Sign Petition To Grow 2012

Diunggah oleh

Jeanne VinalDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Sign Petition To Grow 2012

Diunggah oleh

Jeanne VinalHak Cipta:

Format Tersedia

Memo To: Re: Businesses/Concerned Citizens From: Jeanne Vinal Tax Plan to Boost U.S.

Employment For Your Immediate Approval to Submit to Congress Date: November 2012

Request the following Amendment to Tax Code to Boost US Employment Double Deduction allowed to employers for Employees in US AND Limit 179 Deduction to American Made Goods AND Double Deduction for Employee Education Double Deduction allowed to employers for Employees in US This means that business can take a double deduction on whatever it spends on employment in the US. Example, if the business spends 500,000 on employment in the US, the business can deduct 1,000,000 on its tax form. If a business spends 100,000 on wages, it can deduct 200,000. Benefits: Decrease lay offs Increase number employed Increase salaries of existing employees Decrease off shoring employment Reward and encourage job creators Reward and encourage successful US companies Keep money circulating in private sector Decrease social programs for the unemployed and underemployed. Increase of W-2s versus 1099 Fair use of economic stimulus- EVERY employer gets to use it. Targeted use of economic stimulus Targeting on job retention, increased family income and increased US employment Simple to implement: Only one line addition on annual income tax. No complicated applications for the stimulus with review and management I AGREE; Congress please enact immediately. _________________________ Name Date: ___________________ ____________________________ Company

Fax 716-832-6735/email vinalsesq@aol.com /Mail 193 Delaware Av, Bflo, NY 14202

Limit 179 Deduction to American Made Goods We allow immediate deduction on equipment purchased, rather than the traditional depreciation. This makes purchases of services of foreign make goods underwritten by US taxpayers. This special incentive should be limited to only American Made goods. Benefits: Increase American Manufacturing by US companies. Increase Manufacturing in America by foreign companies in order to get the American Made certification. Reverse off-shoring of manufacturing. I AGREE; Congress please enact immediately. _________________________ Name Date: ___________________ ____________________________ Company

Double Deduction for Employee Education Employers will be allowed to take a double deduction for any expenses paid for employees to continue their education. Benefits: Employers are in the best position to determine WHAT education and training makes their employees more valuable to the company. Support local colleges, universities and training centers. Make individual employees more valuable and productive. Increase knowledge of work force. Reward and encourage job creators Reward and encourage successful US companies. Reward and encourage companies that invest in their US employees. Fair use of economic stimulus- EVERY employer gets to use it. Targeted use of economic stimulus Targeting on job retention, increased family income and increased US employment Simple to implement: Only one line addition on annual income tax. I AGREE; Congress please enact immediately. _________________________ Name Date: ___________________ ____________________________ Company

Fax 716-832-6735/email vinalsesq@aol.com /Mail 193 Delaware Av, Bflo, NY 14202

Anda mungkin juga menyukai

- 2023 Tax Deduction Cheat Sheet and LoopholesDokumen24 halaman2023 Tax Deduction Cheat Sheet and LoopholesKrisstian AnyaBelum ada peringkat

- Address Office: # Cell: # Fax: # Email: (Insert Email Address)Dokumen40 halamanAddress Office: # Cell: # Fax: # Email: (Insert Email Address)James ZacharyBelum ada peringkat

- Covered California Grants: For Outreach To IndividualsDokumen2 halamanCovered California Grants: For Outreach To IndividualsKelli RobertsBelum ada peringkat

- LANE-Concise Daily Routine For TromboneDokumen12 halamanLANE-Concise Daily Routine For Trombonemaskedhombre100% (1)

- Answer To The Case StudyDokumen11 halamanAnswer To The Case StudyNahidul Islam IU100% (3)

- The Art of Using Paper Space in AutoCAD, All Secrets of Using Layout Tab and Paper Space in AutoCAD 2010 To 2020 PDFDokumen218 halamanThe Art of Using Paper Space in AutoCAD, All Secrets of Using Layout Tab and Paper Space in AutoCAD 2010 To 2020 PDFKyaw ZinBelum ada peringkat

- Immunization RecordDokumen1 halamanImmunization RecordJordan Simmons ThomasBelum ada peringkat

- 3 Users of Accounting InformationDokumen23 halaman3 Users of Accounting Informationapi-267023512100% (1)

- (Applied Econ.) Module 4. - Introduction To Applied EconomicsDokumen5 halaman(Applied Econ.) Module 4. - Introduction To Applied Economicsrowena marambaBelum ada peringkat

- Economic ProfitDokumen11 halamanEconomic ProfitUzma AriesBelum ada peringkat

- CivproDokumen60 halamanCivprodeuce scriBelum ada peringkat

- BS 1139-6-2005 Metal Scaffolding. Specification For Prefabricated Tower Scaffolds Outside The Scope of BS en 1004, But Utilizing Components From Such SystemsDokumen16 halamanBS 1139-6-2005 Metal Scaffolding. Specification For Prefabricated Tower Scaffolds Outside The Scope of BS en 1004, But Utilizing Components From Such SystemsHiệpBáBelum ada peringkat

- Business Plan GuidelinesDokumen2 halamanBusiness Plan GuidelinesKaren SnowBelum ada peringkat

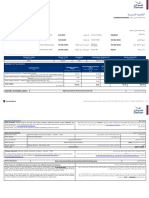

- Invoice Form 9606099Dokumen4 halamanInvoice Form 9606099Xx-DΞΛDSH0T-xXBelum ada peringkat

- THE Story OF THE Rizal LAW (RA 1425) : FilibusterismoDokumen5 halamanTHE Story OF THE Rizal LAW (RA 1425) : FilibusterismoKristine PangahinBelum ada peringkat

- YSE 2014 Business Plan SampleDokumen19 halamanYSE 2014 Business Plan SamplesyahadahrizkaBelum ada peringkat

- Business Math11 12 q2 Clas4 Benefits Given To Wage Earners v2 Joseph AurelloDokumen15 halamanBusiness Math11 12 q2 Clas4 Benefits Given To Wage Earners v2 Joseph AurelloKim Yessamin Madarcos100% (2)

- IRN - 18.07.2019 - Harshad Panchal - Revision-0 - Furnace Fabrica - JNK - PORVAIR - RIL PDFDokumen3 halamanIRN - 18.07.2019 - Harshad Panchal - Revision-0 - Furnace Fabrica - JNK - PORVAIR - RIL PDFsaptarshi jashBelum ada peringkat

- CORPO Case Doctrines Lex TalionisDokumen20 halamanCORPO Case Doctrines Lex TalionisJustin YañezBelum ada peringkat

- Solutionomics: Innovative Solutions for Achieving America's Economic PotentialDari EverandSolutionomics: Innovative Solutions for Achieving America's Economic PotentialBelum ada peringkat

- Make A Product or Provide A Service How Goods/services Are Exchanged Deal W/ All Money MattersDokumen5 halamanMake A Product or Provide A Service How Goods/services Are Exchanged Deal W/ All Money MattersSalik AsgharBelum ada peringkat

- ECO615 AAkinmoladunDokumen9 halamanECO615 AAkinmoladunAndrewAkinmolaProfBelum ada peringkat

- Chamber of Commerce LetterDokumen3 halamanChamber of Commerce LetterJohn BinderBelum ada peringkat

- Obama US MFG Tax IncentivesDokumen3 halamanObama US MFG Tax IncentivescocoparkBelum ada peringkat

- The Managers DilemaDokumen3 halamanThe Managers DilemaKrishan Kumar Sharma0% (1)

- Chapter 4.socio-Economic Impact ActivityDokumen15 halamanChapter 4.socio-Economic Impact ActivityDJianne Sulangon-GurayBelum ada peringkat

- The Role of Business in A Mixed EconomyDokumen5 halamanThe Role of Business in A Mixed EconomyDevBelum ada peringkat

- Complete NoteDokumen8 halamanComplete NoteAkannaya ChiamakaBelum ada peringkat

- Bring Jobs Home To America - Presentation 062111Dokumen19 halamanBring Jobs Home To America - Presentation 062111scheath2670Belum ada peringkat

- Economic StagesDokumen22 halamanEconomic StagesMarius BuysBelum ada peringkat

- Business Notes: The Economic Problem: Needs, Wants and ScarcityDokumen15 halamanBusiness Notes: The Economic Problem: Needs, Wants and ScarcityAndy MwirigiBelum ada peringkat

- Topic 1 Role of BusinessDokumen8 halamanTopic 1 Role of BusinessDisha MittalBelum ada peringkat

- MODULE 6. Effects of Contemporary Economic Issues Affecting The FilipinoDokumen32 halamanMODULE 6. Effects of Contemporary Economic Issues Affecting The FilipinoCarolina PangilinanBelum ada peringkat

- Natural Resources Human Resources Capital: Entrepreneurship: Five Types of Stakeholders Are Involved in A BusinessDokumen4 halamanNatural Resources Human Resources Capital: Entrepreneurship: Five Types of Stakeholders Are Involved in A BusinessMaxamed xasanBelum ada peringkat

- BE Unit 1 Notes - StudentDokumen8 halamanBE Unit 1 Notes - StudentMR PROBelum ada peringkat

- Business Objectives and Stakeholder ObjectivesDokumen4 halamanBusiness Objectives and Stakeholder ObjectivesBryan MendozaBelum ada peringkat

- Ext Influences On Bus ActDokumen11 halamanExt Influences On Bus Actattackdfg2002Belum ada peringkat

- Chapter 27 - Economic Issues Update 2Dokumen20 halamanChapter 27 - Economic Issues Update 2Amour PartekaBelum ada peringkat

- Full Letter: Florida Restaurant Owners Send Letter To Governor Requesting Immediate Economic ReliefDokumen7 halamanFull Letter: Florida Restaurant Owners Send Letter To Governor Requesting Immediate Economic ReliefActionNewsJaxBelum ada peringkat

- Making Sense of The BudgetDokumen9 halamanMaking Sense of The BudgetJoveis QuekBelum ada peringkat

- Deductions There Are Two KindsDokumen5 halamanDeductions There Are Two KindsESCAÑO , Jersy AnnBelum ada peringkat

- Electroparts Manufacturing, InCDokumen10 halamanElectroparts Manufacturing, InCWilliam Andrew Gutiera BulaqueñaBelum ada peringkat

- Tax SavingDokumen24 halamanTax SavingcrazysidzBelum ada peringkat

- J.K. Lasser's Guide to Self-Employment: Taxes, Tips, and Money-Saving Strategies for Schedule C FilersDari EverandJ.K. Lasser's Guide to Self-Employment: Taxes, Tips, and Money-Saving Strategies for Schedule C FilersBelum ada peringkat

- A Unique OpportunityDokumen21 halamanA Unique OpportunityBhup InderBelum ada peringkat

- Business Math11 12 q2 Clas4 Benefits Given To Wage Earners v2 Joseph AurelloDokumen15 halamanBusiness Math11 12 q2 Clas4 Benefits Given To Wage Earners v2 Joseph AurelloKim Yessamin MadarcosBelum ada peringkat

- Topic 6 - External Influences On BusinessDokumen11 halamanTopic 6 - External Influences On BusinesstandmacgmBelum ada peringkat

- Mba:-First Year: Rasiklal .M. Dhariwal Institute of ManagementDokumen9 halamanMba:-First Year: Rasiklal .M. Dhariwal Institute of ManagementAmol MahajanBelum ada peringkat

- Business Objectives: Mission StatementDokumen17 halamanBusiness Objectives: Mission StatementCRAZYBLOBY 99Belum ada peringkat

- English Business Plan QuestionnaireDokumen11 halamanEnglish Business Plan QuestionnaireSonia VermaBelum ada peringkat

- Dfi 201 Lec Three Managing Taxes Teaching NotesDokumen14 halamanDfi 201 Lec Three Managing Taxes Teaching Notesraina mattBelum ada peringkat

- Business Revision 1Dokumen30 halamanBusiness Revision 1Sik Hin ChongBelum ada peringkat

- Concepts in Federal Taxation 2013 20th Edition Murphy Test Bank 1Dokumen36 halamanConcepts in Federal Taxation 2013 20th Edition Murphy Test Bank 1dianabrowncgmkxyerfn100% (27)

- Summary of The Case StudyDokumen2 halamanSummary of The Case StudyMehedi HasanBelum ada peringkat

- Economic Issues IGCSE (Business Studies)Dokumen4 halamanEconomic Issues IGCSE (Business Studies)an4Belum ada peringkat

- Introduction To EconomicsDokumen12 halamanIntroduction To EconomicsBaro LeeBelum ada peringkat

- 2009 R-3 Class Notes PDFDokumen5 halaman2009 R-3 Class Notes PDFAgayatak Sa ManenBelum ada peringkat

- Business Section 6 Notes (Igcse)Dokumen13 halamanBusiness Section 6 Notes (Igcse)Anushree JalanBelum ada peringkat

- Aldersgate College: School of Business, Management and AccountancyDokumen5 halamanAldersgate College: School of Business, Management and AccountancyAlfred LopezBelum ada peringkat

- GOP Tax Bill HighlightsDokumen2 halamanGOP Tax Bill HighlightsWashington Examiner100% (1)

- GOP Jobs Plan WorksDokumen10 halamanGOP Jobs Plan WorksKim HedumBelum ada peringkat

- HD Employee Layoff Due Covid 19 Crisis EmailDokumen1 halamanHD Employee Layoff Due Covid 19 Crisis EmailShailendra PandavBelum ada peringkat

- AssignmentDokumen5 halamanAssignmentkhaebanalintlemamorieeBelum ada peringkat

- Year 9 Commerce NotesDokumen10 halamanYear 9 Commerce NotesieatgrassmoooBelum ada peringkat

- Business Income, Deductions, and Accounting MethodsDokumen37 halamanBusiness Income, Deductions, and Accounting MethodsMo ZhuBelum ada peringkat

- Home Work - I Economics of DisasterDokumen6 halamanHome Work - I Economics of DisasterKarthik VadlapatlaBelum ada peringkat

- 2015 Trends and Predictions Guide for Small Business: Everything you need to know to run a successful business in 2015Dari Everand2015 Trends and Predictions Guide for Small Business: Everything you need to know to run a successful business in 2015Belum ada peringkat

- JK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LineDari EverandJK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LineBelum ada peringkat

- Labor BreakfastDokumen1 halamanLabor BreakfastSunlight FoundationBelum ada peringkat

- Inc 2Dokumen19 halamanInc 2MathiBelum ada peringkat

- Charcoal Pile-2016Dokumen3 halamanCharcoal Pile-2016ZerotheoryBelum ada peringkat

- Chartering TermsDokumen9 halamanChartering TermsNeha KannojiyaBelum ada peringkat

- G.R. No. 203610, October 10, 2016Dokumen7 halamanG.R. No. 203610, October 10, 2016Karla KatigbakBelum ada peringkat

- BPI Payment ProcedureDokumen2 halamanBPI Payment ProcedureSarina Asuncion Gutierrez100% (1)

- Columbus Stainless Product CatalogueDokumen14 halamanColumbus Stainless Product CatalogueRPBelum ada peringkat

- In Re John H. Gledhill and Gloria K. Gledhill, Debtors, State Bank of Southern Utah v. John H. Gledhill and Gloria K. Gledhill, 76 F.3d 1070, 10th Cir. (1996)Dokumen26 halamanIn Re John H. Gledhill and Gloria K. Gledhill, Debtors, State Bank of Southern Utah v. John H. Gledhill and Gloria K. Gledhill, 76 F.3d 1070, 10th Cir. (1996)Scribd Government DocsBelum ada peringkat

- Tax Challenges Arising From DigitalisationDokumen250 halamanTax Challenges Arising From DigitalisationlaisecaceoBelum ada peringkat

- By His Excellency's Command: E.B. LittlechalesDokumen1 halamanBy His Excellency's Command: E.B. LittlechalesPentortoiseBelum ada peringkat

- Foods: BY Gohar Abid Fatima Khalil Omer Jan Shaukat Shahbano Arshad Mehr NasirDokumen13 halamanFoods: BY Gohar Abid Fatima Khalil Omer Jan Shaukat Shahbano Arshad Mehr NasirGohar AbidBelum ada peringkat

- IBP V AtienzaDokumen6 halamanIBP V AtienzaDaniel OngBelum ada peringkat

- University of Health Sciences, Lahore: Entrance Test - 2011Dokumen20 halamanUniversity of Health Sciences, Lahore: Entrance Test - 2011Aqsa BalouchBelum ada peringkat

- Teks MC TM 2Dokumen2 halamanTeks MC TM 2ERLINDA YUNITA DEWIBelum ada peringkat

- Animal Word Search Puzzle Sample3Dokumen2 halamanAnimal Word Search Puzzle Sample3tebugreenBelum ada peringkat

- Article 1419 DigestDokumen1 halamanArticle 1419 DigestCheng AyaBelum ada peringkat

- Vistar - The Rural InitiativeDokumen14 halamanVistar - The Rural InitiativePRAPTI TIWARIBelum ada peringkat

- Intellectual CapitalDokumen3 halamanIntellectual CapitalMd Mehedi HasanBelum ada peringkat

- Microsoft Server Downgrade RightsDokumen7 halamanMicrosoft Server Downgrade RightsJanuaryBelum ada peringkat

- MSI BidDokumen7 halamanMSI BidAshwin MBelum ada peringkat