Financial Modelling and Valuation

Diunggah oleh

ibshyd1Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Financial Modelling and Valuation

Diunggah oleh

ibshyd1Hak Cipta:

Format Tersedia

Financial Valuation Concepts Points to Consider Financial valuations are often the end result of a financial modeling exercise,

, and a good financial analyst will ensure a rigorous approach, grounded in sound knowledge of valuation concepts, is taken to calculating and performing financial valuations when building a financial model. Some points to consider whenever performing a financial valuation: How much can the key assumptions change without altering the decision? Are the assumptions realistic? Sales growth, operating margins, capital expenditure, discount rate, etc. Be realistic about synergies. Often synergies are manufactured to justify a deal. Avoid hockey stick forecasts where a dramatic turnaround for an underperforming company is forecast. This is often not the case in real world business situations, where gradual changes are most common, and sharp turnarounds considered a rare upside. What could go wrong that would invalidate the decision? How likely is that to occur? Search for mental blindspots such as off-balance sheet items. What if a key executive was ill? Avoid short cuts Use the nine-step DCF process! Financial Valuation Concepts Discounted Cash Flow When a financial analyst is required to conduct a financial valuation on the business or company being forecasted by the financial model, a commonly used valuation technique in a financial modeling exercise is the Discounted Cash Flow (DCF) method. The DCF method uses a nine step process to value a business enterprise: 1. Forecast Free Cash Flow (FCF) 2. Estimate the Weighted Average Cost of Capital (WACC) 3. Use WACC to discount FCF 4. Estimate terminal value (as known as residue value) 5. Use WACC to discount terminal value 6. Estimate total present value of FCF 7. Add value of non-operating assets 8. Subtract value of liabilities assumed 9. Calculate value of common stock Real Options (Strategic Options) in Financial Modeling The traditional, financial results led approach to assessing the viability of a project or business in a financial modeling exercise continues to work very well today, however, a more strategic approach to decision making has also emerged to complement the traditional process.

Real options (or strategic options) are opportunities embedded in projects or investments that are likely to exist and have a material economic impact on cash flow and risk. The recognition of real options embedded in a project will result in the projects strategic net present value (NPV) to differ from its traditional NPV, as follows: Strategic NPV = Traditional NPV + Value of real options We highlight a number of the most common categories of real options which can occur in when performing financial modeling on a project or investment. Abandonment Option The option to terminate or abandon a project before the end of its planned lifespan. This option allows executives or project owners to minimize or avoid monetary losses on projects that turn financially unsuccessful. A good financial modeler who explicitly recognizing the abandonment option when evaluating a project often increases the NPV. Flexibility Option The option to incorporate a greater degree of fluctuation / flexibility into a companys operations, especially manufacturing & production. It generally includes the opportunity to design the manufacturing & production process to accept multiple inputs, use flexible manufacturing techniques / technologies to create a range of outputs by reconfiguring the same set of plant and equipment, and purchase and retain excess capacity in capital intensive industries subject to wide fluctuations in output demand and long lead times in building new capacity from the ground up. A financial modeling and analysis exercise that recognizes this option embedded in a capital expenditure should be able to increase the NPV of a project. Growth Option The option to develop follow on businesses or projects, expand in new or existing markets, retool or increase plants, etc, that would not be possible without the on going existence of the project that is being evaluated for implementation. If a project being considered has the potential to open new avenues for growth if successful, then recognition of the cash flows from such opportunities should be included in the financial model of the initial decision making process. Growth opportunities embedded in a project often increases the projects NPV. Timing Option The option to determine when various actions related to a project are implemented. This option recognizes the companys opportunity to postpone or delay acceptance of a project for one or more time periods, or to either accelerate or slow down the process of implementing a project in response to new information, or to discontinue a project temporarily in response to changes in the competitive landscape or general market conditions. As in the case of the other type of real options, the explicit recognition of timing opportunities in a financial model can improve the NPV of a project that fails to recognize this option in an investment decision.

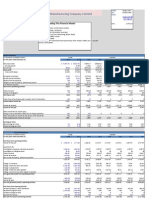

The Concept Of Free Cash Flow (FCF) Free cash flow (FCF) is equal to the after-tax operating earnings of the company plus noncash charges less investments in working capital, plant, property and equipment (or PP&E), and other assets. FCF is the cash flow generated by a company that is available to all providers of capital, both debt and equity. The table illustrates how free cash flow can be derived from financial statements or results of a financial modeling and financial valuation exercise. 2008 2009 Revenue Operating Expenses EBIT Taxes Net Operating Profit plus Depreciation Gross Cash Flow (A) Change in Working Capital Capital Expenditure Include in Other Assets Gross Investment Total (B) FREE CASH FLOW (A - B) 1,200 1,380 240 144 30 174 9 72 3 84 90 276 166 33 199 18 83 10 111 88 2010 1,587 349 (140) 209 37 246 21 95 2 118 128 2011 1,746 384 (154) 230 41 271 16 105 3 124 147 2012 1,920 422 (169) 253 46 299 17 115 3 135 164

(960) (1,104) (1,238) (1,362) (1,498) (96) (110)

Financial Valuation Concepts The Internal Rate of Return (IRR) The internal rate of return (or IRR) is a common financial valuation metric used by financial analysts to calculate and assess the financial attractiveness / viability of capital intensive projects or investments. As the IRR is normally easier to understand than the result of a discounted cash flow (DCF) analysis (i.e. the net present value or NPV) for non-financial executives, it is often used to explain and justify investment decisions, although a good financial modeler should know that the IRR is after all an estimated value, especially when calculated in Excel, and should be used in conjunction with other financial metrics such as the NPV and comparable valuation multiples when presenting a business or investment case. So what exactly is the IRR? The IRR is the interest rate that makes the net present value of all cash flow equal to zero. In financial analysis terms, the IRR can be defined a

discount rate at which the present value of a series of investments is equal to the present value of the returns on those investments. All projects or investments with an IRR that has been calculated in a financial modelingexercise to be greater than the Weighted Average Cost of Capital (or WACC) should technically be considered as financially viable and accepted. When choosing between projects or investments whose outcomes or performance are absolutely independent of one another, a good financial modeler should deem the project or investment with the highest calculated IRR to be the most financially attractive, so long as we continue to keep in mind that the IRR value also needs to be higher than the WACC. Modified Internal Rate Of Return (MIRR) The modified IRR (MIRR) is said to reflect the profitability of a project or investment more realistically than an IRR. The reason why this is so is because the IRR assumes the cash flow from an investment or project to be reinvested at the IRR, whereas the modified IRR assumes that all cash flows to be reinvested at the investors / firms cost of capital. The MIRR is used extensively in real estate financial analysis due to the nature and timing of cash flows and investments for real estate investments. Dividend IRR The ongoing financial returns to investors who own and retain the equity of a business or project is essentially by way of financial / cash dividend payouts. As equity investors are typically last in rank in the cash flow waterfall, and therefore face the greatest risk of not being paid should the investment turn sour when compared to holders of other forms of ownership in the same investment, equity investors would therefore expect the highest return. The dividend IRR is therefore used extensively by equity investors to calculate and measure the discount rate at which the present value of cash dividend payouts equal the present value of equity investments. Capital Budgeting and the Pros and Cons of IRR and NPV Capital budgeting is an executive decision making technique that all good financial analysts should be familiar with, in order to ensure that their financial modeling and analysis skill set remains relevant and practical to business realities. Capital budgeting is essentially an assessment on whether a capital investment into a project or business asset is worth undertaking from a financial attractiveness perspective. A good financial analyst should recognize that superior capital budgeting ability is reflected through a sound procedure that evaluates, compares and selects between 2 or more alternatives of an investment / capital expenditure that delivers satisfactory cash flows and rates of return. There are 2 primary capital budgeting metrics that have been traditionally used for this process: the net present value (NPV) and the internal rate of return (IRR), along with a secondary derivative of the IRR the modified internal rate of return (MIRR). If 2 or more investments are compared using the NPV method, a discount rate that fairly reflects the risk of each of the investments under consideration should be chosen. It would be realistic for a financial analyst to assess different projects at different discount rates

because the risks of each project generally differs. However, a good financial analyst would always keep mind that the result of an NPV based capital budgeting assessment can only be as reliable as the discount rate that is chosen. If the discount rate chosen for the NPV assessment of an investment is unrealistic, the decision to accept or reject the investment would therefore be unreliable. Like the NPV method to capital budgeting, the IRR method also uses cash flows and recognizes the time value of money. Whilst being easy to compute and understand, the IRR method does have some drawbacks. The main problem with the IRR method is that it often gives unrealistic rates of return. Assume we are assessing the financial attractiveness of an investment with a hurdle rate of 10% and the IRR is calculated to be 30%. An immediate assumption that financial analysts may infer from the IRR of 30% is that the investment is financially attractive and should be immediately accepted. However this is far from the reality, as an IRR of 30% assumes that there is an opportunity to reinvest future cash flows at 30%, rather than an actual return of 30%. If proven, historical business performance and general economic conditions indicate that a 30% return is an exceeding high rate for future re-investments, there would be reason for a good financial analyst to suspect that an IRR of 30% is unrealistic. Simply speaking, an IRR of 30% can be considered too good to be true. Hence, unless the calculated IRR is a reasonable rate for reinvestment of future cash flows, it should not be used as a yardstick to accept or reject an investment. A good financial analyst should also be aware that the IRR method may entail more problems than a financial modeler may anticipate. Another problem with the IRR method is that the IRR method may give rise to different rates of return. Assume a situation where there are 2 discount rates (i.e. 2 IRRs) that make the present value of an investment equal to the initial investment. In this case, a financial analyst would struggle to choose between the 2 rates as a decision factor for comparison with the cutoff rate. However, in practice, the IRR method is considered more popular and straightforward than the NPV approach for financial management and decision making, especially for business executives without an advanced level of financial knowledge. Generally speaking, to balance to trade offs between the NPV method and the IRR method, a good financial modeler would rely on both the NPV and the IRR when performing a capital budgeting assessment. If the IRR results of an assessment returns a very high value, a financial modeler must question whether such an impressive IRR is possible to maintain by looking at past and existing benchmarks, as well as future business opportunities, to see whether an opportunity to reinvest cash flows at such a high IRR really exists. If not, a good financial analyst would reevaluate the financial attractiveness of the investment by the NPV method, using a discount rate that is well researched and proven to be realistic and viable.

Anda mungkin juga menyukai

- Financial Model of Zynga IPODokumen76 halamanFinancial Model of Zynga IPOJack Macharla100% (1)

- Financial ModelDokumen22 halamanFinancial ModelRobert MascharanBelum ada peringkat

- Simple LBO ModelDokumen14 halamanSimple LBO ModelSucameloBelum ada peringkat

- Advanced Finacial ModellingDokumen1 halamanAdvanced Finacial ModellingLifeis BeautyfulBelum ada peringkat

- Ultimate Financial ModelDokumen36 halamanUltimate Financial ModelTom BookBelum ada peringkat

- SBDC Valuation Analysis ProgramDokumen8 halamanSBDC Valuation Analysis ProgramshanBelum ada peringkat

- Merger And Acquisition A Complete Guide - 2020 EditionDari EverandMerger And Acquisition A Complete Guide - 2020 EditionBelum ada peringkat

- Financial ModellingDokumen12 halamanFinancial Modellingalokroutray40% (5)

- LBO Valuation Model 1 ProtectedDokumen14 halamanLBO Valuation Model 1 ProtectedYap Thiah HuatBelum ada peringkat

- AAPL DCF ValuationDokumen12 halamanAAPL DCF ValuationthesaneinvestorBelum ada peringkat

- Valuation Cash Flow A Teaching NoteDokumen5 halamanValuation Cash Flow A Teaching NotesarahmohanBelum ada peringkat

- VISION: Our Strategic Infrastructure Roadmap ForwardDari EverandVISION: Our Strategic Infrastructure Roadmap ForwardBelum ada peringkat

- ITC Analysis FMDokumen19 halamanITC Analysis FMNeel ThobhaniBelum ada peringkat

- WACC CalculatorDokumen4 halamanWACC CalculatormayankBelum ada peringkat

- Qualcomm - DCF ModelDokumen11 halamanQualcomm - DCF ModelbusywaghBelum ada peringkat

- Summary of Mahendra Ramsinghani's The Business of Venture CapitalDari EverandSummary of Mahendra Ramsinghani's The Business of Venture CapitalBelum ada peringkat

- LBO Modeling Test ExampleDokumen19 halamanLBO Modeling Test ExampleJorgeBelum ada peringkat

- Ultimate Financial ModelDokumen33 halamanUltimate Financial ModelTulay Farra100% (1)

- Cost Of Capital A Complete Guide - 2020 EditionDari EverandCost Of Capital A Complete Guide - 2020 EditionPenilaian: 4 dari 5 bintang4/5 (1)

- Chp. 19Dokumen9 halamanChp. 19Mathew Stacks RinconBelum ada peringkat

- Financial Model-Mega BrandDokumen4 halamanFinancial Model-Mega BrandHongrui (Henry) Chen100% (1)

- Mezzanine Debt StructuresDokumen2 halamanMezzanine Debt StructuresJavierMuñozCanessaBelum ada peringkat

- Intermediate Financial ModellingDokumen95 halamanIntermediate Financial ModellingWilliam WilliamsonBelum ada peringkat

- Financial Model (Solera Holdings Inc.)Dokumen7 halamanFinancial Model (Solera Holdings Inc.)Hongrui (Henry) Chen0% (1)

- Habib Bank Limited - Financial ModelDokumen69 halamanHabib Bank Limited - Financial Modelmjibran_1Belum ada peringkat

- Financial Model - 225 East 13th Street, New YorkDokumen13 halamanFinancial Model - 225 East 13th Street, New YorkAliHaidar85100% (2)

- BpmToolbox 6.0-Historical & Forecast Business Planning Model Example (Basic)Dokumen66 halamanBpmToolbox 6.0-Historical & Forecast Business Planning Model Example (Basic)kunjan2165Belum ada peringkat

- CFADS Calculation ApplicationDokumen2 halamanCFADS Calculation Applicationtransitxyz100% (1)

- Startup Financial ModelDokumen136 halamanStartup Financial ModelChinh Lê ĐìnhBelum ada peringkat

- Business ValuationDokumen2 halamanBusiness Valuationjrcoronel100% (1)

- Financial Model Template Financial Model Template Financial Model TemplateDokumen29 halamanFinancial Model Template Financial Model Template Financial Model TemplatetfnkBelum ada peringkat

- 03 Financial ModelDokumen32 halaman03 Financial Modelromyka0% (1)

- LBO in PracticeDokumen12 halamanLBO in PracticeZexi WUBelum ada peringkat

- Hammond Manufacturing Company Limited: Guide of Reading This Financial ModelDokumen4 halamanHammond Manufacturing Company Limited: Guide of Reading This Financial ModelHongrui (Henry) Chen100% (1)

- Semi-Annual Debt in A Quarterly ModelDokumen2 halamanSemi-Annual Debt in A Quarterly ModelSyed Muhammad Ali SadiqBelum ada peringkat

- Mergers Acquisitions Valuation With ExcelDokumen4 halamanMergers Acquisitions Valuation With ExcelTazeen Islam0% (1)

- Lbo Model Long FormDokumen6 halamanLbo Model Long FormadsadasMBelum ada peringkat

- Free Cash Flow To Equity Valuation Model For Coca ColaDokumen5 halamanFree Cash Flow To Equity Valuation Model For Coca Colaafridi65Belum ada peringkat

- Damodaran - Corporate Finance - Measuring ReturnDokumen91 halamanDamodaran - Corporate Finance - Measuring ReturntweetydavBelum ada peringkat

- Innovation and Entrepreneurship: Company Valuation - 11Dokumen22 halamanInnovation and Entrepreneurship: Company Valuation - 11hussain_n100% (3)

- ValuationDokumen55 halamanValuationarunzexyBelum ada peringkat

- Financial Modelling A Complete GuideDokumen29 halamanFinancial Modelling A Complete GuideArihant patilBelum ada peringkat

- Report On Financial ModellingDokumen5 halamanReport On Financial ModellingSourabh Singh100% (1)

- Commercial Real Estate Valuation Model1Dokumen2 halamanCommercial Real Estate Valuation Model1cjsb99Belum ada peringkat

- Financial Modeling of TCS LockDokumen43 halamanFinancial Modeling of TCS LockSiddhesh GurjarBelum ada peringkat

- Capital StructureDokumen25 halamanCapital StructureMihael Od SklavinijeBelum ada peringkat

- DCF ModelDokumen6 halamanDCF ModelKatherine ChouBelum ada peringkat

- Lbo DCF ModelDokumen36 halamanLbo DCF ModeljtmoniiiBelum ada peringkat

- Project IRR Vs Equity IRRDokumen2 halamanProject IRR Vs Equity IRRmajorkonig100% (1)

- Kellogg: Balance SheetDokumen14 halamanKellogg: Balance SheetSubhajit KarmakarBelum ada peringkat

- Ebook: Financial Advice With Robo Advisors (English)Dokumen25 halamanEbook: Financial Advice With Robo Advisors (English)BBVA Innovation CenterBelum ada peringkat

- Fcffsimpleginzu ITCDokumen62 halamanFcffsimpleginzu ITCPravin AwalkondeBelum ada peringkat

- How Do Investment Banks Value Initial Public Offerings (Ipos) ?Dokumen32 halamanHow Do Investment Banks Value Initial Public Offerings (Ipos) ?mumssrBelum ada peringkat

- Valuation Report DCF Power CompanyDokumen34 halamanValuation Report DCF Power CompanySid EliBelum ada peringkat

- Netflix Equity Debt Convertible Investment Banking Pitch BookDokumen15 halamanNetflix Equity Debt Convertible Investment Banking Pitch BookphuBelum ada peringkat

- Project NPV Sensitivity AnalysisDokumen54 halamanProject NPV Sensitivity AnalysisAsad Mehmood100% (3)

- (Lecture 1 & 2) - Introduction To Investment Appraisal MethodsDokumen21 halaman(Lecture 1 & 2) - Introduction To Investment Appraisal MethodsAjay Kumar Takiar100% (1)

- (Lecture 1 & 2) - Introduction To Investment Appraisal Methods 2Dokumen21 halaman(Lecture 1 & 2) - Introduction To Investment Appraisal Methods 2Ajay Kumar TakiarBelum ada peringkat

- Module 2 - Analysis and Techniques of Capital BudgetingDokumen42 halamanModule 2 - Analysis and Techniques of Capital Budgetinghats300972Belum ada peringkat

- Invoice Ce 2019 12 IVDokumen8 halamanInvoice Ce 2019 12 IVMoussa NdourBelum ada peringkat

- Vlue AdDokumen153 halamanVlue AdsindhushankarBelum ada peringkat

- OITE - MCQ S QuestionsFinal2011Dokumen67 halamanOITE - MCQ S QuestionsFinal2011KatKut99100% (7)

- Appendix I Leadership Questionnaire: Ior Description Questionnaire (LBDQ - Form XII 1962) - The Division IntoDokumen24 halamanAppendix I Leadership Questionnaire: Ior Description Questionnaire (LBDQ - Form XII 1962) - The Division IntoJoan GonzalesBelum ada peringkat

- CH 2 & CH 3 John R. Schermerhorn - Management-Wiley (2020)Dokumen9 halamanCH 2 & CH 3 John R. Schermerhorn - Management-Wiley (2020)Muhammad Fariz IbrahimBelum ada peringkat

- Adobe Voice Assessment Tool-FinalDokumen1 halamanAdobe Voice Assessment Tool-Finalapi-268484302Belum ada peringkat

- Questionnaire HRISDokumen4 halamanQuestionnaire HRISAnonymous POUAc3zBelum ada peringkat

- Proff Ethi PDFDokumen12 halamanProff Ethi PDFgeethammani100% (1)

- Jackson Et Al 2019 Using The Analytical Target Profile To Drive The Analytical Method LifecycleDokumen9 halamanJackson Et Al 2019 Using The Analytical Target Profile To Drive The Analytical Method LifecyclerbmoureBelum ada peringkat

- Chapter 1Dokumen16 halamanChapter 1MulugetaBelum ada peringkat

- Oral Abstract PresentationDokumen16 halamanOral Abstract Presentationapi-537063152Belum ada peringkat

- 5909 East Kaviland AvenueDokumen1 halaman5909 East Kaviland Avenueapi-309853346Belum ada peringkat

- Chemistry Chapter SummariesDokumen23 halamanChemistry Chapter SummariesHayley AndersonBelum ada peringkat

- Normalization Techniques For Multi-Criteria Decision Making: Analytical Hierarchy Process Case StudyDokumen11 halamanNormalization Techniques For Multi-Criteria Decision Making: Analytical Hierarchy Process Case StudyJohn GreenBelum ada peringkat

- Ron Clark ReflectionDokumen3 halamanRon Clark Reflectionapi-376753605Belum ada peringkat

- Mark Scheme (Results) Summer 2019: Pearson Edexcel International GCSE in English Language (4EB1) Paper 01RDokumen19 halamanMark Scheme (Results) Summer 2019: Pearson Edexcel International GCSE in English Language (4EB1) Paper 01RNairit100% (1)

- Uprooted Radical Part 2 - NisiOisiN - LightDokumen307 halamanUprooted Radical Part 2 - NisiOisiN - LightWillBelum ada peringkat

- SpreadsheetDokumen8 halamanSpreadsheetSMBelum ada peringkat

- Roman Catholic of Aklan Vs Mun of Aklan FULL TEXTDokumen33 halamanRoman Catholic of Aklan Vs Mun of Aklan FULL TEXTDessa Ruth ReyesBelum ada peringkat

- WLAS - CSS 12 - w3Dokumen11 halamanWLAS - CSS 12 - w3Rusty Ugay LumbresBelum ada peringkat

- Transportation Research Part F: Andreas Lieberoth, Niels Holm Jensen, Thomas BredahlDokumen16 halamanTransportation Research Part F: Andreas Lieberoth, Niels Holm Jensen, Thomas BredahlSayani MandalBelum ada peringkat

- The Endless Pursuit of Truth: Subalternity and Marginalization in Post-Neorealist Italian FilmDokumen206 halamanThe Endless Pursuit of Truth: Subalternity and Marginalization in Post-Neorealist Italian FilmPaul MathewBelum ada peringkat

- The Christian Life ProgramDokumen28 halamanThe Christian Life ProgramRalph Christer MaderazoBelum ada peringkat

- An Equivalent Circuit of Carbon Electrode SupercapacitorsDokumen9 halamanAn Equivalent Circuit of Carbon Electrode SupercapacitorsUsmanSSBelum ada peringkat

- You Are Loved PDFDokumen4 halamanYou Are Loved PDFAbrielle Angeli DeticioBelum ada peringkat

- GK-604D Digital Inclinometer System PDFDokumen111 halamanGK-604D Digital Inclinometer System PDFKael CabezasBelum ada peringkat

- SAP Workflow Scenario: Maintenance Notification ApprovalDokumen6 halamanSAP Workflow Scenario: Maintenance Notification ApprovalPiyush BoseBelum ada peringkat

- Notes Structs Union EnumDokumen7 halamanNotes Structs Union EnumMichael WellsBelum ada peringkat

- Art 3-6BDokumen146 halamanArt 3-6BCJBelum ada peringkat

- Pplied Hysics-Ii: Vayu Education of IndiaDokumen16 halamanPplied Hysics-Ii: Vayu Education of Indiagharib mahmoudBelum ada peringkat