My Part

Diunggah oleh

Siddhartha MohapatraDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

My Part

Diunggah oleh

Siddhartha MohapatraHak Cipta:

Format Tersedia

How would the industry behave and look like in the Short Term (1 year), Medium Term (3-5

years) and Long Term (8-10 years) In the short-term, the steel industry in India shows promising growth, after the slowdown in 2011, according to reports released by the World Steel Association recently. According to the April 2012 Short Term Outlook released by WSA, Indian steel production is projected to grow by 6.9% to 72.5 million tones. It should be noted that this predicted growth will be nearly twice of the projected global rate of 3.6%. Further, there are projections that this could increase to 9.4% in 2013 riding on the back of urbanization and rapid infrastructural investment. This prediction takes into cognizance the fact that the projected investment in infrastructure in India during the 12th Plan Period has been pegged at $1trillion. The short term outlook for the global steel industry also looks promising with the global steel production predicted to increase by 3.6% to 1422 million tones and by 4.5% to around 1486mt in 2013.Juxtaposing this with the past, the growth last year was 5.6%.In contrast the Steel production in China will rise by only 4% to 648.8 million tonnes in 2012.

In the Medium Term, the growth of the Steel Industry looks promising. India is projected to become the second largest steel producer by 2013, during which its installed capacity is expected to rise to 120 tonnes from the present 80 tonnes. The Steel Ministry of India has also decided to formulate a new National Policy and vision document to guide the steel industry in India. The medium term horizon in the same is 10 years while the long term horizon of 25 years. The panel which will comprise luminaries from the industry will submit a whitepaper on the road map to be followed in the case. A large number of steel projects are currently in the pipeline. Notable among them include the expansions of SAIL, RINL, Tata, Essar, JSW and JSPL. The Greenfield projects in the pipeline include POSCO & Arcelor Mittal though both seem to have run aground recently. The Land Acquisition problems are a major hurdle in the growth story of Indias Steel Industry. India being a thickly populated country, land is much valued and culturally people hold a deep attachment to their ancestral land as well. In light of this, the Land Acquisition and Rehabilitation Bill that the government proposes will be a major step. It is hoped that this will solve the issue of acquisition of land without proper compensation, rehabilitation and/or employment which has already played a major role in the massive protests again the proposed Greenfield steel projects in India. Globally the Steel Industry is expected to gradually recover over the next five years as overcapacity is addressed and the pressure from rising raw material costs reduces. The Global Steel industry in the last few years has been burdened by overcapacity and rising raw material costs. However developing countries like India and China have been relatively insulated from this because of a strong internal demand driven economy. The global demand for steel is almost led only by China and this is expected to grow at over 5% a year to 2016 . The long term outlook for Steel Industry seems promising as India aspires to become a global economic superpower by 2020. The industry outlook is that there will be an increase of atleast 70 to 100MT by 2020, which will make India the worlds second largest Steelmaker after China. For this India needs to reach a per capita consumption of at least 100kgs by 2020. With population estimated to reach 1.4 billion in 2020, this means a steel requirement of at least 140 million tonnes per year which gels well

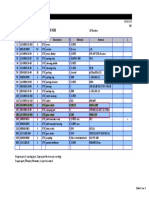

with the fact that China increased its steel production by 70mT in 4 years from 2000 to 2003. For India this entails an investment of about 300,000 crores in 16 years. As per the Indian Bureau of Mines, which cites information based on the revised National Steel Policy, Indias steel production has been pegged at 180 million tonnes to meet demand. However this requires an iron ore requirement of atleast 500 million tonnes annually. The present production is 220 million tonnes annually. To be able to reach this, apart from conventional mining, beneficiation followed by agglomeration of Iron Ore fines needs to be followed in a large scale. India has a huge potential in low grade ores in the states of Goa, Odisha, Jharkhand, et al. It should be brought into notice that currently such low grade ores is mostly treated as waste and only Essar has a facility to beneficiate and process such ores on a large scale. How has the industry evolved over time The Indian Steel Industry has evolved over the past 100 years. The Tata Iron & Steel Company was the first integrated steel plant to be set up in 1907. It was incidentally also the first steel company to be freed from the stifling licensing regime in 1990-91 and the pricing and distribution controls. Indias steel industry mainly rides on the exceptionally high demand generated by its internal economy as well as that of its neighbor China. The New Industrial Policy drafted by the Government of India, opened up the iron and steel sector for private sector by removing it from the exclusivity of the Public Sector companies and exempting it from compulsory licensing. Both foreign investment as well as the import of foreign technology are freely permitted upto a certain limit by GOI. Soaring demand by sectors such as automobiles, infrastructure, real estate, et al both at home and abroad has put India on the world map. Tata Steel dominates the Indian Steel landscape and with its acquisition of the global steel giant Corus, created the countrys biggest buyout. In the meantime LN Mittal owned Mittal steel company acquired Arcelor to create the worlds biggest steel company Arcelor-Mittal. POSCO is also pumping huge investments into Odisha to create the countrys biggest single location facility, a record which is currently held by Essar. The following chart illustrates the past and the present states of the steel industry in India:

Indian steel industry : Production for Sale (in million tonnes) Category Pig Iron Sponge Iron Total Finished Steel (alloy + non alloy) 2007-08 2008-09 2009-10 2010-11 2011-12* 5.28 20.37 56.07 6.21 21.09 57.16 5.88 24.33 60.62 5.68 25.08 68.62 5.78 20.37 73.42

Source: Joint Plant Committee; *provisional

Anda mungkin juga menyukai

- Iron and Steel Industry in IndiaDokumen16 halamanIron and Steel Industry in IndiaAnonymous gQyrTUHX38100% (1)

- CH 2 CP - 1Dokumen11 halamanCH 2 CP - 1PearlBelum ada peringkat

- CCI Iron and Steel Industry in IndiaDokumen16 halamanCCI Iron and Steel Industry in IndiaShubham KhattriBelum ada peringkat

- Combined Research PaperDokumen11 halamanCombined Research PaperSibikshaBelum ada peringkat

- Industry Profile: Steel Industry Is Becoming More and More Competitive With Every Passing Day. During TheDokumen19 halamanIndustry Profile: Steel Industry Is Becoming More and More Competitive With Every Passing Day. During Thevinay8464Belum ada peringkat

- Iron and Steel IndustryDokumen14 halamanIron and Steel IndustryMeethu Rajan100% (1)

- Iron and Steel Industry in IndiaDokumen10 halamanIron and Steel Industry in IndiaJordan SarasanBelum ada peringkat

- Jaya BlackBook Final1Dokumen75 halamanJaya BlackBook Final1SauravBelum ada peringkat

- Problem and Prospect of LSIDokumen14 halamanProblem and Prospect of LSIakky.vns2004Belum ada peringkat

- Steel Industry in IndiaDokumen2 halamanSteel Industry in IndiaKuber BishtBelum ada peringkat

- Steel IndustryDokumen21 halamanSteel IndustryBhupen YadavBelum ada peringkat

- An Overview of The Steel Industry: Group Number: 6Dokumen9 halamanAn Overview of The Steel Industry: Group Number: 6MohitBelum ada peringkat

- Steel Industry Concept PaperDokumen4 halamanSteel Industry Concept PaperAjay ChauhanBelum ada peringkat

- Steel Word2Dokumen8 halamanSteel Word2Ankita SharmaBelum ada peringkat

- FinMod Final AssignmentDokumen17 halamanFinMod Final Assignmentvirat kohliBelum ada peringkat

- Bhavin SapmDokumen16 halamanBhavin SapmArbaz TaiBelum ada peringkat

- Precision Steel TubesDokumen9 halamanPrecision Steel TubesRam KumarBelum ada peringkat

- Steel Industry in IndiaDokumen8 halamanSteel Industry in IndiaakashBelum ada peringkat

- Infrastructural Challenges in Steel Industry - Best Paper Published in 4th International Steel Logistics Conference in AntwerpDokumen38 halamanInfrastructural Challenges in Steel Industry - Best Paper Published in 4th International Steel Logistics Conference in Antwerpsubrat_sahoo19690% (1)

- Steel Scenario: Kushagra JadhavDokumen12 halamanSteel Scenario: Kushagra JadhavKushagra JadhavBelum ada peringkat

- Steelplant SeminarDokumen28 halamanSteelplant SeminarBharat L. YeduBelum ada peringkat

- Development of Indonesian Steel Industry and Its Investment OpportunitiesDokumen6 halamanDevelopment of Indonesian Steel Industry and Its Investment OpportunitiesNURUL SYAMIMI ZAINALBelum ada peringkat

- Chapter-Ii: Industry Profile Company ProfileDokumen10 halamanChapter-Ii: Industry Profile Company ProfiledyanirajBelum ada peringkat

- RK Goyal Kalyani SteelDokumen3 halamanRK Goyal Kalyani SteelZulfikar GadhiyaBelum ada peringkat

- Iron and Steel Industry: Economics AssignmentDokumen10 halamanIron and Steel Industry: Economics Assignmentsamikshya choudhuryBelum ada peringkat

- Investment Cell: Steel Industry OutlookDokumen2 halamanInvestment Cell: Steel Industry OutlookRandy AdamsBelum ada peringkat

- A Study of Electronic Data Storage Steel Factory in Mumbai11 150218034403 Conversion Gate02Dokumen51 halamanA Study of Electronic Data Storage Steel Factory in Mumbai11 150218034403 Conversion Gate02NIKHIL CHAUHANBelum ada peringkat

- Essar Steel Finance ReportDokumen53 halamanEssar Steel Finance ReportJigar PatelBelum ada peringkat

- Salma Final Report 12345Dokumen29 halamanSalma Final Report 12345ArsenalAfreedAhmedBelum ada peringkat

- Feb 2014 PDFDokumen72 halamanFeb 2014 PDFsatish_trivediBelum ada peringkat

- Why Steel Consumption in India Should Rise?Dokumen4 halamanWhy Steel Consumption in India Should Rise?fahrgeruste3961Belum ada peringkat

- An Overview of Steel SectorDokumen3 halamanAn Overview of Steel SectorAnand SagarBelum ada peringkat

- A Project Report On V.S.L Limited ParamenahalliDokumen77 halamanA Project Report On V.S.L Limited Paramenahallirameshamba51Belum ada peringkat

- Steel Industry in India AbstractDokumen8 halamanSteel Industry in India AbstractPawan Kumar VulluriBelum ada peringkat

- Bhushan Power & Steel LimitedDokumen64 halamanBhushan Power & Steel LimitedSyaape100% (1)

- Steel Industry: BY-Mithil Joshi Khyati PatelDokumen27 halamanSteel Industry: BY-Mithil Joshi Khyati PatelMithil JoshiBelum ada peringkat

- Cluster IronDokumen31 halamanCluster IronPraneeth Kumar V RBelum ada peringkat

- A Study of Electronic Data Storage Steel Factory in Mumbai11Dokumen71 halamanA Study of Electronic Data Storage Steel Factory in Mumbai11Thirupal Nk100% (3)

- The Global Steel IndustryDokumen13 halamanThe Global Steel Industryakashghadge44Belum ada peringkat

- Steel Has An Oligopoly Market IDokumen6 halamanSteel Has An Oligopoly Market Iarchana783Belum ada peringkat

- Steel Industry NewsDokumen26 halamanSteel Industry NewsNimish JainBelum ada peringkat

- Tata CorusDokumen14 halamanTata CorusSameer SunnyBelum ada peringkat

- Steel Industry in India: Project FinanceDokumen32 halamanSteel Industry in India: Project FinanceSharvil Vikram Singh100% (1)

- Internship ReportDokumen41 halamanInternship ReportPankaj KumarBelum ada peringkat

- ChapterDokumen6 halamanChapterMaria Sebastian ManjalyBelum ada peringkat

- Steel Industry Group 9Dokumen10 halamanSteel Industry Group 9Priyanka MhatreBelum ada peringkat

- Strategy Review - Tata SteelDokumen20 halamanStrategy Review - Tata SteelKen SekharBelum ada peringkat

- Wire DrawingDokumen18 halamanWire DrawingstaniBelum ada peringkat

- Introduction About The Internship: Kirloskar Ferrous Industries LTDDokumen49 halamanIntroduction About The Internship: Kirloskar Ferrous Industries LTDchethan kumar.s100% (1)

- Marketing Strategies and 4 P's of Bokaro SteelDokumen73 halamanMarketing Strategies and 4 P's of Bokaro SteelAmit Kumar100% (7)

- Sec-F Grp-3 CF-II Project - Tata SteelDokumen20 halamanSec-F Grp-3 CF-II Project - Tata SteelPranav BajajBelum ada peringkat

- Steel Industry Financial AnalysisDokumen27 halamanSteel Industry Financial AnalysisPrakash Singh100% (1)

- Template - The Love For Indian SteelDokumen1 halamanTemplate - The Love For Indian SteelBharadwaj KABelum ada peringkat

- Industry and Company AnalysisDokumen76 halamanIndustry and Company AnalysisAnsu MishraBelum ada peringkat

- A Study On Analysis of Profitability Position of Jindal Steel LimitedDokumen59 halamanA Study On Analysis of Profitability Position of Jindal Steel LimitedsathiyaBelum ada peringkat

- ChapterDokumen91 halamanChaptersuryadtp suryadtpBelum ada peringkat

- Sail ProjectDokumen69 halamanSail ProjectBhoomika SrivastavaBelum ada peringkat

- Hazel Rhs Horticulture Level 2 Essay 1Dokumen24 halamanHazel Rhs Horticulture Level 2 Essay 1hazeldwyerBelum ada peringkat

- SweetenersDokumen23 halamanSweetenersNur AfifahBelum ada peringkat

- The Common Reader-Virginia WoolfDokumen216 halamanThe Common Reader-Virginia WoolfRusudan VardiashviliBelum ada peringkat

- Science7 q2 Mod6of8 Asexual Sexualrep v2Dokumen26 halamanScience7 q2 Mod6of8 Asexual Sexualrep v2Ishi OcheaBelum ada peringkat

- Water Sensitive Urban Design GuidelineDokumen42 halamanWater Sensitive Urban Design GuidelineTri Wahyuningsih100% (1)

- Video Tutorials of Read and Write Seagate F3 Series HDDs by MRT - MRT LabDokumen1 halamanVideo Tutorials of Read and Write Seagate F3 Series HDDs by MRT - MRT LabBusur DataBelum ada peringkat

- Smith KJ Student Mathematics Handbook and Integral Table ForDokumen328 halamanSmith KJ Student Mathematics Handbook and Integral Table ForStrahinja DonicBelum ada peringkat

- Product Specifications: MB3F-PSA4-19DEDokumen2 halamanProduct Specifications: MB3F-PSA4-19DEВадим ЧеховскийBelum ada peringkat

- B.Pharm - Semester - III-10.07.2018Dokumen16 halamanB.Pharm - Semester - III-10.07.2018SAYAN BOSEBelum ada peringkat

- 3rd Stage ComplicationsDokumen84 halaman3rd Stage ComplicationsDream100% (1)

- E Numbers Are Number Codes ForDokumen3 halamanE Numbers Are Number Codes ForaradhyaBelum ada peringkat

- Chapter 01Dokumen16 halamanChapter 01deepak_baidBelum ada peringkat

- Excretory Products and Their EliminationDokumen13 halamanExcretory Products and Their Eliminationaravind kishanBelum ada peringkat

- 6.003 Homework #12 Solutions: ProblemsDokumen9 halaman6.003 Homework #12 Solutions: ProblemsSamu PacurucuBelum ada peringkat

- Buckthorpe Etal 23 Optimising Early Stage ACL Rehab ProcessDokumen24 halamanBuckthorpe Etal 23 Optimising Early Stage ACL Rehab ProcessCole VincentBelum ada peringkat

- Unit-1 Infancy: S.Dharaneeshwari. 1MSC - Home Science-Food &nutritionDokumen16 halamanUnit-1 Infancy: S.Dharaneeshwari. 1MSC - Home Science-Food &nutritionDharaneeshwari Siva-F&NBelum ada peringkat

- Unit 3 InfiltrationDokumen5 halamanUnit 3 InfiltrationHRIDYA MGBelum ada peringkat

- Biasing Opamps Into Class ADokumen11 halamanBiasing Opamps Into Class AsddfsdcascBelum ada peringkat

- Medical CodingDokumen5 halamanMedical CodingBernard Paul GuintoBelum ada peringkat

- PANCREATITISDokumen38 halamanPANCREATITISVEDHIKAVIJAYANBelum ada peringkat

- Chemistry Jun 2010 Mark Scheme Unit 3Dokumen15 halamanChemistry Jun 2010 Mark Scheme Unit 3dylandonBelum ada peringkat

- Chapter 1 - Part 1 Introduction To Organic ChemistryDokumen43 halamanChapter 1 - Part 1 Introduction To Organic ChemistryqilahmazlanBelum ada peringkat

- What A Wonderful WorldDokumen3 halamanWhat A Wonderful Worldapi-333684519Belum ada peringkat

- Etl 213-1208.10 enDokumen1 halamanEtl 213-1208.10 enhossamBelum ada peringkat

- 基礎居合講座Dokumen33 halaman基礎居合講座任平生100% (1)

- Aesa Based Pechay Production - AbdulwahidDokumen17 halamanAesa Based Pechay Production - AbdulwahidAnne Xx100% (1)

- DLL - Mapeh 6 - Q2 - W8Dokumen6 halamanDLL - Mapeh 6 - Q2 - W8Joe Marie FloresBelum ada peringkat

- List ToolingDokumen10 halamanList Toolingyohanes adi saputroBelum ada peringkat

- Defect Origin (J) Phase Requirement Analysis Design Coding Unit TestingDokumen87 halamanDefect Origin (J) Phase Requirement Analysis Design Coding Unit Testingashish_jain_csBelum ada peringkat

- مستر رمضان عوضDokumen24 halamanمستر رمضان عوضSamuel SaadBelum ada peringkat