Market - Commentary - 7-23-2012

Diunggah oleh

CLORIS4Deskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Market - Commentary - 7-23-2012

Diunggah oleh

CLORIS4Hak Cipta:

Format Tersedia

Weekly Commentary July 23, 2012 The Markets

ThemanwithhisfingeronthepulsesaystheU.S.economyfacestwomainrisks.Wehavenocontrol overoneofthoserisksandtheother,well,wedohavesomecontrol,butwhetherourpoliticianswill appropriatelyexercisethatcontrolisabigquestion.

FederalReserveChairmanBenBernankefacedCongresslastweekandhedeliveredarathersubdued outlookinhissemiannualmonetarypolicyreport.Hesaidoureconomyfacestwomajorheadwinds:

1. TheEuroareafiscalandbankingcrisisanditspotentialspillovereffectsonoureconomy. 2. TheunsustainablepathoftheU.S.fiscalsituation(e.g.,thefiscalcliff).

Source:FederalReserve

TheU.S.haslittlecontrolovertheeuroareasituationsowereatthemercyofEuropeanleadersto makeboldandtoughdecisionstogettheirhousesinorder.Theseconditem,though,isclearlywithin ourcontrol.

Thesocalledfiscalcliff,inwhichaseriesoftaxhikesandspendingcutswilltakeeffectin2013if Congresstakesnofurtheraction,couldthrowtheeconomybackintoarecession.TheCongressional BudgetOfficeestimatesifnopolicychangesaremade,thenour2013federalbudgetdeficitwill declinebyabout$600billion.Onthesurface,thatsoundsgreat.However,suchahugeshocktoour systeminashortperiodoftimecouldbeproblematic.

So,willCongressagreetoadjustthelegislationforthebenefitoftheeconomy?Wellsee.

Forhispart,BernankesaidtheFederalReserveispreparedtotakefurtheractionasappropriateto promoteastrongereconomicrecoveryandsustainedimprovementinlabormarketconditionsina contextofpricestability.ItsgoodtoknowthattheFedisreadytohelpifneeded.

Dataasof7/20/12 1Week YTD 1Year 3Year 5Year 10Year

Standard&Poor's500(DomesticStocks) DJGlobalexUS(ForeignStocks) 10yearTreasuryNote(YieldOnly) Gold(perounce) DJUBSCommodityIndex DJEquityAllREITTRIndex

0.4% 0.6 1.5 1.2 4.2 1.1

8.4% 0.5 N/A 0.1 3.9 16.0

2.8% 16.9 2.9 0.6 11.1 9.5

12.7% 3.3 3.6 18.3 6.3 31.4

2.3% 7.8 5.0 18.3 3.4 2.7

5.2% 5.6 4.6 17.2 3.8 12.1

Notes:S&P500,DJGlobalexUS,Gold,DJUBSCommodityIndexreturnsexcludereinvesteddividends(golddoesnotpayadividend)andthe three,five,and10yearreturnsareannualized;theDJEquityAllREITTRIndexdoesincludereinvesteddividendsandthethree,five,and10 yearreturnsareannualized;andthe10yearTreasuryNoteissimplytheyieldatthecloseofthedayoneachofthehistoricaltimeperiods. Sources:Yahoo!Finance,Barrons,djindexes.com,LondonBullionMarketAssociation. Pastperformanceisnoguaranteeoffutureresults.Indicesareunmanagedandcannotbeinvestedintodirectly.N/Ameansnotapplicable.

ITSBEENALMOSTAYEARsinceAugust5,2011,thedaytheU.S.lostitscovetedAAAcreditrating fromStandardandPoors.So,howhavethefinancialmarketsrespondedintheyearsince?Quitewell, actually.

Itmaynotfeellikeit,butthebroadU.S.stockmarket,asmeasuredbytheS&P500index,rose13.6 percentbetweenAugust5,2011andlastFriday,accordingtodatafromYahoo!Finance.Despiteallthe angstfromthecreditdowngrade,thethreatofadoublediprecessionandtheturmoilinEurope,the stockmarkethashunginthere.

Thereturnsinthebondmarketareperhapsevenmorestartling.The10yearTreasuryyielded2.56 percentonAugust5,2011andbylastFriday,theyieldhaddroppedto1.46percent,accordingto Yahoo!Finance.Normally,youmightexpectinterestratestoriseafteracreditdowngradesincethe ratingsagencyisessentiallysayingyourbondsareriskierthanpreviouslythought.

TheU.S.,though,isperhapsaspecialcase.Thedayafterthecreditdowngrade,noneotherthan WarrenBuffettwentonBloombergtelevisionandsaidhethoughttheU.S.shouldbeaquadrupleA rating.And,tothisday,theU.S.dollarremainstheworldsleadingreservecurrencyasmorethan60 percentoftheworldsforeigncurrencyreservesareheldinU.S.dollars,accordingtoBusinessWeek.

Weshouldntgetoverconfident,though.WhiletheU.S.hastremendousassets,itmightonlytakea fewbaddecisionsfromourleaderstoundowhattookdecadestobuild.

WeeklyFocusThinkAboutIt

ThereisnothingwrongwithAmericathatthefaith,loveoffreedom,intelligence,andenergyofher citizenscannotcure. DwightD.Eisenhower,34thpresidentoftheUnitedStates Bestregards,

PattyLoris,MBA,CFP LPLFinancialAdvisor

P.S.Pleasefeelfreetoforwardthiscommentarytofamily,friends,orcolleagues.Ifyouwouldlikeus toaddthemtothelist,pleasereplytothisemailwiththeiremailaddressandwewillaskfortheir permissiontobeadded. SecuritiesofferedthroughLPLFinancial,MemberFINRA/SIPC.

* This newsletter was prepared by Peak Advisor Alliance. * The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. * The DJ Global ex US is an unmanaged group of non-U.S. securities designed to reflect the performance of the global equity securities that have readily available prices. * The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the longterm bond market. * Gold represents the London afternoon gold price fix as reported by the London Bullion Market Association. Precious metal investing is subject to substantial fluctuation and potential for loss. * The DJ Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998. * The DJ Equity All REIT TR Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones. * Yahoo! Finance is the source for any reference to the performance of an index between two specific periods. * Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. * Past performance does not guarantee future results. * You cannot invest directly in an index.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Patty Loris Weekly Commentary please reply to this e-mail with Unsubscribe in the subject line. Compliance Number: 1-085807

Anda mungkin juga menyukai

- SPEX Issue 17Dokumen10 halamanSPEX Issue 17SMU Political-Economics Exchange (SPEX)Belum ada peringkat

- Market Commentary 11-26-12Dokumen3 halamanMarket Commentary 11-26-12CLORIS4Belum ada peringkat

- Plus: A 2011 Forecast From GFT'S David Morrison, Kathy Lien and Boris SchlossbergDokumen23 halamanPlus: A 2011 Forecast From GFT'S David Morrison, Kathy Lien and Boris Schlossbergn73686861Belum ada peringkat

- On Our Minds - : Week AheadDokumen28 halamanOn Our Minds - : Week AheadnoneBelum ada peringkat

- Weekly Market Commentary 10/22/2012Dokumen3 halamanWeekly Market Commentary 10/22/2012monarchadvisorygroupBelum ada peringkat

- The Monarch Report 04-23-12Dokumen3 halamanThe Monarch Report 04-23-12monarchadvisorygroupBelum ada peringkat

- Market Commentary 10-31-11 PAADokumen3 halamanMarket Commentary 10-31-11 PAAmonarchadvisorygroupBelum ada peringkat

- Economic Insights 25 02 13Dokumen16 halamanEconomic Insights 25 02 13vikashpunglia@rediffmail.comBelum ada peringkat

- Weekly Commentary January 22, 2013: The MarketsDokumen4 halamanWeekly Commentary January 22, 2013: The MarketsStephen GierlBelum ada peringkat

- Morning News Notes: 2010-02-03Dokumen2 halamanMorning News Notes: 2010-02-03glerner133926Belum ada peringkat

- The Monarch Report 6-18-2012Dokumen4 halamanThe Monarch Report 6-18-2012monarchadvisorygroupBelum ada peringkat

- Weekly Market Commentary 6-17-13Dokumen3 halamanWeekly Market Commentary 6-17-13Stephen GierlBelum ada peringkat

- June 142010 PostsDokumen28 halamanJune 142010 PostsAlbert L. PeiaBelum ada peringkat

- The Monarch Report 1/22/2013Dokumen3 halamanThe Monarch Report 1/22/2013monarchadvisorygroupBelum ada peringkat

- 3Q2011 Markets Outlook USDokumen12 halaman3Q2011 Markets Outlook USsahil-madhani-3137Belum ada peringkat

- LCG 2011 Economic OutlookDokumen7 halamanLCG 2011 Economic OutlookC. Bradley ChapmanBelum ada peringkat

- Market Commentary 12-17-12Dokumen4 halamanMarket Commentary 12-17-12Stephen GierlBelum ada peringkat

- Tracking The World Economy... - 26/07/2010Dokumen3 halamanTracking The World Economy... - 26/07/2010Rhb InvestBelum ada peringkat

- The Pensford Letter - 1.16.12Dokumen5 halamanThe Pensford Letter - 1.16.12Pensford FinancialBelum ada peringkat

- Weekly Market Commentary 07-05-2011Dokumen4 halamanWeekly Market Commentary 07-05-2011Jeremy A. MillerBelum ada peringkat

- Don't Forget To R.S.V.P. For Our Kevin Elko Event at Cabana On October 8 at 6:00 P.MDokumen4 halamanDon't Forget To R.S.V.P. For Our Kevin Elko Event at Cabana On October 8 at 6:00 P.MmonarchadvisorygroupBelum ada peringkat

- In The NewsDokumen6 halamanIn The Newsapi-244981307Belum ada peringkat

- Curve BallsDokumen2 halamanCurve BallswbfgresearchBelum ada peringkat

- Key Rates: Home Business Markets World Politics Tech Opinion Breakingviews Money Life Pictures VideoDokumen23 halamanKey Rates: Home Business Markets World Politics Tech Opinion Breakingviews Money Life Pictures Videosujeet1077Belum ada peringkat

- Weekly Market Commentary 7-3-2012Dokumen3 halamanWeekly Market Commentary 7-3-2012monarchadvisorygroupBelum ada peringkat

- Weekly Market Commentary 06012015Dokumen4 halamanWeekly Market Commentary 06012015dpbasicBelum ada peringkat

- The Pensford Letter - 7.22.13Dokumen6 halamanThe Pensford Letter - 7.22.13Pensford FinancialBelum ada peringkat

- Is The Market Telling Us Whats ComingDokumen6 halamanIs The Market Telling Us Whats ComingKSIRCapitalBelum ada peringkat

- Market Commentary1!14!13Dokumen3 halamanMarket Commentary1!14!13CLORIS4Belum ada peringkat

- HSBC India - Jan-March 2012 Issue of Wealth StrategiesDokumen44 halamanHSBC India - Jan-March 2012 Issue of Wealth StrategiesRohitava SahaBelum ada peringkat

- Why Real Yields Matter - Pictet Asset ManagementDokumen7 halamanWhy Real Yields Matter - Pictet Asset ManagementLOKE SENG ONNBelum ada peringkat

- The Monarch Report 6/3/2013Dokumen4 halamanThe Monarch Report 6/3/2013monarchadvisorygroupBelum ada peringkat

- Lane Asset Management 2012 Stock Market Commentary and 2013 Fearless ForecastDokumen18 halamanLane Asset Management 2012 Stock Market Commentary and 2013 Fearless ForecastEdward C LaneBelum ada peringkat

- Where Do They Stand?: PerspectiveDokumen8 halamanWhere Do They Stand?: Perspectiverajesh palBelum ada peringkat

- Market Commentary 12-10-12Dokumen3 halamanMarket Commentary 12-10-12CLORIS4Belum ada peringkat

- Global Connections 75Dokumen11 halamanGlobal Connections 75henriquepcsBelum ada peringkat

- Weekly Market Commentary 6-19-2012Dokumen4 halamanWeekly Market Commentary 6-19-2012monarchadvisorygroupBelum ada peringkat

- Weekly Market Commentary 3-19-2012Dokumen4 halamanWeekly Market Commentary 3-19-2012monarchadvisorygroupBelum ada peringkat

- 2011-11-07 Horizon CommentaryDokumen3 halaman2011-11-07 Horizon CommentarybgeltmakerBelum ada peringkat

- Market Commentary January 7, 2013 The Markets: 1-Week Y-T-D 1-Year 3-Year 5-Year 10-YearDokumen4 halamanMarket Commentary January 7, 2013 The Markets: 1-Week Y-T-D 1-Year 3-Year 5-Year 10-YearCLORIS4Belum ada peringkat

- Market Commentary 1.28.2013Dokumen3 halamanMarket Commentary 1.28.2013CLORIS4Belum ada peringkat

- Market Commentary 7-30-12Dokumen3 halamanMarket Commentary 7-30-12CLORIS4Belum ada peringkat

- Project On RecessionDokumen10 halamanProject On Recessionjaswantmaurya0% (1)

- Weekly Market Commentary 7/1/2013Dokumen4 halamanWeekly Market Commentary 7/1/2013monarchadvisorygroupBelum ada peringkat

- Weekly Economic Commentary: Beige Book: Window On Main StreetDokumen7 halamanWeekly Economic Commentary: Beige Book: Window On Main Streetapi-136397169Belum ada peringkat

- Microsoft India The Best Employer: Randstad: What Are The Differences Between Closed Economy and Open Economy ?Dokumen5 halamanMicrosoft India The Best Employer: Randstad: What Are The Differences Between Closed Economy and Open Economy ?Subramanya BhatBelum ada peringkat

- IMF's Bold Recipe For Recovery: TagsDokumen5 halamanIMF's Bold Recipe For Recovery: TagsKrishna SumanthBelum ada peringkat

- Weekly Economic Commentary 5/13/2013Dokumen5 halamanWeekly Economic Commentary 5/13/2013monarchadvisorygroupBelum ada peringkat

- The Global View: What Does The ISM Mean For US Equities?Dokumen5 halamanThe Global View: What Does The ISM Mean For US Equities?mustafa-ahmedBelum ada peringkat

- The Monarch Report 10/28/2013Dokumen4 halamanThe Monarch Report 10/28/2013monarchadvisorygroupBelum ada peringkat

- Volume 2.10 The Artificial Economic Recovery July 23 2010Dokumen12 halamanVolume 2.10 The Artificial Economic Recovery July 23 2010Denis OuelletBelum ada peringkat

- Context: Upcoming Budget DiscussionsDokumen2 halamanContext: Upcoming Budget DiscussionsgradnvBelum ada peringkat

- Vinod Gupta School of Management, IIT KHARAGPUR: About Fin-o-MenalDokumen4 halamanVinod Gupta School of Management, IIT KHARAGPUR: About Fin-o-MenalFinterestBelum ada peringkat

- The Pensford Letter - 1.28.13Dokumen6 halamanThe Pensford Letter - 1.28.13Pensford FinancialBelum ada peringkat

- Economic Downturn Guide 1Dokumen32 halamanEconomic Downturn Guide 1Corina HerreraBelum ada peringkat

- 2010 Has The Look and Feel of 2007Dokumen3 halaman2010 Has The Look and Feel of 2007ValuEngine.comBelum ada peringkat

- JPM Weekly MKT Recap 3-19-12Dokumen2 halamanJPM Weekly MKT Recap 3-19-12Flat Fee PortfoliosBelum ada peringkat

- Weekly Commentary 11-27-12Dokumen4 halamanWeekly Commentary 11-27-12Stephen GierlBelum ada peringkat

- G10 Annual OutlookDokumen27 halamanG10 Annual OutlookansarialiBelum ada peringkat

- Market Commentary 2/25/13Dokumen3 halamanMarket Commentary 2/25/13CLORIS4Belum ada peringkat

- Market Commentary1!14!13Dokumen3 halamanMarket Commentary1!14!13CLORIS4Belum ada peringkat

- Market Commentary 3/18/13Dokumen3 halamanMarket Commentary 3/18/13CLORIS4Belum ada peringkat

- Market Commentary April 22, 2013Dokumen3 halamanMarket Commentary April 22, 2013CLORIS4Belum ada peringkat

- Market Commentary 1.28.2013Dokumen3 halamanMarket Commentary 1.28.2013CLORIS4Belum ada peringkat

- Market Commentary January 7, 2013 The Markets: 1-Week Y-T-D 1-Year 3-Year 5-Year 10-YearDokumen4 halamanMarket Commentary January 7, 2013 The Markets: 1-Week Y-T-D 1-Year 3-Year 5-Year 10-YearCLORIS4Belum ada peringkat

- Market Commentary 12-03-12Dokumen3 halamanMarket Commentary 12-03-12CLORIS4Belum ada peringkat

- Market Commentary 12-10-12Dokumen3 halamanMarket Commentary 12-10-12CLORIS4Belum ada peringkat

- Market Commentary 11-12-12Dokumen4 halamanMarket Commentary 11-12-12CLORIS4Belum ada peringkat

- Market Commentary 10-22-12Dokumen3 halamanMarket Commentary 10-22-12CLORIS4Belum ada peringkat

- Market Commentary 9-17-2012Dokumen3 halamanMarket Commentary 9-17-2012CLORIS4Belum ada peringkat

- Market Commentary 10-15-12Dokumen3 halamanMarket Commentary 10-15-12CLORIS4Belum ada peringkat

- Market Commentary 10-08-12Dokumen3 halamanMarket Commentary 10-08-12CLORIS4Belum ada peringkat

- Market Commentary 10-29-12Dokumen3 halamanMarket Commentary 10-29-12CLORIS4Belum ada peringkat

- How Will Expenses Change Your RetirementDokumen1 halamanHow Will Expenses Change Your RetirementCLORIS4Belum ada peringkat

- Exit Strategies For EntrepreneursDokumen1 halamanExit Strategies For EntrepreneursCLORIS4Belum ada peringkat

- Exit Strategies For EntrepreneursDokumen1 halamanExit Strategies For EntrepreneursCLORIS4Belum ada peringkat

- Marrige and Your FiancesDokumen1 halamanMarrige and Your FiancesCLORIS4Belum ada peringkat

- Intelux Electronics Private Limited September 07 2016 RRDokumen6 halamanIntelux Electronics Private Limited September 07 2016 RRunmeshjobs1999Belum ada peringkat

- Chap 5 Pcs Bm3303Dokumen40 halamanChap 5 Pcs Bm3303Kayula Carla ShulaBelum ada peringkat

- Entrepreneur: Warren BuffetDokumen12 halamanEntrepreneur: Warren BuffetAnadi GuptaBelum ada peringkat

- 10 5923 J Ijcem 20180701 01Dokumen21 halaman10 5923 J Ijcem 20180701 01Atul SethBelum ada peringkat

- XII STD - Economics EM Combined 11.03.2019 PDFDokumen296 halamanXII STD - Economics EM Combined 11.03.2019 PDFMonika AnnaduraiBelum ada peringkat

- O2 - BasketDokumen4 halamanO2 - BasketShekky007Belum ada peringkat

- Private Company ValuationDokumen35 halamanPrivate Company ValuationShibly0% (1)

- Tax 102 Prelim ExamDokumen5 halamanTax 102 Prelim ExamDonna TumalaBelum ada peringkat

- Pinku 123Dokumen91 halamanPinku 123bharat sachdevaBelum ada peringkat

- Carter CleaningDokumen1 halamanCarter CleaningYe GaungBelum ada peringkat

- Dcom307 - DMGT405 - Dcom406 - Financial Management PDFDokumen318 halamanDcom307 - DMGT405 - Dcom406 - Financial Management PDFBaltej singhBelum ada peringkat

- 2023 Internal Audit Plan For The CrewDokumen4 halaman2023 Internal Audit Plan For The CrewLateef LasisiBelum ada peringkat

- 03 Partnership Dissolution ANSWERDokumen4 halaman03 Partnership Dissolution ANSWERKrizza Mae MendozaBelum ada peringkat

- Essential Economics For Business Chapter 6 - 7Dokumen12 halamanEssential Economics For Business Chapter 6 - 7ridaBelum ada peringkat

- Coca Cola Company PresentationDokumen29 halamanCoca Cola Company PresentationVibhuti GoelBelum ada peringkat

- Primus Industries - TOC Case StudyDokumen2 halamanPrimus Industries - TOC Case StudySUJIT SONAWANEBelum ada peringkat

- Claiming Back Tax Paid On A Lump Sum: What To Do Now If The Form Is Filled in by Someone ElseDokumen9 halamanClaiming Back Tax Paid On A Lump Sum: What To Do Now If The Form Is Filled in by Someone ElseErmintrudeBelum ada peringkat

- On Companies Act 2013Dokumen23 halamanOn Companies Act 2013Ankit SankheBelum ada peringkat

- 2013 Deutsche Bank Operational Due Diligence SurveyDokumen48 halaman2013 Deutsche Bank Operational Due Diligence SurveyRajat CBelum ada peringkat

- Child Care Business PlanDokumen15 halamanChild Care Business Plandeepakpinksurat100% (5)

- BSA 1 13 Group 4 - Exercises 6 1 and 6 2Dokumen10 halamanBSA 1 13 Group 4 - Exercises 6 1 and 6 2vomawew647Belum ada peringkat

- The Unbanked and Underbanked by StateDokumen11 halamanThe Unbanked and Underbanked by StatecaitlynharveyBelum ada peringkat

- Sagar Suresh Gupta: Career ObjectiveDokumen3 halamanSagar Suresh Gupta: Career ObjectiveakashniranjaneBelum ada peringkat

- Deutsche Telekom Change MGT Case 1Dokumen10 halamanDeutsche Telekom Change MGT Case 1hadiasiddiqui100% (1)

- Mahila Samman Savings Certificate 2023 - FAQsDokumen3 halamanMahila Samman Savings Certificate 2023 - FAQsketanaurangabad3733Belum ada peringkat

- Amazon StrategiesDokumen2 halamanAmazon StrategiesanushriBelum ada peringkat

- 4.2 Accounting For Depreciation and Disposal of Non-Current AssetsDokumen10 halaman4.2 Accounting For Depreciation and Disposal of Non-Current Assetsnoahsilva374Belum ada peringkat

- Chapter 5Dokumen19 halamanChapter 5Flordeliza HalogBelum ada peringkat

- Money in The Nation's EconomyDokumen18 halamanMoney in The Nation's EconomyAnne Gatchalian67% (3)

- Management Theory and PracticalDokumen4 halamanManagement Theory and Practicalvipin mohanBelum ada peringkat

- Stonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonDari EverandStonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonPenilaian: 4.5 dari 5 bintang4.5/5 (21)

- The Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteDari EverandThe Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VotePenilaian: 4.5 dari 5 bintang4.5/5 (16)

- The War after the War: A New History of ReconstructionDari EverandThe War after the War: A New History of ReconstructionPenilaian: 5 dari 5 bintang5/5 (2)

- The Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpDari EverandThe Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpPenilaian: 4.5 dari 5 bintang4.5/5 (11)

- The Shadow War: Inside Russia's and China's Secret Operations to Defeat AmericaDari EverandThe Shadow War: Inside Russia's and China's Secret Operations to Defeat AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (12)

- The Next Civil War: Dispatches from the American FutureDari EverandThe Next Civil War: Dispatches from the American FuturePenilaian: 3.5 dari 5 bintang3.5/5 (48)

- The Courage to Be Free: Florida's Blueprint for America's RevivalDari EverandThe Courage to Be Free: Florida's Blueprint for America's RevivalBelum ada peringkat

- Thomas Jefferson: Author of AmericaDari EverandThomas Jefferson: Author of AmericaPenilaian: 4 dari 5 bintang4/5 (107)

- A History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationDari EverandA History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationPenilaian: 4 dari 5 bintang4/5 (11)

- The Quiet Man: The Indispensable Presidency of George H.W. BushDari EverandThe Quiet Man: The Indispensable Presidency of George H.W. BushPenilaian: 4 dari 5 bintang4/5 (1)

- We've Got Issues: How You Can Stand Strong for America's Soul and SanityDari EverandWe've Got Issues: How You Can Stand Strong for America's Soul and SanityPenilaian: 5 dari 5 bintang5/5 (1)

- Look Again: The Power of Noticing What Was Always ThereDari EverandLook Again: The Power of Noticing What Was Always TherePenilaian: 5 dari 5 bintang5/5 (3)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassDari EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassBelum ada peringkat

- Modern Warriors: Real Stories from Real HeroesDari EverandModern Warriors: Real Stories from Real HeroesPenilaian: 3.5 dari 5 bintang3.5/5 (3)

- Game Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeDari EverandGame Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimePenilaian: 4 dari 5 bintang4/5 (572)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingDari EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingPenilaian: 4.5 dari 5 bintang4.5/5 (97)

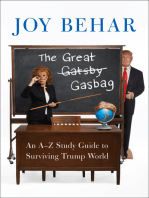

- The Great Gasbag: An A–Z Study Guide to Surviving Trump WorldDari EverandThe Great Gasbag: An A–Z Study Guide to Surviving Trump WorldPenilaian: 3.5 dari 5 bintang3.5/5 (9)

- The Red and the Blue: The 1990s and the Birth of Political TribalismDari EverandThe Red and the Blue: The 1990s and the Birth of Political TribalismPenilaian: 4 dari 5 bintang4/5 (29)

- The Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaDari EverandThe Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaBelum ada peringkat

- Crimes and Cover-ups in American Politics: 1776-1963Dari EverandCrimes and Cover-ups in American Politics: 1776-1963Penilaian: 4.5 dari 5 bintang4.5/5 (26)

- Economics 101: How the World WorksDari EverandEconomics 101: How the World WorksPenilaian: 4.5 dari 5 bintang4.5/5 (34)

- The Deep State: How an Army of Bureaucrats Protected Barack Obama and Is Working to Destroy the Trump AgendaDari EverandThe Deep State: How an Army of Bureaucrats Protected Barack Obama and Is Working to Destroy the Trump AgendaPenilaian: 4.5 dari 5 bintang4.5/5 (4)

- The Meth Lunches: Food and Longing in an American CityDari EverandThe Meth Lunches: Food and Longing in an American CityPenilaian: 5 dari 5 bintang5/5 (5)