2012-08-21 AAPL US (Topeka Capita) The $500B+ Market Cap Fallacy Put To Rest, Next St... Condensed) .60691878

Diunggah oleh

kevinipDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

2012-08-21 AAPL US (Topeka Capita) The $500B+ Market Cap Fallacy Put To Rest, Next St... Condensed) .60691878

Diunggah oleh

kevinipHak Cipta:

Format Tersedia

IT HARDWARE & NETWORKING

August 21, 2012 Company Update

Apple Inc. (AAPL - $665.15)

The $500B+ Market Cap Fallacy Put to Rest, Next Stop $1 Trillion Summary

In June, analysts and market pundits expressed growing concern that Apple would succumb to the $500 billion "market cap flu" and the stock would finally roll over. In a note on June 18, we highlighted why we felt this was a fallacious argument and pointed out that investors should think of Apple's market cap in terms of "trillions" and not "billions". Based on our calculations, Apple is now the most valuable company ever, finally surpassing the market value of Microsoft at the peak, and removing a key sentiment barrier for the stock.

RATING: Buy Price Target: $1,111.00

Brian J. White, CFA

bw@topekacapitalmarkets.com Tel: 212-709-5730 Topeka Trading: 212-709-5750

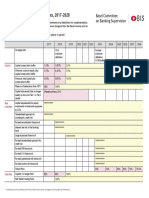

STOCK DATA

Price Price Target Market Cap ($M) 52-Week Range Shares (mil) ADTV (000) Enterprise Value ($M) Free Cash Flow ($M) Dividend Per Share Yield Debt To Capitalization $665.15 $1,111.00 $629,936 $310.50 - $665.15 947.1 23,494 $512,715 $48,647.0 $10.60 1.6% 0%

FINANCIAL DATA

ROE Net Cash/ Share Tangible Book Value 2012E P/E Ratio 15.2x 32.90% $123.77 $112.23 2013E 13.5x 2014E 12.1x

REVENUE ($M)

FY September Q1 Q2 Q3 Q4 FY 2012E 46,333.0A 39,186.0A 35,023.0A 34,262.7E 2013E 50,152.5E 40,076.5E 42,685.6E 42,583.5E 2014E 56,560.2E 44,267.8E 47,048.6E 47,638.9E

154,804.7E 175,498.1E 195,515.6E

EPS

FY September Q1 Q2 Q3 Q4 FY 2012E 13.87A 12.30A 9.32A 8.22E 43.69E 2013E 14.08E 11.17E 12.00E 11.89E 49.14E 2014E 16.25E 12.34E 13.13E 13.17E 54.88E

EPS: 1. EPS denotes Pro Forma EPS

Footnotes and disclaimers are contained in the second page of this report.

Topeka Capital Markets

Apple Inc. August 21, 2012

IMPORTANT DISCLOSURES AND INFORMATION ABOUT THE USE OF THIS DOCUMENT

This report has been prepared by Topeka Capital Markets (Topeka). Topeka is a broker-dealer registered with the SEC and member of FINRA, and Investor Protection Corporation (SIPC). Topeka Capital Markets is located at 40 Wall Street, Suite 1702, New York, New York 10005.

Analyst Certification

The recommendations and guidance expressed in the foregoing research report accurately reflect the personal views of Brian J. White who is principally responsible for the preparation of this report about the subject security and issuer as of the date of this report. No part of the compensation received by the analyst principally responsible for the preparation of this report was, is, or will be directly, or indirectly, related to the specific recommendations or views contained in this research report. Direct or indirect analyst compensation may be based on performance-related considerations associated with the recommendations and guidance expressed by the analyst in this report.

Company Disclosures

For up-to-date company disclosures, please click on the following link or paste URL in a web browser: www.topekacapitalmarkets.com Topeka Capital Markets Inc. does not make a market in any of the securities mentioned in this report. Topeka Capital Markets Inc. and/or its affiliates and employees may hold positions in the securities mentioned in this report. However, none of those positions equal or exceed 1%. No analyst nor member of their household, who participated in the creation of this report holds a position in any securities issued by any company in this report. Topeka Capital Markets Inc. and/or its affiliates has not provided Investment Banking services to the subject company in the past 12 months nor intends to seek any in the 3 month following publication of this report. We have no intent to solicit any company as a client in any manner. The information and rating included in this report represent the long-term view as described more fully below. The analyst may have different views regarding short term trading strategies with respect to the stocks covered by the rating, options on such stocks, and/or other securities or financial instruments issued by the company. Our brokers and analysts may make recommendations to their clients, and our affiliates may make investment decisions that are contrary to the recommendations contained in this research report. Such recommendations or investment decisions are based on the particular investment strategies, risk tolerances, and other investment factors of that particular client or affiliate. From time to time, Topeka, and its respective directors, officers, employees, or members of their immediate families may have a long or short position in the securities or other financial instruments mentioned in this report. We provide to certain customers on request specialized research products or services that focus on covered stocks from a particular perspective. These products or services include, but are not limited to, compilations, reviews, and analysis that may use different research methodologies or focus on the prospects for individual stocks as compared to other covered stocks or over differing time horizons or under assumed market events or conditions. Readers should be aware that we may issue investment research on the subject companies from a

Footnotes and disclaimers are contained in the second page of this report.

Page 2

Topeka Capital Markets

Apple Inc. August 21, 2012

technical perspective and/or include in this report discussions about options on stocks covered in this report and/or other securities or financial instruments issued by the company. These analyses are different from fundamental analysis, and the conclusions reached may differ. Technical research and the discussions concerning options and other securities and financial instruments issued by the company do not represent a rating or coverage of any discussed issuer(s). The disclosures concerning distribution of ratings and price charts refer to fundamental research and do not include reference to technical recommendations or discussions concerning options and other securities and financial instruments issued by the company.

Option Specific Disclosures

Buying Options - Investors who buy call (put) options risk loss of the entire premium paid if the underlying security finishes below (above) the strike price at expiration. Investors who buy call or put spreads also risk a maximum loss of the premium paid. The maximum gain on a long call or put spread is the difference between the strike prices, less the premium paid. Selling Options - Investors who sell calls on securities they do not own risk unlimited loss of the security price less the strike price. Investors who sell covered calls (sell calls while owning the underlying security) risk having to deliver the underlying security or pay the difference between the security price and the strike price, depending on whether the option is settled by physical delivery or cash-settled. Investors who sell puts risk loss of the strike price less the premium received for selling the put. Investors who sell put or call spreads risk a maximum loss of the difference between the strikes less the premium received, while their maximum gain is the premium received. All calculations assume the positions are maintained until the expiration date of the particular option illustrated unless otherwise stated. Note that short options may be assigned prior to expiration and result in returns higher or lower than those illustrated. Past performance should not be taken as an indication or guarantee of future results. Prices are subject to market fluctuations and to availability. As with all option strategies, deviations from the reference prices due to market price fluctuations may affect the ability to execute at stated prices and could cause returns to be different from those illustrated. Supporting documentation for any claims (including any claims made on behalf of options programs or the options expertise of sales persons), comparisons, recommendations, statistics or other technical data, will be supplied upon request. Specific disclosures on any of the securities mentioned may be obtained by contacting Michael Gargano at 212-709-5705. For options settled by physical delivery, the above risks assume the options buyer or seller, buys or sells the resulting securities at the settlement price on expiry. This material has been prepared by the Derivatives Strategy Team of Topeka Capital Markets and is not meant to be viewed as a complete analysis of any security. This analysis is narrowly focused, and may be based either purely on quantitative models or other unique factors such as market supply/demand factors surrounding potential market moving events. When making an investment decision this information should be viewed as just one factor in your investment decision process. Options trading involves a high degree of risk and is not suitable for every investor. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options (ODD). Copies of the ODD and OCC Prospectus are available by calling 1-888-OPTIONS, or from The Options Clearing Corporation, One North Wacker Drive, Suite 500, Chicago, Illinois 60606.

Footnotes and disclaimers are contained in the second page of this report.

Page 3

Topeka Capital Markets

Disclaimer

Apple Inc. August 21, 2012

Information about our recommendations, holdings and investment decisions: The information presented in this report is for informational purposes only. It was prepared based on information and sources that we believe to be reliable, but we make no representations or guarantees as to the accuracy or completeness of the information contained herein. This report is not to be construed as an offer to sell or a solicitation of an offer to buy any security. The opinions expressed in this report may change without notice. Topeka Capital Markets Inc. reports are intended for use by institutional investors. The securities discussed in Topeka Capital Markets Inc. research reports may not be suitable for some investors. Investors must make their own determination as to the appropriateness of an investment in any securities referred to herein, based on their specific investment objectives, financial status and risk tolerance. Past performance is no guarantee of future results and the predictions made in this report may not be met. Topeka Capital Markets Inc. accepts no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this report. Topeka Capital Markets Inc. specifically prohibits the re-distribution of this report by third parties, via the internet or otherwise, and accepts no liability whatsoever for the actions of such third parties in this respect. Additional information is available to clients upon request.

Stock Ratings

Buy - The stock is expected to trade higher on an absolute basis or outperform relative to the market or its peer stocks over the next 12 months. Hold - The stock has average risk/reward and is expected to perform in line with the market or its peer stocks over the next 12 months. Sell - The stock is expected to trade lower on an absolute basis or underperform relative to the market or its peer stocks over the next 12 months.

Ratings Distribution for Topeka Capital Markets as of August 21, 2012

Count Buy Hold Sell 32 24 7 % of total 50.79% 38.10% 11.11%

Source: Topeka Capital Markets

Footnotes and disclaimers are contained in the second page of this report.

Page 4

Anda mungkin juga menyukai

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Multiple Choice Questions: Answer: B. Wealth MaximisationDokumen20 halamanMultiple Choice Questions: Answer: B. Wealth MaximisationArchana Neppolian100% (1)

- 31-The Forex GambitDokumen6 halaman31-The Forex Gambitlowtarhk100% (1)

- Final Income Tax Rates and RulesDokumen26 halamanFinal Income Tax Rates and RulesJason MablesBelum ada peringkat

- HRC June Combined OCRDokumen2.847 halamanHRC June Combined OCRkevinipBelum ada peringkat

- General Re: June ReflectionsDokumen4 halamanGeneral Re: June ReflectionskevinipBelum ada peringkat

- WMI - Plan (With Signed Order)Dokumen807 halamanWMI - Plan (With Signed Order)kevinipBelum ada peringkat

- WMI - DS (With Signed Order)Dokumen1.091 halamanWMI - DS (With Signed Order)kevinipBelum ada peringkat

- Tutorial 7 Financial Instrument (Q) CRCIDokumen2 halamanTutorial 7 Financial Instrument (Q) CRCIts tanBelum ada peringkat

- Danbobi Note... Thesis PDFDokumen91 halamanDanbobi Note... Thesis PDFBirhanu Meshesha100% (1)

- Basel III transitional arrangements 2017-2028 summaryDokumen1 halamanBasel III transitional arrangements 2017-2028 summarygoonBelum ada peringkat

- Unit Five: Relevant Information and Decision MakingDokumen39 halamanUnit Five: Relevant Information and Decision MakingEbsa AbdiBelum ada peringkat

- Week 09 - Inventory EstimationsDokumen3 halamanWeek 09 - Inventory EstimationsPj ManezBelum ada peringkat

- Project Evaluation Techniques Non-Discounted Cash FlowDokumen3 halamanProject Evaluation Techniques Non-Discounted Cash FlowYameteKudasaiBelum ada peringkat

- CRM AssignmentDokumen32 halamanCRM AssignmentRajdeep PradhaniBelum ada peringkat

- Nucleon Inc Case Study SolutionDokumen19 halamanNucleon Inc Case Study Solutioncriric.bBelum ada peringkat

- Ronin 2Dokumen2 halamanRonin 2Arvind SinghBelum ada peringkat

- ASX Selects DLT To Replace CHESS - Media Release 7 December 2017Dokumen2 halamanASX Selects DLT To Replace CHESS - Media Release 7 December 2017lfsequeiraBelum ada peringkat

- Idea FinalDokumen482 halamanIdea Finalsatwinder sidhuBelum ada peringkat

- Sonata Manufacturing Corporation Decided To Expand Its Operations and OpenDokumen1 halamanSonata Manufacturing Corporation Decided To Expand Its Operations and OpenTaimour HassanBelum ada peringkat

- Prepare Financial Statements From Trial Balance in ExcelDokumen5 halamanPrepare Financial Statements From Trial Balance in ExcelShania FordeBelum ada peringkat

- Tybfm Sem Vi QBDokumen27 halamanTybfm Sem Vi QBHitesh BaneBelum ada peringkat

- Making AgreemenDokumen4 halamanMaking AgreemenEvan VarianBelum ada peringkat

- ACC3201Dokumen6 halamanACC3201natlyhBelum ada peringkat

- Mergers and AcquisitionsDokumen4 halamanMergers and Acquisitionsmayaverma123pBelum ada peringkat

- Chart of Accounts For BanksDokumen26 halamanChart of Accounts For BankscahyoBelum ada peringkat

- Modigliani and Miller Reply to Criticism of Their TheoryDokumen16 halamanModigliani and Miller Reply to Criticism of Their TheoryTrangBelum ada peringkat

- Hartalega Holdings Berhad (5168) PDFDokumen3 halamanHartalega Holdings Berhad (5168) PDFGiddy YupBelum ada peringkat

- Corporate LiquidationDokumen15 halamanCorporate LiquidationGen BBelum ada peringkat

- The Boston Beer CompanyDokumen52 halamanThe Boston Beer CompanyLarsBelum ada peringkat

- All Practice Set SolutionsDokumen22 halamanAll Practice Set SolutionsJohn TomBelum ada peringkat

- Barrons - 2020 12 21Dokumen77 halamanBarrons - 2020 12 21scribdggg100% (1)

- Calicut University Bcom SyllabusDokumen57 halamanCalicut University Bcom Syllabuslibison1Belum ada peringkat

- Bladex - Yankee CD Info MemoDokumen2 halamanBladex - Yankee CD Info MemoGuido ValderramaBelum ada peringkat

- Accounting For Corporations IIDokumen25 halamanAccounting For Corporations IIibrahim mohamedBelum ada peringkat