Paper-Wise Exemptions On Reciprocal Basis To Icsi and Icwai Students

Diunggah oleh

Arun KumarDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Paper-Wise Exemptions On Reciprocal Basis To Icsi and Icwai Students

Diunggah oleh

Arun KumarHak Cipta:

Format Tersedia

ANNOUNCEMENT PAPER-WISE EXEMPTIONS ON RECIPROCAL BASIS TO ICSI AND ICWAI STUDENTS The Council of the Institute has given

approval that the final passed students of ICWAI can avail exemptions in the following papers of Foundation Programme, Executive Programme and Professional Programme of the Company Secretaryship Course under the New Syllabus effective from 1st Novermber, 2007, 1st February, 2008 and 1st August, 2008 respectively. Scheme of Exemptions Exemption to CS passed candidates in papers of ICWAI. Foundation Course (4 papers) Complete exemption Intermediate Course 1. Financial Accounting (Paper 5) 2. Applied Direct Taxation (Paper 7) Exemption to CWA passed candidates in Papers of ICSI. Complete exemption Foundation Programme (4 papers) Executive Programme 1. Company Accounts, Cost & Management Accounting (Module I, Paper 2) 2. Tax Laws (Module I, Paper 3) Final Course 3. Financial Management & Professional Programme 3. Financial, International Finance (Paper 12) 4. Treasury and Forex Management (Module Indirect & Direct Tax Management (Paper II, Paper 3) 4. Advanced Tax Laws & 14) Practice (Module III, Paper 6) Students enrolled to Company Secretary-ship Course and wish to seek above said paperwise exemption(s) - on the strength of having passed the final examination of ICWAI may make their request in writing to Director (Students Services) at C-37, Sector-62, NOIDA-201 309 (U.P) together with the requisite exemption fee @Rs.100 per paper by way of Demand Draft drawn in favor of `The Institute of Company Secretaries of India` payable at New Delhi and the valid document in support of having passed the Final examination of the Institute of Cost & Works Accountants of India on or before the last date of submission of enrolment application for the CS Examination. The above exemption respectively. scheme is effective from December, 2008/ June, 2009 for Foundation/Executive Programme and CS Professional Programme examination(s)

Anda mungkin juga menyukai

- Navigating Professional Paths: A Guide to CA, MBA, UPSC, SSC, Banking, GATE, Law, and UGCDari EverandNavigating Professional Paths: A Guide to CA, MBA, UPSC, SSC, Banking, GATE, Law, and UGCBelum ada peringkat

- Stages To Become A Company Secretary: Icsi - EduDokumen6 halamanStages To Become A Company Secretary: Icsi - EduRoshan SinghBelum ada peringkat

- Audit Risk Alert: Employee Benefit Plans Industry Developments, 2018Dari EverandAudit Risk Alert: Employee Benefit Plans Industry Developments, 2018Belum ada peringkat

- 74932bos Transition Scheme NsetDokumen47 halaman74932bos Transition Scheme NsetShubhamBelum ada peringkat

- Paper Wise Exemption On The Basis of Higher Qualifications: (As Per Revised Guidelines Effective From 1 December 2013)Dokumen1 halamanPaper Wise Exemption On The Basis of Higher Qualifications: (As Per Revised Guidelines Effective From 1 December 2013)Shubham MaheshwariBelum ada peringkat

- International Public Sector Accounting Standards Implementation Road Map for UzbekistanDari EverandInternational Public Sector Accounting Standards Implementation Road Map for UzbekistanBelum ada peringkat

- How To Become A Company SecretaryDokumen21 halamanHow To Become A Company SecretaryPriyanshu PalBelum ada peringkat

- Tax AdvisorDokumen55 halamanTax AdvisorTimothy KawumaBelum ada peringkat

- ADMISSION TO THE CS COURSE Is Open Throughout The Year. Examinations Are Held Twice A Year in June & DecemberDokumen10 halamanADMISSION TO THE CS COURSE Is Open Throughout The Year. Examinations Are Held Twice A Year in June & DecemberSomprasad PoudelBelum ada peringkat

- CA ProspectusDokumen103 halamanCA ProspectusDigambar JangamBelum ada peringkat

- CA Transition SchemeDokumen47 halamanCA Transition SchemeBhavitha SiriBelum ada peringkat

- Booklet April2013 R2Dokumen46 halamanBooklet April2013 R2Michael FuBelum ada peringkat

- Scheme Finance Assistance 01022022Dokumen13 halamanScheme Finance Assistance 01022022CmaChanduBelum ada peringkat

- 75282bos Transition Scheme NsetDokumen54 halaman75282bos Transition Scheme NsetPranay JaiswalBelum ada peringkat

- Ca Examinations - An OverviewDokumen7 halamanCa Examinations - An OverviewBKLMMDFKLFBBelum ada peringkat

- Paperwise Exemption ForHighQualDokumen1 halamanPaperwise Exemption ForHighQualAyush BishtBelum ada peringkat

- Attention Students: WWW - Icsi.eduDokumen3 halamanAttention Students: WWW - Icsi.edusatyamgsharmaBelum ada peringkat

- BCom-Accounting-Finance (Integrated ACCA)Dokumen3 halamanBCom-Accounting-Finance (Integrated ACCA)Abhishek RathodBelum ada peringkat

- PGDTDokumen68 halamanPGDTFahmi AbdullaBelum ada peringkat

- Directorate of Certificate in Accounting Technicians: Admission To CATDokumen2 halamanDirectorate of Certificate in Accounting Technicians: Admission To CATVishu VishwaroopBelum ada peringkat

- Final Course: Direct Taxes and Indirect Taxes Direct Tax Laws and Indirect Tax LawsDokumen9 halamanFinal Course: Direct Taxes and Indirect Taxes Direct Tax Laws and Indirect Tax LawsAshish MittalBelum ada peringkat

- IPCE New Guidance November2020Dokumen22 halamanIPCE New Guidance November2020MLastTryBelum ada peringkat

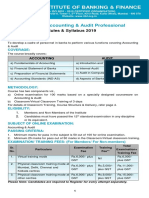

- Useful For Certified Accounting & Audit Professional 1Dokumen340 halamanUseful For Certified Accounting & Audit Professional 1nageswara kuchipudi100% (1)

- SCS 2008 04Dokumen52 halamanSCS 2008 04Suppy PBelum ada peringkat

- 1 Taxation 2009 SupplementaryDokumen84 halaman1 Taxation 2009 Supplementaryabc3579Belum ada peringkat

- IGNOU ProgramsDokumen2 halamanIGNOU Programssuganthy1Belum ada peringkat

- Diploma in Treasury, Investment and Risk Management PDFDokumen10 halamanDiploma in Treasury, Investment and Risk Management PDFAbhishek Kaushik0% (6)

- Applicability of The Finance Act For June 2019Dokumen1 halamanApplicability of The Finance Act For June 2019Josef AnthonyBelum ada peringkat

- Indirect Tax Laws: Final Course Study MaterialDokumen17 halamanIndirect Tax Laws: Final Course Study MaterialoverclockthesunBelum ada peringkat

- GST Internship ProgrammeDokumen4 halamanGST Internship ProgrammeVivek BeheraBelum ada peringkat

- Profession of CharteredDokumen20 halamanProfession of CharteredSaru BashaBelum ada peringkat

- Indian Institute of Banking & Finance: Certificate Examination in Risk in Financial ServicesDokumen10 halamanIndian Institute of Banking & Finance: Certificate Examination in Risk in Financial Servicesbenzene4a1Belum ada peringkat

- Icwai: The Institute of Cost and Works Accountants of India (ICWAI)Dokumen12 halamanIcwai: The Institute of Cost and Works Accountants of India (ICWAI)mknatoo1963Belum ada peringkat

- Frequently Asked Questions (Faqs) On Direct Entry To Chartered Accountancy CourseDokumen12 halamanFrequently Asked Questions (Faqs) On Direct Entry To Chartered Accountancy Coursesreyans banthiaBelum ada peringkat

- IPCE - November - 2022 - Guidance Notes - SifyDokumen23 halamanIPCE - November - 2022 - Guidance Notes - SifySakshiK ChaturvediBelum ada peringkat

- Swargam AnushkaDokumen11 halamanSwargam AnushkaAnushka SwargamBelum ada peringkat

- Acctng&aud 290518 PDFDokumen9 halamanAcctng&aud 290518 PDFManohar VennapusaBelum ada peringkat

- Frequently Asked Questions (Faqs) : Directorate of Student ServicesDokumen26 halamanFrequently Asked Questions (Faqs) : Directorate of Student Servicesjayaramgowda.268619Belum ada peringkat

- Exemption in Professional ExaminationsDokumen3 halamanExemption in Professional ExaminationsRishabh RaiBelum ada peringkat

- IPCE New May 2022 Guidance NotesDokumen20 halamanIPCE New May 2022 Guidance Noteslove smileBelum ada peringkat

- KJSSC CC Tally2019Dokumen9 halamanKJSSC CC Tally2019Common ManBelum ada peringkat

- Chartered Accountacy Course OverviewDokumen40 halamanChartered Accountacy Course OverviewAbhinav Madaan100% (1)

- Amendments ForDokumen12 halamanAmendments Forrrinku_abhinavBelum ada peringkat

- ExamDokumen12 halamanExamAvi SiBelum ada peringkat

- Foundations in Taxation FTX (UK) Jun-Dec 20 - FinalDokumen19 halamanFoundations in Taxation FTX (UK) Jun-Dec 20 - FinalBurhanMTHBelum ada peringkat

- (Under Regulation 28G (4) of The Chartered Accountants Regulations, 1988)Dokumen21 halaman(Under Regulation 28G (4) of The Chartered Accountants Regulations, 1988)Aryan MauryaBelum ada peringkat

- CS - January 2013 - STUDENTSERVICES PDFDokumen28 halamanCS - January 2013 - STUDENTSERVICES PDFtejpalBelum ada peringkat

- Indian Institute of Banking & FinanceDokumen8 halamanIndian Institute of Banking & FinanceAnonymous QqGiVVKwDGBelum ada peringkat

- Indirect Tax Laws: Final Course Study MaterialDokumen9 halamanIndirect Tax Laws: Final Course Study Materialdipesh shahBelum ada peringkat

- CPA Students Brochure NewDokumen8 halamanCPA Students Brochure NewTunone Julius100% (1)

- (Under The Syllabus Approved by The Council Under Regulation 31 (Ii) of The Chartered Accountants Regulations, 1988)Dokumen22 halaman(Under The Syllabus Approved by The Council Under Regulation 31 (Ii) of The Chartered Accountants Regulations, 1988)wedanBelum ada peringkat

- Exemptions From Appearing in Papers or Group of Chartered AccountancyDokumen8 halamanExemptions From Appearing in Papers or Group of Chartered Accountancythe305boricuaBelum ada peringkat

- Frequently Asked Questions (Faqs) : Directorate of Student ServicesDokumen29 halamanFrequently Asked Questions (Faqs) : Directorate of Student Servicesav_meshramBelum ada peringkat

- ADMISSION TO THE CS COURSE Is Open Throughout The Year. Examinations Are Held Twice A Year in June & DecemberDokumen5 halamanADMISSION TO THE CS COURSE Is Open Throughout The Year. Examinations Are Held Twice A Year in June & DecemberAmbika BmBelum ada peringkat

- Indian Institute of Banking & Finance: Certified Credit ProfessionalDokumen10 halamanIndian Institute of Banking & Finance: Certified Credit ProfessionalsvijayswarupBelum ada peringkat

- Incentive Scheme 2021Dokumen11 halamanIncentive Scheme 2021shyam krishnaBelum ada peringkat

- Chartered Accountancy Course Fee StructureDokumen5 halamanChartered Accountancy Course Fee StructureSaru BashaBelum ada peringkat

- Intermediate Guideline Notes PDFDokumen20 halamanIntermediate Guideline Notes PDFshivam kharivale 55Belum ada peringkat

- M Venkateswara RaoDokumen2 halamanM Venkateswara Raovenkat marellaBelum ada peringkat

- ITDokumen4 halamanITMahesh KumarBelum ada peringkat

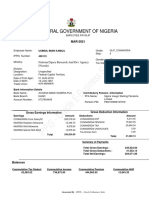

- IPPIS - Oracle E-Business Suite: Federal Government of NigeriaDokumen1 halamanIPPIS - Oracle E-Business Suite: Federal Government of NigeriaKamil Usman100% (1)

- Computation For Suman SharmaDokumen2 halamanComputation For Suman Sharmaakhil kwatraBelum ada peringkat

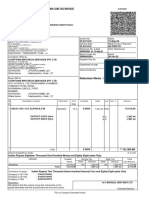

- Tax Invoice: Gstin Drug Licence NoDokumen1 halamanTax Invoice: Gstin Drug Licence Nopranay dasBelum ada peringkat

- Mutual Funds Taxation Rules FY 2020-21 - Capital Gains & DividendsDokumen7 halamanMutual Funds Taxation Rules FY 2020-21 - Capital Gains & DividendsSushant ChhotrayBelum ada peringkat

- Chapter 11Dokumen5 halamanChapter 11张心怡Belum ada peringkat

- ITOC AnalysisDokumen15 halamanITOC AnalysisVoldBelum ada peringkat

- Clubbing of IncomeDokumen3 halamanClubbing of IncomeVachanamrutha R.VBelum ada peringkat

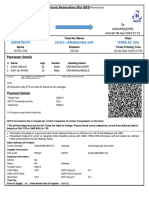

- Tez Ticket PrintDokumen1 halamanTez Ticket Printosama amjad.hy8ggBelum ada peringkat

- Chapter 5 - TBTDokumen8 halamanChapter 5 - TBTKatKat Olarte100% (2)

- Can I Claim Them As A Dependent?: Your Income TaxesDokumen1 halamanCan I Claim Them As A Dependent?: Your Income TaxesAly SmallwoodBelum ada peringkat

- 2018-09-05 DOC Re EIN Confirmation (DSJ Real Estate Holdings)Dokumen2 halaman2018-09-05 DOC Re EIN Confirmation (DSJ Real Estate Holdings)Doo Soo KimBelum ada peringkat

- Tutorial 8Dokumen3 halamanTutorial 8Aaron Tan Wayne JieBelum ada peringkat

- OD124032170162246000Dokumen1 halamanOD124032170162246000Avnish KumarBelum ada peringkat

- Gift TaxDokumen13 halamanGift TaxRaiha MoriyomBelum ada peringkat

- Income Tax Return Online - WEB ONLINE CADokumen56 halamanIncome Tax Return Online - WEB ONLINE CAwebonlineca2024Belum ada peringkat

- Cardekho: Salary Slip For The Month of November - 2021Dokumen2 halamanCardekho: Salary Slip For The Month of November - 2021Røcky DêêpåkBelum ada peringkat

- Invoice 9Dokumen1 halamanInvoice 9QusaiBelum ada peringkat

- Wa0000Dokumen1 halamanWa0000Sainath ReddyBelum ada peringkat

- Challan Cum Tax InvoiceDokumen1 halamanChallan Cum Tax InvoiceSahil KadamBelum ada peringkat

- Kenny Delight Inv 375 30 KGS PistaDokumen2 halamanKenny Delight Inv 375 30 KGS Pistavinay sainiBelum ada peringkat

- CIR vs. PNB 736 SCRA 609 2014 VELOSODokumen2 halamanCIR vs. PNB 736 SCRA 609 2014 VELOSOAnonymous MikI28PkJc100% (2)

- Tax Return Filing Instructions: For The Year EndingDokumen54 halamanTax Return Filing Instructions: For The Year EndingDavid BriggsBelum ada peringkat

- FABM2Dokumen27 halamanFABM2Shai Rose Jumawan QuiboBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDokumen1 halamanIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruBANDARU SRINUBelum ada peringkat

- Durbin-Booker Fundraising FlyerDokumen2 halamanDurbin-Booker Fundraising FlyerChadMerdaBelum ada peringkat

- Regular Allowable Itemized DeductionsDokumen29 halamanRegular Allowable Itemized Deductionsdelacruzrojohn600Belum ada peringkat

- 3 CIR vs. AlgueDokumen2 halaman3 CIR vs. AlguemaggiBelum ada peringkat

- MH0ihh081h6754910230616041100202 PDFDokumen2 halamanMH0ihh081h6754910230616041100202 PDFLogan GoadBelum ada peringkat

- TEF Canada Expression Écrite : 150 Topics To SucceedDari EverandTEF Canada Expression Écrite : 150 Topics To SucceedPenilaian: 4.5 dari 5 bintang4.5/5 (17)

- The Complete Guide to Getting Certified Cisco CCNA 200-301: Complete Your CCNA Exam Training and Preparation with 400 Exam Level Practice QuestionDari EverandThe Complete Guide to Getting Certified Cisco CCNA 200-301: Complete Your CCNA Exam Training and Preparation with 400 Exam Level Practice QuestionBelum ada peringkat

- Learn Faster and Better: The Art and Science of Learning Something NewDari EverandLearn Faster and Better: The Art and Science of Learning Something NewPenilaian: 3.5 dari 5 bintang3.5/5 (3)

- Make It Stick by Peter C. Brown, Henry L. Roediger III, Mark A. McDaniel - Book Summary: The Science of Successful LearningDari EverandMake It Stick by Peter C. Brown, Henry L. Roediger III, Mark A. McDaniel - Book Summary: The Science of Successful LearningPenilaian: 4.5 dari 5 bintang4.5/5 (55)

- 1,001 Questions & Answers for the CWI Exam: Welding Metallurgy and Visual Inspection Study GuideDari Everand1,001 Questions & Answers for the CWI Exam: Welding Metallurgy and Visual Inspection Study GuidePenilaian: 3.5 dari 5 bintang3.5/5 (7)

- LMSW Passing Score: Your Comprehensive Guide to the ASWB Social Work Licensing ExamDari EverandLMSW Passing Score: Your Comprehensive Guide to the ASWB Social Work Licensing ExamPenilaian: 5 dari 5 bintang5/5 (1)

- The Everything Guide to Study Skills: Strategies, tips, and tools you need to succeed in school!Dari EverandThe Everything Guide to Study Skills: Strategies, tips, and tools you need to succeed in school!Penilaian: 4.5 dari 5 bintang4.5/5 (6)

- TEF Canada Writing & Speaking - NCLC 7 at first attemptDari EverandTEF Canada Writing & Speaking - NCLC 7 at first attemptBelum ada peringkat

- Learning Outside The Lines: Two Ivy League Students with Learning Disabilities and ADHD Give You the Tools for Academic Success and Educational RevolutionDari EverandLearning Outside The Lines: Two Ivy League Students with Learning Disabilities and ADHD Give You the Tools for Academic Success and Educational RevolutionPenilaian: 4 dari 5 bintang4/5 (17)

- IELTS Speaking Vocabulary Builder (Band 5-6): Master Phrases and Expressions for the IELTS Speaking ExamDari EverandIELTS Speaking Vocabulary Builder (Band 5-6): Master Phrases and Expressions for the IELTS Speaking ExamPenilaian: 5 dari 5 bintang5/5 (1)

- Learning Outside The Lines: Two Ivy League Students With Learning Disabilities And Adhd Give You The Tools For Academic Success and Educational RevolutionDari EverandLearning Outside The Lines: Two Ivy League Students With Learning Disabilities And Adhd Give You The Tools For Academic Success and Educational RevolutionPenilaian: 4 dari 5 bintang4/5 (19)

- CCSP Certified Cloud Security Professional A Step by Step Study Guide to Ace the ExamDari EverandCCSP Certified Cloud Security Professional A Step by Step Study Guide to Ace the ExamBelum ada peringkat

- SIE Exam Prep 2021-2022: SIE Study Guide with 300 Questions and Detailed Answer Explanations for the FINRA Securities Industry Essentials Exam (Includes 4 Full-Length Practice Tests)Dari EverandSIE Exam Prep 2021-2022: SIE Study Guide with 300 Questions and Detailed Answer Explanations for the FINRA Securities Industry Essentials Exam (Includes 4 Full-Length Practice Tests)Penilaian: 5 dari 5 bintang5/5 (1)

- AP® World History: Modern Crash Course, For the New 2020 Exam, Book + Online: Get a Higher Score in Less TimeDari EverandAP® World History: Modern Crash Course, For the New 2020 Exam, Book + Online: Get a Higher Score in Less TimeBelum ada peringkat

- HowExpert Guide to Study Skills: 101 Tips to Learn How to Study Effectively, Improve Your Grades, and Become a Better StudentDari EverandHowExpert Guide to Study Skills: 101 Tips to Learn How to Study Effectively, Improve Your Grades, and Become a Better StudentPenilaian: 5 dari 5 bintang5/5 (8)

- ATI TEAS Study Guide: The Most Comprehensive and Up-to-Date Manual to Ace the Nursing Exam on Your First Try with Key Practice Questions, In-Depth Reviews, and Effective Test-Taking StrategiesDari EverandATI TEAS Study Guide: The Most Comprehensive and Up-to-Date Manual to Ace the Nursing Exam on Your First Try with Key Practice Questions, In-Depth Reviews, and Effective Test-Taking StrategiesBelum ada peringkat

- NCMHCE Exam Prep Practice Questions with Answers and Pass the National Clinical Mental Health Counseling ExaminationDari EverandNCMHCE Exam Prep Practice Questions with Answers and Pass the National Clinical Mental Health Counseling ExaminationBelum ada peringkat

- GED Exam Prep A Study Guide to Practice Questions with Answers and Master the General Educational Development TestDari EverandGED Exam Prep A Study Guide to Practice Questions with Answers and Master the General Educational Development TestBelum ada peringkat

- Master the Public Safety Dispatcher/911 Operator ExamDari EverandMaster the Public Safety Dispatcher/911 Operator ExamPenilaian: 5 dari 5 bintang5/5 (1)