CBSE SCH VI Material

Diunggah oleh

Tanuj JhunjhunwalaDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

CBSE SCH VI Material

Diunggah oleh

Tanuj JhunjhunwalaHak Cipta:

Format Tersedia

Website: www.cbse.nic.

in

Phone: 23220155 Email-id: sugandh.cbse@live.com

CENTRAL BOARD OF SECONDARY EDUCATION

(An Autonomous Organization under the Union Ministry of Human Resource Development, Govt. of India)

Shiksha Sadan , 17, Rouse Avenue, New Delhi-110 002 ACAD/CBSE/DIR(ACAD&T) 2012 All the Heads of the CBSE affiliated schools Subject: Additional information on Adoption of Revised Schedule VI Part I of the Companies Act 1956 in the transaction of the Accountancy syllabus of Class XII for the Board Examination 2013. Circular No. Acad-13/2012 dated 10th May, 2012 and Circular No: Acad54/2012 Dated 24th August, 2012. Circular No. Acad-73/2012 21st September, 2012

Reference:

Dear Principal, In continuation with the Circulars cited above, it is further brought to your kind attention that the Board has developed additional questions for practice of Class XII Accountancy students and defined the topics affected by the revised Schedule VI to the Companies Act, 1956. These questions along with the ones given in the Sample Question Paper uploaded on the CBSE website www.cbse.nic.in provide a full coverage to the topics of the Accountancy syllabus affected by the revision of the Schedule VI to the Companies Act, 1956. The material, which has been included as Annexure A to this Circular, may kindly be brought to the notice of concerned teachers and students. For any further queries in this regard, please also contact Mrs. Sugandh Sharma, Education Officer ( Commerce) at 011- 23220155 or email at eo-commerce@cbseacademic.in with a copy to Director ( Academic and Training) at email id sadhanap.cbse@nic.in . With best wishes, Yours Sincerely,

(Ram Shankar) Joint Director (Acad. & Voc.) Encl. Annexure A

Copy with a request to respective Heads of Directorates/KVS/NVS/CTSA as indicated below to also disseminate the information to all concerned schools under their jurisdiction:1. The Commissioner, Kendriya Vidyalaya Sangathan, 18-Institutional Area, Shaheed Jeet Singh Marg, New Delhi- 16. 2. The Commissioner, Navodaya Vidayalaya Samiti, A-28, Kailash Colony, New Delhi. 3. The Director of Education, Directorate of Education, Govt. of NCT of Delhi, Old Secretariat, Delhi- 54. 4. The Director of Public Instructions (Schools), Union Territory Secretariat, Sector-9, Chandigarh- 160017. 5. The Director of Education, Govt. of Sikkim, Gangtok, Sikkim- 737101. 6. The Director of School Education, Govt. of Arunachal Pradesh, Itanagar-791111 7. The Director of Education, Govt. of A&N Islands, Port Blair- 744101. 8. The Director of Education, S.I.E., CBSE Cell, VIP Road, Junglee Ghat, P.O. 744103, A&N Islands. 9. The Secretary, Central Tibetan School Administration, ESS ESS Plaza, Community Centre, Sector 3, Rohini, Delhi- 85 10. The General Secretary, COBSE New Delhi, 6H, BigJos Tower, A-8, Netaji Subhash Place Ring Road, Delhi - 110034 11. All the Regional Officers of CBSE with the request to send this circular to all the Heads of the affiliated schools of the Board in their respective regions. 12. The Joint Director (Acad. & Voc.), CBSE, Rouse Avenue, New Delhi. 13. The Education Officers/ AEOs of the Academic Branch, CBSE. 14. The Research Officer (T) with the request to put this circular on the CBSE Academic website. 15. The Library and Information Officer, CBSE. 16. PRO, CBSE 17. APRO, CBSE, Rouse Avenue, New Delhi. 18. E.O. to Chairman/PS to Chairman, CBSE, 19. DO/ PA to Secretary, CBSE 20. PA to CE, CBSE 21. PA to Director (Acad. & Trg.) 22. PA to HOD (Spl. Exam)

Joint Director (Acad. & Voc.)

ANNEXURE A

IMPACT OF REVISED SCHEDULE VI ON VARIOUS TOPICS OF THE ACCOUNTANCY SYLLABUS Part A- Accounting for Partnership Firms and Companies: 60 marks. Units Affected Areas Total marks Marks of the Affected Unit/s 35 18 Nil 3-4

1&2Accounting for Partnership Firms 3. Accounting for Share Capital Issue of Shares

Nil (a) Presentation of Share Capital in the Balance Sheet as per Revised Schedule VI.

4. Accounting for Debentures Issue and redemption of debentures

(b) Presentation of Debentures issued as a collateral security as per Revised Schedule VI.

Part B- Financial Statements Analysis :20 marks. Units Affected Areas Total marks of the Unit/s 12 Entirely affected 3-4 Marks Affected

5. Analysis of Financial Statements Balance Sheet of the Company in the prescribed form with major headings and subheadings as per Revised Schedule VI to the Companies Act 1956.

Tools for Financial Statement Analysis: (a) Comparative Statements Comparative Income Statement Comparative Balance Sheet Entirely affected 3-4

(b) Common Size Statements Common Size Income Statement. Common Size Balance Sheet Ratio Analysis: Not affected because it is a managerial tool. The information may be presented to the management as required by them. The elements/ Components of individual ratios will be given in the question. Not affected because the information given in the 2012-13 examination will be assumed to be the same as stated under the head in the Balance Sheet. For example- if the Debentures are given under the head Long Term Borrowings, they will be treated as a Non current Liability. --

6. Cash Flow Statement

Nil

QUESTIONS 1. From the following Statement of Profit and Loss of Star Ltd., for the years ended 31st March 2011 and 2012, prepare a comparative Statement of Profit or Loss. Note 2010-11 2011-12 Particulars No. (`) (`) Revenue from operations 16,00,000 20,00,000 Employee benefits expenses 8,00,000 10,00,000 Other expenses 2,00,000 1,00,000 Tax rate 40%

Solution.

Comparative Statement of Profit or Loss for the years ended 31st March 2011and 31st March 2012 Particulars 2010-11 2011-12 Absolute Percentage increase/ increase/ (`) (`) decrease decrease (%) (`) Revenue from operations 16,00,000 20,00,000 4,00,000 25 I Less: Expenses: II Employee benefits expenses 8,00,000 10,00,000 2,00,000 25 Other expenses 2,00,000 1,00,000 (1,00,000) (50) III Profit before tax 6,00,000 9,00,000 3,00,000 50 Less tax @40% 2,40,000 3,60,000 1,20,000 50 IV Profit after tax 3,60,000 5,40,000 1,80,000 50

2. From the following Balance Sheets of Universe Ltd., as on 31st March 2011 and 2012, prepare a Comparative Balance Sheet. Particulars Note No. 2010-11 (`) 2011-12 (`) EQUITY AND LIABILITIES (1) Shareholders Funds (a) Share capital 15,00,000 20,00,000 (b) Reserves and Surplus 4,00,000 3,00,000 (2) Non Current Liabilities Long Term Borrowings 6,00,000 9,00,000 (3) Current Liabilities Trade Payables 2,00,000 3,00,000 Total 27,00,000 35,00,000 ASSETS (1) Non Current Assets Fixed assets (i) Tangible assets 15,00,000 20,00,000 (ii) Intangible Assets 6,00,000 9,00,000 (2) Current Assets (a) Inventories 4,00,000 3,00,000 (b) Cash and Cash equivalents 2,00,000 3,00,000 Total 27,00,000 35,00,000 Solution. Comparative Balance Sheet of Star Ltd. as on 31st March 2011 and 31st March 2012 Particulars 2010-11 (`) 2011-12 (`) Absolute increase/ decrease (`) Percentage increase/ decrease (%)

EQUITY AND LIABILITIES (1) Shareholders Funds (a) Share capital (b) Reserves and Surplus (2) Non Current Liabilities Long Term Borrowings (3) Current Liabilities Trade Payables Total ASSETS (1) Non Current Assets Fixed assets (i) Tangible assets (ii) Intangible Assets (2) Current Assets (a) Inventories (b) Cash and Cash equivalents Total

15,00,000 20,00,000 5,00,000 4,00,000 3,00,000 (1,00,000) 6,00,000 9,00,000 3,00,000 1,00,000 8,00,000

33.33 (25) 50 50 33.3

2,00,000 3,00,000 27,00,000 35,00,000

15,00,000 20,00,000 6,00,000 9,00,000

5,00,000 3,00,000

33.33 50 (25) 50 33.33

4,00,000 3,00,000 (1,00,000) 2,00,000 3,00,000 1,00,000 27,00,000 35,00,000 8,00,000

3. From the following Balance Sheets of Sun Ltd., as on 31st March 2011 and 2012, prepare a common size Balance Sheet. Particulars EQUITY AND LIABILITIES (1) Shareholders Funds (a) Share capital (b) Reserves and Surplus (2) Non Current Liabilities Long Term Borrowings (3) Current Liabilities Short Term borrowings Total ASSETS (1) Non Current Assets (a) Fixed assets (i) Tangible assets (ii) Intangible Assets (2) Current Assets (a) Inventories (b) Cash and Cash equivalents Total Note No. 2010-11 (`) 2011-12 (`)

30,00,000 40,00,000 4,00,000 6,00,000 10,00,000 12,00,000 6,00,000 2,00,000 50,00,000 60,00,000

30,00,000 40,00,000 6,00,000 2,00,000 10,00,000 12,00,000 4,00,000 6,00,000 50,00,000 60,00,000

Solution. Common Size Balance Sheet of Sun Ltd. as on 31st March 2011 and 31st March 2012 Particulars 2010-11 (`) EQUITY AND LIABILITIES (1) Shareholders Funds (a) Share capital (b) Reserves and Surplus (2) Non Current Liabilities Long Term Borrowings (3) Current Liabilities Short Term borrowings Total ASSETS (1) Non Current Assets (a) Fixed assets (i) Tangible assets (ii) Intangible Assets (2) Current Assets (a) Inventories (b) Cash and Cash equivalents Total 2011-12 (`) Percentage Percentage of total of total 2010-11 2010-11

30,00,000 40,00,000 4,00,000 6,00,000 10,00,000 12,00,000 6,00,000 2,00,000 50,00,000 60,00,000

60 8 20 12 100

66.7 10.0 20.0 3.3 100.0

30,00,000 40,00,000 6,00,000 2,00,000 10,00,000 12,00,000 4,00,000 6,00,000 50,00,000 60,00,000

60 12 20 8 100

66.7 3.3 20.0 10.0 100.0

4. Following are the Balance Sheets of Mittal Ltd., as on 31st March 2011 and 2012: Particulars EQUITY AND LIABILITIES (1) Shareholders Funds (a) Share capital (b) Reserves and Surplus (2) Non Current Liabilities Long term borrowings (3) Current Liabilities Short Term provisions Total ASSETS (1) Non Current Assets (a) Fixed assets (i) Tangible assets (ii) Intangible Assets (2) Current Assets (a) Inventories (b) Trade Receivables (b) Cash and Cash equivalents Total Notes to Accounts: Note 2010-11 No. (`) 2011-12 (`)

1 2 3

10,00,000 14,00,000 4,00,000 5,00,000 2,00,000 6,00,000

60,000 80,000 16,60,000 25,80,000

4 5

9,00,000 16,00,000 2,00,000 1,40,000 2,00,000 2,50,000 3,00,000 5,00,000 60,000 90,000 16,60,000 25,80,000

Note 1 Particulars

As on 31.3.2011 (`)

As on 31.3.2012 (`)

Reserves and Surplus Surplus (balance in Statement of profit and Loss) 4,00,000 5,00,000 Note 2 Particulars As on 31.3.2011 (`) As on 31.3.2012 (`) Long term borrowings (i) 9% Deposits 2,00,000 6,00,000 Note 3 Particulars Short Term provisions (i) Provision for tax Note 4 Particulars Tangible assets (i) Machinery Note 5 Particulars Intangible Assets (i) Goodwill As on 31.3.2011 (`) 60,000 As on 31.3.2011 (`) 9,00,000 As on 31.3.2012 (`) 80,000 As on 31.3.2012 (`) 16,00,000

As on 31.3.2011 (`) 2,00,000

As on 31.3.2012 (`) 1,40,000

Prepare a Cash Flow Statement after taking into account the following adjustments: (a) The company paid interest `45,000 on its Deposits. (b) Depreciation provided on machinery during the year ` 2,00,000.

Solution: Cash Flow Statement for the year ending 31st March 2012 Particulars A. CASH FLOWS FROM OPERATING ACTIVITIES Profit before tax Add: Depreciation on machinery Interest on deposits Goodwill written off Operating Profit before working capital changes Less: Increase in Inventories Increase in Trade Receivables Cash flows from operations Less tax paid Net Cash generated from operating activities Details (`) 1,80,000 2,00,000 45,000 60,000 4,85,000 (50,000) (2,00,000) 2,35,000 (60,000) 1,75,000 Amount (`)

B. CASH FLOWS FROM INVESTING ACTIVITIES Machinery purchased Net Cash used in investing activities C. CASH FLOWS FROM FINANCING ACTIVITIES Issue of Shares 9% Deposits raised Interest paid Net Cash generated from financing activities NET INCREASE IN CASH AND CASH EQUIVALENTS (A+B+C) Add opening balance of cash and cash equivalents Closing balance of cash and cash equivalents

(9,00,000) (9,00,000)

4,00,000 4,00,000 (45,000) 7,55,000 30,000 60,000 90,000

5. The authorized capital of XYZ Ltd is ` 20,00,000 divided into ` 2,00,000 equity shares of ` 10 each. Out of these the company issued 1,00,000 equity shares of ` 10 each at a discount of 10%. The amount is payable as follows: On application ` 2, on allotment ` 4 and on final call ` 3. The public applied for ` 90,000 equity shares and all the money was duly received. How will you show the Share Capital A/c in the Balance-sheet of the company. Also prepare Notes to Accounts for the same. (1x3 = 3 Marks)

Solution: Balance Sheet of XYZ Ltd. As at .. Particulars Note No. Amount current Amount previous year (`) year (`) Equity and Liablities Shareholders Fund (a) Share Capital 1 9,00,000 1 Mark Note No.1 Share Capital Authorised Capital 2,00,000 Equity Shares of ` 10 each Issued Capital 1,00,000 equity shares of ` 10 each Subscribed & Fully paid 90,000 equity shares of ` 10 each (`) 20,00,000 10,00,000 9,00,000 (1+3=4 Marks)

I (1)

Anda mungkin juga menyukai

- Cash Flow StatementDokumen7 halamanCash Flow StatementVinod KumarBelum ada peringkat

- Data Analysis and InterpretationDokumen50 halamanData Analysis and InterpretationNazir Hussain100% (1)

- QP March2012 f2Dokumen16 halamanQP March2012 f2g296469Belum ada peringkat

- Ratio AnalysisDokumen50 halamanRatio AnalysisSweetie Arshad AliBelum ada peringkat

- Financial Performance of HBLDokumen36 halamanFinancial Performance of HBLAdnan KhanBelum ada peringkat

- Loyola College (Autonomous), Chennai - 600 034 Loyola College (Autonomous), Chennai - 600 034 Loyola College (Autonomous), Chennai - 600 034Dokumen3 halamanLoyola College (Autonomous), Chennai - 600 034 Loyola College (Autonomous), Chennai - 600 034 Loyola College (Autonomous), Chennai - 600 034Mohan MuthusamyBelum ada peringkat

- Toronto Employment & Social Services Capital Budget Analyst Notes 2012 BudgetDokumen22 halamanToronto Employment & Social Services Capital Budget Analyst Notes 2012 BudgetarthurmathieuBelum ada peringkat

- QP F2 May 2013Dokumen20 halamanQP F2 May 2013kazimkorogluBelum ada peringkat

- Answers S3T1P1Dokumen7 halamanAnswers S3T1P1mananleo88Belum ada peringkat

- Subodha Accounts Term PaperDokumen51 halamanSubodha Accounts Term PaperRakesh KumarBelum ada peringkat

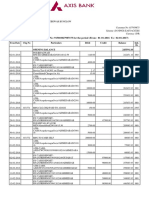

- AXIS Bank AnalysisDokumen44 halamanAXIS Bank AnalysisArup SarkarBelum ada peringkat

- Business ProjectDokumen16 halamanBusiness Projectlaiba khanBelum ada peringkat

- F2 - Financial ManagementDokumen20 halamanF2 - Financial Managementkarlr9Belum ada peringkat

- Toronto Shelter, Support and Housing Admin Capital Budget Analyst Notes Budget 2012Dokumen23 halamanToronto Shelter, Support and Housing Admin Capital Budget Analyst Notes Budget 2012arthurmathieuBelum ada peringkat

- Acct1511 2013s2c2 Handout 2 PDFDokumen19 halamanAcct1511 2013s2c2 Handout 2 PDFcelopurpleBelum ada peringkat

- Suggested Answer - Syl2012 - Jun2014 - Paper - 20 Final Examination: Suggested Answers To QuestionsDokumen16 halamanSuggested Answer - Syl2012 - Jun2014 - Paper - 20 Final Examination: Suggested Answers To QuestionsMdAnjum1991Belum ada peringkat

- Taxation Vol. IIDokumen364 halamanTaxation Vol. IISaibhumi100% (2)

- Accounting Vol. IIDokumen405 halamanAccounting Vol. IISaibhumi100% (3)

- P6529+Elkins+HCFI+ +Final+Exam+ +fall+2012Dokumen18 halamanP6529+Elkins+HCFI+ +Final+Exam+ +fall+2012camille_marquis654Belum ada peringkat

- San Diego City Employees' Retirement System: Popular Annual Financial ReportDokumen6 halamanSan Diego City Employees' Retirement System: Popular Annual Financial Reportapi-201256435Belum ada peringkat

- Asessment of Budget Preparation and Controlling System On The Case of Aau 6kiloDokumen13 halamanAsessment of Budget Preparation and Controlling System On The Case of Aau 6kiloYukihira SomaBelum ada peringkat

- Acct1511 Final VersionDokumen33 halamanAcct1511 Final VersioncarolinetsangBelum ada peringkat

- 2012 Cimb PDFDokumen187 halaman2012 Cimb PDFMmu ProjBelum ada peringkat

- S A Ipcc Nov 2011 - GR IDokumen97 halamanS A Ipcc Nov 2011 - GR ISaibhumi100% (1)

- Tutorial 9Dokumen3 halamanTutorial 9Krishnaah SmuglerzzBelum ada peringkat

- NET SyllabusDokumen10 halamanNET SyllabusansBelum ada peringkat

- University of Cambridge International Examinations General Certificate of Education Advanced Subsidiary Level and Advanced LevelDokumen8 halamanUniversity of Cambridge International Examinations General Certificate of Education Advanced Subsidiary Level and Advanced LevelSherjeel AhmedBelum ada peringkat

- Public Financial Management Systems—Indonesia: Key Elements from a Financial Management PerspectiveDari EverandPublic Financial Management Systems—Indonesia: Key Elements from a Financial Management PerspectivePenilaian: 5 dari 5 bintang5/5 (1)

- Calculations of Funds From Operation and Cash From Operation For The Year Ended (Rs in Thousand) Particulars 2003-2004 2004-2005 2005-2006 2006-2007Dokumen34 halamanCalculations of Funds From Operation and Cash From Operation For The Year Ended (Rs in Thousand) Particulars 2003-2004 2004-2005 2005-2006 2006-2007netplanetBelum ada peringkat

- 2nd Year EnglishDokumen8 halaman2nd Year EnglishKAJAL YADAVBelum ada peringkat

- HHM Class 12 CommerceDokumen26 halamanHHM Class 12 CommerceAnujBelum ada peringkat

- Management Accounting QBDokumen31 halamanManagement Accounting QBrising dragonBelum ada peringkat

- Business, Accounting and Financial Studies: Public AssessmentDokumen33 halamanBusiness, Accounting and Financial Studies: Public AssessmentShanice MorrisonBelum ada peringkat

- Axis BankDokumen22 halamanAxis Bankअक्षय गोयल67% (3)

- Case # 1: Institute of Cost and Management Accountants of PakistanDokumen4 halamanCase # 1: Institute of Cost and Management Accountants of PakistanSajid AliBelum ada peringkat

- Project Report On Financial Statement Analysis - 1640789194274Dokumen25 halamanProject Report On Financial Statement Analysis - 1640789194274RIDDHI AGARWALBelum ada peringkat

- Bil Quarter 2 ResultsDokumen2 halamanBil Quarter 2 Resultspvenkatesh19779434Belum ada peringkat

- Hoang Tue Linh ReportDokumen19 halamanHoang Tue Linh ReportVy PhạmBelum ada peringkat

- Tan - Final ExamDokumen15 halamanTan - Final ExamKent Braña Tan100% (1)

- Practic Question Paper Term 2 Accountancy Class 12Dokumen52 halamanPractic Question Paper Term 2 Accountancy Class 12Final Strike50% (2)

- 00HB130912LFDokumen385 halaman00HB130912LFManoj KumarBelum ada peringkat

- December 2014 Examination FM 11 / eFM 11 Financial & Management AccountingDokumen5 halamanDecember 2014 Examination FM 11 / eFM 11 Financial & Management AccountingNaman RawatBelum ada peringkat

- BUDGET AT A GLANCE Full PDFDokumen440 halamanBUDGET AT A GLANCE Full PDFTamilnadu KaatumanarkovilBelum ada peringkat

- 2012 Dec QCF QDokumen3 halaman2012 Dec QCF QMohamedBelum ada peringkat

- Preparation of A Cash Flow Statement FromDokumen22 halamanPreparation of A Cash Flow Statement FromUddish BagriBelum ada peringkat

- FSK ProjectDokumen16 halamanFSK Projectlaiba khanBelum ada peringkat

- Accounting Information, Regression Analysis, and Financial ManagementDokumen60 halamanAccounting Information, Regression Analysis, and Financial ManagementShahrul FadreenBelum ada peringkat

- Coca Cola CompanyDokumen21 halamanCoca Cola Companyapi-251714046Belum ada peringkat

- M1 - CIMA Masters Gateway Assessment (CMGA) 22 November 2011 - Tuesday Afternoon SessionDokumen16 halamanM1 - CIMA Masters Gateway Assessment (CMGA) 22 November 2011 - Tuesday Afternoon SessionrasheleduBelum ada peringkat

- Ashok Ley LandDokumen105 halamanAshok Ley LandAmit NagarBelum ada peringkat

- Accounts Project 1Dokumen20 halamanAccounts Project 1qwertyBelum ada peringkat

- Assignment Front Sheet: BusinessDokumen13 halamanAssignment Front Sheet: BusinessHassan AsgharBelum ada peringkat

- AC100 Exam 2012Dokumen17 halamanAC100 Exam 2012Ruby TangBelum ada peringkat

- Ing Vy Sy A Bank Limited Annual ReportDokumen156 halamanIng Vy Sy A Bank Limited Annual ReportJugal AgarwalBelum ada peringkat

- Subject: Accountancy: Kendriya Vidyalaya Sangathan Guwahati RegionDokumen170 halamanSubject: Accountancy: Kendriya Vidyalaya Sangathan Guwahati RegionHimangi AgarwalBelum ada peringkat

- Business FinanceDokumen16 halamanBusiness FinanceVy PhạmBelum ada peringkat

- Funds Flow AnalysisDokumen20 halamanFunds Flow AnalysisRajeevAgrawalBelum ada peringkat

- Section 1: Overview: 20% Assessment 1 Instructions & Questions: FINC20018 T2 2019Dokumen8 halamanSection 1: Overview: 20% Assessment 1 Instructions & Questions: FINC20018 T2 2019rejuBelum ada peringkat

- No.............................. MAY'2011: Ipco Group-I Paper-1 AccountingDokumen12 halamanNo.............................. MAY'2011: Ipco Group-I Paper-1 AccountingSamson KoshyBelum ada peringkat

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionDari EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionBelum ada peringkat

- Grovy Alcove, JVC Dubai +971 4553 8725Dokumen19 halamanGrovy Alcove, JVC Dubai +971 4553 8725SandeepBelum ada peringkat

- Building and Managing Successfully Businesses in The Middle EastDokumen12 halamanBuilding and Managing Successfully Businesses in The Middle EastbooksarabiaBelum ada peringkat

- Summer Internship File Very ImportantDokumen32 halamanSummer Internship File Very ImportantYash SharmaBelum ada peringkat

- TASK 2 - BSBMGT517 Manage Operational Plan TASK 2 - BSBMGT517 Manage Operational PlanDokumen14 halamanTASK 2 - BSBMGT517 Manage Operational Plan TASK 2 - BSBMGT517 Manage Operational PlanVioleta Hoyos Lopez68% (19)

- Job Order Contract Ground MowingDokumen2 halamanJob Order Contract Ground MowingLiza BacudoBelum ada peringkat

- Surfcam Velocity BrochureDokumen8 halamanSurfcam Velocity BrochureLuis Chagoya ReyesBelum ada peringkat

- Informed Manufacturing: Reaching For New HorizonsDokumen20 halamanInformed Manufacturing: Reaching For New HorizonsCognizantBelum ada peringkat

- NCDDP Revised CBPM Volume One Ver Oct25 - 2014Dokumen149 halamanNCDDP Revised CBPM Volume One Ver Oct25 - 2014ARTHUR R MARCOBelum ada peringkat

- Hidden-City Ticketing The Cause and ImpactDokumen27 halamanHidden-City Ticketing The Cause and ImpactPavan KethavathBelum ada peringkat

- Deed of SaleDokumen7 halamanDeed of SaleRab AlvaeraBelum ada peringkat

- EntrepreneurshipDokumen191 halamanEntrepreneurshipWacks Venzon50% (2)

- Revenue Cycle ReportDokumen15 halamanRevenue Cycle ReportKevin Lloyd GallardoBelum ada peringkat

- MCQDokumen9 halamanMCQthaker richaBelum ada peringkat

- Business Structure Sample PDFDokumen5 halamanBusiness Structure Sample PDFAnujAggarwalBelum ada peringkat

- Books of AccountsDokumen18 halamanBooks of AccountsFrances Marie TemporalBelum ada peringkat

- Brazil Key Player in Beauty and Personal CareDokumen45 halamanBrazil Key Player in Beauty and Personal CaregabrielraoniBelum ada peringkat

- Chapter 13 - HW With SolutionsDokumen9 halamanChapter 13 - HW With Solutionsa882906100% (1)

- Introduction To Engro PakistanDokumen15 halamanIntroduction To Engro Pakistanasfand yar waliBelum ada peringkat

- Anthony Mosha CVDokumen6 halamanAnthony Mosha CVanthony_mosha2445Belum ada peringkat

- Region Sales Manager, Director, Vice PresidentDokumen2 halamanRegion Sales Manager, Director, Vice Presidentapi-76809725Belum ada peringkat

- RetailersDokumen11 halamanRetailersrakshit1230% (1)

- The Champion Legal Ads: 01-27-22Dokumen36 halamanThe Champion Legal Ads: 01-27-22Donna S. SeayBelum ada peringkat

- CBOK 2015 Stakeholder Overview For Institutes - June 2014Dokumen10 halamanCBOK 2015 Stakeholder Overview For Institutes - June 2014danielaBelum ada peringkat

- 4A. Financial Proposal Submission Form. 4B. Summary of Costs. 4C. Breakdown of CostDokumen6 halaman4A. Financial Proposal Submission Form. 4B. Summary of Costs. 4C. Breakdown of Costpankaj kadkolBelum ada peringkat

- CE462-CE562 Principles of Health and Safety-Birleştirildi PDFDokumen663 halamanCE462-CE562 Principles of Health and Safety-Birleştirildi PDFAnonymous MnNFIYB2Belum ada peringkat

- PDFDokumen7 halamanPDFNikhilAKothariBelum ada peringkat

- Case General Motors Onstar ProjectDokumen10 halamanCase General Motors Onstar ProjectSergio IvánBelum ada peringkat

- Sourcing Manager or Supply Chain Manager or Commodity Manager orDokumen2 halamanSourcing Manager or Supply Chain Manager or Commodity Manager orapi-121441611Belum ada peringkat

- Acquisition Plan TemplateDokumen13 halamanAcquisition Plan TemplateMuhammad Sajid SaeedBelum ada peringkat

- Research Paper - Sample SimpleDokumen15 halamanResearch Paper - Sample Simplewarblade_02Belum ada peringkat