Accounting of Partnership

Diunggah oleh

Tulika AnandDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Accounting of Partnership

Diunggah oleh

Tulika AnandHak Cipta:

Format Tersedia

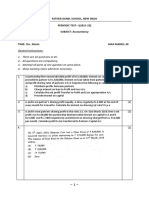

Assuming all other data to be the same and the capital of Rs.

1,00,000 is owned by the two partners Mani and Murthy as Rs. 30,000 and Rs. 70,000 respectively. Trial Balance of M/s Wearall Textlies as on 31st March 2006 Particulars Mani's Capital Murthy's Capital Opening Stock Closing Stock Purchases Rent Paid Sales Wages Commission Received Assets Debtors Creditors Total L/F Debit Amount Credit Amount (in Rs) (in Rs) 70,000 30,000 15,000 25,000 1,50,000 25,000 3,20,000 50,000 3,000 1,51,000 45,000 38,000 4,61,000 4,61,000

The Trading and profit and loss account would be the same Net Profit = Rs. 1,08,000. Dr Trading and Profit and Loss a/c Cr Amount Amount Amount Amount Particulars Particulars (in Rs) (in Rs) (in Rs) (in Rs) To Opening Stock 15,000 By Sales 3,20,000 To Purchases 1,50,000 By Closing Stock 25,000 To Wages 50,000 To Gross Profit 1,30,000 3,45,000 3,45,000 To Rent 25,000 By Gross Profit 1,30,000 To Net Profit c/d 1,08,000 By Commission Received 3,000 1,33,000 1,33,000 To Net Profit (Mani) 36,000 By Net Profit b/d 1,08,000 To Net Profit 72,000 (Murty) 1,08,000 1,08,000

Distribution of Profits among Partners

Partners profit sharing ratio Mani : Murthy = 1 : 2

1 2 : 3 3

Partners share of profits = Firms profit Profit sharing proportion Mani's Share = Rs. 1,08,000 Rs. 1,08,000 1 = Rs. 36,000 3 2 = Rs. 72,000 3 Rs. 72,000 Murthy (in Rs) 30,000 72,000 1,02,000 1,02,000

Murthy's Share =

Dr

Partners Capital a/c's Cr Mani Murthy Mani Particulars (in Rs) (in Rs) (in Rs) 1,06,00 1,02,00 To Balance c/d By Balance b/d 70,000 0 0 By Net Profit 36,000 1,06,00 1,02,00 1,06,00 0 0 0 1,06,00 By Balance b/d 0 Particulars

The difference that you can notice is that the profit of Rs. 1,08,000 instead of getting into the account representing a single owner (capital account) is distributed among all the owners i.e. their respective capital accounts.

Anda mungkin juga menyukai

- Financial Statement Analysis: Business Strategy & Competitive AdvantageDari EverandFinancial Statement Analysis: Business Strategy & Competitive AdvantagePenilaian: 5 dari 5 bintang5/5 (1)

- The Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionDari EverandThe Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionBelum ada peringkat

- DK Goel Accountancy Solutions Class 12 Vol 1 Chapter 1Dokumen4 halamanDK Goel Accountancy Solutions Class 12 Vol 1 Chapter 1AYUSHMAAN SAINIBelum ada peringkat

- CBSEDokumen3 halamanCBSEKaran Veer SinghBelum ada peringkat

- 04 Sample PaperDokumen45 halaman04 Sample Papergaming loverBelum ada peringkat

- 12 Accountancy sp04Dokumen45 halaman12 Accountancy sp04Priyansh AryaBelum ada peringkat

- Accountancy 12th Class PaperDokumen5 halamanAccountancy 12th Class PaperSanjana SinghBelum ada peringkat

- +2 Accounts RTP 2023-24 Partnership Fundamental & Goodwill - 29089845Dokumen9 halaman+2 Accounts RTP 2023-24 Partnership Fundamental & Goodwill - 29089845vanshkapoorr3Belum ada peringkat

- Class 12 Accountancy Solved Sample Paper 2 - 2012Dokumen37 halamanClass 12 Accountancy Solved Sample Paper 2 - 2012cbsestudymaterialsBelum ada peringkat

- IPCC MTP2 AccountingDokumen7 halamanIPCC MTP2 AccountingBalaji SiddhuBelum ada peringkat

- Acc Xii Pt1 PreptDokumen5 halamanAcc Xii Pt1 PreptNishi AroraBelum ada peringkat

- 9 Partnership Question 3Dokumen5 halaman9 Partnership Question 3kautiBelum ada peringkat

- AccountDokumen67 halamanAccountchamalix100% (1)

- Introduction To Partnership AccountsDokumen20 halamanIntroduction To Partnership Accountsanon_672065362100% (1)

- Financial Reporting For Financial Institutions MUTUAL FUNDS & NBFC'sDokumen77 halamanFinancial Reporting For Financial Institutions MUTUAL FUNDS & NBFC'sParvesh Aghi0% (1)

- Accounts - Prelim 5 - Question PaperDokumen8 halamanAccounts - Prelim 5 - Question PaperPawan TalrejaBelum ada peringkat

- Goodwill: ICM 12 Standard Gautam BeryDokumen9 halamanGoodwill: ICM 12 Standard Gautam BeryGautam KhanwaniBelum ada peringkat

- M Com Part I Accounts Question PDFDokumen15 halamanM Com Part I Accounts Question PDFpink_key711Belum ada peringkat

- 12 Revision p2Dokumen2 halaman12 Revision p2LexBelum ada peringkat

- Account Ch-1 Partnership Firm - FundamentalsDokumen19 halamanAccount Ch-1 Partnership Firm - Fundamentalsapsonline8585Belum ada peringkat

- CTF Edited Solved Paper 1Dokumen2 halamanCTF Edited Solved Paper 1Umesh JaiswalBelum ada peringkat

- Tar Ge T 100: JS AccountancyDokumen33 halamanTar Ge T 100: JS Accountancyvishal joshiBelum ada peringkat

- Mixed Prac Accounts - 2Dokumen3 halamanMixed Prac Accounts - 2vihaanjain85200258Belum ada peringkat

- Top 25 Problems On Dissolution of A Partnership Firm PDFDokumen1 halamanTop 25 Problems On Dissolution of A Partnership Firm PDFDaniza Rose AltoBelum ada peringkat

- Financial ManagementDokumen16 halamanFinancial ManagementManish FloraBelum ada peringkat

- Question Bank CH-Retirement and DeathDokumen6 halamanQuestion Bank CH-Retirement and Deathsuchitasingh1106Belum ada peringkat

- Module-2 Sample Question PaperDokumen18 halamanModule-2 Sample Question PaperRay Ch100% (1)

- Financial StatementDokumen15 halamanFinancial StatementPankaj SharmaBelum ada peringkat

- Paper - 1: Financial Reporting Questions Consolidated Balance Sheet (Chain Holding)Dokumen52 halamanPaper - 1: Financial Reporting Questions Consolidated Balance Sheet (Chain Holding)Anonymous duzV27Mx3Belum ada peringkat

- Valuation of GoodwillDokumen5 halamanValuation of GoodwillChaaru VarshiniBelum ada peringkat

- Problems On Joint VentureDokumen8 halamanProblems On Joint VentureKrishna Prince M MBelum ada peringkat

- CBSE Test Paper 03 Ch-2 Fundamentals of Partnership and GoodwillDokumen8 halamanCBSE Test Paper 03 Ch-2 Fundamentals of Partnership and GoodwillT.Gayatri Devi Guest FacultyBelum ada peringkat

- Problems On Ratio AnalysisDokumen5 halamanProblems On Ratio AnalysisPadyala Sriram100% (1)

- Holding Co. QuestionsDokumen77 halamanHolding Co. Questionsअक्षय गोयलBelum ada peringkat

- 03 - Accounts - Prelims 3Dokumen7 halaman03 - Accounts - Prelims 3Pawan TalrejaBelum ada peringkat

- Corporate Tax ProblemsDokumen21 halamanCorporate Tax Problemsnavtej02Belum ada peringkat

- Advanced Financial Accounting Degree Question Paper Free Download Goodwill Tuition Centre, Kochi, Kerala PH: 9567902805, 9846710963Dokumen7 halamanAdvanced Financial Accounting Degree Question Paper Free Download Goodwill Tuition Centre, Kochi, Kerala PH: 9567902805, 9846710963Rainy GoodwillBelum ada peringkat

- Financial Reporting and Analysis Trimester - 1 End Term: Time Allowed - 2 Hours Max Marks - 40Dokumen3 halamanFinancial Reporting and Analysis Trimester - 1 End Term: Time Allowed - 2 Hours Max Marks - 40PRIYA KUMARIBelum ada peringkat

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen10 halamanStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Father Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40Dokumen4 halamanFather Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40fffffBelum ada peringkat

- Acc Book 1st SemDokumen74 halamanAcc Book 1st Semlanguage hub100% (1)

- Change in Profit Sharing Ratio Among The Existing PartnersDokumen15 halamanChange in Profit Sharing Ratio Among The Existing Partnersvajoj90546Belum ada peringkat

- S A Ipcc May-2011-Gr-1Dokumen100 halamanS A Ipcc May-2011-Gr-1Saibhumi100% (1)

- CBSE Sample Papers 2018-19Dokumen84 halamanCBSE Sample Papers 2018-19simran ThapaBelum ada peringkat

- XIIAccountancySQP 2018-19 PDFDokumen10 halamanXIIAccountancySQP 2018-19 PDFShivam SinghBelum ada peringkat

- Lecture 9 Shri Govind NumericalDokumen1 halamanLecture 9 Shri Govind Numericalhimanshumaholia0% (1)

- Issues in Partnership Accounts: Basic ConceptsDokumen40 halamanIssues in Partnership Accounts: Basic Conceptsjsus22Belum ada peringkat

- 591617884861 (1)Dokumen9 halaman591617884861 (1)YashviBelum ada peringkat

- Accounts XiiDokumen12 halamanAccounts XiiTanya JainBelum ada peringkat

- Partnership and Non-For-Profit OrganisationsDokumen4 halamanPartnership and Non-For-Profit OrganisationsJoshi DrcpBelum ada peringkat

- Death of A PartnerDokumen2 halamanDeath of A PartnerAarya KhedekarBelum ada peringkat

- Top 100 Questions of AccountsDokumen75 halamanTop 100 Questions of Accountschauhanthakur554Belum ada peringkat

- Exemplar Questions: TH THDokumen9 halamanExemplar Questions: TH THAman KakkarBelum ada peringkat

- Valuation of Goodwill Class NotesDokumen4 halamanValuation of Goodwill Class NotesRajesh NangaliaBelum ada peringkat

- 12 Accountancy Sample Paper 2014 04Dokumen6 halaman12 Accountancy Sample Paper 2014 04artisingh3412Belum ada peringkat

- Test 3 QPDokumen7 halamanTest 3 QPDharmateja ChakriBelum ada peringkat

- Class 12 Accounts CA Parag GuptaDokumen368 halamanClass 12 Accounts CA Parag GuptaJoel Varghese0% (1)

- Accountancy QP-Term II-Pre Board 1 - Class XIIDokumen6 halamanAccountancy QP-Term II-Pre Board 1 - Class XIIRaunofficialBelum ada peringkat

- CBSE Class 12 Accountancy Accounting For Partnership Firms Worksheet Set BDokumen8 halamanCBSE Class 12 Accountancy Accounting For Partnership Firms Worksheet Set BJenneil CarmichaelBelum ada peringkat

- c2 Partnership ProblemsDokumen6 halamanc2 Partnership ProblemsSiva SankariBelum ada peringkat