Chapter 14

Diunggah oleh

Le QuangDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Chapter 14

Diunggah oleh

Le QuangHak Cipta:

Format Tersedia

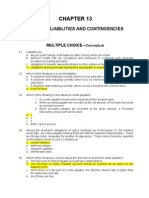

Answers to Chapter 14 Questions 1.

A comparison of Table 11-2 with Table 14-3 reveals that unlike banks, savings institutions hold the vast majority of their assets in the form of mortgages and mortgage backed securities. Like banks, the liabilities of savings institutions consist primarily of demand and time deposits. The assets of commercial banks are more diversified than those of savings institutions. Although there is a wide dispersion of sizes for commercial banks, we can see from Figure 11-8 that in 2004 there were 7,769 banks with assets of $7,602.5 billion, giving us an average size of $979 million. From Table 14-5, we see there were 1,365 savings institutions with assets totaling $1,632.6 billion giving us an average of $1,196 million. Surprisingly, the average bank size is smaller than the average savings institution. This speaks to the large number of relatively small banks reported in Table 11-5. If we separate the savings associations from the savings banks, their sizes are $1,047 million and $1,500 million respectively, in 2004. 2. The original mandate of the thrift industry was to pool small deposits from individuals and households in order to finance mortgage lending. Residential home ownership was deemed to be socially desirable and therefore this sector of the financial services industry received a franchise to encourage mortgage financing. This franchise became less valuable with the growth of the securitized mortgage market. Thus, the value of the intermediation function performed by thrifts (funneling small savings into home mortgage lending) was eroded by competition. At the same time, the Federal Reserve changed its conduct of monetary policy, allowing interest rates to rise significantly and become much more volatile. This change in policy had the worst possible impact on thrifts with their portfolios of long-term, fixed- rate mortgages. The interest rate increases caused the market value of the thrifts' mortgage portfolios to decline, thereby rendering many of the thrifts insolvent. Since the value of the thrift franchise already had been eroded, thrifts had very little to lose when they received expanded lending powers in 1980 and 1982. They took wild gambles on risky undertakings with the realization that they were betting with taxpayers' money. The only thing that the thrift owners really had to lose was the thrift charter. Many savings institutions failed as a result of these risky investments. 3. The Depository Institutions Deregulation and Monetary Control Act (DIDMCA) of 1980 sought to allow thrifts to compete with nondepository FIs by offering market rates of interest on deposits. This was accomplished via a lifting of the Regulation Q ceilings on deposit interest rates over the period from 1980 until 1986. Furthermore, to make thrift and bank deposits more attractive to the public, the ceiling on deposit insurance coverage was lifted from $40,000 to $100,000. The Garn-St. Germain Depository Institutions Act of 1982 (DIA) further expanded the lending powers of federally chartered thrifts and allowed interest-bearing NOW accounts to be opened. The impact of these initiatives, however, was to increase interest expenses for thrifts and other depository institutions. Therefore, thrifts were given added powers to invest in higher yielding consumer and commercial loans so as to provide them with the opportunity to earn a positive net interest margin (the spread between interest income and interest expense). However, this led to excessive risk taking and eventually led to the failure of thrifts.

85

4. The major shortcoming shared by the DIDMCA and the DIA legislation was their failure to resolve moral hazard problems so as to induce incentive compatible behavior. The changes in the savings institution (SI) industry had eroded the value of owning a traditionally managed thrift. Therefore, when confronted with new banking powers, traditional SI owners had very little to lose if they undertook very risky endeavors. Indeed, it was a game of Aheads I win, tails you lose@ with American taxpayers. If the risky endeavor succeeded, the potential profit was high and went entirely to the thrift owners. More likely, however, the risky endeavor would fail, in which case, the deposit insurance fund would pay out insured (and sometimes uninsured) depositors, with the ultimate cost borne by American taxpayers. 5. The FIRREA of 1989 rescinded some of the expanded SI lending powers of the DIDMCA of 1980 and the Garn St. Germain Act of 1982 by instituting the qualified thrift lender test (which requires all thrifts to hold portfolios predominately comprised of mortgages). It also required thrifts to divest their junk bonds by 1994 and replaced the FSLIC with a new thrift deposit insurance fund, FDIC-SAIF. The FDICIA of 1991 amended the DIDMCA of 1980 by introducing risk-based deposit insurance premiums in 1993 to prevent excess risk-taking. It also introduced prompt corrective actions (PCA) so that regulators could close banks faster when they failed. Previously, a policy of forbearance allowing them to continue as long as possible and led to the high cost of bailouts of the thrifts in the late 1980s. FDICIA also amended the International Banking Act of 1978 by expanding the regulatory oversight powers over foreign banks. 6. In Table 14B3, the SAIF-Insured Institutions column (1) shows the balance sheet of SAIF-insured savings associations in 2004. On this balance sheet, mortgages and mortgage-backed securities (securitized pools of mortgages) represent 75.60 percent of total assets. Figure 14-3 shows the distribution of mortgage related assets for all savings institutions as of 2004. As noted earlier, the FDICIA uses the QTL test to establish a minimum holding of 65 percent in mortgage-related assets for savings institutions. Reflecting the enhanced lending powers established under the 1980 DIDMCA and 1982 DIA, commercial loans and consumer loans amounted to 4.23 and 5.92 percent of assets, respectively. Finally, savings associations are required to hold cash and investment securities for liquidity purposes and to meet regulator-imposed reserve requirements. In 2004, cash, U.S. Treasury, and other non-mortgage securities holdings amounted to 7.26 percent of total assets. Small time and savings deposits are still the predominant source of funds, with total deposits accounting for 60.34 percent of total liabilities and net worth. The second most important source of funds is borrowing from the 12 Federal Home Loan Banks (FHLBs), which the savings associations themselves own. Because of their size and government-sponsored status, FHLBs have access to wholesale money markets for notes and bonds and can relend the funds borrowed on these markets to savings associations at a small markup over wholesale cost. Other borrowed funds include repurchase agreements and direct federal fund borrowings. Finally, net worth is the book value of the equity holders= capital contribution; it amounted to 11.39 percent in 2004. 7. Both specialize in providing deposit and lending services to households. They obtain their funds from small savings and demand deposits usually held by households. They utilize their deposit sources to make loans to households, usually in the form of home mortgages and consumer loans. Savings associations concentrate on home mortgages. Both savings associations and savings banks service the general consumer market. Savings banks differ from savings associations to the extent that they are allowed to diversify into corporate bonds and stocks.

86

8. Savings associations are regulated by the Office of Thrift Supervision and the FDIC-SAIF deposit insurance fund. Savings banks are regulated by the FDIC-BIF as well as by state agencies for state chartered savings banks. Both offer deposit insurance for deposits up to $100,000. The risk-based insurance premium should result in more prudent lending by thrifts since the costs of investing in risky assets will increase under this program. 9. The value of the savings institutions charter has gone down dramatically in the period of time since October 1979. This charter gave the FI a mandate to pool short term deposit liabilities into long-term mortgage loans. This Ashort book@ strategy became very risky (and unprofitable) in an environment of increasing and highly volatile interest rates. The yields on short-term liabilities rose above the fixed rates on long-term mortgages. If the savings institution paid the market rates on deposits, then interest expenses would exceed interest income, resulting in a negative spread If the savings institution did not pay market rates, then depositors withdrew their money and accessed the nonbanking FIs that provided money management services (Adisintermediation@). Savings institutions also were being pressured on the earnings side since they were experiencing greater competition in their niche market: the residential mortgage market. The proliferation of mortgage brokers and quasi-governmental agencies that specialized in mortgage financing (GNMA, FNMA, FHLMC) created a threat to the savings institutions' dominance in the residential mortgage market. The result of both of these circumstances was a marked decline in profitability during this period. 10. Mutual organizations are savings institutions in which the depositors are also legally the owners of the institution. 11. Figure 14-4 shows this trend in mutual versus stock charters and asset size for savings institutions from 1988 through 2004. Both the number of mutual savings institutions and the assets they hold are declining. Prior to 1994, there were more mutual organizations than stock charters. As of 1994, however, the numbers have reversed. 12. The high interest rates in the late 1970s and early 1980s led to stiff competition in the deposit markets for savings institutions, which had to offer higher rates to stem the flow of funds to other financial institutions. Although the DIDMCA and DIA acts in the early 1980s allowed for more flexibility in investments, they induced managers to invest in more risky projects, such as junk bonds. This led to a real decline in their net worth and, since regulatory forbearance resulted in a number of these banks being kept open even though they were technically insolvent, they ultimately had to be bailed out by regulators. The net result has been a slow and steady decline in the assets of the savings institution industry. 13. The answer to this S&P question will vary depending on the date of the assignment. 14. Historically, savings associations have concentrated primarily on residential mortgages while savings banks have been operated as more diversified savings associations having a large concentration of residential mortgage assets but holding commercial loans, corporate bonds, and corporate stock as well. Credit unions have historically focused on consumer loans funded with member deposits. Figure 14-1 illustrates the differences in the three types of depository institutions.

87

15. Credit unions did not suffer the same fate as the savings institutions because their portfolios were much more conservative than those of savings associations and savings banks; they specialize in making short-term consumer loans and tend to hold more government securities and less long-term residential mortgages. Their members usually belong to the credit union because of their association with work or geography, which results in more loyalty and a lower inclination to move to other institutions. Thus, the factors that led to the thrift crisis, higher interest rates and riskier investments, were not experienced by credit unions. 16. Over 33 percent of CU assets are in the form of small consumer loans. Total loans, however, comprised 65 percent of total assets in 2004. Figure 14-6 illustrates the composition of the loan portfolio for all CUs. As mentioned in the Chapter=s introduction, CUs concentrate mainly on servicing the financial needs of its membersCmainly individual consumers. Accordingly, 69.8 percent of the loan portfolio consists of first mortgages and (new and used) vehicle loans. Credit unions invest heavily in investment securities (over 30 percent of total assets in 2004). Figure 14-7 shows that 57.5 percent of the investment portfolio of CUs is in U.S. government Treasury securities or federal agency securities, while investments in other FIs (banks, savings institutions, and corporate credit unions) totaled 34.4 percent of the investment portfolio. The investment portfolio composition, along with cash holdings (6 percent of total assets), allow credit unions ample liquidity to meet their daily cash needs. CUs also have increased their off-balance-sheet activity. Unused loan commitments, including credit card limits and home equity lines of credit were greater than $83 billion in 2004. Credit union funding comes mainly from member deposits (86.1 percent of total funding in 2004). Figure 14-8 presents the distribution of these deposits in 2004. Regular share transaction accounts (similar to NOW accounts at other depository institutions) accounted for 36.3 percent of all CU deposits, followed by certificates of deposits (22.5 percent of deposits) and share draft accounts (12.4 percent of deposits). In 2004, CUs capital to assets ratio was 8.97 percent compared to 11.39 percent for savings associations, 10.08 percent for savings banks, and 9.96 percent for commercial banks. 17. Like savings associations and savings banks, credit unions can be federally or state chartered. Approximately two-thirds of credit unions are federally chartered and subject to National Credit Union Administration (NCUA) regulation. In addition, through its insurance fund (NCUIF), the NCUA provides deposit insurance guarantees of up to $100,000 for insured credit unions. Currently, the NCUIF covers 98 percent of all credit union deposits. As of 2004, the majority of the 9,210 CUs were federally chartered. 18. As CUs have expanded in number, size, and services, bankers claim that CUs unfairly compete with small banks that have historically been the major lender in small towns. For example, the American Bankers Association has made claims that the tax exemption for CUs gives them the equivalent of a $1 billion a year subsidy. The response of the Credit Union National Association (CUNA) is that any cost to taxpayers from CUs= tax exempt status is more than offset by benefits to members and, therefore, the social good they create. The CUNA estimates that the benefits of CU membership can range from $200 to $500 a year per member or, with almost 70 million members, a benefit of $14 billion to $35 billion per year.

88

In 1997, the banking industry filed two lawsuits in its push to narrow the widening membership rules governing credit unions. The first lawsuit challenged an occupation-based credit union=s ability to accept members from companies unrelated to the firm that originally sponsored the credit union. In the second lawsuit, the American Bankers Association asked the courts to bar the federal government from allowing occupation-based credit unions to convert to community-based charters. Bankers argued in both lawsuits that such actions, broadening the membership of credit unions along other than occupation-based guidelines, would further exploit an unfair advantage allowed through the credit union tax-exempt status. In February 1998, the Supreme Court sided with banks in its decision that credit unions could no longer accept members that were not a part of the common bond of membership. In April 1998, however, the U.S. House of Representatives overwhelmingly passed a bill that allowed all existing members to keep their credit union accounts. The bill was passed by the Senate in July 1998 and signed into law in August 1998. The final legislation not only allowed CUs to keep their existing members but it allowed CUs to accept new groups of membersCincluding small businesses and low income communities that had been locked out by the Supreme Court ruling. 19. The three types of finance companies are (1) sales finance institutions, (2) personal credit institutions, and (3) business credit institutions. Finance companies differ from commercial banks in that they rely on short-and long-term borrowings, such as commercial paper and bonds, instead of deposits. Their assets consist mainly of business and consumer loans, usually short term. They are less regulated and as a result also tend to hold more equity to assets to signal their solvency because they are heavy borrowers in the credit markets. 20. Consumer lending, business lending, and mortgage financing. 21. A comparison of Table 14-7 with Table 11-2 shows that finance companies hold relatively more equity, 13.4% for finance companies and 9.96% for commercial banks. The difference is most likely attributable to the debt of commercial banks being insured, usually by the FDIC. This insurance make the debt safer from the depositors' and stockholders' perspective. This allows the commercial bank to take on more debt than the uninsured finance company. 22. Business and consumer loans (called accounts receivable) are the major assets held by finance companies; in 2004 they represented 72.1 percent of total assets. In 2004, consumer loans constituted 40.57 percent of all finance company loans, mortgages represented 19.40 percent, and business loans comprised, 40.03 percent. In 2004 commercial paper amounted to $150.8 billion (8.7 percent of total assets); other debt (due to parents and not elsewhere classified) totaled $881.1 billion (50.4 percent of total assets). Total capital comprised $233.9 billion (13.4 percent of total assets), and bank loans totaled $64.1 billion (3.7 percent of total assets). 23. According to Table 14-9, nonconsumer finance areas, especially, equipment leases and loans as well as real estate loans. 24. Presumably because finance companies generally attract a riskier class of customers than do banks. In the late 1990s, however, economic problems in emerging market countries resulted in unusually low car sales in the U.S. As an incentive to clear the expanding stock of new cars, auto finance companies owned by the major auto manufacturers slashed interest rates on new car loans.

89

25. The answer to this S&P question will vary depending on the date of the assignment 26. First, finance companies are not subject to regulations that restrict the types of products and services they can offer. Second, they have no regulators monitoring them since they do not accept deposits. Third, since they are usually subsidiaries of industrial companies, they are likely to have more product expertise. Fourth, they are more willing to take on risky customers. Finally, finance companies have lower overhead than banks. 27. Because they do not accept deposits the way commercial banks do. 28. Since the Tax Reform Act of 1986, only home equity loans offer tax deductible interest for the borrower. Hence these types of loans are much more popular than those without a tax deduction. The increased demand for these types of loans has attracted the finance companies into this product line. 29. A wholesale loan is a loan to a company used to finance business with its suppliers as opposed to a retail loan that finances a transaction between a company and a consumer. 30. This would likely be interpreted as a signal of safety and ability to borrow more money if needed. As such it is a positive signal.

90

Anda mungkin juga menyukai

- Chapter 18Dokumen5 halamanChapter 18Le QuangBelum ada peringkat

- Chapter 17Dokumen7 halamanChapter 17Le QuangBelum ada peringkat

- Chapter 16Dokumen5 halamanChapter 16Le QuangBelum ada peringkat

- Chapter 11Dokumen10 halamanChapter 11Le QuangBelum ada peringkat

- Answers To Chapter 10 QuestionsDokumen7 halamanAnswers To Chapter 10 QuestionsLe QuangBelum ada peringkat

- Chapter 15Dokumen4 halamanChapter 15Le QuangBelum ada peringkat

- Answers To Chapter 13 QuestionsDokumen7 halamanAnswers To Chapter 13 QuestionsLe QuangBelum ada peringkat

- Chapter 12Dokumen2 halamanChapter 12Le QuangBelum ada peringkat

- Chapter 09Dokumen5 halamanChapter 09Le QuangBelum ada peringkat

- Chapter 08Dokumen5 halamanChapter 08Le QuangBelum ada peringkat

- Chapter 07Dokumen6 halamanChapter 07Le QuangBelum ada peringkat

- Answers To Chapter 6 QuestionsDokumen4 halamanAnswers To Chapter 6 QuestionsLe QuangBelum ada peringkat

- Answers To Chapter 2 QuestionsDokumen11 halamanAnswers To Chapter 2 QuestionsĐức ĐặngBelum ada peringkat

- Chapter 03Dokumen6 halamanChapter 03Đức ĐặngBelum ada peringkat

- Chapter 05Dokumen7 halamanChapter 05Le QuangBelum ada peringkat

- Role of Financial Institutions in Facilitating Resource AllocationDokumen5 halamanRole of Financial Institutions in Facilitating Resource AllocationAnthony FullertonBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Intermediate Accouting Testbank ch13Dokumen23 halamanIntermediate Accouting Testbank ch13cthunder_192% (12)

- Great Depression - Graphic OrganizerDokumen2 halamanGreat Depression - Graphic Organizerapi-252609657Belum ada peringkat

- Starting at PNB Vs Tejano - G.R. No. 173615, 16 October 2009Dokumen82 halamanStarting at PNB Vs Tejano - G.R. No. 173615, 16 October 2009Allen SoBelum ada peringkat

- Legal Notice (138) GurudevDokumen4 halamanLegal Notice (138) Gurudevpardeep100% (1)

- An Ephemeral Study On Contribution of Exim Bank India in Export Financing 2017 - Verma-ReevaDokumen3 halamanAn Ephemeral Study On Contribution of Exim Bank India in Export Financing 2017 - Verma-ReevaChris JasabeBelum ada peringkat

- Islamic Finance Cases 1987-2009Dokumen54 halamanIslamic Finance Cases 1987-2009Charme Chevronnie0% (1)

- Full Download Bank Management Koch 8th Edition Test Bank PDF Full ChapterDokumen36 halamanFull Download Bank Management Koch 8th Edition Test Bank PDF Full Chapterexosmosetusche.mmh69100% (17)

- Dissertation Project Report (2013-2015)Dokumen61 halamanDissertation Project Report (2013-2015)Dinesh SingalBelum ada peringkat

- Directives - Unified Directives 2067 EnglishDokumen474 halamanDirectives - Unified Directives 2067 EnglishManoj ThapaliaBelum ada peringkat

- SBI Gold LoanDokumen12 halamanSBI Gold Loan1208059010100% (1)

- Ebcl ScannerDokumen506 halamanEbcl ScannerA0913KHUSHI RUNGTABelum ada peringkat

- NSCI Training Programmme: National Safety CouncilDokumen5 halamanNSCI Training Programmme: National Safety Councildan_geplBelum ada peringkat

- 05-01-13 Taibbi: Secret and Lies of The BailoutDokumen17 halaman05-01-13 Taibbi: Secret and Lies of The BailoutWilliam J GreenbergBelum ada peringkat

- Banking RFP Template Not For ProfitDokumen2 halamanBanking RFP Template Not For ProfitJill MarinoBelum ada peringkat

- JP Morgan Chase acquisition of Bear StearnsDokumen2 halamanJP Morgan Chase acquisition of Bear StearnsDaryaBokach100% (2)

- BST Worksheet Class 11Dokumen26 halamanBST Worksheet Class 11btsqueen62Belum ada peringkat

- Role of District Industries CentreDokumen19 halamanRole of District Industries CentreakjsdkuwBelum ada peringkat

- Assignment On Marketing Mix of HSBCDokumen9 halamanAssignment On Marketing Mix of HSBCSalil ShrivastavaBelum ada peringkat

- Student Visa Application Process For The UKDokumen1 halamanStudent Visa Application Process For The UKMd AlauddinBelum ada peringkat

- Lessons in M&A: Difficulty Level A Risky Business With A 70% Plus Failure-Rate.'Dokumen35 halamanLessons in M&A: Difficulty Level A Risky Business With A 70% Plus Failure-Rate.'kimngangs1607Belum ada peringkat

- Payments Technology Drives New RevenueDokumen18 halamanPayments Technology Drives New RevenueHubab Khalid100% (1)

- 2019 Fsi GuideDokumen218 halaman2019 Fsi GuideCitrineDiadem QueenBelum ada peringkat

- CG German Model Project DRAFTDokumen64 halamanCG German Model Project DRAFTMussadaq JavedBelum ada peringkat

- Auditing and AssuranceDokumen14 halamanAuditing and AssurancePrincess Vie RomeroBelum ada peringkat

- Functions of Commercial BanksDokumen14 halamanFunctions of Commercial Banksroobhini100% (6)

- NesDokumen99 halamanNesMichelleBanilaEvangelista100% (1)

- Determinants of The Asset Structure of Malaysian Islamic Banks: A Panel StudyDokumen17 halamanDeterminants of The Asset Structure of Malaysian Islamic Banks: A Panel StudyAhmadazams SulaimanBelum ada peringkat

- NeoGrowth Social Impact Report 2018Dokumen47 halamanNeoGrowth Social Impact Report 2018Krishnanand GaurBelum ada peringkat

- SPA Dip and PayDokumen10 halamanSPA Dip and PayKhristine B.Belum ada peringkat

- เฉลย o-net51-engDokumen30 halamanเฉลย o-net51-engSummer RobinsonBelum ada peringkat