A Project Report On A Mutual Fund Concept at Birla Sun Life Insurence

Diunggah oleh

Babasab Patil (Karrisatte)Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

A Project Report On A Mutual Fund Concept at Birla Sun Life Insurence

Diunggah oleh

Babasab Patil (Karrisatte)Hak Cipta:

Format Tersedia

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY

Objectives and Research Methodology

Objective

1. To understand the behavior pattern of business class with respect to

investments. 2. To test the awareness of various investment products among the business class.

3. Build relations with the newly interested business class

Research Methodology:

Conclusive research

The research undertaken was conclusive research as the data needs were clear. The research was conducted to study about the investment pattern of business people.

Sampling process

Population:Element: The research was restricted to business people. Extent: Bhosari Industrial Area, Pune

Sample size:

The total sample size consists of 100 business people.

Sampling method:Non probability:The business people were selected on the basis of convenience.

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY

Data Collection:For the research purpose the data is collected in the form of Primary data and Secondary data. Primary data is collected in the form of Structured Questionnaire. Secondary data is collected from various Bouchers, Books, Magazines and Web sites.

Primary Data:Primary data is collected through direct interviews and telephonic interviews. The data is collected from the business person through questionnaires which was prepared depending upon the need of study. A prepared to collect the data structured questionnaire was

Secondary Data:The source of secondary data were published Journals, magazines, like investime and web sites, www.amfi.com www.indiainfolin.com www.birlasunlife.com www.mutualfundindia.com www.valuereserchonline.com

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY

Limitations: Sample size is very small as compared to the total population. Most of the business people dont five out the exact invest figures their assets and their finical planning The method which is applied for the data collection may not be right Lack of knowledge in the survey sample about the mutual funds. The result obtained from the sample may not be the result of the whole population.

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY

Introduction to Mutual Funds

A mutual fund is the ideal investment vehicle for todays complex & modern financial scenario. Markets for enquiry shares bonds and other fixed income instruments, real estate, derivatives and other assets have become mature and information driven. Price changes in these assets are driven by global events occurring in faraway places. A typical individual is unlikely to have the knowledge, skills, inclination and time to keep track of events, understand their implications and act speedily. An individual also finds it difficult to keep track of ownership of this assets, investments, brokerage dues & bank transactions etc. A mutual fund is the answer to all these situations. It appoints professionally qualified and experienced staff that manages each of these functions on a full time bases. The large pool of money collected in the fund allows it to hire such staff at a very; low cost to each investor. In effect the mutual fund vehicle exploits economies of scale in all three areas research, investments, transaction processing. While the concept of individual coming together to invest the money collectively is not new, the mutual fund in its present form is a 20th century phenomenon. In fact mutual funds gained popularity only after the Second World War. Globally there are thousands of firms offering tens of thousands of mutual funds with different investment objectives. Today mutual funds collectively manage almost as much as or more money as compared to banks. To get a better understanding of mutual funds it is necessary to know the industry in detail. In the following sections a detailed descriptions of the mutual funds industry will be discussed.

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY

Concept of a mutual fund

A mutual fund is a common pool of money into which investors place their contributions that are to be invested with a stated objective. The ownership of the fund is thus joint or mutual and the fund belongs to all investors. A single investors ownership of the fund is in the same ratio as the amount of contribution made by him or bears to the total amount of the fund.

Meaning of Mutual Fund

Mutual Funds are investment products that operate on the principles of Strength in Numbers. They collect money from a large group of investors, pool it together, and invest it in various securities in line with their objective. They are an alternative to investing directly. A more convenient alternative yet no less rewarding. Take stocks, trading into the market by yourself would mean knowing at the very least, how to analyze and track companies, the way of the market and the intermediaries who will help you buy and sell shares. A mutual fund that invests in stocks relieves you of all such hassles, while giving you the same investment option for individuals handicapped by a lack of investing acumen or time, or generally disciplined to take charge of their personal finances. Mutual funds are not magic investment vehicles that do it all youll have to come to terms with the fact that they assure neither returns nor the value of yours original investment. Youll have to accept the reality that even they, who are supposedly experts in investments matter, can go wrong. These are inherent risks, but these can be managed. Mutual funds offer several advantages that make them a powerful and convenient wealth creation vehicle worthy of yours consideration

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY

Characteristics of a Mutual Fund

A Mutual fund actually belongs to the investors who have pooled their funds. The ownership of the mutual funds is in the hands of the investors. In case of mutual fund the contributors and the beneficiaries of the funds are the same class of people namely the investors. Investment professionals manage a mutual fund and other service providers, who earn a fee for their services provided, from the fund. The pool of funds is invested in a portfolio of marketable investments. The value of the portfolio is updated every day. The investors share in the fund is denominated by UNITS. The value of the units changes with the change in the portfolios value, everyday. The value of one unit of investment is called as the net asset value or NAV HOW ARE THE MUTUAL FUNDS STRUCTURED? Mutual funds can be structured in the following ways: Company form, in which investors hold shares of the mutual fund. In this structure, management of the fund is in the hands of an elected board, which in turn appoints investment managers to manage the fund. Trust form, in which the funds of the investors are held by a trust, on behalf of the investors. The trust appoints investment managers and monitors their functioning in the interest of investors.

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY The company form of organization is very popular in the United States. In India, mutual funds are organized as trusts. The trust is created by sponsor, who is the actually the entity interested in creating the mutual fund business. The trust is either managed by a Board of trustees, or by a trustee company, formed for this purpose. The

investors funds are held by the trust.

Types of Mutual Funds Open-End Funds

An open-ended fund is one that has units available foe sale and repurchase at all times. An investor can buy or redeem units from the fund itself at a price based on the Net Asset Value (NAV) per unit. NAV per unit is obtained by dividing the amount of the market value of the funds assets by the number of units outstanding. The number of outstanding goes up or down every time the fund issues new units or repurchase existing units.

Closed-End Funds

Unlike an open-end fund, the unit capital of a closed-ended fund is fixed, as it makes a one-time sale of a fixed number of units. Closed-ended funds do not allow investors but or redeem units directly from the funds. However, to provide the muchneeded liquidity to investors, any closed-end funds get themselves listed on stock exchanges. Trading through a stock exchange enables investors to buy or sell units of a closed-end mutual fund from each other.

Load and No-Load Funds

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY Marketing of a new mutual fund scheme involves initial expenses. These expenses may be recovered from the investors in different ways at different times. Three usual ways in which a fund's sales expenses may recover from the investors are: 1. At the time of investor's entry into the fund/scheme, by deducting a specific amount from his Initial contribution, or 2.By charging the fund/scheme with a fixed amount each year, during the stated number of years, or 3.At the time of the investor's exit from the fund/scheme, by deducting a specified amount from the redemption proceeds payable to the investor. These charges made by the fund managers to the investors to cover

distribution/sales/marketing expenses often called "loads". The load charged to the investor at the time of his entry into a scheme is called front-end or entry load". The load amount charged to the scheme over period of time is called a deferred load. The load that the investor pays at the time his exit is called a "back-end or exit load".

Some funds may also charge different amounts of loads to the investors, depending upon how many years the investor is stayed with the fund; the longer the investor stays with the fund, less the amount of exit load" he charged. This is called contingent deferred sales charge". Funds that charge front-end, back-end or deferred loads are called load funds. Funds that make no such charges or loads for sales expenses are called no-load funds. A load fund's declared NAV does not include the loads. Hence, a new investor must add any front-end load amount per unit the NAV per unit to calculate his purchase price. An outgoing investor needs to deduct the amount of any back-end load per unit from his sale price per unit to get to know the net sale proceeds he would receive.

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY Tax Exempt and Non-Tax Exempt Funds Generally, when a fund invests in tax-exempt securities, it is called a tax-exempt fund. In the U.S.A, For example, municipal bonds pay interest that is tax-free, while interest on corporate and other bonds is taxable. In India, after the 1999 Union Government Budget, all of the dividend income received from many of the Mutual funds is tax-free in the hands of the investor. However, funds other than Equity Funds have to pay a distribution tax, before distributing income to investors. In other words, equity mutual fund schemes are tax-exempt investment avenues, while other funds are taxable for distributable income.

While Indian Mutual funds currently offer tax-free income, any capital gains arising out of sale of fund nits are taxable. All these tax considerations are important in the decision on where to invest as the tax exemptions or concessions alter returns obtained from these investments. Hence, classification Of Mutual funds from the taxability perspective has great significance for investors. Broad Fund types by Nature of Investments Mutual funds may invest in equities, bonds or other fixed income securities, or short-term money market securities. So we have Equity, Bond and Money Market Funds. All of them invest in financial assets. But there are funds that invest in physical assets. For example, we may have Gold or other Precious Metals Funds, or Real Estate Funds. Broad Fund Types by Investment Objective Investors and hence the mutual funds pursue different objectives while investing. Thus, Growth Funds invest for medium to long-term capital appreciation. Income Funds invest to generate regular income, and less for capital appreciation. Value Funds invest in

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY equities that are considered under-valued today, whose value will be unlocked in the future.

Broad Fund Types by Risk Profile The nature of a fund's portfolio and its investment objective imply different levels of risk undertaken. Funds are therefore often grouped in order of risk. Thus, Equity funds have a greater risk of capital loss than a Debt Fund that seeks to protect the capital while looking for income. Money Market Funds are exposed to less risk than even the Bond Funds,' since they invest in short-term fixed income securities, as compared to longer-term portfolios of Bond Funds. Money Market Funds Often considered the lowest rung order of risk level, Money Market Funds invest in securities of a short-term nature, which generally means securities of less than one-year maturity. The typical, short-term interest-bearing instruments these funds invest in include Treasury Bills issued by governments. Certificates of Deposit issued by banks and Commercial Paper issued by companies. In India Money market Mutual funds also invest in the inter-bank call money market. The major strengths of money market funds are the liquidity and safety or principal that investors can normally expect from shortterm investments.

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY

Gilt Funds Gilts are government securities with medium to long-term maturities, typically of over one year (under one-year instruments being money market securities). In India we have now seen the emergence of Government Securities or Gilt Funds that invest in government paper called dated securities (unlike Treasury Bills that mature less These funds have little risk of default and hence offer better protection of principal. However, investors have to recognize the potential changes in values of debt securities held by the funds that are caused 'by changes in the market price of debt securities quoted on the stock exchanges (Just like the equities).Debt securities' prices fall when interest rate levels increase (and vice versa).

Debt Funds (or Income Funds) Next in the order of risk level, we have the general category Debt Funds. Debt funds invest in debt instruments issued not only by governments, but also by private companies, banks and financial institutions and other entities such as infrastructure companies/utilities. By investing in debt, these funds target low risk and stable income for the investor as their key objectives. However, as compared to the money market funds, they do have a higher price fluctuation risk, since they invest longer-term securities. Similarly compared to Gilt Funds, general debt funds do have a higher risk of default by their borrowers. Debt Funds are largely considered as Income Funds as they do not target capital appreciation, look for high current income, and therefore distribute a substantial part of

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY their surplus to investors. Income funds that target returns substantially above market levels can face more risks. The Income Funds fall largely in the category of Debt Funds as they invest primarily in fixed income generating debt instruments. Again, different investment objectives set by the fund managers would result in different risk profiles. Diversified Debt Funds A debt fund that invests in all available types of debt securities, issued by entities across all industries and sectors is a properly diversified debt fund. While debt funds offer high income and less risk than equity funds, investors need to recognize that debt securities are subject to risk of default by the issuer on payment of interest or principal. A diversified debt fund has the benefit of risk reduction through diversification and sharing of any default-related losses by a large number of investors. Hence a diversified debt fund is less risky than a narrow-focus fund that invests in debt securities of a particular sector or industry.

Focused Debt Funds Some debt funds have a narrower focus, with less diversification in its investments. Examples include sector, specialized and offshore debt funds. These funds are similar to the funds described later in the equity category except that debt funds have a substantial part of their portfolio invested in debt instruments and are therefore more income oriented and inherently less risky than equity funds. However 'the Indian financial markets have demonstrated that debt funds should not be automatically considered to be less risky than equity funds, as there have been relatively large default by issuers of debt and many funds have non-performing assets in their debt portfolios. It should also be recognized that market values of debt securities will also fluctuate more as Indian debt markets witness more trading and interest rate volatility in the future.

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY High Yield Debt Funds Usually, Debt Funds control the borrower default risk by investing in securities issued by borrowers who are rated by credit rating agencies and are considered to be of "investment grade". There are High Yield Debt Fund that seek to obtain higher returns by investing in debt instruments that are considered "below investment grade. Clearly, these funds are exposed to higher risk. In U.S.A., funds that invest in debt instruments that are not backed by tangible assets and rated below investment grade (popularly known as junk bonds) are called Junk Bond Funds. These funds tend to be more volatile than other debt funds, although they may earn higher returns as a result of the higher risks taken. Assured Return Funds Fundamentally, mutual funds hold assets in trust for investors. All returns and risks are for account of the investor. The role of the fund Manager is to provide the professional management service and to ensure the highest possible return consistent with the investment objective of the fund. Assured return debt fund certainly reduce the risk level.

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY Fixed Term Plans Fixed Term Plans are closed-end, but usually for shorter term-less than a year. Being of short duration, they are not listed on a stock exchange. As investors move from Debt Fund category to Equity Funds they face increased risk level. However, there is a large variety of Equity Funds and all of them are not equally riskprone. Investors and their advisors need to sort out and select the right equity fund that suits their risk appetite Equity funds invest a major portion of their corpus in equity shares issued by companies, acquired directly in initial public offerings or through the secondary market. Equity funds would be exposed to the equity price fluctuation risk at the market level at the industry or sector level and at the company-specific level. Equity Funds Net Asset Values fluctuate with all these price movements. These prices are caused by all kinds of external factors, political and social as well as economic. Hence, Equity Funds are generally considered at the higher end of the risk spectrum among all funds available in the market. Equity funds adopt different investment strategic resulting in different levels of risk. Hence, they are generally separated into different types in terms of their investment styles. Some of the major types of equity funds, arranged in order of higher to lower risk level. Aggressive Growth Funds There are many types of stocks/shares available in the market; Blue Chips that are recognized market leaders, less researched stocks that are considered to have future growth potential, and even some speculative stocks of somewhat unknown or unproven issuers. Fund managers seek out and invest in different types of stocks in line with their own perception of potential returns and appetite for risk.

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY Aggressive growth funds target maximum capital appreciation, invest in less researched or speculative shares and may adopt speculative investment strategies to attain their objective of high returns for the investor. Consequently, they tend to be more volatile and riskier than other funds. Growth Funds These funds invest in companies whose earnings are expected to rise at an above average rate. These companies may be operating in sectors like technology considered having a growth potential, but not entirely unproven and speculative. The primary objective of Growth Funds is capital appreciation over a three to five year span. Growth funds are therefore less volatile than funds that target aggressive growth. Specialty Funds These funds have a narrow portfolio orientation and invest in only companies that meet pre-defined criteria. For example, at the height of the South African apartheid regime, many funds in the U.S. offered plans that promised not to invest in South African companies. Some funds may build portfolios that will exclude Tobacco companies. Funds that invest in particular regions such as the Middle East or the ASEAN countries are also an example of specialty funds. Within the Specialty Funds category, some funds may be broad-based in terms of the types of investments in the portfolio. However, most specialty funds tend to be concentrated funds, since diversification is limited to one type of investment. Clearly, concentrated specialty funds tend to be more volatile than diversified funds.

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY Sector Funds Sector funds' portfolios consist of investments in only one industry or sector of the market such as Information on Technology, Pharmaceuticals or Fast Moving Consumer Goods that have recently been launched in India. Since sector funds do not diversify into multiple se Offshore Funds. Offshore Funds These funds invest in equities in one or more foreign countries thereby achieving diversification across the country's borders. However they also have additional risks - such as the foreign exchange rate risk - and their performance depends on the economic conditions of the countries they invest in. Offshore Equity Funds may invest in a single country (hence riskier) or many countries (hence more diversified).

Small Cap Equity Funds These funds invest in shares of companies with relatively lower market capitalization than that of big, blue chip companies. They may thus be more volatile than other funds, as smaller companies' shares are not very liquid in the markets. In terms of risk characteristics, small company funds may be aggressive-growth or just growth type.

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY Option Income Funds Option Income Funds write options on a significant part of their portfolio. While options are viewed as risky instruments, they may actually help to control volatility, if properly used. Conservative option funds invest in large, dividend paying companies, and then sell options against their stock positions. This ensures a stable Income stream in the form of premium income through selling options and dividends. Diversified Equity Funds A fund that seeks to invest only in equities except for a very small portion in liquid money market securities, but is not focused on any one or few sectors or shares, may be termed a diversified equity funds seek to reduce the sector or stock specific risks through diversification. They have mainly market risk exposure. Diversified funds arc clearly at the lower risk level than growth funds

Equity Linked Saving Schemes: An Indian Variant In India, the investors have been given tax concessions to encourage them to invest in equity markets through these special schemes. Investment in these schemes entitles the investor to claim an income tax rebate, but usually has a lock-in period before the end of which funds cannot be withdrawn. These funds are subject to the general SEBI investment guidelines for all equity funds, and would be in the Diversified Equity Fund category. However, as there are no specific restrictions on which sectors these funds ought to invest in, investors should clearly look for where the Fund Management Company proposes to invest and accordingly judge the level of risk involved.

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY Equity Index Funds An index fund tracks the performance of a specific stock market index. The objective is to match the performance of the stock market by tracking an index that represents the overall market. The fund invests in shares that constitute the index and in the same proportion as the index. Since they generally invest in a diversified market index portfolio, these funds take only the overall market risk, while reducing the sector and stock specific risks through diversification.

Value Funds

Value Funds try to seek out fundamentally sound companies whose shares arc currently under-priced in the market. Value Funds will add only those shares to their portfolios that are selling at low price-earnings ratios, low market to book value ratios and are undervalued by other yardsticks. Value funds have the equity market price fluctuation risks, but stand often at a lower end of the risk spectrum in comparison with the Growth Funds. Value Stocks may be from a large number of sectors and therefore diversified. Equity Income funds Usually income funds are in the Debt Funds category, as they target fixed income investments. However, there are equity funds that can be designed to give the investor a high level of current income along with some steady capital appreciation, investing mainly in shares of companies' with high dividend yields.

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY

Hybrid Funds Quasi Equity/Quasi Debt Money market holdings will constitute a lower proportion in the overall portfolios of debt or equity funds. There are funds that, however, seek to hold a relatively balanced holding of debt and equity securities in their portfolio. Such funds are termed "hybrid funds" as they have a dual equity/bond focus. Balanced Fund A balanced fund is one that has a portfolio comprising debt instruments, convertible securities, and Preference equity shares. Their assets are generally held in more or less equal proportions between debt/money market securities and equities. By investing in a mix of this nature, balanced funds seek to attain the objectives of income, moderate capital appreciation and preservation of capital, and are ideal for investors with a conservative and long-term orientation. Growth-and-Income Funds Unlike income-focused or growth-focused funds, these funds seek to strike a balance between capital appreciation and income for the investor. Their portfolios are a mix between companies with good dividend paying records and those with potential for capital appreciation. These funds would be less risky than pure growth funds, though more risky than income fund.

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY Commodity Funds Commodity funds specialize in investing in different commodities directly or through shares of commodity companies or through commodity future contracts. Specialized funds may invest in a single commodity or a commodity group such as edible oils or grains, while diversified commodity funds will spread their assets over many commodities. Real Estate Funds Specialized Real Estate Funds would invest in Real Estate directly, or may fund real estate developers, or lend to them, or buy shares of housing finance companies or may even buy their securities assets. The funds may have a growth orientation or seek to give investors regular income. There has recently been an initiative to offer such an income fund by the HDFC. TYPES OF MUTUAL FUND:MUTUALFUND TYPE WHO SHOULD INVEST Objective Investment portfolio Risk Ideal investment

Diversified equity funds

Moderate and aggressive investors Aggressive investors Moderate investors

High growth

Equity shares

High

1-3years

Sector fund Index fund

High growth To generate returns which are similar to the returns of the respective index

Equity shares Portfolio like BSE. Sensex, Nifty,etc

Very high Returns of NAV, very with index performance

1-3years 1-3years

Equity linked saving scheme(ELSS)

Moderate and aggressive investors

Long-term growth with tax saving

Equity shares

High

1-3years

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY

Balance fund Moderate and aggressive investors Growth and regular income Balance ratio of equity and debt fund to ensure higher returns at lower risk Predominantly debenture government securities, corporate bonds Government securities Call money commercial papers, treasury bill short-term G-secs Treasury bills, certificate of deposits , commercial papers, securities call money Capital market risk and interest rate risk Over 2 years

Bond funds

Salaried and conservative investors

Regular income

Credit risk and interest rate risk

Over 9-12months

Gilt fund

Salaried and conservative investors Investors with surplus shortterm fund

Security and income Liquidity and moderate income

Interest rate risk Linked interest rate risk

Over 12 months 3weeks 3months

Short-term funds

Liquidity funds

Investors who park their fund in current account or short term bank fixed deposits

Liquidity +moderate income preservation of capital

Negligible Risk

2days 3weeks

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY

Benefits of Mutual Fund

Portfolio Diversification Return on investment from just one industry or sector are subject to how well or poorly the industry fares. But with mutual fund ones money is invested across different sector. This reduces the risk of low returns on investments, because rarely do different sectors decline at the same time.

Professional Management A mutual fund draws on the professional expertise of a team of research analysts and fund managers in investing ones saving in a number of securities. Reduction of Transaction Costs The purchase or sale of financial assets through the exchanges entails a certain proportion of changes known as transaction made. Investments through mutual fund reduce these costs considerably as they enjoy the benefits of economies of scale. Liquidity If one invests in an open-ended mutual fund, one can claim the money at net asset value related prices from the mutual fund itself.

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY

Convenience and Flexibility One has access to up-to-date information on the value of the investment in addition to the investments that have been made by the scheme, the proportion allocated to different assets and the fund managers investment strategy.

Return Potential Investing in a Mutual Fund reduces paperwork and helps to avoid many problems such as bad deliveries, delayed payments and follow up with brokers and companies. Mutual Funds save time and make investing easy and convenient. Transparency Through features such as regular investment plans, regular withdrawal plans and dividend reinvestment plans, one can systematically invest or withdraw funds according to once needs and convenience. Affordability Investors individually may lack sufficient funds to invest in high-grade stocks. A mutual fund because of its large corpus allows even a small investor to take the benefit of its investment strategy.

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY

Well Regulated All Mutual Funds are registered with SEBI and they function within the provisions of strict regulations designed to protect the interests of investors. The operations of Mutual Funds are regularly monitored by SEBI.

Mutual Fund Industry-A Profile

Origin of Mutual Funds

The Mutual Fund industry traces its roots to England in the mid 1800s. The enactment of two British laws, the joint stock companies Acts of 1862 and 1867, permitted investors, for the first time to share in the profits of an investments enterprise, and limited investor liability to the amount of investment capital devoted to the enterprise. Shortly thereafter, in 1868, the Foreign and Colonial Government Trust formed in London. This trust resembled a mutual fund in basic structure, providing the investor of moderate means the same advantage as the large capitalists by spreading the investment over a number of different stocks. This concept of offering the investment potential of financial markets to all individuals spawned additional investment companies in Britain and Scotland and among other things helped finance the development of the post-civil was US economy. Most of the early British investment companies or trusts resembled todays closed-end funds by issuing a fixed number of shares to groups of investors whose pooled assets were invested in various companies. The Scottish American Investment Trust, formed on February 1, 1873 by fund pioneer Robert Fleming, was significant because it invested in the economic

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY potential of the United States Chiefly through American railroad bonds. Many other trusts followed that not only target investment in America, but more importantly led to the introduction of investment fund concept on U. S shares in the late 1800s and early 1900s.

History of the Indian Mutual Fund Industry

The mutual fund industry in India started in 1963 with the formation of Unit Trust of India, at the initiative of the Government of India and Reserve Bank the. The history of mutual funds in India can be broadly divided into four distinct phases --------------------------------------------------------------------------------

First Phase 1964-87

Unit Trust of India (UTI) was established on 1963 by an Act of Parliament. It was set up by the Reserve Bank of India and functioned under the Regulatory and administrative control of the Reserve Bank of India. In 1978 UTI was de-linked from the RBI and the Industrial Development Bank of India (IDBI) took over the regulatory and administrative control in place of RBI. The first scheme launched by UTI was Unit Scheme 1964. At the end of 1988 UTI had Rs.6, 700 crores of assets under management.

Second Phase 1987-1993 (Entry of Public Sector Funds)

1987 marked the entry of non- UTI, public sector mutual funds set up by public sector banks and Life Insurance Corporation of India (LIC) and General Insurance Corporation of India (GIC). SBI Mutual Fund was the first non- UTI Mutual Fund established in June 1987 followed by Can bank Mutual Fund (Dec 87), Punjab National Bank Mutual Fund (Aug 89), Indian Bank Mutual Fund (Nov 89), Bank of India (Jun 90), Bank of Baroda

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY Mutual Fund (Oct 92). LIC established its mutual fund in June 1989 while GIC had set up its mutual fund in December 1990. At the end of 1993, the mutual fund industry had assets under management of Rs.47,004 crores.

Third Phase 1993-2003 (Entry of Private Sector Funds)

With the entry of private sector funds in 1993, a new era started in the Indian mutual fund industry, giving the Indian investors a wider choice of fund families. Also, 1993 was the year in which the first Mutual Fund Regulations came into being, under which all mutual funds, except UTI were to be registered and governed. The erstwhile Kothari Pioneer (now merged with Franklin Templeton) was the first private sector mutual fund registered in July 1993. The 1993 SEBI (Mutual Fund) Regulations were substituted by a more comprehensive and revised Mutual Fund Regulations in 1996. The industry now functions under the SEBI (Mutual Fund) Regulations 1996. The number of mutual fund houses went on increasing, with many foreign mutual funds setting up funds in India and also the industry has witnessed several mergers and acquisitions. As at the end of January 2003, there were 33 mutual funds with total assets of Rs. 1,21,805 crores. The Unit Trust of India with Rs.44,541 crores of assets under management was way ahead of other mutual funds.

Fourth Phase since February 2003

In February 2003, following the repeal of the Unit Trust of India Act 1963 UTI was bifurcated into two separate entities. One is the Specified Undertaking of the Unit Trust of India with assets under management of Rs.29,835 crores as at the end of January 2003, representing broadly, the assets of US 64 scheme, assured return and certain other schemes. The Specified Undertaking of Unit Trust of India, functioning under an administrator and under the rules framed by Government of India and does not come under the purview of the Mutual Fund Regulations.

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY

The second is the UTI Mutual Fund Ltd, sponsored by SBI, PNB, BOB and LIC. It is registered with SEBI and functions under the Mutual Fund Regulations. With the bifurcation of the erstwhile UTI which had in March 2000 more than Rs.76,000 crores of assets under management and with the setting up of a UTI Mutual Fund, conforming to the SEBI Mutual Fund Regulations, and with recent mergers taking place among different private sector funds, the mutual fund industry has entered its current phase of consolidation and growth. As at the end of September, 2004, there were 29 funds, which manage assets of Rs.153108 crores under 421 schemes. The graph indicates the growth of assets over the years

GROWTH IN ASSETS UNDER MANAGEMENT

Growth of MF

250000 200000 Rs. in Crores 150000 100000 50000 0 Mar- Mar- Mar- Mar- Mar- Mar- Mar65 87 93 03 04 05 06 Year Rs. In Crore

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY

LIST OF MUTUAL FUNDS IN INDIA

Mutual Fund

Bank sponsored BOB Asset Management Co. Ltd Can Bank Investment Management Services Ltd., S.B.I. Funds Management Ltd., UTI Asset Management Co., Pvt. Ltd., G.I.C. Asset Management Co. Ltd., Jeevan Bhima Sahyoga Asset Management Co. Ltd.,

Sponsors

Year of Entry

1992 1987 1987 1963

Bank of Baroda Canara Bank State Bank of India SBI, PNB, BOB, LIC

Institutions

General Insurance Corporation & other 4 PSU GIC LIC 1990 1989 2001 1997 1996 1994 1998 1995 1996 1996 1995

Private Sectors Benchmark Asset Management Co. NICHE Financial Pvt. Ltd., Services Chola Mandalam Asset Chola Mandalam Management Co. Ltd., Investments Escorts Asset Management Ltd., Escorts Finance J. M. Capital Management Pvt. Ltd., J.M. Shares and Stock Brokers Kotak Mahindra Asset Management Kotak Mahindra Bank Co. Ltd., Reliance Capital Asset Management Reliance Capital Co. Ltd., Sahara Asset Management Co. Pvt. Sahara India Finance Ltd., Sundaram Asset Management Co. Sunadaram Finance Ltd., Tata Asset Management Pvt. Ltd., Tata Sons

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY Joint Ventures Predominantly Indian Birla Sun Life Asset Management Birla Global Finance Pvt. Ltd., D.S.P. Merrill Lynch Fund Manager D.S.P. Merrill Lynch Ltd., HDFC Asset Management Co. Ltd., HDFC & Std Life Investment

1994 1996 2000

Joint Ventures Predominantly Foreign

Alliance Capital Asset Management Pvt. Ltd., Deutsche Asset Management Pvt. Ltd., Franklin Templeton Asset Management Pvt. Ltd., HSBC Asset Manageent Pvt. Ltd., ING Inveatment Management Pvt. Ltd., Morgan Stanley Investment Management Pvt. Ltd., Prudential ICICI Asset Management Pvt. Ltd., Principal Asset Management Co. Pvt. Ltd., Standard Charted Asset Management Ltd., Alliance Capital Management Deutsche Asset Management Franklin Templeton Investments HSBC Security ING Group Morgan Stanley Prudential ICICI Principal Financial Service Standard Charted Bank 1994 2002 1996 2002 1999 1993 1993 1994 2000

( Source: Outlook Money : Laymens guide to MUTUAL FUND )

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY

Sales Practices in the Indian Mutual Fund Market Agent commissions Agents are compensated by the funds through commissions, commission rates. In India there are no rules prescribed for governing the minimum r maximum commissions payable by a fund to its agents. Each fund has discretion to decide the commission structure for its agents. Thus sundaram pays commission to its agents as a basic rates plus an incentive that depends on the volume of business. In recent times funds have been paying commissions in the range of 1.5-2 % on equity oriented funds and 0.4-0.8 % on debt based funds. Higher commissions are generally paid in case of investments that are made with the purpose of taking tax benefits, since investors are required to lock in their funds for a longer period. SEBI Regulations Although SEBI does not prescribe the minimum or maximum amount of commission payable by a fund to agents under SEBI (MF) Regulations, 1996, all initial expenses including Brokerage paid to agents are limited to 6 % of resources raised under the schemes. In additions, SEBI regulated open-end funds are authorized to charge the investors are entry & exit loads to cover the fund distribution expenses. These loads should not exceed the percentage specified in the schemes offer document. In case the agents commissions paid by the fund result in over all distribution expenses are to be borne by AMC i.e. the excess cannot be passed on to the unit holders. A no load, charging no entry or exit loads is authorized to charge the schemes with the commissions paid to agents as part of the regular management & marketing expenses allowed by SEBI. SEBI puts a cap on the total expenses (including commissions) that can be charged to a scheme each year. Any excess over allowable expenses is required to be borne by the AMC.

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY

Marker Practice Some funds pay the entire commission up- fronts to the agents (i.e. at the time of sale of units), while others pay apart of it up-front and the balance in phases. The latter practice is known as trail commission. Some funds follow the practice of non-paying the balance to the agent if the investor exits the scheme before a specified period or stop paying the commission after the investor exits whenever he does. On the issue of commissions, is that of rebating by the agent to the investor of a part of the commission received from the fund on the sale to that investor. Although agent commissions in the in the mutual industry are not at the same levels as in insurance, investors have come to expect such rebates from agents of all financial products. It is possible in future such rebates might reduce in future & may even disappear. He distributors themselves will tend to realize that they provide useful processing and advisory services to investors, & have to incur costs in the process that need to be covered from their well deserve commissions received from the funds Agents Obligation Commission/other arrangements are between the fund and agent/broker. Sub-brokers serve as agents of the principle agent and the fund is not answerable for their activities. Clearly, given the need for and widespread existence of a sub-broker network in India their role cannot be washed away. But the distributors need to make the investors aware of whom they are dealing with, whom the commission rebate is received from, & whom should they contact in case of any problems. Agents are well advised to practice honesty & transparency in explaining the commission structure & the timing of any rebate payment to the investors, whose trust will build a long-term relationship.

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY

The AMFI Code of Ethics One of the objects of the Association of Mutual Funds in India (AMFI) is to promote the investors interest by defining and maintaining high ethical and professional standards in the mutual fund industry. In pursuance of this objective, AMFI had constituted a Committee under the Chairmanship of Shri A. P. Pradhan with Shri S. V. Joshi, Shri C. G. Parekh and Shri M. Laxman Kumar as members. This Committee, working in close cooperation with Price WaterhouseLLP under the FIRE Project of USAID, has drafted the Code, which has been approved and recommended by the Board of AMFI for implementation by its members. I take opportunity to thank all of them for their efforts. The AMFI Code of Ethics, The ACE for short, sets out the standards of good practices to be followed by the Asset Management Companies in their operations and in their dealings with investors, intermediaries and the public. SEBI (Mutual Funds) Regulation 1996 requires all Asset Management Companies and Trustees to abide by the Code of conduct as specified in the Fifth Schedule to the Regulation. The AMFI Code has been drawn up to supplement that schedule, to encourage standards higher than those prescribed by the Regulations for the benefit of investors in the mutual fund industry. This is the first edition of the Code and it may be supplemented further as may be necessary. I hope members of AMFI would implement the code and ensure that their employees are made fully aware of the Code. 1.0 1.1 INTEGRITY Members and their key personnel, in the conduct of their business shall observe high standards of integrity and fairness in all dealings with investors, issuers, market intermediaries, other members and regulatory and other government authorities.

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY

1.2

Mutual Fund Schemes shall be organized, operated, managed and their portfolios of securities selected, in the interest of all classes of unit holders and not in the interest of Sponsors Directors of Members Members of Board of Trustees or directors of the Trustee company Brokers and other market intermediaries Associates of the Members A special class selected from out of unit holders

2.0 2.1

Due Diligence Members in the conduct of there Asset Management business shall at all time. Render high standards of service. Exercise due diligence. Exercise independent professional judgement.

2.2

Members shall have and employ effectively adequate resources and procedures, which are needed for the conduct of Asset Management activities.

3.0 3.1

Disclosures Members shall ensure timely dissemination to all unit holders of adequate, accurate, and explicit information presented in a simple language about the investment objectives, investment policies, financial position and general affairs of the scheme.

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY 3.2 Members shall disclose to unit holders investment pattern, portfolio details, ratios of expenses to net assets and total income and portfolio turnover wherever applicable in respect of schemes on annual basis. 3.3 Members shall in respect of transactions of purchase and sale of securities entered into with any of their associates or any significant unit holder. Submit to the Board of Trustees details of such transactions, justifying its fairness to the scheme. Disclose to the unit holders details of the transaction in brief through annual and half yearly reports. 3.4 All transactions of purchase and sale of securities by key personnel who are directly involved in investment operations shall be disclosed to the compliance officer of the member at least on half yearly basis and subsequently reported to the Board of Trustees if found having conflict of interest with the transactions of the fund. 4.0 4.1 4.2 4.3 Professional Selling Practices Members shall not use any unethical means to sell, market or induce any investor to buy their products and schemes Members shall not make any exaggerated statement regarding performance of any product or scheme. Members shall endeavor to ensure that at all times Investors are provided with true and adequate information without any misleading or exaggerated claims to investors about their capability to render certain services or their achievements in regard to services rendered to other clients,

Investors are made aware of attendant risks in members schemes before the investors make any investment decision, Copies of prospectus, memoranda and related literature is made available to investors on request,

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY Adequate steps are taken for fair allotment of mutual fund units and refund of application moneys without delay and within the prescribed time limits and, Complaints from investors are fairly and expeditiously dealt with. 4.4 Members in all their communications to investors and selling agents shall Not present a mutual fund scheme as if it were a new share issue Not create unrealistic expectations Not guarantee returns except as stated in the Offer Document of the scheme approved by SEBI, and in such case, the Members shall ensure that adequate resources will be made available and maintained to meet the guaranteed returns. Convey in clear terms the market risk and the investment risks of any scheme being offered by the Members. Not induce investors by offering benefits, which are extraneous to the scheme. Not misrepresent either by stating information in a manner calculated to mislead or by omitting to state information which is material to making an informed investment decision. 5.0 5.1 Investment Practice Members shall manage all the schemes in accordance with the fundamental investment objectives and investment policies stated in the offer documents and take investment decisions solely in the interest of the unit holders.

5.2

Members shall not knowingly buy or sell securities for any of their schemes from or to Any director, officer, or employee of the member Any trustee or any director, officer, or employee of the Trustee Company

6.0

Operations

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY

6.1

Members shall avoid conflicts of interest in managing the affairs of the schemes and shall keep the interest of all unit holders paramount in all matters relating to the scheme.

6.2

Members or any of their directors, officers or employees shall not indulge in front running (buying or selling of any securities ahead of transaction of the fund, with access to information regarding the transaction which is not public and which is material to making an investment decision, so as to derive unfair advantage).

6.3

Members or any of their directors, officers or employees shall not indulge in selfdealing (using their position to engage in transactions with the fund by which they benefit unfairly at the expense of the fund and the unit holders).

6.4

Members shall not engage in any act, practice or course of business in connection with the purchase or sale, directly or indirectly, of any security held or to be acquired by any scheme managed by the members, and in purchase, sale and redemption of units of schemes managed by the members, which is fraudulent, deceptive or manipulative.

6.5

Members shall not, in respect of any securities, be party to Creating a false market, Price rigging or manipulation

Passing of price sensitive information to brokers, Members of stock exchanges and other players in the capital markets or take action, which is unethical or unfair to investors. 6.6 Employees, officers and directors of the Members shall not work as agents/ brokers for selling of the schemes of the Members, except in their capacity as employees of the Member or the Trustee Company.

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY 6.7 Members shall not make any change in the fundamental attributes of a scheme, without the prior approval of unit holders except when such change is consequent on changes in the regulations. 6.8 Members shall avoid excessive concentration of business with any broking firm, and excessive holding of units in a scheme by few persons or entities. 7.0 7.1 Reporting Practices Members shall follow comparable and standardized valuation policies in with the SEBI Mutual Fund Regulations. 7.2 Accordance Members shall follow uniform performance reporting on the basis of total return. 7.3 Members shall ensure scheme wise segregation of cash and securities accounts. 8.0 Unfair Competition Members shall not make any statement or become privy to any act, practice or competition, which is likely to be harmful to the interests of other Members or is likely to place other. Members in a disadvantageous position in relation to a market player or investors, while competing for investible funds.

9. O

Observance of Statutes, Rules and Regulations Members shall abide by the letter and spirit of the provisions of the Statutes, rules and regulations, which may be applicable, and relevant to the activities carried on by the members.

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY 10.0 Enforcement Members shall Widely disseminate the AMFI Code to all persons and entities covered by it Make observance of the Code a condition of employment Make violation of the provisions of the code, a ground for revocation of contractual arrangement without redress and a cause for disciplinary action Require that each officer and employee of the Member sign a statement that he/she has received and read a copy of the Code Establish internal controls and compliance mechanisms, including assigning supervisory responsibility Designate one person with primary responsibility for exercising compliance with power to fully investigate all possible violations and report to competent authority File regular reports to the Trustees on a half yearly and annual basis regarding observance of the Code and special reports as circumstances require Maintain records of all activities and transactions for at least three years, which records shall be subject to review by the Trustees Dedicate adequate resources to carrying out the provisions of the Code

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY

Procedure for registering a mutual fund with SEBI. An applicant proposing to sponsor a mutual fund in India must submit an Application in Form A along with a fee of Rs.25, 000. The application is examined and once the sponsor satisfies certain conditions such as being in the financial services business and possessing positive net worth for the last five years, having net profit in three out of the last five years and possessing the general reputation of fairness and integrity in all business transactions, it is required to complete the remaining formalities for setting up a mutual fund. These include inter alias, executing the trust deed and investment management agreement, setting up a trustee company/board of trustees comprising two- thirds independent trustees, incorporating the asset management company (AMC), contributing to at least 40% of the net worth of the AMC and appointing a custodian. Upon satisfying these conditions, the registration certificate is issued subject to the payment of registration fees of Rs.25.00 lacs for details; see the SEBI (Mutual Funds) Regulations, 1996.

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY

SECURITIES AND EXCHANGE BOARD OF INDIA INVESTMENT MANAGEMENT DEPARTMENT

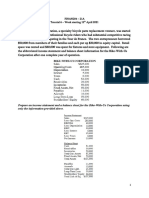

Trends in Transactions on Stock Exchanges by Mutual Funds (since January 2000) Equity (Rs in Crores) Gross Purchase

Jan 2000-March 2000. April 2000 -March 2001. April 2001-March 2002. April 2002-March 2003 April 2003-March 2004 April 2004-March 2005 April 2005-March 2006 April 2006. May 2006 (upto 19th) Total (April - May '06) 11070.54 17375.78 12098.11 14520.89 36663.58 45045.25 100389.30 12752.47 11837.29 24589.76

Debt (Rs in Crores) Net Purchase/ Sales

-421.65 -2766.98 -3795.88 -2066.70 1307.91 448.02 14305.66 3120.56 4430.64 7551.20

Gross Sales

11492.19 20142.76 15893.99 16587.59 35355.67 44597.23 86083.64 9631.91 7406.65 17038.56

Gross Purchase

2764.72 13512.17 33583.64 46663.83 63169.93 62186.46 109622.51 11227.96 9746.45 20974.41

Gross Sales

1864.29 8488.68 22624.42 34059.41 40469.18 45199.17 73003.67 6800.08 4110.53 10910.61

Net Purchase/ Sales

900.43 5023.49 10959.22 12604.42 22700.75 16987.29 36618.84 4427.88 5635.92 10063.80

Trends in Transactions on Stock Exchanges by Mutual Funds (Provisional and subject to revision) May 2006

Equity (Rs in crores) Gross Purchases 543.63 722.59 855.53 761.83 401.00 726.92 981.53 456.65 778.21 1274.82 1103.60 707.24 1244.54 1279.20 11837.29 Net Purchases / Sales 48.83 142.38 274.91 234.41 -170.78 151.51 528.23 -67.93 356.17 785.36 343.21 193.30 762.69 848.35 4430.64 Debt (Rs in crores) Gross Purchases 389.58 555.27 285.41 409.98 537.41 564.28 813.02 1475.45 619.55 748.34 925.49 1325.27 738.64 358.76 9746.45 Net Purchases/ Sales 65.16 325.39 166.40 257.68 333.09 330.01 415.96 1228.54 253.68 404.28 653.57 688.66 378.53 134.97 5635.92

Transaction Date 02.05.06 03.05.06 04.05.06 05.05.06 08.05.06 09.05.06 10.05.06 11.05.06 12.05.06 15.05.06 16.05.06 17.05.06 18.05.06 19.05.06 Total

Gross Sales 494.80 580.21 580.62 527.42 571.78 575.41 453.30 524.58 422.04 489.46 760.39 513.94 481.85 430.85 7406.65

Gross Sales 324.42 229.88 119.01 152.30 204.32 234.27 397.06 246.91 365.87 344.06 271.92 636.61 360.11 223.79 4110.53

Market meltdown shows Mutual Funds run with the bulls, get mauled by the bears

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY Underperformance is worrying: MFs have lagged the Sensex by 3.5 percentage points over a month to 8.7 percentage points over a year Take all diversified equity mutual fund schemes. Find out how they fared over various time periods. Crunch the numbers. Put them against the market benchmark, the BSE Sensex. What do you get? A rather uninspiring look at fund managers, experts who we pay about 2.5 per cent of our investment to outperform markets. Take a look: During the past month, when the Sensex crashed by 25.4 per cent, the average fall in 158 diversified equity funds was 28.9 per cent-an underperformance of 3.4 percentage points. Only one out of 10 funds managed to beat the Sensex in this period. In the past two weeks, when the Sensex fell by 12.8 per cent, the funds on an average fell by 16.6 per cent, an underperformance of 3.8 percentage points, with just 16 of 161 funds being able to beat the Sensex. In other words, just 9.9 per cent of funds were able to deliver returns better than the Sensex. A study of 161 diversified mutual funds over the past week, two weeks, one month, three months, six months, 12 months and 36 months shows that on an average the funds have been lagging the Sensex in all but the 36-month period. But it is not merely the level but the extent of underperformance that's disturbing. Barring 36-month comparisons, in all other time frames, the percentage of funds that has lagged the Sensex has ranged from 74.6 per cent for 12-month performance to 96.3 per cent over one week-which means more than nine out of 10 funds delivered below benchmark returns. Now, the industry is likely to say that when you invest in an equity mutual fund, it is not for weeks or months but years. Which is right? Over a three year period, between June 2003 and June 2006, when the Sensex rose by 40.7 per cent per annum, 52 out of 61 funds (or 85.2 per cent) outperformed. On an average, the funds outperformed the Sensex by 9.6 percentage points, rising 50.3 per cent per annum during the period (SBI Magnum Global and SBI Magnum Umbrella dished out returns of 82 and 79 per cent, per annum).

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY The former is an arbitrage fund, buying companies as well as futures with a minimum 25 per cent debt exposure, and because of which its volatility, and hence the underperformance, is low. The latter invests in international equities, with exposures to companies like 3M, Atlas Cop co AB, BASF AG and so on. On the other end of the spectrum, the one fund that consistently figures among the three worst performers is Taurus Discovery Stock, whose objective is to "identify and select low priced stocks through price discovery mechanism" to bring long term capital appreciation. Its top holdings include J P Associates, NDTV, SRF and Reliance Capital. The problem with many underperforming funds is really their exposure to mid-cap and small-cap stocks. These stocks are neither liquid enough to sell in quantities, nor do they have futures to hedge with (only 142 actively traded shares do). As a result, when a fall comes, funds are unable to exit on time or in quantities as the stocks hit lower circuits. Much of which points to the direction of investments in the last leg of the Bull run that began in April 2003. Fund managers have not been seeking value or growth but riding momentum, that is, following the latest fast-growing fad and moving to the next. Something likes stocks staccato. A strategy that has worked well for them on the rise. But today, when the bulls are taking a much needed breather before stampeding on the 8-10 per cent GDP growth highway, the short-term weak links are showing that while funds can match the Indian bull march, they're in a Canadian forest when it comes to dealing with the Grizzly. Mutual fund (MF) houses disappointed investors during the May 10 to June 9 periods with equity schemes across-the-board showing sharp fall in returns. Equity funds of LIC Mutual Fund lead the pack, registering a fall of 29.91% on return during the period under review. The average NAV (net asset value) of two equity fund schemes decreased from Rs 18.08 to Rs 12.67. Among the two equity fund schemes, the highest decline in NAV was registered in the case of LIC MF Equity Fund-D. The fund's NAV declined from Rs 14.67 to Rs 10.28.

R Swami Nathan, Associate VP, IDBI Capital, said, "Over heated market was waiting for an opportunity to cool down. The correction started in a broad-based manner irrespective of

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY large cap, mid cap or small cap scrips. The effect of the market downfall has been experienced in the erosion of the net asset value of mutual fund equity schemes." "At this juncture when the market is volatile, an investor should take stock of his portfolio for a review. He can add some equity funds, provided his asset allocation plan permits. This is the time one can look at the equity funds again for investment with a medium to long-term perspective," Mr. Swami Nathan pointed out. The top 5 MF houses according to the average NAV of equity fund schemes as on June 9, 2006 are Reliance Capital MF (Rs 81.79), Franklin Templeton MF (Rs 57.88), Birla Sun Life MF (Rs 52.50), HDFC MF (Rs 40.78) and Prudential ICICI MF (Rs 34.09). Among these, highest decline in average NAV of equity funds was seen in the case of Reliance Capital MF (26.82%).

Abstract

International mutual funds are key contributors to the globalization of financial markets and one of the main sources of capital flows to emerging economies. Despite their importance in emerging markets, little is known about their investment allocation and strategies. This article provides an overview of mutual fund activity in emerging markets. It describes their size, asset allocation, and country allocation and then focuses on their behavior during crises in emerging markets in the 1990s. It analyzes data at both the fundmanager and fund-investor levels. Due to large redemptions and injections, funds' flows are not stable. Withdrawals from emerging markets during recent crises were large, which is consistent with the evidence on financial contagion.

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY

Structure of Mutual Funds in India

Like other countries, India has a legal framework within which mutual funds be constituted. Unlike in the UK, where two distinct trust and corporate structures are followed with separate regulations, in India open-end and closed end funds operate under the same regulatory structure and are constituted along one unique structure as unit trusts. A mutual fund in India is allowed to issue open-end and closed-end schemes under a common legal structure. Therefore, a mutual fund may have several different schemes (open-end and closed-end) under it. That is under one unit trust, at any point of time. The structure is required to be followed by mutual funds in India is laid down under SEBI (mutual fund) regulations, 1996. In the following paragraphs, we look at the structure of each of the fund constituent

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY

SEBI TRUSTEE OPERATIONS AMC SPONSOR

FUND MANAGER

MARKET / SALES

MUTUAL FUND SCHEMES INVESTOR

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY

Sponsor

What a promoter is to a company, a sponsor is to a mutual fund. The sponsor initiates the idea to set up a mutual fund. It could be a financial services company, a bank or a financial institution. It could be Indian of foreign. It could do it alone or through a joint venture. In order to run a mutual fund in India, the sponsor has to obtain a license from SEBI. For this, it has to satisfy certain conditions, such as a capital and profits, back records (at least five years in financial services), default free dealings and a general reputation for fairness.

Asset Management Company (AMC) An AMC is the legal entity formed by the sponsor to run a mutual fund. Its the AMC that employs fund managers and analyst, and other personnel. Its the AMC that handles all operational matters of a mutual fund from launching schemes to managing them to interacting with investors. The people in the AMC who should matter the most to you are those who take investment decisions. There is the head of the fund house, generally referred to as the chief executive officer (CEO). Under him comes the chief investment officer (CIO), who shapes the funds investment philosophy and fund managers who manage its schemes. A team of analysts, who track markets, sectors and companies, assists them.

Trustees

Trustees are like internal regulations in a mutual fund, and their job is to protect the interests of unit holders. Trustees are appointed or corporate bodies. In order to ensure they

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY are impartial and fair, SEBI rules mandate that at least two thirds of the trustees be independent that is, not have any association with the sponsor. Trustees appoint the AMC, subsequently seeks their approval for the work it does and reports periodically to them on how the business is being run. Trustees float and market schemes and secure necessary approvals. They check if the AMC investments are within defined limits and whether the funds accountable for financial irregularities in the mutual fund.

Custodian A custodian handles the investment back office of a mutual fund. Its responsibilities include receipt and delivery of securities, collection of income, and distribution of dividends and segregation of assets between schemes. The sponsor of a mutual fund cannot act as a custodian to the fund. This condition, formulated in the interest of investors, ensures that the assets of a mutual fund are not in the hands of its sponsor. For example Deutsche Bank is a custodian but it cannot service Deutsche Mutual Fund, its mutual fund arm.

Registrar Registrars also known as transfer agents, handles all investor related services. This includes issuing and red reaming units. Sending fact sheet and annual reports. Some fund houses handle such functions in house. Others outsource it to registrars; Karvy and CAMS are the more popular ones. It doesnt really matter which model your mutual fund opts for, as long

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY as it is prompt and efficient in servicing you. Most mutual funds in addition to registrars also have investor service centers of their own in some cities.

Recent Trends in Mutual Fund Industry

The most important trend in the mutual fund industry is the aggressive expansion of the Foreign owned mutual fund companies and the decline of the companies floated by Nationalized Banks and smaller Private Sector players. Many Nationalized banks got into the mutual fund business in the early nineties and got off to a good start due to the stock market boom prevailing then. These banks did not really understand the mutual fund business and they just viewed it as another kind of banking activity. Few hired specialized staff and generally chose to transfer staff from the parent organization. The performance of the schemes floated by these funds was not good.

Some schemes offered guaranteed returns and their parent organization had to bail out these AMCs by paying large amounts of money as the difference between the guaranteed and actual returns. The service levels were also very bad. Most of these AMCs have not been able to retain staff, float new schemes etc. and it is doubtful whether, barring a few exceptions they have serious plans of continuing the activity in a major way. The experience of some of the AMCs floated by private sector Indian companies was also very similar. They quickly realized that the AMC business, which makes money in the long term and requires deep-pocketed support in the intermediate years. Some have sold out to Foreign owned companies, some have merged with others and there is general restructuring going on. The Foreign owned companies have deep pockets and come in here with the expectation of a long haul. They can be credited with introducing many new practices such as new product innovation, sharp improvement in service standards and disclosure, usage of technology, broker education and support etc. In fact they have forced the industry to

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY upgrade itself and service levels of organizations like UTI have improved dramatically in the last few years in response to the competition provided by these companies.

Future Scenario The asset base will continue to grow at an annual rate of about 30 to 35% over the next few years as investors shift their assets from banks and other traditional avenues. Some of the older and private sector players will either close shop or be taken over.

In the coming years the market will witness a flurry of new players entering the arena. There will be a large number of offers from various AMCs in the time to come. Some big names like Fidelity, Principal, Old Mutual etc. are looking at Indian market seriously. One important reason for it is that most major players already have presence here and hence these big names would hardly like to get left behind. The mutual fund industry is awaiting the introduction of Derivatives in India as this would enable it to hedge its risk and this in turn would be reflected in its NAV. SEBI is working out the norms for enabling the existing mutual fund schemes to trade in derivatives. Importantly, many market players have called on the regulator to initiate the process immediately, so that the mutual funds can implement the changes that are required to trade derivatives.

Global Scenario

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY

Some basic facts

The money market mutual fund segment has a total corpus of $ 1.48 trillion in the U.S. against a corpus of $ 100 million in India. Out of the top 10 mutual funds worldwide, eight are bank- sponsored. Only Fidelity and Capital are non-bank mutual funds in this group. In the U.S. the total number of schemes is higher than that of the listed companies while in India we have just 277 schemes Internationally, mutual funds are allowed to go short. In India fund managers do not have such leeway.

In the U.S. about 9.7 million households will manage their assets on-line by the year 2003, such a facility is not yet of avail in India. On- line trading is a great idea to reduce management expenses from the current 2 % of total assets to about 0.75 % of the total assets. 85% of the core customer bases of mutual funds in the top 50-broking firms in the U.S. are expected to trade on-line by 2003. Internationally, on- line investing continues its meteoric rise. Many have debated about the success of e- commerce and its breakthroughs, but it is true that this aspect of technology could and will change the way financial sectors function. However, mutual funds cannot be left far behind. They have realized the potential of the Internet and are equipping themselves to perform better.

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY In fact in advanced countries like the U.S.A, mutual funds buy- sell transactions have already begun on the Net, while in India the Net is used as a source of Information. Such changes could facilitate easy access, lower intermediation costs and better services for all. A research agency that specializes in Internet technology estimates that over the next four years Mutual Fund Assets traded on- line will grow ten folds from $ 128 billion to $ 1,227 billion; whereas equity assets traded on-line will increase during the period from $ 246 billion to $ 1,561 billion. This will increase the share of mutual funds from 34% to 40% during the period. Such increases in volumes are expected to bring about large changes in the way Mutual Funds conduct their business.

Here are some of the basic changes that have taken place since the advent of the Net. Lower Costs Distribution of funds will fall in the online trading regime by 2003. Mutual funds could bring down their administrative costs to 0.75% if trading is done on- line. As per SEBI regulations, bond funds can charge a maximum of 2.25% and equity funds can charge 2.5% as administrative fees. Therefore if the administrative costs are low, the benefits are passed down and hence Mutual Funds are able to attract mire investors and increase their asset base.

Better advice

Mutual funds could provide better advice to their investors through the Net rather than through the traditional investment routes where there is an additional channel to deal with the Brokers. Direct dealing with the fund could help the investor with their financial planning. In India,

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY brokers could get more Net savvy than investors and could help the investors with the knowledge through get from the Net.

New investors would prefer online Mutual funds can target investors who are young individuals and who are Net savvy, since servicing them would be easier on the Net. India has around 1.6 million net users who are prime target for these funds and this could just be the beginning. The Internet users are going to increase dramatically and mutual funds are going to be the best beneficiary. With smaller administrative costs more funds would be mobilized .A fund manager must be ready to tackle the volatility and will have to maintain sufficient amount of investments which are high liquidity and low yielding investments to honor redemption.

Net-based advertisements There will be more sites involved in ads and promotion of mutual funds. In the U.S. sites like AOL offer detailed research and financial details about the functioning of different funds and their performance statistics. a is witnessing a genesis in this area . There are many sites such as indiainfoline.com and indiafn.com that are doing something similar and providing advice to investors regarding their investments. In the U.S. most mutual funds concentrate only on financial funds like equity and debt. Some like real estate funds and commodity funds also take an exposure to physical assets.

Babasabpatilfreepptmba.com

A MUTUAL FUND CONCEPT BIRLA SUN LIFE DISTRIBUTION COMPANY The latter type of funds are preferred by corporate who want to hedge their exposure to the commodities they deal with. For instance, a cable manufacturer who needs 100 tons of Copper in the month of January could buy an equivalent amount of copper by investing in a copper fund. For Example, Permanent Portfolio Fund, a conservative U.S. based fund invests a fixed percentage of its corpus in Gold, Silver, Swiss francs, specific stocks on various bourses around the world, short term and long-term U.S. treasuries etc. In U.S.A. apart from bullion funds there are copper funds, precious metal funds and real estate funds (investing in real estate and other related assets as well.). In India, the Canada based Dundee mutual fund is planning to launch a gold and a real estate fund before the year-end. In developed countries like the U.S.A there are funds to satisfy everybodys requirement, but in India only the tip of the iceberg has been explored. In the near future India too will concentrate on financial as well as physical funds.