Indian Scenario

Diunggah oleh

Rti'lal ChavadaDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

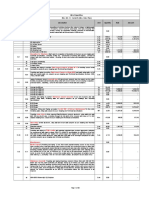

Indian Scenario

Diunggah oleh

Rti'lal ChavadaHak Cipta:

Format Tersedia

Oil and Gas

Introduction Riding on a growing economy, India is a significant consumer of oil and natural gas. The country is Asia's thirdlargest oil consumer and world's fifth largest energy consumer. According to the International Energy Agency (IEA), hydrocarbons account for the majority of India's energy consumption while coal and oil satisfy about twothirds of the same. Natural gas accounts for 7 per cent share, which is expected to increase with the discovery of new gas deposits. The Indian oil and gas sector is one of the six core industries and has very substantial forward integration with the entire economy. The petroleum and natural gas industry in India has attracted foreign direct investment (FDI) worth US$ 3, 338.75 million from April 2000 to March 2012, according to the data provided by Department of Industrial Policy and Promotion (DIPP). Production and Consumption According to the provisional production data released by the Ministry of Petroleum and Natural Gas in a press release:

Crude Oil production was recorded at 3.144 million metric tonnes (MMT) for April 2012. Natural Gas production was 3, 632.7 million cubic metres (MCM) for April 2012. During April 2012, 13.614 MMT of crude oil was refined.

According to Business Monitor International (BMI)'s India Oil and Gas Report for second quarter of 2012, India's average oil and liquids production for 2011 is estimated at 939, 000 barrels per day (B/D) which will touch the peak production at 1.06 million B/D in 2015. Further giving its demand outlook, BMI projects consumption to rise sharply to 4.07 million B/D by 2016 from 3.27 million B/D in 2011. Total gas consumption is estimated by BMI at around 92 billion cubic meters (BCM) in 2016 from around 68 BCM in 2011. Gas Gas, as an energy resource, is very high on demand across the industrial, residential and power sectors. BMI states that gas consumption in India has increased by more than 160 per cent since 1995 while average annual demand would grow by 6 per cent over next few years. Gas production is estimated at 52 BCM in 2011 while total gas consumption is predicted at 92 BCM in 2016 from an estimated 68 BCM in 2011 by BMI. Key Developments and Investments

ONGC has planned to invest Rs 440 crore (US$ 79.43 million) to undertake drilling of 40 oil and gas wells in the Krishna-Godavari basin in 2013-14. The proposal is with the Ministry of Environment and Forests for approval and the onshore wells are located at East Godavari, West Godavari and Krishna Districts of Andhra Pradesh. Gujarat State Petronet Ltd (GSPL) has formed a joint venture (JV) with three public sector oil companies - Indian Oil Corporation Ltd (IOCL), Bharat Petroleum Corporation Ltd (BPCL) and Hindustan Petroleum Corporation Ltd (HPCL) - for setting up three cross-country natural gas transmission pipelines that would extend for 3, 995 km. India's biggest liquefied natural gas (LNG) importer Petronet LNG, has inked an agreement to infuse Rs 4,500 crore (US$ 812.42 million) in establishing a 5 MT import terminal at Gangavaram Port on the Andhra coast. This will be the country's fifth LNG terminal after Dahej, Dahbol, Hazira and Kochi. Reliance Power, Shell and Kakinada Sea Ports Ltd (KSPL) JV has recommended setting up a gas import terminal on the East coast with an annual capacity of 5 MT (expandable to 10 MT). The project would require an investment of around US$ 1 billion and is expected to be ready by 2014. Trafigura Pte Ltd, the Singapore-based unit of the world's third-largest crude oil trader, Netherlands' TrafiguraBeheer BV, has acquired a 24 per cent stake in Nagarjuna Oil Corporation Limited (NOCL) for Rs 650 crore (US$ 117.35 million). NOCL is setting up an oil refinery in Tamil Nadu. Trafigurawill also invest Rs 600 crore (US$ 108.32 million) in Portoil Ltd - an 80:20 JV between NOCL and Trafigura.

Government Initiatives

The Indian government is planning to leverage upon its goodwill with Afghanistan and is hoping to secure oil and gas exploration blocks in the country, while it may also participate in the upcoming auction of six blocks to the north of Mazar-i-Sharif. An Indian delegationis expected to visit Afghanistan regarding the same. India, in order to diversify its gas basket, has signed the gas sale purchase agreement (GSPA) for the Turkmenistan-Afghanistan-Pakistan-India (TAPI) gas pipeline. The Tapi gas project values around US$7.6billion. The state government of Andhra Pradesh and GDF Suez LNG UK Ltd will implement a project framework for establishing a floating storage re-gasification unit at Kakinada seaport. With an investment of Rs 4, 000 crore (US$ 722.15 million), the terminal will be set up by GAIL and APGDC and is expected to be completed by the end of 2013. The facility would be highly beneficial for gas-based independent power generation companies and hence, would give an intense impetus to the economic activity in the East Coast. Road Ahead According to Petroleum Minister Jaipal Reddy, India's natural gas sector is poised to grow at a compounded annual growth rate (CAGR) of 19.5 per cent over 2012-17 while consumption is expected to grow from the current 166.2 million standard cubic metres per day (MSCMD) to 473 MSCMD in 2017. BMI predicts that greater development of offshore and unconventional gas resources would enhance India's gas basket that would be instrumental in meeting burgeoning demand. On the similar lines, refining segment is projected to expand rapidly with new projects coming up. India is anticipated to surpass Singapore as Asia'stop exporter of refined fuels over the forecast period of 2011-21.

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- MSDS Pennzoil UltraDokumen2 halamanMSDS Pennzoil UltraGeal Geol PentolBelum ada peringkat

- Project Execution Plan For TankDokumen3 halamanProject Execution Plan For TankiwansalmaBelum ada peringkat

- Sika PDS - E - Sika FastFix - 138 TPDokumen2 halamanSika PDS - E - Sika FastFix - 138 TPlwin_oo2435Belum ada peringkat

- Healthcare Supply Chain Management in Malaysia: A Case StudyDokumen11 halamanHealthcare Supply Chain Management in Malaysia: A Case StudyPulkit BhardwajBelum ada peringkat

- Faa Aim PDFDokumen2 halamanFaa Aim PDFLisaBelum ada peringkat

- Primjena ERP (Enterprise Resourch Planning)Dokumen15 halamanPrimjena ERP (Enterprise Resourch Planning)Lejla DedovicBelum ada peringkat

- Ship Models: LNG / LPG Carriers Tankers Bulk CarriersDokumen4 halamanShip Models: LNG / LPG Carriers Tankers Bulk CarriersRAMSINGH CHAUHANBelum ada peringkat

- GE Lighting Systems Natural Lightstyles Pole Brochure 1-73Dokumen4 halamanGE Lighting Systems Natural Lightstyles Pole Brochure 1-73Alan MastersBelum ada peringkat

- Effectiveness of Shell's Radio Advertising for V-Power Nitro PlusDokumen76 halamanEffectiveness of Shell's Radio Advertising for V-Power Nitro PlusMhykl Nieves-Huxley100% (1)

- Incoterms® 2020 Used For Import Export Global TradeDokumen9 halamanIncoterms® 2020 Used For Import Export Global TradeSanlin TunnBelum ada peringkat

- BSP-02-Standard-1632 - Safety Signs and Colour Codes Mod 28Dokumen25 halamanBSP-02-Standard-1632 - Safety Signs and Colour Codes Mod 28Fratila Lucian100% (2)

- Bill of Quantities for Culverts (Box, Slab, PipeDokumen38 halamanBill of Quantities for Culverts (Box, Slab, PipeDeepak_pethkarBelum ada peringkat

- Hardox 400 UkDokumen2 halamanHardox 400 Uksingaravelan narayanasamyBelum ada peringkat

- Logistic and Supply ChainDokumen20 halamanLogistic and Supply ChainWilliam BudiharsonoBelum ada peringkat

- Conrema Repair Material Steelcord BeltsDokumen24 halamanConrema Repair Material Steelcord BeltsPetros IosifidisBelum ada peringkat

- Flat Slab Floor System Advantages & DisadvantagesDokumen8 halamanFlat Slab Floor System Advantages & DisadvantagesPrantik Adhar Samanta100% (1)

- 150MW Coal Power Plant Seismic Code ComparisonDokumen1 halaman150MW Coal Power Plant Seismic Code ComparisondantevariasBelum ada peringkat

- JICA Current Project in Cambodia and New Strategies For TCPDokumen8 halamanJICA Current Project in Cambodia and New Strategies For TCPNarith009Belum ada peringkat

- Classification of Retail Formats ExplainedDokumen36 halamanClassification of Retail Formats ExplainedpraveennaikBelum ada peringkat

- Bulk Carriers - Handle With Care (Edition 2)Dokumen55 halamanBulk Carriers - Handle With Care (Edition 2)Daniel Rolandi100% (2)

- Upmilling Vs DownmillingDokumen4 halamanUpmilling Vs DownmillingSaurabh BiswasBelum ada peringkat

- Textile ProgressDokumen60 halamanTextile Progressranjann349Belum ada peringkat

- Paris Connections: Charles de Gaulle AirportDokumen8 halamanParis Connections: Charles de Gaulle AirportmittentenBelum ada peringkat

- Suez Canal Rules of NavigationDokumen216 halamanSuez Canal Rules of NavigationVasilis Eliades100% (1)

- Transportation of Petroleum LiquidsDokumen17 halamanTransportation of Petroleum LiquidsWaseem SiddiqueBelum ada peringkat

- Plumbing-Max FajardoDokumen175 halamanPlumbing-Max Fajardoaj80% (5)

- Improved Efficiency and Reduced Co2Dokumen20 halamanImproved Efficiency and Reduced Co2chrisvakarisBelum ada peringkat

- ODFL100Dokumen285 halamanODFL100Sameer ShindeBelum ada peringkat

- Supply Chain Management PepsiDokumen25 halamanSupply Chain Management Pepsipop_pop12121100% (1)