C.A IPCC Capital Budgeting

Diunggah oleh

Akash GuptaDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

C.A IPCC Capital Budgeting

Diunggah oleh

Akash GuptaHak Cipta:

Format Tersedia

Tax Shield Education Centre

MAFA-1

CAPITAL BUDGETING CAPITAL BUDGETING PROCESS Capital budgeting is a complex process which may be divided into the following phases : Identification of potential investment opportunities Assembling of proposed investments Decision making Preparation of capital budget and appropriations Implementation Performance review

Identification of Potential Investment Opportunities The capital budgeting process begins with the identification of potential investment opportunities. Typically, the planning body (it may be an individual or a committee organised formally or information) develops estimates of future sales which serve as the basis for setting production targets. This information, in helpful in identifying required investments in plant and equipment. For imaginative identification of investment ideas it is helpful to (i) monitor external environment regularly to scout investment opportunities, (ii) formulate a well defined corporate strategy based on a thorough analysis of strengths, weakness, opportunities, and threats, (iii) share corporate strategy and perspectives with persons who are involved in the process of capital budgeting, and 9iv) motivate employees to make suggestions. Assembling of Investment Proposals Investment proposals identified by the production department and other departments are usually submitted in a standardised capital investment proposal form. Generally, most of the proposals, before they reach the capital budgeting committee or some body which assembles them, are routed through several persons. The purpose of routing a proposal through several persons is primarily to ensure that the proposal is viewed from different angles. It also helps in creating a climate for bringing about co-ordination of interrelated activities. Investment proposals are usually classified into various categories for facilitating decision-making, budgeting, and control. An illustrative classification is given below. 1. Replacement investments 2. Expansion investments 3. New product investments 4. Obligatory and welfare investments Decision Making A system of rupee gateways usually characterises capital investment decision making . Under this system, executives are vested with the power to okay investment proposals up to certain limits. For example, in one company the plant superintendent can okay investment outlays up to Rs.200,000, the works manager up to Rs.500,000, and the managing director up to Rs.2,000,000. Investment requiring higher outlays need the approval of the board of directors. Preparation of Capital Budget and Appropriations Projects involving smaller outlays and which can be decided by executives at lower levels are often covered by a blanket appropriation for expeditious action. Projects involving larger outlays are included in the capital budget after necessary approvals. Before undertaking such projects an appropriation order is usually required. The purpose of this

Tax Shield Education Centre

MAFA-2

check is mainly to ensure that the funds position of the firm is satisfactory at the time of implementation. Further, it provides an opportunity to review the project at the time of implementation. Implementation Translating an investment proposal into a concrete project is a complex, time-consuming, and risk-fraught task. Delays in implementation, which are common, can lead to substantial cost-overruns. For expeditious implementation at a reasonable cost, the following are helpful. 1. Adequate formulation of projects The major reason for delay is inadequate formulation of projects. Put differently, if necessary homework in terms of preliminary studies and comprehensive and detailed formulation of the project is not done, many surprises and shocks are likely to spring on the way. Hence the need for adequate formulation of the project cannot be over-emphasised. Use of the principle of responsibility accounting Assigning specific responsibilities to project managers for completing the project within the defined time-frame and cost limits is helpful for expeditious execution and cost control. Use of network techniques For project planning and control several network techniques like PERT (Programme Evaluation Review Technique) and CPM (Critical path Method) are available. With the help of these techniques, monitoring becomes easier.

2.

3.

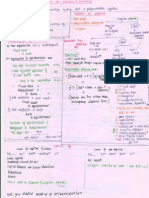

Performance Review Performance review, or post-completion audit, is a feedback device. It is a means for comparing actual performance with projected performance. It may be conducted, most appropriately, when the operations of the project have stabilised. It is useful in several ways : (i) it throws light on how realistic were the assumptions underlying the project; (ii) it provides a documented log of experience that is highly valuable for decision-making; (iii) it helps in uncovering judgmental biases; and 9iv) it induces a desired caution project sponsors. Some Important Conceptions Cash Flow Movement of cash during the project period. Cash flows are of two types 1. (a) Capital nature (b) Revenue nature. In general discussion, investment in fixed asset and working capital are known as cash outflow. Investment on a project is not a matter of one day. However for simplicity purpose, it is assumed that the total investment is made at the starting of the project i.e. the day when commercial production starts. Cash outflow of revenue nature are adjusted with the revenue cash inflows. Cash inflow = Profit After Tax ( PAT) + Depreciation. Calculation of cash inflow PBDT less: Depreciation PBT less: Tax @ -- % PAT Add: Depreciation Cash Inflow Cash outflow

2.

Rs.

NOTE :: Depreciation is a non-cash item. Depreciation is a deduction from profit, it will save certain amount of cash outflow through savings of tax. This savings in tax payment is denoted as tax shield. If there is no tax rate given in the problem do not charge depreciation in the calculation of cash Inflow, rather Cash-Inflow = PBDT. 3. Cash inflow at the end of the project :

Tax Shield Education Centre

MAFA-3

(i)Working capital will be recovered in full (unless otherwise stated in the problem) and hence it is cash inflow at the end of the project. (ii) (a) Sale of machinery at the end of the project

If the asset is fully depreciated, then sales value is the cash inflow or scrap value is the cash inflow. But if the sale value is more than the scrap value or book value, then there will be profit of short term mature and tax will be paid on that item. Therefore cash in flow = sale proceeds tax on profit. (b)If the asset is sold in an earlier year & sale proceed is less than book value, then the difference will be treated as loss on sale of asset. This loss can be set off against business income (from same or different project of the company) to produce tax shield i.e. cash inflow in terms of opportunity gain. (iii) Selling of the old asset at the beginning of the project:

(a)

If block of asset concept is not applied then pay tax on profit or losses in 1st year , But only sale proceeds of old assets is the cash inflow of the 0th year and utilised for the purpose of reducing the cash outflow in the 0th year. Tax on the profit is paid in the next year. (b) If block of assets concept is applied Depreciation is calculated on remaining value of assets No tax will be paid on profit or loss of on sale of fixed assets. However, the effect of such will be realised through difference in depreciation from coming years. 4. Choice of cut-off rates & Discounted cash - flow : Cost of rate given Loan investment No cash outflow In 0th year

Cut off not given Cash outflow in 0th year as interest Rate = cut off rate. is not a part of PBT i.e. PBT i.e. PBIT = PBT is not considered Cash outflow.

Interest on loan

is a part of PBT i.e. PBT = PBIT I Cash out-flow at the Year of payment

Loan repayment

5. Working Capital (WC) : Investment in WC is cash outflow this is generally made at the beginning of the project . If subsequent increase in WC is required during the project life then it will be considered as cash outflow of the year of impact. We know, WC = Stock + Debtors + Cash + Bank Sundry Creditors If the change in element of WC are specifically mentioned in the problems then corresponding cash inflow and outflow following their changes are to be noted for the purpose of NPV & DCF calculations Different techniques The Capital Budgeting techniques are : 1. When Cash flows are certain A. Traditional Approach. B. Time Value of Money Approach (TVM) or Discounted cash Flow Technique ( DCF ). 2. When Cash flows are un-certain :

Tax Shield Education Centre A. GENERAL TECHNIQUE B. Quantitatives Techniques . 1(A). Traditional Approach : (1) Pay Back Period Method (a) When cash inflows are uniform throughout the project lifePay Back Period = Original Investment Cash Inflow p.a. Lower the Pay Back period higher the acceptability.

MAFA-4

(b) When cash Inflows are not uniform through out the project life: Apply the method of simple interpolation for pay back period calculation . REQUIRED TIME - LOWER LIMIT = REQUIRED INVESTMENT - LOWER LIMIT UPPER LIMIT - LOWER LIMIT UPPER LIMIT - LOWER LIMIT (2) Average rate of return ( ARR): ARR = Average PAT Average Investment NOTE : Sometimes , ARR = Average PAT / INVESTMENT ( PAT + DEPRECIATION + INTEREST ) DEBT REPAID + INTEREST on debt repaid

(3) Debt service coverage ratio (DSCR) =

(4) Pay Back reciprocal : amount of cash in-flow after the investment is over. (B) DISCOUNTED CASH FLOW TECHNIQUE : 1. NET PRESENT VALUE METHOD ( NPV ) 2. INTERNAL RATE OF RETURN ( IRR ) 3. PROFITABILITY INDEX ( PI ) 4. TERMINAL VALUE METHOD ( TVM ) 5. DISCOUNTED PAY BACK 6. DISCOUNTED PAY BACK PROFITABILITY DERIVATIONA OF ANNUITY FORMULA Future value of an annuity : Present value of an annuity : Present value of a perpetuity : A A (1 + k)n 1 k (1 + k)n 1 k (1 + k)n

A. k The derivations of these formulae are discussed below. Future Value of an Annuity The future value of an annuity is : FVn = A(1 + k)n-1 + A(1 + k)n-2 + + A(1 + k) + A Multiplying both the sides of Eq. (4A.1) by (1 + k) gives : FVAn (1 + k) = A(1 + k)n + A(1 + k)n-1 + + A(1 + k)2 + A(1 + k) Subtracting Eq. (4A.1) from Eq. (4A.2) yields :

Tax Shield Education Centre FVAn k = A [(1 + k)n 1 ] Dividing both the sides of Eq. (4A.3) by k yields : FVAn = A Present Value of an Annuity The present value of an annuity is : PVAn = A(1 + k) -1 + A(1 + k)-2 + + A(1 + k) n Multiplying both the sides of Eq. (4A.5) by (1 + k) gives : PVAn (1 + k) = A + A(1 + k) 1 + + A(1 + k) n+1 Subtracting Eq. (4A.5) from Eq. (4A.6) yields : PVAnk = A [1 (1 + k) n] = A Dividing both the sides of Eq. (4A.7) by k results in : PVAn = A Present Value of a perpetuity (1 + k)n 1 k(1 + k)n (1 + k)n 1 (1 + k)n (1 + k)n 1 k

MAFA-5

A perpetuity is an annuity of an infinite duration. Hence the present value of a perpetuity is expressed as : PVA: = A(1 + k) 1 + A(1 + k) 2 + + A(1 + k) Multiplying both the sides of Eq. (4A.9) by (1 + k) gives : PVA: (1 + k) = A + A(1 + k) 1 + + A(1 + k) Subtracting Eq. (4A.9) from Eq. (4A.10) yields : : PVA: k = A [ 1 (1 + k) - ] As (1 + k) : : +1 : +1

+ A(1 + k) -

This means :

0, Eq. (4A.1) becomes : PVA: k = A

PVA: = A . K Equation (4A.13) implies that the present value of a perpetuity of Re.1 is simply :

1. k

CONTINUOUS COMPOUNDING AND DISCOUNTING Continuous Compounding In Chapter 4, the following relationship was established for a case where compounding occurred m times a year. r = 1+ k. m where r = effective rate of interest

m

-1

Tax Shield Education Centre k m = = nominal rate of interest frequency with which compounding is done in a year

MAFA-6

Equation may be expressed as r = 1+ k .

m/k k

-1 m/k

Putting x = m/k in Eq. (4B.2), we get r = 1+ 1 . x

x k

-1

In continuous compounding m : . This means x : Lim

X:

in Eq.

1+1. x

= e = 2.71828

So from Eq. we get r = ek 1 This leads to (1 + r) = ek Thus, the equation for future value, when continuous compounding is done, is a follows : FVn = PV x ekn To illustrate, the future value of Rs.50,000 deposited today for 5 years at 8 percent, compounded continuously, is equal to : FV5 = = = Rs.50,000 (2.71828) .08x5 Rs.50,000 (1.49182) Rs.74,591

Continuous Discounting Employing the about reasoning the present value of a future sum, when continuous discounting is done, is given by the following formula : PV = where PV FVn k = = = FVn x e kn

present value of a future sum future sum at the end of n years nominal discount rate

To illustrate, the present value of a future sum of Rs.50,000 receivable after 7 years, when discounting is done at 12 percent on a continuous basis, is equal to PV = = = Methods under DCF Technique : (1) Net Present Value Method : (NPV) = Total Discounted cash Inflow - Total Discounted Cash outflow Rs.50,000 x 2.71828 12x7 Rs.50,000 x .431711 Rs.21,585.55

Tax Shield Education Centre Comment :Higher the NPV higher the acceptability.

MAFA-7

(2) Internal Rate of Return : (IRR) It is that rate of return where total discounted cash in-flow = total discounted cash outflow . Select two rates of return where NPVs of the project is just positive & just negative , then apply method of interpolation . (3) Terminal Value Method : Here future cash inflows are reinvested in such a way , that it is compounded and received on the closing date of the project. So all the cash inflows occur at the and of the project life. Then this total amount is discounted with the desired rate of return for a proper comparison with its O th year investments. (4) Profitability Index : (PI) = Total Discounted cash Inflow Total Discounted Cash Outflow NOTE : In problems where decisions are different following different methods, then select that project according to the following priority list : (i) Profitability index (ii) NPV (iii) IRR NOTE :P.I. = DCIF DCOF Again , NPV = DCIF DCOF Or, DCIF = NPV + DCOF Or, NPV = (PI 1) x DCOF (5) DISCOUNTED PAY BACK = TOTAL DISCOUNTED CASH OUT-FLOW DISCOUNTED CASH IN-FLOW p.a. If discounted cash inflows are not uniform , apply method of simple interpolation . (6) Discounted Pay Back Profitability = DISCOUNTED CASH INFLOW AFTER PAY-BACK PERIOD RISK Analysis in Capital Budgeting In our previous discussion, we assumed, for the sale of expository convenience, that all investments had equal risk and the average cost of capital for the firm could be used for evaluating investment proposals. Investment proposals, however, differ in risk. An investment proposal to manufacture a new product, for example, is likely to be more risky than one involving replacement of anexisting plant. In view of such differences, variations in risk need to be considered in capital investment appraisal. To underscore this point, let us consider an example. Suppose you have a choice between two alternatives, A and B : Possible Outcome A B Rs.8,000 Rs.0 Rs.4,000 Probability 0.5 0.5 1

Which would you choose ? If you are a typical decision maker you would choose B. Why ? While the expected gain of both A and B is the same,1 As outcome is highly variable, whereas Bs outcome is certain. You choose B because risk (variability) matters per se. This chapter, concerned with risk analysis of capital investments, one of the most complex, controversial, and slippery areas in finance, is divided into six sections. The first section describes various measures used to denote risk; the second explains the method of mathematical analysis for assessing risk; the third presents the technique of sensitivity analysis used popularly to guage the riskless of investment projects; the fourth discusses the method of monte carlo simulation for analysing the risk of investment projects; the fifth dwells on various approaches to selection of projects, given information about their return and risk characteristics; finally, the sixth describes risk analysis in practice. MEASURES OF RISK Risk refers to variability, of which there are several measures. The important ones are : Range

Tax Shield Education Centre Mean absolute deviation Standard deviation Coefficient of variation Semi-variance

MAFA-8

The various measures of risk are defined below :

Measure Range Mean absolute deviation Standard deviation Coefficient of variation Semi-variance

Where Rb RI Pi Ri 2 (Ri - 2 ) = = = = = = =

Definiton Rg = Rb R1 MAD = pi I Rt - 2 I = [ pi(Rt - 2 )] CV = / 2 SV = pi (Rt - 2 )2 (9.1) (9.2) (9.3) (9.4) (9.5)

highest value of the distribution Lowest value of the distribution probability associated with the ith possible value ith possible value of the variable arithmetic mean (Ri - 2 ) when Ri < 2 when Ri > 2

Out of the above measures of risk, the standard deviation is most commonly used in financial analysis. We shall also look at the standard deviation in our subsequent discussion. Use of Subjective Probabilities For measuring the expected value and dispersion of a variable, its probability distribution is required. In some cases the probability distribution can be defined with a fairly high degree of objectivity on the basis of past evidence. A wildcatter, for example, may be able to define with a high degree of objectivity, the probabilities associated with certain states of nature if sufficient records for similar ventures are available. Since such a probability distribution is substantially based on objective facts, it may be referred to as an objective probability distribution. However, in most of the real life situations, such objective evidence may not be available for defining probability distributions. In such cases knowledge persons may pool their experience and judgement to define the probability distributions. Since there is likely to be a high element of subjectivity in these distributions, such distributions are generally referred to as subjective probability distributions. ANALYTICAL DERIVATION OR SIMPLE ESTIMATION Under certain circumstances, the expected net present value and the standard deviation of net present value may be obtained through analytical derivation or simple estimation. Three cases of such analysis are discussed here : (i) no correlation among cash flows, (ii) perfect correlation among cash flows, and (iii) moderate correlation among cash flows. Uncorrelated Cash Flows When the cash flows of different years are uncorrelated, the cash flow for year t is independent of the cash for year t r. Put differently, there is no relationship between cash flows from one period to another. In this case the expected net present value and the standard deviation of net present value are defined as follows :

n

Tax Shield Education Centre NPV =

t=1

MAFA-9 t (1 + i)t

n t=1

. I

where NPV t i I (NPV) t

= = = = = =

2t . 2t (1 + i) expected net present value expected cash flow for year t risk-free interest rate initial outlay standard deviation of net present value standard deviation of the cash flow for year t

(NPV) =

In the above formulae, it may be noted, the discount rate is the risk-free interest rate because we try to separate the time value of money and the risk factor. The risk of the project, reflected in (NPV), is considered in conjunction with NPV computed with the risk-free discount rate. If NPV is computed using a risk-adjusted discount rate and then if this is viewed along with (NPV), the risk factor would be double counted. Example A project involving an outlay of Rs.10,000 has the following benefits associated with it :

Year 1 . Net cash flow flow Probability Rs.3000 0.3

Year 2 Probability Net cash flow 0.2 Probability Rs.3000

Year 3 Net cash 0.3

Rs.20,000

Perfectly Correlated Cash Flows If cash flows are perfectly correlated, the behaviors of cash flows in all periods is alike. This means that if the actual cash flow in one year is standard deviations to the left of its expected value, cash flows in other years will also be standard deviations to the left of their respective expected values. Put in other words, cash flows of all years are linearly related to one another. The expected value and the standard deviation of net present value, when cash flows are perfectly correlated, are as follows :

NPV =

t=1

t . 1 (1 + i)t

n

(NPV) =

t=1

t . 1 (1 + i)t

Example An investment project involves a current outlay of Rs.10,000. The mean and standard deviation of cash flows, which are perfectly correlated, are as follows :

Year 1 2 3 4

t Rs.5,000 3,000 4,000 3,000

t 1,500 1,000 2,000 1,200

Calculate NPV and (NPV), assuming a risk-free interest rate of 6 percent.

Tax Shield Education Centre Moderately Correlated Cash Flows

MAFA-10

When the cash flows are moderately correlated and hence do not conform to the two patterns independence and perfect correlation described above, simple and convenient formulae cannot be used for assessing and risk. Moderately correlated cash flows may be evaluated with the help of a series of conditional probability distributions. To illustrate this approach, let us consider a project which involves an outlay of Rs.100,000. The cash inflows expected to be generated by the project are shown in Table 9.1. From this table we find that there are eight possible cash slows streams. The first cash flow stream consists of Rs.30,000 in year 1, Rs.30,000 possible cash flow streams. The first cash flow

Conditional Probability Distribution Approach

Year 1 Net Joint Cash Flow Initial Net

Year 2 Conditional probability P(2/1) 35,000 40,000 45,000 flow 0.6 0.4 0.5 Net

Year 3 Conditional Cash cash probability flow

probability cash probability P(1) flow P(1,2,3) 30,000 40,000 0.8 0.2

P(3/2,1) stream 1 2 3 0.24 0.16 0.05

30,000

stream consists of Rs.30,000 in year 1, Rs.30,000 in year 2, and Rs.35,000 in year 3, the second cash flow stream consists of Rs.30,000 in year 1, Rs.30,000 in year 2, and Rs.40,000 in year3, so on and so forth. The probabilities associated with these cash flow streams are given in the last column of the exhibit. It may be noted that the probability with which a cash flow stream occurs is simply the joint probability of the individual elements in that cash flow stream. The probability of the first cash flow stream, for example, is1 P (Rs.30,000 in year 1) x P (Rs.30,000 in year 2/Given Rs.30,000 in year 1) x P (Rs.35,000 in year 3/Given Rs.30,000 in year 1 and Rs.30,000 in year 2) = (0.5) (0.8) (0.6) = 0.24 The probability distribution of the net present value of this project, given a risk-free interest rate of 6 percent, is shown in Table 9.2. From this probability distribution we find that : NPV = Rs.21,186 (NPV) = Rs.33,647 Standardising the Distribution Knowledge of NPV and (NPV) is very useful for evaluating the risk characteristics of a project. If the NPV of a project is approximately normally distributed, we can calculate the probability of NPV being less than or more than a certain specified value. This probability is obtained by finding the area under the probability distribution curve to the left or right of the specified value. Suppose the probability distribution of NPV is as shown in Fig. 9.1. if we want to calculate the probability of NVP being less than a specified value, say 0, we have to obtain the area under the probability distribution curve to the left of 0 this is indicated by the shaded region on the left. If we are interested in finding the probability that NPV exceeds a certain value, say Rs.2 mln, we calculate the area under the probability curve to the right of Rs.2 mln this area is shown as the shaded region on the right. How can we calculate the area to the left or right of a specified ? To calculate the area to the left or right of a specified point, we use the following procedure.

0.5

Step 1 : Standardise the difference between the specified point and NPV. To do this the difference between the specified point and NPV is divided by (NPV). The standardised difference may be referred to as Z. The purpose of

Tax Shield Education Centre

MAFA-11

standardisation is to transform the actual distribution of NPV into a standard normal distribution. The standard normal distribution has a mean of 0 and standard deviation of 1. Figure 9.2 shows the standard normal distribution and Table 9.3 gives cumulative probability. Step 2 : Refer to the standard normal distribution table and find the probability to the left (or right depending on our interest) of the Z value obtained in step 1. To illustrate the above procedure suppose that a projects NPV and (NPV) are Rs.96,000 and Rs.60,000 respectively and we want to find the probability that BPV will be less than 0. This may be done as follows. Step 1 : The standardised difference between specified point (NPV = 0) and NPV = Rs.96,000 is : 0 96,0000 = 1.6 60,000 Step 2 : The cumulative probability up to Z = 1.6 as seen from the standard normal distribution given in Table 21.3 is .055. This means that there is a 5.5 percent change that NPV will be equal to or less than 0.

Cumulative probability up to Z for Standard Normal Distribution

Z -3.0 -2.8 -2.6 -2.4 -2.2 -2.0 -1.8 -1.6 -1.4 -1.2 -1.0 -0.8 -0.6 -0.4 -0.0

SENSITIVITY ANALYSIS

Cumulative probability 0.001 0.003 0.005 0.008 0.014 0.023 0.036 0.055 0.081 0.115 0.159 0.212 0.274 0.345 0.500

Z 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 2.0 2.2 2.4 2.6 2.8

Cumulative probabbility 0.579 0.655 0.726 0.788 0.841 0.885 0.919 0.945 0.964 0.977 0.986 0.992 0.995 0.997

Sensitivity analysis, sometimes called what if analysis, answers questions like : What will happen to net present value (or some other criterion of merit) if sales are only 50,000 units rather than the expected 75,000 units ? What will happen to net present value if the economic life of the project is only five years, rather than the expected eight years ?

Procedure Fairly simple, sensitivity analysis consists of the following steps : 1. Set up the relationship between the basic underlying factors (like the quantity sold, unit selling price, life of the project, etc.) and net present value (or some other criterion of merit).

Tax Shield Education Centre 2. 3.

MAFA-12

Estimate the range of variation and the most likely value of each of the basic underlying factors. Study the effect on net present value of variations in the basic variables. (Typically one factor is varied at a time).

Illustration Anischit Enterprises is analysing an investment proposal. The following net present value relationship has been set up :

n

NPV = where NPV Q P V F D T k n S I = = = = = = = = = = =

t=1

[ Q(P V) F D] (1 T) + D + S -1 (1 + k)t (1 + n)n

net present value of the project number of units sold annually selling price per unit variable cost per unit total fixed costs, excluding depreciation and interest annual depreciation charge income tax rate cost of capital project life in years net salvage value initial cost

The range and most likely value of each of the basic variables are given in Table 9.4.

Range and Most Likely Value of Basic Variables

Variable value Q P V F D T k

Range 1,000 2,000 Rs.600 Rs.1,000 Rs.300 Rs.500 Rs.120,000 Rs.120,000 Rs.160,000 Rs.160,000 0.60 0.60 0.08 0.11

Most 1,600 Rs.750 Rs.400 Rs.120,000 Rs.160,000 0.60 0.10

Likely

Given the range and most likely value of basic variables, we can study the impact of variation in each variable on net present value, holding other variables constant at their most likely levels. To illustrate the nature of this analysis we shall look at the relationship between (i) k and NPV, and (iii) P and NPV. k and NPV The relationship between k and NPV given the most likely values of other variables is :

n

NPV =

t=1

[1,600(750 400) 120,000 160,000] (1 0.6) + 160,000 (1 + k)t

+ 400,000 - 1,200,000 (1 + k)5

n

t=1

272,000 + 400,000 - 1,200,000 (1 + k)t (1 + k)5

The net present value for various values of k is shown below. The same relationship is shown graphically as below

Tax Shield Education Centre

MAFA-13

k 11%

8%

9%

10%

Relationship between k and NPV P and NPV The relationship between P and NPV, given the most likely values of other factors, is :

t=1

NPV =

[1,600(P 400) 120,000 160,000] (1 0.6) + 160,000 (1.10)t

+ 400,000 - 1,200,000 (1.10)5

n 5

t=1

640 P - 208,00 + 400,00 1,200,000 (1.10)t t = 1 (1.10)t (1.10)5

The net present value for various values of P is shown below.

P NPV

600 -Rs.284,384

700

750 79,552

800

900

1,000

-41,760

200,864 443,488

The same relationship is shown graphically as below

Tax Shield Education Centre

MAFA-14

Relationship between P and NPV A useful way of presenting the results of sensitivity analysis is to show how net present value behaves for different percentages of unfavourable changes (from their most likely values) in the basic variables. The behaviour of net present value when there is 5 percent, 10 percent, 15 percent, and 20 percent unfavourable change in k, other factors remaining unchanged at their most likely levels, is shown as follows : Percentage unfavourable variation 5 10 15 20 Value of k 10.5 11.0 11.5 12.0 Net present value 60,418 42,700 24,681 7.575

The behaviour of net present value when there is 5 percent, 10 percent, 15 percent, and 20 percent unfavourable variation in P is shown as follows : Percentage unfavourable variation 5 10 15 20 Value of P 713 675 638 600 Net present value (10,308) (102,500) (192,267) (284,384)

Figure 9.5 shows graphically the behaviour of net present value for various unfavourable percentage variations of k and P. Such a visual presentation is helpful in identifying variables which are crucial for the success of the project. Evaluation Sensitivity analysis, a popular method for assessing risk, has certain merits : It forces management to identify the underlying variables and their interrelationships. It shows how robust or vulnerable a project is to changes in the underlying variables. It indicates the need for further work. If the net present value or internal rate of return is highest sensitive to changes in some variable, it is desirable to gather further information about that variable. Sensitivity analysis, however, suffers from severe limitations : It may fail to provide leads if sensitivity analysis merely presents a complicated set of switching values it may not shed light on the risk characteristics of the project. The study of the impact of variation in one factor at a time, holding other factors constant, may not be very meaningful when the underlying factors are likely to be interrelated. What sense does it make to consider the effect of variation in price while holding quantity (which is likely to be closely related to price) unchanged ? SIMULATION ANALYSIS Sensitivity analysis indicates the sensitivity of the criterion of merit (NPV, IRR, or any other) to variations in basic factors and provides information of the following type : If the quantity produced and sold decreases by 1 percent, other things being equal, the NPV falls by 6 percent. Such information, though useful, may not be adequate for decision making. The decision maker would also like to know the likelihood of such occurrences. This information can be generated by simulation analysis which may e used for developing the probability profile of a criterion of merit by random combining values of variables which have a bearing on the chosen criterion. Procedure The steps involved in simulation analysis are given below :

Tax Shield Education Centre 1.

MAFA-15

2. 3. 4. 5. 6.

Model the project. The model of the project shows how the net present value is related to the parameters and the exogenous variables. (Parameters are input variable specified by the decision maker and held constant over all simulation runs. Exogenous variables are input variables which are stochastic in nature and outside the control of the decision maker.) Specify the values of parameters and the probability distributions of the exogenous variables. Select a value, at random, form the probability distributions of each of the exogenous variables. Determine the net present value corresponding to the randomly generated values of exogenous variables and pre-specified parameter values. repeat steps (3) and (4) a number of times to get a large number of simulated net present values. Plot the frequency distribution of the net present value.

Illustration To illustrate the nature of simulation a simple example is given here. Zenith Chemicals is evaluating an investment project. There is uncertainty associated with two aspects of this project : annual net cash flow and life of the project. The net present value model for the project is :

n

NPV =

t=1

CFt (1 + i)t

(9.11)

In the net present value model embodied in Eq.(9.11), t, the risk-free interest rate, and I, the initial investment, are parameters (i = 10 percent and I = Rs.13,000) whereas CF, and n are stochastic exogenous variables with the following distributions. Annual Cash Flow Project Life

Value Rs.1,000 1,500 2,000 2,500 3,000 3,500 4,000

Prbability 0.02 0.03 0.15 0.15 0.30 0.20 0.15

Value 3 years 4 5 6 7 8 9

Probability 0.05 0.10 0.30 0.25 0.15 0.10 0.03

The firm wants to perform 10 manual simulation runs for this project. To perform the simulation funs, we have to generate values, at random, for the two exogenous variables : annual cash flow and project life. For this purpose, we have to (i) set up the correspondence between the values of exogenous variables and random numbers, and (ii) choose random number generating device. Table 9.5 shows the correspondence between various values of exogenous variables and

Correspondence between Values of Exogenous Variables and two Digit Random Numbers

Annual Cash Flow

Value Probability Cumulative probability Two degit random numbers 00 to 01 02 to 04 05 to 19 20 to 34 35 to 64 65 to 84 86 to 99 Value Probability

Project Life

Cumulative probability Two degit random numbers 00 to 04 05 to 14 15 to 44 45 to 69 70 to 84 85 to 94 95 to 97 98 to 99

Rs. 1,000 1,500 2,000 2,500 3,000 3,500 4,000

.02 .03 .15 .15 .30 .20 .15

.02 .05 .20 .35 .65 .85 1.00

Years 3 4 5 6 7 8 9 10

.05 .10 .30 .25 .15 .10 .03 .02

.05 .15 .45 .70 .85 .95 .98 1.00

Tax Shield Education Centre

MAFA-16

two digits random numbers. Table below presents a table of random digits that will be used for obtaining two random numbers.1

Now we are ready for simulation. In order to obtain random numbers from Table 9.6 we may begin anywhere at random in the table and read any pair of adjacent columns (since we are interested in a twodigit random number) and read column-wise or row-wise. For our example , let us use the first two columns of Table 9.6. Starting from the top, we will read down the column. For the first simulation run we need two two-digit random numbers, one for annual cash flow, and the other for project life. These numbers are 53 and 97 and the corresponding values for annual cash flow and project life are Rs.3,000 and 9 years respectively. We go future in this manner. Table 9.7 shows the random numbers so obtained and the results of simulation.

53479 97344 66023 99776 30176 81874 19839 09337 31151

81115 70328 38277 75723 48979 83339 90630 33435 58295

Random Numbers 98036 12217 58116 91964 74523 71118 03172 43112 92153 38416 14988 99937 71863 95053 53869 52769 40823 41330

59526 26240 84892 83086 42436 13213 55532 18801 21093

Simulation Results

Annual Cash Flow Run present Random number value Corresponding value of annual flow 1 53 3,000 2 66 3,500 3 30 2,500 Life Disparity 4 19 2,000 5 In some cases the mutually exclusive alternatives 31 2,500 Random

Project Life Corresponding number project life 97 9 4277 99 10 8506 81 7 (829) 09 4 (7660) 67 varying lives :6distemper painting versus plastic (2112) have value Net of

emulsion painting, re-building a plant versus replacing it. Life disparity may lead to conflict in ranking. To illustrate, consider two projects, P and Q, being evaluated by a firm which has a cost of capital of 12 percent : Initial outlay Cash inflows Year 1 Year 2 Year 3 Project P Rs.200,000 300,000 Project Q Rs.200,000 80,000 80,000 280,000

The NPV, PI, and IRR for projects P and Q are : Initial outlay Present value of Cash inflows Project P Rs.200,000 Rs.267,857 Project Q Rs.200,000 Rs.334,512

Tax Shield Education Centre NPV PI IRR Rs. 67,857 1,339 50% Rs.134,512 1,673 40%

MAFA-17

Which project should be selected when there is a life disparity ? One approach is to compare alternatives on the basis of their equivalent annual benefit (EAB) and select the alternative with the highest EAB of a project is equal to : Net present value x capital recovery factor To illustrate, the EAB of the projects P and Q are calculated below : Net present value Life Capital recovery factor1 (given k = 10%) EAB Project P Rs.67,857 1 year 1.100 Rs.74,643 Project Q Rs.134,512 3 years 0.402 Rs.54,074

While the EAB concept appealing because it expresses the gains from the project in an annualised form and hence renders easy comparison between projects with differing lives, it is based on a certain assumption which is crucial to its validity : It assumes that each investment will be replaced with another investment which will be equally profitable. When this assumption is suspect, we have to compare the two alternatives in a common horizon time-frame using appropriate re-investment rate assumptions. Suppose in our preceding illustration, a re-investment rate of 20 percent is considered reasonable. The NPV* for the two alternatives, using a three year time horizon, is worked out below :

Projet P Terminal value Rs.491,200

Multiple Rates of Return The equation of internal rate of return is :

n t=0

Project Q

Rs.432,000

CFt . = 0 (1 + r)t

where CFt = cash flow at the end of year t r = the internal rate of return Expanding Eq. (10.5) and multiplying every term in it by (1 + r)n we get CF0(1 + r)n + CF1(1 + r) r-1 + + CFn = 0 This is a polynomial expression of the nth degree in (1 + r). If the initial cash flow is an outflow (this means that CF0 is negative) and the subsequent cash flows are inflows (this means that CF1, CF2, CFn are all positive) the polynomial expression has only change in sign. Hence, it has only real root. If the cash flow stream has multiple changes of sign there may be more than one internal rate of return. Consider a project will the following cash flow stream :1

Year 0 1 2

Cash Flow (1,600) 10,000 (10,000)

Tax Shield Education Centre The internal rate of return equation for this cash flow stream is : -16,00 + 10,000 10,000 = 0 (1 = r) (1 + r)2 Multiplying this equation by (1 + r)2, we get 1,600 (1 + r)2 + 10,000 (1 + r) 10,000 = 0

MAFA-18

This equation has two changes in sign. Hence, it has two roots. These are 1.25 and 5.00. The internal rates of return corresponding to these roots are 25 percent and 400 percent. This is illustrated vividly by the net present value profile of the project shown in Fig. 10.1. When the discount rate is 0 percent the net present value is : - 1,600 + 10,000 10,000 (1 + 0) (1 + 0)2 As the discount rate rises, the first term, - 16,000, is unaffected, the second term, 10,000 declines, (1 + r) and the third term, - 10,000, increases. The increase in the term is more rapid than the decline in the ( 1 = r)2 second term. The effect of these changes is to push the net present value upwards. The net present value of the project turns positive when the discount rate exceeds 25 percent. The net present value continues to increase till the discount rate rises to 100 percent. Thereafter the present value of future flows (flows for years 1 and 2) declines in importance in relation to the initial flow of 1,600. As a result of this, the net present value decline. The net present value becomes zero when the discount rate touches 400 percent and turns negative thereafter. In general, if a polynomial of the nth degree has k changes in sign it has k real roots and n k imaginary roots. Since our interest is only in real roots which are > because values of (1 = r) I do not make economic sense, we ask : which of the k earl rooks are > 1 ? Only such roots are of interest to us. It is likely that through there are several changes in sign (and consequently several real roots), there may be only one real root > 1. For example, there is only one real root > 1 for the following cash flow stream through there are two changes in sign :

Illustration

The technique of decision tree analysis may be explained with the help of an illustration. An oil wildcatter, evaluating a particular basin, is considering three alternatives : (i) He may drill. (ii) He may conduct a seismic experiment to find the nature of the underlying soil structure and decide on that basis. (iii) He may nor do anything. If he drills, he is likely to find one of the following oil-bearing states ; dry, wet, or soaking. A dry well hardly yields anything, a wet well provides a moderate quantity of oil, and a soaking well generates a substantial quantity of oil. If he conducts as seismic experiment, he can learn about the underlying soil structure before deciding whether to drill or not. The underlying soil structure, or closed structure. If no structure is discovered the prospects of finding oil are bleak; if open structure is found the prospects of finding oil are fair, and if closed structure is discovered the prospects of finding oil are bright. The decision tree corresponding to this situation is shown in Fig.10.2. Note that as a convention a decision fork is represented by a square and a chance fork by a circle.

Year 0 1 3

Cash Flow Rs. (10,000) 15,000 (2,600)

Tax Shield Education Centre

MAFA-19

The decision tree delineated, the next phase of analysis calls for gathering information about probabilities and monetary values associated with various outcomes in the decision tree. The oil wildcatter reviews his experiences, analyses statistics relating to oil discovers, and consults geological experts. He comes up with the following information : Probabilities for various Oil bearing States probabilities for various oil-bearing states are : If he drills without conducting seismic experiments, the

Oil Bearing State Dry Wet Soaking

Probability .50 .25 .25

Probabilities for Various Soil Structures If he conducts a seismic experiment (which costs Rs.200,000) he is likely to find the following underlying geological structure with probabilities mentioned against them :

Geological Structure No structure (NS) Open structure (OS) Closed structure (CS)

Probability .40 .30 .30

Relationship Between the Underlying Geological Structures and Oil bearing States The relationship between the underlying geological structures and oil-bearing states expressed in terms of joint probabilities is as follows :

Underlying Geological Structure Oil-bearing Marginal State probability Dry Wet No Open structure structure

Closed structure of state

Monetary Values of Outcomes The net present value of cash flows, calculated at 12 percent discount rate, associated with the three states for 5 years (which is the maximum duration of oil drilling) is given below : State Dry Wet Soaking Net Present Value Rs.6 mln Rs.8 mln Rs.24 mln

.32 .04

.15 .10

.03 .11

.50 .25

Figure 10.3 shows the decision tree incorporating information regarding probabilities and monetary values of outcomes discussed above. With this decision tree we evaluate the alternative courses of action as follows : 1. Starting at the right-hand end of the tree, the expected monetary values at chance forks, C1, C3, C4, and C5, which come first as we proceed leftwards, are determined : EMV (C1) = Rs.5.00 mln EMV (C3) = - Rs.1.60 mln EMV (C4) = Rs.3.67 mln EMV (C5) = Rs.15.13 mln

Tax Shield Education Centre 2.

MAFA-20

Given the above expected monetary values, the alternatives at the last stage decision points and their expected monetary values are defined as follows :

Decision Point monetary value D2 D3 D4

3.

Alternatives D12 (Drill) D22 (Do not drill) D31 (Drill) D32 (Do not drill) D41 (Drill)

Expected - Rs.1.6 mln 0 4.67 mln 0 15,13 mln

On the basis of the above information, the alternatives selected at the decision points D2, D3, and D4 are D22 (do not drill), D31 (drill), and D41 (drill), respectively. The values assigned to the decision points D2, D3, and D4 are 0, Rs.4.67 mln, and Rs.15.13 mln, respectively. Proceeding leftward the expected monetary value at chance fork C2 is calculated. Expected monetary value at C2 = .4 x 0 + .3 x 4.67 + .3 x 15.13 = Rs.5.64 mln

4.

5.

Moving leftward the first-stage decision point is reached. The alternatives and their expected monetary values, at this decision point, are :

Alternative D11 (Drill) D12 (Conduct seismic experiments) D13 (Do nothing)

Expected monetary value Rs.5 mln Rs.5.44 mln 0

Looking at the expected monetary values we find that D12 (conduct seismic experiments) is the most desirable alternative at the first-stage decision point. Below shows the decision tree with expected values at change points and decision points. Based on the above evaluation of alternatives, we find that the optimal decision strategy is as follows : Choose D12 (conduct seismic experiments) at decision point D1 and wait for the outcome at chance point C2. If the outcome at C2 is C21 (no structure), then choose D22 (do not drill); if the outcome at C2 is C22 (open structure), then choose D31 (drill); if the outcome at C2 is C23 (closed structure), then choose D41 (drill). Following the above decision strategy, the decision-maker may, depending on the outcome at chance points, traverse paths shown in Table 10.1. The mean and standard deviations of the above distribution are NPV = Rs.5.44 mln, (NPV) = Rs.10.44 mln. 2A . General Techniques: (1) Risk Adjusted discount rate : Calculate NPVs with risk full rate &/or risk less rate , then decide accordingly (2) Certainty equivalent co- efficiant = Risk less cash flow Risky cash flow Here, cash inflows are taken as risk full cash inflowes. So calculate NPV on the basis of risk-less cash inflowes .

Tax Shield Education Centre 2B. QUANTITATIVE TECHNIQUES

MAFA-21

1) SENSITIVITY ANALYSIS for each factor , Sensitivity Index = Net Present Value . x 100 Discounted cash flow of the factor On market basis Sensitivity, market is classified as : Pecemistic , Most likely & Optimistic . Decisions are taken on the nature of the entrepreneurs after calculating NPV under each case. 2) EXPECTED VALUE APPROACH ( E.V . ) When discounting factors are not given EV = Pi Xi When discounting factors are given EV =(Pi Xi x Discounting factor) - Discounted cash outflow 3) STANDARD DEVIATION When discounting factors are not given SD = ( Pi Xi 2 - { Pi Xi }2 ) When discounting factors are given SD = Variance of NPV where variance of NPV = PiXi2 - ( PiXi )2 . - Variance of discounted cash outflow ( 1 + int rate)2n 4) CO- EFFICIENT OF VARIATION = Standard Deviation Mean 100 Accept that project where co - efficient of variation is low . Here, mean defines NPV when discounting factors are given 5 ) DECISION TREE ANALYSIS :: FOLLOW Operation research Hillers Model: Hiller argues that the uncertainty or the risk associated with a capital expenditure proposal is shown by the standard deviation of the expected cash flows. In other words, the more certain a project is lesser would be the deviation of various cash flows from the mean cash flows. Let us take the example of a bank deposit where the rate of interest stipulated is subject to changes according to the Reserve Bank Regulations. It is also known with a fair degree of certainty that even if the rate of interest is revised downwards, the existing deposits will normally be protected. Similarly, it is known that if the rate of interest is revised upwards there is some probability that the existing deposits may also be covered. Now there are at best two or three possible cash flows: the first at the contracted rate of interest, the second at a rate of interest one step higher and third at a rate of interest two steps higher. It is quite obvious that the standard deviation of this proposal would be much lower as compared to the standard deviation of a proposal whereby the same money is invested in a small scale unit exporting garments. In the latter case there are a large number of variables which would affect the cash inflows and therefore, the range of cash inflows would be much larger in numbers resulting in a higher standard deviation. Hillier thus argues that working out the standard deviation of the various ranges of cash flow would be helpful in the process of taking cognisance of uncertainty involved with future projects. Hillier has developed a model to evaluate the various alternative cash flows that may arise from a capital expenditure proposal. He takes into account the mean of present value of the cash flows and the standard deviation of such cash flows, which may be determined with the help of the following formulae: n M = (1 + r) -1 Mi i=0 n 2 = (1 + r) -2I 2 i i=0 Where, Mi is the i-th period. R is the discounting factor and 2 i is the variance of cash flows.

Tax Shield Education Centre Illustration Assume that discount rate is 10 percent and the cash flows are as follows: Period (i) 0 1 2 Mean (Mi) (Rs.) - 16000 1500 1000

MAFA-22

Standard deviation (i) (Rs.) 400 500 600

Note : M I is reached by taking an average of the various probable estimates of cash flows for a particular year. (a) Compute the mean of the present value distribution. (b) Compute the standard deviation of the present value distribution. Hertzs Model Hertz has suggested that simulation technique which is a highly flexible tool of operational research may be used in capital budgeting exercise. He argues that planning problems of a firm are so complex that they cannot be described by a mathematical model. Even if we do so we may make certain inherent assumption because of which the solution is not reliable for practical purposes. Moreover, in most of the solutions due to the uncertainties involved, a satisfactory mathematical model cannot be built. He, therefore suggests that a simulation model may be developed for the investment decision making also. The suggested model for introduction of a new product developed by Hertz is given below: 1. 2. 3. 4. 5. 6. 7. 8. 9. Market size Selling prices Market growth rate Eventual share of market Total investment required (for computing its cost) Useful life of facilities Residual value Operating cost Fixed cost Range 1,00,000 3,40,000 385 575 0 6% 3 17% 7 10 5 13 35 50 370 545 253 375 (Expected value) (1,50,000) (1,50,000) (510) (3%) (9.5) (10) (45) (450) (300)

PROBLEMS: 1. X Ltd. is considering the purchase of a new machine which will carry out some operations at present performed by labour. Two alternative models - A and B - are available for the purpose. From the following information, prepare a profitability statement using pay Back Period and Pay Back Profitability for submission to management : Machine A Machine B Estimated life (years) 5 6 Cost of machine (Rs.) 80,000 1,50,000 Estimated additional costs (Rs.( : Maintenance (per month) 500 750 Indirect materials (p.a.) 2,000 3,000 Supervision (per quarter) 3,000 4,500 Estimated savings in scrap (p.a.) (Rs.) 8,000 12,000 Estimated savings in direct wages per annum: Employees not required 10 15 Wages per employee (Rs.) 7,200 7,200 Depreciation is calculated using straight line method. Taxation may be taken at 50% of profit (net savings). 2. A Company manufacturing agricultural Tractors has a capacity to reduce 6,000 tractors annually. The capital employed in the project as on date is Rs. 20 crores. With increasing cost of production and reducing margins the company is fast narrowing its margin of safety. The return on capital employed fell from 10% in the previous year to 6% in the current year, i.e., the current year profit is Rs. 1.20 crores. The company wants to maintain the original cut off rate of 12% and various possibilities have been examined for this propose.

Tax Shield Education Centre

MAFA-23

The company is at present manufacturing and marketing 6,000 tractors annually though there is imbalance in the plant. The company has the following major production departments with percentage capacity ultisation for the present production : Production Dept. Capacity utilized Machine Shop 75% Assembly Shop 100% Heat treatment Shop 75% Induction hardening 50% The Company operates a single shift of 8 hours per day on an average for 300 days in a year. For technical reason the plant will have to operate on single shift basis only. The two alternatives which have emerged after a detailed study are : (a) To hire out the surplus capacity in the productions shops for which constant demand exists. The following income and expenditure projections are drawn out : Hire charges per hour Incremental cost per hour Rs. Rs. Machine Shop 10,000 2,000 Heat-treatment Shop 7,500 1,500 Induction-hardening 5,000 1,000 (b) To increase the installed capacity to 8,000 tractors by spending Rs. 2 crores on additional machinery for the assembly for the assembly shop. The incremental revenue from the additional sale will be Rs. 5,000 per tractor. The cost of additional finance will be 12% being the cost of existing capital employed. In addition tax benefits on an average will work out to 1% of additional investment. Your are required : (I) To work out the profitability, i.e., average rate of return of the two alternatives and recommend the better alternative, (ii) To comment on the advisability of maintaining an imbalance plant from a long-term point of view. 3. BS ELECTRONICS is considering a proposal to replace one of its machines. In this connection, the following information is available : The existing machine was bought 3 years ago for Rs. 10 lakhs, It was depreciated at 25% p.a., on reducing balance basis. It has remaining life of 5 years, but its maintenance cost is expected to increase by Rs. 50,000 p.a. from the 6th year of its installation. its present realisable value is Rs. 6 lakhs. The new machine costs Rs. 15 lakhs and is subject to the same rate of depreciation. On sale after 5 years, it is expected to net Rs. 9 lakhs. With the new machine, opening costs (excluding depreciation) are expected to decrease by Rs. 1 lakh p.a. In addition, the speed of the new machine would increase productivity on account of which net revenues would increase by Rs. 1.5 lakhs p.a. The tax rate applicable is 40% and the cost of capital 10%. Is the proposal financially viable ? Please advise the firm on the basis of Net Present Value of the proposal. The capital budgeting committee of the board of directors of Khalifa Ltd. is considering the acquisition of a unit of equipment costing Rs. 76,000. Shipping and installation costs are estimated at an additional Rs. 4,000. The equipment is expected to have a useful life of 5 years with a salvage, value of Rs. 5,000 at the end of 5 years. Before considering the effect of depreciation, the annual cash flow returns after income tax from the use of this equipment are estimated at Rs. 20,000. One member of the committee believes that the equipment now in service of this production can be used for another year. A new and improved model is expected in another year that can be acquired at a cost of Rs. 91,000. Shipping and installation costs are also estimated at Rs. 4,000, and the estimated salvage value at the end of the expected 5-year life is Rs. 5,000. Annual cash flow returns after income-tax but before considering the effect of depreciation are estimated at Rs. 23,000. The company has set a minimum rate of return objective of 18%. Depreciation is to be deducted by the sum of the years digits method. The income tax rate is 40%. Does it appear that the equipment should be purchased now, or should the company wait for a year for the new model. use the net present value method and show computations.

4.

5.

SCL Limited, a highly profitable company is engaged in the manufacture of power intensive conductors. As part of its iversification plans, the company proposes to put up a Windmill to generate electricity. The details of the scheme are as follows : (1) (2) Cost of the Windmill Cost of Land Rs. Rs. 300 lakhs 15 lakhs

Tax Shield Education Centre (3) (4) (5) (6) (7) (8) (9)

MAFA-24

Subsidy from State Government to be received at the end of first year of installation Rs. 15 lakhs Cost of electricity will be Rs. 2.25 per unit in year 1. This will increase by Re. 0.25 per unit every year till year 7 . After that it will increase by Re. 0.50 per unit. Maintenance cost will be Rs. 4 lakhs in year 1 and the same will increase by Rs. 2 lakhs every year. Estimated life 10 years with cost of capital 15%. Tax rate 40%. Residual value of Windmill will be nil. However land value will go up to Rs. 60 lakhs, at the end of year 10. Depreciation will be 100% of the cost of the Windmill in year 1 and it will be allowed for tax purposes. As Windmills are expected to work based on wind velocity, the efficiency is expected to be an average 30%. Gross electricity generated at this level will be 25 lakhs units per annum. 4% of this electricity generated will be committed free to the State Electricity Board as per the agreement. From the above information you are required to calculate the net present value.

6.

Elite Builders, a leading construction company have been approached by a Foreign Embassy to build for them a block of six flats to be used as guest houses. As per the terms of contract the Foreign Embassy would provide Elite Builders the plans and the land costing Rs. 25 lakhs. Elite Builders would build the flats at their own cost and lease them out to the Foreign Embassy for 15 years at the end of which the flats will be transferred to the Foreign Embassy for a nominal value of Rs. 8 lakhs. Elite Builders estimates the cost of construction as follows : Area per flat 1,000 sq.ft. Construction cost Rs. 400 per sq. ft. Registration and other costs 2.5% of cost of construction. Elite Builders will also incur Rs. 4 lakhs each in year 14 and 15 towards repairs. Elite builders proposes to charge the lease rentals as follows : Years Rentals 1 to 5 Normal 6 to 10 120% of Normal 11 to 15 150% of Normal Elite Builders present tax rate averages at 35%. The full cost of construction and registration will be written off over 15 years and will be allowed for tax purposes. You are required to calculate the normal lease rental per annum per flat. For your exercise assume : (a) Minimum desired return of 10% (b) Rentals & repairs will arise on the last day of the year.] (c) Construction registration and other costs will be incurred at time O. (d) The relevant discount factors are : A Limited Company is manufacturing a product Hindon with the help of a group of machines having a book value of Rs. 65,000 after deducting depreciation on straight line basis. The company is considering the replacement of these machines by new ones. The new machines would cost Rs. 1,00,000 while the old machines could be sold only for Rs. 45,000. The new machines would have a life of four years. The existing machines could also be kept in operation for four more years provided it would be economical to do so. The scrap values of both the new and old machines would be zero after four years. The current costs per unit of manufacturing Hindon on the existing and new machine would be as under : Existing Machines New Machines Materials Rs. 22.00 Rs. 20.00 Labour (32 hours @ Rs.1.25) 40.00 (16 hrs.@Rs.1.25) 20.00 Overhead(32 hours @ Re.0.60) 19.20 (16 hrs@Rs.1.80)28.80 Total cost 81.20 68.80 Overheads are charged to products on the basis of direct labour hour rate method comprising : Existing Machine New Machine Variable Overhead Re. 0.25 Re. 0.625 Fixed Overhead(including depreciation) 0.35 Rs. 1.175 The present sales of Hindon are 1,000 units per annum @ Rs. 90 each. In the event of new machines being purchased, the output would increase to 1,200 units and selling price would stand reduced to Rs. 80. A Limited requires a minimum rate of return on investment at 20% per annum ( ignore tax) in money terms. materials costs, overhead costs and selling prices will increase at the rate of 15% per annum. Labour costs would increase by 20% per annum. it may be assumed that receipts and payments would accrue at the end of each year. Advise . The Directors of Alpha Cement Works Ltd. have before them the following two schemes of expansion. They request you to ascertain which of the schemes will be more beneficial to the Company in a total period of 14 years. Scheme 1

7.

8.

Tax Shield Education Centre

MAFA-25

By adoption of a device in which the capacity of the plant will be increased to a production of 600 tonnes per day from 400 tonnes (now). The following information is available : Rs. (1) Written down value of a portion of the present plant which will not be required 30,00,000 (2) Estimated scrap value 15,00,000 (3) Cost of new portion of the plant 1,00,00,000 (4) Cost of erection 10,00,000 (5) Estimated life of the plant (i.e., the period in which 95% of the cost can be written off) 15 years of 300 working days (6) Net sale price per ton Rs. 150 (7) Other costs per ton (excluding interest) 120 (8) Interest @ 10% on Rs. 70,00,000 to be borrowed payable in 5 years in equal installments plus interest-the first installment being payable after a year. Scheme II By installing a new plant with a capacity of manufacturing 300 tonnes of cement per day. The following information is available (1) Cost of new plant Rs 2,00,00,000 (2) Cost of erection 35,00,000 (3) Estimated life(i.e. the period during which 95% of the cost can be written off) 20 years of 300 working days (4) Net sale price per tonne Rs. 150 (5) Other costs per tonne (excluding interest) 120 (6) Interest-10% on Rs. 1,80,00,000 payable in 9 years in equal annual installments plus interest-the first installment being payable after a year. 9. A company is setting up a project at cost of Rs. 300 lakhs. It has to decide whether to locate the plant in a Forward Area (FA) or Backward Area (BA). Locating in Backward Area means a cash subsidy of Rs. 15 lakhs from the Central Govt. Besides the taxable profits to the extent of 20% is exempt from tax for 10 years. The project envisages a borrowing of Rs. 200 lakhs in either case. The cost of borrowing will be 12% in Forward Area and 10% in Backward Area. However, the revenue costs are bound to be higher in Backward Area. The borrowings have to be repaid in 4 equal annual installments beginning from the end of the 4th year. With the help of following information and by using DCF techniques, you are required to suggest the proper location for the Project : year Profit (Loss) before Interest and Depreciation Present Value (Rs. in lakhs) Factor FA BA (at 15%) 1 (6.00) (50.00) 0.87 2 34.00 (20.00) 0.76 3 54.00 10.00 0.66 4 74.00 20.00 0.57 5 108.00 45.00 0.50 6 142.00 100.00 0.43 7 156.00 155.00 0.38 8 230.00 190.00 0.33 9 330.00 230.00 0.28 10 430.00 330.00 0.25 The annual depreciation may be taken at Rs. 30 lakhs. Interest on borrowings may be worked out at the respective rates. Average Rte of Tax may be taken as 35%. Also calculate DSCR. 10. A theaters, with some surplus accommodation, proposes to extend its catering facilities to provide light meals to its patrons. The management is prepared to make the initial funds available to cover the capital costs. It requires that these be repaid over a period of five years at a rate of interest of 14% per annum. The capital costs are estimated at Rs. 60,000 for equipment that will have a life of 5 years and no residual value. Running costs of staff etc. will be Rs. 20,000 in the first year, increasing by Rs. 2,000 in each subsequent year. The management proposes to charge Rs. 5,000 per annum for electricity and other expenses and wants a nominal Rs. 2,500 per annum to cover any unforeseen contingencies. Apart from this, the management is not looking for any profit as such from the extension of these facilities because it believes that these will enable more tickets to be sold for the cinema shows at the theaters. It is proposed that costs should be recovered by setting prices for the food at double the direct cost.

Tax Shield Education Centre

MAFA-26

It is not expected that the full sales level will be reached until year 3. The proportion of that level reached in year 1 and 2 are 35% and 65% respectively. You are required to calculate the sales that need to be achieved in each of the five years to meet the managements targets. Ignore inflation and taxation. 11. Swastik Ltd. manufactures of special purpose machine tools, have two divisions which are periodically assisted by visiting teams of consultants. The management is worried about the steady increase of expenses in this regard over the year. An analysis of last years expenses reveals the Rs. Consult ants Remuneration 2,50,000 Travel and Conveyance 1,50,000 Accommodation Expenses 6,00,000 Boarding Charges 2,00,000 Special Allowances 50,000 12,50,000 The management estimates accommodation expenses to increase by Rs. 2,00,000 annually. As part of a cost reduction drive, Swastik Ltd. are proposing to construct a consultancy centre to take care of the accommodation requirements of the consultants. This centre will additionally save the company Rs. 50,000 in boarding charges and Rs. 2,00,000 in the cost of Executive Training Programmes hitherto conducted outside the companys premises, every year. The following details are available regarding the construction and maintenance of the new centre : (a) Land : at a cost of Rs. 8,00,000 already owned by the company, will be used. (b) Construction cost: Rs. 15,00,000 including special furnishings. (c) Cost of annual maintenance : Rs. 1,50,000 (d) Construction cost will be written off over 5 years being the useful life. Assuming that the write-off of construction cost as aforesaid will be accepted for tax purposes, that the rate of tax will be 40% and that the desired rate of return is 15%; you are required to analyse the feasibility of the proposal and make recommendations. The Electric Gadgets Division of Home Appliances Ltd. is considering production and sell a mini personal computer for household use. The plant to be purchased for this project will cost Rs. 2,40,000 Project analysis done by the Divisional Accountant give the following figures : Year Sales (Rs. 000) Costs (Rs. 000) Materials : Opening Stock Add : Purchases Less : Closing Stock Cost of Material used Labour Production Expenses Depreciation Group Administration Allowed Interest Net Profit 1 400 40 200 240 80 160 80 80 40 54 22 ----436 (36) 2 600 80 240 320 80 240 120 90 40 76 22 ---588 12 3 800 80 300 380 60 320 120 92 40 74 22 ----688 132 4 600 60 180 240 240 80 100 40 74 22 -----556 44

12.

(I) The plant used for this product is highly specialised and is unlikely to have any terminal value after meeting dismantling costs at the end of its four-year working life. However, depreciation is based on a six-year life using the straight line method. (ii) The opening stock has to be purchased before the project starts. (iii) Production expenses is inclusive of a proportion of fixed factory overheads charged out as 25% of labour costs. The remaining production expenses are all incremental cash costs.

Tax Shield Education Centre

MAFA-27

(iv) When the project is commissioned, existing old machinery will become redundant, since the new plant can do the work of the old machinery in its spare time, at a cost saving of Rs. 36,000 per annuam. The old machinery which is completely written down for tax purposes, has a book value of Rs. 60,000 but could be sold at once for Rs. 20,000 which will be subject to tax. These cost savings are ignored in the above analysis except that the disposal proceeds have been deducted from the envisaged external incremental borrowings and are reflected in a reduced interest charge. (v) Home Appliances Ltd. requires a return of 14% on capital projects to equal the cost of capital for the Division. The Marketing Director has expressed his reservation to the project on the grounds that the calculation excludes : (i) An advertising campaign to launch the product costing an estimated Rs. 40,000 before production commences, with supplementary expenditure of Rs. 10,000 per annum in the first three years of the project. (ii) The new product will compete with an electronic calculator, already marketed by the Division and will force a revision of budgeted sales as under : Year Original Forecast Revised Forecast 1 5,000 X Rs. 160 5,000 X Rs. 150 2 4,000 X Rs. 120 3,000 X Rs. 100 3 2,000 X Rs. 80 4 Production Costs are Budgeted as follows : Year 1 2 3 Variable Costs (Rs.) 120 90 60 Fixed Costs allocated 20 20 20 140 110 80 (iii) The Marketing Director has his own doubts about 14% as the cost of capital of the Division. In the light of the above observations and figures supplied, you are required to advise whether the project is viable at 14% as the cost of capital and also comment at what cost of capital the product ceases to be viable. Assume Corporate Tax is 40% for the next five years. 13. Cost of Machine = Rs. 10,000 Estimate life of Machine = 4 Years Cash inflows = Rs. 6,000 in first year & increased by Rs.1,000 p.a. Cost of Capital r = 15% Expected interest rates, at which cash inflows shall be re-invested : Year end Percentage 1 12% 2 12% 3 10% 4 13% Whether the project should be accepted under terminal Value Method ? From the following data, state which project is better: Project Cash flows: Year A B

14.

0 -10,000 -10,000 1 4,000 5,000 2 4,000 5,000 3 2,000 3,000 Risk less discount rate is 5%. Project A is less risky as compared to Project B. The management considers risk premium rates at 5% and 10% respectively appropriate for discounting the cash inflows. 15. Using the information given in above illustration , state which project is better if certainty equivalent coefficient are: Project A Project B 1 st .90 .80 2 nd .80 .70 3 rd .60 .50 3. M/s. GLOBE INDIA LTD. uses a mixing machine on its production line ( project life 5 years )and intends to replace the existing obsolete machine by a new high technology version. The company wishes to determine the optimum replacement cycle for the new machine which has the following costs : 4.

Tax Shield Education Centre

MAFA-28 Age of machine (hears) 0 1 2 3 (Rs.) (Rs.) (Rs.) (Rs.) ------------------------------------------------------80,000 52,000 40,000 32,000 16,000 20,000 40,000

Cost Re sale value Running costs

The asset will never be kept for longer than 3 years. The replacements will be identical assets. There is no inflation and the discount rate is 12 percent, Ignore taxation. 5. The Hypothetical Company Limited has given the following possible cash inflows for two of their projects X and Y out of which one they wish to undertake together with their associated probabilities. Both the projects will require an equal investment of Rs. 5,000. You are requested to give your considered opinion regarding the selection of the project. Project X Project Y Possible Event Cash Inflows Probability Cash Inflows Probability . A 4,000 .10 12,000 .10 B 5,000 .20 10,000 .15 C 6,000 .40 8,000 .50 D 7,000 .20 6,000 .15 E 8,000 .10 4,000 .10 . 18. ABC Company Limited is attempting to evaluate two mutually exclusive project A & B. Each project requires a net investment of Rs. 10,000 and the annual cash inflows from each of the project is estimated at Rs. 2,000 per annuam in the next 15 years. The Companys is cost of capital may be taken at 10%. The management has made the following optimistic, most likely and pessimistic estimates of the annual cash inflows associated with each of these projects : Project A Project B Initial Investment Rs. 10,000 Rs. 10,000 Estimated cash inflows (per annum) Pessimistic 1,500 Most likely 2,000 2,000 Optimistic 2,500 4,000 You are required to give your considered opinion for helping the management in arriving at a decision. 19. Pace Setter Ltd. manufactures certain sophisticated gadgets. These rapidly become obsolete and the company follows the policy of redesigning or abandoning each type of gadget after a life of 4 years in order to avoid uneconomic levels of output. One gadget Housewifes helper is under review now. The Research and Development Department has produced a new design HH4 at a cost of Rs. 23,000. Selling Price would be set at Rs. 60 per unit and it is estimated that variable costs will be Rs. 25 per unit and that fixed cost of the firm would be reduced by Rs. 55,000 per annum if the product were to be abandoned. Sales of previous models HH1, HH2, HH3, all of which have been sold at Rs. 60 per unit have been as under : HH 1 Year 1990 1991 1992 1993 Units 1800 2100 2800 2100 Year 1994 1995 1996 1997 HH2 Units 1200 2000 3400 2200 Year 1998 1999 2000 2001 HH3 Units 1300 2300 3600 2500

A trend line fitted to the sales data using linear regression analysis has been estimated as follows : Sales volume in year n = 1564 + 98 (n 1989 ). The cost of capital of Pace Setter Ltd. is 20% per annum. Sales may be assumed to occur and production costs to be incurred on the last day of each year. Your are required : (I) to predict the volume of sales of HH4 for each of the four years 1992 to 1995 assuming the sales fluctuate around the trend line given above to the extent that depends on the age of the model.

Tax Shield Education Centre

MAFA-29

(ii) to calculate the maximum outlay at which the introduction of the new model HH4 could just he preferable to abandonment. Ignore taxation. 20. M/s Light Home Limited have estimated the following probabilities for the net cash flows generated by a project. You are required to calculate the present value of the expected monetary cash flows & co-efficient of variance at 10% discount rate. The following information has been made available to you : 1st year Cash inflow(Rs) Rs. 100 200 300 400 21. 2nd year Probability .30 .20 .30 .20 Cash in flow 100 200 300 400 Probability .20 .30 .40 .10 3rd year Cash inflows Probability 100 .30 200 .40 300 .20 400 .10

The Management of Premier Tyres Ltd. which has assets of about Rs. 15,00,000 is considering two possible investment projects. Only one project has to be chosen. The initial cash outlay required for each project is as follows : Project A : Rs. 1,00,000 Project B : Rs. 6,00,000 For each projects in each year only two potential after-tax cash flows are available. The after-tax cash flows and their estimated probabilities of accruing are : Each of first 3 years Each of the next 3 years Each of last 3 years Probability Amount Probability Amount Probability Amount Project A .50 45,000 .75 20,000 .50 10,000 .50 15,000 .25 0 .50 0 Project B .50 .50 75,000 15,000 .60 .40 50,000 2,00,000 .75 .25 1,00,000 4,00,000

Although, no internal funds are available for the financing of either of the proposed project, the company can obtain enough outside funds for either at a cost that would leave the companys overall after-tax cost of capital at its present level of 8%. On the basis of expected net present value only, which proposed projects, if either, should management choose. Submit your calculations. 22. ABC Limited, a manufacturing company, is considering the market potential for a new product Jai Prakash. The Sales Manager is of the opinion that the total sales of the new machine during the period of five years will not be less than 5,000 units per annum. The maximum capacity of the plant is likely to be 80,000 units per annum. The Sales Manager reports that there are two chances in five for a sales volume of 50,000 units per annum. The probability that the sales volume will exceed 50,000 units if four times the probability that it will be less that 50,000. If sales exceed 50,000 units, volumes of 60,000 and 80,000 units are equally likely. However, a sales volume of 70,000 units if four times as likely as either of the two given above. The marginal production costs are estimated at Rs. 30 per unit. The selling price is likely to be Rs. 50 per unit and special manufacturing equipment (without any salvage volume or alternative use) costs Rs. 8 lakhs. You may presume that the above mentioned are only possible sales volumes. You are required to advise ABC Limited whether they should take up the new product or not. Your recommendations should be supported by detailed computations. 23. Forward Planning Ltd. is considering whether to invest in a project which would entail immediate expenditure on capital equipment of Rs. 40,000. Expected Sales from the project are as follows : Probability Sales Volume (Units) 0.10 2,000 0.25 6,000 0.40 8,000 0.15 10,000 0.10 14,000

Tax Shield Education Centre

MAFA-30

Once sales are established at a certain volume in the first year, they will continue at that same volume in subsequent years. The unit selling prices will be Rs. 10, the unit variable cost Rs. 6 and the additional fixed costs will be Rs. 20,000 (all cash items). The project would have a life of 6 years after which the equipment would be sold for scrap which would fetch Rs. 3,000. You are required to find out (a) the expected value of the NPV of the project. (b) the minimum volume of sales per annum required to justify the project. The cost of capital of the company is 10%. Ignore Taxation. 24. The Shortsight Company is at attempting to decide whether or not to invest in a project that requires an initial outlay of Rs. 4 lakhs. The cash flows of the project are known to be made up of two parts, one of which varies independently over time and the other one which displays perfect positive correlation. The cash flows for the six year life of the project are : Year 1 2 3 4 5 6 Perfectly Correlated Components Mean Standard Deviation Rs. Rs. 40,000 4,400 50,000 4,500 48,000 3,000 48,000 3,200 55,000 4,000 60,000 4,000 Independent Component Mean Standard Deviation Rs. Rs. 42,000 4,000 50,000 4,400 50,000 4,800 50,000 4,000 52,000 4,000 52,000 3,600

25.