Earnout: Acquisitions by Robert F. Bruner. See Chapter 22 For Further Discussion of Earnout Valuation

Diunggah oleh

LuisMendiolaJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Earnout: Acquisitions by Robert F. Bruner. See Chapter 22 For Further Discussion of Earnout Valuation

Diunggah oleh

LuisMendiolaHak Cipta:

Format Tersedia

Earnout Copyright 2003 by Robert F. Bruner.

This spreadsheet automates the valuation of a simple earnout structure using Monte Carlo Simulation. The exhibits given in the next two worksheet are identical to Exhibits 3 and 4 in Chapter 22, "Structuring and Valuing Contingent Payments in M&A," of Applied Mergers and Acquisitions by Robert F. Bruner. See Chapter 22 for further discussion of earnout valuation. Prepared by Scott Stiegler and Professor Robert F. Bruner of the Darden Graduate School of Business Administration, University of Virginia, http://faculty.darden.edu/brunerb/. Please note: 1) This spreadsheet should be opened using Crystal Ball add-in simulation software. 2) This is a working model. Assumptions / Inputs presented can be changed to vary the results. 3) As long as default spreadsheet calculation is "expected value" the impact of changing assumptions will be computed in real time. If calculation is set as "monte carlo" you should press the F9 function key to recalculate results, and run a simulation to obtain a distribution of the results.

This software was prepared solely for non-commercial educational purposes as a supplement to the book, Applied Mergers and Acquisitions , by Robert F. Bruner. While it has been reviewed with care, and to the best of the author's knowledge performs as described in the book, the publisher and author do not represent that this software is error-free, and cannot be accountable for errors or omissions, nor for any liability arising from uses of this software. ALL WARRANTIES, EXPRESS AND IMPLIED, INCLUDING THE WARRANTY OF MERCHANTABILITY, AND FITNESS FOR A PARTICULAR PURPOSE, ARE HEREBY DISCLAIMED. NEITHER THE AUTHOR OR PUBLISHER SHALL BE LIABLE OR RESPONSIBLE FOR ANY LOSS, INJURY, CLAIM, LIABILITY, DAMAGE OR EXPENSE OF ANY KIND OR NATURE CAUSED BY OR ARISING IN CONNECTION WITH THE USE OF THIS SOFTWARE, INCLUDING BUT NOT LIMITED TO DEFECTS IN THE MEDIUM, OR ERRORS, OMISSIONS, OR INACCURACIES IN THE DATA PRODUCED BY THIS SOFTWARE. IF FOR ANY REASON, BY OPERATION OF LAW OR OTHERWISE, ANY PORTION OF THE FOREGOING LIMITATION OF LIABILITY SHALL BE VOID OR OTHERWISE UNENFORCEABLE, THEN, IN SUCH EVENT, THE MAXIMUM LIABILITY OF THE PUBLISHER OR AUTHOR, IF ANY, SHALL BE NOT EXCEED THE TOTAL AMOUNT ACTUALLY PAID TO THE PUBLISHER BY THE USER FOR THE SOFTWARE. This software is intended for use as an educational tool, and not as a substitute for legal, financial or other professional or expert advice. Use by the reader of this software constitutes assent to the terms of use and disclaimer of liability.

Copyright 2003 by Robert F. Bruner. All rights reserved. Use is subject to the terms and conditions given on the "Intro" page.

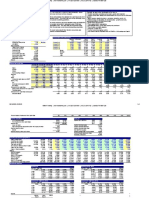

Exhibit 3 Buyer (XYZ) Valuation

Base Year Sales Earnout Period, in Years Sales Growth Rate min most likely max

$ 10,000 5

Year 1 #NAME?

Year 2 #NAME? #NAME?

Year 3 #NAME? #NAME?

Year 4 #NAME? #NAME?

Year 5 #NAME? #NAME?

0% 5% 10%

#NAME?

Operating Income Profit Margin min most likely max 0% 5% 10%

#NAME? #NAME?

#NAME? #NAME?

#NAME? #NAME?

#NAME? #NAME?

#NAME? #NAME?

Earnout Target Annual Earnout Value Present Value of the Earnout, Discounted at 5% Dollars at Closing Valuation of Proposed Total Payment

$ 250 #NAME?

$ 500 #NAME?

$ 750 #NAME?

$ 1,000 #NAME?

$ 1,250 #NAME?

#NAME? $ 2,000

#NAME?

Note: This exhibit shows the results of one draw of the simulation. Each time the model is opened, it recalculates, producing different numbers from those appearing in Exhibit 3 of Chapter 22. Please allow for this in comparing the results of this table with Exhibit 3.

Distribution for Enterprise Valuation of Proposed Earnout

0.12

Minimum $ Mean $ Maximum $ 2,000 2,414 3,316 Note: The minimum, mean, and maximum are based on a simulation of 100 draws. Repeating this simulation, especially with more draws will likely produce slightly different estimates. With a very large number of draws, the estimates should be reasonably consistent from simulation to

PROBABILITY

0.1 0.08 0.06 0.04 0.02 0

$2 ,0 00 $2 ,1 32 $2 ,2 63 $2 ,3 95 $2 ,5 26 $2 ,6 58 $2 ,7 90 $2 ,9 21 $3 ,0 53 $3 ,1 85

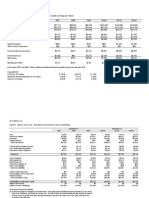

Base Year Sales Earnout Period, in Years Sales Growth Rate min most likely max

$ 10,000 5

Year 1 #NAME?

Year 2 #NAME? #NAME?

Year 3 #NAME? #NAME?

Year 4 #NAME? #NAME?

Year 5 #NAME? #NAME?

10% 15% 20%

#NAME?

Operating Income Profit Margin min most likely max 5% 10% 15%

#NAME? #NAME?

#NAME? #NAME?

#NAME? #NAME?

#NAME? #NAME?

#NAME? #NAME?

Earnout Target Annual Earnout Value Present Value of the Earnout, Discounted at 5% Dollars at Closing Valuation of Proposed Total Payment

$ 250 #NAME?

$ 500 #NAME?

$ 750 #NAME?

$ 1,000 #NAME?

$ 1,250 #NAME?

#NAME? $ 2,000

#NAME?

Note: This exhibit shows the results of one draw of the simulation. Each time the model is opened, it recalculates, producing different numbers from those appearing in Exhibit 4 of Chapter 22. Please allow for this in comparing the results of this table with Exhibit 4.

Distribution for Enterprise Valuation of Proposed Earnout

0.16 0.14 0.12 0.1 0.08 0.06 0.04 0.02 0

Minimum Mean Maximum $ $ $ 2,892 5,484 7,606

PROBABILITY

$2 ,8 92 $3 ,3 63 $3 ,8 35 $4 ,3 06 $4 ,7 77 $5 ,2 49 $5 ,7 20 $6 ,1 92 $6 ,6 63 $7 ,1 35

Anda mungkin juga menyukai

- Revised ModelDokumen27 halamanRevised ModelAnonymous 0CbF7xaBelum ada peringkat

- LBO (Leveraged Buyout) Model For Private Equity FirmsDokumen2 halamanLBO (Leveraged Buyout) Model For Private Equity FirmsDishant KhanejaBelum ada peringkat

- Loan Modification CalculatorDokumen4 halamanLoan Modification CalculatorElizabeth ThomasBelum ada peringkat

- Lbo W DCF Model SampleDokumen33 halamanLbo W DCF Model Samplejulita rachmadewiBelum ada peringkat

- $ in Millions, Except Per Share DataDokumen59 halaman$ in Millions, Except Per Share DataTom HoughBelum ada peringkat

- Investment Banking, 3E: Valuation, Lbos, M&A, and IposDokumen10 halamanInvestment Banking, 3E: Valuation, Lbos, M&A, and IposBook SittiwatBelum ada peringkat

- Flash Inc Financial StatementsDokumen14 halamanFlash Inc Financial Statementsdummy306075% (4)

- Investment Banking: Valuation, Leveraged Buyouts, and Mergers & AcquisitionsDokumen8 halamanInvestment Banking: Valuation, Leveraged Buyouts, and Mergers & AcquisitionsMarta RodriguesBelum ada peringkat

- Chapter 13. Tool Kit For Corporate Valuation, Value-Based Management and Corporate GovernanceDokumen19 halamanChapter 13. Tool Kit For Corporate Valuation, Value-Based Management and Corporate GovernanceHenry RizqyBelum ada peringkat

- In Thousands of USD: Lightspeed ForecastDokumen15 halamanIn Thousands of USD: Lightspeed ForecastAmy TruongBelum ada peringkat

- Markaz-GL On Financial ProjectionsDokumen10 halamanMarkaz-GL On Financial ProjectionsSrikanth P School of Business and ManagementBelum ada peringkat

- DCF ModelDokumen6 halamanDCF ModelKatherine ChouBelum ada peringkat

- Excel Spreadsheet For Mergers and Acquisitions ValuationDokumen6 halamanExcel Spreadsheet For Mergers and Acquisitions Valuationisomiddinov100% (2)

- Rolling Budget and Forecast : Model KeyDokumen2 halamanRolling Budget and Forecast : Model KeyomernoumanBelum ada peringkat

- Flash MemoryDokumen9 halamanFlash MemoryJeffery KaoBelum ada peringkat

- Existing Building AnalysisDokumen15 halamanExisting Building AnalysisAmir H.TBelum ada peringkat

- DELL LBO Model Part 1 CompletedDokumen45 halamanDELL LBO Model Part 1 CompletedascentcommerceBelum ada peringkat

- Neptune Model CompleteDokumen23 halamanNeptune Model CompleteChar_TonyBelum ada peringkat

- BpmToolbox 6.0-Historical & Forecast Business Planning Model Example (Basic)Dokumen66 halamanBpmToolbox 6.0-Historical & Forecast Business Planning Model Example (Basic)kunjan2165Belum ada peringkat

- 1 2 3 4 5 6 7 8 9 File Name: C:/Courses/Course Materials/3 Templates and Exercises M&A Models/LBO Shell - Xls Colour CodesDokumen46 halaman1 2 3 4 5 6 7 8 9 File Name: C:/Courses/Course Materials/3 Templates and Exercises M&A Models/LBO Shell - Xls Colour CodesfdallacasaBelum ada peringkat

- Free Cash Flow To Firm DCF Valuation Model Base DataDokumen3 halamanFree Cash Flow To Firm DCF Valuation Model Base DataTran Anh VanBelum ada peringkat

- 22 22 YHOO Merger Model Transaction Summary AfterDokumen101 halaman22 22 YHOO Merger Model Transaction Summary Aftercfang_2005Belum ada peringkat

- Earn-Out TemplateDokumen9 halamanEarn-Out Templatevaibhav sinhaBelum ada peringkat

- 1/29/2010 2009 360 Apple Inc. 2010 $1,000 $192.06 1000 30% 900,678Dokumen18 halaman1/29/2010 2009 360 Apple Inc. 2010 $1,000 $192.06 1000 30% 900,678X.r. GeBelum ada peringkat

- Apple & RIM Merger Model and LBO ModelDokumen50 halamanApple & RIM Merger Model and LBO ModelDarshana MathurBelum ada peringkat

- Flash Memory IncDokumen9 halamanFlash Memory Incxcmalsk100% (1)

- Bond ValuationDokumen10 halamanBond ValuationVivek SuranaBelum ada peringkat

- Merger Model - Blank Template: Control Panel Outputs Sensitivities Model Comps Data Diluted Shares CalculationDokumen49 halamanMerger Model - Blank Template: Control Panel Outputs Sensitivities Model Comps Data Diluted Shares CalculationGugaBelum ada peringkat

- Lbo W DCF Model SampleDokumen43 halamanLbo W DCF Model SamplePrashantK100% (1)

- AAPL DCF ValuationDokumen12 halamanAAPL DCF ValuationthesaneinvestorBelum ada peringkat

- Sy0 601 01Dokumen17 halamanSy0 601 01SABRINA NUR AISHA AZAHARI100% (1)

- Yates Financial ModellingDokumen18 halamanYates Financial ModellingJerryJoshuaDiazBelum ada peringkat

- CAPE Accounting Entire SBA (Merlene)Dokumen8 halamanCAPE Accounting Entire SBA (Merlene)Merlene Dunbar56% (9)

- Cheniere Energy Valuation ModelDokumen11 halamanCheniere Energy Valuation Modelngarritson1520100% (1)

- Wind Valuation ModelDokumen87 halamanWind Valuation ModelprodiptoghoshBelum ada peringkat

- 3 Statement Model: Strictly ConfidentialDokumen13 halaman3 Statement Model: Strictly ConfidentialLalit mohan PradhanBelum ada peringkat

- Lbo DCF ModelDokumen38 halamanLbo DCF ModelBobbyNicholsBelum ada peringkat

- LBO Test - 75Dokumen84 halamanLBO Test - 75conc880% (1)

- Simple LBODokumen16 halamanSimple LBOsingh0001Belum ada peringkat

- Practive LBO StepsDokumen19 halamanPractive LBO Stepszzduble1100% (1)

- Earn Out Excel WorkingDokumen2 halamanEarn Out Excel WorkingpremoshinBelum ada peringkat

- CFI 3 Statement Model CompleteDokumen14 halamanCFI 3 Statement Model CompleteMAYANK AGGARWALBelum ada peringkat

- LBO Valuation Model 1 ProtectedDokumen14 halamanLBO Valuation Model 1 ProtectedYap Thiah HuatBelum ada peringkat

- A Great CEODokumen2 halamanA Great CEOnochip10100% (1)

- Intrinsic ValuationDokumen33 halamanIntrinsic ValuationLuisMendiolaBelum ada peringkat

- The Investment Case For Junior Mining Companies: Eric Hommelberg May 28, 2008Dokumen10 halamanThe Investment Case For Junior Mining Companies: Eric Hommelberg May 28, 2008LuisMendiolaBelum ada peringkat

- CFI 3 Statement Model CompleteDokumen9 halamanCFI 3 Statement Model CompleteHacker's ClubBelum ada peringkat

- Balance StatementDokumen4 halamanBalance StatementVitor BinghamBelum ada peringkat

- Chapter 15 Data Managment Maturity Assessment - DONE DONE DONEDokumen16 halamanChapter 15 Data Managment Maturity Assessment - DONE DONE DONERoche ChenBelum ada peringkat

- Flash Memory ExcelDokumen4 halamanFlash Memory ExcelHarshita SethiyaBelum ada peringkat

- Flash Memory, Inc.Dokumen2 halamanFlash Memory, Inc.Stella Zukhbaia0% (5)

- Case 1 SwanDavisDokumen4 halamanCase 1 SwanDavissilly_rabbit0% (1)

- NYSF Practice TemplateDokumen22 halamanNYSF Practice TemplaterapsjadeBelum ada peringkat

- Merger Model PP Allocation BeforeDokumen100 halamanMerger Model PP Allocation BeforePaulo NascimentoBelum ada peringkat

- Simple LBO ModelDokumen14 halamanSimple LBO ModelSucameloBelum ada peringkat

- Blank Financial ModelDokumen109 halamanBlank Financial Modelrising_aboveBelum ada peringkat

- Short Form DCFDokumen1 halamanShort Form DCFjess236Belum ada peringkat

- Excel SampleDokumen8 halamanExcel SampleVõ Văn PhúcBelum ada peringkat

- Exer 10 1Dokumen14 halamanExer 10 1AbhishekKumar0% (2)

- Discounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No FormulasDokumen2 halamanDiscounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No Formulasrito2005Belum ada peringkat

- CAT ValuationDokumen231 halamanCAT ValuationMichael CheungBelum ada peringkat

- Homework Notes Unit 3 MBA 615Dokumen9 halamanHomework Notes Unit 3 MBA 615Kevin NyasogoBelum ada peringkat

- Assignment 2Dokumen11 halamanAssignment 2Rupal BilaiyaBelum ada peringkat

- Valuing SynergiesDokumen4 halamanValuing SynergiesAnonymous hPo9UwBelum ada peringkat

- Calculating The Sroi: Stage 5Dokumen8 halamanCalculating The Sroi: Stage 5Chuluunzagd BatbayarBelum ada peringkat

- SolutionsDokumen30 halamanSolutionsNitesh AgrawalBelum ada peringkat

- Cost Benefit Analysis Template: Engineering Solutions On-Line Presents TheDokumen28 halamanCost Benefit Analysis Template: Engineering Solutions On-Line Presents TheLucky AndroidBelum ada peringkat

- Retail Payments: Overview, Empirical Results, and Unanswered QuestionsDokumen20 halamanRetail Payments: Overview, Empirical Results, and Unanswered QuestionsLuisMendiolaBelum ada peringkat

- Topics in Finance Part VI - Capital Budgeting: American Journal of Business Education - July 2011 Volume 4, Number 7Dokumen10 halamanTopics in Finance Part VI - Capital Budgeting: American Journal of Business Education - July 2011 Volume 4, Number 7LuisMendiolaBelum ada peringkat

- 2Q04ReconciliationEBIT EBITDADokumen1 halaman2Q04ReconciliationEBIT EBITDALuisMendiolaBelum ada peringkat

- Finexec BRDokumen3 halamanFinexec BRLuisMendiolaBelum ada peringkat

- Cases 5645Dokumen7 halamanCases 5645LuisMendiolaBelum ada peringkat

- Finance and Accounting For The Nonfinancial Executive: Dates: November 15 - 20, 2015Dokumen2 halamanFinance and Accounting For The Nonfinancial Executive: Dates: November 15 - 20, 2015LuisMendiolaBelum ada peringkat

- Panoro Minerals LTD.: An Exploration Stage Company Consolidated Financial Statements December 31, 2009 and 2008Dokumen23 halamanPanoro Minerals LTD.: An Exploration Stage Company Consolidated Financial Statements December 31, 2009 and 2008LuisMendiolaBelum ada peringkat

- The Investment Case For Junior Mining Companies: Part I: Technical ViewDokumen9 halamanThe Investment Case For Junior Mining Companies: Part I: Technical ViewLuisMendiolaBelum ada peringkat

- Panoro Minerals LTD.: An Exploration Stage Company Consolidated Financial Statements September 30, 2010 and 2009Dokumen18 halamanPanoro Minerals LTD.: An Exploration Stage Company Consolidated Financial Statements September 30, 2010 and 2009LuisMendiolaBelum ada peringkat

- 2009Q4MDADokumen14 halaman2009Q4MDALuisMendiolaBelum ada peringkat

- Panoro Minerals LTD.: Management's Discussion and Analysis For The Period Ended September 30, 2010 November 5, 2010Dokumen16 halamanPanoro Minerals LTD.: Management's Discussion and Analysis For The Period Ended September 30, 2010 November 5, 2010LuisMendiolaBelum ada peringkat

- The Danish Mortgage Solution On A Worldwide Basis.: Re: Credit Risk Retention Proposed RuleDokumen2 halamanThe Danish Mortgage Solution On A Worldwide Basis.: Re: Credit Risk Retention Proposed RuleLuisMendiolaBelum ada peringkat

- Beta According To BloombergDokumen6 halamanBeta According To BloombergLuisMendiolaBelum ada peringkat

- Q4 2010 Earnings Call Company Participants: OperatorDokumen7 halamanQ4 2010 Earnings Call Company Participants: OperatorLuisMendiolaBelum ada peringkat

- 033 - Fam Bus Cases - Case ListDokumen22 halaman033 - Fam Bus Cases - Case ListLuisMendiolaBelum ada peringkat

- Parker Economic Regulation Preliminary Literature ReviewDokumen37 halamanParker Economic Regulation Preliminary Literature ReviewTudor GlodeanuBelum ada peringkat

- Chapter - 1Dokumen5 halamanChapter - 1MAG MAGBelum ada peringkat

- Case Study Project Income Statement BudgetingDokumen186 halamanCase Study Project Income Statement BudgetingKate ChuaBelum ada peringkat

- Cost Accounting 3Dokumen13 halamanCost Accounting 3Frenz VerdidaBelum ada peringkat

- Questionnaire: TITLE: The Effect of Liquidity Management On Financial Performance Section A: Demographic ProfileDokumen4 halamanQuestionnaire: TITLE: The Effect of Liquidity Management On Financial Performance Section A: Demographic ProfileDeeqow XayeesiBelum ada peringkat

- AFM Important QuestionsDokumen2 halamanAFM Important Questionsuma selvarajBelum ada peringkat

- Cash Flows and Accrual Accounting in Predicting Future Cash FlowsDokumen210 halamanCash Flows and Accrual Accounting in Predicting Future Cash FlowsNicolai AquinoBelum ada peringkat

- Case Study (ENT530)Dokumen12 halamanCase Study (ENT530)Nur Diyana50% (2)

- Case Bloomsbury Capital NCDokumen39 halamanCase Bloomsbury Capital NCashmangano0% (1)

- About APSCA D 021Dokumen2 halamanAbout APSCA D 021VABelum ada peringkat

- Uplift Construction and Development CorporationDokumen3 halamanUplift Construction and Development CorporationDAXEN STARBelum ada peringkat

- FAR Acc TemplatesDokumen13 halamanFAR Acc TemplatesNimfa GumiranBelum ada peringkat

- Roject Harter: 1.0 Project Identification Name Description Sponsor Project Manager Project Team ResourcesDokumen2 halamanRoject Harter: 1.0 Project Identification Name Description Sponsor Project Manager Project Team ResourcesKomal SoomroBelum ada peringkat

- West Chemical Company Produces Three Products The Operating ResDokumen1 halamanWest Chemical Company Produces Three Products The Operating ResAmit PandeyBelum ada peringkat

- SAP Global Certification: CertificateDokumen7 halamanSAP Global Certification: CertificateAbdullah SalehBelum ada peringkat

- HOWA QA-HW-12 Supplier Quality Manual Rev.8 (English) - SignedDokumen25 halamanHOWA QA-HW-12 Supplier Quality Manual Rev.8 (English) - Signedl.hernandezBelum ada peringkat

- Case StudyDokumen35 halamanCase Studytuan nasiruddinBelum ada peringkat

- Registration and Incorporation of CompanyDokumen18 halamanRegistration and Incorporation of CompanySurendrasingh ZalaBelum ada peringkat

- EBS Receivable Implementation GuideDokumen110 halamanEBS Receivable Implementation Guideaimi99Belum ada peringkat

- Components of Inventory CostDokumen33 halamanComponents of Inventory CostJohn PangBelum ada peringkat

- 2 MODUL LogisticsDokumen4 halaman2 MODUL LogisticsGiska AdeliaBelum ada peringkat

- Articles of Organization: United StatesDokumen2 halamanArticles of Organization: United Stateshasan jamiBelum ada peringkat

- Term:2008-2009 B.Tech Iv/Cse Iind Semester Unit-V PPT Slides Text Books: 1. Frontiers of Electronic Commerce - Kalakata, Whinston, Pearson. 2. E-Commerce, S.Jaiswal - GalgotiaDokumen50 halamanTerm:2008-2009 B.Tech Iv/Cse Iind Semester Unit-V PPT Slides Text Books: 1. Frontiers of Electronic Commerce - Kalakata, Whinston, Pearson. 2. E-Commerce, S.Jaiswal - GalgotiaMohit SainiBelum ada peringkat

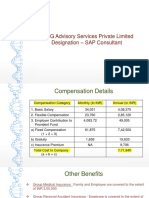

- KPMG Advisory Services Private Limited Designation - SAP ConsultantDokumen8 halamanKPMG Advisory Services Private Limited Designation - SAP ConsultantDhanad AmberkarBelum ada peringkat