Lucknow facility.

Rs

38,83,460

with 0%

Tolerance

AND

Rs.

3917100

with 5%

Tolerance

Anda mungkin juga menyukai

- Solution Manual For Managerial Economics in A Global Economy 8th Edition by SalvatoreDokumen20 halamanSolution Manual For Managerial Economics in A Global Economy 8th Edition by SalvatorePoonam Singh100% (8)

- Mergers and Acquisitions ModuleDokumen116 halamanMergers and Acquisitions Modulegs_waiting_4_u80% (10)

- PM Challenge '19 - XLRIDokumen9 halamanPM Challenge '19 - XLRIRajat PaliwalBelum ada peringkat

- Case 3 - Indias Alibaba - IndiaMartDokumen2 halamanCase 3 - Indias Alibaba - IndiaMartSourav HalderBelum ada peringkat

- Kimura K.K. Can This Customer Be Saved?: Spartacus - The User MR Hashimoto, The Finance Director, Who Is Against TheDokumen4 halamanKimura K.K. Can This Customer Be Saved?: Spartacus - The User MR Hashimoto, The Finance Director, Who Is Against TheCuca Bleck100% (1)

- Hummus Bar IB Group 1Dokumen4 halamanHummus Bar IB Group 1srishti mishraBelum ada peringkat

- Mortein Vaporiser Marketing AnalysisDokumen19 halamanMortein Vaporiser Marketing AnalysisTanuj Kukreti100% (1)

- Problem Set 2Dokumen2 halamanProblem Set 2nskabra0% (1)

- Kalanick's Leadership Style at UberDokumen4 halamanKalanick's Leadership Style at UberFarhan Thaib0% (1)

- BIR Clarification On Senior Citizens DiscountDokumen13 halamanBIR Clarification On Senior Citizens DiscountPaolo Antonio EscalonaBelum ada peringkat

- Case StudyDokumen5 halamanCase StudyJatinder KumarBelum ada peringkat

- Amul Keeping Up With The TimesDokumen4 halamanAmul Keeping Up With The TimeschiragBelum ada peringkat

- Movie Rental Business PDFDokumen6 halamanMovie Rental Business PDFAmir khanBelum ada peringkat

- Managing Performance and Sales Force at Pharma CompaniesDokumen9 halamanManaging Performance and Sales Force at Pharma CompaniesValakBelum ada peringkat

- Group 4 discusses DIL sales organization and reducing attritionDokumen11 halamanGroup 4 discusses DIL sales organization and reducing attritionYash Vardhan33% (3)

- Sales & Marketing Case - EV Charging Infra SolutionDokumen11 halamanSales & Marketing Case - EV Charging Infra SolutionAtul ChaudharyBelum ada peringkat

- KCPL Case AnalysisDokumen12 halamanKCPL Case AnalysisAlok SinghBelum ada peringkat

- A Blogger in The Midst - Critical AnalysisDokumen4 halamanA Blogger in The Midst - Critical AnalysisJaskaranBelum ada peringkat

- Sweet Water Case StudyDokumen2 halamanSweet Water Case Studynirvick02050% (2)

- GBS Group 7 - Blue Ridge SpainDokumen16 halamanGBS Group 7 - Blue Ridge SpainAnurag YadavBelum ada peringkat

- Problem Set 2Dokumen2 halamanProblem Set 2Rithesh KBelum ada peringkat

- Kanpur Confectioneries PVT LTDDokumen6 halamanKanpur Confectioneries PVT LTDJAYKISHAN JOSHI67% (3)

- CROWN'S DESIGN SERVICE STRATEGYDokumen18 halamanCROWN'S DESIGN SERVICE STRATEGYRizki Setyo Pratomo0% (2)

- Ammonia Storage and Filling FaciltyDokumen24 halamanAmmonia Storage and Filling FaciltyRavian Lhr100% (1)

- Inventory Management in Pharmacy Practice: A Review of LiteratureDokumen6 halamanInventory Management in Pharmacy Practice: A Review of LiteratureMohammed Omer QurashiBelum ada peringkat

- Simplify The Above ParagraphDokumen56 halamanSimplify The Above ParagraphAmjad NiaziBelum ada peringkat

- Solved Pacific Coast Fisheries Corporation Issued More Than 5 Percent ofDokumen1 halamanSolved Pacific Coast Fisheries Corporation Issued More Than 5 Percent ofAnbu jaromiaBelum ada peringkat

- Presented By: Azeem Rahman K.MDokumen32 halamanPresented By: Azeem Rahman K.Mpratyush05010% (1)

- SM AssignesDokumen8 halamanSM AssignesYugandhar MakarlaBelum ada peringkat

- Suzuki Samurai Case Analysis GROUP 03Dokumen52 halamanSuzuki Samurai Case Analysis GROUP 03Maddala Srinivasa Rao50% (2)

- GEP Gameplan 2021 BschoolDokumen12 halamanGEP Gameplan 2021 BschoolSweta Sahu100% (1)

- HP Compaq MergerDokumen23 halamanHP Compaq Mergerpoojaarora_10_juneBelum ada peringkat

- Managing Business Markets (MBM) : Case Analysis Note - Kunst1600 - Understanding Customer ValueDokumen6 halamanManaging Business Markets (MBM) : Case Analysis Note - Kunst1600 - Understanding Customer ValueRohit SharmaBelum ada peringkat

- Acquisition and Merger of Kia Motors by Hundai Motors Rev 1.0Dokumen13 halamanAcquisition and Merger of Kia Motors by Hundai Motors Rev 1.0Tejaswi Monangi100% (1)

- Cavinkare: Building Human Capital For Performance Excellence (Group 2)Dokumen11 halamanCavinkare: Building Human Capital For Performance Excellence (Group 2)Prince NarwariyaBelum ada peringkat

- Strategic Analysis of Ti Cycles IndiaDokumen6 halamanStrategic Analysis of Ti Cycles Indiamonk0062006Belum ada peringkat

- Strategy Indigo Report Group 7Dokumen26 halamanStrategy Indigo Report Group 7Vvb SatyanarayanaBelum ada peringkat

- Chapter 4 SlidesDokumen71 halamanChapter 4 SlidesShivi Shrivastava75% (4)

- Growth and Financing of a Major Indian Engineering CompanyDokumen6 halamanGrowth and Financing of a Major Indian Engineering CompanySiddhanth MunjalBelum ada peringkat

- Jabong CaseDokumen23 halamanJabong CaseSatish GuraddiBelum ada peringkat

- Navratna Product PositioningDokumen5 halamanNavratna Product PositioningSoniya DhyaniBelum ada peringkat

- EMC: Delivering Customer Centricity: Group Number 08Dokumen7 halamanEMC: Delivering Customer Centricity: Group Number 08DEEPAKBelum ada peringkat

- Tata Nano : ONE LakhDokumen24 halamanTata Nano : ONE Lakharunaghanghoria2803Belum ada peringkat

- Case2 Transportation CaseDokumen4 halamanCase2 Transportation CaseaakashblueBelum ada peringkat

- TWA grp8Dokumen10 halamanTWA grp8Aryan Anand100% (1)

- Case Analysis - Michigan Manufacturing CorporationDokumen2 halamanCase Analysis - Michigan Manufacturing CorporationhemanthillipilliBelum ada peringkat

- Reckitt Case SolutionDokumen9 halamanReckitt Case SolutionSaif AkhtarBelum ada peringkat

- Case Study 1 - FishBay - in - PDFDokumen8 halamanCase Study 1 - FishBay - in - PDFVasu AgarwalBelum ada peringkat

- Docslide Us Jet Blue Airways Managing Growth Case SolutionDokumen12 halamanDocslide Us Jet Blue Airways Managing Growth Case SolutionprateekBelum ada peringkat

- Amul - BCG MatrixDokumen9 halamanAmul - BCG MatrixBaidhani Mandal100% (1)

- Group 1 BM B Amul AssignmentDokumen14 halamanGroup 1 BM B Amul AssignmentAayush GulatiBelum ada peringkat

- Finlatics 1Dokumen5 halamanFinlatics 1paras paliwalBelum ada peringkat

- KDokumen5 halamanKJaspreet Kaur50% (2)

- Keggfarms' Dual Focus on Profit & Social ChangeDokumen12 halamanKeggfarms' Dual Focus on Profit & Social ChangeAnkesh SinghBelum ada peringkat

- Gemini PPT 1Dokumen21 halamanGemini PPT 1Bhanu NirwanBelum ada peringkat

- Trade Offs When Selecting Transportation ModeDokumen2 halamanTrade Offs When Selecting Transportation ModeAmarnath DixitBelum ada peringkat

- B2B - Group 3 - Jackson Case StudyDokumen5 halamanB2B - Group 3 - Jackson Case Studyriya agrawallaBelum ada peringkat

- PESTLE FlipkartDokumen23 halamanPESTLE FlipkartKratik singhBelum ada peringkat

- PV Technologies, Inc.: Were They Asleep at The Switch?Dokumen12 halamanPV Technologies, Inc.: Were They Asleep at The Switch?Sumedh Bhagwat0% (1)

- IndiaMART Solution - MBMDokumen4 halamanIndiaMART Solution - MBMUjjwal BhardwajBelum ada peringkat

- Annexure 1 - RFP 2022 Instruction DocumentDokumen4 halamanAnnexure 1 - RFP 2022 Instruction DocumentRaamBelum ada peringkat

- Upstream:: This Sector Is Also Named As He Exploration and Production (E&P) SectorDokumen7 halamanUpstream:: This Sector Is Also Named As He Exploration and Production (E&P) SectorAratrika PaulBelum ada peringkat

- KECDokumen3 halamanKECsappy2shailBelum ada peringkat

- Introduction and Background of The CompanyDokumen4 halamanIntroduction and Background of The CompanyshrutiBelum ada peringkat

- AGTL Slides Updates 2Dokumen39 halamanAGTL Slides Updates 2salmaniqbal001Belum ada peringkat

- Question 2 - CVP Analysis and Decision Making: RequiredDokumen3 halamanQuestion 2 - CVP Analysis and Decision Making: RequiredYawer AliBelum ada peringkat

- Global Craft Beer MarketDokumen2 halamanGlobal Craft Beer MarkettagotBelum ada peringkat

- FIDE OA Vol 3Dokumen616 halamanFIDE OA Vol 3Jordan WilliamsBelum ada peringkat

- Unit 2a: Develop Products With SAP R&D Solutions For Process IndustriesDokumen11 halamanUnit 2a: Develop Products With SAP R&D Solutions For Process Industriesshipra177Belum ada peringkat

- Developing an Employment Vocabulary. 7thDokumen18 halamanDeveloping an Employment Vocabulary. 7thzoya maryamBelum ada peringkat

- LofransCat LowRec 2019Dokumen72 halamanLofransCat LowRec 2019Mauricio Da Cunha AlmeidaBelum ada peringkat

- First Things First (1964 & 2000)Dokumen5 halamanFirst Things First (1964 & 2000)MarinaCórdovaAlvésteguiBelum ada peringkat

- Mistak Done by IndiansDokumen28 halamanMistak Done by Indiansamit mittal100% (1)

- Analyzing The Phenomenon of The Increase of Brand PDFDokumen6 halamanAnalyzing The Phenomenon of The Increase of Brand PDFPanpanBelum ada peringkat

- Samahan NG Optometrists Sa Pilipinas v. AcebeoDokumen2 halamanSamahan NG Optometrists Sa Pilipinas v. AcebeoIvee OngBelum ada peringkat

- Lecture One Introduction To Management Summarised NotesDokumen14 halamanLecture One Introduction To Management Summarised NotesMburu KaranjaBelum ada peringkat

- Linear Example DataDokumen7 halamanLinear Example DataSanjay S RayBelum ada peringkat

- 528419772Dokumen1 halaman528419772Hasib BillahBelum ada peringkat

- Prefabricated StructureDokumen129 halamanPrefabricated Structureemraan Khan100% (1)

- Welcome To Mini Project Presentation On A Compartive Financial Performance Analysis of and Power by Means of Ratios Tata Steel and Jindal SteelDokumen11 halamanWelcome To Mini Project Presentation On A Compartive Financial Performance Analysis of and Power by Means of Ratios Tata Steel and Jindal Steelब्राह्मण विभोरBelum ada peringkat

- 1 Fundamentals of Market Research 2 1Dokumen34 halaman1 Fundamentals of Market Research 2 1Reem HassanBelum ada peringkat

- Lean Six Sigma Essential Glossary of TermsDokumen17 halamanLean Six Sigma Essential Glossary of TermsDebashishDolonBelum ada peringkat

- Mitigation of Delays Attributable To The Contractors in The Construction Industry of Sri Lanka - Consultants' PerspectiveDokumen10 halamanMitigation of Delays Attributable To The Contractors in The Construction Industry of Sri Lanka - Consultants' Perspectivesajid khanBelum ada peringkat

- FM SMN 01 Memorandum of Agreement 1Dokumen5 halamanFM SMN 01 Memorandum of Agreement 1MineBelum ada peringkat

- MM Elec 2Dokumen17 halamanMM Elec 2juliesa villarozaBelum ada peringkat

- SE Chapter-1 semVIDokumen12 halamanSE Chapter-1 semVIAmrutraj KumbharBelum ada peringkat

- Entrepreneurship (MGT602) Fall 2020 Assignment No.02 Topic: The Importance of Entrepreneurship BackgroundDokumen2 halamanEntrepreneurship (MGT602) Fall 2020 Assignment No.02 Topic: The Importance of Entrepreneurship BackgroundjenniferBelum ada peringkat

- EQPS MAF451 - July2020Dokumen10 halamanEQPS MAF451 - July2020Nur AthirahBelum ada peringkat

- 2015 Contract II (Vol2) PartnershipDokumen178 halaman2015 Contract II (Vol2) PartnershipGarvit ChaudharyBelum ada peringkat

- Dell EMC ProDeploy For PowerStoreDokumen14 halamanDell EMC ProDeploy For PowerStoreMohamed AddaBelum ada peringkat