Pricing Index Futures Models

Diunggah oleh

sa281289Deskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Pricing Index Futures Models

Diunggah oleh

sa281289Hak Cipta:

Format Tersedia

Pricing Index Futures

1-Pricing future

Pricing of futures contract is very simple. Using the cost-of-carry logic, we calculate the fair value of a futures contract. Every time the observed price deviates from the fair value, arbitragers would enter into trades to capture the arbitrage profit. This in turn would push the futures price back to its fair value. The cost of carry model used for pricing futures is given below: F = SerT Where: r- Cost of financing (using continuously compounded interest rate) T- Time till expiration in years e- 2.71828 Example: Security XYZ Ltd trades in the spot market at Rs. 1150. Money can be invested at 11% p.a. The fair value of a one-month futures contract on XYZ is calculated as follows: F=SerT =1150*e0.11*1/12 =1160

2-Pricing equity index futures

A futures contract on the stock market index gives its owner the right and obligation to buy or sell the portfolio of stocks characterized by the index. Stock index futures are cash settled; there is no delivery of the underlying stocks. In their short history of trading, index futures have had a great impact on the worlds securities markets. Its existence has revolutionized the art and science of institutional equity portfolio management. The main differences between commodity and equity index futures are that: There are no costs of storage involved in holding equity. Equity comes with a dividend stream, which is a negative cost if you are long the stock and a positive cost if you are shorts the stock. Therefore, Cost of carry = Financing cost - Dividends. Thus, a crucial aspect of dealing with equity futures as opposed to commodity futures is an accurate forecasting of dividends. The better the forecast of dividend offered by a security, the better is the estimate of the futures price. Pricing index futures given expected dividend amount The pricing of index futures is based on the cost-of-carry model, where the carrying cost is the cost of financing the purchase of the portfolio underlying the index, minus the present value of dividends obtained from the stocks in the index portfolio. This has been illustrated in the Example below. Nifty futures trade on NSE as one, two and three-month contracts. Money can be borrowed at a rate of 10% per annum. What will be the price of a new two-month futures contract on Nifty? 1. Let us assume that ABC Ltd. will be declaring a dividend of Rs.20 per share after 15 days of purchasing the contract. 2. Current value of Nifty is 4000 and Nifty trades with a multiplier of 100. 3. Since Nifty is traded in multiples of 100, value of the contract is 100*4000 = Rs.400, 000. 4. If ABC Ltd. has a weight of 7% in Nifty; its value in Nifty is Rs.28, 000 i.e. (400,000 * 0.07).

5. If the market price of ABC Ltd. is Rs.140, then a traded unit of Nifty involves 200 shares of ABC Ltd. i.e. (28,000/140). 6. To calculate the futures price, we need to reduce the cost-of-carry to the extent of dividend received. The amount of dividend received is Rs.4000 i.e. (200*20). The dividend is received 15 days later and hence compounded only for the remainder of 45 days. To calculate the futures price we need to compute the amount of dividend received per unit of Nifty. Hence we divide the compounded dividend figure by 100. 7. Thus, the futures price is calculated as;

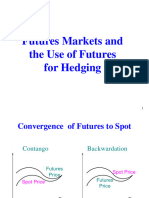

Pricing index futures given expected dividend yield If the dividend flow throughout the year is generally uniform, i.e. if there are few historical cases of clustering of dividends in any particular month, it is useful to calculate the annual dividend yield. F = Se(r-q) T Where: F- Futures price S- Spot index value r- Cost of financing q- Expected dividend yield T- Holding period Example A two-month futures contract trades on the NSE. The cost of financing is 10% and the dividend yield on Nifty is 2% annualized. The spot value of Nifty 4000. What is the fair value of the futures contract ? F= 4000e (0.1-0.02) (60 / 365) = Rs. 4052.95 The cost-of-carry model explicitly defines the relationship between the futures price and the related spot price. As we know, the difference between the spot price and the futures price is called the basis. Nuances: As the date of expiration comes near, the basis reduces - there is a convergence of the futures price towards the spot price. On the date of expiration, the basis is zero. If it is not, then there is an arbitrage opportunity. Arbitrage opportunities can also arise when the basis (difference between spot and futures price) or the spreads (difference between prices of two futures contracts) during the life of a contract are incorrect. At a later stage we shall look at how these arbitrage opportunities can be exploited.

Fig- Variation of basis over time

The figure above shows how basis changes over time. As the time to expiration of a contract reduces, the basis reduces. Towards the close of trading on the day of settlement, the futures price and the spot price converge. The closing price for the June 28 futures contract is the closing value of Nifty on that day.

Anda mungkin juga menyukai

- Financial engineering assignment explores cross currency futures and optionsDokumen8 halamanFinancial engineering assignment explores cross currency futures and optionsGautam TandonBelum ada peringkat

- Application of Futures: Chitra PotdarDokumen31 halamanApplication of Futures: Chitra PotdarDarshit ShahBelum ada peringkat

- Seminar On SFM - Ca Final: Archana Khetan B.A, CFA (ICFAI), MS Finance, 9930812721Dokumen53 halamanSeminar On SFM - Ca Final: Archana Khetan B.A, CFA (ICFAI), MS Finance, 9930812721shankar k.c.Belum ada peringkat

- Derivatives - Options, FuturesDokumen102 halamanDerivatives - Options, Futuresmanmohanbora100% (2)

- Hedging Through Futures: Prof Mahesh Kumar Amity Business SchoolDokumen21 halamanHedging Through Futures: Prof Mahesh Kumar Amity Business SchoolasifanisBelum ada peringkat

- 1 RMFDDokumen27 halaman1 RMFDArchin PadiaBelum ada peringkat

- CA Tarun Mahajan: CA Final Strategic Financial Management, Paper 2, Chapter 5Dokumen26 halamanCA Tarun Mahajan: CA Final Strategic Financial Management, Paper 2, Chapter 5chandreshBelum ada peringkat

- Forward & Futures PricingDokumen41 halamanForward & Futures Pricingasifanis100% (3)

- Accounting of Index Futures TransactionsDokumen12 halamanAccounting of Index Futures TransactionsSmartKevalBelum ada peringkat

- Chapter 5 - Pricing Forwards and Futures (S.V.)Dokumen39 halamanChapter 5 - Pricing Forwards and Futures (S.V.)flippy23Belum ada peringkat

- What Is NAV of Mutual Fund, Check Latest MF NAV OnlineDokumen7 halamanWhat Is NAV of Mutual Fund, Check Latest MF NAV Onlineakash ThakurBelum ada peringkat

- Chapter - Four: Bond and Stock Valuation and The Cost of CapitalDokumen10 halamanChapter - Four: Bond and Stock Valuation and The Cost of CapitalWiz Santa0% (1)

- Term-to-Maturity Refers To The Number of Years Remaining For The Bond To Mature. Coupon: Coupon Refers To The Periodic Interest Payments That AreDokumen5 halamanTerm-to-Maturity Refers To The Number of Years Remaining For The Bond To Mature. Coupon: Coupon Refers To The Periodic Interest Payments That Arehims_rajaBelum ada peringkat

- Future strategies for hedging portfolio riskDokumen68 halamanFuture strategies for hedging portfolio riskRoshni MoryeBelum ada peringkat

- Risk ManagementDokumen24 halamanRisk ManagementSoujanya NagarajaBelum ada peringkat

- KLCI Futures Contracts AnalysisDokumen63 halamanKLCI Futures Contracts AnalysisSidharth ChoudharyBelum ada peringkat

- Financial Assets ValuationDokumen9 halamanFinancial Assets ValuationGraceBelum ada peringkat

- Interest Rate Models and Derivatives 2019Dokumen69 halamanInterest Rate Models and Derivatives 2019Elisha MakoniBelum ada peringkat

- Strategic Financial ManagementDokumen26 halamanStrategic Financial ManagementKC XitizBelum ada peringkat

- 2 Unit Theories of Forwards & Future PricingDokumen60 halaman2 Unit Theories of Forwards & Future Pricingvijay kumarBelum ada peringkat

- 50767066Dokumen27 halaman50767066omprakashBelum ada peringkat

- 5.fin17 Derivatives9 - 10 Done AskDokumen33 halaman5.fin17 Derivatives9 - 10 Done AskPratik GuptaBelum ada peringkat

- Security Valuation: Learning OutcomesDokumen38 halamanSecurity Valuation: Learning OutcomesRaja1234Belum ada peringkat

- Derivatives and Risk Management - Futures MMSDokumen66 halamanDerivatives and Risk Management - Futures MMSgrshneheteBelum ada peringkat

- FRM Unit-3Dokumen29 halamanFRM Unit-3prasanthi CBelum ada peringkat

- FRM Practice QuestionsDokumen4 halamanFRM Practice Questionsshubendu ghoshBelum ada peringkat

- Estimation of Forwards & Futures Price MBADokumen91 halamanEstimation of Forwards & Futures Price MBAPRANJAL BANSALBelum ada peringkat

- Cost of CapitalDokumen4 halamanCost of Capitalkomal mishraBelum ada peringkat

- Int. Rate Derivatives & It's Application in IndiaDokumen52 halamanInt. Rate Derivatives & It's Application in IndiaSachin GadhaveBelum ada peringkat

- Financial Derivatives NotesDokumen26 halamanFinancial Derivatives NotesManish RaiBelum ada peringkat

- Understanding Derivatives: Risks, Uses and Valuation TechniquesDokumen28 halamanUnderstanding Derivatives: Risks, Uses and Valuation TechniquesBalu MahindraBelum ada peringkat

- Financial DerivativeDokumen54 halamanFinancial DerivativePrashant SinghBelum ada peringkat

- Convergence of Future and Spot PricesDokumen7 halamanConvergence of Future and Spot PricesIgnacio MaldonadoBelum ada peringkat

- BANK3014 Week 6 Tutorial Suggested Solutions - Week 5 MaterialDokumen5 halamanBANK3014 Week 6 Tutorial Suggested Solutions - Week 5 Materialdarcy whiteBelum ada peringkat

- Lecture 3B Bonds Capital Markets. Pricing, Yield For Coupon Paying BondsDokumen23 halamanLecture 3B Bonds Capital Markets. Pricing, Yield For Coupon Paying BondsdishaparmarBelum ada peringkat

- DRM 04Dokumen58 halamanDRM 04Kannan MeiyurBelum ada peringkat

- FD ch5 PPT HullDokumen37 halamanFD ch5 PPT HullBuller CatBelum ada peringkat

- Security Valuation: Learning OutcomesDokumen38 halamanSecurity Valuation: Learning OutcomesMadhuratha MuraliBelum ada peringkat

- DRIVATIVES Options Call & Put KKDokumen134 halamanDRIVATIVES Options Call & Put KKAjay Raj ShuklaBelum ada peringkat

- FuturesDokumen5 halamanFuturesVishnuBelum ada peringkat

- Note On FRA 8lxfUBjR4HDokumen9 halamanNote On FRA 8lxfUBjR4HAnosh ModyBelum ada peringkat

- Solution To Previous Year Questions Course Code: Course NameDokumen25 halamanSolution To Previous Year Questions Course Code: Course NameSHAFI Al MEHEDIBelum ada peringkat

- Chapter 4 Valuing Bonds Concept Review and Self-Test AnswersDokumen4 halamanChapter 4 Valuing Bonds Concept Review and Self-Test AnswersHuu DuyBelum ada peringkat

- MAF 675 Topic 2 - Forwards and FuturesDokumen59 halamanMAF 675 Topic 2 - Forwards and FuturesAbdul BatenBelum ada peringkat

- Hedging With STIR FuturesDokumen15 halamanHedging With STIR FuturesBach Nguyen Hoai AnhBelum ada peringkat

- Updtd Derivatives and Risk Management 16th SepDokumen8 halamanUpdtd Derivatives and Risk Management 16th SepmaheshBelum ada peringkat

- Index Futures RMFDDokumen17 halamanIndex Futures RMFDAbhi_The_RockstarBelum ada peringkat

- Exam DerDokumen20 halamanExam DerhukaBelum ada peringkat

- Paul WilmottDokumen3 halamanPaul Wilmottkylie05Belum ada peringkat

- Tutorial 10 - SolutionsDokumen5 halamanTutorial 10 - Solutionstrang snoopyBelum ada peringkat

- Determination of Forward and Futures PricesDokumen3 halamanDetermination of Forward and Futures PricesScorpio GirlBelum ada peringkat

- Derivatives 2Dokumen14 halamanDerivatives 2Omkar DeshmukhBelum ada peringkat

- LM06 Pricing and Valuation of Futures Contracts IFT NotesDokumen7 halamanLM06 Pricing and Valuation of Futures Contracts IFT NotesRidhtang DuggalBelum ada peringkat

- Derivaties CNDokumen34 halamanDerivaties CNMarshBelum ada peringkat

- 2 Forwards & Futures PricingDokumen60 halaman2 Forwards & Futures PricingparthBelum ada peringkat

- FIS Assignment 1 Bitan SahaDokumen6 halamanFIS Assignment 1 Bitan SahaBitan SahaBelum ada peringkat

- Fin4003 - Lecture04 - Determination - of - Forward - and - Futures - Prices 14 Sep 2019Dokumen39 halamanFin4003 - Lecture04 - Determination - of - Forward - and - Futures - Prices 14 Sep 2019Who Am iBelum ada peringkat

- Derivatives Risk ManagementDokumen61 halamanDerivatives Risk ManagementMayankSharmaBelum ada peringkat

- Summary of Philip J. Romero & Tucker Balch's What Hedge Funds Really DoDari EverandSummary of Philip J. Romero & Tucker Balch's What Hedge Funds Really DoBelum ada peringkat

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideDari EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideBelum ada peringkat

- Study On XBRL Implementation For Financial Reporting.Dokumen41 halamanStudy On XBRL Implementation For Financial Reporting.sa281289100% (1)

- 8-Dissertation - CYTL 2012-Akash ShettyDokumen10 halaman8-Dissertation - CYTL 2012-Akash Shettysa281289Belum ada peringkat

- 8-Dissertation - CYTL 2012-Akash ShettyDokumen10 halaman8-Dissertation - CYTL 2012-Akash Shettysa281289Belum ada peringkat

- 8-Dissertation - CYTL 2012-Akash ShettyDokumen10 halaman8-Dissertation - CYTL 2012-Akash Shettysa281289Belum ada peringkat

- 8-Dissertation - CYTL 2012-Akash ShettyDokumen10 halaman8-Dissertation - CYTL 2012-Akash Shettysa281289Belum ada peringkat

- 3 Premium, Discount SharesDokumen4 halaman3 Premium, Discount Sharessa281289Belum ada peringkat

- Hindalco & NovelisDokumen27 halamanHindalco & Novelissa281289Belum ada peringkat

- Hindalco & NovelisDokumen27 halamanHindalco & Novelissa281289100% (1)

- Report SbiDokumen124 halamanReport SbiAbhishek DubeyBelum ada peringkat

- SAARCDokumen39 halamanSAARCsa281289Belum ada peringkat

- SAARCDokumen41 halamanSAARCsa281289Belum ada peringkat

- Apple's Foreign Exchange Risk ManagementDokumen17 halamanApple's Foreign Exchange Risk Managementamirul asyrafBelum ada peringkat

- ICICI, Bank Reverse Merger An Acid TestDokumen3 halamanICICI, Bank Reverse Merger An Acid TestPriyamvada ChouhanBelum ada peringkat

- Firda Arfianti - LC53 - CONSOLIDATION BALANCE SHEET Exercise 3-3Dokumen2 halamanFirda Arfianti - LC53 - CONSOLIDATION BALANCE SHEET Exercise 3-3FirdaBelum ada peringkat

- 01 The Term Structure and Interest Rate DynamicsDokumen38 halaman01 The Term Structure and Interest Rate DynamicsGastón Saint-HubertBelum ada peringkat

- Dividend Discount ModelDokumen54 halamanDividend Discount ModelVaidyanathan Ravichandran100% (1)

- Module 2 - AnswersDokumen26 halamanModule 2 - AnswersSinghan SBelum ada peringkat

- Financial Ratio Analysis Guide for Short and Long Term Solvency, Liquidity, Profitability and ReturnsDokumen3 halamanFinancial Ratio Analysis Guide for Short and Long Term Solvency, Liquidity, Profitability and ReturnsMikaela LacabaBelum ada peringkat

- Tradersworld GannDokumen91 halamanTradersworld Gannnicolas arias100% (1)

- How To Profit From ChaosDokumen8 halamanHow To Profit From ChaosEnrique MontesBelum ada peringkat

- DG Retail Partners - Investment Opportunity Concept & InformationDokumen19 halamanDG Retail Partners - Investment Opportunity Concept & Informationpvk750Belum ada peringkat

- IPD Annual Property IndexDokumen2 halamanIPD Annual Property IndexAlister HumanBelum ada peringkat

- Benefits of Listing On BseDokumen7 halamanBenefits of Listing On BseTarun LoharBelum ada peringkat

- Pablo Fernández 80 Common Errors in Company Valuation IESE Business SchoolDokumen27 halamanPablo Fernández 80 Common Errors in Company Valuation IESE Business SchoolFFBelum ada peringkat

- CTM IndividualDokumen6 halamanCTM IndividualPhang Yu ShangBelum ada peringkat

- Bloomberg CodesDokumen4 halamanBloomberg CodeskapuskondaBelum ada peringkat

- Q2 2023 Alta Fox Capital Quarterly LetterDokumen7 halamanQ2 2023 Alta Fox Capital Quarterly LetterThanasiri VisanondBelum ada peringkat

- Understanding Style PremiaDokumen9 halamanUnderstanding Style PremiaZen TraderBelum ada peringkat

- Experience The Difference: Annual Report & Accounts 2003Dokumen41 halamanExperience The Difference: Annual Report & Accounts 2003thestorydotieBelum ada peringkat

- The Panera Bread LBO: Nikita Gulgule (B19031) Snehal Tiwari (B19031) Anusha Sinha (B19068)Dokumen6 halamanThe Panera Bread LBO: Nikita Gulgule (B19031) Snehal Tiwari (B19031) Anusha Sinha (B19068)snehal0% (1)

- ADXDokumen3 halamanADXhiru2pBelum ada peringkat

- Chapter 1. L1.4 Nature of Securities and Risks InvolvedDokumen3 halamanChapter 1. L1.4 Nature of Securities and Risks InvolvedvibhuBelum ada peringkat

- EBIT-EPS Analysis ExplainedDokumen10 halamanEBIT-EPS Analysis ExplainedKUMARI MADHU LATABelum ada peringkat

- Make Money With This Forex Trading SystemDokumen14 halamanMake Money With This Forex Trading SystemLideresEmpredimientoLiderazgoTransformacionalBelum ada peringkat

- Wray 2008. Financial Markets Meltdown. What Can We Learn From MinskyDokumen53 halamanWray 2008. Financial Markets Meltdown. What Can We Learn From MinskyppphhwBelum ada peringkat

- Laurence Fink's Remarks on Building a Global BusinessDokumen11 halamanLaurence Fink's Remarks on Building a Global BusinessRamkumarBelum ada peringkat

- Contemporary Financial Management 12th Edition Moyer Test BankDokumen25 halamanContemporary Financial Management 12th Edition Moyer Test BankChristopherKnightagem100% (55)

- Market Analysis April 2022Dokumen19 halamanMarket Analysis April 2022Penguin DadBelum ada peringkat

- Chapter 14 The Marketing Mix PlaceDokumen16 halamanChapter 14 The Marketing Mix PlaceENG ZI QINGBelum ada peringkat

- Stock Market Investing and Fundamental Analysis For Equity InvestmentsDokumen53 halamanStock Market Investing and Fundamental Analysis For Equity InvestmentsChanz CatlyBelum ada peringkat

- Session 3 Convexity ImmunizationDokumen20 halamanSession 3 Convexity ImmunizationRabeya AktarBelum ada peringkat