Banking Sector in India

Diunggah oleh

priyavanvariDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Banking Sector in India

Diunggah oleh

priyavanvariHak Cipta:

Format Tersedia

Banking Sector in India: Counting on Credit Growth

Fast Facts

Indias banking industry has evolved over a long period of more than two centuries.

Despite the recent growth of private banks, the sector is dominated by governmentcontrolled banks that hold nearly three-fourths of total bank assets.

Indias banking industry is considered to be very stable with healthy balance sheets and low exposure to risky assets. The global financial crisis did not affect the Indian banks significantly.

Nearly 40% of the population does not have a bank account and only 15% have borrowed from banks.

Even after sustained growth since the nineties, the share of consumer credit remains very

low in total bank loans.

The banking sector in India has a relatively high proportion of women CEOs. The chief executives of leading domestic lenders ICICI Bank and Axis Bank, besides the country heads of HSBC, JP Morgan, UBS, and RBS are all women. Until recently, two among the Reserve Bank of Indias four deputy governors were also women.

In 2008, when the global banking industry was being shaken by the tremors of the unfolding financial crisis, only one bank in India felt the aftershocks, and this, only because one of its overseas subsidiaries had made an opportunistic bet on debt issued by the failed investment bank Lehman Brothers. While the market valuations of all the leading banks in India slipped as equity prices tumbled, their businesses were not affected and their balance sheets remained healthy. Most domestic commentators continue to hold up this episode as evidence of the inherent strengths of the Indian banking industry and have lauded the Reserve Bank of India (RBI), the countrys central bank and banking regulator, for sticking with its conservative approach. When regulators around the world were loosening their grasp over the banking and financial services industry, RBI steadfastly held on to the strings that prevented banks in India from making risky investments and following highly aggressive business practices. Though some of the countrys younger banks have fast growing asset management and insurance businesses, the industrys bread and butter is still industrial lending. Asset Backed Securities and Collateralized Mortgage Obligations are still unheard of in the country, while Indian lenders warmed up to the idea of teaser rate mortgages only after the global financial crisis. So far, they do not appear to be any worse for it. The Indian banking industry is also well capitalized and capital ratios are above the global average. The average tier-1 capital adequacy ratio of the Indian banking industry is above 10%, when compared to the Basel III norm of 8.5% including the contingency buffer. The average total capital of banks in India stood at 14.5% as of March 31, 2010, compared to the Basel III requirement of 10.5%.

Leading Indian Banks by Assets and Market Capitalization Asset Size Market Majority Bank Capitalization (in Stock Listing Shareholding $ Billions) (in $ Billions) Mumbai, State Bank of India Government 314 36.6 London Mumbai, ICICI Bank Private 81 25.6 New York Punjab National Bank Government 66 7.6 Mumbai Bank of Baroda Government 62 7.3 Mumbai Bank of India Government 61 5.1 Mumbai Canara Bank Government 59 5.5 Mumbai IDBI Bank Government 52 2.9 Mumbai HDFC Bank Private 49 22.2 Mumbai Union Bank of India Government 43 3.7 Mumbai Mumbai, Axis Bank Private 40 11.6 London Market capitalization data based on full capitalization as on March 18, 2011 Bank Assets as on March 31, 2010; Source: Indian Banks Association

However, it can also be argued that the cautious regulatory controls have stifled the growth of the banking industry in India. This is the sector with the most entry barriers as the RBI has not issued new banking licenses for well over a decade. Foreign shareholdings in domestic banks are restricted and foreign banks have to wait years to get permission to start banking operations or expand their network. Except for a few cases where the large banks were encouraged by the RBI to acquire failing banks, the industry has not seen any meaningful consolidation. As a result, while India continues to move up the ranks of the largest economies in the world, most Indian banks are significantly smaller than their global counterparts. They are no match to even banks in other emerging economies like China, and only one bank from India is ranked among the global top-100 in terms of asset size. Also the cost of financial intermediation is relatively high in India and banks enjoy wide net interest margins. Access to banking services is poor across vast areas of the countrys rural hinterlands and as a result, more than 40% of the population does not have bank accounts and only about 15% have received some form of bank credit. The World Economic Forum currently ranks India 37th out of 55 countries in financial development, behind other large emerging economies like China, South Africa, and Brazil. An industry built over more than two centuries The origins of the banking industry in India go as far back as the 18th century but many of the early banks promoted by groups of businessmen to finance their trading activities did not survive long.

Joint-stock banks made their entry during the second half of the 19th century and a few of them, including Allahabad Bank and Punjab National Bank, have survived to this day. So have several of the banks promoted by the small kingdoms during the first half of the 20th century, which later came under the control of the Indian government. Foreign banks, including The Chartered Bank, which came to the country in 1858, and HSBC, which followed in 1867, were attracted to the increasing trade between India and Britain in the 19th century. The early 19th century also saw the emergence of three large banks, Bank of Bengal, Bank of Bombay, and the Bank of Madras, named after the three major cities that were the regional administrative bases of the English East India Company, which ruled most of the country during that period. Collectively called the presidency banks, they dominated the industry as bankers to the government, and also functioned as the countrys central bank. The Imperial Bank of India was established during the first half of the 20th century by the merger of the presidency banks, and gave up its role as the central bank only after the Reserve Bank of India was formed by the British government in 1935. It was subsequently renamed the State Bank of India after India became free from British rule in 1947. Interestingly, one of the earliest banking industry crises in India was triggered by the American Civil War. As cotton supplies to Britain from the U.S. fell sharply after the war started in 1861, demand for raw cotton exports from India surged. To exploit this opportunity better, some cotton traders set up banks to finance their export trade. However, as the war ended in 1865 and exports from the U.S. resumed, demand for Indian cotton also reverted to the earlier levels. Traders who had large inventories and the banks that financed them went bankrupt.

At the time of Indias independence, almost all major banks except the State Bank of India were privately owned. They remained so for the next two decades until 1969, when the federal government took control of more than a dozen of the largest banks in the country. More than ninetenths of the banking industry came under government control after the forced acquisition of private banks continued in 1980. The industry remained closed to private promoters until the early nineties, when the government decided to issue new banking licenses as part of economic liberalization.

Though the entry and growth of new private banks over the last two decades has transformed the Indian banking industry, the government-controlled banks still dominate. Together they command nearly three-fourths of the total banking industry assets and an even bigger share of the branch network. However, the new private banks have been far ahead of the government-controlled banks in utilizing technology to integrate their network and offer more efficient services. They have also been more aggressive in exploiting the business opportunities in the financial services space. Some of the largest private banks in India are now also among the top players in insurance and asset management. Their strong presence in the fast growing financial services sector has helped the leading private banks attract far higher equity market valuations, despite their relatively small balance sheet size. Banking regulation remains cautious As in most countries, the central bank is entrusted with the role of banking regulator in India and the Reserve Bank of India is widely acknowledged as an efficient, but cautious regulator. The government still drives the broader policy framework for the industry, including setting the limits for foreign investments in the sector. While the Indian government has opened up most sectors of the economy to foreign investors over the last two decades, it has been more guarded about banking and financial services. Accordingly, the aggregate foreign investment limit in domestic private banks increased from 49% to 74% only in 2004, but it remains at a low 20% in banks where the government is the major shareholder. The limit covers all investments by foreigners, including portfolio investments. In addition, the RBI has other restrictions that are aimed at ensuring wider distribution of bank shareholding. Investments exceeding 5% of a banks equity capital by a foreign investor require RBI approval, and a single foreign investor cannot hold more than 10%. These restrictions have also been progressively applied to the domestic shareholders of the smaller private banks, but some of the larger and healthier banks have been given specific exemptions. Further, no bank can hold more than 5% of the shares of another bank, except when a bank on the verge of failure is acquired. The limits on foreign investment do not apply to foreign banks starting a subsidiary or branch network, wholly-owned by the promoting bank. Like regulators in some other countries, in granting new banking licenses, the RBI often favors applicants from countries that have favorable policies for Indian banks seeking to open overseas branches or expand existing ones. As a result, it may take several years for a new foreign aspirant to get a license. More than a dozen applications from foreign banks for banking licenses now await RBI approval, including well-known names like Goldman Sachs. The RBI has also been careful when allowing new branches for existing foreign banks, but the number of branches approved has always exceeded Indias WTO commitment of a dozen new branches a year. Whats more, the RBI also has policies to direct bank credit to sectors that are deemed socially or economically important by the government. Accordingly, all domestic banks are required to lend at

least 40% of their total net credit outstanding to exporters, farmers, small businessmen, and lowincome borrowers. For foreign banks, the requirement is lower at 32% of net credit. Limited deposit insurance is available to customers of all banks, including foreign banks. Though it influences the credit policies of the banking industry through specific lending requirements, the Indian government generally has less sway over banks when compared to select other emerging economies like China. By and large, banks in India do not boost or curtail credit flows at the governments bidding. Though the government occasionally encourages the banks to increase credit availability, as it did during the global financial crisis, even the governmentcontrolled banks are not forced to comply. This apparent autonomy, though limited in many ways, has allowed most Indian banks to follow prudent credit standards and prevent excessive bad loan losses. However, there have also been cases of banks being pushed to the verge of failure by corruption and political manipulation. Some of the leading banks have also occasionally disagreed with regulatory policies and guidance, though the senior officers of all government-controlled banks are appointed by the government with the consent of the RBI. For instance, the State Bank of India recently refused to withdraw its teaser rate mortgages from the market though the RBI repeatedly expressed its dislike for such loans. Industry structure evolving at a measured pace The business composition of banks in India has seen significant changes over the last two decades, but the rate of change has been more measured. Lending to industrial borrowers, including construction, constituted well over half of total bank credit during the mid-nineties. This ratio has now come down to 44% in 2010 and most of the decline has been absorbed by consumer loans, which doubled in share to nearly 20% during the same period. Among industrial borrowers, the banks have the most credit exposure to utilities. This reflects the number of power generation projects that have commenced construction in recent years.

Though the growth in consumer credit has been most evident in urban areas, in recent years semiurban and even rural areas are seeing excellent growth in this segment. Home mortgages account for more than half of all consumer loans, as housing demand and home prices have increased substantially since the nineties. Also, rising consumer aspirations are driving increased credit demand for purchasing automobiles and durables. However, Indian consumers are more cautious when it comes to credit card debt, which has a share of only 3% of all consumer loans. Interestingly, total credit card outstanding has declined in recent years, though aggregate consumer spending has continued to grow.

Government-Controlled Banks: As mentioned earlier, despite the rapid growth of the private banks, the government-controlled banks continue to hold the dominant share in industry assets and branch network. Except for some of the largest banks which have branches in most areas of the country, most of them have their business concentrated in a state or region. As they have been around for a while and their brands are well-recognized, these banks are often among the popular choices for both depositors and borrowers. The financial backing from the government adds to their allure to depositors, and the government has consistently bailed out the failing banks it controls, through capital infusions. Over the last couple of years, helped by a $3 billion World Bank loan, the government has provided additional capital to several of the smaller banks. At the same time, the government has steadfastly held on to its policy of retaining majority shareholding in all banks under its control. This may restrict the capital raising options for some of the banks, as the government shareholding is already close to the threshold. For instance, at the State Bank of India, which may require the most capital as it is the largest, the government holding is already down to 59%. Hence, the government may have to deploy additional capital if it wants to retain majority holding of 51% or above. Without the support of institutions like the World Bank, fiscal constraints may prevent the government from providing sufficient capital to retain its majority shareholding. The government-controlled banks also have pension liabilities, which are not fully recognized on their balance sheets. These liabilities arose from a settlement with older employees who wanted to revert to a defined benefit program, which some of them had opted out several years back in favor of a defined contribution plan. The aggregate liabilities for all banks are currently estimated to be

below $3 billion and banks are expected to recognize their additional liabilities over a period of several years. New bank employees are not offered defined benefit pension plans and hence these liabilities are not expected to accumulate in the future.

Foreign Banks are Ahead in Most Profitability and Return Ratios Cost of Funds Net Interest Return on Total Total Capital % Margin % Assets % Adequacy % Government-controlled 5.3 3.8 1.0 13.3 Banks Private Banks 4.8 5.1 1.3 17.5 Foreign Banks 2.8 7.2 1.3 17.3 Data as on March 31, 2010; Source: Reserve Bank of India

Private Banks: Apart from the new banks that started in the nineties, this group also includes the older private banks, which escaped nationalization in 1969 and 1980. In performance parameters and business style, these subgroups are distinct from each other. The new private banks have aggressive business strategies and generate a relatively higher percentage of their total income from fee-based services. They have also utilized technology better and some of them have extensive financial services businesses. The older private banks, on the other hand, are more comparable to the government-controlled banks, but they are much smaller in size. The largest private banks have enjoyed higher equity market valuations because of their presence in financial services, besides the perception that they are better placed to exploit the future opportunities in the banking sector. Unlike the government-controlled banks, the private banks have no restrictions on raising additional capital, other than the governments foreign investment limits. They also have leaner organizations and a younger workforce, factors that are considered a distinct competitive advantage.

Foreign Banks also have more Fee Income, but have Higher Employee Costs and Bad Loans Other Income Employee Costs Bad Loans Number of as % of Total Branches % of Total Cost % of Net Assets Income Government-controlled 13.6 14.8 1.1 61,301 Banks Private Banks 19.6 12.8 1.0 10,387 Foreign Banks 27.4 23.5 1.8 310 Data as on March 31, 2010; Source: Reserve Bank of India

Foreign Banks: Though foreign banks have a long history in India, they have remained only a small part of the banking industry. Among them, they had only 310 branches as of last year and almost all of them are concentrated in major cities. Most foreign banks focus on business banking in India, servicing the domestic operations of their global clients. But the aggressive overseas expansion by some of the large Indian businesses has opened up more opportunities for these lenders in recent years. Foreign banks derive more than a quarter of their total revenues from feebased services, a far higher ratio than the domestic banks. Only a handful of the foreign banks have made serious efforts to expand their retail business. All foreign banks in India now operate as fully-owned branches of their parents, though the RBI has encouraged them to open domestic subsidiaries. The foreign banks have not opted for the subsidiary model as there is some skepticism about the future policy requirements. The Committee on Financial Sector Assessment, appointed by the RBI, recently opined that the 74% foreign investment limit should be made applicable to subsidiaries of foreign banks as well. If imposed, this limit, which currently applies to only domestic private banks, will force foreign banks to seek domestic equity partners in their subsidiaries. The committee, however, favors listing the foreign bank subsidiaries on the domestic stock exchanges. Interestingly, depository receipts of Standard Chartered, which is one of the largest and oldest foreign banks in India, are listed on the domestic exchanges.

Largest Foreign Banks in India Asset Size and Branches Assets Number of Number of Branches Employees in $ Billions Citibank 21 4,613 43 Standard Chartered 20 7,903 95 HSBC 20 6,685 50 Deutsche Bank 6 1,498 13 RBS 5 2,716 31 Barclays 5 1,083 7 Data as on March 31, 2010; Source: Reserve Bank of India

Consolidation moves stifled by employee and political opposition Over the past several years, the Indian government and the RBI have tried to encourage some of the government-controlled banks to gain size through mergers. Though the bank managements have favored the idea, the bank employee unions and some political parties have vehemently opposed it. While the resistance is mostly because of their economic ideologies, regional factors have also played a part. Several of these banks have a strong presence in select states and the respective state governments view the banks as important institutions, which are crucial for the regional economy. Naturally, the state governments are wary of mergers, which may dilute the regional focus of the banks.

These political and regional undercurrents have also prevented the consolidation within the State Bank Group. The State Bank of India has several regional subsidiaries, which were promoted by the former kingdoms, but were subsequently taken over by the federal government. Though all of them are under the State Bank umbrella, each of these subsidiaries is very closely identified with their respective states or regions. The group has been trying for the last several years to merge all the subsidiaries with the parent, but progress has been very slow. Five more subsidiaries, of which three are listed on the domestic exchanges, await consolidation. Consumer credit to drive future growth in banking

Like in most other emerging economies, the share of consumer credit remains very low in India, despite the recent growth. Average income levels are still very low and subsistence spending takes away most of the personal incomes of the lower income groups. This leaves very little earnings surplus available for debt servicing and reduces their creditworthiness, and banks will be hesitant to lend to them. Hence, the marketing efforts by banks to promote consumer finance products and services are now mostly limited to cities and towns where there is a larger concentration of higher income customers. However, as average income levels are expected to rise further, the number of potential bank customers with sufficient earnings surplus will also grow. Though the growth of income levels is likely to be measured and the potential loan size will remain small, the aggregate market size for consumer credit will become larger because of the large population size. This market will be made more attractive by Indias demographic advantage of a relatively young population, who are likely to see faster income growth. Besides, younger customers are generally considered to be more receptive towards new financial products and services. Even in business banking, India may continue to offer attractive growth opportunities. The ratio of total business credit to GDP in India is less than half the level in China. While this gap mostly reflects the substantially larger industrial sector in China, it also indicates the potential credit requirement if Indian industry sustains its growth. Bond markets remain grossly underdeveloped in India, while exchange risks reduce the attractiveness of international bond markets to domestic

borrowers. Hence, it is likely that most of the increased industrial credit requirements will have to be financed by banks. However, it is also widely accepted that the Indian banking industry may find it difficult to achieve its potential without further regulatory initiatives. It is evident that without increased competition, financial intermediation costs will remain high and banking services will not spread widely across the vast rural areas of the country. Also, to improve efficiency and compete better, it is believed that domestic banks in India need to build scale through consolidation. As past reports and policy statements by the Indian government and the RBI have made repeated references to these issues, it is hoped that entry barriers will come down in the banking sector and restrictive policies will be diluted. It is expected that the shareholding and investment norms will be further liberalized, while new banking licenses will be made available to both domestic players and foreign banks.

The government and the RBI have already announced a new policy framework to issue new banking licenses to domestic applicants. While the RBI is expected to maintain its preference for wider shareholding distribution in banks, corporations with good reputation and track record that have large public shareholdings, may also be allowed to promote new banks. Confirming the attractiveness of the Indian banking sector, it has been reported that nearly a dozen applicants, including some of the most prominent business groups, are eager to acquire licenses. The banking sector is one of the most crucial sectors in any economy, and plays an instrumental role in promoting economic growth. In India, the sector is even more important as the expansion of banking services to rural areas may also play a significant role in reducing poverty and ensuring sustainable income levels. If favorable regulatory support is ensured, India will likely have a mature banking industry with sufficient scale and reach to support its fast growing economy.

The Indian Banking industry, which is governed by the Banking Regulation Act of India, 1949 can be broadly classified into two major categories, non-scheduled banks and scheduled banks. Scheduled banks comprise commercial banks and the cooperative banks. In terms of ownership, commercial banks can be further grouped into nationalized banks, the State Bank of India and its group banks, regional rural banks and private sector banks (the old/ new domestic and foreign). These banks have over 67,000 branches spread across the country. The first phase of financial reforms resulted in the nationalization of 14 major banks in 1969 and resulted in a shift from Class banking to Mass banking. This in turn resulted in a significant growth in the geographical coverage of banks. Every bank had to earmark a minimum percentage of their loan portfolio to sectors identified as priority sectors. The manufacturing sector also grew during the 1970s in protected environs and the banking sector was a critical source. The next wave of reforms saw the nationalization of 6 more commercial banks in 1980. Since then the number of scheduled commercial banks increased four-fold and the number of bank branches increased eight-fold. After the second phase of financial sector reforms and liberalization of the sector in the early nineties, the Public Sector Banks (PSB) s found it extremely difficult to compete with the new private sector banks and the foreign banks. The new private sector banks first made their appearance after the guidelines permitting them were issued in January 1993. Eight new private sector banks are presently in operation. These banks due to their late start have access to state-of-the-art technology, which in turn helps them to save on manpower costs and provide better services. During the year 2000, the State Bank Of India (SBI) and its 7 associates accounted for a 25 percent share in deposits and 28.1 percent share in credit. The 20 nationalized banks accounted for 53.2 percent of the deposits and 47.5 percent of credit during the same period. The share of foreign banks (numbering 42), regional rural banks and other scheduled commercial banks accounted for 5.7 percent, 3.9 percent and 12.2 percent respectively in deposits and 8.41 percent, 3.14 percent and 12.85 percent respectively in credit during the year 2000. Current Scenario The industry is currently in a transition phase. On the one hand, the PSBs, which are the mainstay of the Indian Banking system are in the process of shedding their flab in terms of excessive manpower, excessive non Performing Assets (Npas) and excessive governmental equity, while on the other hand the private sector banks are consolidating themselves through mergers and acquisitions. PSBs, which currently account for more than 78 percent of total banking industry assets are saddled with NPAs (a mind-boggling Rs 830 billion in 2000), falling

revenues from traditional sources, lack of modern technology and a massive workforce while the new private sector banks are forging ahead and rewriting the traditional banking business model by way of their sheer innovation and service. The PSBs are of course currently working out challenging strategies even as 20 percent of their massive employee strength has dwindled in the wake of the successful Voluntary Retirement Schemes (VRS) schemes. The private players however cannot match the PSBs great reach, great size and access to low cost deposits. Therefore one of the means for them to combat the PSBs has been through the merger and acquisition (M& A) route. Over the last two years, the industry has witnessed several such instances. For instance, Hdfc Banks merger with Times Bank Icici Banks acquisition of ITC Classic, Anagram Finance and Bank of Madura. Centurion Bank, Indusind Bank, Bank of Punjab, Vysya Bank are said to be on the lookout. The UTI bank- Global Trust Bank merger however opened a pandoras box and brought about the realization that all was not well in the functioning of many of the private sector banks. Private sector Banks have pioneered internet banking, phone banking, anywhere banking, mobile banking, debit cards, Automatic Teller Machines (ATMs) and combined various other services and integrated them into the mainstream banking arena, while the PSBs are still grappling with disgruntled employees in the aftermath of successful VRS schemes. Also, following Indias commitment to the W To agreement in respect of the services sector, foreign banks, including both new and the existing ones, have been permitted to open up to 12 branches a year with effect from 1998-99 as against the earlier stipulation of 8 branches. Talks of government diluting their equity from 51 percent to 33 percent in November 2000 has also opened up a new opportunity for the takeover of even the PSBs. The FDI rules being more rationalized in Q1FY02 may also pave the way for foreign banks taking the M& A route to acquire willing Indian partners. Meanwhile the economic and corporate sector slowdown has led to an increasing number of banks focusing on the retail segment. Many of them are also entering the new vistas of Insurance. Banks with their phenomenal reach and a regular interface with the retail investor are the best placed to enter into the insurance sector. Banks in India have been allowed to provide fee-based insurance services without risk participation, invest in an insurance company for providing infrastructure and services support and set up of a separate joint-venture insurance company with risk participation. Aggregate Performance of the Banking Industry Aggregate deposits of scheduled commercial banks increased at a compounded annual average growth rate (Cagr) of 17.8 percent during 1969-99, while bank credit expanded at a Cagr of 16.3 percent per annum. Banks investments in government and other approved securities recorded a Cagr of 18.8 percent per annum during the same period. In FY01 the economic slowdown resulted in a Gross Domestic Product (GDP) growth of only 6.0 percent as against the previous years 6.4 percent. The WPI Index (a

measure of inflation) increased by 7.1 percent as against 3.3 percent in FY00. Similarly, money supply (M3) grew by around 16.2 percent as against 14.6 percent a year ago. The growth in aggregate deposits of the scheduled commercial banks at 15.4 percent in FY01 percent was lower than that of 19.3 percent in the previous year, while the growth in credit by SCBs slowed down to 15.6 percent in FY01 against 23 percent a year ago. The industrial slowdown also affected the earnings of listed banks. The net profits of 20 listed banks dropped by 34.43 percent in the quarter ended March 2001. Net profits grew by 40.75 percent in the first quarter of 2000-2001, but dropped to 4.56 percent in the fourth quarter of 2000-2001. On the Capital Adequacy Ratio (CAR) front while most banks managed to fulfill the norms, it was a feat achieved with its own share of difficulties. The CAR, which at present is 9.0 percent, is likely to be hiked to 12.0 percent by the year 2004 based on the Basle Committee recommendations. Any bank that wishes to grow its assets needs to also shore up its capital at the same time so that its capital as a percentage of the risk-weighted assets is maintained at the stipulated rate. While the IPO route was a much-fancied one in the early 90s, the current scenario doesnt look too attractive for bank majors. Consequently, banks have been forced to explore other avenues to shore up their capital base. While some are wooing foreign partners to add to the capital others are employing the M& A route. Many are also going in for right issues at prices considerably lower than the market prices to woo the investors. Interest Rate Scene The two years, post the East Asian crises in 1997-98 saw a climb in the global interest rates. It was only in the later half of FY01 that the US Fed cut interest rates. India has however remained more or less insulated. The past 2 years in our country was characterized by a mounting intention of the Reserve Bank Of India (RBI) to steadily reduce interest rates resulting in a narrowing differential between global and domestic rates. The RBI has been affecting bank rate and CRR cuts at regular intervals to improve liquidity and reduce rates. The only exception was in July 2000 when the RBI increased the Cash Reserve Ratio (CRR) to stem the fall in the rupee against the dollar. The steady fall in the interest rates resulted in squeezed margins for the banks in general. Governmental Policy After the first phase and second phase of financial reforms, in the 1980s commercial banks began to function in a highly regulated environment, with administered interest rate structure, quantitative restrictions on credit flows, high reserve requirements and reservation of a significant proportion of lendable resources for the priority and the government sectors. The restrictive regulatory norms led to the credit rationing for

the private sector and the interest rate controls led to the unproductive use of credit and low levels of investment and growth. The resultant financial repression led to decline in productivity and efficiency and erosion of profitability of the banking sector in general. This was when the need to develop a sound commercial banking system was felt. This was worked out mainly with the help of the recommendations of the Committee on the Financial System (Chairman: Shri M. Narasimham), 1991. The resultant financial sector reforms called for interest rate flexibility for banks, reduction in reserve requirements, and a number of structural measures. Interest rates have thus been steadily deregulated in the past few years with banks being free to fix their Prime Lending Rates(PLRs) and deposit rates for most banking products. Credit market reforms included introduction of new instruments of credit, changes in the credit delivery system and integration of functional roles of diverse players, such as, banks, financial institutions and non-banking financial companies (Nbfcs). Domestic Private Sector Banks were allowed to be set up, PSBs were allowed to access the markets to shore up their Cars. Implications Of Some Recent Policy Measures The allowing of PSBs to shed manpower and dilution of equity are moves that will lend greater autonomy to the industry. In order to lend more depth to the capital markets the RBI had in November 2000 also changed the capital market exposure norms from 5 percent of banks incremental deposits of the previous year to 5 percent of the banks total domestic credit in the previous year. But this move did not have the desired effect, as in, while most banks kept away almost completely from the capital markets, a few private sector banks went overboard and exceeded limits and indulged in dubious stock market deals. The chances of seeing banks making a comeback to the stock markets are therefore quite unlikely in the near future. The move to increase Foreign Direct Investment FDI limits to 49 percent from 20 percent during the first quarter of this fiscal came as a welcome announcement to foreign players wanting to get a foot hold in the Indian Markets by investing in willing Indian partners who are starved of networth to meet CAR norms. Ceiling for FII investment in companies was also increased from 24.0 percent to 49.0 percent and have been included within the ambit of FDI investment. The abolishment of interest tax of 2.0 percent in budget 2001-02 will help banks pass on the benefit to the borrowers on new loans leading to reduced costs and easier lending rates. Banks will also benefit on the existing loans wherever the interest tax cost element has already been built into the terms of the loan. The reduction of interest rates on various small savings schemes from 11 percent to 9.5 percent in Budget 2001-02 was a much awaited move for the banking industry and in keeping with the reducing interest rate scenario, however the small investor is not very happy with the move. Some of the not so good measures however like reducing the limit for tax deducted at source (TDS) on interest income from deposits to Rs 2,500 from the earlier level of Rs 10,000, in Budget 2001-02, had met with disapproval from the banking fraternity who

feared that the move would prove counterproductive and lead to increased fragmentation of deposits, increased volumes and transaction costs. The limit was thankfully partially restored to Rs 5000 at the time of passing the Finance Bill in the Parliament. April 2001-Credit Policy Implications The rationalization of export credit norms in will bestow greater operational flexibility on banks, and also reduce the borrowing costs for exporters. Thus this move could trigger exports growth in the future. Banks can also hope to earn increased revenue with the interest paid by RBI on CRR balances being increased from 4.0 percent to 6.0 percent. The stock market scam brought out the unholy nexus between the Cooperative banks and stockbrokers. In order to usher in greater prudence in their operations, the RBI has barred Urban Cooperative Banks from financing the stock market operations and is also in the process of setting up of a new apex supervisory body for them. Meanwhile the foreign banks have a bone to pick with the RBI. The RBI had announced that forex loans are not to be calculated as a part of Tier-1 Capital for drawing up exposure limits to companies effective 1 April 2002. This will force foreign banks either to infuse fresh capital to maintain the capital adequacy ratio (CAR) or pare their asset base. Further, the RBI has also sought to keep foreign competition away from the nascent net banking segment in India by allowing only Indian banks with a local physical presence, to offer Internet banking Crystal Gazing On the macro economic front, GDP is expected to grow by 6.0 to 6.5 percent while the projected expansion in broad money (M3) for 2001-02 is about 14.5 percent. Credit and deposits are both expected to grow by 15-16 percent in FY02. India's foreign exchange reserves should reach US$50.0 billion in FY02 and the Indian rupee should hold steady. The interest rates are likely to remain stable this fiscal based on an expected downward trend in inflation rate, sluggish pace of non-oil imports and likelihood of declining global interest rates. The domestic banking industry is forecasted to witness a higher degree of mergers and acquisitions in the future. Banks are likely to opt for the universal banking approach with a stronger retail approach. Technology and superior customer service will continue to be the imperatives for success in this industry. Public Sector banks that imbibe new concepts in banking, turn tech savvy, leaner and meaner post VRS and obtain more autonomy by keeping governmental stake to the minimum can succeed in effectively taking on the private sector banks by virtue of their sheer size. Weaker PSU banks are unlikely to survive in the long run. Consequently, they are likely to be either acquired by stronger players or will be forced to look out for other strategies to infuse greater capital and optimize their operations. Foreign banks are likely to succeed in their niche markets and be the innovators in

terms of technology introduction in the domestic scenario. The outlook for the private sector banks indeed looks to be more promising vis--vis other banks. While their focused operations, lower but more productive employee force etc will stand them good, possible acquisitions of PSU banks will definitely give them the much needed scale of operations and access to lower cost of funds. These banks will continue to be the early technology adopters in the industry, thus increasing their efficiencies. Also, they have been amongst the first movers in the lucrative insurance segment. Already, banks such as Icici Bank and Hdfc Bank have forged alliances with Prudential Life and Standard Life respectively. This is one segment that is likely to witness a greater deal of action in the future. In the near term, the low interest rate scenario is likely to affect the spreads of majors. This is likely to result in a greater focus on better assetliability management procedures. Consequently, only banks that strive hard to increase their share of fee-based revenues are likely to do better in the future.

Anda mungkin juga menyukai

- Bric Spotlight Report India Banking April 2011Dokumen12 halamanBric Spotlight Report India Banking April 2011Tom PeterBelum ada peringkat

- Indian Banking Industry: Challenges and Opportuniti EsDokumen24 halamanIndian Banking Industry: Challenges and Opportuniti EsdelmaBelum ada peringkat

- MCPDokumen56 halamanMCPShona ChaitraBelum ada peringkat

- Universal BankingDokumen50 halamanUniversal BankingBennett CheenathBelum ada peringkat

- Indian Banking Industry: Challenges and Opportunities: Dr. Krishna A. GoyalDokumen11 halamanIndian Banking Industry: Challenges and Opportunities: Dr. Krishna A. GoyalKalyan VsBelum ada peringkat

- Customer SatisficationDokumen27 halamanCustomer SatisficationMukesh ManwaniBelum ada peringkat

- Indian Banking Sector: Present ScenarioDokumen19 halamanIndian Banking Sector: Present ScenarioShweta GargBelum ada peringkat

- Non Performing AssetsDokumen89 halamanNon Performing AssetsNazma MalikBelum ada peringkat

- Introduction ToDokumen44 halamanIntroduction ToYash SoniBelum ada peringkat

- Vinnu Final ProjectDokumen76 halamanVinnu Final ProjectOm Prakash RêígñßBelum ada peringkat

- Corporation Bank MP Birla InternshipDokumen20 halamanCorporation Bank MP Birla InternshipsrikanthkgBelum ada peringkat

- About IdbiDokumen42 halamanAbout IdbiNitesh SinghBelum ada peringkat

- Q. 4 There Are Three Different Phases in The History of Banking in India.Dokumen4 halamanQ. 4 There Are Three Different Phases in The History of Banking in India.MAHENDRA SHIVAJI DHENAKBelum ada peringkat

- Banking Sector Growth StoryDokumen9 halamanBanking Sector Growth Storybiswarup4463Belum ada peringkat

- Study of Mutual Funds at SbiDokumen77 halamanStudy of Mutual Funds at SbiNiroop K MurthyBelum ada peringkat

- Growth in Indian Banking SectorDokumen59 halamanGrowth in Indian Banking SectorKishan KudiaBelum ada peringkat

- Indian Banking Industry: IDBI Bank ING Vyasa Bank SBI Allahabad BankDokumen8 halamanIndian Banking Industry: IDBI Bank ING Vyasa Bank SBI Allahabad Bankaditisharma305292Belum ada peringkat

- Job Satisfaction at SBI Project Report Mba HRDokumen78 halamanJob Satisfaction at SBI Project Report Mba HRBabasab Patil (Karrisatte)0% (1)

- Indian Banking Industry Evolution and Current ScenarioDokumen55 halamanIndian Banking Industry Evolution and Current ScenarioShikha TrehanBelum ada peringkat

- Banking and Finance in India: An OverviewDokumen48 halamanBanking and Finance in India: An Overviewjags1156Belum ada peringkat

- Sbi and Hdfc"COMPARATIVE STUDY OF CUSTOMER'S SATISFACTION TOWARDS HDFC BANK AND STATE BANK OF INDIADokumen68 halamanSbi and Hdfc"COMPARATIVE STUDY OF CUSTOMER'S SATISFACTION TOWARDS HDFC BANK AND STATE BANK OF INDIArupesh singh84% (31)

- Rural DevelopmentsDokumen88 halamanRural DevelopmentsVyom K ShahBelum ada peringkat

- INDIAN MirrorDokumen14 halamanINDIAN MirrordevrajkinjalBelum ada peringkat

- Banking in India - Reforms and Reorganization: Rajesh - Chakrabarti@mgt - Gatech.eduDokumen27 halamanBanking in India - Reforms and Reorganization: Rajesh - Chakrabarti@mgt - Gatech.eduilusonaBelum ada peringkat

- Evolution of Indian BankingDokumen19 halamanEvolution of Indian BankingjyotsnandBelum ada peringkat

- "Credit Risk Management in State Bank of India": Title of The ProjectDokumen43 halaman"Credit Risk Management in State Bank of India": Title of The Projectswarali deshmukhBelum ada peringkat

- A Project Report On Working Capital Assessment at Canara Bank, Circle Office, BangaloreDokumen73 halamanA Project Report On Working Capital Assessment at Canara Bank, Circle Office, BangaloresukanyaBelum ada peringkat

- History of Indian BankingDokumen11 halamanHistory of Indian BankingSohini KarBelum ada peringkat

- Bank of Maharashtra Home LoanDokumen95 halamanBank of Maharashtra Home Loansayyadsajidali100% (5)

- Bank & Bill Discounting: Lalita Choudhary TYBBI, 11Dokumen40 halamanBank & Bill Discounting: Lalita Choudhary TYBBI, 11VIVEK MEHTABelum ada peringkat

- Banking India: Accepting Deposits for the Purpose of LendingDari EverandBanking India: Accepting Deposits for the Purpose of LendingBelum ada peringkat

- Project Report On Personal Loan CompressDokumen62 halamanProject Report On Personal Loan CompressSudhakar GuntukaBelum ada peringkat

- Project Report On Working Capital Assessment CANARA BANKDokumen73 halamanProject Report On Working Capital Assessment CANARA BANKAsrar67% (6)

- Evolution of Indian Banking IndustryDokumen24 halamanEvolution of Indian Banking Industrynnd_27Belum ada peringkat

- A Comparative Study of Customer Services in Sbi and Icici.Dokumen80 halamanA Comparative Study of Customer Services in Sbi and Icici.diwakar0000000Belum ada peringkat

- And Long Term" Which Is Accomplished During The Training Bank of Baroda, SME LOANDokumen246 halamanAnd Long Term" Which Is Accomplished During The Training Bank of Baroda, SME LOANkanchanmbmBelum ada peringkat

- HR Recruitment Practices of State Bank ofDokumen33 halamanHR Recruitment Practices of State Bank ofamitnagaich67% (3)

- Banking Sector in IndiaDokumen20 halamanBanking Sector in IndiaARSHITHA IRENE 2017117Belum ada peringkat

- Afanawari Project @Dokumen55 halamanAfanawari Project @Vivek SatviBelum ada peringkat

- CCCCCCCCCCC C CC CDokumen4 halamanCCCCCCCCCCC C CC CDani KhanBelum ada peringkat

- Role of Banks in Indian EconomyDokumen37 halamanRole of Banks in Indian EconomyKalyan Reddy AnuguBelum ada peringkat

- Banking History: A Flashback Into Past. Banking System in Indian Context. Issues in Banking System. Introduction To Credit and RiskDokumen84 halamanBanking History: A Flashback Into Past. Banking System in Indian Context. Issues in Banking System. Introduction To Credit and RiskMinhaz Iqbal HazarikaBelum ada peringkat

- Nature and Development of Banking LawDokumen4 halamanNature and Development of Banking Lawarti50% (2)

- Indian Financial Structure and MarketingDokumen34 halamanIndian Financial Structure and MarketingSujit KumarBelum ada peringkat

- Sbi and HDFC Comparative Study of Customer S Satisfaction TowardsDokumen67 halamanSbi and HDFC Comparative Study of Customer S Satisfaction TowardsMõørthï Shãrmâ75% (4)

- 1.1 Introduction To Banking Industry: 1.1.1 Evolution of Banking in IndiaDokumen37 halaman1.1 Introduction To Banking Industry: 1.1.1 Evolution of Banking in IndiaAnonymous QOYpqGHE8SBelum ada peringkat

- Challenges and Opportunities for Indian Banking IndustryDokumen11 halamanChallenges and Opportunities for Indian Banking IndustryMukesh MishraBelum ada peringkat

- Banking Industry in IndiaDokumen3 halamanBanking Industry in Indiapammi_meetBelum ada peringkat

- I. Evolution of Banking in IndiaDokumen14 halamanI. Evolution of Banking in IndiaGunjanBelum ada peringkat

- Scenario of Foreign Banks in IndiaDokumen62 halamanScenario of Foreign Banks in IndiaYesha Khona100% (1)

- Executive Summary: NPA Management in State Bank of IndiaDokumen62 halamanExecutive Summary: NPA Management in State Bank of IndiaFurkhan Ahmed SamBelum ada peringkat

- I. Evolution of Banking in IndiaDokumen16 halamanI. Evolution of Banking in IndiaSandeep TogarathiBelum ada peringkat

- Chapter-1: 1.1. An Overview of Banking IndustryDokumen14 halamanChapter-1: 1.1. An Overview of Banking IndustryDipanjan DasBelum ada peringkat

- Change Management - Research PaperDokumen39 halamanChange Management - Research PaperKrishna KediaBelum ada peringkat

- Major Bank Fraud Cases: A Critical ReviewDari EverandMajor Bank Fraud Cases: A Critical ReviewPenilaian: 4.5 dari 5 bintang4.5/5 (6)

- Regional Rural Banks of India: Evolution, Performance and ManagementDari EverandRegional Rural Banks of India: Evolution, Performance and ManagementBelum ada peringkat

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Dari EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Belum ada peringkat

- The role of banks in the regional economic development of Uzbekistan: lessons from the German experienceDari EverandThe role of banks in the regional economic development of Uzbekistan: lessons from the German experienceBelum ada peringkat

- Account # 0304459148: Lifegreen CheckingDokumen4 halamanAccount # 0304459148: Lifegreen CheckingViktoria DenisenkoBelum ada peringkat

- Acc Ch-7 Average Due Date SaDokumen15 halamanAcc Ch-7 Average Due Date SaShivaSrinivas100% (3)

- Temo Letlotlo Guidelines - Final Setswana Version KgaodiDokumen22 halamanTemo Letlotlo Guidelines - Final Setswana Version Kgaodikmathumo3Belum ada peringkat

- Who Uses Accounting and What Are AssetsDokumen2 halamanWho Uses Accounting and What Are AssetsSyeda Malika AnjumBelum ada peringkat

- Kami Export - Depository Institutions Note Taking Guide 2 2 1 l1 PDFDokumen2 halamanKami Export - Depository Institutions Note Taking Guide 2 2 1 l1 PDFapi-296019366Belum ada peringkat

- A STUDY ON LOANS & ADVANCES OF STATE BANK OF INDIADokumen98 halamanA STUDY ON LOANS & ADVANCES OF STATE BANK OF INDIAShanu shriBelum ada peringkat

- Loans and AdvancesDokumen10 halamanLoans and AdvancesshalwBelum ada peringkat

- An Options Approach To Commercial Mortgage and CMBS Valuation and Risk AnalysisDokumen24 halamanAn Options Approach To Commercial Mortgage and CMBS Valuation and Risk AnalysisCameronBelum ada peringkat

- Assignment - 2: Semester Spring 2021Dokumen3 halamanAssignment - 2: Semester Spring 2021Amina HamidBelum ada peringkat

- Accounting For CashDokumen3 halamanAccounting For CashMichael BwireBelum ada peringkat

- Mrunal Handout Complied PDFDokumen290 halamanMrunal Handout Complied PDFhirdyanshuBelum ada peringkat

- Monthly Membership Subscription FAQsDokumen2 halamanMonthly Membership Subscription FAQsm1k0eBelum ada peringkat

- Statement Jul 22 XXXXXXXX2089Dokumen6 halamanStatement Jul 22 XXXXXXXX2089Amarea aprilaBelum ada peringkat

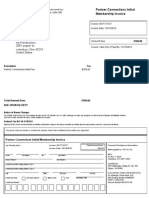

- PartnerConnections - 74127 PDFDokumen1 halamanPartnerConnections - 74127 PDFGeniuss Stunt'n WilliamsBelum ada peringkat

- Media Release: 4 October 2018Dokumen3 halamanMedia Release: 4 October 2018tajuddin8Belum ada peringkat

- Club Treasurer ReportDokumen6 halamanClub Treasurer ReportgrexterBelum ada peringkat

- BondedPromissoryNoteExample PackageToPayOffPublicDebtDokumen7 halamanBondedPromissoryNoteExample PackageToPayOffPublicDebtLucy Maysonet94% (34)

- Bank Codes For Inter-Bank Transfer: PublicDokumen6 halamanBank Codes For Inter-Bank Transfer: PublicGia nnaBelum ada peringkat

- Banking + Current Affairs Questions For SBI PODokumen4 halamanBanking + Current Affairs Questions For SBI POsruthyaBelum ada peringkat

- TFS New 22Dokumen2.385 halamanTFS New 22darshil thakkerBelum ada peringkat

- Introduction EbcDokumen5 halamanIntroduction EbckmkesavanBelum ada peringkat

- CompoundDokumen6 halamanCompoundHarvey Leo RomanoBelum ada peringkat

- Project On The Comparative Study of Debit Cards Vis - Visards Vis 2D E0 2dvis ISO-8859-1 Q Credit Cards 2edocDokumen286 halamanProject On The Comparative Study of Debit Cards Vis - Visards Vis 2D E0 2dvis ISO-8859-1 Q Credit Cards 2edocgagan_benipal7265100% (4)

- What To Include in A Personal Loan Contract?Dokumen2 halamanWhat To Include in A Personal Loan Contract?Ma. Berna Joyce M. SilvanoBelum ada peringkat

- Mary Anne Malubay MacavintaDokumen1 halamanMary Anne Malubay MacavintaMARY ANNE M. SAN JOSEBelum ada peringkat

- State Prelim Marrs International Spelling Bee State Written and Interschool Oral Championship 2018-19Dokumen2 halamanState Prelim Marrs International Spelling Bee State Written and Interschool Oral Championship 2018-19ESBelum ada peringkat

- Howard MarksDokumen15 halamanHoward Marksa4agarwalBelum ada peringkat

- Chapter 2 - Nominal and Effective Interest RatesDokumen16 halamanChapter 2 - Nominal and Effective Interest RatesTanveer Ahmed HakroBelum ada peringkat

- Loans Receivable ProblemsDokumen16 halamanLoans Receivable ProblemsPeter Piper33% (3)

- AL Habib Mahana Munafa Key FactDokumen2 halamanAL Habib Mahana Munafa Key FactAmir Mehmood AbbasiBelum ada peringkat