The 2012 Owners Magazine

Diunggah oleh

NewYorkObserverDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

The 2012 Owners Magazine

Diunggah oleh

NewYorkObserverHak Cipta:

Format Tersedia

P

O

L

I

T

I

C

S

C

U

L

T

U

R

E

R

E

A

L

E

S

T

A

T

E

T

H

E

2

0

1

2

O

W

N

E

R

S

I

N

Q

U

I

S

I

T

I

O

N

N

E

W

Y

O

R

K

C

I

T

Y

S

N

E

X

T

G

E

N

E

R

A

T

I

O

N

O

F

R

E

A

L

E

S

T

A

T

E

D

Y

N

A

S

T

I

E

S

M

A

N

H

A

T

T

A

N

S

C

H

A

N

G

I

N

G

R

E

A

L

E

S

T

A

T

E

L

A

N

D

S

C

A

P

E

A

N

D

M

O

R

E

!

Cover_FINAL_PRINT.indd 1 9/13/12 4:07:12 PM

Untitled-3 1 9/12/12 1:22:00 PM

OWNERS magazine 2012 | 1

Rommel, you magnifcent bastard, I read

your book! General George S. Patton

W

hether the story is true remains unclear, but

legend has it that in a gambit that changed the

course of history, General George S. Patton

was able to get the better of his adversary

Generalfeldmarschall Erwin Rommel during

the North Africa campaign of World War II because he had read a

tactical manual the German military strategist had written. In his

book Infanterie Greift (Infantry Attacks) Rommel describes his

desert warfare tactics in painstaking detail, and General Patton,

having read it, was able to predict the movements of the German

troops and gain a decisive upper hand.

While we make no claim to authoring the real estate industrys

version of Infanterie Greift, we at The Commercial Observer strongly

believe that knowing what makes the competition tick is half the

battle. And while its a stretch to compare a fve-star general to real-

estate icons like Stephen Ross, the similarities are worth noting.

Between them, Manhattans fraternity of commercial real estate

landlords control a purported 400 million square feet of property,

employ an arsenal of thousands of employees and pay literally

billions in property taxes. Its for those reasons and more that titans

like Mr. Ross, Marc Holliday and Donald Trump command outsize

attention from elected offcials, who look to them to feed city and

state coffers. Meanwhile, the industrys periphery of architects, dirt

lawyers, accountants and engineers seek their business, and agencies

like the city Landmarks Preservation Commission curtail them at

every stop.

In short, anyone who crosses their path seems to want a piece of

the modern-day landlord.

It was with such large stakes in mind that The Commercial Observer

set off to chronicle the life and times, struggles and substantive issues

of Manhattans hundreds of commercial real estate owners, from the

property tax increases that continue to impact the bottom line to

the ballooning list of city measures proposed or enacted that makes

operating a building more challenging and costly than ever before.

Indeed, with the help of real estate services frm Cassidy Turley,

we crunched the numbers to determine just how quickly those

operating costs add up in Midtown Manhattan, while Commercial

Observer staff writer Daniel Geiger took a closer look at the citys

mysterious tax assessment formula and how, despite no property

tax hikes in more than a decade, real estate collections continue to

skyrocketnearly double what they were in the salad days before the

21

st

century arrived.

Meanwhile, Mortgage Observer editor Carl Gaines sat down with

the scions of some of Manhattans oldest real estate dynasties to

learn whether their empires were continuing to fourish or, rather,

struggling under the weight of competing real estate investment

trusts and other young upstarts. And Commercial Observer staff writer

Daniel Edward Rosen rounds out the mix with a profle of Leslie

Wohlman Himmel, a principal of Himmel + Meringoff Properties

and one of the citys very few female landlords. Read his story to

understand why so few women compete in such a male-dominated

industry, but also see psychologist Mark Banschicks column on what

drives men to build.

Freelance writer Ian Thomas aimed a wide lens at the real estate

landscape in general and found that, while the economy is improving,

many owners still arent willing to break out the champagne futes just

yet. However, in a separate feature on the citys smaller ownersthose

who own less than 1 million square feet, for examplethe subjects

voice a sense of hope and promise, if also continued uncertainty

surrounding the upcoming presidential elections.

And speaking of those elections, the heart of this years Owners

Magazine is a feature weve dubbed The Owners Inquisition, a

Proust-like questionnaire submitted to the citys biggest and boldest

commercial real estate owners covering everything from favorite

vacation getaway to election predictions.

Those questionnaires, roughly 50 accumulated over the past two

summer months, act as a whos who of the commercial real estate

industry and, as such, a roster of Manhattans power elite and a

veritable feld guide for battle coming into 3Q12.

Jotham Sederstrom,, Editor-in-Chief

2

0

1

2

O

W

N

E

R

S

M

A

G

A

Z

I

N

E

OWNERS_2012_OPERATINGCOSTS.indd 1 9/13/12 4:35:46 PM

2 | OWNERS MAGAZINE 2012

GROW. WISELY.

EisnerAmpers Real Estate Services Group provides a wide

array of audit, tax and advisory services to the real estate

community, including REITs and real estate opportunity funds.

Our goal is to help our clients structure sound transactions

and examine each aspect of operations to help maximize

potential returns and build future success.

And as a leading service provider for fnancial service

companies as well as family offces, EisnerAmper is

uniquely positioned to create synergies that help our real

estate clients grow their businesses.

Lets get down to business.

TM

Aaron Kaiser, CPA

Partner

212.891.8084

aaron.kaiser@eisneramper.com

NEW YORK | NEW JERSEY | PENNSYLVANIA | CALIFORNIA | CAYMAN ISLANDS

EisnerAmper LLP

Accountants & Advisors

Independent Member of PKF International

www.eisneramper.com

Kenneth Weissenberg, CPA, J.D., LLM.

Partner

212.891.4070

kenneth.weissenberg@eisneramper.com

Table of Contents

Fuzzy Math

BY DANIEL GEIGER

P. 16

New York City property taxes

havent ofcially risen in more

than a decade. So why have

collections doubled since 2001?

Family Ties

BY CARL GAINES

P. 10

The next generation of dynastic

commercial real estate scions is

poised to take the reinseven as youthful

new owners attempt to hold their own

As the World Turns

BY IAN THOMAS

P. 6

Leasing numbers are still far from vibrant. But as tech and

media companies inltrate Midtown South, spillover promises

to affect every crevice of Manhattan, and, subsequently, the

building owners themselves.

Does Size

Matter?

BY IAN THOMAS

P. 20

In a real estate industry

lled with Goliaths, Davids

abound.

THE FEMININE

MYSTIQUE

BY DANIEL

EDWARD

ROSEN

P. 22

In a testosterone-

dominated

industry, Leslie

Wohlman

Himmel dees

the odds

HOME

TURF

P. 24

SMOOTH

OPERATOR

P. 26

Owners

Inquisition

P. 29

Altman...............................................30

Behler.................................................32

Cohen.................................................34

Craig..................................................36

Durst..................................................38

Elghanayan, J.....................................40

Elghanayan, T.....................................42

Fetner................................................44

Fisher................................................46

Galin..................................................48

Golub.................................................50

Gray...................................................52

Gural..................................................54

Hidary................................................58

Himmel..............................................60

Holliday.............................................62

Kenny.................................................64

Kushner..............................................66

Laboz..................................................68

Lapidus...............................................70

Levinson.............................................72

Mainetti..............................................74

Malkin.................................................76

Meringoff............................................78

Phillips................................................80

Pizer....................................................82

Rechler................................................84

Resnick................................................86

Ross.....................................................88

Roth....................................................90

Rudin, M...............................................91

Rudin, W...............................................92

Schenker.............................................93

Shah....................................................94

Silverstein..........................................95

Speyer.................................................96

Sturner...............................................97

Trump................................................98

Wacht................................................99

Zar...................................................100

Zuckerman......................................101

Why Men Build

BY MARK R.

BANSCHICK, M.D.

P. 103

If Freud is to be believed,

father knows best

OWNERS_2012_INDEX-INTRO.indd 2 9/13/12 4:27:52 PM

Untitled-9 1 9/13/12 6:26:08 PM

4 | OWNERS magazine 2012

R E A C H I N G N E W

H E I G H T S I S I N E V I T A B L E

WH E N C O N D I T I O N S

A R E E X A C T L Y R I G H T

Expert nancial planning is crucial to growth.

With our vast resources, global expertise and

real estate market knowledge, the professionals

at WeiserMazars explore the many opportunities

that can dramatically impact the ROI of your

portfolio. Let us provide the professionalism,

personal service and custom solutions that

are exactly right for your business.

Please contact

Shahab Moreh

Partner-in-charge, Real Estate Services

212.375.6791 | Shahab.Moreh@WeiserMazars.com

www.WeiserMazars.com

WeiserMazars LLP is an independent member rm of Mazars Group. Exactly Right.

A C C O U N T I N G | T A X | A D V I S O R Y

016461 CommObserv_v1.indd 1 8/27/12 4:01 PM

321 West 44th Street, New York, NY 10036

212.755.2400

Jotham Sederstrom

Editor-in-Chief

Daniel Geiger

Daniel Edward Rosen

Carl Gaines

Stephen Kleege

Ian Thomas

Mark R. Banschick

Contributers

Noam S. Cohen

Copy Editor

Robyn Reiss

Director of Real Estate

Ed Johnson

Production and Creative Director

Peter Lettre

Photo Editor

Christe Wright

Designer

Lisa Medchill

Advertising Production

Joel Kimmel, Jordin Isip, Jonanthan Levy

Illustration Contributors

OBSERVER MEDIA GROUP

Jared Kushner

Publisher

Christopher Barnes

President

Barry Lewis

Executive Vice President

Jamie Forrest

Associate Publisher, Senior Vice President

Michael Woodsmall

Editorial Manager

Zarah Burstein

Marketing Manager

Mark Pomerantz

Controller

Tracy Roberts

Accounts Payable Manager

Accounts Receivable

Ian McCormick

Owners Magazine

OWNERS_2012_INDEX-INTRO.indd 4 9/13/12 4:28:35 PM

Untitled-15 1 9/12/12 11:27:22 AM

6 | OWNERS magazine 2012

As the World Turns

Leasing numbers are stiLL far from vibrant. but as tech and media companies

infiLtrate midtown south, spiLLover promises to affect every crevice of

manhattan, and, subsequentLy, the buiLding owners themseLves.

BY IAN THOMAS

A

s a pair of 26-foot steel beams were

hoisted high above Manhattan on April

30, the crowd below spoke of resilience,

hope and remembrance.

one world trade center had just hit a height of 1,271 feet, making

it the citys tallest building. port authority executive director pat

foye said in a press conference that the building will anchor Lower

manhattan and its rebirth for many generations to come.

but tourists and tristate residents arent the only ones noticing

the change in the city skyline. a number of commercial property

owners are looking to the tower and other developments as a hopeful

bellwether for the future, despite what most analysts still describe as

a stagnant market.

the numbers speak for themselves. real estate brokers leased 12.9

million square feet through July 31, 2012, a

28 percent drop from the 17.9 million square

feet inked during the same period in 2011,

according to a cbre report. vacancy sat at

7.5 percent, no change from a year earlier.

even so, theres a big thanks to be given to

midtown south, which has ridden the tech

and media boom in the area to the lowest

vacancy rate of all u.s. central business

districts in the second quarter of 2012,

according to cbre. the vacancy rate in the

area, which spans roughly from 34th street

to canal street, was 4.8 percent through July

31, compared with 6.9 percent at the same

time last year. Leasing activity is hot too, with

3.27 million square feet leased so far in 2012,

compared with 2.99 million square feet the

previous year.

needless to say, theres a lot riding on the 2.6

million square feet expected to be unleashed

onto the market when 1 wtc is opened in

2014 by the durst organization and the port

authority of new york and new Jersey. Larry

silersteins 4 world trade center, with its 1

million square feet of space, and edward minskoffs 51 astor place,

with its 400,000 square feet, are just a few of the high-profle towers

slated for ribbon-cuttings in the next few years, as more and more

property owners are hoping their gamble on downtown manhattan

pays off.

midtown south is a hot market for media and tech frms, with the

lowest vacancy in the country, which will lead to spillover in other

markets, said brookfeld offce properties chief executive dennis

friedrich, who operates seven buildings with 12.8 million square

feet downtown. given the pricing disparity that still exists between

midtown and downtown, we believe that downtown is likely to be

the greatest benefciary of this spillover effect.

the vacancy rate in the downtown market has continued to drop

since the third quarter of 2011, when it was 9.9 percent, according to

a report from cushman & wakefeld. it currently sits at 8.9 percent.

asking rents have decreased slightly to $40.06 per square foot from

$40.18 per square foot last quarter, according to the report, and the

infux of even more space may push tenants farther downtown.

historically, midtown was the location that companies focked to for

affordable rent following a recession, but thats not the case this time,

said Ken mccarthy, senior economist and senior managing director

at cushman & wakefeld, in a recent market report. instead, weve

seen companies look for space in the midtown south submarket, and

its so tight there that tenants are looking at neighboring downtown

and lower midtown, such as the garment district.

no company fts that description better than media conglomerate

cond nast, which will leave its times square

digs behind for 1 million square feet as the

anchor tenant in 1 wtc in 2015. marketing

and advertising research company nielsen

is also in talks to lease 160,000 square feet

in metLifes 85 broad street tower, moving

away from its vornado realty trust-owned

building at 770 broadway, according to the

wall street Journal.

tenants are going farther afeld to satisfy

their space requirements, said steven

durels, director of leasing and real property

at sL green, during a July 27 conference call.

that may mean a tenant who is on fifth

avenue, who you normally thought was going

to stay in another two- or three-block radius

of the current space, is now opening it up and

saying, ill go to midtown south because i

just like the lifestyle, or ill go farther west

because im chasing a lower rate.

but perhaps the two factors that will

dictate where big tenants will decide to

locate themselves will hinge on this: asking

rents in midtown are up more than four

dollars compared with last year, $64.46 per square foot in July 2012

compared with $60.18 per square foot in July 2011, despite the fact

that the vacancy rate actually increased 0.5 percentage points, from

7.7 percent to 8.2 percent, according to data from cbre.

the other key: midtown south only has seven available blocks of

space greater than 100,000 square feet, down by more than half since

2009, according to cushman & wakefeld.

the thing that downtown can do that midtown cant, is that

the downtown market can lease very large blocks of space and

Tenants are going farther

afeld to satisfy their space

requirements. That may

mean a tenant who is on Fifth

Avenue, who you normally

thought was going to stay in

another two- or three-block

radius of the current space,

is now opening it up and

saying, Ill go to Midtown

South because I just like the

lifestyle.

OWNERS_2012_THOMAS_OVERVIEW.indd 6 9/13/12 3:59:39 PM

ABS proudly represents property owners throughout the East Coast as advisors, managing agents

and/or leasing agents. Our commitment to excellence is based upon integrity, professionalism and

the ability to provide a wide range of services to the real estate industry.

absre.com

WE BUILD PARTNERSHIPS THAT LAST

For leasing information on any of our properties,

cohIacI Pichard Farley 212.400.2356

44 WALL ST 210 ELEVENTH AVE 380 SECOND AVE 20 WEST 22ND ST 547 BROADWAY

9 EAST 37TH ST 250 CANAL ST 200 PARK AVE SO.

270 MADISON AVE 162 FIFTH AVE 915 BROADWAY

19 UNION SQ WEST

407 BROADWAY 425 EAST 61ST ST

1001 SIXTH AVE

1ABSRE116_Owners Magazine.indd 1 8/22/12 2:58 PM

Untitled-15 1 8/29/12 2:25:14 PM

8 | OWNERS magazine 2012

accommodate that size, said Andrew Levin, senior vice president

of leasing at Boston Properties, which operates eight properties in

Manhattan totalling more than 8.6 million square feet.

Still, Mr. Levin said, the draw for companies to move into Midtown

has not declined, and leasing velocity and pricing are both stable in

the neighborhood.

Midtown Manhattan for Class A offce space is a fxed-supply

market, he said. If were at stable levels, then were doing well.

Boston Properties is set to boost that market when it opens the

1.1-million-square-foot tower known as 250 West 55th Street in 2014.

Law frm Morrison Foerster has signed up for space at the building,

and reportedly law frm Kaye Scholar will take space there as well.

Every 10 to 15 years, the market needs that introduction of new

stock, of new property for companies to move and expand into, said

Dave Cheikin, vice president of leasing at Brookfeld Properties. The

beneft of the New York City economy is that its diversifed enough

that if it fips around, it can still be steady.

Another steady aspect for the real estate market has been

concessions, with most property owners seeing little change.

Concessions have been pretty fat, Boston Properties Levin said

of the Midtown market, mentioning that theres typically been 6 to 10

months of free rent, and TIs between $50 and $60 per square foot.

It really depends on the size of the tenant youre talking about,

said Mr. Durels. If its a small tenant, call it 10,000 square feet or less,

youve got to deliver the space built, which is why youre not seeing us

stop the pre-build program.

Perhaps one of the most important changes on the horizon has to

do with the upcoming presidential election, as some owners suggested

that policy changes and a more optimistic view of the world economy

could boost leasing activity.

It feels like tenants are hesitant to make long-term lease

commitments until there is more clarity about the future, said

Nicholas C. Bienstock, managing partner of Savanna. The

uncertainties about the upcoming federal election, how government

regulation will affect fnancial institutions and their business models,

the continued deterioration in Europe and potential slowdown in

Asia make it diffcult for companies to feel optimistic about growth.

For a lot of potential tenants, the leasing environment right now is

at a stable place that could set up 2013 quite well.

I think a lot of people are getting their thoughts together for

the end of 2013, said Fred Posniak, senior vice president at W&H

Properties, which operates a portfolio that includes the Empire State

Building and 1 Grand Central Place. Summer is often a planning

stage, he said, adding that while leasing has been slow, his company

has had a very busy summer in terms of touring, which gives him

hope for the rest of the year.

Youre seeing a broader geographic search by a lot of tenants, and

thats whats adding a different twist to the competitive landscapes,

Mr. Durels said.

Whether the favored landscape in 2013 turns out to be Downtown,

the West Side, Midtown South or other perennial favorites, the

only thing certain is that every property owner will be looking up,

looking for the next glimpse of hope for the future of commercial

real estate.

OM

500

1000

1500

2000

2500

3000

3500

4000

1000

2000

3000

4000

5000

6000

7000

8000

Boston Properties, $3,983.2 million

Meraas Capital, $3,949.0 million

Goldman Sachs, $3,949.0 million

Paramount Group, $1,522.7 million

Allianz, $1,460.0 million

Carlyle Group, $937.3 million

Shorenstein Properties, $924.0 million

Abu Dhabi Invt Authority, $799.2 million

Kuwait Investment Authority, $705.0 million

Ashkenazy Acquisition Corp, $680.0 million

Macklowe Properties, $6,392.0 million

Prudential RE Investors, $928.7 million

Sorgente SGR, $799.2 million

Hiro Real Estate Co. $680.0 million

Caisse de Depot, $310.0 million

SL Green, $310.0 million

McSam Hotel Group, $280.3 million

JD Carlisle Development Corp., $275.0 million

DLJ RE Capital Partners, $275.0 million

Kushner Companies, $257.3 million

top 10 most active BUyers dUring recession

(dec. 2007-jUne 2009)

top 10 most active sellers dUring recession

(dec. 2007-jUne 2009)

OWNERS_2012_THOMAS_OVERVIEW.indd 8 9/13/12 4:00:03 PM

OFFICE LEASING

David Cheikin

212.417.7102 | david.cheikin@brookfield.com

RETAIL LEASING

Edward Hogan

212. 417.7062 | edward.hogan@brookfield.com

REDEFINING

LOWER MANHATTAN

worldfinancialcenter.com | Facebook.com/WFCNewYork | Twitter.com/WFCNewYork

A NEW DESTINATION COMING SOON

WATERFRONT DINING

CURATED FASHION

ARTS AND EVENTS

EXCEPTIONAL RESTAURANTS

LIFESTYLE AMENITIES

A SEAMLESS COMMUTE

West Street streetscape

West Street entrance pavilion Vesey Street outdoor dining

Untitled-18 1 9/10/12 9:17:35 AM

10 | OWNERS MAGAZINE 2012

Family Ties

THE NEXT GENERATION OF DYNASTIC COMMERCIAL REAL ESTATE SCIONS IS POISED TO

TAKE THE REINSEVEN AS YOUTHFUL NEW OWNERS ATTEMPT TO HOLD THEIR OWN

BY CARL GAINES

O

n a recent late-summer conference

call, William Rudin, Michael Rudin

and Samantha Rudin Earlsthree

members of one of New York Citys most

venerable commercial real estate families

were engaged in a bit of dactylonomy.

The three werent trying to come up with the number of buildings

currently in the familys commercial and residential portfolio, but

rather were adding up the number of family members currently

working at the company.

Thats two, four ... Some names were mumbled. After a little

back and forth, they settled on nine.

In a city known for the prominence of a handful of families in

commercial real estate, single names like Rudin, Durst, Rose, Muss

and LeFrak have come to symbolize the industry. These families

have survived the worst economic catastrophe since the Great

Depression while witnessing, along with the rest of us, the rise of

real estate investment trusts, the top three of which now have a

combined New York portfolio of roughly 67.6 million square feet.

In a era when the word dynasty is often overused and left to trail

behind words likelets face itsports or Kardashian, it nds

true meaning when one surveys these biggest families in New York

commercial real estate. Many of them, after all, are generations

old and still control vast portfolios of properties while wielding the

type of power that only comes with reputation and recognition.

Theyre also doing something else quite extraordinary, given the

times: theyre building. This past spring, Richard LeFrak and P

H

O

T

O

S

:

S

T

E

V

E

F

R

I

E

D

M

A

N

A

N

D

R

E

B

N

Y

(Top left) Sam Lefrak, Governor George Pataki, Ambassador

Charles Gargano, Richard Lefra; (Top Right) Larry Silverstein,

Burt Resnick; (Bottom left) Bernard Mendik, Harry Helmsley;

(Bottom right) Lew Rudin, Bill Rudin, Jack Rudin.

OWNERS_2012_Gaines_DYNASTY.indd 10 9/13/12 3:43:23 PM

Brooklyn Bridge Park

Advised Toll Brothers City Living in their joint venture with Starwood Capital

to transform Brooklyn Bridge Parks pier one site into a vibrant mixed-use

community with a 200-room hotel and 159 waterfront residences.

The Woolworth Building

Advised the joint venture owners of the Woolworth Building in the

conversion of the top 30 oors to a residential condominium unit, and the

$68 million sale of the unit to Alchemy Properties.

Union Square Hotel Acquisition

Represented Hersha Hospitality Trust in its $104 million acquisition of the

178-room Hyatt Union Square Hotel.

Empire State Building Mortgage Financing

Advised Malkin Holdings, ownership supervisor of the Empire State Building,

in connection with a signicant mortgage nancing for the building.

Starrett-Lehigh Building

Advising RXR Realty in ofce and retail leasing at the 2.3 million square-foot

Starrett-Lehigh building, one of Manhattan's ten largest ofce buildings.

Landmarked Manhattan Building

Helped one of the nations largest banks successfully navigate their

branding plan for a landmarked Manhattan building through approvals by

the New York City Landmarks Preservation Commission.

Domino Sugar Complex

Advised Community Preservation Corporation in the acquisition, nancing,

development and rezoning of the 11.5-acre waterfront complex in

Williamsburg, Brooklyn, formerly home to Domino Sugar.

The High Line

Representing Sherwood Equities in the acquisition, nancing and

development of several West Chelsea sites near the High Line Park, including

508 West 20th Street and 360 Tenth Avenue.

Acquisitions & Sales

Cooperatives, Condominiums

& Community Associations

Development & Construction

Government Relations

Joint Ventures Public and Private

Land Use & Environmental

Leasing

Loan Workouts, Restructuring

& Foreclosures

Real Estate Finance

Real Estate Litigation

www.herrick.com

A real estate powerhouse

Crains New York Business

One of the biggest practices

in the city

The Real Deal

%SRIWXSTWLSTJSVVIEPIWXEXIQEXXIVWPPIH

[MXLTVEGXMGEPERHFYWMRIWWQMRHIHEXXSVRI]W

Chambers USA Guide to Leading Lawyers

ATTORNEY ADVERTISING

Untitled-8 1 9/12/12 9:46:27 AM

12 | OWNERS magazine 2012

his sons spoke to The New York Times about their 600-acre mixed-

use Jersey City development called Newport, which had entered

its fnal phase. And, according to a spokesman, excavation work is

underway on the site for Durst Fetners multifamily tower on West

57th Street and the West Side Highway.

New York real estate is a tough business to break into, and the

next generation of these families commercial real estate elites is

poised to take the reins, even as some young upstartsundeterred

by a family background that doesnt include vast real estate

holdingslook to make their mark.

One member of that next generation, Ms. Rudin Earlsvice

president at Rudin Management and great-granddaughter of

Sam Rudin, who founded Rudin Management Co. along with his

brotherswas almost bound for a different stage.

I studied theater at Tisch at NYU for four years, and guess I

didnt have enough courage, really, to go out on auditions, Ms. Rudin

Earls explained while on the call with her father and brother.

The next-next generation of Rudins was on the call as wellMs.

Rudin Earlss newborn daughter. She didnt have much to add, but her

presence on a call about the family business wasnt out of the ordinary

in the context of how talent is cultivated at Rudin Management.

I would go to meetings, because our father would always

invite us to meetings, even before I started working, Ms. Rudin

Earls remembered. In 2007 I started to work full time and then

one day realized, as I was walking though the lobby of our offce

building345 Parkthat it just felt like home to me, and Ive never

really looked back.

Ms. Rudin Earls said that, though she still loves the theater, she

was drawn in by the appeal of working for her family, whose New

York offce holdings alone are sizeable.

For Samanthas brother Michael, an associate at Rudin

Management, a desire to learn about the family business was

solidifed during the dark days following September 11, 2001.

Hard times for all, they were made even darker by the death of his

grandfather, Lewis Rudin, then head of the family dynasty, a little

over a week later.

I took a semester off of high school after our grandfather passed

away, he said. I basically shadowed my father for about six months

to really learn exactly what it was that our family did in real estate.

He was 16 at the time, and said that it was the frst time that he

could really grasp what the family did, at least in any signifcant

way. Bill Rudin later pointed out that the idea for the time off was

his wife Ophelias.

Regardless, after a little in-depth exposure, Michael said he

knew the real estate business was for him.

Both siblings said there was no pressure to join the businessthey

came to it on their own, though both were immersed in it growing

up. Steve Spinola, president of the Real Estate Board of New York,

which will soon see another member of this new generation ascend

to its chairman spot, said that this immersion is a key factor.

For those who have grown up observing the business and

experiencing it daily, the vision is innate, and its exciting to see what

each subsequent generation will do to build upon the legacy that has

been left to them, Mr. Spinola said. As we welcome our soon-to-be-

chairman, Rob Speyer, who will be the youngest and also the frst

third-generation [member] of the same family to hold the title, it is

clear that the younger generations of real estate families continue

the tradition of a deep understanding and commitment to our city.

1896

The Real Estate

Board of New York

forms with 27

members

1890

1901

The LeFrak

Organization formed

1902

Rudin Management

formed

1906

Muss Development

formed

1909

The Kaufman

Organization formed

1915

The Durst

Organization formed

1919

George Comfort &

Sons formed

1923

Brookfeld formed in

Montreal

1926

Ackman-Zif formed

1928

Rose Associates

formed

1928

Jack Resnick & Sons

formed

1929

Stock market

crashes

1934

Malkin Properties

formed

1943

Mayor LaGuardia

proposes to

establish fashion

district

1946

REBNY celebrates

50th anniversary

OWNERS_2012_Gaines_DYNASTY.indd 12 9/13/12 3:43:35 PM

OWNERS magazine 2012 | 13

Jason Muss, a principal at Muss Development and great-

grandson of Isaac Muss, the frms founder, said that New York real

estate is exciting because of its scale. For him, growing up within

the business sparked an interest, but hes quick to point out that

getting into real estate without the family name just would have

been a different process.

Isaac Muss founded Muss Development, the company Jason

now leads with his father, Joshua, in 1906. Over the years, the

company has owned, developed and managed about 15 million

square feet of commercial real estate throughout the fve boroughs

and Long Island. Among its current roster of projects are the

1.5-million-square-foot, mixed-use Brooklyn Renaissance Plaza

and New York Marriott at the Brooklyn Bridge, the conversion

of 36,000-square-feet at 345 Adams from offce to retail and the

Oceana Condominium & Club15 buildings and 1.2 million square

feet on the ocean in Brighton Beach.

Like others in the real estate families younger generation, he said

he was genuinely interested in the feld and didnt feel pressured by

family members.

I thought I was going to be a baseball player when I was about

10, Mr. Muss said, laughing. Besides that, listen, I went to law

school probably thinking that it was going to be more like business

school than law school. I didnt intend to practice, but its a very

helpful thing for the real estate world. So I never really thought

about doing anything else.

Hes been working for the family business since he graduated

from NYU School of Law in 1996.

But in addition to being realistic about the doors that being a

Muss openedIt puts you on a faster track, maybehe also

insists that it isnt a requirement, and that those open doors come

with not a small amount of responsibility.

Its something that you have to constantly think about and make

sure that youre living up to past generationsthat youre doing

things the right way, he cautioned. People know that behind the

name theres a certain reputation, which were very fortunate to

have, in terms of integrity and the way that we do business. All of

us here beneft from that and make sure not to screw it up. Thats

job one: Dont screw up the reputation.

F

or every real estate dynasty looking to preserve a reputation,

however, there are dozens of young upstarts busily building

theirs. Theyre also busy building something else that

dynasties generally have in abundancecapital.

If youre speaking to real estate familiesthird- or fourth-

generation guystheyre focused on preserving wealth, said

Gregory Jones, who along with his brother Graham started GRJa

fund that has been buying multifamily properties in Manhattan,

starting with the purchase of 227 East 89th Street in November

2011.

Theyre good-looking and well-dressed and look more upstairs

than downstairs, more Bridgehampton than bridge-and-tunnel.

But the New Jersey brothers said they werent funded by anyone.

Graham and I used our own savings, Gregory Jones said of how

they got their start. We were not funded by anyone, we were not

fnanced by anyone, we didnt have any investors ...

Before buying 227 East 89th Street, they had deposits on several

buildings, only to have the deals fall through. It was a hair-raising

process, one that involved putting large amounts of their

2012

Circa 1950s

Fisher Brothers

formed

Circa 1950s

Cohen Brothers

Realty formed

1954

Harry B. Helmsley

takes over as

REBNY Rent Control

Committee Chair

1957

Silverstein

Properties launches

1958

Newmark Holdings

formed

Circa 1960s

Macklowe

Properties formed

1968

Paramount Group

formed

1969

Biggest housing

boom in NYC begins

1970

Mortimer

Zuckerman and

Edward Linde form

Boston Properties

Circa 1970s

Winoker Realty

formed

1973

52 structures

totaling 53.5 million

square feet added to

skyline

1978

Tishman Speyer

Properties formed

Circa 1980s

Real estate market

soars

1980

Stephen L. Green

forms SL Green

Properties

1982

Two Guys formed. It

would later become

Vornado Realty Trust

1983

Jamestown

Properties formed

1985

Blackstone Group

formed

1985

Himmel & Meringof

formed

1987

Stock market meltdown

1996

Conde Nast signs

large lease at Four

Times Square

1996

REBNY celebrates

100th anniversary

1997

SL Green goes

public

1997

Boston Properties

goes public

2000

L&L Holding

Company formed

2010

Forest City Ratner

breaks ground

at site of future

Brooklyn Nets

home

OWNERS_2012_Gaines_DYNASTY.indd 13 9/13/12 3:43:47 PM

14 | OWNERS MAGAZINE 2012

personal savings downGrahams earned while working at a real

estate private equity rm and Gregorys from banking.

It also involved a great deal of savvy and ingenuity in nding

buildings to target in the rst place.

Nobody knew that 227 East 89th Street was for sale, Graham

said. You cant buy anything that Massey Knakal is sending out to

you. Youve got to bring some type of value to what youre doing.

Following 227 East 89th Street, a ve-story walk-up between

Second and Third Avenues, the brothers bought three multifamily

buildings at 50-58 East Third Street, bringing their total portfolio

of buildings to four. They said that they anticipate making an

additional purchase before the year is out, proving that the

toughest part about breaking into the business may simply be

gaining traction and momentum.

Part of the whole process of breaking in has to involve nding

ways to compete with the dynasties, or at least circumvent them.

So in addition to nding smaller deals like 227 East 89th Street that

arent actively being marketed, the brothers also compete, they

said, by sticking their necks out further.

Honestly, we spend a good amount of our time cold-calling owners

and trying to get them to sell us their buildings, Gregory said.

We take a lot of risks that other people arent willing to take,

because at the end of the day we really dont have any option,

added Graham. Its not like throwing darts at the dartboard, but

were willing to make bets that other people might not be willing

to make.

S

amantha Rudin Earls and her brother Michael currently help

run Rudin Management with those numerous relatives they

counted offincluding their uncle Jack, who is chairman,

and their cousin Eric, who is vice chairman and president.

The siblings both worked on the recently 100-percent-sold 130

West 12th Streetthe familys condominium development, which

was marketed by Stribling Marketing Associates.

I actually just had a baby, and the day my baby was born we had

our rst closing, and it felt like that was sort of my rst baby, Ms.

Rudin Earls said. It was such an amazing experience working with

the architect and the marketing team, Stribling, and our family and

the designers from Jed JohnsonArthur Dunnam and Heather

Moore.

Michael, who stayed out in Colorado after graduating from the

University of Colorado at Boulder, moved to Aspen to pursue real

estate opportunities of his own and to get my feet wet a little bit,

as he describes it. He subsequently bought a commercial building

there that is currently being redeveloped.

But when I started working for the family full time about three

years ago, [that] was right around the time that we started working

on 130 West 12th Street, he said, adding that the Saint Vincent

project has also been pretty amazing to work on, for the vantage

it has provided on the different stages of development.

With their different educational backgroundsMichael studied

urban planningthe siblings bring different eyes to challenges

facing commercial real estate in New York today, like sustainability

and marketing. William Rudin said that it was crucial to pay close

attention to ideas coming not only from his children, but from the

other young people who work for the company.

Theres no question about it, he said. And I think Eric and my

sister Beth and my other cousinsfor us, we get in a room and have

discussions, and everybody puts their ideas on the table and vets them.

He credits Michael with adding to the companys knowledge

base in sustainability and Samantha with design and marketing

toucheslike using pieces from her Aunt Beth Rudin DeWoodys

internationally renowned art collection to stage apartments at 310

West 12th Street. People came for the art and ended up buying.

Thats thinking outside the box and connecting the family into the

whole process, William Rudin said.

And what about that youngest Rudin on the call? Are family

members already scoping out a career in commercial real estate

for her? Shes going to be a fashion model, Samantha said of her

daughter. When you got it, you got it.

OM

cgaines@observer.com P

H

O

T

O

S

:

S

T

E

V

E

F

R

I

E

D

M

A

N

A

N

D

R

E

B

N

Y

(Left) Charles Benenson; (Right) Harry

Helmsley, Irving Schneider.

OWNERS_2012_Gaines_DYNASTY.indd 14 9/13/12 3:43:58 PM

www.paramount-group.com

212.237.3100

NEW YORK - WASHINGTON, D.C. - SAN FRANCISCO

60

Free iPhone/iPad

Mobile Application

Our Trophy Portfolio - Over 14 million SF

Owner/Operator - For over 40 years

Disciplined Class A Office Strategy for 15 years

MARKET

ONE

Commercial Observer 7.875x9.75 V2_Paramount 8/20/12 5:21 PM Page 1

Untitled-11 1 9/12/12 10:28:48 AM

16 | OWNERS magazine 2012

Fuzzy Math

New York CitY propertY taxes haveNt offiCiallY riseN iN more

thaN a deCade. so whY have ColleCtioNs doubled siNCe 2001?

By Daniel GeiGer

A

few years ago, a city Department of

Finance official noticed irregularities

in the way certain residential properties

had been appraised by the agency, leading to

slightly lower-than-normal valuations.

to compensate, the offcial suggested the department decrease

its assessments across the board for the group, which mostly

comprised single-family homes and small co-op buildings in an

area of one of the boroughs.

dropping the valuations slightly below usual thresholds would

reduce the taxes the city could collect, but only by a few percentage

pointsa seemingly harmless amount in the face of the billions of

dollars the agency assessesand it would allow the department to

restore uniformity and equanimity to its calculations, one of the

mandates of its process.

what appeared to be an innocuous adjustment, however,

garnered a backlash that was swift and forceful. top offcials at

the department were summoned to mayor bloombergs upper

east side townhouse. there they were confronted by the mayor

and irate senior executives from the citys budget offce, the person

said. though the theme of the meeting was ostensibly to discuss

the irregularities and why the department had chosen lower

assessments, the underlying message was clear: dont trife with the

citys revenue.

i feel like we got taken out to the backyard to get whipped, the

source said, requesting anonymity because of the sensitive nature

of the meeting.

the episode would seem to lend credence to a complaint that

real estate industry executives and advocates have voiced for years.

though the city has not raised real estate tax rates in a decade,

these people say it has used a complex appraisal process to arrive

at values that essentially accomplish the same thing, albeit far

more conveniently, because it allows elected offcials to avoid the

political repercussions of lifting the tax rate.

indeed, total collections on commercial buildings have jumped

from about $3.8 billion in 2001 to nearly double that today.

few industry observers would disagree that commercial and

residential property has appreciated dramatically in that time. but

the fact that property taxes never fagged, even in the aftermath

of a serious recession, is evidence, analysts insist, that the city has

come to treat real estate as a golden goose for revenue.

we had four years of falling prices, but real estate tax collections

never fell, said robert knakal, a chairman at the real estate

brokerage and services company massey knakal, said. how does

that even work?

when mr. knakal launched his real estate career in the 1980s,

the city used a different method of calculating real estate values

that was more closely tied to sale prices. the formula was altered in

the early 1990s, he said, a conspicuous juncture for those who feel

the city has been leaning too heavily on the industry for revenue,

because that was when the recession of that period began pulling

values down.

values started to drop, and then suddenly the old appraisal

system wasnt good anymore and the city abandoned it, mr. knakal

said, suggesting the city had adopted a newer methodology during

that period in order to raise collections from the industry.

to calculate an assessment for an offce building, the city frst

determines its income, which owners are required to report every

september, then plugs that number into a rate of return for the

property and deduces the value. detaching the process from

the value of a building as determined by its sale, or the sale of

a comparable asset, is not a decision landlords argue with, even

though a sale-price-based method would clearly have brought

taxes down during the recession when landlords were looking

for breaks. property values during that period plummeted by

40 percent. the fip side of such a system, however, would mean

that, as property sale prices have shot up during times of frenzied

buying, landlords across the city would have had to suffer the

consequences on their tax bills. M

I

C

H

A

E

L

K

A

P

P

E

L

E

R

/

A

F

P

/

G

E

t

t

y

I

M

A

G

E

s

OWNERS_2012_GEIGER_PropertyTax.indd 16 9/13/12 3:41:31 PM

Untitled-2 1 9/11/12 2:10:48 PM

18 | OWNERS magazine 2012

You could have an owner coming in from some far-off place and

he just wants to plant his money in a safe haven, and hes willing to

pay a very high price and accept a 2 percent cap rate, but thats not

the value I or another investor might pay, landlord and developer

Edward Minskoff said.

W

hile owners generally agree with the rationale of

an income-based approach, many criticize certain

assumptions the city makes in its process. For instance,

city appraisers factor in both market vacancy rates and rents when

determining the value of an owners empty space, assumptions

that often sway value higher. So if a Midtown building has, say, a

20 percent vacancy rate, the Department of Finance would blend

that with the neighborhoods overall vacancy, which is currently

around 10 percent, and arrive at a 15 percent estimate. Average

rents would be used to then determine income from that phantom

occupancy.

The valuation process gets more complicated in determining the

cap rate for the property, the return a building earns. To calculate

this fgure, the city weighs a number of factors, including the debt

a building may carry, which it constructs from prevailing market

lending rates and leverage levelsdebt

that may or may not correlate with the

actual fnancing on a property. Some

landlords say the city has been quick

to adopt lower cap rates, which infate

values, as the sales market in Manhattan

swiftly recovered in the aftermath of the

recession.

The assessments are a snapshot of cash

fow right now, but it often fails to weigh the

real fnancial conditions of the building,

said Michael Lippman, an attorney

with the frm Sherman & Gordon who

represents major landlords in contesting

their property values with the city.

I think the city makes an effort to

get it right, he added. Its a complex

process.

The result has been that property

taxes for commercial buildings have

risen steadily. Data released by the city and an individual analysis

of the tax bills for several major offce buildings show that

assessments have grown since at least the mid 1990s. During the

last 10 years, total collections for commercial properties in the

city doubled from $3.87 billion in 2001 to $7.67 billion this year,

even though the period includes two recessions.

To those who balk at the level of taxes the city levies from the

real estate sector, the numbers indicate a system designed to

capture steady gains but cede few, if any, declines.

Others, of course, disagree.

Allan Schwartz, a real estate tax attorney, says the steady or

rising building assessments of recent years is due to the fact that

real estate income is typically locked in through long-term leases

that are not impacted by rocky economic times.

Its a common-sense question: how is it possible from 2007 to

now, a few years after we have suffered a recession, for building

values not to have gone down? Mr. Schwartz said. Its because

buildings incomes havent necessary suffered. And the city is

using that income to calculate the values.

But Mr. Schwartz also said that tax gains have begun to consume

an unprecedented portion of the income landlords generate from

rents, a sign that tax growth has outpaced infation and other

reasonable measures of growth.

The taxes are approaching 24, 25, 27 percent of the rents

commercial landlords collect, Mr. Schwartz said. Numerous

sources familiar with taxes in other major cities in the U.S. say that

New York Citys tax burden is far higher than in other markets.

The situation doesnt just put a strain on owners but also on

tenants, affecting the economic fabric of the entire city, landlords

say. Thats because most leases in the city are structured to pass tax

increases on to the tenants in a building during their occupancy.

The costs make it more diffcult for companies to afford to operate

in a city that is already expensive, landlords say.

It would defnitely incentivize more and more companies to

want to be in the city if taxes went down or stopped rising, Mr.

Minskoff said. It would be very positive because, by lowering

taxes, the city could actually increase its tax base, because more

tenants would want to be here.

Mr. Minskoff, who is in the process of building a 400,000-square-

foot offce property at 51 Astor Place, said taxes have been

an especially big hurdle for new

development in the city, construction

that is widely seen as necessary to keep

Manhattans offce stock competitive

with other global cities. Landlords

already have to charge premium rents to

justify the cost of these developments,

Mr. Minskoff explained, and the tax

payments that get layered on top of

the base rents make committing to

such projects an even more expensive

proposition for tenants.

The Real Estate Board of New York, the

citys largest and most powerful real estate

industry and lobbying group, has stepped

up efforts to intervene on the issue in

the hope of staving off further increases.

Mary Ann Tighe, chairwoman of the trade

association, told The Commercial Observer

that taxes would be a leading issue for

the incoming REBNY chairman, Robert Speyer, a top executive at

the investment company Tishman Speyer, when he succeeds her in

January of next year.

[Its a] huge issue, she wrote in an email.

Surprisingly, some real estate executives interviewed were

either resigned to or even supportive of the citys collection

efforts toward the industry.

No one complains when theyre buying or selling properties at

$1,000 or $1,500 a foot that in 2005 and 2006 they were paying

$700 or $800 [for], said Norman Sturner, chief executive of

the real estate investment frm Murray Hill Properties. No one

complains that the city has 4 million vistors a month, which is

making the retail, hotels and everything else do incredibly well.

[And] no one complains that since 9/11 we have been safe.

All of these things cost money, and where does it come from?

he added. I will not complain about a rise in taxes that are being

spent properly, and it seems that they have.

dgeiger@observer.com

We had four years of falling

prices, but real estate tax

collections never fell, said

Robert Knakal, a chairman at

the real estate brokerage and

services company Massey

Knakal, said. How does that

even work?

OM

OWNERS_2012_GEIGER_PropertyTax.indd 18 9/13/12 3:41:46 PM

New York Headquarters

One Battery Park Plaza

26th Floor

New York, NY 10004

(212) 972-3600

Relationship Driven. Execution Focused.

In the mortgage business, transacting ability

matters. But relationships matter even more.

For more than 20 years, Meridian has stood

prominently at the cross-section of the most

active lenders and deal makers. During that

t|me, no fnanc|ng |ntermed|ary |n New York

has earned the trust and confdence that

Meridian enjoys.

Nor can anyone match our track record.

ln New York O|ty a|one, we have comp|eted

more than 21,700 transactions totaling over

$90 b||||on, many on beha|f of the wor|d`s

most soph|st|cated owners.

We built our reputation by leveraging our

unique relationships to provide building

owners a broad array of propr|etary

solutions featuring the most favorable

terms and fex|b|||ty |n the marketp|ace.

Please contact Meridian today. And let

us put our deep relationships, market

know|edge and exper|ence to work for you.

350 Park Avenue

New York, NY

Ofce Property

585,000 Sq. Ft.

$300,000,000

Ba|ance Sheet Financing

Columbus Square

New York, NY

Retai| Portfo|io

500,000 Sq. Ft.

$280,000,000

Ba|ance Sheet Financing

568 Broadway

New York, NY

Ofce Property

350,000 Sq. Ft.

$200,000,000

Conduit Financing

www.meridiancapital.com

B&L Portfolio

New York, NY

Mu|tifami|y Portfo|io

25 Bui|dings

$160,000,000

Agency and Ba|ance Sheet

Financing

2012 Owners Magazine vFINAL.indd 1 9/13/12 12:02 PM

Untitled-27 1 9/13/12 12:41:31 PM

20 | OWNERS MAGAZINE 2012

Does Size Matter?

IN A REAL ESTATE INDUSTRY FILLED WITH GOLIATHS, DAVIDS ABOUND.

BY IAN THOMAS | ILLUSTRATION BY ED JOHNSON

O

n a balmy July afternoon, a few members of

SL Greens management staff pushed their

way through the revolving doors of 711

Third Avenue, the companys 500,000-square-foot,

20-floor tower between 44th and 45th Streets.

They passed through the gallery-style lobby, framed by both Greek

Thassos white and De Savoi grey-blue marble, carrying a few boxes.

An original Hans Hoffman mosaic mural, designed in 1956, adorned

the hallway farther down.

They sliced open the boxes and put on green aprons emblazoned

with the rms stylized logoand so the ice cream party for the

buildings tenants began.

In a market full of haves and have-nots, there are benets to being

the biggest sh in the pond.

SL Green, with more than 24 million square feet of Manhattan

ofce space, is the whale shark of the market, commandeering world-

class buildings with more features than a CLS-class Mercedes, and

offering clients a whole lot more than Italian ices and chipwiches

on a hot day.

But in the sea of buildings across the city, there are plenty of sh

awaiting their day to become the predator, and most possess game

plans similar to the big guys.

We try to buy very well located buildings, and our management

strategy is to be very hands-on, said Kenneth Aschendorf, a principal

at APF Properties who oversees the companys New York portfolio.

APF Properties buildings include 28 West 44th Street, a

370,000-square-foot asset the company purchased from SL Green in

a joint venture with Prudential Real Estate Investors for $161 million

in 2011, and 24 West 57th Street, a 110,000-square-foot building in

the Plaza district.

It would be a lot less expensive to outsource the management,

but we are very mindful of our tenants complaints and experiences,

said Mr. Aschendorf.

APF went a step further to make sure the company was aware of

its customer concerns at that building: it became a tenant itself. It

leased 5,000 square feet for 10 years on the seventh oor of what

is now called the Club Row Building after nearby collegiate clubs

Harvard, Cornell, Princeton and Penn.

Were going to be renovating all of the common areas, as well

as the elevator cabs, bathrooms and windows, Aschendorf told The

Commercial Observer when the move was announced in June 2011.

While the issues the commercial real estate market currently faces

affect all property holders, no matter their size, some smaller owners

shared a sense of optimism about the varied types of businesses

hoping to call the city home.

New York City has shown some remarkable strengths, which

we see reected in leasing across our portfolio and tenant base,

including growth in technology, new media, education, health care

and professional services rms, said Nicholas Bienstock, managing

partner of Savanna, which operates 3.4 million square feet of space

across Manhattan, including 100 Wall Street and the landmarked

104 West 40th Street.

The company has been bolstered in recent months by a urry of

OWNERS_2012_THOMAS_SmallOwners.indd 20 9/13/12 4:00:35 PM

OWNERS magazine 2012 | 21

top 10 most active BUyers

jUly 2011- jUly 2012 (in millions)

top 10 most active sellers

jUly 2011- jUly 2012 (in millions)

leasing deals as well as by

the purchase of 576 Fifth

Avenue, a 72,000-square-

foot offce building, after it

took the propertys defaulted

frst mortgage in February

2011, as reported in The

Commercial Observer.

The small tenant

market that we cater to

remains fairly active, and

by providing good value to

those tenants, we continue

to sign leases at a decent

pace, Mr. Bienstock said.

Small tenants have been

strong in a stagnant market

and, as a result, so have the

rental market and asking

rents for owners.

Rents in Lower Manhattan for the smaller deals, those under

16,000 square feet, have frmed up and, in some circumstances,

have moved up slightly, said Kent Swig, president of Swig Equities.

I would attribute this to the more diversifed tenant base, growth

in the creative industries and from more tenants looking to move

Downtown.

Swig, which operates 1.3 million square feet in Manhattan, mostly

in the Financial District at buildings like the 900,000-square-foot 100

William Street, which the company signed a $161.5 million loan to

refnance and is now 97 percent leased .

Complementarily to rents increasing, there has been a

corresponding slight fnancial improvement for owners, resulting

from reduced amounts of free rent and work allowances needed to

complete lease transactions, said Mr. Swig.

In addition, investment in property in Manhattan and the city as

a whole hasnt been as badly affected by the global recession, said

Savannas Mr. Bienstock.

If you are an international investor who wants to invest in the

United States, you want to invest in two to three gateway cities, led

by New York, so New York will beneft disproportionately from that

capital fow and investment, he said.

But at the end of the day, it doesnt matter what type of tile your

building is foored in, how much ice cream you give away or how

many buildings you own; the success of a commercial property owner

comes down to one important detail.

Its not rocket science: its 100 percent customer service, said Fred

Posniak, senior vice president at W&H Properties, which operates

the one of the citys most recognizable buildings, the Empire State

Building. Once the lease is signed, that should only be beginning.

At 1359 Broadway, a 22-foor, 476,403-square-foot building located

in Midtown that W&H Properties owns, Mr. Posniak said, tenants

demanded a quality white-table restaurant.

We want to know whats wrong, not whats right, and thats what a

landlord should do. Mr. Posniak said. Its all about what do I do that

differentiates me from others.

The company is now seeking a high-end restaurant to fll the retail

spaces in the building, he said.

Its simple: happy tenants renew and they make referrals, said Mr.

Posniak.

Words for all owners to live by, no matter how big a fsh they are.

OM

The small tenant

market that we cater

to remains fairly active,

and by providing good

value to those tenants,

we continue to sign

leases at a decent

pace, said Savannas

Nicholas Bienstock.

500

1000

1500

2000

500

1000

1500

2000

2500

Vornado Realty Trust, $2,262.7 million

SL Green, $ 1,200.1 million

RXR Realty, $1,200.0 million

Rockwood Capital, $1,081.0 million

Crown Acquisitions $1,014.8 million

Lehman Brothers Holdings Inc, $988.6 million

Jef Sutton, $799.7 million

JP Morgan, $710.0 million

Sahara India Pariwar, $649.4 million

MetLife, $637.5 million

Chetrit Group, $1,792.7 million

Bank of America, 1,482.6 million

Kushner Companies, 1,260.4 million

Carlyle Group, 1,154.4 million

Barclays Group, 1,132.6 million

Rockpoint Group, 1,101.4 million

L&L Holding, 847.0 million

Crown Acquisitions, 816.3 million

Goldman Sachs, 797.2 million

Lehman Brothers Holdings Inc, 790.5 million

OWNERS_2012_THOMAS_SmallOwners.indd 21 9/13/12 4:00:49 PM

22 | OWNERS MAGAZINE 2012

The Feminine Mystique

IN A TESTOSTERONE-DOMINATED INDUSTRY, LESLIE WOHLMAN HIMMEL DEFIES THE ODDS

BY DANIEL EDWARD ROSEN

C

urious onlookers often wonder aloud

whom Leslie Wohlman Himmel is

married to.

The question has less to do with her romantic life than with her

rise as one of New York Citys few female building owners, a position

she has navigated with aplomb as one half of Himmel + Meringoff

Properties, the real estate ownership group she has overseen with

partner Stephen Meringoff for nearly three decades.

To hear it from colleagues, competitors and peers, her gender has

caused many to presume, incorrectly, that she either married into

the industry or had exchanged vows with her partner in

business, Mr. Meringoff.

She arrived on the scene, not from a New York City

family, said Mary Ann Tighe, chief executive ofcer

of CBRE. In the early years, when she was acquiring

properties, people would say, Whos she related to?

The number of women who can actually boast the title

owner-slash-landlord is slim, largely due to difculties

in obtaining capital. Women like Laurie Zucker of

the Zucker Organization, Helena Durst of The Durst

Organization, Amy Rose of Rose Associates, and Veronica

Mainetti of the Sorgente Group are notable landladies

in a male-dominated eld of New York owners. Alas,

they, like Ms. Himmel, are outliers in an era when it is

becoming harder for women to earn the money required

to elevate them to the same ranks as male owners.

Women traditionally make less pay than men,

leaving less money available to them for startup capital,

said Jennifer Carey, president of the Association of Real

Estate Women.

Leslie Himmel is a very rare breed to have been able to create

and grow the business she created with her partner into such a

successful company, Ms. Carey added.

The White Plains native was not a real estate scion, but rather

the daughter of an accountant and a housewife.

After graduating from the University of Pennsylvania and

Harvard Business School, Ms. Wohlman Himmel joined Integrated

Resources, a New York Stock Exchange Syndicator, for which she

procured properties across the country. It was during that time that

friends helped sneak her into the Real Estate Board of New Yorks

annual gala, where, upon hearing the premier landlords of that

eraHarry Helmsley, Larry Silverstein, Bernie Mendickspeak,

Ms. Wohlman Himmel had an epiphany.

I realized at that point, having the experience of buying with

other peoples money on behalf of a public company, that I wanted

to one day be an owner myself, said Ms. Himmel.

She went into business with Mr. Meringoff in 1985, and the two

quickly snapped up properties while leaving those on the sidelines

to wonder if they were more than just business partners.

I hate to say it, but in the mid-80s, I think people thought we

were married, said Mr. Meringoff, who, in fact, is not married to

Ms. Wohlman Himmel (that distinction belongs to Alan Shuch, a

retired partner and advisory director at Goldman Sachs.)

Leslie said, No. Were just a business, added Mr. Meringoff.

Indeed, Himmel + Meringoff is a business, and a successful one

at that. Since 1985, it has amassed a portfolio estimated at more

than $500 million.

Ms. Himmel is arguably New York Citys most prominent female

landlord, and she belongs to the small sorority of female building

owners who inhabit the male-dominated world of commercial real

estate. She insists that the disparity still surprises her.

I dont actually understand it, said Ms. Wohlman

Himmel. I sit at the [REBNY] Executive Committee

table and I am the only woman owner. I dont understand

why, because there is nothing that unusual about the

tasks involved with the business: The math, the law.

Women are certainly capable.

Ms. Himmel believes that in the world of Manhattan

real estate, where there is a will there is a wayas long

as that will has access to substantial capital.

You just have to really believe in yourself and in

your ability to create business opportunities and make

money with it, and you have to convince others to give

you money to do that, she said. I dont think there is

anything stopping women from doing that at all.

She has a good eye for the assets themselves, said Ms.

Tighe. And shes picked the right partner in Meringoff:

shes the quant, hes the lawyer, and they both speak

each others languages.

Among her favorite deals was the one for 158 West

27th Street, a building Meringoff + Himmel closed on in December

2010 for $25 million.

We had looked at it before it came on the market at all and had

the opportunity to buy it directly from the lender, she said.

What helped that deal, and other deals she has closed in recent

years, was the favorably low interest rates.

Weve been a bit concerned that at these historically low cap

rates at these very high prices, that when the interest rates snap

backwhich we think they will in a few yearswere a little

concerned that people are getting too aggressive on the cap rates

for the secondary ofce buildings, she said.

Competing in a market ooded with foreign funds and public

investment vehicles has been tough, she concedes.

The dynamics of New York are constantly changing in terms

of ofce market opportunities, she said. Were lucky. We have

approximately 2 million square feet and a portfolio that had huge

increases in tenant rents, and weve enjoyed this wave, although

weve been frustrated in trying to buy new properties.

OM

drosen@observer.com

OWNERS_2012_ROSEN_HIMMEL.indd 22 9/13/12 3:52:16 PM

Untitled-1 1 9/12/12 12:57:02 PM

24 | OWNERS magazine 2012

Home Turf

From Washington Heights to Lower Manhattan,

nearly every neighborhood includes at least a little

offce space. And while it can be diffcult to discern

on the ground, most neighborhoods and ZIP codes

have a single, predominant landlord who rules

the roost. To determine who controls each of the

boroughs nearly 50 ZIP codes, we combed the

portfolios of the Manhattans 20 largest owners

and drafted a turf map of sorts. In cases where

none of the 20 largest landlords owned offce

property, such as in some areas of the Lower

East Side and the West Village, no victor is listed.

Gathered from each companys offcial website and

media liaisons, as well as the United States Postal

Service, the data includes ZIP codes for single

buildings, numbered in inset maps. OM

Single-Building Zipcodes

M

a

p

b

y

j

o

n

a

t

h

a

n

l

e

v

y

OWNERS_2012_OPERATINGCOSTS.indd 24 9/13/12 3:38:36 PM

212.888.1811

Ownership & Acquisitions

Creating Value in Real Estate Since 1978

HMC-1027 H+M OwnersMagAd_rev2TM.indd 1 9/12/12 2:06 PM

Untitled-7 1 9/12/12 2:19:27 PM

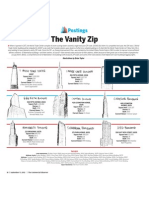

26 | OWNERS MAGAZINE 2012

SMOOTH OPERATOR

CLEANING

$2.68 per square foot

SECURITY

$1.06 per square foot

UTILITIES

$4.65 per square foot

WAGES AND

BENEFITS

$1.92 per square foot

ADMINISTRATIVE

$0.48 per square foot

REPAIRS AND

MAINTENANCE

$1.41 per square foot

INSURANCE

$0.51 per square foot

REAL ESTATE TAXES

$10.09 per square foot

Before the typical Manhattan landlord even considers a new acquisition, his eet of accountants, lawyers, risk managers and

engineers weighs the high cost of operating in New York City. Indeed, when even some midsize properties can rival the populations

of a Midwestern town, it shouldnt be a surprise that the day-to-day expenses of everything from window washing and elevator

maintenance to ofce equipment, insurance and property taxes can add up faster than a New York minute. Analysts at Cassidy

Turley, a full-service commercial real estate services provider, averaged the operating costs of several dozen Midtown buildings

ranging in size from 250,000 square feet to more than 1 million square feetand then shared their ndings with us. The result:

Annual operating costs ranging from $5.7 million to well above $23 million that would cause even the most successful real estate

titans to lose sleep. Below, a breakdown of the cost of owning in New York City today.

TOTAL:

$22.80

per square foot

window washing/rubbish

removal/extermination

services/snow removal/union

custodial/etc.

engineering costs/building

management/sta ng/etc.

tax assessment/ property

taxes/accounting/etc.

non-union concierge services/

outsourced 1- and 2-man

security details/etc.

Phones/o ce supplies/

computers/paper & pens/

management fees/etc.

elevator maintenance/

heating, ventilation & air

conditioning repairs/lighting/

light mechanical

gas/electric/steam/water/

cable/internet/etc.

property insurance/liability &

coverage based on valuation

of building/etc.

OWNERS_2012_OPERATINGCOSTS.indd 26 9/13/12 3:38:52 PM

Handler Real Estate is a driving force in the leasing and management of

premium commercial properties in New York City and beyond. We continue

to pursue third-party leasing assignments and in the past year our own

properties have reached 98% occupancy. Whats more, we have been retained

by a national retailer to be their exclusive leasing agent. During this period of

dynamic growth we are currently evaluating new acquisition opportunities

and are looking to aggressively expand our brokerage division. This is an

exciting opportunity to thrive, as we expand our commitment to excellence.

Contact Scott Galin:

sgalin@handler-re.com

The Future

With Half a Century of

Real Estate Leadership

Behind Us, We're All About

561 SEVENTH AVE, 15TH FL NY, NY 10018

212.398.1888 HANDLER-RE.COM

1HANDR077_8x8.25Comm.indd 1 9/10/12 9:53 AM

Untitled-2 1 9/11/12 2:01:03 PM

28 | OWNERS MAGAZINE 2012