Solution 04

Diunggah oleh

api-26315128Deskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Solution 04

Diunggah oleh

api-26315128Hak Cipta:

Format Tersedia

3.

27

P = −15 000 − 800(P/A, 0.5%, 24) + 20 000(P/F, 0.5%, 24)

+ 1000(P/A, 0.5%, 12) + 1200(P/A, 0.5%, 12)(P/F, 0.5%, 12)

− [200 + 20(A/G, 0.5%, 18)](P/A, 0.5%, 18)(P/F, 0.5%, 6)

= −15 000 − 800(22.558) + 20 000(0.88721) + 1000(11.616)

+ 1200(11.616)(0.94192) − [200 + 20(8.3198)](17.168)(0.97052)

= −15 000 − 18 046 + 17 744 + 11 616 + 13 130 − 6105 = 3339

The present worth of this investment is $3339. Yogajothi should buy the

house.

4.5

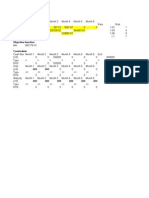

Project

A Æ to sell X division

B Æ to buy Barco

C Æ Get New Financing

D Æ Expand in US

Restrictions

C is B is D is D is Feasible ?

contingent on contingent on contingent on contingent on

A B C D B or D A or C B Not(A)

DN

1 o

2 o x No

3 o x No

4 o x No

5 o o

6 o o x No

7 o o x x No

8 o o

9 o o x No

10 o o x No

11 o o o

12 o o o x No

13 o o o x No

14 o o o

15 o o o o x No

Then we select the Alternatives: DN do nothing

1 A

5 AB

8 BC

11 ABC

14 BCD

4.7

(a) PW = −28 000 + 5000(P/A, 15%, 10) + 3000(P/F, 15%, 10)

= −28 000 + 5000(5.0188) + 3000(0.24718)

= −2164.46

The present worth of the project is about −$2164.

(b) AW = −28 000(A/P, 15%, 10) + 5000 + 3000(A/F, 15%, 10)

= −28 000(0.19925) + 5000 + 3000(0.04925)

= −431.25

Or using the result of part (a):

AW = PW(A/P, 15%, 10) = −2164.46(0.19925) = −431.27

The annual worth of the project is about −$431.

(c) FW = −28 000(F/P, 15%, 10) + 5000(F/A, 15%, 10) + 3000

= −28 000(4.0456) + 5000(20.304) + 3000

= −8756.8

Or using the result of part (a):

FW = PW(F/P, 15%, 10) = −2164.46(4.0456) = −8756.54

The future worth of the project in 10 years is about −$8757.

Anda mungkin juga menyukai

- NotesDokumen14 halamanNotesKakarotWrldBelum ada peringkat

- 1º Concurso de Becas (Áreas DE) 04 de AbrilDokumen13 halaman1º Concurso de Becas (Áreas DE) 04 de Abrilcepru.a61093480Belum ada peringkat

- Unit 5 BingoDokumen4 halamanUnit 5 BingoMrs. HedrickBelum ada peringkat

- 14 Statistics and ProbabilityDokumen37 halaman14 Statistics and ProbabilityMuhammad AliBelum ada peringkat

- Partepamela RemovedDokumen5 halamanPartepamela RemovedJuan De La CruzBelum ada peringkat

- 1º Concurso de Becas (Áreas DE) 04 de AbrilDokumen13 halaman1º Concurso de Becas (Áreas DE) 04 de Abrilcepru.a61093480Belum ada peringkat

- 1º Concurso de Becas (Áreas DE) 04 de Abril - UnlockedDokumen13 halaman1º Concurso de Becas (Áreas DE) 04 de Abril - Unlockedcepru.a61093480Belum ada peringkat

- Lect 7 and 8. Constraint Satisfaction ProblemDokumen88 halamanLect 7 and 8. Constraint Satisfaction Problemdarakhshan syedBelum ada peringkat

- Resonance AIEEE IIT Study Material Maths CompleteDokumen341 halamanResonance AIEEE IIT Study Material Maths CompleteNeil Mahaseth86% (72)

- Gender Consistency in Terms of Performance in InternalDokumen5 halamanGender Consistency in Terms of Performance in Internalavni purohitBelum ada peringkat

- Teoria de Exponentes - Nivel 3Dokumen3 halamanTeoria de Exponentes - Nivel 3Alan Zelada MoriBelum ada peringkat

- Tablet Weaving Patterns PDFDokumen16 halamanTablet Weaving Patterns PDFconfused597Belum ada peringkat

- Solving Equations Review: WorksheetDokumen3 halamanSolving Equations Review: WorksheetsnehaBelum ada peringkat

- Topic 3Dokumen74 halamanTopic 3tilki2007Belum ada peringkat

- BCI PHD SeminarDokumen20 halamanBCI PHD Seminarastronom.saradnikBelum ada peringkat

- NovidadeDokumen3 halamanNovidadeALEXANDREBelum ada peringkat

- Kapasitas Tenaga Putty P2Dokumen48 halamanKapasitas Tenaga Putty P2usfa fatihBelum ada peringkat

- UntitledDokumen3 halamanUntitledDurgesh KhannaBelum ada peringkat

- Tables PDFDokumen10 halamanTables PDFNeha ThakkarBelum ada peringkat

- Lecture 4-Chapter 3: Dr. Guofeng Zhang 24 September 2019Dokumen37 halamanLecture 4-Chapter 3: Dr. Guofeng Zhang 24 September 2019Brian LiBelum ada peringkat

- Econ Assignment 20Dokumen1 halamanEcon Assignment 20jagggypoopooBelum ada peringkat

- Econ Assignment 22Dokumen1 halamanEcon Assignment 22jagggypoopooBelum ada peringkat

- Econ Assignment 18Dokumen1 halamanEcon Assignment 18jagggypoopooBelum ada peringkat

- Econ Assignment 23Dokumen1 halamanEcon Assignment 23jagggypoopooBelum ada peringkat

- Econ Assignment 21Dokumen1 halamanEcon Assignment 21jagggypoopooBelum ada peringkat

- Econ Assignment 19Dokumen1 halamanEcon Assignment 19jagggypoopooBelum ada peringkat

- Answers: Working With Unfamiliar Problems: Part 1Dokumen129 halamanAnswers: Working With Unfamiliar Problems: Part 1Shyam MahendraBelum ada peringkat

- ECOn Assignment #17Dokumen1 halamanECOn Assignment #17jagggypoopooBelum ada peringkat

- ECN Assignment1Dokumen1 halamanECN Assignment1jagggypoopooBelum ada peringkat

- ECN Assignment2Dokumen1 halamanECN Assignment2jagggypoopooBelum ada peringkat

- ECN Assignment4Dokumen1 halamanECN Assignment4jagggypoopooBelum ada peringkat

- ECN Assignment3Dokumen1 halamanECN Assignment3jagggypoopooBelum ada peringkat

- Campselection2010 SolutionsDokumen7 halamanCampselection2010 SolutionsJosé Eduardo López CorellaBelum ada peringkat

- Grade 9 Unit 1 AnswersDokumen29 halamanGrade 9 Unit 1 AnswersSei DelBelum ada peringkat

- Mathematics HL - Worked Solutions - Pearson 2012Dokumen563 halamanMathematics HL - Worked Solutions - Pearson 2012Aditi100% (1)

- Boas - Mathematical Methods in The Physical Sciences 3ed Instructors SOLUTIONS MANUALDokumen71 halamanBoas - Mathematical Methods in The Physical Sciences 3ed Instructors SOLUTIONS MANUALgmnagendra12355% (20)

- English Common Expressions - How To Say It In Chinese? Book OneDari EverandEnglish Common Expressions - How To Say It In Chinese? Book OnePenilaian: 1 dari 5 bintang1/5 (2)

- Answers to Selected Problems in Multivariable Calculus with Linear Algebra and SeriesDari EverandAnswers to Selected Problems in Multivariable Calculus with Linear Algebra and SeriesPenilaian: 1.5 dari 5 bintang1.5/5 (2)

- Mid Term2006Dokumen3 halamanMid Term2006api-26315128Belum ada peringkat

- Lecture 10Dokumen5 halamanLecture 10api-26315128100% (1)

- Mid-Term 2006 SolutionsDokumen6 halamanMid-Term 2006 Solutionsapi-26315128100% (1)

- Solution 03Dokumen3 halamanSolution 03api-26315128Belum ada peringkat

- Lecture 12Dokumen5 halamanLecture 12api-26315128Belum ada peringkat

- Lecture 09Dokumen3 halamanLecture 09api-26315128Belum ada peringkat

- Assign. 2 F-07Dokumen3 halamanAssign. 2 F-07api-263151280% (1)

- M&A ListDokumen12 halamanM&A Listapi-26315128Belum ada peringkat

- CH 4Dokumen2 halamanCH 4api-26315128Belum ada peringkat

- Solution Lec06Dokumen1 halamanSolution Lec06api-26315128Belum ada peringkat

- Solution A3Dokumen6 halamanSolution A3api-26315128Belum ada peringkat

- Breakeven New ProductDokumen2 halamanBreakeven New Productapi-26315128Belum ada peringkat

- Solution 220 Lec10Dokumen1 halamanSolution 220 Lec10api-26315128Belum ada peringkat

- Solution 220 Lec09Dokumen3 halamanSolution 220 Lec09api-26315128Belum ada peringkat

- Solution 220 Lec07Dokumen2 halamanSolution 220 Lec07api-26315128Belum ada peringkat

- Solution Lec05Dokumen1 halamanSolution Lec05api-26315128Belum ada peringkat

- Lecture 3Dokumen1 halamanLecture 3api-26315128Belum ada peringkat

- 73 220 Lecture14 SolnDokumen13 halaman73 220 Lecture14 Solnapi-26315128Belum ada peringkat

- 220 Lecture08Dokumen3 halaman220 Lecture08api-26315128Belum ada peringkat

- 73 220 Lecture19Dokumen6 halaman73 220 Lecture19api-26315128Belum ada peringkat

- 73 220 Lecture21Dokumen21 halaman73 220 Lecture21api-26315128Belum ada peringkat

- 73 220 Lecture18Dokumen14 halaman73 220 Lecture18api-26315128Belum ada peringkat

- Common Metallurgical Defects in Grey Cast IronDokumen9 halamanCommon Metallurgical Defects in Grey Cast IronRolando Nuñez Monrroy100% (1)

- CV - Nguyen Quang HuyDokumen5 halamanCV - Nguyen Quang HuyĐoan DoãnBelum ada peringkat

- Material DevOps Essentials DEPC enDokumen88 halamanMaterial DevOps Essentials DEPC enCharlineBelum ada peringkat

- Novozymes IPRDokumen19 halamanNovozymes IPRthereisaneedBelum ada peringkat

- 5th Year PES Mrs - Hamdoud Research Methodology 2Dokumen3 halaman5th Year PES Mrs - Hamdoud Research Methodology 2Rami DouakBelum ada peringkat

- INCOME TAX AND GST. JURAZ-Module 4Dokumen8 halamanINCOME TAX AND GST. JURAZ-Module 4TERZO IncBelum ada peringkat

- Dislocations and StrenghteningDokumen19 halamanDislocations and StrenghteningAmber WilliamsBelum ada peringkat

- Steps To Control Water Depletion Jun2019Dokumen2 halamanSteps To Control Water Depletion Jun2019chamanBelum ada peringkat

- 13 DocumentsDokumen38 halaman13 DocumentsPoorClaresBostonBelum ada peringkat

- Annex B Brochure Vector and ScorpionDokumen4 halamanAnnex B Brochure Vector and ScorpionomarhanandehBelum ada peringkat

- Choosing Your PHD TopicDokumen9 halamanChoosing Your PHD TopicvilaiwanBelum ada peringkat

- Hukbalahap: March 16, 2019 Godwin M. Rarama Readings in The Philippine History Seat No. 35Dokumen2 halamanHukbalahap: March 16, 2019 Godwin M. Rarama Readings in The Philippine History Seat No. 35Godwin RaramaBelum ada peringkat

- SYKES - Telework Work Area AgreementDokumen2 halamanSYKES - Telework Work Area AgreementFritz PrejeanBelum ada peringkat

- Arm Corelink Sse-200 Subsystem: Technical OverviewDokumen29 halamanArm Corelink Sse-200 Subsystem: Technical OverviewStudent of VIT 20MVD0047Belum ada peringkat

- System Description For Use With DESIGO XWORKS 17285 HQ enDokumen48 halamanSystem Description For Use With DESIGO XWORKS 17285 HQ enAnonymous US9AFTR02100% (1)

- FZCODokumen30 halamanFZCOawfBelum ada peringkat

- 001-026 Labor RevDokumen64 halaman001-026 Labor RevDexter GasconBelum ada peringkat

- Renderoc LA55Dokumen2 halamanRenderoc LA55Mansoor AliBelum ada peringkat

- Assignment No. 1: Semester Fall 2021 Data Warehousing - CS614Dokumen3 halamanAssignment No. 1: Semester Fall 2021 Data Warehousing - CS614Hamza Khan AbduhuBelum ada peringkat

- Standards For Pipes and FittingsDokumen11 halamanStandards For Pipes and FittingsMohammed sabatinBelum ada peringkat

- Web Bearing and Buck1ling To BS en 1993Dokumen3 halamanWeb Bearing and Buck1ling To BS en 1993antoninoBelum ada peringkat

- Dilip - SFDC CPQ Architect14 GCDokumen5 halamanDilip - SFDC CPQ Architect14 GCmariareddy17100% (1)

- What Is Aggregate DemandqwertDokumen9 halamanWhat Is Aggregate DemandqwertShahana KhanBelum ada peringkat

- Lets Talk About Food Fun Activities Games Oneonone Activities Pronuncia - 1995Dokumen1 halamanLets Talk About Food Fun Activities Games Oneonone Activities Pronuncia - 1995IAmDanaBelum ada peringkat

- Landini Tractor 7000 Special Parts Catalog 1820423m1Dokumen22 halamanLandini Tractor 7000 Special Parts Catalog 1820423m1katrinaflowers160489rde100% (122)

- Windows XP, Vista, 7, 8, 10 MSDN Download (Untouched)Dokumen5 halamanWindows XP, Vista, 7, 8, 10 MSDN Download (Untouched)Sheen QuintoBelum ada peringkat

- Instruction Manual Series 880 CIU Plus: July 2009 Part No.: 4416.526 Rev. 6Dokumen44 halamanInstruction Manual Series 880 CIU Plus: July 2009 Part No.: 4416.526 Rev. 6nknico100% (1)

- OTP Protocol PharmacistsDokumen14 halamanOTP Protocol PharmacistsericBelum ada peringkat

- Lesson 1 - Basic Concept of DesignDokumen32 halamanLesson 1 - Basic Concept of DesignSithara BandaraBelum ada peringkat

- C28x WorkshopDokumen400 halamanC28x WorkshopMarcio De Andrade VogtBelum ada peringkat