Deduct Medical Insurance Premiums under Section 80D

Diunggah oleh

sedunairDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Deduct Medical Insurance Premiums under Section 80D

Diunggah oleh

sedunairHak Cipta:

Format Tersedia

80D DEDUCTION

Section 80D of Indian Income Tax Act is especially useful if your employer does not cover your health or medical expenses. It is a good idea to get medical insurance or health insurance for you, your spouse, dependent children or dependent parents, as you can claim a deduction of upto Rs. 15000/- per anum for the premia paid on this insurance. For senior citizen this limit is Rs. 20000. You can claim the total of the following items for deduction under section 80D. 1. Total amount of premium paid for health insurance of family (meaning spouse + children), or Rs. 15,000 , whichever less. 2. Total amount of premium paid for health insurance of your parents or Rs. 15,000, whichever less. Thus if you are paying premiums of mediclaim policies for your spouse children and parents you can get a total tax deduction of upto Rs. 30,000. Available Deduction - For individuals less than 65 years of age, amount of health insurance premium paid or Rs. 15,000, whichever is lesser. For senior citizens above 65 years, amount of health insurance premium paid or Rs. 20,000, whichever is lesser. A further deduction of Rs 15,000 could be claimed, for buying health insurance policy for your parents (Rs 20,000 if either of your parents is a senior citizen). This is irrespective of whether theyre dependent on you or not. No deductions can be claimed for in-laws. Scope of Deduction - Individual assesses can claim deduction for premiums paid towards health insurance of self, spouse, parents and children. Key Factors to keep in mind 1. The premium may be paid by any mode of payment, other than cash. 2. The health insurance premium that you pay must be from the taxable income applicable for the year you claim. Premiums should not be from gifts received by you. 3. Part payment of premium is allowed. For example, suppose your parents contribute 50% of their health insurance premium and you pay the balance 50% of their premium. In such a case, you could avail the deduction for the amount contributed by you and your parents too could avail deduction for their contribution.

The deduction is available for individuals of age less than 65years, on the amount of health insurance premium paid or Rs.15,000 whichever is less. The deduction for senior citizens above 65years of age is available on the health insurance premium paid or Rs.20,000 whichever is less. A further deduction of Rs.15,000 could be claimed for buying health insurance for your parents and of rs.20,000 if either of your parents is a senior citizen. Irrespective of whether they are dependent on you or not. This allows a deduction for the payment of your medical insurance premium. All individuals and HUF (Hindu Undivided Family). The amount must have been paid using the taxpayers income chargeable to tax. In case an individual is taking the deduction, the medical insurance policy can be take in the name of any of the following: the taxpayer or the spouse, parents or dependent children of the taxpayer. In case a HUF is taking the deduction, the medical insurance policy can be taken in the name of any member of the family. The general deduction available to each taxpayer is Rs.15,000, for self, spouse and children. An additional deduction for parents is Rs. 15,000. If the amount paid is for a senior citizen, then one can claim an additional exemption of Rs.5,000. Deduction is allowed for any medical insurance premium under an approved scheme of General Insurance. corporation of India, (popularly known as MEDICLAIM) or of any other insurance company, paid by any mode except cash, out of assessees taxable income during the previous year, in respect of the following: What are the eligible instruments? All medical insurance policies are eligible for the 80D deduction up to the specified amount. Please remember that the premium towards the policy cannot have been paid in cash. Please check with your tax advisor in case from time to time there are some changes to the amount or type of deduction available under 80D. For Whom Deduction u/s 80D is available (a) In case of an individual- Insurance on the health (health insurance) of the assessee, or wife or husband, or [dependent] parents or dependent children. (b) In case of an H.U.F.- Insurance on the health of any member of the family.

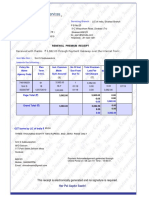

Maximum Rs. 15,000 (Rs.20,000 in case any person insured is a senior citizen). Example of Mediclaim deduction If A has paid medical insurance premium (mediclaim) u/s 80D as follows Deduction u/s 80C for PPF, NSC/LIC 1,20,000/-

Medical Insurance Premium (Health Insurance Premium) -For self, wife and dependent children -For parents (both Senior Citizens) Total Sum paid by A Solution: Allowable Deductions Deduction u/s 80C for PPF, NSC/LIC Medical Insurance Premium -For self, wife and dependent children -For parents (both Senior Citizens) Total Allowable Deduction 15,000/20,000/1,35,000/1,00,000/18,000/22,000/1,60,000/-

1. 2) In Case of an H.U.F, the maximum deduction is Rs. 15000 (Rs.20,000 in case any person insured is a senior citizen.) Section 80D is available other than 100000 deduction available under 80C for life insurance,ppf,gpf,tuition fee,ULIP,House loan repayment etc. 2. Insurer covered:This deduction is available for medical claim policy which should be framed in this behalf by o by GIC(General insurance Corporation) or by o any other insurer but approved by IRDA(Insurance Regulatory Development authority) 3. Available to :Deduction is available to o Individual (resident or non resident ,Indian Citizen or foreign citizen) o HUF(Hindu undivided Family may be resident or non resident)

4. Mode of payment:Insurance Premium should be paid by any mode other than by Cash .Means if insurance premium is paid by cash then no deduction is available.Before Assessment year 2008-09 ,only payment by cheque was allowed under this section but from Ay 2008-09 onwards the deduction is allowed by other mode also like online payment which is now a days is very popular or by credit card is also allowed. 5. Out of Income :The amount should be paid out of the income chargeable to tax. 6. Proposer of the policy is not must:The premium is to be paid to effect or keep inforce insurance policy ,there is no condition that assessee should be the proposer of the policy , 7. Partly contribution: Assessee can partly contribute the premium amount but amount should be paid directly to insurance company and paid through mode other than by cash (see example) 8. Insurance cover on?:First deduction given below :Insurance Premium may be paid for medical claim insurance policy for assessee himself or spouse or dependent children or any combination of three. 9. Addition for parents:Second deduction given below:Insurance premium may be paid for medical claim insurance for assessee parents (father or mother or for both) 10. Deduction upto 40000:Theoretically ,maximum deduction can be claimed for Rs 40000.(detail as given below) Amount Of deduction : Two type of Deductions are available to Individuals under this section from Assessment year 2009-10 1. Deduction on Medical insurance premium paid for himself,spouse,dependent children =Rs 15000 maximum. 2. Deduction on Medical insurance premium paid for parents ,whether dependent on assesee or not =Rs 15000 maximum Deduction to HUF: Deduction to HUF is available on insurance premium paid for policy taken for of any member of the HUF

Addition deduction for Resident Senior Citizen:In addition to two point above, additional deduction of Rs 5000 is available where assessee or his spouse (wife or husband) or dependent parents or any member of the family in case one and father or mother is a resident in India and a senior citizen in case two.And same in the case of HUF assessee if policy has been taken on member which is senior citizen than additional Rs 5000/- deduction is available also to HUF. Senior citizen means who is at least of 65 year of age or more at any time during the previous year. Example : An individual assessee pays (through any mode other than by cash) during the previous year medical insurance premium as under 1. Rs 12000/- to keep in force an insurance policy on his health and on his wife and dependent children 2. Rs 17000/- to keep in force an insurance policy on the health of his parents. According to above provisions he will be allowed of Rs 27000/-(12000/- +15000/-) if neither of his parents is senior citizen .however if any of his parent is a resident senior citizen ,he will be allowed a deduction of 29000(12000+17000) .whether the parents is dependent or not is not a consideration for deciding the deduction under section 80D(from assessment year 2009-10 )(previous year 2008-09) Further, in the above example ,if cost of insurance on the health of the parents is 30000/- out of which Rs 17000/- is paid (by any non cash mode) by the son and rs 13000/- by the father (who is senior citizen), out of their respective taxable income ,the son get the deduction of Rs 17000/- (in addition to deduction of Rs 12000/- for the medical insurance on self and family) and the father will get deduction under section Rs 13000/-

Any amount paid by an Individual or HUF to an Insurance company as Medical Insurance Premium i.e. premium paid in respect of Mediclaim Policy can be claimed as deduction under section 80D. Note: Life Insurance Premium is NOT covered under this category.

Important points: 1. Premium paid should be in respect of Mediclaim Insurance policy. 2. The deduction is also available when the Taxpayer makes any contribution towards Central Government Health Scheme. 3. Deduction is available only to Individuals and HUFs (Hindu Undivided Family). Corporates or Partnership firms cannot claim this deduction. 4. Deduction is not allowed when the premium is paid by cash. In other words, the deduction will be allowed when the premium is paid by modes other than cash i.e. cheque or DD. 5. Deduction is allowed in respect of following persons: Taxpayer Individual Insured Person On the health of taxpayer himself/herself, spouse, parents, dependent children of taxpayer On the health of any of the member of the family

Hindu Undivided Family (HUF)

Amount exempted under Section 80D Least of the following is allowed to be deducted from Gross Total Income of the Taxpayer for 80D: a. b. Actual Mediclaim Insurance Premium paid Rs. 15,000

In case the Mediclaim Insurance Premium paid is for a Senior Citizen (person above 65 years), least of the following is allowed as deduction : a. b. Actual Mediclaim Insurance Premium paid Rs. 20,000

Anda mungkin juga menyukai

- Employer's QUARTERLY Federal Tax Return: Report For This Quarter of 2020Dokumen2 halamanEmployer's QUARTERLY Federal Tax Return: Report For This Quarter of 2020Marie Alex100% (1)

- Allocation of Refund (Including Savings Bond Purchases) : 56 Direct DepositDokumen4 halamanAllocation of Refund (Including Savings Bond Purchases) : 56 Direct DepositJahe FameBelum ada peringkat

- Tax Presentation-29.01.2023Dokumen25 halamanTax Presentation-29.01.2023Abhinav Parhi100% (2)

- Health Insurance, IsIP-222033Dokumen3 halamanHealth Insurance, IsIP-222033AhmedBelum ada peringkat

- Your Renewal Premium Receipt (Provisional) : Receipt Number: OT007932427 Date: 02-03-2019Dokumen2 halamanYour Renewal Premium Receipt (Provisional) : Receipt Number: OT007932427 Date: 02-03-2019Ritik Goyal100% (1)

- Employee pay slip detailsDokumen1 halamanEmployee pay slip detailsAmar Rajput58% (12)

- Apollo MunichDokumen2 halamanApollo MunichLalith NeeleeBelum ada peringkat

- 11 - Estoconing v. PeopleDokumen1 halaman11 - Estoconing v. PeoplechrisBelum ada peringkat

- Renewal NoticeDokumen2 halamanRenewal NoticeJerry LamaBelum ada peringkat

- New VinothDokumen3 halamanNew VinothRenga NathanBelum ada peringkat

- Shweta Nair Roll No 29 ODDokumen36 halamanShweta Nair Roll No 29 ODsedunairBelum ada peringkat

- Dushyant HP Apollo 2017Dokumen10 halamanDushyant HP Apollo 2017niren4u1567Belum ada peringkat

- Basic Own DamageDokumen3 halamanBasic Own DamageHarsh PriyaBelum ada peringkat

- Ganga Prasad's 8.5% Fixed Deposit Maturing in Sep 2014Dokumen1 halamanGanga Prasad's 8.5% Fixed Deposit Maturing in Sep 2014dpk0Belum ada peringkat

- Premium Paid CertificateDokumen1 halamanPremium Paid CertificateSenthil balasubramanianBelum ada peringkat

- Business Tax & VAT ProblemsDokumen2 halamanBusiness Tax & VAT ProblemsAyessa ViajanteBelum ada peringkat

- Pawan S PDF CompletedDokumen1 halamanPawan S PDF CompletedAsifshaikh7566Belum ada peringkat

- Prashant (1) CompletedDokumen1 halamanPrashant (1) CompletedAsifshaikh7566Belum ada peringkat

- HDFC ERGO Health Insurance RenewalDokumen4 halamanHDFC ERGO Health Insurance RenewalAhesan Ali MominBelum ada peringkat

- Health InsuranceDokumen40 halamanHealth InsuranceSubhadeep SahaBelum ada peringkat

- Asf Shaikh TAX NEW2014Dokumen1 halamanAsf Shaikh TAX NEW2014Asifshaikh7566Belum ada peringkat

- Life Insurance Premium CertificateDokumen1 halamanLife Insurance Premium CertificateNirantar SenBelum ada peringkat

- Premium Paid Certificate DetailsDokumen2 halamanPremium Paid Certificate DetailsGuy LoveBelum ada peringkat

- 1865362Dokumen1 halaman1865362Bhavesh ParekhBelum ada peringkat

- CPOLICYdoc 01050048194100221639 PDFDokumen2 halamanCPOLICYdoc 01050048194100221639 PDFRaman SaxenaBelum ada peringkat

- Renewal Premium Receipt: Policy Number Date & Time AmountDokumen1 halamanRenewal Premium Receipt: Policy Number Date & Time AmountGokuBelum ada peringkat

- Tax Certificate - of Anjali Lalwani PDFDokumen2 halamanTax Certificate - of Anjali Lalwani PDFBasant GakhrejaBelum ada peringkat

- PI InsuranceDokumen7 halamanPI InsuranceMike Matshona0% (1)

- Tax Certificate - 008927742 - 131310Dokumen2 halamanTax Certificate - 008927742 - 131310Vignesh MahadevanBelum ada peringkat

- ULIP Pension PlansDokumen5 halamanULIP Pension PlanskammapurathanBelum ada peringkat

- LIC Sikha PDFDokumen1 halamanLIC Sikha PDFsikha singh100% (1)

- PMJBY Scheme Provides Rs. 2 Lakh Life Cover for Rs. 330/YearDokumen2 halamanPMJBY Scheme Provides Rs. 2 Lakh Life Cover for Rs. 330/YearrbuvanesBelum ada peringkat

- Premium Paid AcknowledgementDokumen1 halamanPremium Paid AcknowledgementArpit SinghalBelum ada peringkat

- LIC's JEEVAN RAKSHAK (UIN: 512N289V01) - : Policy DocumentDokumen11 halamanLIC's JEEVAN RAKSHAK (UIN: 512N289V01) - : Policy DocumentSaravanan DuraiBelum ada peringkat

- Star Health and AlliedDokumen1 halamanStar Health and Allieddisk_la_poduBelum ada peringkat

- ReceiptPrint UIMTH-17890 PDFDokumen1 halamanReceiptPrint UIMTH-17890 PDFPubg UsaBelum ada peringkat

- Father Mediclaim ApplicationDokumen2 halamanFather Mediclaim ApplicationAnil VishwakarmaBelum ada peringkat

- Akshay VII Proposal FormDokumen9 halamanAkshay VII Proposal FormNarendar Kumar0% (1)

- Salary Slip PDFDokumen3 halamanSalary Slip PDFmohd aslamBelum ada peringkat

- Family Health Optima Insurance PlanDokumen16 halamanFamily Health Optima Insurance PlanvedavathiBelum ada peringkat

- Online premium receipt confirmationDokumen1 halamanOnline premium receipt confirmationSasidharKalidindiBelum ada peringkat

- This Is To Certify That The Following Payments Have Been Made Under Life Insurance Policies Held byDokumen1 halamanThis Is To Certify That The Following Payments Have Been Made Under Life Insurance Policies Held bySumanthBelum ada peringkat

- POLICY SCHEDULEDokumen4 halamanPOLICY SCHEDULEamit_264Belum ada peringkat

- Subject: Policy Number: 0000000009425420-01: Customer - Care@sbigeneral - inDokumen31 halamanSubject: Policy Number: 0000000009425420-01: Customer - Care@sbigeneral - inUday NainBelum ada peringkat

- ICICI Health InsuranceDokumen1 halamanICICI Health Insurancecanjiatp76260% (1)

- SBI Life Cerificate PDFDokumen1 halamanSBI Life Cerificate PDFsachin sawantBelum ada peringkat

- Consolidated StatementDokumen1 halamanConsolidated StatementParameswararao BillaBelum ada peringkat

- Airasia Online Print Tax InvoiceDokumen15 halamanAirasia Online Print Tax InvoiceDarshan DarshanBelum ada peringkat

- Hospitalization Benefit Plan 1 Plan 2 Plan 3 Plan 4Dokumen4 halamanHospitalization Benefit Plan 1 Plan 2 Plan 3 Plan 4Jahankeer MzmBelum ada peringkat

- WeeNNglHvNqn1597554384894 PDFDokumen1 halamanWeeNNglHvNqn1597554384894 PDFM VARAPRASADREDDYBelum ada peringkat

- 10789103Dokumen7 halaman10789103Sachit MalikBelum ada peringkat

- Policy Doc PDFDokumen4 halamanPolicy Doc PDFGajen SinghBelum ada peringkat

- Premium Certificate for Health Insurance DeductionDokumen1 halamanPremium Certificate for Health Insurance DeductionnikhilBelum ada peringkat

- Premium paid certificate for ICICI Pru Endowment policyDokumen1 halamanPremium paid certificate for ICICI Pru Endowment policyPraveen KumarBelum ada peringkat

- HDFC ERGO General Insurance Company LimitedDokumen4 halamanHDFC ERGO General Insurance Company LimitedMandar JadhavBelum ada peringkat

- AEGON RELIGARE Premium Payment Receipt 2013 PDFDokumen1 halamanAEGON RELIGARE Premium Payment Receipt 2013 PDFHarishBelum ada peringkat

- Group Activ Travel - Certificate of Insurance: Insured Person DetailsDokumen2 halamanGroup Activ Travel - Certificate of Insurance: Insured Person Detailsabhinay anandBelum ada peringkat

- Renew your Health PolicyDokumen2 halamanRenew your Health PolicyVikas YadavBelum ada peringkat

- Premium Paid CertificateDokumen1 halamanPremium Paid Certificatemsurendra642Belum ada peringkat

- New - Life Insurance Corporation of India - Sowmya - 2023Dokumen1 halamanNew - Life Insurance Corporation of India - Sowmya - 2023boddu sowmyaBelum ada peringkat

- 80D SelfDokumen1 halaman80D Selfnikhil nadakuditiBelum ada peringkat

- LIC Premium Paid Statement 2017-2018Dokumen1 halamanLIC Premium Paid Statement 2017-2018Swapnil NageBelum ada peringkat

- Digitally Signed Motor Insurance CertificateDokumen2 halamanDigitally Signed Motor Insurance CertificateNandakishor AjBelum ada peringkat

- LIC renewal premium receiptDokumen1 halamanLIC renewal premium receiptshivadreamsBelum ada peringkat

- Consolidated Premium Paid STMT 2012-2013Dokumen1 halamanConsolidated Premium Paid STMT 2012-2013jahmeddBelum ada peringkat

- Section 80D Deduction For Mediclaim Insurance PremiumDokumen46 halamanSection 80D Deduction For Mediclaim Insurance PremiumsameerBelum ada peringkat

- Mediclaim 80dDokumen5 halamanMediclaim 80dPaymaster ServicesBelum ada peringkat

- Maternity Benefit Act 1961Dokumen11 halamanMaternity Benefit Act 1961Saahil LedwaniBelum ada peringkat

- Payment of ChequesDokumen2 halamanPayment of ChequesManish MaheshBelum ada peringkat

- ESI Scheme Punjab ChandigarhDokumen12 halamanESI Scheme Punjab ChandigarhsedunairBelum ada peringkat

- Low PerformanceDokumen1 halamanLow PerformancesedunairBelum ada peringkat

- Provident FundDokumen18 halamanProvident FundsedunairBelum ada peringkat

- 120 (Book 2) 2016Dokumen132 halaman120 (Book 2) 2016Jerico Kier YesyesBelum ada peringkat

- Train Law Income TaxationDokumen9 halamanTrain Law Income TaxationRuth CepeBelum ada peringkat

- Chapter I: Introduction of Study: Goods and Service Tax (GST)Dokumen73 halamanChapter I: Introduction of Study: Goods and Service Tax (GST)Prajakta KambleBelum ada peringkat

- Cta Vat CaseDokumen9 halamanCta Vat CasemmeeeowwBelum ada peringkat

- Draft Work Order For Tree ShiftingDokumen2 halamanDraft Work Order For Tree Shiftingsunil kumarBelum ada peringkat

- What Is Input Tax Credit and How To Adjust or Set-Off ITC It?Dokumen2 halamanWhat Is Input Tax Credit and How To Adjust or Set-Off ITC It?Filing BuddyBelum ada peringkat

- Tax1-BIR Ruling 13-2004 (Headquarters Exempt)Dokumen4 halamanTax1-BIR Ruling 13-2004 (Headquarters Exempt)SuiBelum ada peringkat

- Guidelines and Instruction For BIR Form No 1702 RTDokumen2 halamanGuidelines and Instruction For BIR Form No 1702 RTRahrahrahn100% (2)

- Clouie Jid Malino TLA 6.2Dokumen9 halamanClouie Jid Malino TLA 6.2Raynon AbasBelum ada peringkat

- Dmart BillDokumen1 halamanDmart BillSai Sidhartha TanneruBelum ada peringkat

- PAYSLIP DETAILSDokumen3 halamanPAYSLIP DETAILSamitBelum ada peringkat

- Tax Planning and ManagementDokumen4 halamanTax Planning and ManagementPravina SantoshBelum ada peringkat

- SOAL Kuis Materi UAS Inter 2Dokumen2 halamanSOAL Kuis Materi UAS Inter 2vania 322019087Belum ada peringkat

- Hillsborough County Real Estate A0214340000 2020 Annual BillDokumen1 halamanHillsborough County Real Estate A0214340000 2020 Annual BillFaro farakBelum ada peringkat

- Calculation On Freight - Different ScenariosDokumen5 halamanCalculation On Freight - Different ScenariosDISHIMUKH YADAVBelum ada peringkat

- Bill Sivareddy2Dokumen1 halamanBill Sivareddy2yogikorramutlaBelum ada peringkat

- Deductions and Exclusions for Individual and Corporate TaxpayersDokumen4 halamanDeductions and Exclusions for Individual and Corporate TaxpayersIvan AnaboBelum ada peringkat

- Latest TDS Forms, Return and procedure at eTaxIndiaDokumen25 halamanLatest TDS Forms, Return and procedure at eTaxIndiaSanjay AjudiaBelum ada peringkat

- The Constitutional LimitationsDokumen3 halamanThe Constitutional LimitationskjaspioBelum ada peringkat

- Notification No. 15/2021-Central Tax (Rate)Dokumen2 halamanNotification No. 15/2021-Central Tax (Rate)santanu sanyalBelum ada peringkat

- NOTES 6 - Income Tax 601 - BBA-6 SemDokumen9 halamanNOTES 6 - Income Tax 601 - BBA-6 Semmkv statusBelum ada peringkat

- A. Alfiyyah Syahadati Juana (A031191101) - CH15 P15-7 AKUNTANSI KEUANGAN LANJUTAN KELAS DDokumen4 halamanA. Alfiyyah Syahadati Juana (A031191101) - CH15 P15-7 AKUNTANSI KEUANGAN LANJUTAN KELAS DAshdhBelum ada peringkat

- Yeah Yeah Yeah Yeah YeahDokumen7 halamanYeah Yeah Yeah Yeah YeahMika MolinaBelum ada peringkat

- Return of Percentage TaxDokumen2 halamanReturn of Percentage TaxfatmaaleahBelum ada peringkat