Case Study-Precision Worldwide

Diunggah oleh

Justin DohDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Case Study-Precision Worldwide

Diunggah oleh

Justin DohHak Cipta:

Format Tersedia

Precision Worldwide, Inc.

Case Study

Precision Worldwide, Inc. Case Study Involved Parties: Competitor-French Firm: Henri Poulenc Precision Worlwide, Inc.-German Firm Hans Thorborg-General Manager Gerhard Henk-Sales Manager Bodo Eisenbach- Development Engineer Patrick Corrigan-Parent Company Spokesman Background: Precision Worldwide, Inc. (PWI) manufactures industrial machines and equipment for sale in numerous countries. Repair and replacement parts account for a substantial part of the companys business. The replacement part in question, steel rings, occur in the machines manufactured only in PWIs Frankfurt Germany plant, but can also be used on some competitors machines. The steel ring manufactured by PWI has an average normal life of about 2 months. Machines require between 2 and 6 rings to operate. Individual rings are replaced as they wear out. Over the years, competition had increased and now a competitor company, the French firm Henri Poulenc, has entered the market with a superior plastic ring that replaces the steel ring. The plastic ring is less costly to manufacture and has a longer life. Situation: The PWI sales manager, Gerhard Henk, is asking when this product will be available for him to sell that his competitor already has on the market, particularly in France where the competitor is the strongest. Bodo Eisenbach, the PWI development Engineer, estimates the plastic rings can be produced in about 4 months at a tool and equipment cost of about $7,500. PWI currently has about $390,000 worth of special steel in current inventory that cannot be sold, even for scrap. Patrick Corrigan, from the parent company spokesman, expects Thorborg to exhaust all steel supplies. If sales of the steel ring continued until the plastic rings were ready for the market about 15,100 rings would remain in stock upon the plastic rings release date. Information supplied from PWIs cost accounting department:

Note: Overhead was allocated on the basis of direct labor cost. It was estimated that the variable overhead costs included here were largely fringe benefits related to direct labor and amounted to $0.80 per direct labor dollar or about 40% of the departmental amounts. Possible Scenarios for PWI: 1) Sell only steel rings until plastics rings are ready for the market. Thereafter, sell only plastic rings and scrap all remaining steel rings and steel inventory (sunk cost). 2) Sell only steel rings until plastics rings are ready for the market. Thereafter, sell plastic rings only in markets where the competitor offers plastic rings. Manufacture and sell steel rings in other markets till all steel is exhausted. Then sell plastic rings only. 3) Sell steel rings until plastics rings are ready for the market. Thereafter, sell plastic rings in markets where the competitor offers plastic rings and sell steel rings in other markets till all currently manufactured steel rings are exhausted. Scrap remaining steel stock. Then sell plastic rings only. 4) Sell steel rings until plastics rings are ready for the market. Thereafter, sell both plastic and steel rings. Sell steel rings at a reduced cost due to less longevity than plastic ring. Manufacture and sell steel rings until all steel stock is exhausted. Then sell plastic rings only. 5) Sell steel rings only and do not sell plastic rings at all. Possible Concerns for PWI: 1) Cost of scrapping unused manufactured steel rings. 2) Cost of scrapping unused steel stock. 3) Ramifications of alienating customers that learn later that a superior plastic ring in existence was not offered to them by PWI. 4) Not entering the plastic ring market soon enough or at all could lose existing or potential customers. 5) The effect of plastic ring versus steel ring lifespan. Relevant Information:

Table 1: Relevant cost from Table A of case study supplied by cost accounting department of PWI, with administrative overhead cost removed and departmental overhead cost reduced. Table 2: Relevant cost from Table A of case study supplied by cost accounting department of PWI with steel ring material costs included as a sunk cost, administrative overhead cost removed, and departmental overhead cost reduced. Table 3: Relevant cost from Table A of case study supplied by cost accounting department of PWI with steel ring Labor costs at the 70% of regular wages during slack period and, steel ring material costs included as a sunk cost, administrative overhead cost removed, and departmental overhead cost reduced. 6) Table 4: The effect of Plastic Ring versus Steel Ring Lifespan. Conclusion: Hans should go with my scenario number 4; Sell steel rings until plastics rings are ready for the market. Thereafter, sell both plastic and steel rings. Sell steel rings at a reduced cost due to less longevity than plastic ring. Manufacture and sell steel rings until all steel stock is exhausted. Then sell plastic rings only. Hans should instruct his development engineer, Bodo Eisenbach, to begin the process to enable the company to manufacture the plastic rings. He should continue to manufacture and sell steel rings until the plastic rings are available. When the plastic rings become available he should instruct his Sales Manager, Gerhard Henk, to sell the plastic rings only in the jeopardized markets and to push the steel rings, at a reduced cost (table 3), in all other markets. All customers should be notified of the new plastic rings and given the choice of plastic or steel. During the slack manufacturing period, Hans should instruct the factory to concentrate on manufacturing steel rings at the reduced labor rate to incur a surplus of steel rings and during peak season to concentrate on manufacturing plastic rings. Manufacturing and selling of the steel rings should be continuously monitored. If a point in time arrives, that steel ring sales are faltering, than production of steel rings should stop and all remaining steel scrapped as a sunk cost. This should also be enough justification for Patrick

Corrigan, the Parent Company Spokesman, who suggested that all remaining steel stock be used up. Eventually the company will sell plastic rings only and all remaining steel will be a sunk cost, but I think Hans should try to take advantage of the lower labor cost during the off season and sell as much of the inventory steel as possible.

Points To Address In Precision Case Study

Precision Worldwide, Inc case study. Begin by talking about the issues .. Substantive Issues Raised. The primary issue at hand involves the relevant cost of a set of replacement parts. The parts, however, range from those that are totally manufactured and ready for sale, to those that have not yet been manufactured but for which raw material is on hand, to those that have not yet been manufactured and for which no inventory of raw material exists. The case solution turns in large part on the use of contribution analysis. However, the concepts of sunk costs, opportunity costs, and product substitution are prominent aspects of any reasonable analysis. The product in question, a steel ring, is used as a replacement part for industrial machines manufactured and sold by both Precision Worldwide, Inc and their competitors. It sells for $1,350 per hundred rings with annual sales of approximately 36,000 rings. One competitor, Henri Poulenc, has introduced a plastic ring. This ring lasts up to four times as long and is priced at about the same level as PWIs product. Mr. Thorborg, the gm of the German plant of PWI, must analyze the data, the conflicting views of his sales manager and his development engineer, and make a decision as to whether PWI should begin the manufacture of a plastic ring. In addition, a plan needs to be designed as to the pricing policy to follow for both the steel and the plastic rings. Finally, some consideration should be given to the effect of the decision upon the firms image in the marketplace. Many of the issues involved in the suggested analysis of the case cluster around relevant costs and contribution analysis. The case illustrates several different layers of sophistication in terms of relevant cost analysis. Some ideas to review: address the concept of eliminating applied fixed overhead in a short run, relevant cost analysis analyze and discuss the concept of sunk costs in a relevant cost analysis, look at the product substitution aspects of contribution analysis, and analyze based on the information above to provide the numerical framework within which pricing decisions can be taken. Start with a listing of alternatives that Mr. Thorborg has available to him.

Another point look at the elimination of fixed overhead, This data could lead to the conclusions that since either type of ring could sell for the same price, the plastic ring would be more profitable to produce. Another point eliminating the applied fixed overhead, however does not provide a clear picture of the underlying economics. There are still other items to consider. The raw material costs are they irrelevant? The special steel used in the manufacture of the rings has already been purchased. Is there an alternative market for the raw steel. Producing the steel rings requires no further raw material cost. Another point- the amount of labor costs involved in manufacturing steel rings may be challenged. This may be done on the basis of the argument that Hans could decide, in May, to use some of the excess summer labor to convert the raw steel into rings. One may determine that without the labor savings the steel ring is still much more expensive to produce than the plastic ring. During the slack season it would be profitable to convert the existing raw steel inventory into rings. Another issue to address involves the unequal lives of the steel and the plastic rings. If the tests run to date by PWIs development engineer are indicative, the plastic rings will last at least four times as long as the steel rings. Thus, the market demand (in units) for the plastic rings is likely to be significantly worse than the demand that currently exists for the steel rings. Questions - how long is it prudent to sell a short-lived, highly profitable replacement part without jeopardizing the companys image and market share? What price relationship is likely to prevail between the steel rings and the plastic rings once the latter become widespread? How should the 15,100 finished steel rings that will still be on hand in September be treated for analytical purposes? Other aspects to talk about How much inventory is around in May? What is the maximum loss if all steel rings were scrapped in September? How important from a financial perspective is the new ring to PWI? Tables you could create

Eliminating Applied Fixed Overhead (ex) Item Plastic Rings Steel Rings Material $17.65 $321.90 Direct labor $65.50 $196.50 Direct o/h $52.40 $157.20 Total $135.55 $675.60 Additional ideas for tables Difference in Lives of Rings. Opportunity Costs Price Relationships

Anda mungkin juga menyukai

- Precision Worlwide Inc Case AnalysisDokumen4 halamanPrecision Worlwide Inc Case AnalysisAbhimanyu DevBelum ada peringkat

- Precision Worldwide FinalDokumen17 halamanPrecision Worldwide Finalmarjunem100% (5)

- Precision WorldwideDokumen9 halamanPrecision WorldwideSanchit JasujaBelum ada peringkat

- Precision Worldwide, Inc. Case StudyDokumen3 halamanPrecision Worldwide, Inc. Case Studytico6020% (1)

- Precision WorldwideDokumen9 halamanPrecision WorldwidePedro José ZapataBelum ada peringkat

- Industrial Grinders NVDokumen6 halamanIndustrial Grinders NVCarrie Stevens100% (1)

- Precision Worldwide IncDokumen9 halamanPrecision Worldwide IncDeepak AgarwalBelum ada peringkat

- Precision Worldwide, Inc. - Basilan StraitDokumen8 halamanPrecision Worldwide, Inc. - Basilan StraitMakame Mahmud DiptaBelum ada peringkat

- Precision Worldwide, Inc. - Section B - Group 9Dokumen3 halamanPrecision Worldwide, Inc. - Section B - Group 9Varun Baxi100% (4)

- Precision WorldwideDokumen5 halamanPrecision WorldwideKing PuentespinaBelum ada peringkat

- MGT431 - AppleDokumen13 halamanMGT431 - AppleMokshBelum ada peringkat

- DynashearsDokumen2 halamanDynashearsIlia Imerlishvili75% (4)

- Scott & Sons Company Case Solution From Syndicate 3Dokumen3 halamanScott & Sons Company Case Solution From Syndicate 3Murni Fitri FatimahBelum ada peringkat

- Surecut Shears, Inc.: AssetsDokumen8 halamanSurecut Shears, Inc.: Assetsshravan76Belum ada peringkat

- Dynashears StudyDokumen2 halamanDynashears Studylika rukhadze100% (1)

- Destin Brass Case Study SolutionDokumen5 halamanDestin Brass Case Study SolutionAmruta Turmé100% (2)

- Case Study of Stryker CorporationDokumen5 halamanCase Study of Stryker CorporationYulfaizah Mohd Yusoff40% (5)

- Compagnie Du Froid PDFDokumen18 halamanCompagnie Du Froid PDFGunjanBelum ada peringkat

- Case 17-3, Powerpoint Presentation SHELTER PARTNERSHIPDokumen33 halamanCase 17-3, Powerpoint Presentation SHELTER PARTNERSHIPFrancisco MarvinBelum ada peringkat

- Stryker Case - BriefDokumen4 halamanStryker Case - BriefCorinne Williams0% (4)

- Group 1 - New Balance - Operations StrategyDokumen6 halamanGroup 1 - New Balance - Operations StrategyAninda DuttaBelum ada peringkat

- Case Analysis - Toy WorldDokumen11 halamanCase Analysis - Toy Worldvarjin71% (7)

- This Study Resource Was: Stryker Corp: In-Sourcing PcbsDokumen5 halamanThis Study Resource Was: Stryker Corp: In-Sourcing PcbsHina SaharBelum ada peringkat

- Toy World IncDokumen10 halamanToy World IncHàMềm100% (1)

- Always Use 2 Decimal Places (When % As Percent - Not As Fractions) and Provide Detail of The Calculations MadeDokumen2 halamanAlways Use 2 Decimal Places (When % As Percent - Not As Fractions) and Provide Detail of The Calculations MadeKirtiKishanBelum ada peringkat

- Harley Davidson Case StudyDokumen8 halamanHarley Davidson Case StudyfossacecaBelum ada peringkat

- New Balance Case StudyDokumen3 halamanNew Balance Case StudyDimas AdityaBelum ada peringkat

- CASE STUDY Vershire CompanyDokumen7 halamanCASE STUDY Vershire CompanyAradhysta Svarnabhumi0% (1)

- Forner Carpet CompanyDokumen6 halamanForner Carpet CompanyShaunakJindalBelum ada peringkat

- Markstrat Report Round 0-3 Rubicon BravoDokumen4 halamanMarkstrat Report Round 0-3 Rubicon BravoDebadatta RathaBelum ada peringkat

- Forner Carpet Case StudyDokumen7 halamanForner Carpet Case StudySugandha GuptaBelum ada peringkat

- Bill French CaseDokumen6 halamanBill French CaseAnthonyTiuBelum ada peringkat

- Toy World Inc.Dokumen11 halamanToy World Inc.Ivaner CentenoBelum ada peringkat

- Chema LiteDokumen8 halamanChema LiteHàMềmBelum ada peringkat

- HansonDokumen6 halamanHansonAnosh DoodhmalBelum ada peringkat

- Symphony Orchestra Case StudyDokumen3 halamanSymphony Orchestra Case StudyBrandon ElkinsBelum ada peringkat

- Bioco: Preparation SheetDokumen0 halamanBioco: Preparation SheetMss BranchesBelum ada peringkat

- Instruction For Nantucket NectarsDokumen4 halamanInstruction For Nantucket NectarsTanaporn SuwanchaiyongBelum ada peringkat

- Hilton Case1Dokumen2 halamanHilton Case1Ana Fernanda Gonzales CaveroBelum ada peringkat

- Cartwright Lumber CompanyDokumen6 halamanCartwright Lumber Companykiki0% (2)

- Dynashears Inc CaseDokumen4 halamanDynashears Inc Casepratik_gaur1908Belum ada peringkat

- Forner Carpet CompanyDokumen8 halamanForner Carpet CompanyJolo LeachonBelum ada peringkat

- 03 Gilbert Lumber CompanyDokumen36 halaman03 Gilbert Lumber CompanyEkta Derwal PGP 2022-24 BatchBelum ada peringkat

- Precision Worldwide, Inc.Dokumen3 halamanPrecision Worldwide, Inc.karan_w3Belum ada peringkat

- Genzyme CaseDokumen2 halamanGenzyme CaseUday Shukla50% (2)

- Hilton Manufacturing Company 1201326783827489 2Dokumen6 halamanHilton Manufacturing Company 1201326783827489 2julijulijulioBelum ada peringkat

- Bob's BarloneyDokumen4 halamanBob's BarloneyRafael Martinez Figueroa0% (2)

- Sure CutDokumen37 halamanSure Cutshmuup1100% (4)

- Presentation 1Dokumen3 halamanPresentation 1Debdyuti Datta GuptaBelum ada peringkat

- Fortis Case AnalysisDokumen1 halamanFortis Case AnalysisRj Kumar100% (1)

- Case Study Synthite Syndicate 5Dokumen1 halamanCase Study Synthite Syndicate 5okki hamdaniBelum ada peringkat

- Running Head: Sugar Bowl Case Study-Q&A 1Dokumen9 halamanRunning Head: Sugar Bowl Case Study-Q&A 1Stanley K. NyasaniBelum ada peringkat

- 1 Heinz Case StudyDokumen8 halaman1 Heinz Case Studysachin2727100% (2)

- Kanthal Case Study SolutionsINTRODUCTIONKanthal Is Comp Termpaper Essay Studies Test 1071194975Dokumen5 halamanKanthal Case Study SolutionsINTRODUCTIONKanthal Is Comp Termpaper Essay Studies Test 1071194975rahuldesai1189Belum ada peringkat

- Catawba Industrial Company-Case QuestionsDokumen1 halamanCatawba Industrial Company-Case QuestionsSumit Kulkarni0% (3)

- Business CommunicationDokumen2 halamanBusiness CommunicationDeepakSuhagBelum ada peringkat

- Reichard QDokumen4 halamanReichard QN ParamitaBelum ada peringkat

- Precision Worldwide FinalDokumen17 halamanPrecision Worldwide FinalPedro José ZapataBelum ada peringkat

- Precision Worldwide FinalDokumen17 halamanPrecision Worldwide FinalPedro José ZapataBelum ada peringkat

- Reichard MaschinenDokumen23 halamanReichard MaschinenAliefiah AZBelum ada peringkat

- CBLM Rmo Core 5Dokumen26 halamanCBLM Rmo Core 5Valcy Madz100% (1)

- APLIKASI Cee Dan Zee Purlin: Pt. Bluescope Lysaght Indonesia June 2014Dokumen34 halamanAPLIKASI Cee Dan Zee Purlin: Pt. Bluescope Lysaght Indonesia June 2014gama adisetiantoBelum ada peringkat

- Mpy315 FinalDokumen21 halamanMpy315 FinalCharles ChivengahBelum ada peringkat

- Understanding Motor Controls 3rd Edition Herman Solutions ManualDokumen2 halamanUnderstanding Motor Controls 3rd Edition Herman Solutions Manuala471886600Belum ada peringkat

- Corrugated High Density Polyethylene (HDPE) Grease Interceptor TanksDokumen4 halamanCorrugated High Density Polyethylene (HDPE) Grease Interceptor TanksAhmad Zubair RasulyBelum ada peringkat

- The Finex® ProcessDokumen16 halamanThe Finex® ProcessNavin Kumar BinitBelum ada peringkat

- Muzaffarpur Thermal Power Project (2 X 195 MW) : Sr. Description by by No Vendor BHEL A MechanicalDokumen3 halamanMuzaffarpur Thermal Power Project (2 X 195 MW) : Sr. Description by by No Vendor BHEL A MechanicalHimadri SBelum ada peringkat

- 2K NTNK 101 Matt Coat TilDokumen3 halaman2K NTNK 101 Matt Coat TilpassqwertyBelum ada peringkat

- ParkerDokumen196 halamanParkerj3r007Belum ada peringkat

- Tarea 3 CalorDokumen3 halamanTarea 3 CalorLuis AngelBelum ada peringkat

- Design of Offshore Structures - Web PDFDokumen2 halamanDesign of Offshore Structures - Web PDFkarthickmectrBelum ada peringkat

- Aisin Warner 450-43LE 1998-Up - Nissan UD - Isuzu RNJ - Mitsubishi FUSO 94628 TransmissionDokumen8 halamanAisin Warner 450-43LE 1998-Up - Nissan UD - Isuzu RNJ - Mitsubishi FUSO 94628 Transmissionchente_b100% (2)

- Zoom Pet Upright: User GuideDokumen26 halamanZoom Pet Upright: User GuideUKBelum ada peringkat

- 2nd YearDokumen24 halaman2nd YearAlxalx Alex50% (2)

- SRSDokumen7 halamanSRSCLC 18C4Belum ada peringkat

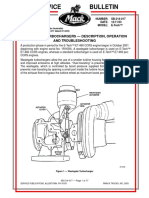

- Wastegate Turbochargers - Description, OperationDokumen17 halamanWastegate Turbochargers - Description, OperationHamilton Miranda100% (1)

- INTERFLEX Catalogue (Conduits and Fittings)Dokumen8 halamanINTERFLEX Catalogue (Conduits and Fittings)cherif yahyaouiBelum ada peringkat

- Natural Water Filter - An Indigenous Rural ApplicationDokumen3 halamanNatural Water Filter - An Indigenous Rural ApplicationShwetha KamathBelum ada peringkat

- Conveyor IdlersDokumen255 halamanConveyor IdlersEd AceBelum ada peringkat

- Rocket Lab ReportDokumen4 halamanRocket Lab Reportbishopclark98Belum ada peringkat

- Nt20703 Lab Report Dietary FiberDokumen2 halamanNt20703 Lab Report Dietary FiberAmne BintangBelum ada peringkat

- SoP Kanmani ChockalingamDokumen3 halamanSoP Kanmani ChockalingamPrakharKulshreshtha100% (1)

- Wood Gasifier ManualDokumen12 halamanWood Gasifier ManualEvan AV90% (10)

- 009 Propulsion Azimuth Thruster - SDokumen504 halaman009 Propulsion Azimuth Thruster - SSuchindran Varadaraj100% (1)

- Betts - 3-Inch-Steam-Jacketed-Hydrolet-Qrb-Valve-90-Degree-ElbowDokumen3 halamanBetts - 3-Inch-Steam-Jacketed-Hydrolet-Qrb-Valve-90-Degree-ElbowBrayan JimenezBelum ada peringkat

- Iom Daikin Ahu DDM Fuw DDWDokumen40 halamanIom Daikin Ahu DDM Fuw DDWMichael Percy Curasi Paredes100% (4)

- D 7264 - D 7264M - 15Dokumen10 halamanD 7264 - D 7264M - 15AMAR SAI PRABHUBelum ada peringkat

- Catalogue Power Transformers 2012Dokumen24 halamanCatalogue Power Transformers 2012SatyaBelum ada peringkat

- EBCS 13final PDFDokumen115 halamanEBCS 13final PDFDawit Solomon93% (14)

- falchemspecFALCOOL2k PDFDokumen2 halamanfalchemspecFALCOOL2k PDFandhito yanaBelum ada peringkat