Linear Interpolation ISDA

Diunggah oleh

Ali30180 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

49 tayangan1 halamanHak Cipta

© Attribution Non-Commercial (BY-NC)

Format Tersedia

XLS, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai XLS, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

49 tayangan1 halamanLinear Interpolation ISDA

Diunggah oleh

Ali3018Hak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai XLS, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 1

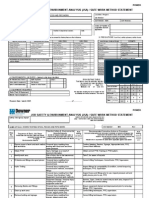

ISDA

This spreadsheet has been developed for educational use only.

Example: Determining an unknown rate using linear interpolation

Enter data in shaded cells

Description Fixing date Maturity Rate Days

1M Libor (R1) 6/27/2007 7/30/2007 5.32000 33

2M Libor (R2) 6/27/2007 8/29/2007 5.34000 63

Payment date 8/14/2007 48

Libor source: British Bankers Association

Given:

Earlier known rate R1 5.32000

Later known rate R2 5.34000

Maturity oI R1 T1 33

Maturity oI R2 T2 63

Maturity oI unknown rate Tn 48

Interpolated rate

Formula 1

SLOPE (R2-R1)/(T2-T1) 0.00067

Rn R1 + SLOPE`(Tn-T1) 5.33000

Formula 2

(Tn - T1) 15

(T2 - Tn) 15

T2-T1 30

Rn ((R1`(T2-Tn))+(R2`(Tn-T1)))/(T2-T1) 5.3300

Both formulas should always give same calculation

lick here Ior market conventions pertaining to BBA Libor

lick here Ior market conventions pertaining to Euribor

lick here Ior Euribor business day conventions

Please address comments on this spreadsheet to:

David Mengle, Head oI Research dmengleisda.org

Note. Dates must be adfusted according to business day conventions

applicable to rate source (see below).

Anda mungkin juga menyukai

- Premium Questions by ISTQB Guru 01Dokumen135 halamanPremium Questions by ISTQB Guru 01Ali3018Belum ada peringkat

- Risk Iea Retd 2011 6Dokumen150 halamanRisk Iea Retd 2011 6Arturo MartinezBelum ada peringkat

- 2012 Erp Practice Exam 1Dokumen44 halaman2012 Erp Practice Exam 1shashinmishra4222Belum ada peringkat

- The Imbalance of Power Wholesale Costs and Retail Prices LOW RES July 2013Dokumen47 halamanThe Imbalance of Power Wholesale Costs and Retail Prices LOW RES July 2013Ali3018Belum ada peringkat

- How Does EMIR Impact My ISDA Master AgreementDokumen56 halamanHow Does EMIR Impact My ISDA Master AgreementAli3018Belum ada peringkat

- OTCDokumen20 halamanOTCLameuneBelum ada peringkat

- The Art of OnboardingDokumen2 halamanThe Art of OnboardingAli3018Belum ada peringkat

- 2010 GARP ERP Sample QuestionsDokumen25 halaman2010 GARP ERP Sample QuestionsBhuvanBelum ada peringkat

- Market Outlook and Npower Strategy 2014-09-25Dokumen12 halamanMarket Outlook and Npower Strategy 2014-09-25Ali3018Belum ada peringkat

- Exam FeesDokumen1 halamanExam FeesAli3018Belum ada peringkat

- TSO - Passing The PRINCE2 Examinations (2005) Historical MaterialDokumen75 halamanTSO - Passing The PRINCE2 Examinations (2005) Historical MaterialAli3018Belum ada peringkat

- PRINCE2 Quick GuideDokumen11 halamanPRINCE2 Quick GuideMaven TrainingBelum ada peringkat

- BH0 013 PDFDokumen7 halamanBH0 013 PDFAli3018Belum ada peringkat

- Tesco Mag VouchersDokumen136 halamanTesco Mag VouchersAli3018Belum ada peringkat

- PRINCE2 Quick GuideDokumen11 halamanPRINCE2 Quick GuideMaven TrainingBelum ada peringkat

- FRM Reference Material PDFDokumen16 halamanFRM Reference Material PDFDruthi KolaBelum ada peringkat

- The Adventures of Huckleberry Finn by Mark TwainDokumen289 halamanThe Adventures of Huckleberry Finn by Mark TwainBooks100% (5)

- JPMorgan Guide To Credit DerivativesDokumen88 halamanJPMorgan Guide To Credit Derivativesl_lidiyaBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5782)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Trimble S8 User Guide 57352002 Ver6Dokumen173 halamanTrimble S8 User Guide 57352002 Ver6Helton AmorimBelum ada peringkat

- 330B Excavators Hydraulic Systems: 3YR1-UP 5LR1-UP 4RS1-UP 5LS1-UPDokumen2 halaman330B Excavators Hydraulic Systems: 3YR1-UP 5LR1-UP 4RS1-UP 5LS1-UPJim LiebBelum ada peringkat

- Ecommerce Opportunity Tracking SheetDokumen6 halamanEcommerce Opportunity Tracking SheetdeepakBelum ada peringkat

- Difference Between API 650 & API 620Dokumen5 halamanDifference Between API 650 & API 620job saputraBelum ada peringkat

- Process Safety KPIsDokumen2 halamanProcess Safety KPIssheerazali100% (1)

- 23 00924 PPP-ACKAPP - Application Acknowledgement-1633942Dokumen4 halaman23 00924 PPP-ACKAPP - Application Acknowledgement-1633942guz.ewaBelum ada peringkat

- JSA M36 Hydro Testing Spool Pieces & PipeworkDokumen4 halamanJSA M36 Hydro Testing Spool Pieces & PipeworkMianBelum ada peringkat

- Greisinger OXY 3690 MP User ManualDokumen4 halamanGreisinger OXY 3690 MP User ManualesatpehlivanBelum ada peringkat

- Quality Assurance & Testing of Powder Coatings: by Chuck Danick Mcwhorter Technologies. Presented atDokumen27 halamanQuality Assurance & Testing of Powder Coatings: by Chuck Danick Mcwhorter Technologies. Presented atСтанислав Подольский100% (1)

- A Self-Biased Mixer in CMOS For An Ultra-Wideband ReceiverDokumen9 halamanA Self-Biased Mixer in CMOS For An Ultra-Wideband ReceiverwwwBelum ada peringkat

- Literature Review Loughborough UniversityDokumen8 halamanLiterature Review Loughborough Universityxbvtmpwgf100% (1)

- Salam and Istisna: From Current Issues To An Ideal Model For Islamic Banks in PakistanDokumen14 halamanSalam and Istisna: From Current Issues To An Ideal Model For Islamic Banks in PakistanMr BalochBelum ada peringkat

- Biotech Companies in IndiaDokumen4 halamanBiotech Companies in IndiaBusinessBelum ada peringkat

- 13th International Conference on Heat Transfer, Fluid Mechanics and Thermodynamics AerodynamicsDokumen6 halaman13th International Conference on Heat Transfer, Fluid Mechanics and Thermodynamics AerodynamicsLeo LonardelliBelum ada peringkat

- Cobb Douglas Utility Function QuestionsDokumen6 halamanCobb Douglas Utility Function Questionshuda.rauf781Belum ada peringkat

- MIESDokumen4 halamanMIESSumit YadavBelum ada peringkat

- SEO StrategyDokumen10 halamanSEO StrategyLuanaBelum ada peringkat

- Managing Human Resources Snell 16th Edition Solutions ManualDokumen19 halamanManaging Human Resources Snell 16th Edition Solutions ManualJohnDixoneitz100% (39)

- Kinetika Kimia: Bambang WidionoDokumen77 halamanKinetika Kimia: Bambang WidionoFardaawBelum ada peringkat

- (17CS82) 8 Semester CSE: Big Data AnalyticsDokumen169 halaman(17CS82) 8 Semester CSE: Big Data AnalyticsPrakash GBelum ada peringkat

- Cashpor ReportDokumen91 halamanCashpor ReportAnand Gautam100% (1)

- Samr ModelDokumen23 halamanSamr ModelRenita Eclar LaranangBelum ada peringkat

- Residual Stress Modeling in Electric Discharge Machining (EDM) byDokumen4 halamanResidual Stress Modeling in Electric Discharge Machining (EDM) byhasib_07Belum ada peringkat

- Stelara Jjpaf ApplicationDokumen5 halamanStelara Jjpaf ApplicationjayBelum ada peringkat

- Field Modules: Specifications DescriptionDokumen2 halamanField Modules: Specifications DescriptionjorgemalagaBelum ada peringkat

- Cplus Steepds CPPDokumen3 halamanCplus Steepds CPPshyamBelum ada peringkat

- A300 600Dokumen2 halamanA300 600NadeemBelum ada peringkat

- Sri Venkateshwara College of EngineeringDokumen3 halamanSri Venkateshwara College of EngineeringpavanBelum ada peringkat

- ETS12-01-02 - 12-24KV Limiting Fuse Link For SwicthgearDokumen13 halamanETS12-01-02 - 12-24KV Limiting Fuse Link For SwicthgearTerex14253Belum ada peringkat

- 5 PracticeDokumen12 halaman5 PracticeAyush DhamijaBelum ada peringkat