Module 1 CFP Mock Test

Diunggah oleh

chitra_shresthaDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Module 1 CFP Mock Test

Diunggah oleh

chitra_shresthaHak Cipta:

Format Tersedia

Module 1 Introduction to Financial Planning 1) Money has time value. It derives this value due to existence of several conditions.

. Which one of the following is not one of the conditions contributing to the existence of this value? (1) a) b) c) d) The fees and commission sources of the firm Possibility of increase in tax rates over time. Ability to buy/ rent assets generating revenue Cost of foregoing present consumptions

Solution (b) 2) You have term deposits of Rs. 4,00,000 with a bank. In order to meet sudden requirements for liquidity and short-term credit, you are applying for an overdraft facility with the bank. What is the rate of interest you will pay on this facility? (1) a) b) c) d) The bank will apply a flat rate of interest on the amount of overdraft allowed to actually utilize. The bank will apply a flat rate of interest on the amount of overdraft allowed to you. The bank will apply rate of interest linked to the term deposit rate, on the amount of overdraft utilized. The bank will apply rate of interest linked to the term deposit rate, on the average amount of overdraft remaining unutilized from the OD limit.

Solution (c) 3) The Nifty has doubled since the last time you advised your client to reduce his equity exposure. The client is annoyed. What might be the most appropriate action to take immediately? (1) a) b) c) d) Apologize for wrongly forecasting the market Change his asset allocation by increasing his equity exposure Help the client understand the logic of his asset allocation Rebalance his asset allocation by reducing equity investments

Solution (c) 4) A professional indemnity policy protects the insured from risk arising out of _________________. a) b) c) d) Intentional misconduct Misrepresentation of professional competence Negligence Undisclosed conflict of interest (1)

Solution (c)

Financial Planning Standards Board (FPSB) India 312, Turf Estate, Off Dr. E. Moses Road, Mahalaxmi, Mumbai 400011 Phone: 022 66663268, 66663314; Fax: 022 56663269 Email: info@fpsbindia.org; Website: www.fpsbindia.org

Page 1 of 6

5) Protector International is a financial services firm that specializes in investment advisory services. In its brochure for Financial Planning services, it may state _____________. (1) a) It can offer superior investment returns on customer portfolios and talk of the arrangements to offer advice in other areas b) It has the competence to take care of all Financial advisory requirements of the customer c) Its competence in investment advisory services and the arrangements to offer advice in other areas d) Its Financial Planning services are the best available in the market in light of its investment advisory capabilities and arrangements to offer advice in other areas Solution (c) 6) Which of the following is a concurrent indicator of the phase of the business cycle? a) b) c) c) Wholesale price Index Index of Industrial production Labor costs and capacity utilization Order levels in the manufacturing sector (1)

Solution (b) 7) What is the main difference between the personal Financial Planning needs of the employed and the selfemployed? (1) a) b) c) d) Attitude to risk/Risk appetite Need to fund children's education Need to fund retirement The extent of any employer-provided pension benefits

Solution (d) 8) Immunization protects bondholders from which of the following risk/s: 1) Interest rate risk 2) Reinvestment rate risk 3) Maturity risk a) b) c) d) 1 only 2 only 1 & 2 only 1, 2 & 3 (1)

Solution (c)

Financial Planning Standards Board (FPSB) India 312, Turf Estate, Off Dr. E. Moses Road, Mahalaxmi, Mumbai 400011 Phone: 022 66663268, 66663314; Fax: 022 56663269 Email: info@fpsbindia.org; Website: www.fpsbindia.org

Page 2 of 6

9) The modern portfolio theory suggests that the portfolio returns can be optimized by ________________. a) b) c) e) Investing in diversified equity funds. Investing in treasury bills and equities. Laddering the bond portfolio. Moving closer to the efficient frontier in terms of the risk return equation.

(1)

Solution (d) 10) The economy is going through a phase of expansion and growth. Industrial production and profitability are high. Your client has a portfolio that is heavily invested in bonds. Which of the following fears of the client is well founded? (1) a) b) c) d) Solution (a) 11) Ram is a Financial Planner in a large firm. His wife has some large investments in the shares of a few companies. Ram is required to offer views on almost all of these holdings to clients. Under the Code of Ethics and Rules of Professional Conduct _______ (1) a) b) c) d) Ram must disclose the fact to his client(s) so as to make them aware of any potential conflict of interest Ram has to disclose these holdings only to his employers, if required by the firm's internal compliance rules Ram need not follow any code of ethics and rules of professional conduct. Ram will not violate the Code and the Rules if he does not disclose his wife's holdings Higher rates of growth will increase demand for funds and interest rates will firm up, leading to fall in bond prices. Higher rates of growth will require higher imports and expenses. The government deficits will go up. The central bank will try to reduce rates to make funding of business cheaper and reduce costs. That will depress returns on bonds. The currency will become convertible and interest rates will rise as a consequence.

Solution (a) 12) How are financing costs included in NPV and IRR calculations? a) b) c) d) By including them in the interest payments. By considering the interest rate in the setting of the discount rate As a tax deduction By including them in the earnings (1)

Solution (b)

Financial Planning Standards Board (FPSB) India 312, Turf Estate, Off Dr. E. Moses Road, Mahalaxmi, Mumbai 400011 Phone: 022 66663268, 66663314; Fax: 022 56663269 Email: info@fpsbindia.org; Website: www.fpsbindia.org

Page 3 of 6

13) Consider a portfolio of two investments viz. A & B. The sum total of volatility of A and B respectively, represented by standard deviation of the two investments, will be equal to the volatility of the portfolio as a whole if _________________. (2) a) b) c) d) A and B have a correlation of Zero A and B have a correlation of 1 The portfolio is equally divided between A and B The return on the portfolio is equal to the sum of returns of A and B

Solution (a) 14) Which of the following is a correct interpretation of the Rules of Conduct pertaining to the Ethic of Confidentiality? (2) a) A Member must when requested by the client, provide to a person authorized by the client, all original documents prepared or received by the Member in undertaking the advisory task b) A Member owes to the Member's partners or co-owners a responsibility to act in good faith (expectations of confidentiality) only while in business together, not thereafter c) The Member shall maintain the same standards of confidentiality to employers as to clients d) Under no circumstance, will any Member divulge any information or knowledge regarding the FPSB India or its members that they may know or be exposed to Solution (c) 15) Mr. Rajan's investment portfolio comprises Rs.2 lakh in equity, Rs.5 lakh in debt and Rs. 1 lakh in his bank current account. Over one year the returns on equity and debt are 5% and 12%. At the end of the year to maintain his current asset allocation, he needs to _____________. (2) a) b) c) d) Do nothing. He needs to move Rs, 10000/- from equity and Rs. 60000/- from debt to cash. He needs move Rs.7500/- to equity from debt and Rs. 8750/-to cash from debt He needs to invest Rs. 70000/- in debt and equity.

Solution (c) 16) A 10 year 8.0% bond (Face Value- Rs.1000, interest payable semi-annually) maturing 6 years from today is available at a yield to maturity of 6.0%. It is likely to be priced at _______________. (2) a) b) c) d) Rs. 1100 Rs. 1149 Rs. 1168 Rs. 1498

Solution (a)

Financial Planning Standards Board (FPSB) India 312, Turf Estate, Off Dr. E. Moses Road, Mahalaxmi, Mumbai 400011 Phone: 022 66663268, 66663314; Fax: 022 56663269 Email: info@fpsbindia.org; Website: www.fpsbindia.org

Page 4 of 6

17) Raykar is an accomplished Financial Planner and is also an expert on derivatives and high yielding bonds. He understands client requirements well and is able to come up with appropriate portfolio restructuring ideas for clients. He believes in quickly moving clients from one investment to another through a dynamic process of research and recommendations. What according to the Rules relating to the Code of Ethics is the most applicable in this case? (2) a) b) c) d) He does not violate the Rules if he explains to the client the reasons and is able to show that the moves are appropriate to the client He does not violate the Rules since he conducts and has access to research and advises on products relevant to clients based on an understanding of their requirements He does not violate the Rules since he is an acknowledged expert and knows what is best for his clients He violates the Rules as it amounts to active churning of client portfolios

Solution (a) 18) Mrs. & Mr. Arora are aged 55 and 58 years respectively. Both expect to work till they turn 65. Their only goal is to fund their retirement. Which of the following is likely to be an appropriate asset allocation strategy for them? (2) a) b) c) d) 10% sectoral equity, 20% diversified equity, 30% long-term debt, and 40% medium term debt 20% Sectoral equity, 60% diversified equity, 20% long-term debt 30% Sectoral equity, 30% diversified equity, 40% cash/ liquid investments. 80% long-term debt, 20% medium term debt

Solution (a) 19) ABC Ltd. is willing to prepay your Cumulative Fixed Deposit with them, without any penalty and with all the accumulated interest (compounded half yearly). You had invested Rs. 4000 with them 3.5 years back. If they are giving you back Rs. 4985, what is the annualized rate of interest you have earned? (4) a) b) c) d) 6.40% 3.2%. 6.5%. 7.2%.

Solution (a) (((((4985/4000)^(1/7))-1)*100)*2) 20) Which of the following is a tort of negligence? (4) a) Mr. Joy was playing golf. He swings a new golf club on the fairway and the head of the club flies off, and hit another golfer who was standing 20 feet away. b) Mr. Vishal takes medication that he knows makes him drowsy and then proceeds to drive. He gets into an accident injuring the passengers in another car. c) Mrs. Jaya locks Ms. Rani in a room to prevent him from leaving the building d) Mrs. Priti experienced a sudden surge of chest pain while driving, which causes her to lose control of her car and hit another car. Solution (b)

Financial Planning Standards Board (FPSB) India 312, Turf Estate, Off Dr. E. Moses Road, Mahalaxmi, Mumbai 400011 Phone: 022 66663268, 66663314; Fax: 022 56663269 Email: info@fpsbindia.org; Website: www.fpsbindia.org

Page 5 of 6

21) Any possible occurrence which may have a negative financial implication, can be plotted on a graph with X axis measuring the frequency (low-high) and Y axis measuring the financial impact (low-high). You can view the classification in four quadrants. Quadrant I - Low frequency, Low Impact Quadrant II - Low frequency, High Impact Quadrant III - High frequency, High Impact Quadrant IV - High frequency, Low Impact It would not be practical to purchase insurance for events falling in _________________. (4) a) b) c) d) Quadrant I & IV Quadrant I, II & IV Quadrant I, III & IV Quadrant III

Solution (c)

22) Karan wants to withdraw Rs. 1200/- at the end of each month for the next 5 years. He expects to earn 10% interest compounded monthly on his investments. What lump sum should he deposit now? (4) a) b) c) d) Rs. 56949 Rs. 58630 Rs. 56478 Rs. 59119

Solution (c) PV(10%/12,5*12,-1200)

END

Financial Planning Standards Board (FPSB) India 312, Turf Estate, Off Dr. E. Moses Road, Mahalaxmi, Mumbai 400011 Phone: 022 66663268, 66663314; Fax: 022 56663269 Email: info@fpsbindia.org; Website: www.fpsbindia.org

Page 6 of 6

Anda mungkin juga menyukai

- CHALLENGE STATUS STAGE I EXAMINATION - SAMPLE PAPERDokumen26 halamanCHALLENGE STATUS STAGE I EXAMINATION - SAMPLE PAPERNeelam Jain100% (1)

- Investment Planning (Finally Done)Dokumen146 halamanInvestment Planning (Finally Done)api-3814557100% (2)

- Sample Questions - Challenge Status - CFPDokumen13 halamanSample Questions - Challenge Status - CFPBronil W DabreoBelum ada peringkat

- Retirement Workbook 3.2Dokumen31 halamanRetirement Workbook 3.2Tejas Shah83% (6)

- Portfolio Management Extra Practice QuestionsDokumen17 halamanPortfolio Management Extra Practice QuestionsVANDANA GOYALBelum ada peringkat

- Prashant FinalReportDokumen29 halamanPrashant FinalReportadhia_saurabh100% (1)

- CFP RaipDokumen3 halamanCFP RaipsinhapushpanjaliBelum ada peringkat

- Ashwini Agarwal Age34 - Case - A - MasterDokumen61 halamanAshwini Agarwal Age34 - Case - A - MasterAmit GuptaBelum ada peringkat

- Sahanubhuti Case Study 2017 Que & SolDokumen13 halamanSahanubhuti Case Study 2017 Que & SolIBBF FitnessBelum ada peringkat

- 6.1 Code of EthicsDokumen66 halaman6.1 Code of EthicsViplav RathiBelum ada peringkat

- Compound Interest Explained: Calculating Future and Present Value of AnnuitiesDokumen30 halamanCompound Interest Explained: Calculating Future and Present Value of AnnuitiesAshia12Belum ada peringkat

- Questions Case StudyDokumen4 halamanQuestions Case StudyKrupa VoraBelum ada peringkat

- CFP Sample Paper Tax PlanningDokumen4 halamanCFP Sample Paper Tax PlanningamishasoniBelum ada peringkat

- Ref Date 1/4/17 Sahanubhuti SP-2 Pattern Question Bank (15 Questions: 2 HRS)Dokumen4 halamanRef Date 1/4/17 Sahanubhuti SP-2 Pattern Question Bank (15 Questions: 2 HRS)preeti chhatwalBelum ada peringkat

- Case Study For CFPDokumen1 halamanCase Study For CFPsinghanshu21100% (2)

- Sanjay Case Study 2017 QsDokumen3 halamanSanjay Case Study 2017 QsIBBF FitnessBelum ada peringkat

- Review Extra CreditDokumen8 halamanReview Extra CreditMichelle de GuzmanBelum ada peringkat

- WN - 2Dokumen6 halamanWN - 2bhaw_shBelum ada peringkat

- IMS Proschool CFA EbookDokumen356 halamanIMS Proschool CFA EbookAjay Yadav0% (1)

- CFP Mock TestDokumen25 halamanCFP Mock TestEvIlTurn0% (1)

- FPSB India - Retirement Module Sample Paper - Simplified Solution Using Calculator - March 2013Dokumen9 halamanFPSB India - Retirement Module Sample Paper - Simplified Solution Using Calculator - March 2013Krupa VoraBelum ada peringkat

- Exam4 PastCaseStudy 2010Dokumen46 halamanExam4 PastCaseStudy 2010Namrata PrajapatiBelum ada peringkat

- CFP Financial ExamsDokumen5 halamanCFP Financial Examskeyur1975Belum ada peringkat

- BOOST UP PDFS - Quantitative Aptitude - SI & CI Problems (Hard Level Part-1)Dokumen23 halamanBOOST UP PDFS - Quantitative Aptitude - SI & CI Problems (Hard Level Part-1)ishky manoharBelum ada peringkat

- 9 CFP Exam5-Afp-2008 Case Studies PDFDokumen130 halaman9 CFP Exam5-Afp-2008 Case Studies PDFankur892Belum ada peringkat

- Retirement Workbook 1Dokumen27 halamanRetirement Workbook 1Pankaj Mathpal100% (1)

- Gurpreet Case Study - Only AnswersDokumen12 halamanGurpreet Case Study - Only Answerspooja katariya0% (1)

- Manual Financial Calculator FC-200V - 100V - EngDokumen149 halamanManual Financial Calculator FC-200V - 100V - Engm2biz05Belum ada peringkat

- Advance Financial Planning Study Notes Part 2Dokumen63 halamanAdvance Financial Planning Study Notes Part 2Meenakshi0% (1)

- Insurance Objective Qtn&AnsDokumen26 halamanInsurance Objective Qtn&AnsSsengondo100% (1)

- Personal Wealth Management Plan for Ms. Sahanubhuti VanaspatiDokumen9 halamanPersonal Wealth Management Plan for Ms. Sahanubhuti VanaspatiAditya GulatiBelum ada peringkat

- Exam5 CaseStudy 2009Dokumen248 halamanExam5 CaseStudy 2009Swetal ParmarBelum ada peringkat

- Spiral 2 - FPSB CasesDokumen66 halamanSpiral 2 - FPSB CasesAditya LohiaBelum ada peringkat

- CFP Risk Analysis and Insurance Planning Practice Book SampleDokumen34 halamanCFP Risk Analysis and Insurance Planning Practice Book SampleMeenakshi100% (7)

- Intro Practice Book Sample FPDokumen35 halamanIntro Practice Book Sample FPnaresh2011Belum ada peringkat

- Limited Preview of CFP Study Material of IMS ProschoolDokumen96 halamanLimited Preview of CFP Study Material of IMS ProschoolSai Krishna DhulipallaBelum ada peringkat

- CasesDokumen43 halamanCasesapi-3814557Belum ada peringkat

- DocDokumen6 halamanDoctai nguyenBelum ada peringkat

- RTPBDokumen87 halamanRTPBKr PrajapatBelum ada peringkat

- CFP Mock Test Tax PlanningDokumen8 halamanCFP Mock Test Tax PlanningDeep Shikha67% (3)

- TVM Question 55Dokumen8 halamanTVM Question 55jaiBelum ada peringkat

- Risk and Insurance 2Dokumen61 halamanRisk and Insurance 2amrut85100% (1)

- Ashwin Case Study 2017 Que & SolDokumen14 halamanAshwin Case Study 2017 Que & SolIBBF FitnessBelum ada peringkat

- TestDokumen47 halamanTestsamcool87Belum ada peringkat

- Demo - Nism 5 A - Mutual Fund ModuleDokumen7 halamanDemo - Nism 5 A - Mutual Fund ModuleDiwakarBelum ada peringkat

- Investment Planning Mock Test: Practical Questions: Section 1: 41 Questions (1 Mark Each)Dokumen17 halamanInvestment Planning Mock Test: Practical Questions: Section 1: 41 Questions (1 Mark Each)its_different17Belum ada peringkat

- CFP Retirerment Planning Practice Book SampleDokumen43 halamanCFP Retirerment Planning Practice Book SampleMeenakshi100% (4)

- Practice Qs 2Dokumen24 halamanPractice Qs 2SANCHITA PATIBelum ada peringkat

- Chapter Five Investment PolicyDokumen14 halamanChapter Five Investment PolicyfergiemcBelum ada peringkat

- Sample Question CFPDokumen15 halamanSample Question CFPapi-3814557100% (7)

- Retail Banking and Wealth ManagementDokumen36 halamanRetail Banking and Wealth Managementamanjotkaur10sainiBelum ada peringkat

- Tybms Sem6 Sample QuestionsDokumen37 halamanTybms Sem6 Sample Questions64-Shashank SagarBelum ada peringkat

- As2114 2021 QPDokumen8 halamanAs2114 2021 QPTuff BubaBelum ada peringkat

- Question Bank-MCQ FM&CF (KMBN, KMBA 204)Dokumen27 halamanQuestion Bank-MCQ FM&CF (KMBN, KMBA 204)Amit ThakurBelum ada peringkat

- Financial Planning Sample QuestionsDokumen3 halamanFinancial Planning Sample Questionsraman927Belum ada peringkat

- Project Finance Question PaperDokumen3 halamanProject Finance Question PaperBhavna0% (1)

- Multiple Choice at The End of LectureDokumen6 halamanMultiple Choice at The End of LectureOriana LiBelum ada peringkat

- Acca FM PT 2 (091020)Dokumen7 halamanAcca FM PT 2 (091020)Sukhdeep KaurBelum ada peringkat

- Questions Based On F Inancial Managem EntDokumen21 halamanQuestions Based On F Inancial Managem EntHemant kumarBelum ada peringkat

- End - of - Semester Examination Semester SessionDokumen6 halamanEnd - of - Semester Examination Semester Sessionkenha2000Belum ada peringkat

- WhatDokumen3 halamanWhatchitra_shresthaBelum ada peringkat

- TadaDokumen4 halamanTadachitra_shresthaBelum ada peringkat

- UploadDokumen5 halamanUploadchitra_shresthaBelum ada peringkat

- Payment and Settlement SystemDokumen16 halamanPayment and Settlement Systemchitra_shresthaBelum ada peringkat

- SixDokumen5 halamanSixchitra_shresthaBelum ada peringkat

- SevenDokumen5 halamanSevenchitra_shresthaBelum ada peringkat

- Your New Beginning Starts HereDokumen2 halamanYour New Beginning Starts Herechitra_shresthaBelum ada peringkat

- FiveDokumen6 halamanFivechitra_shresthaBelum ada peringkat

- Applications of Motivation: Group - 5Dokumen7 halamanApplications of Motivation: Group - 5chitra_shresthaBelum ada peringkat

- Financial ManagementDokumen9 halamanFinancial Managementchitra_shresthaBelum ada peringkat

- Case Study On Tata SkyDokumen4 halamanCase Study On Tata Skychitra_shresthaBelum ada peringkat

- Barings Bank Scandal, Derivative ScamsDokumen24 halamanBarings Bank Scandal, Derivative Scamschitra_shresthaBelum ada peringkat

- What Is Mean by Mutual FundDokumen38 halamanWhat Is Mean by Mutual Fundchitra_shresthaBelum ada peringkat

- Relative ValuationDokumen3 halamanRelative Valuationchitra_shresthaBelum ada peringkat

- Creative Math Techniques - The Indian WayDokumen3 halamanCreative Math Techniques - The Indian Waychitra_shresthaBelum ada peringkat

- Fasten Up Your Calculations Using Ancient Indian Principles of Vedic MathDokumen3 halamanFasten Up Your Calculations Using Ancient Indian Principles of Vedic Mathchitra_shresthaBelum ada peringkat

- Mobile WorkforceDokumen4 halamanMobile Workforcechitra_shresthaBelum ada peringkat

- Gravitation Questions On Gravitation, Paper 1: G 3 GR 4 G 3 GR 4Dokumen2 halamanGravitation Questions On Gravitation, Paper 1: G 3 GR 4 G 3 GR 4chitra_shresthaBelum ada peringkat

- Oil, Gas and CoalDokumen3 halamanOil, Gas and Coalchitra_shresthaBelum ada peringkat

- AnilDokumen10 halamanAnilanilhnBelum ada peringkat

- SR No Date Amount Invested Op Bal WithdrawalDokumen2 halamanSR No Date Amount Invested Op Bal Withdrawalchitra_shresthaBelum ada peringkat

- NewDokumen19 halamanNewchitra_shresthaBelum ada peringkat

- Presented By:-Harsh Pathak Anand Swaroop Rajvardhan Manmohan Sachlin SinghDokumen21 halamanPresented By:-Harsh Pathak Anand Swaroop Rajvardhan Manmohan Sachlin Singhchitra_shresthaBelum ada peringkat

- Oil, Gas and CoalDokumen3 halamanOil, Gas and Coalchitra_shresthaBelum ada peringkat

- Boiled Rice UpmaDokumen1 halamanBoiled Rice Upmachitra_shresthaBelum ada peringkat

- The Scorpio StoryDokumen4 halamanThe Scorpio Storychitra_shresthaBelum ada peringkat

- Circular Motion Paper-1 PDFDokumen3 halamanCircular Motion Paper-1 PDFManoj Janardan Jayashree TerekarBelum ada peringkat

- Function Keys in Microsoft Excel: Shift CTRL ALT Ctrl+Shift Alt+Shift F1 F2 Function KeyDokumen1 halamanFunction Keys in Microsoft Excel: Shift CTRL ALT Ctrl+Shift Alt+Shift F1 F2 Function Keychitra_shresthaBelum ada peringkat

- Mobile WorkforceDokumen4 halamanMobile Workforcechitra_shresthaBelum ada peringkat

- Ned Wicker's AssumptionsDokumen2 halamanNed Wicker's Assumptionschitra_shresthaBelum ada peringkat

- Instructional Material FOR ECON 30063 Monetary Economics: Polytechnic University of The PhilippinesDokumen9 halamanInstructional Material FOR ECON 30063 Monetary Economics: Polytechnic University of The PhilippinesMonicDuranBelum ada peringkat

- Business Transactions and Their Anlysis - BSAIS 1A - Group 2Dokumen32 halamanBusiness Transactions and Their Anlysis - BSAIS 1A - Group 2Marydelle De Austria-De GuiaBelum ada peringkat

- HSBC Bank Usa, N.A.: Trade & Supply Chain Foreign Exchange and Risk ManagementDokumen13 halamanHSBC Bank Usa, N.A.: Trade & Supply Chain Foreign Exchange and Risk ManagementStephen BgoyaBelum ada peringkat

- Genealogy ReportDokumen2 halamanGenealogy Reportzhaodonghk3Belum ada peringkat

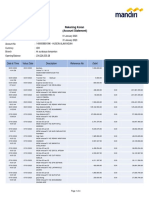

- Rek Koran Mandiri PT HAI Jan-April 2023Dokumen14 halamanRek Koran Mandiri PT HAI Jan-April 2023wahyu suhartonoBelum ada peringkat

- MUH - SYUKUR - A031191077) AKUNTANSI MANAJEMEN-PROBLEM 11-18 Return On Investment (ROI) and Residual IncomeDokumen3 halamanMUH - SYUKUR - A031191077) AKUNTANSI MANAJEMEN-PROBLEM 11-18 Return On Investment (ROI) and Residual IncomeRismayantiBelum ada peringkat

- Handover Notes-Finance and Admin - 31 August 2021Dokumen5 halamanHandover Notes-Finance and Admin - 31 August 2021Liberty RuzvidzoBelum ada peringkat

- ALEKSANDRADokumen1 halamanALEKSANDRARODRIGUE ACCIAROBelum ada peringkat

- CT1 QP 0506Dokumen4 halamanCT1 QP 0506Subhash KumarBelum ada peringkat

- Astronaut AstroDokumen2 halamanAstronaut AstroSugar SugarBelum ada peringkat

- Philippine Bond MarketDokumen30 halamanPhilippine Bond MarketMARY JUSTINE PAQUIBOTBelum ada peringkat

- Capitalization TableDokumen10 halamanCapitalization TableDiego OssaBelum ada peringkat

- Exercise: The Market For Foreign Exchange: BMFM 33135 Oct 2020Dokumen3 halamanExercise: The Market For Foreign Exchange: BMFM 33135 Oct 2020Sylvia GynBelum ada peringkat

- Cfas MidtermDokumen7 halamanCfas MidtermChristian De GuzmanBelum ada peringkat

- Chapter 13 Mini-CaseDokumen5 halamanChapter 13 Mini-CaseSaima Fazal0% (1)

- Form OC-10 Appl 4 FRNDokumen51 halamanForm OC-10 Appl 4 FRNBenne James100% (4)

- Multiple Choice Questions (MCQS) : InstructionsDokumen5 halamanMultiple Choice Questions (MCQS) : InstructionsMubashir HussainBelum ada peringkat

- Foreign Currency TransactionsDokumen58 halamanForeign Currency TransactionsKatzkie Montemayor GodinezBelum ada peringkat

- ACCT 102 Lecture Notes Chapter 13 SPR 2018Dokumen5 halamanACCT 102 Lecture Notes Chapter 13 SPR 2018Sophia Varias CruzBelum ada peringkat

- SLM-Unit 01Dokumen25 halamanSLM-Unit 01nikilraj123Belum ada peringkat

- Financial Statements PreparationDokumen6 halamanFinancial Statements Preparationana lopezBelum ada peringkat

- Financial Flexibility Framework AnalysisDokumen9 halamanFinancial Flexibility Framework AnalysisEdwin GunawanBelum ada peringkat

- Black Book CompleteDokumen77 halamanBlack Book CompletedhrupkhadseBelum ada peringkat

- Exchange Deed: Description of The DeedDokumen3 halamanExchange Deed: Description of The DeedAdan HoodaBelum ada peringkat

- Different Types of Loan Products Offered by Private Commercial Banks in Bangladesh - A Case Study On Modhumoti Bank LimitedDokumen16 halamanDifferent Types of Loan Products Offered by Private Commercial Banks in Bangladesh - A Case Study On Modhumoti Bank LimitedSharmin Mehenaz TonneeBelum ada peringkat

- LT E-BillDokumen2 halamanLT E-BillSachin VaishnavBelum ada peringkat

- A Study On 269SS & 269 TDokumen4 halamanA Study On 269SS & 269 TsivaranjanBelum ada peringkat

- Exposure To Trading Market-TradejiniDokumen5 halamanExposure To Trading Market-TradejiniJessica VarmaBelum ada peringkat

- FixedDepositsDokumen1 halamanFixedDepositsTiso Blackstar GroupBelum ada peringkat

- Final Report - Payments ProcessDokumen32 halamanFinal Report - Payments Processmrshami7754Belum ada peringkat