Bsmauditwkngpprs - Materiality

Diunggah oleh

Ann PlebianDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Bsmauditwkngpprs - Materiality

Diunggah oleh

Ann PlebianHak Cipta:

Format Tersedia

Auditing Lovitts

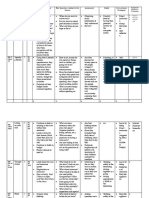

Boon Sim Murray Standard Audit Working Papers WP CODE

PLANNING

WP NAME

Risks of material misstatement and audit responses Understanding of the clients business Analytical review procedures for audit planning Preliminary materiality estimation and allocation Control environment evaluation Risk assessment and monitoring Understanding of the information systems Summary of application system IT environment appreciation General audit strategy Instructions to IT Audit

COMMENT

Comprises descriptions of the process and any revisions; attach minutes of team meetings

PL1-RMR

PL2-UCB PL3-ARP

Attach data tables and calculations, including annualisation of current part year data First part of internal control structure Further analysis of internal control structure Summary of clients applications Summary flowchart for each system supported by further explanation as needed for the audit response Preliminary investigation of IT general controls Memorandum containing instructions if further evaluation of IT controls is needed for audit response

PL4-PME PL5-CEE PL6-RAM PL7-UIS PL8-SAS-x

PL9-IEA PL10-GAS PL11-ITA

PL-TCR-x-yPL-TCT-x-y PL-ART-x-z

TESTING

Transaction class risk assessment Transaction class testing Account balance risk assessment and testing Audit test programme Matters to report to management

TE-ATP-x

REPORTING

RP1-MRM

For x above, substitute letters for appropriate cycle where transaction cycle audit approach is adopted: Rev for revenue, Inv for inventory, Exp for expenditure, Int for investments, Cap for capital expenditure. For y above, substitute letters for transaction class: CrS for Credit Sales Invoices, CaS for Cash Sales Invoices, CrN for Credit Notes (for returns from debtors), CaR for Cash Receipts; PrI for Purchase Invoices, DeN for Debit Notes (for returns to suppliers), PaS for Payments to Suppliers, HuI (for Human resource inputs (i.e., hours worked, leave taken, etc.)). For z above, substitute letter for account balance: AcR for Accounts Receivable, AcP for Accounts Payable, ClI for Closing Inventory, CaD for Cash, Bank Balances and Deposits, HuL for Human resource liabilities (deducted tax, superannuation, etc.), ShE for Shareholders Equity.

PL1-RMR: Client Audit for year ending

Risks of material misstatement and audit responses

(Summary of audit risk assessment process and conclusions)

FACTOR

Process in assessment of risk of material misstatement through fraud or error

COMMENTS <this section requires a summary of our process in arriving at our assessment of the risk of material misstatements, including a summary of: a) our inquiries within the entity, including our discussions with management on the business and on their assessments of the risks and the controls they have in place to address them, b) our observations and inspections, c) our analytical review procedures, d) if we are relying on audit work performed last year and have copies working papers prepared then, how we have confirmed that the information remains true>

Audit team meeting held to discuss risk of material misstatement

<this section requires a summary of the meeting of the audit team and a cross reference to the attached Minutes of Meeting; these will include the location, date and time of the meeting, the name and level of personnel involved, and a summary of the discussions and conclusions; the record of discussions must include staff assessments of risks of material misstatement, from error or fraud, both at the financial report level and at the assertion level, and the responses in the audit to these assessments of risk (the proposed audit strategy)>

Revision of risk assessments

<this section will include a summary of any revisions to the initial risk assessments and comment on how the audit testing strategy was revised as a result of the revisions>

Summary of final audit strategy

<this section will include a summary of the audit strategy as it was after any revisions; it will refer to PL10-GAS and other working papers for points of detail>

Prepared by/Date

Signature

Reviewed by/Date

Signature

PL2-UCB: Client Audit for year ending

Understanding of the clients business

FACTOR

Explain relevant industry, regulatory and other external factors, including the applicable financial framework Explain nature of entity: operations ownership and governance investments made or planned structure financing Explain and evaluate managements selection and application of accounting policies Summarise entitys objectives and strategies and related business risks that may result in material misstatement of the financial report Evaluate the processes for measurement and review of the clients financial performance, including their implications for risk of material misstatement Implications for the current years audit

COMMENTS

Prepared by/Date

<include here comment on the risk of material misstatements at the financial report level> Signature Reviewed by/Date Signature

PL3-ARP: Client Audit for year ending

Analytical review procedures for audit planning

FACTOR

Discussion of analysis

COMMENTS

<this section must include a summary and discussion of attached tabulations of data, including explanation of the assumptions and calculations behind the current year data that was used (required to be calculated from the year to date data and equivalent to a revised company budget)>

Implications for the audit

<this section must include comment on the implications for the current audit and where appropriate (e.g., where the client seems likely to experience increasing liquidity problems) on future audits>

Prepared by/Date

Signature

Reviewed by/Date

Signature

PL4-PME: Client Audit for year ending

Preliminary materiality estimation and allocation

FACTOR Discussion of source of data

COMMENTS

<justify data used in calculations>

Operating profit base method

<calculate 5% and 10% of estimated before tax profit for the year under audit and discuss judgement of place within range>

Judgement from profit base method

Blended method

0.5% of assets ($ ) 0.5% of revenue ($ ) 5% of profit before tax ($ ) 2% of gross profit after depreciation ($ 1% of equity ($ ) Total Average /5 Judgement from blended method

$ $

Planning materiality conclusion Allocation of planning materiality to components discus sion allocat ion

<explain decision on figure derived from the above> <comment on reasons for allocation of preliminary materiality to components>

Revenue/accounts receivable Expenditure/accounts payable Cost of sales/inventory Non-current assets (tangible) Non-current assets (intangible) Cash/deposits etc

TOTAL

Prepared by/Date Signature Reviewed by/Date Signature

PL5-CEE: Client Audit for year ending

Control environment evaluation

FACTOR

Communication and enforcement of integrity and ethical values - means Commitment to competence recognition of skill requirements for jobs and implementation Participation by those charged with governance (e.g., activities of audit committee) Managements philosophy and operating style (including interest in accounting) Organisational structure (e.g., structure for achievement of entitys objectives) Assignment of authority and responsibilities Human resource policies and practices recruitment, training, evaluating, compensation, etc Conclusion (e.g., potential for material misstatement)

COMMENTS

<attach outline organisational charts, with detail for accounting function (IT function chart appears under PL9IEA)> <include comment on evidence of effective delegation and supervision>

<include comment on implications for risk of material misstatements at the financial report level> Signature Reviewed by/Date Signature

Prepared by/Date

PL6-RAM: Client Audit for year ending

Risk assessment and monitoring

FACTOR

Explain managements process for identifying business risks and taking action to address those risks

(NB: Circumstances giving rise to risks include:

COMMENTS

Changes in operating environment New personnel New or revamped information systems Rapid growth New technology New business models, products or activities Corporate restructurings Expanded foreign operations New accounting pronouncements)

<summarise the processes, formal or informal, by which management identifies business risks and decides on action to mitigate them to an appropriate level, focusing on those risks that may cause material misstatements>

Explain how the entity: monitors internal control over financial reporting takes corrective action

<summarise monitoring by management and/or internal auditors or other monitoring agencies>

Evaluate the effectiveness of the risk assessment and monitoring processes and comment on implications for the current years audit

Prepared by/Date

Signature

Reviewed by/Date

Signature

PL7-UIS: Client Audit for year ending

Understanding of the information systems

FACTOR

Summarise the entitys information systems, including related business processes, relevant to financial reporting: Relevant classes of transactions Processing and reporting procedures Accounting records Capturing events significant to the financial report Financial reporting process

COMMENTS

<give in this section an overall summary of the clients information systems and cross reference it to a summary flowchart (PL8-SAS) for each major accounting application; give narrative explanations, here or below the flowchart, to meet the specified requirements; the explanations should cover all transaction classes, including changes to accounting estimates, and should follow the processing through transaction processing systems to the general ledger>

Summarise the means by which the entity communicates financial reporting roles and responsibilities and significant matters relating to financial reporting

<focus on communication processes pertinent to governance and control, including policy and accounting manuals, training for those with supervisory responsibilities, etc.>

Prepared by/Date

Signature

Reviewed by/Date

Signature

Cycle Client Audit for year ending Summary of application system

PL8-SAS-x

<insert system name here>

<add or remove inputs, outputs and databases on the attached flowchart as required>

Standing data changes

Databases Inputs Processes Outputs

Various performance reports

Summary of programmed processes and controls:

<give a narrative summary of the programmed processes; if a detailed understanding of any programmed process is required in the audit, attach this here or give the cross reference to it>

Summary of manual processes and controls

<to support the summary flowchart, give narrative descriptions (or attach detailed flowcharts) of the transaction flows, with enough information for the design of substantive tests of details of the transactions and balances> <only if the audit strategy is likely to include an expectation of the operating effectiveness of internal controls, include a summary of the key controls, but note that details of the assessment of control are given later with form PL-TCR-x-y if this audit strategy is adopted>

Preliminary assessment of the operating effectiveness of identified internal controls

TRANSACTION CLASS/ ACCOUNT BALANCE ASSESSMENT OF INTERNAL CONTROLS FOR POSSIBLE AUDIT RELIANCE

<from the examination of the systems and controls, give a preliminary assessment of the potential for audit reliance on the operating effectiveness of the controls for each assertion for each transaction class and account balance; include general or specific comment on the dependence of the controls on IT-general controls>

Dependence of the controls on IT-general controls

Potential for the use of computer assisted auditing techniques

TRANSACTION CLASS/ ACCOUNT BALANCE POSSIBLE USES

<from the examination of the systems and controls, suggest uses for CAATs, including: uses of client software (e.g., inquiry language), use of BSMs PC-based audit software, and techniques for testing client programs>

Prepared by/Date

Signature

Reviewed by/Date

Signature

PL9-IEA: Client Audit for the year ending

IT environment appreciation

(To be prepared by IT Audit specialist if clients system is multi-user)

FACTOR

Explain governance and management of IT function

COMMENTS <e.g., IT Steering Committee, IT Manager reporting line>

Summarise segregation of functions within computer department, referring to organisational chart Summarise computer department physical controls (access, climate, etc.) Summarise logical access controls and monitoring through automated logs Summarise control over data centre and network operations (backup, monitoring, etc) Summarise system software acquisition, change and maintenance Summarise controls over application system acquisition, development and maintenance, including program change controls Summarise current or planned projects, including in-house and outsourced developments Explain extent and apparent effectiveness of quality assurance and/or IT audit Comment on potential for use of computer assisted auditing techniques

<e.g., feasibility of data testing or programmed process testing> Signature Reviewed by/Date Signature

Prepared by/Date

PL10-GAS: Client Audit for year ending

General audit strategy

COMPONENT GENERAL

STRATEGY

Risks of material misstatement at the financial report level

<explain any identified risk at the financial report level>

Overall audit responses to address these risks

<comment on intended responses in terms of audit strategy and resources required>

Revenue

<For each component: Recommend an audit strategy, including particularly whether we should include an expectation of the operating effectiveness of internal control in our assessment of the risk or material misstatements, referring as appropriate to PL8SAS and other working papers containing assessments of risk. Explain any risks that we have assessed to be significant risks, including the transaction class or account balance assertions which they affect, and explain whether we should report these to management. Explain any assertions for which, in our assessment, the audit strategy must comprise the testing of the relevant internal controls.>

Inventory Expenditure Non-Current Assets Liquid Assets

(Cash, Deposits)

Investments Loans Equity

Prepared by/Date

Signature

Reviewed by/Date

Signature

Cycle Client Audit for the year ending Transaction class

Assertions/ Possible material misstatements Occurrence Controls to prevent or detect the misstatements - complete this column only if assessment includes expectation of effectiveness of controls)

PL-TCR-x-y

Transaction class risk assessment

Risk of material misstatement give level (significant, auditcritical, high, medium, low) and comment

O1 O2

Completeness

C1 C2

Accuracy/Classification

A1 A2

Presentation/Disclosure

P1

Prepared by/Date

Signature

Reviewed by/Date

Signature

Cycle Client Audit for the year ending

PL-TCT-x-y

Transaction class testing

Transaction class

Assertions

Proposed control tests if applicable

(cross reference to controls)

Proposed substantive tests (analytical review procedures and tests of details) Analytical procedures

Occurrence

OC1

OS1 OS2

Tests of details

Completeness

CC1

Analytical procedures

CS1 CS2

Tests of details

Accuracy/ Classification

AC1

Analytical procedures

AS1 AS2

Tests of details

Presentation/ Disclosure

PC1

Tests of details

P1

Prepared by/Date

Signature

Reviewed by/Date

Signature

Cycle Client Audit for the year ending Account balance

Assertions/ Possible material misstatements Existence Assessed risk of material misstatements after taking into account transaction class controls

PL-ART-x-z

Account balance risk assessment and testing

Proposed substantive tests (analytical review procedures and tests of details) Analytical procedures

ES1 ES2

Tests of details

Completeness

Analytical procedures

CS1 CS2

Tests of details

Rights/Obligations

Analytical procedures

RS1 RS2

Tests of details

Valuation/Allocation

Analytical procedures

VS1 VS2

Tests of details

Presentation/Disclosure

Tests of details

PS1

Prepared by/Date

Signature

Reviewed by/Date

Signature

TE-ATP-x Client Audit for the year ending

Audit test programme

Audit Tests

Risk assessment references Sample size (if applicable) Working paper references Done by

Prepared by/Date

Signature

Reviewed by/Date

Signature

RP1-MRM: Client Audit for year ending

Matters to report to management

W/P R E F E R E N C E

EXPLANATION

<give reference to working paper(s) in which the risk was identified>

Evaluation

<comment on overall degree of risk arising from factors listed above>

Prepared by/Date

Signature

Reviewed by/Date

Signature

Anda mungkin juga menyukai

- Audit Programme and Checklists For Completion of Audit Audit ProgrammeDokumen26 halamanAudit Programme and Checklists For Completion of Audit Audit ProgrammejafarBelum ada peringkat

- Audit ProgrammeDokumen34 halamanAudit ProgrammesurajBelum ada peringkat

- Audit Risk Alert: Employee Benefit Plans Industry Developments, 2018Dari EverandAudit Risk Alert: Employee Benefit Plans Industry Developments, 2018Belum ada peringkat

- Pre-Audit Checklist: Prepare for Your Upcoming AuditDokumen13 halamanPre-Audit Checklist: Prepare for Your Upcoming AuditRosley Ramly0% (1)

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsDari EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsBelum ada peringkat

- Chapter 9Dokumen4 halamanChapter 9Andrin LlemosBelum ada peringkat

- The Controller's Function: The Work of the Managerial AccountantDari EverandThe Controller's Function: The Work of the Managerial AccountantBelum ada peringkat

- QAR of FS in Accordance With PSADokumen169 halamanQAR of FS in Accordance With PSAMarco Fernando Lumanlan NgBelum ada peringkat

- 141 ISACA NACACS Auditing IT Projects Audit ProgramDokumen86 halaman141 ISACA NACACS Auditing IT Projects Audit Programkautaliya100% (6)

- 141 ISACA NACACS Auditing IT Projects Audit ProgramDokumen85 halaman141 ISACA NACACS Auditing IT Projects Audit ProgramkirwanicholasBelum ada peringkat

- New Audit Plan ISADokumen6 halamanNew Audit Plan ISAindrawanBelum ada peringkat

- Audit Evidence and ProceduresDokumen11 halamanAudit Evidence and ProceduresHolymaita TranBelum ada peringkat

- Audit Strategy Planning ProgrammingDokumen1 halamanAudit Strategy Planning ProgrammingSuhag PatelBelum ada peringkat

- Audit Planning MemoDokumen10 halamanAudit Planning MemoChyrra ALed ZuRc100% (3)

- Audit Planning MemoDokumen9 halamanAudit Planning MemoJerald Oliver Macabaya100% (1)

- Audit Planning & DocumentationDokumen12 halamanAudit Planning & DocumentationMerlin Gey BlessingsBelum ada peringkat

- SummaryDokumen6 halamanSummaryMarock RajwinderBelum ada peringkat

- Mapping Tool — External Audit TasksDokumen2 halamanMapping Tool — External Audit TasksDhana BalashanmugamBelum ada peringkat

- List of Accounting Books OnlineDokumen28 halamanList of Accounting Books Onlinemar_pogi100% (2)

- IRRBADokumen135 halamanIRRBAKathleenBelum ada peringkat

- Understanding Risk Assessment Procedures for Entity's EnvironmentDokumen14 halamanUnderstanding Risk Assessment Procedures for Entity's EnvironmentPhia TeoBelum ada peringkat

- Audit Planning Memorandum SamplesDokumen15 halamanAudit Planning Memorandum SamplesabellarcBelum ada peringkat

- AICPA Guide For Prospective Financial StatementDokumen19 halamanAICPA Guide For Prospective Financial StatementBetty Wong Low MingBelum ada peringkat

- At.1609 - Audit Planning - An OverviewDokumen6 halamanAt.1609 - Audit Planning - An Overviewnaztig_017Belum ada peringkat

- Assess risks of fraud in key audit areasDokumen20 halamanAssess risks of fraud in key audit areasVera Magdalena HutaurukBelum ada peringkat

- Audit ProcessDokumen2 halamanAudit Processrajahmati_28Belum ada peringkat

- 6 - Audit PlanningDokumen17 halaman6 - Audit PlanningJayson Manalo Gaña100% (1)

- How to Prepare an Audit PlanDokumen8 halamanHow to Prepare an Audit PlanJay Ann100% (1)

- Position Description - Assurance Compliance Analyst: Business Group: Finance Finance Sub Job Family: FinanceDokumen2 halamanPosition Description - Assurance Compliance Analyst: Business Group: Finance Finance Sub Job Family: FinanceHasyimah RasipBelum ada peringkat

- Developing an Audit Strategy for Financial Statement AuditsDokumen14 halamanDeveloping an Audit Strategy for Financial Statement AuditssammycoombsBelum ada peringkat

- 010-109-Audit Strategy ChecklistDokumen14 halaman010-109-Audit Strategy ChecklistKris Anne SamudioBelum ada peringkat

- Chapter 6 070804Dokumen14 halamanChapter 6 070804Shahid Nasir MalikBelum ada peringkat

- IG AT IO N: Audit PlanningDokumen19 halamanIG AT IO N: Audit PlanningAmeer ShafiqBelum ada peringkat

- Sikkim Manipal University Audit Programme FactorsDokumen14 halamanSikkim Manipal University Audit Programme FactorsRaza OshimBelum ada peringkat

- Form 4Dokumen18 halamanForm 4JULLIE CARMELLE H. CHATTOBelum ada peringkat

- Management Financial AccountingDokumen387 halamanManagement Financial AccountingNarendra Reddy LokireddyBelum ada peringkat

- CH 10Dokumen4 halamanCH 10Minh Thu Võ NgọcBelum ada peringkat

- A&a L4 EditedDokumen5 halamanA&a L4 EditedKimosop Isaac KipngetichBelum ada peringkat

- Analyze Financial RatiosDokumen170 halamanAnalyze Financial RatiosMohsena MunnaBelum ada peringkat

- Training ManualDokumen45 halamanTraining ManualbezawitwubshetBelum ada peringkat

- Tut 103 Slides - 30 April 2020Dokumen30 halamanTut 103 Slides - 30 April 2020phosagontseBelum ada peringkat

- Risk Assessment & Audit PlanDokumen20 halamanRisk Assessment & Audit PlanAreej FatimaBelum ada peringkat

- M A SDokumen11 halamanM A SPatricia Delos SantosBelum ada peringkat

- 141 Auditing IT Projects Audit Report TemplateDokumen12 halaman141 Auditing IT Projects Audit Report Templatekirwanicholas100% (2)

- Audit PlanningDokumen15 halamanAudit Planningemc2_mcv75% (4)

- Audit Planning GuideDokumen9 halamanAudit Planning GuidegumiBelum ada peringkat

- CA Inter Audit Important Topics For November 2023Dokumen9 halamanCA Inter Audit Important Topics For November 2023Sagar GuptaBelum ada peringkat

- Operational Audit Best PracticesDokumen4 halamanOperational Audit Best PracticesChelsea BorbonBelum ada peringkat

- Internal Audit Report To Audit CommitteeDokumen38 halamanInternal Audit Report To Audit CommitteeFarrukh Touheed83% (12)

- Plan Audit EffectivelyDokumen12 halamanPlan Audit Effectivelysadananda52Belum ada peringkat

- ACCTG 136 Module 2 Audit PlanningDokumen21 halamanACCTG 136 Module 2 Audit PlanningKaren PortiaBelum ada peringkat

- Cpa Review School of The Philippines: Related Psas: Psa 300, 310, 320, 520 and 570Dokumen5 halamanCpa Review School of The Philippines: Related Psas: Psa 300, 310, 320, 520 and 570Ma Yra YmataBelum ada peringkat

- Planning an Audit of Financial StatementsDokumen4 halamanPlanning an Audit of Financial StatementsMd Joinal AbedinBelum ada peringkat

- Chap.3 Audit Plannng, Working Paper and Internal Control-1Dokumen10 halamanChap.3 Audit Plannng, Working Paper and Internal Control-1Himanshu MoreBelum ada peringkat

- Record to Report: The End-to-End Financial Process CycleDokumen4 halamanRecord to Report: The End-to-End Financial Process CycleDANIELBelum ada peringkat

- Quality Management ProceduresDokumen10 halamanQuality Management Proceduresselinasimpson1201Belum ada peringkat

- Business Process Overview Meeting Template PDFDokumen9 halamanBusiness Process Overview Meeting Template PDFmarilynwalcott84Belum ada peringkat

- 12-18 AuditDokumen15 halaman12-18 AuditAvinash KumarBelum ada peringkat

- Chapter 6 Accounting For Foreign Currency TransactionDokumen21 halamanChapter 6 Accounting For Foreign Currency TransactionMisganaw DebasBelum ada peringkat

- Closing Your Savings Account FormDokumen1 halamanClosing Your Savings Account FormtafseerahmedBelum ada peringkat

- Online BankingDokumen38 halamanOnline BankingROSHNI AZAMBelum ada peringkat

- Internal Control PPT UoS 2018-03-06Dokumen14 halamanInternal Control PPT UoS 2018-03-06Zesorith ThunderBelum ada peringkat

- Unit - Ii Entrepreneurial Idea and InnovationDokumen49 halamanUnit - Ii Entrepreneurial Idea and InnovationAkriti Sonker0% (1)

- Income From SalaryDokumen60 halamanIncome From SalaryroopamBelum ada peringkat

- Influence of Microfinance On Small Business Development in Namakkal District, TamilnaduDokumen5 halamanInfluence of Microfinance On Small Business Development in Namakkal District, Tamilnaduarcherselevators100% (1)

- Icici Prudential Life InsuranceDokumen19 halamanIcici Prudential Life InsuranceShubhanshu DubeyBelum ada peringkat

- Garima Axis Bank SDokumen3 halamanGarima Axis Bank SSajan Sharma100% (1)

- Passage No 50Dokumen7 halamanPassage No 50SanchitBelum ada peringkat

- Solved Copy The Mike Owjai Manufacturing Financial Statements From Problem 1Dokumen1 halamanSolved Copy The Mike Owjai Manufacturing Financial Statements From Problem 1DoreenBelum ada peringkat

- LATAM Airlines Group 20F AsFiledDokumen394 halamanLATAM Airlines Group 20F AsFiledDTBelum ada peringkat

- Class 1 - Introduction The Foundation of Islamic EconomicsDokumen22 halamanClass 1 - Introduction The Foundation of Islamic EconomicsBayu MurtiBelum ada peringkat

- Subramanian Cibil ReportDokumen13 halamanSubramanian Cibil ReportManish KumarBelum ada peringkat

- Day 3 PDFDokumen14 halamanDay 3 PDFDinesh GadkariBelum ada peringkat

- Corporate Management Accounting Merge Colour Deleted NotesDokumen246 halamanCorporate Management Accounting Merge Colour Deleted Notesgautam shahBelum ada peringkat

- ICE Cotton BrochureDokumen6 halamanICE Cotton BrochureAmeya PagnisBelum ada peringkat

- Consolidated CSOFP of Jasin Bhd GroupDokumen4 halamanConsolidated CSOFP of Jasin Bhd GroupNoor ShukirrahBelum ada peringkat

- Van Den Berghs LTD V ClarkDokumen6 halamanVan Den Berghs LTD V ClarkShivanjani KumarBelum ada peringkat

- Pelatihan Penyusunan Laporan Keuangan Bagi Usaha Industri Kreatif Di TangerangDokumen7 halamanPelatihan Penyusunan Laporan Keuangan Bagi Usaha Industri Kreatif Di Tangerangfaesal fazlurahmanBelum ada peringkat

- Welcome To The Bank of The Philippine Islands - BPIDokumen2 halamanWelcome To The Bank of The Philippine Islands - BPIGlenn J. Gabule0% (1)

- Dnata Campus To Corporate ProgramDokumen28 halamanDnata Campus To Corporate ProgramAmit Kushwaha100% (1)

- Exam Timetable 2013Dokumen2 halamanExam Timetable 2013Bukola BukkyBelum ada peringkat

- Elements of Capital BudgetingDokumen3 halamanElements of Capital BudgetingDivina SalazarBelum ada peringkat

- Chapter 1 History and Development of Banking System in MalaysiaDokumen18 halamanChapter 1 History and Development of Banking System in MalaysiaMadihah JamianBelum ada peringkat

- FXCM Traits of Successful Traders GuideDokumen43 halamanFXCM Traits of Successful Traders GuidefizzBelum ada peringkat

- Top 6 Best Accounting and Auditing Firms in The PhilippinesDokumen4 halamanTop 6 Best Accounting and Auditing Firms in The Philippineschelsea kayle licomes fuentesBelum ada peringkat

- Pedro Santos' Transportation Business General Journal For The Month of JulyDokumen8 halamanPedro Santos' Transportation Business General Journal For The Month of Julyლ itsmooncakes ́ლBelum ada peringkat

- Registration flow and documentsDokumen22 halamanRegistration flow and documentsmdzainiBelum ada peringkat

- Calm Finance Unit PlanDokumen7 halamanCalm Finance Unit Planapi-331006019Belum ada peringkat