Et At.: in Re

Diunggah oleh

Chapter 11 Dockets0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

16 tayangan3 halamanUNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK In re: Chapter II GRAND PRIX FIXED LESSEE LLC INNKEEPERS USA TRUST, et at.

Deskripsi Asli:

Judul Asli

10000005192

Hak Cipta

© Attribution Non-Commercial (BY-NC)

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniUNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK In re: Chapter II GRAND PRIX FIXED LESSEE LLC INNKEEPERS USA TRUST, et at.

Hak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

16 tayangan3 halamanEt At.: in Re

Diunggah oleh

Chapter 11 DocketsUNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK In re: Chapter II GRAND PRIX FIXED LESSEE LLC INNKEEPERS USA TRUST, et at.

Hak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 3

UNITED STATES BANKRUPTCY COURT

SOUTHERN DISTRICT OF NEW YORK

In re:

Chapter II

GRAND PRIX FIXED LESSEE LLC

INNKEEPERS USA TRUST, et at.

Debtors Case# 10-13825 & 10-13800

Transferor:

NOTICE OF TRANSER OF CLAIM PURSUANT TO

F.R.B.P. RULE 3001(E) (1)

Prinova

PO Box 1089

San Jose, CA 95108

Please note that your claim in the amount of$499.37 has been partially transferred in the amount of

$234.83 (unless previously expunged by court order) to:

Transferee: Sierra Liquidity Fund, LLC

2699 White Road, Suite 255

Irvine, CA 92614

The transfeJTed amount of$234.83 represents an amount sold by Prinova to Sierra Liquidity fund, LLC.

No action is required if you do not object to the transfer of your claim. However, IF YOU

OBJECT TO THE TRANSFER OF YOUR CLAIM, WITHIN 20 DAYS OF THE DATE OF

THIS NOTICE, YOU MUST:

FILE A WRITTEN OBJECTION TO THE TRANSFER with:

United States Bankruptcy Court

Alexander Hamilton Custom House

Attn: Bankruptcy Clerk

One Bowling Green

New York, NY I 0004-1408

SEND A COPY OF YOUR OBJECTION TO THE TRANSFEREE:

Refer to INTERNAL CONTROL No. __ in your objection.

If you file an objection, a hearing will be scheduled.

IF YOUR OBJECTION IS NOT TIMELY FILED, THE TRANSFEREE WILL BE

SUBSTITUTED ON OUR RECORDS AS THE CLAIMANT.

FOR CLERK'S OFFICE ONLY:

This notice was mailed to the first party, by first mail, postage prepaid on , 20

INTERNAL CONTROL NO. ____ ~ - -

Copy: (check) Claims Agent __ Transferee ____ Debtor's Attorney __ _

Deputy Clerk

Transfer of Claim

INNKEEPERS USA TRVST,etat.

alk/a GRAND PRIX FIXED LESSEE LLC & GRAND PRIX FLOATING

LESSEE LLC & GRAND PRIX ANAHEIM ORANGE LESSEE LLC

This agreement (the "Agreement") is entered into between __ ------- ("Assignor")

and Sierra Liquidity Fund. LLC or assignee ("Assignee") with regard to the following matters:

1. Assignor in consideration of the sum of Jf the current amount outstanding in U.S. Dollars on the Assignor,s

trade claim (the "Purchase Price"), does hereby tmnsfer to Assignee all of the Assignor's right. tHie and interest in and to all of the claims of

Assignor, Including the right to amotmts owed under any executory comract and a:ny respeclive cure amount related to the potential assumption

and cure of such a contract (the "Claim"), against Innkeepers USA Trust, e1 al. (aftlllates, subsidiaries and other related debtors) (the

''Debtor"), in proceedings fl",. rPnl:IWli7.ation (the in the States Bankruptcy Court. Southern District of New York, in the

current amount of not less -- Jt ?. .'?</, ? 3 m the amount due, which shall be defined as

'"the Claim Amount"}, and all rights and benefits of the As-signor relating to lhe Claim including, without limitation, Assignor's rights to

receive interest, penalties and fees, if any, which may be paid with respect to the Claint, and all cash, securities. inscruments. cure payments,

and other property which may be paid or issued by the Debtor in satisfaction of the Claim. right to litigate, receive litigation proceeds and any

and all voting rights related to the Claim . The Claim is based on amounts owed to Assignor by Debtor as set forth below and this assigmuent

is an absolute tnd unconditional assigrunent of ownership of the Claim. and shall not be deemed to create a security interest.

2. Assignee shall be entitled to aU distributions mode by the Debtor on account of the Claim, even distributions made rutd attributable to the

Claim being allowed in the Debtor's case. in an amount in el!;cess of the Claim AmOimt. Assignor and warrants that the amount of

the Claim is not less than the Claim Amount, that this amount is lhe true and correct amount owed by the Debtor to the Assignor, and that no

valid defense or right of set-offto the Claim exists.

3. Assignor further representS and wllll'8.nts that no payment has been received by Assignor or by any third party claiming through Assignor. in

full or partial satisfaction of the Claim, that Assignor has not previously assigned, sold or pledged the Cfaim, in whole or in part. to any third

party. that Assignor owns and has title w the Claim free and clear of any and all liens. security interest1i or encumbrances of any kind or nature

whatsoever. and that there are no offsets or defenses that have been or may be asserted by or on behalf of the Debtor or any other party to

reduce the amount of the Claim or to impalr its value.

4. Should It be determined any transfer by the Debtor to the Assignor is or could have been avoided as a preferential payment, Assignor

shall repay such transfer to the Debtor in a manner. Should Assignor fail to repay such transfer to the Debtor, then Assignee, solely at its

own option, shall be entitled to make said payment on account of the avoided transfer, nnd the Assignor sh;:aJI indemnify the Assignee for any

amounts paid to the Debtor. To lhe extent necessary, Assignor grams to Assignee a Power of Attomey whereby die Assignee is authorized at

Assignee's own expense to defend against all avoidance actions. preferential payment suits, and fraUdulerlt conveyance actions for the benefit of

the Assignor and the Assignee; however Assignee has no obligation to defend against sucll actions. If the Bar Date for filing a Proof of Claim

hfls passed. Assignee reserves the right, but not the obligation, to purchase the Trade Claim for the amount published in the Schedule F.

S. Assi,gnor is awnre 1hat lhe Purchase Price may differ (rom the amount ultimately distributed In lhe Proceedings with respect to the Claim and that

such amount may not l'le absolutely determined until of a finaJ order confirming n plan of reorganianion. Assignor acknowledges that, except as

set fmth in this agreement, neither As!iignee nor any asem or representative of Assignee has made any represeruation whatsoever 10 Assignor regarding

mancr relating to the proceedings, !.he Debtor, or the

likelihood of recovery of the Claim. Assignor represents tAIU it has adequate information conceminB: the business and financial condition of the Debtor

nnd the status of the Proceedings to make an informed decision regarding its sale of the Claim.

6. Assignee wi11.1Ssume all of the recovery risk in terms of the paid on the Claim. if any. at emergence from bankruptcy or liquidation.

Assignee does not a.ssume any of the risk relating 10 the amount of the claim attested to by the Assignor. rn Ute event that the Clain1 is

reduced. subordinated or impaired for any reason whatsoever, Assignor agree.. to inunediately refund and pay to Assignee. a pro-

rota share of the Purchase Price equal to the ratio of the amounc of the Claim disallowed divided by Ute Claim, plus 8% interest per annum from

the date of this Agreement until the date of repayment. The Assignee. as set fonh below. shall have no obligation to otherwise detend the

Claim. and the refund obligation of the Assignor pursuant to this section shall he absolutely payable to Assignee without regard to whether

Assignee defends the Claim. The Assignee or Assignor shall have the right to defend the claim. only at its own expense and shall uor look to

the counterparty for any reimbursement fur legal expenses.

7. To the extent that it may be required by applicable law, Assignor hereby irrevocably appoinLS Assignee or James S. Riley as its true and

lawful attomey . as the true and lawful agent and special attorneys-in-fact of the Assignor with respect to the Claim, whh full power of

substitution (such power of attorney being deemed to be an irrevocnble power coupled with an interest), and authorizes Assignee or James S.

Riley to net in Assignor's stead. to demand. sue for, compromise and recover all such amounts as now are. or n1ay hereafter becOJne. due

payable for or on account nf the Claim. litigate for any dnmages. omissions or other related lo this claim. vote in any proceedings. or any olher

actions that may enl1ance recovery or protect lhe interests of the Claim. Assignor grancs unto Assignee fullaulhorily to do all things necessary

to enforce the Claim and Assignor's rights there under. Assignor agrees that 1he powers granted by this paragraph are discretionary in nalure

and that the Assignee may exercise or decline to exercise such powers at Assignee's sole option. Assignee shQJI have no obligation lO lake any

action to prove or defend the Claim's validity or amow1t in the Proceedings or in any other dispute arising out of or relating to the Claim.

whether or not suit or other proceedings are commenced, and whether in mediation, arbitration, at trial, on appeaJ. or in administrative

proceedings. Assignor agrees to take such reasonable further action. as may be necessary or desirable to effect the Assignment of the Claim

and any payments or distributions on account of the Claim 10 Assignee including, without limitation, the execution of appropriate transfer

powers, corporate resolutions and consents. The Power of Attorney shall include without lim.itacion, (I) the right to vote, inspect books and

records, (2) the right to execute on behalf of Assignor, all assignments, certifiCates, documents and instruments that may be required for the

purpose of transfening the Claim owned by the Assignor, (3) the right to deliver cash, securities and other instmments distributed on account of

the Claim. together with a.U accompanying evidences of transfer and authenticity to, or upon the order of, the Assignee; and (4) the right after

the date of this Agreement 10 receive all benefits and cash distributions, endone checks payable to the Assignor and otherwise exercise all

rights of beneficial ownership of the Claim. '111e Purchaser shall not be required to post a bottd of any nature in connection with this power of

attorney.

8. Assignor shall forward to Assignee all notices received from tlle Debtor, the court or any third pany with respect to the Claim. including any

ballot with regard to voting the Claim in the Proceeding, and shaH take such action with respecl to the Claim in the proceedings, as Assignee

may request from time to time, including the provision ro the Assignee of an necessary supporting documentation evidencing the validity or the

Assignor's claim. Assignor that any distribution received by Assignor on account of the Claim from any source. whether in

form of cash. securities, instrument or any other property or right, is lhe property of and absolutely owned by the Assignee, thnt Assignor holds

and will hold such property in trust for the benefit of Assignee and will. at its own expense, promptly deliver to Assignee any such property in

the same fonn received, together with any endorsements or documents necessary to transfer such property to A'isignee.

9. In rile event of any dispute arising out of or relating to rhis Agreement, whether or not suit or other proceedings is commenced, and whether

in mediation. arbirnuion. at trial. on appeal, in administrative proceedings, or in bankruptcy (including, without limitation, any adversary

proceeding or contested matter in any bankrupccy case filed on account of the Assignor), the prevailing pnrty shall be entitled to its costs and

ex.penses incurred, including reasonable attorney fees.

JO. The tenus of this Agreement shall be binding upon, and s.h.all inure to the benefit of Assignor, Assignee and their respective successors and

assigns.

J I. Assignor hereby acknowledges that Assignee may at nny time further assign the Claim together with all rights. Iitle and interests of A5signl!e under

lhis Agreemenl. All representations and warranties of the Assignor made herein shall survive the execurion and delivery of this Agreement. This

Agreement may be exec01ed in councerparts and all such counterparts tilken together shall be deemed to constitute a single agreemen1.

12. This contract is not valid and enforceable without &ccepttutce of this Agreement with all necessary supporting documents by the Assignee,

as evidenced by a countersignature of this Agreement. The Assignee may reject the proffer of this contract for any reason whatsoever.

13. This Agreement shall be governed by and cocstrued in accordance with the Jaws of !he Stme of California. Any action arising under or relrning to

this Agreemenl may be hr<1ught in any state or federal court localed In Califomia. and Assignor consems 10 and confers personal jurisdiction over

Assignor by such court or couns and agrees that service of process may hr.! upon Assignor by mailing a copy of process to A!lsignor &t the address

set forth in this Agreement, and in any aClion hereunder, Assignor and Assignee waive llllY righl to demand a trial by jury.

You must include invoices, purchase orders. and/or proofs of delivery that relate to the claim,

Assignor hereby acknowledges and consents to all of the terms set forth in this Abrreement and hereby waives its right to raise any objection

thereto and its 1ight to receive norice pursuant to rule 3001 of the rules of the Bankruptcy procedure.

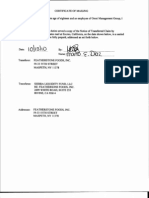

IN WITNESS WHEREOF. the undersigned As..;ignor l1ereto sets his hand this N, day . 2010.

ATTEST .

Signature \!

G . \'t\ 7 {e':,.\\>X

[Print Name and Title]

5 10 - o., "==\ (o- D-=\. '=1 0

Phone Number

Sierra Liquidity Fund, LLC et at.

2699 White Rd, Ste 255, Irvine, CA 92614

9496601144 x !()or 22; fax: 949-6600632

(.;il.ttl!U!'It ... ,)m

Name of Company

\ .),<o:.E.

Street Address

\-\ ,\:_ \:1

City, State & Zip '

N')_ @> Q.()\ ,(.Ct"-

10/12/2010

Anda mungkin juga menyukai

- Prinova: in ReDokumen3 halamanPrinova: in ReChapter 11 DocketsBelum ada peringkat

- Your Claim in The Amount Of$885.04 Against The Debtors Has Been Transferrecl ToDokumen3 halamanYour Claim in The Amount Of$885.04 Against The Debtors Has Been Transferrecl ToChapter 11 DocketsBelum ada peringkat

- In Re:: Your Claim in The Amount of $463.81 Against The Debtors Has Been Transferred ToDokumen3 halamanIn Re:: Your Claim in The Amount of $463.81 Against The Debtors Has Been Transferred ToChapter 11 DocketsBelum ada peringkat

- In ReDokumen3 halamanIn ReChapter 11 DocketsBelum ada peringkat

- In Re: DebtorsDokumen3 halamanIn Re: DebtorsChapter 11 DocketsBelum ada peringkat

- Your Claim in The Amount of $746.40 Against The Debtors Has Been Transferred ToDokumen3 halamanYour Claim in The Amount of $746.40 Against The Debtors Has Been Transferred ToChapter 11 DocketsBelum ada peringkat

- Deobtors Case #10-13825 10-13800: Chap-Rer 11Dokumen3 halamanDeobtors Case #10-13825 10-13800: Chap-Rer 11Chapter 11 DocketsBelum ada peringkat

- Prinova: Your Claim in The Amount Of$499.37 Against The Debtors Has Been Transferred ToDokumen3 halamanPrinova: Your Claim in The Amount Of$499.37 Against The Debtors Has Been Transferred ToChapter 11 DocketsBelum ada peringkat

- Your Claim in The Amount of $751.38 Against The Debtors Has Been Transferred ToDokumen3 halamanYour Claim in The Amount of $751.38 Against The Debtors Has Been Transferred ToChapter 11 DocketsBelum ada peringkat

- Crystal Flowers: New NYDokumen3 halamanCrystal Flowers: New NYChapter 11 DocketsBelum ada peringkat

- Prinova 30925 Wiegman RoadDokumen3 halamanPrinova 30925 Wiegman RoadChapter 11 DocketsBelum ada peringkat

- Et Al.: Crystal Flowers 2020 West El Camino RealDokumen3 halamanEt Al.: Crystal Flowers 2020 West El Camino RealChapter 11 DocketsBelum ada peringkat

- In Re:: Your Claim in The Amount Ofs339.18 Against The Debtors Has Been TransferredDokumen3 halamanIn Re:: Your Claim in The Amount Ofs339.18 Against The Debtors Has Been TransferredChapter 11 DocketsBelum ada peringkat

- Et AlDokumen3 halamanEt AlChapter 11 DocketsBelum ada peringkat

- In Re:: The Transterred Amount $216.24 Represents An Amount Sold Avid Airline Products of RI, Inc., ToDokumen3 halamanIn Re:: The Transterred Amount $216.24 Represents An Amount Sold Avid Airline Products of RI, Inc., ToChapter 11 DocketsBelum ada peringkat

- Et Al.: To: (Transferor) ADokumen3 halamanEt Al.: To: (Transferor) AChapter 11 DocketsBelum ada peringkat

- In Re:: Your Claim in The Amount of $4,847.72 Against The Debtors Has Been Transferred ToDokumen3 halamanIn Re:: Your Claim in The Amount of $4,847.72 Against The Debtors Has Been Transferred ToChapter 11 DocketsBelum ada peringkat

- In Re:: Please Note That Your Claim in The Amount Of$4,457.20 Has Been Partially Transferred in The Amount ofDokumen3 halamanIn Re:: Please Note That Your Claim in The Amount Of$4,457.20 Has Been Partially Transferred in The Amount ofChapter 11 DocketsBelum ada peringkat

- In Re:: The Transferred Amount Of$212.13 Represents An Amount Sold by Diversified:rviorgan Supply, Inc. To SierraDokumen3 halamanIn Re:: The Transferred Amount Of$212.13 Represents An Amount Sold by Diversified:rviorgan Supply, Inc. To SierraChapter 11 DocketsBelum ada peringkat

- Debtors: Et AlDokumen3 halamanDebtors: Et AlChapter 11 DocketsBelum ada peringkat

- In ReDokumen3 halamanIn ReChapter 11 Dockets100% (1)

- Et At.: Your Claim in The Amount of $1,039.50 Against The Debtors Has Been Transferred ToDokumen3 halamanEt At.: Your Claim in The Amount of $1,039.50 Against The Debtors Has Been Transferred ToChapter 11 DocketsBelum ada peringkat

- In Re:: Your Claim in The Amount Of$1,130.09 Against The Debtors Has Been Transferred ToDokumen3 halamanIn Re:: Your Claim in The Amount Of$1,130.09 Against The Debtors Has Been Transferred ToChapter 11 DocketsBelum ada peringkat

- In Re:: Your Claim in The Amount of $2,320.85 Against The Debtors Has Been Transferred ToDokumen3 halamanIn Re:: Your Claim in The Amount of $2,320.85 Against The Debtors Has Been Transferred ToChapter 11 DocketsBelum ada peringkat

- In Re:: Your Claim in The Amount Of$280.00 Against The Debtors Has Been Transferred ToDokumen3 halamanIn Re:: Your Claim in The Amount Of$280.00 Against The Debtors Has Been Transferred ToChapter 11 DocketsBelum ada peringkat

- In ReDokumen3 halamanIn ReChapter 11 DocketsBelum ada peringkat

- Your Claim in The Amount Of$243.75 Against The Debtors Has Been Transferred ToDokumen3 halamanYour Claim in The Amount Of$243.75 Against The Debtors Has Been Transferred ToChapter 11 DocketsBelum ada peringkat

- Your Claim in The Amount of $930.00 Against The Debtors Has Been Transferred ToDokumen3 halamanYour Claim in The Amount of $930.00 Against The Debtors Has Been Transferred ToChapter 11 DocketsBelum ada peringkat

- Et At.: in ReDokumen3 halamanEt At.: in ReChapter 11 DocketsBelum ada peringkat

- Debtors &: The Water Man 115 S. Euclid StreetDokumen3 halamanDebtors &: The Water Man 115 S. Euclid StreetChapter 11 DocketsBelum ada peringkat

- COU T: DebtorsDokumen3 halamanCOU T: DebtorsChapter 11 DocketsBelum ada peringkat

- In ReDokumen3 halamanIn ReChapter 11 DocketsBelum ada peringkat

- Et At.: Please Note That Your Claim in The Amount Of$751.38 Has Been Partially Transferred in The Amount ofDokumen3 halamanEt At.: Please Note That Your Claim in The Amount Of$751.38 Has Been Partially Transferred in The Amount ofChapter 11 DocketsBelum ada peringkat

- In Re:: Your Claim in The Amount of $1,177.02 Against The Debtors Has Been TransferredDokumen3 halamanIn Re:: Your Claim in The Amount of $1,177.02 Against The Debtors Has Been TransferredChapter 11 DocketsBelum ada peringkat

- Innkeepers Usa Trust, Et Al.: Has Been ToDokumen3 halamanInnkeepers Usa Trust, Et Al.: Has Been ToChapter 11 DocketsBelum ada peringkat

- Diversified Morgan Supply, Inc. 3233 Royal Melbourne Planet, TX 75093Dokumen3 halamanDiversified Morgan Supply, Inc. 3233 Royal Melbourne Planet, TX 75093Chapter 11 DocketsBelum ada peringkat

- Et At.: in ReDokumen3 halamanEt At.: in ReChapter 11 DocketsBelum ada peringkat

- Et Al. Debtors: 730 SW Street Renton, WA 98057Dokumen3 halamanEt Al. Debtors: 730 SW Street Renton, WA 98057Chapter 11 DocketsBelum ada peringkat

- The Transferred Amount Of$72.02 Represents An Amount Sold Seattle Print Works, Inc., To SierraDokumen3 halamanThe Transferred Amount Of$72.02 Represents An Amount Sold Seattle Print Works, Inc., To SierraChapter 11 DocketsBelum ada peringkat

- In Re:: Debtor'sDokumen3 halamanIn Re:: Debtor'sChapter 11 DocketsBelum ada peringkat

- N:Fal: : Nam-E - Ro (J:L :: PDokumen5 halamanN:Fal: : Nam-E - Ro (J:L :: PChapter 11 DocketsBelum ada peringkat

- Debtors &: Et AlDokumen3 halamanDebtors &: Et AlChapter 11 DocketsBelum ada peringkat

- In Re:: Your Claim in The Amount of $2,346.57 Against The Debtors Has Been Transferred ToDokumen3 halamanIn Re:: Your Claim in The Amount of $2,346.57 Against The Debtors Has Been Transferred ToChapter 11 DocketsBelum ada peringkat

- Case 5 #: Et AlDokumen3 halamanCase 5 #: Et AlChapter 11 DocketsBelum ada peringkat

- The Transferred Amount of $203.93 Represents An Amount Sold Washington Automated, Inc., To SierraDokumen3 halamanThe Transferred Amount of $203.93 Represents An Amount Sold Washington Automated, Inc., To SierraChapter 11 DocketsBelum ada peringkat

- Et Al.: Washington Automated, IncDokumen3 halamanEt Al.: Washington Automated, IncChapter 11 DocketsBelum ada peringkat

- Et Al.: Your Claim in The Amount Of$741.76 Against The Debtors Has Been Transferred ToDokumen3 halamanEt Al.: Your Claim in The Amount Of$741.76 Against The Debtors Has Been Transferred ToChapter 11 DocketsBelum ada peringkat

- Innkeepers Usa Trust,: 730 SW 34thDokumen3 halamanInnkeepers Usa Trust,: 730 SW 34thChapter 11 DocketsBelum ada peringkat

- In Re:: Your Claim in The Amount Of$458.23 Against The Debtors Has Been Transferred ToDokumen3 halamanIn Re:: Your Claim in The Amount Of$458.23 Against The Debtors Has Been Transferred ToChapter 11 DocketsBelum ada peringkat

- Name:O Z : 1) Icrj..RDokumen5 halamanName:O Z : 1) Icrj..RChapter 11 DocketsBelum ada peringkat

- In Re:: Your Claim in The Amount of $870.54 Against The Debtors Has Been Transferred ToDokumen3 halamanIn Re:: Your Claim in The Amount of $870.54 Against The Debtors Has Been Transferred ToChapter 11 DocketsBelum ada peringkat

- In Re:: Your Claim in The Amount of $274.54 Against The Debtors Has Been Transferred ToDokumen3 halamanIn Re:: Your Claim in The Amount of $274.54 Against The Debtors Has Been Transferred ToChapter 11 DocketsBelum ada peringkat

- Et Al.: Washington Automated, Inc. Everett, WA 98203 $669.67 Order) ToDokumen3 halamanEt Al.: Washington Automated, Inc. Everett, WA 98203 $669.67 Order) ToChapter 11 DocketsBelum ada peringkat

- 10000003926Dokumen5 halaman10000003926Chapter 11 DocketsBelum ada peringkat

- N/Cof: Fdcl2Dokumen5 halamanN/Cof: Fdcl2Chapter 11 DocketsBelum ada peringkat

- 10000003920Dokumen5 halaman10000003920Chapter 11 DocketsBelum ada peringkat

- 10000005259Dokumen5 halaman10000005259Chapter 11 DocketsBelum ada peringkat

- Arctica Ice Cream Street Miami, FL 33179: 500 NE 185thDokumen3 halamanArctica Ice Cream Street Miami, FL 33179: 500 NE 185thChapter 11 DocketsBelum ada peringkat

- Your Claim in The Amount of $300.50 Against The Debtors Has Been TransferredDokumen3 halamanYour Claim in The Amount of $300.50 Against The Debtors Has Been TransferredChapter 11 DocketsBelum ada peringkat

- SEC Vs MUSKDokumen23 halamanSEC Vs MUSKZerohedge100% (1)

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Dokumen28 halamanAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsBelum ada peringkat

- Wochos V Tesla OpinionDokumen13 halamanWochos V Tesla OpinionChapter 11 DocketsBelum ada peringkat

- National Bank of Anguilla DeclDokumen10 halamanNational Bank of Anguilla DeclChapter 11 DocketsBelum ada peringkat

- Zohar 2017 ComplaintDokumen84 halamanZohar 2017 ComplaintChapter 11 DocketsBelum ada peringkat

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Dokumen47 halamanAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsBelum ada peringkat

- PopExpert PetitionDokumen79 halamanPopExpert PetitionChapter 11 DocketsBelum ada peringkat

- Home JoyDokumen30 halamanHome JoyChapter 11 DocketsBelum ada peringkat

- Energy Future Interest OpinionDokumen38 halamanEnergy Future Interest OpinionChapter 11 DocketsBelum ada peringkat

- Kalobios Pharmaceuticals IncDokumen81 halamanKalobios Pharmaceuticals IncChapter 11 DocketsBelum ada peringkat

- Zohar AnswerDokumen18 halamanZohar AnswerChapter 11 DocketsBelum ada peringkat

- NQ LetterDokumen2 halamanNQ LetterChapter 11 DocketsBelum ada peringkat

- Quirky Auction NoticeDokumen2 halamanQuirky Auction NoticeChapter 11 DocketsBelum ada peringkat

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDokumen4 halamanUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsBelum ada peringkat

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDokumen5 halamanDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsBelum ada peringkat

- A320 Basic Edition Flight TutorialDokumen50 halamanA320 Basic Edition Flight TutorialOrlando CuestaBelum ada peringkat

- Computer First Term Q1 Fill in The Blanks by Choosing The Correct Options (10x1 10)Dokumen5 halamanComputer First Term Q1 Fill in The Blanks by Choosing The Correct Options (10x1 10)Tanya HemnaniBelum ada peringkat

- Research Article: Finite Element Simulation of Medium-Range Blast Loading Using LS-DYNADokumen10 halamanResearch Article: Finite Element Simulation of Medium-Range Blast Loading Using LS-DYNAAnonymous cgcKzFtXBelum ada peringkat

- As 60068.5.2-2003 Environmental Testing - Guide To Drafting of Test Methods - Terms and DefinitionsDokumen8 halamanAs 60068.5.2-2003 Environmental Testing - Guide To Drafting of Test Methods - Terms and DefinitionsSAI Global - APACBelum ada peringkat

- Hotel ManagementDokumen34 halamanHotel ManagementGurlagan Sher GillBelum ada peringkat

- Basic DfwmacDokumen6 halamanBasic DfwmacDinesh Kumar PBelum ada peringkat

- Lab 6 PicoblazeDokumen6 halamanLab 6 PicoblazeMadalin NeaguBelum ada peringkat

- SAS SamplingDokumen24 halamanSAS SamplingVaibhav NataBelum ada peringkat

- GR L-38338Dokumen3 halamanGR L-38338James PerezBelum ada peringkat

- Privacy: Based On Slides Prepared by Cyndi Chie, Sarah Frye and Sharon Gray. Fifth Edition Updated by Timothy HenryDokumen50 halamanPrivacy: Based On Slides Prepared by Cyndi Chie, Sarah Frye and Sharon Gray. Fifth Edition Updated by Timothy HenryAbid KhanBelum ada peringkat

- ESG NotesDokumen16 halamanESG Notesdhairya.h22Belum ada peringkat

- HandloomDokumen4 halamanHandloomRahulBelum ada peringkat

- Proceedings of SpieDokumen7 halamanProceedings of SpieNintoku82Belum ada peringkat

- EnerconDokumen7 halamanEnerconAlex MarquezBelum ada peringkat

- Assignment - 2: Fundamentals of Management Science For Built EnvironmentDokumen23 halamanAssignment - 2: Fundamentals of Management Science For Built EnvironmentVarma LakkamrajuBelum ada peringkat

- Fake PDFDokumen2 halamanFake PDFJessicaBelum ada peringkat

- CI Principles of EconomicsDokumen833 halamanCI Principles of EconomicsJamieBelum ada peringkat

- Astm E53 98Dokumen1 halamanAstm E53 98park991018Belum ada peringkat

- The Art of Blues SolosDokumen51 halamanThe Art of Blues SolosEnrique Maldonado100% (8)

- Dry Canyon Artillery RangeDokumen133 halamanDry Canyon Artillery RangeCAP History LibraryBelum ada peringkat

- Online Learning Interactions During The Level I Covid-19 Pandemic Community Activity Restriction: What Are The Important Determinants and Complaints?Dokumen16 halamanOnline Learning Interactions During The Level I Covid-19 Pandemic Community Activity Restriction: What Are The Important Determinants and Complaints?Maulana Adhi Setyo NugrohoBelum ada peringkat

- RYA-MCA Coastal Skipper-Yachtmaster Offshore Shorebased 2008 AnswersDokumen28 halamanRYA-MCA Coastal Skipper-Yachtmaster Offshore Shorebased 2008 AnswersSerban Sebe100% (4)

- MORIGINADokumen7 halamanMORIGINAatishBelum ada peringkat

- Recommended Practices For Developing An Industrial Control Systems Cybersecurity Incident Response CapabilityDokumen49 halamanRecommended Practices For Developing An Industrial Control Systems Cybersecurity Incident Response CapabilityJohn DavisonBelum ada peringkat

- SCDT0315 PDFDokumen80 halamanSCDT0315 PDFGCMediaBelum ada peringkat

- Employees' Pension Scheme, 1995: Form No. 10 C (E.P.S)Dokumen4 halamanEmployees' Pension Scheme, 1995: Form No. 10 C (E.P.S)nasir ahmedBelum ada peringkat

- Professional Regula/on Commission: Clarita C. Maaño, M.DDokumen31 halamanProfessional Regula/on Commission: Clarita C. Maaño, M.Dmiguel triggartBelum ada peringkat

- Apm p5 Course NotesDokumen267 halamanApm p5 Course NotesMusumbulwe Sue MambweBelum ada peringkat

- GL 186400 Case DigestDokumen2 halamanGL 186400 Case DigestRuss TuazonBelum ada peringkat

- How Yaffs WorksDokumen25 halamanHow Yaffs WorkseemkutayBelum ada peringkat

- The Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseDari EverandThe Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseBelum ada peringkat

- Contracts: The Essential Business Desk ReferenceDari EverandContracts: The Essential Business Desk ReferencePenilaian: 4 dari 5 bintang4/5 (15)

- Law of Contract Made Simple for LaymenDari EverandLaw of Contract Made Simple for LaymenPenilaian: 4.5 dari 5 bintang4.5/5 (9)

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsDari EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsBelum ada peringkat

- Legal Guide to Social Media, Second Edition: Rights and Risks for Businesses, Entrepreneurs, and InfluencersDari EverandLegal Guide to Social Media, Second Edition: Rights and Risks for Businesses, Entrepreneurs, and InfluencersPenilaian: 5 dari 5 bintang5/5 (1)

- Crash Course Business Agreements and ContractsDari EverandCrash Course Business Agreements and ContractsPenilaian: 3 dari 5 bintang3/5 (3)

- How to Win Your Case In Traffic Court Without a LawyerDari EverandHow to Win Your Case In Traffic Court Without a LawyerPenilaian: 4 dari 5 bintang4/5 (5)

- How to Win Your Case in Small Claims Court Without a LawyerDari EverandHow to Win Your Case in Small Claims Court Without a LawyerPenilaian: 5 dari 5 bintang5/5 (1)

- Learn the Essentials of Business Law in 15 DaysDari EverandLearn the Essentials of Business Law in 15 DaysPenilaian: 4 dari 5 bintang4/5 (13)

- Digital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetDari EverandDigital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetBelum ada peringkat

- The Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityDari EverandThe Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityBelum ada peringkat

- Fundamentals of Theatrical Design: A Guide to the Basics of Scenic, Costume, and Lighting DesignDari EverandFundamentals of Theatrical Design: A Guide to the Basics of Scenic, Costume, and Lighting DesignPenilaian: 3.5 dari 5 bintang3.5/5 (3)

- Contract Law for Serious Entrepreneurs: Know What the Attorneys KnowDari EverandContract Law for Serious Entrepreneurs: Know What the Attorneys KnowPenilaian: 1 dari 5 bintang1/5 (1)

- The Certified Master Contract AdministratorDari EverandThe Certified Master Contract AdministratorPenilaian: 5 dari 5 bintang5/5 (1)

- Reality Television Contracts: How to Negotiate the Best DealDari EverandReality Television Contracts: How to Negotiate the Best DealBelum ada peringkat

- Technical Theater for Nontechnical People: Second EditionDari EverandTechnical Theater for Nontechnical People: Second EditionBelum ada peringkat