TFF-RF: O, QL O/a¡

Diunggah oleh

Chapter 11 DocketsJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

TFF-RF: O, QL O/a¡

Diunggah oleh

Chapter 11 DocketsHak Cipta:

Format Tersedia

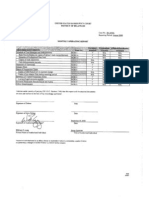

UNITED STATES BANKRUPTCY COURT DISTRICT OF DELAWARE

rn re: Pacific Energy Alaska Oiierating. LLC.

Debtor

Case No. 09- J 0789

Reporting Period: May 200

MONTHLY OPERATING REPORT

REQulimDDoCuMNTS

Schedule of C.1sh Receints and Disbursements

Bank Reconciliation (or copies of debtor's bank reconcilations)

FrmNo.

MOR-I MOR-Ia MOR-Ib

Document Attached

EXPi.~Il11tion Affdavit/$upplenient

Schedule of Professional Pees Paid Coiiies of bank statements Cash disbursements journals St.1ement of Opemtions

Balance Sheet

./ ./

Attached Attached

N/A N/A N/A N/A N/A NlA N/A N/A N/A N/A N/A N/A N/A NfA

N/A N/A N/A N/A N/A N/A N/A N/A NlA N/A N/A NIA N/A N/A

'.

',.. '.'.' .......

./

N/A N/A

of Postpetition Taxes Copies of IRS Form 6123 or payiient receipt Copies of tax returns fied during reiiorting iiriod Summary 9fUnpaidPostpetition Debts Listing 9 aged accounts'Davable ACCntsReceivable Reconciliitiniind Aginl! DebtorQuestionnaiTe

Status

MOR-2 MOR-3 MOR-4

":",,,.,.,

:,"7'..

MOR-4

\

.,.'....

./ ./ ./

....

N/A N/A

MdlM

MOR-5 MOR-5

./ ./ ./ ./

r declare tinder penalty of perjury (28 U.S.C. Section J 746) that this report and the altached documents

are true and correct to the best of my knowledge and belief.

Signature of Debtor

Date

Date

o,ql;o/a

Title of Authorized riidividual

~ tff-rf

'Authorized iiidividu,u muSi be aii of director or shareholder if debtor is a corporation; a parner jf debior ticer, is a pannership: a manager or member if debtor is a limited liability company,

MaR

(04107

In re: Pacric Erirov Alaska OirntinR, LLC.

Debtor

Cns l\o,~

Repoiing Period:_YJay 2009_

SCHEDULE OF CASH RECEIPTS AND DISBURSEMENTS

BANK ACCUNS

SEGREAlED

OPll

CASH BEGINNING OI'PERIOD

148,7141

LOX

CURENT

249,943 I

.,

RETO.

P.CASH

55,86 I

ACTAL ACTAL

272 03

MO. CU. TO DATE

2,37611

953,917 I , 822,527 I

RECEIPT

CASH SALES

LOA"'! AXDADVAloCES

272.03

433 54

11

1.30.726

1,560.217

lll:-SfERS

OTHER

433 557

6078

439 624

5165637 272.04

5 165,637

51 51

5.171,766

5,677,356

5,168 450

TOTAt. RECEIPTS

8,072,393

DISBURSEMENTS

OPERA mw EXPENSES

mANSFERS TO LOCXBOX

33.327

25

33

336,68

956,519

TRAi'SFERS TO ESCROW

TRANSFERS TO PEO llANSFERS TO OPERATING

11 11

400,00

11

DEBT RED1Jo."

11\'TEREST PA YMENTS

271.96

20

271,96

1 ,309 647

Onir.R

TOTAL DISBURSEMENTS

338,33

272,013

20

22 22

246 333

610,930

8.00

2674577

NET CAH Fl.OW

RECEll lE DlSBUltSEMl\SI

CASH. EXD 01' MONTH

DISBURSEMENTS FOR CALCULTING US TRUSTEE QUARTELY FEES: (FROM CURRENT MONrH ACTAL COLUlIN!

TOTAL DISBtiRSEME.'i'r

I I I I

610,930

111

2674,577

LESS; TRANSFERS TO DEBTOR II' POSESSION ACCOUNrS

PLUS: ESAn D1SBUREME.'S MADE BY OUTSIDE

(40,011

2274,566

SOURCES (i,e, rronlCorow :Knls)

610.919

TOTAL DISBURSI!ME.'lTS fOR CALCUI..T1f'G 11,S. TRUSEE OUARTI!RI.\' FEES

FORM MOR-I

((~11

. PACIFIC ENERGY

June 30,2009

Offce of the United States Trustee

Subject: Attestation Reqard Bank Account Reconcilations

The debtor, Pacific Enemy Alaska Operatino, LLC., hereby submits this attestation regarding

bank account reconciliations in lieu of providing copies of bank statements and copies of all account reconciliations.

The debtor has, on a timely basis, performed all bank account reconciliation in the ordinary

course of its business. Copies of bank account statements and reconciliations are available

inspection upon request by the United States Trustee's Office.

for

Sworn to

and Subscribed

before me on this

30th

day of June, 2009.

Notary P blic

~i,~;

i~;W-I:?

j 'Nc ~la :: W ", lOSAHES COONTY

J .. ',' "~C.~.JAN20i2?~3J .. T _... .. ..' _ _ir .. .".,. ."'.."" 'I"

~:.... COMM, #183124( m

l' , ~ ' , . . MAGAi M~ ii L

MyCommission Expires:

Pacific Energy Resources Ltd, 111 West

Ocean Blvd., Suile 1240 Long Beach, CA 90802, Ph: 562-628-1526 Fax: 562-628-1536

. PACIFIC ENERGY

June 30, 2009

Office of the United States Trustee

Subject: Attestation of Reaard Postpetition Taxes

The debtor, Pacific Enerqv Alaska Operatinq, LLC., hereby

pospetition taxes.

submits this attestation regarding

All postpetition taxes for the debtor, which are not subject to dispute or reconcilation, are current. There are no material tax disputes or reconcilations.

Name: Gerry Tywon'uk

~-

Position: Sr. VP& ief Financial Offcer Sworn to and Subscribed

this 30th day of June, 2009.

before me on

_ 1.~' Notar ublic

My Commission Expires: t:J .1)

~, ' \ CQMM. 1#1831246 ~

r 1 d : t ~MAAiTi(riC' f

l3 . iNQai ~a :: LOSANlfSCO

).. u ..',. !"~'.~~~2J~3J

Pacific Energy Resources Ltd, 111 West Ocean Blvd., Suite 1240 Long Beach, CA90802, Ph: 562-628-1526 Fax: 562-628-1536

In reo Pacific Enellv Alaska Ooeraiinii. LLC, Debtor

Case No. 09.10789

Reporting Period:_May 2009_

BANK RECONCJLlA nONS

Coniio..ilon She.i ror :\IOR.l

IBALAi"CE PlR BOOKS

BANK BALCE

(+) DEPOSIT IN TIA:0Srr (AITACH L1SI) (-) OUTANDh'lG CHECKS (AITACH LIST)

OTHER (ATTACH EXPLANA11O~)

467.327

249,974

5,t65.617

552,709

2.043

6,37.670

-

(217,327)

250,000

249,974

-

(217.327 )

-

ADJUTED BAlI'K BALANCE'

. Adjusted bank ii1Jae must equ.iJ

5,165.617

-

552,709

-

2,043

-

6.iiO,.l43

-

balnce ocr bool:

FOM MOR-I:i (0107)

In re: Pacific Energy Alaska Ooeratine:. LLC.

Debtor

Case No. 09-10789 Reporting Period:_May 2009_

SCHEDULE OF PROFESIONAL FEES AND EXPENSES PAID

P~ee

Payor

Period Covered

Amount _Approved

Check Number Date

Year-To-Date

Amunt Paid Fees Exenses

Fees

Expenses

No profesional fees were paid post-petition.

FORM MOR-Ib

(04/07)

In re: Pacific Energy Alaska Operating, LLC. Debtor

Case No. 09-10789

Reporting Period:_May 2009_

STA TEMENT OF OPERATIONS

(I ncome Statement)

REVENES

Oil and "as production revenue

Rovlties Net Revenue

Cumulative

Month

S

F" ill! to Date

386,121

082,022)

204.099

596,166 1,201,122 46,564 726,002 169,634

OPERATING EXPENSES

Reoairs and maintenance

Salariesfcomrssioiif ees

8,043.717 718.375 8,762.092

TranSPortation expense

Utilties

Insurance EmDlovee benefit pro!!rams Taxes - oroduction

Inventorv chanJ!e

2,051,317 3.942,608 1,287,884 3.078,741 497,771

I i 5.523

39,780

20,081 (909,630) 290,831 409 243.567 81,231 214.279 27,865

(2,543.801 )

-

Rent and lease exiiense

SuoDJies

Taxes - Dlvroll Taxes - real estate

General and administrative

DeDreciation, deoIetion and amortization

Net Profit (Loss) Before Other Income & Expenses

OTIJER INCOME AND (EXPENSES)

Accretion of discunts and amoi1ization of deren-ed financinJ! costs

ImereSl eXDense- non-cash - Daid in kind Stock cOIDDensalion eXDense

62,760 (5.919.992) 842.444 722 413.005 245,415 1,237,607 (1,231,011) 2.137,299

-

(806,7i4)

-

rnterest and dividends Realized l!ain/(Ioss) on derivatives

Interest eXDcnse- cosh

Other revenue General eXDlomtion exoense

Loss from noneonsolidated subsidiarv

7.257 420,480 (248,520) -

191,760

0,324,852)

(1.936,001) (14,460)

-

(14,460)

-

I moaimieni eXDelis

Net Profit (Loss) Before Reomanizmion Items

887,042

(4,684.015)

REORGANIZATION ITES

Professional Fees Net Profit (Loss)

0,492,002)

(6,36,983)

(6,436.983)

0,492,002) $

Noie: The cummulaiive income statements above reflect the Company's activity for the entire inmh or March.

FORM ~OR-2

(0410)

In fe: Paific F-nerev Alaska Oocratin~ ILC

Debtor

Case 1\0. ..

Reponing Penod:_May 2009_

BALANCE SHEET

CURREI\'T ASSETS

UnreSlcted Cash and &iuivalelilS

ASSE

BOOK VALUE AT END OF

CURR'T REPORTING MONTH

S

Restrcted Cash and Cash &iuivalems AccouoIs Receivable (Net)

805,120

5.4 15,591

383,71 I

Inventors

Prepaid E~penses

Professional Reiainers

Othr Cuent Assets (See Aiiached Schedule)

6.878.02

429.605

-

TOTAL CURREJ'T ASSETS

3,209,799

S

PROPERTY AND EOUIPMEl-'T

Proved Pronis Includi Lease and Well F.ouiDmem

t7.t21,858

448.559. i 82

In Procss Devdopmem

Unproved Prooes Offce Equipment and Software

Vehicles

O1r &illmenl nnd leasehold Imorovemenls

2J.783,656 925.535

84,061

-

Pipeline Eqiiipmeni

Les Aecunnlaied Depreiation

19,246

PROPERTY & EOUIPMENT OTHER ASSETS

TOTAl, Otr Assets (See AI~iched Schedule)

$

S

(/65,006,596) 308.365.085

7,949.705

TOTAL ASSETS

$

333.436.648

LIABILITIS N T SUBJECT TO COMPROMISE (PosoolltJon) o

Accounis Pavable an Accrud liabilties

LIABILITIES AND OWl''ER EQUITY

BOOK VALUE AT END OF CURRENT REPORTING MONTH

Taxes Pavable W.~es Pavable

Notes Pavable - Debtor-in-oossession fiiiancin.:

Rem I wses - BuildiliwF.ouipiinl Secured Debt I Ailuale Protection Pavmems

:;

10.170,088

-

Professional Fees

JlUercomoanv Pavables

Asset Reiirement Oblieations

100,967.192

12.123.981

S

Accrud Interest Other Uabilties TOTAL I'STPETlTlON L1AlLmGS LIABILITIES SUBJECT TO COMPROMISE (Pre-Petition)

Secured Debt

Pnorty Deb!

123.261,261

321,986.214

Unsecurd Debi

lnlercomo.nv Pavables TOTAL PRE-PEITIO1\ L1ABILlTIFS

$

64,793.824

1 t9,95 1,461

506,731,499

629.992,760 I

-

ITOTALLIABILITES OWNER EOUITY Share Caiital

Contrbute Surolus

1$

S

Warnts

Addition.il Paid In CaDital

Accumulated Other Comprehensive Loss

Paners' Capital Accout

Ownr's EQuiiy Account

0 15,032,141

Relained Eaiinos . Pre-Petition

Retained Eainl! - P0Soctition

(305.151,270)

Adiustnieni to owner &iuitv (allaeh scliedule)

(6,36.983)

$

Posliiilion Conlnbulions (Disinbution (Draws) (attch schedule)

NET SHAREHOLDERS' EQUITY

(29.556,112)

333.436,648

TOTAL LIABILITIES Ai'lD OWNERS' EQUIY

$

FORM )'(DR..l

(.'J

In re: Pacific Energy Alaska Ooerating, LLC. Debtor

Case No. 09-10789

Reporting Period:_May 2009_

BALANCE SHEET. continuation sheet

BOOK VALUE AT END OF CURRET REPORTING MONTH

ASSETS

Other Current Assets

IntereomDanv Receivables

Derivative Assets Advances

Other Receivables

1,309,678

-

Total Other Current Assets Other Assets

Perfoimance Bonds

$

S

22,597 1,877524 3,209,799

Investments-Abandonment Toial Other Assets

1,315.40

6,634,297 7,949.705

FORM ~OR.) CONT'O

()/o?)

In re: Pacific Energy Alaska Ooerating, LLC. Debtor

STA TUS OF POSTPETITION TAXES

Beginning Tax

Case No. 09- i 0789

Reporting Period:_May 2009_

Amount

WlIhheld or

Llabllty

Federal

Withholding FICA-EmDlovee

FICA -Employer

I

Accred

I

Amount Paid

I

Dale PaId

CheckNlI. or EFT

I

Ending Tax Liability

See Attestation of Regard Postpetition Taxes

Unemolovinent Ineome

Total Pedetl Taxes

I

f - I

I I

i I - J

I I - I

State and Lol

Withholdine Sales Excise

UnemDlovment

Real PronerlY

-I

Personal Prooerty

Total Staie and Loal

1'olal Ta.ices

SUMMARY OF UNPAID POSTPETITION DEBTS

Number or Days From InvoIce Dale

Accounts Pavable

Non-ODerated Accruals

Accrued Rovaliies

Accrued ORRis

Accrued OoeTaiinl! &oenses

Total Poslpclilon Debts

0-30 293,055 4,629,675 68,995 29,010 124.429 5,145.164

31-60 61.90 Over 90

18,489 -

Total

-

4,503.466

-

73,842 104,072 132,598 329,001

120,866

-

4,815,010 4,629,675 263,703

133,082 328,618 10,170.088

71,591 4,695,923

FORM MOR.4

(04107)

In re: Pacific Enerl!y Alaska Ooeratine, LLC.

Debtor

Case No. 09-10789

Reporting Period:_May 2009_

ACCOUNTS RECEIVABLE RECONCILIATION AND AGING

Accounts Receivable Aging

0- 30 days old

Amount

17,791

31 - 60 days old 61 - 90 days old 91+ days old

365.920 .

-

Total Accounts Receivable Amount considered uncollectible (Bad Debt)

Accounts Receivable (Net)

383,711 . 383,711

DEBTOR QUESTIONNAIRE

Must be completed each month

I. Have any assets been sold or transfered outside the normal course of business this reporting peiod? If yes, provide an explanation below.

2. Have any funds been disbursed from any account other than a debtor in possession account this repolting period? If yes, provide an explanation below.

Yeso

No

No

Yes

3. Have all postpetition tax returns been timely fied? r no, provide an explanation

below.

4. Are workers compensation, general

liability and other necessary insurance coverages in effect? If no, provide an explanation below.

Yes Yes

5. Has any bank account been opened dUling the reporiing period? If yes, provitle

documentation identifying the opened aecount(s). rf an investment account has been opened

provide the required documentation pursuant to the Delaware Local Rule 400 I -3,

FORM .\fOR-S

(04107)

Anda mungkin juga menyukai

- Financial Reporting and AnalysisDokumen50 halamanFinancial Reporting and AnalysisGeorge Shevtsov83% (6)

- Requi Docunts: DocentDokumen11 halamanRequi Docunts: DocentChapter 11 DocketsBelum ada peringkat

- Ggiii X : Authori D Is Partnership A or Member If Debtor Is Limited Liability CompanyDokumen14 halamanGgiii X : Authori D Is Partnership A or Member If Debtor Is Limited Liability CompanyChapter 11 DocketsBelum ada peringkat

- Required) Ocuments: I Na EhDokumen11 halamanRequired) Ocuments: I Na EhChapter 11 DocketsBelum ada peringkat

- Mstrict of Uela Ware: Attached AttachedDokumen11 halamanMstrict of Uela Ware: Attached AttachedChapter 11 DocketsBelum ada peringkat

- Debtor: District of Dela WareDokumen11 halamanDebtor: District of Dela WareChapter 11 DocketsBelum ada peringkat

- ..P,.4.Ffykp:P) Ein:Ent Fqulrd Docum Is FormDokumen11 halaman..P,.4.Ffykp:P) Ein:Ent Fqulrd Docum Is FormChapter 11 DocketsBelum ada peringkat

- SBN State Mall. Facsimile: O16) Califomia Conholler's Office oDokumen5 halamanSBN State Mall. Facsimile: O16) Califomia Conholler's Office oChapter 11 DocketsBelum ada peringkat

- SR Iip-Rc Fó: Date..Dokumen17 halamanSR Iip-Rc Fó: Date..Chapter 11 DocketsBelum ada peringkat

- District of Dela W Are: United States Bankrljptcy CourtDokumen11 halamanDistrict of Dela W Are: United States Bankrljptcy CourtChapter 11 DocketsBelum ada peringkat

- Balance Sheet Mor-3'¡ N/A Nta: Copies of Bank Statements NT A NT A NT ADokumen11 halamanBalance Sheet Mor-3'¡ N/A Nta: Copies of Bank Statements NT A NT A NT AChapter 11 DocketsBelum ada peringkat

- Eq'Ujr1'Bocljments Yjo":: CH ofDokumen12 halamanEq'Ujr1'Bocljments Yjo":: CH ofChapter 11 DocketsBelum ada peringkat

- Monthly Operating Report: N/A N/ADokumen12 halamanMonthly Operating Report: N/A N/AChapter 11 DocketsBelum ada peringkat

- United States Bankruptcy Court: RN Re: Pacific Energy Alaska Holdings. Inc. Reporting Period: Mav 2009Dokumen9 halamanUnited States Bankruptcy Court: RN Re: Pacific Energy Alaska Holdings. Inc. Reporting Period: Mav 2009Chapter 11 DocketsBelum ada peringkat

- Exp!Nn (In MF - Daviusuppicrnent Required Documents:: Oeqt.Dokumen12 halamanExp!Nn (In MF - Daviusuppicrnent Required Documents:: Oeqt.Chapter 11 DocketsBelum ada peringkat

- Oistrict of Dela W Arj : Summai of Unpaid Postpetition DebtsDokumen12 halamanOistrict of Dela W Arj : Summai of Unpaid Postpetition DebtsChapter 11 DocketsBelum ada peringkat

- Reporting: DebtorDokumen15 halamanReporting: DebtorChapter 11 DocketsBelum ada peringkat

- N, Il ¡ /-Y¡: Requid DocumntsDokumen9 halamanN, Il ¡ /-Y¡: Requid DocumntsChapter 11 DocketsBelum ada peringkat

- Wionthl Y Operating Report Summary For Month Of:: De1ta Produce, LP 12... 00073-lmc-11Dokumen13 halamanWionthl Y Operating Report Summary For Month Of:: De1ta Produce, LP 12... 00073-lmc-11Chapter 11 DocketsBelum ada peringkat

- United States Nankiwptcy Court: District of DelawareDokumen12 halamanUnited States Nankiwptcy Court: District of DelawareChapter 11 DocketsBelum ada peringkat

- Ks L' $?4f". .S K¿ E'1) ': United States Bankruptcy CourtDokumen9 halamanKs L' $?4f". .S K¿ E'1) ': United States Bankruptcy CourtChapter 11 DocketsBelum ada peringkat

- Mor-3 VDokumen9 halamanMor-3 VChapter 11 DocketsBelum ada peringkat

- Date (L I: 5 (Vi R-C (ÓDokumen9 halamanDate (L I: 5 (Vi R-C (ÓChapter 11 DocketsBelum ada peringkat

- MRJR ..: United States .. Bankrup'Tcy CourtDokumen19 halamanMRJR ..: United States .. Bankrup'Tcy CourtChapter 11 DocketsBelum ada peringkat

- United States Bankruptcy Court District of Delaware: MOR (041W)Dokumen9 halamanUnited States Bankruptcy Court District of Delaware: MOR (041W)Chapter 11 DocketsBelum ada peringkat

- Monthly Operating ReportDokumen12 halamanMonthly Operating ReportChapter 11 DocketsBelum ada peringkat

- .¡ N/a N/a .¡ N/a N/a .¡ N/a N/a .¡ N/a N/a .¡ N/a N/a .¡ N/a N/a .¡ N/a N/a .¡ N/a N/a .¡ N/a N/a .¡ N/a N/aDokumen9 halaman.¡ N/a N/a .¡ N/a N/a .¡ N/a N/a .¡ N/a N/a .¡ N/a N/a .¡ N/a N/a .¡ N/a N/a .¡ N/a N/a .¡ N/a N/a .¡ N/a N/aChapter 11 DocketsBelum ada peringkat

- This Repel Is To Be Sub LSSD Fur .5 Boa .Suuw, Tu 00W.Pr - Sodjy Isui, Suinsd by A. Pest. Us D.BboDokumen2 halamanThis Repel Is To Be Sub LSSD Fur .5 Boa .Suuw, Tu 00W.Pr - Sodjy Isui, Suinsd by A. Pest. Us D.BboChapter 11 DocketsBelum ada peringkat

- Si ,,LL: I/l HfoDokumen9 halamanSi ,,LL: I/l HfoChapter 11 DocketsBelum ada peringkat

- Ginal: TRFTRDokumen8 halamanGinal: TRFTRChapter 11 DocketsBelum ada peringkat

- Qocumeqt Expjna (Icn Tffidvit/$Qpplemnt: Rpflij1Tili) Nneilmi'NiqDokumen11 halamanQocumeqt Expjna (Icn Tffidvit/$Qpplemnt: Rpflij1Tili) Nneilmi'NiqChapter 11 DocketsBelum ada peringkat

- United States Bankruptcy Court District of Delaware: or Isa A If Isa A IsaDokumen9 halamanUnited States Bankruptcy Court District of Delaware: or Isa A If Isa A IsaChapter 11 DocketsBelum ada peringkat

- Debtor: ReturnsDokumen9 halamanDebtor: ReturnsChapter 11 DocketsBelum ada peringkat

- This Rpoit Is To Be Submitted For All That Maintained by DebtorDokumen2 halamanThis Rpoit Is To Be Submitted For All That Maintained by DebtorChapter 11 DocketsBelum ada peringkat

- Yes. N.D: SJGNED "" - G - "'L - "Dokumen13 halamanYes. N.D: SJGNED "" - G - "'L - "Chapter 11 DocketsBelum ada peringkat

- Fee Auditor'S Final Report - Page 1: Pac FR Steptoe 6th Int 6-8.10.wpdDokumen5 halamanFee Auditor'S Final Report - Page 1: Pac FR Steptoe 6th Int 6-8.10.wpdChapter 11 DocketsBelum ada peringkat

- $"'y-B/?' Sa /Ð-, Y: United States SSankruptcy CourtDokumen9 halaman$"'y-B/?' Sa /Ð-, Y: United States SSankruptcy CourtChapter 11 DocketsBelum ada peringkat

- Debtors Nomer Pacific Energy Resources LTD.: This Report It To Be Submlaed Fag 05 N.1Tta1Ood Coofinmitite Debt"Dokumen2 halamanDebtors Nomer Pacific Energy Resources LTD.: This Report It To Be Submlaed Fag 05 N.1Tta1Ood Coofinmitite Debt"Chapter 11 DocketsBelum ada peringkat

- 'Dtcunu Avppiencn .Orni No... T (Accd Atlached. Attached Mor-1Dokumen12 halaman'Dtcunu Avppiencn .Orni No... T (Accd Atlached. Attached Mor-1Chapter 11 DocketsBelum ada peringkat

- EXHIBIT A....... TP Inc V Bank of America NA/PRLAP/Jonathan JoynerDokumen9 halamanEXHIBIT A....... TP Inc V Bank of America NA/PRLAP/Jonathan JoynerJames RimesBelum ada peringkat

- In Re:) : Debtors.)Dokumen51 halamanIn Re:) : Debtors.)Chapter 11 DocketsBelum ada peringkat

- CRC Ace Far 1ST PBDokumen9 halamanCRC Ace Far 1ST PBJohn Philip Castro100% (1)

- Documentexplanation Affida%Itjsuppiexuviii Rf:U1Red Docume Is Form No. Att Ichcd Attached CiiedDokumen9 halamanDocumentexplanation Affida%Itjsuppiexuviii Rf:U1Red Docume Is Form No. Att Ichcd Attached CiiedChapter 11 DocketsBelum ada peringkat

- VT ¡Cfõ: Requidí) OcusDokumen9 halamanVT ¡Cfõ: Requidí) OcusChapter 11 DocketsBelum ada peringkat

- United States Bankruptcy Court District of Delaware: Corporate Montfily Operating ReportDokumen17 halamanUnited States Bankruptcy Court District of Delaware: Corporate Montfily Operating ReportChapter 11 DocketsBelum ada peringkat

- United States Bankruptcy Court District of DelawareDokumen9 halamanUnited States Bankruptcy Court District of DelawareChapter 11 DocketsBelum ada peringkat

- Ebancorp.: Business Equipment Finance GroupDokumen1 halamanEbancorp.: Business Equipment Finance GroupChapter 11 DocketsBelum ada peringkat

- L R L¡ V-C (Ó: Attchd Attch DDokumen9 halamanL R L¡ V-C (Ó: Attchd Attch DChapter 11 DocketsBelum ada peringkat

- Ronald A White Financial Disclosure Report For 2009Dokumen9 halamanRonald A White Financial Disclosure Report For 2009Judicial Watch, Inc.Belum ada peringkat

- At Eli.y: I 'Foio A AebdDokumen9 halamanAt Eli.y: I 'Foio A AebdChapter 11 DocketsBelum ada peringkat

- Onited States Bankruptcy Court: District of Dela WareDokumen9 halamanOnited States Bankruptcy Court: District of Dela WareChapter 11 DocketsBelum ada peringkat

- Requid Documnts Attched Attched: DocentDokumen9 halamanRequid Documnts Attched Attched: DocentChapter 11 DocketsBelum ada peringkat

- Financial Statement Analysis CVP ContractorsDokumen40 halamanFinancial Statement Analysis CVP ContractorsjayajudiaBelum ada peringkat

- Monthly Operating ReportDokumen12 halamanMonthly Operating ReportChapter 11 DocketsBelum ada peringkat

- Doeument L.xplauidirni Aftidavii/Suppkiiieat, R) :Ql:Jrel) Doctlients Form No. Aitached Attached AttachedDokumen11 halamanDoeument L.xplauidirni Aftidavii/Suppkiiieat, R) :Ql:Jrel) Doctlients Form No. Aitached Attached AttachedChapter 11 DocketsBelum ada peringkat

- United States Bankruptcy Court Southern District of New YorkDokumen11 halamanUnited States Bankruptcy Court Southern District of New YorkChapter 11 Dockets100% (1)

- Monthly Operating Report: MOR (O4fl)Dokumen12 halamanMonthly Operating Report: MOR (O4fl)Chapter 11 DocketsBelum ada peringkat

- Reqi'Ireh Docl..Men Is Form Attached Ktraehc, 1: 1N1'FEI)Dokumen9 halamanReqi'Ireh Docl..Men Is Form Attached Ktraehc, 1: 1N1'FEI)Chapter 11 DocketsBelum ada peringkat

- In Re:) : Debtors.)Dokumen308 halamanIn Re:) : Debtors.)Chapter 11 DocketsBelum ada peringkat

- In Re:) : Áa ?hsidDokumen2 halamanIn Re:) : Áa ?hsidChapter 11 DocketsBelum ada peringkat

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Dokumen28 halamanAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsBelum ada peringkat

- Wochos V Tesla OpinionDokumen13 halamanWochos V Tesla OpinionChapter 11 DocketsBelum ada peringkat

- SEC Vs MUSKDokumen23 halamanSEC Vs MUSKZerohedge100% (1)

- Zohar 2017 ComplaintDokumen84 halamanZohar 2017 ComplaintChapter 11 DocketsBelum ada peringkat

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Dokumen47 halamanAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsBelum ada peringkat

- PopExpert PetitionDokumen79 halamanPopExpert PetitionChapter 11 DocketsBelum ada peringkat

- National Bank of Anguilla DeclDokumen10 halamanNational Bank of Anguilla DeclChapter 11 DocketsBelum ada peringkat

- Kalobios Pharmaceuticals IncDokumen81 halamanKalobios Pharmaceuticals IncChapter 11 DocketsBelum ada peringkat

- NQ LetterDokumen2 halamanNQ LetterChapter 11 DocketsBelum ada peringkat

- Energy Future Interest OpinionDokumen38 halamanEnergy Future Interest OpinionChapter 11 DocketsBelum ada peringkat

- Home JoyDokumen30 halamanHome JoyChapter 11 DocketsBelum ada peringkat

- Zohar AnswerDokumen18 halamanZohar AnswerChapter 11 DocketsBelum ada peringkat

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDokumen5 halamanDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsBelum ada peringkat

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDokumen4 halamanUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsBelum ada peringkat

- Quirky Auction NoticeDokumen2 halamanQuirky Auction NoticeChapter 11 DocketsBelum ada peringkat

- Exercise 17.1 Budgeted Cash Flow Statement - Top Hats: © Simmons & Hardy Cambridge University Press, 2019 1Dokumen46 halamanExercise 17.1 Budgeted Cash Flow Statement - Top Hats: © Simmons & Hardy Cambridge University Press, 2019 1STATBelum ada peringkat

- QTTC KeyDokumen20 halamanQTTC KeyThảo Uyên TrầnBelum ada peringkat

- Accouts ReceivableDokumen2 halamanAccouts Receivablerhysakhil catamponganBelum ada peringkat

- Chapter 4 - Partnership LiquidationDokumen4 halamanChapter 4 - Partnership LiquidationMikaella BengcoBelum ada peringkat

- HOMEWORK 1 (No. 14)Dokumen7 halamanHOMEWORK 1 (No. 14)Joana TrinidadBelum ada peringkat

- Acps 4 Complete SolutionsDokumen2 halamanAcps 4 Complete SolutionsLuna ShiBelum ada peringkat

- Admission of Partner PDFDokumen6 halamanAdmission of Partner PDFBHUMIKA JAINBelum ada peringkat

- © The Institute of Chartered Accountants of IndiaDokumen13 halaman© The Institute of Chartered Accountants of Indiajanardhan CA,CSBelum ada peringkat

- Ratio Analysis For Nissan (2008) : Liquidity Ratios RatiosDokumen2 halamanRatio Analysis For Nissan (2008) : Liquidity Ratios Ratiosatifrazzaq007Belum ada peringkat

- Act2 1Dokumen7 halamanAct2 1MingBelum ada peringkat

- 11 AmalgmationDokumen38 halaman11 AmalgmationPranaya Agrawal100% (1)

- Ia3 Midterm ExamDokumen7 halamanIa3 Midterm ExamJalyn Jalando-onBelum ada peringkat

- Hoba AcctgDokumen5 halamanHoba Acctgfer maBelum ada peringkat

- Presentation of Financial StatementsDokumen7 halamanPresentation of Financial StatementsAngel RosalesBelum ada peringkat

- FINAMAA Topic 2 Additional ActivityDokumen2 halamanFINAMAA Topic 2 Additional ActivityJeasmine Andrea Diane PayumoBelum ada peringkat

- FIN1161 - Introduction To Finance For Business - Report 2Dokumen6 halamanFIN1161 - Introduction To Finance For Business - Report 2thunlagbd230128Belum ada peringkat

- A. Masay Company Statement of Cost of Goods Manufactured Year Ended XX 2020Dokumen6 halamanA. Masay Company Statement of Cost of Goods Manufactured Year Ended XX 2020Jay Ann DomeBelum ada peringkat

- Ch14 Financial Statement AnalysisDokumen52 halamanCh14 Financial Statement AnalysiskayleBelum ada peringkat

- Invx PTT 240048Dokumen7 halamanInvx PTT 240048dtBelum ada peringkat

- Endole Company Report - 09519832Dokumen31 halamanEndole Company Report - 09519832lchenhan94Belum ada peringkat

- Bus Com 12Dokumen3 halamanBus Com 12Chabelita MijaresBelum ada peringkat

- FAR Monthly Assessment November 2020Dokumen11 halamanFAR Monthly Assessment November 2020Refinej WickerBelum ada peringkat

- Kelompok 4 AKL II Chapter 9Dokumen36 halamanKelompok 4 AKL II Chapter 9Aimer RainBelum ada peringkat

- Magnit ValuationDokumen50 halamanMagnit ValuationNikolay MalakhovBelum ada peringkat

- Amortization of Expenses in FusionDokumen5 halamanAmortization of Expenses in FusionSivaKumarBelum ada peringkat

- High School T&F Operating Budget and ForecastDokumen5 halamanHigh School T&F Operating Budget and ForecastKendrick AragonBelum ada peringkat

- PLDT 4q2017 Financial Statements PDFDokumen156 halamanPLDT 4q2017 Financial Statements PDFAhs DawnBelum ada peringkat

- Financial Ratios Case Homeowork 3Dokumen17 halamanFinancial Ratios Case Homeowork 3Edward Lu100% (1)

- In The Books of Ajit Trading A/C & P/L Account For The Year Ended 31.3.16 Particulars Amount AmountDokumen43 halamanIn The Books of Ajit Trading A/C & P/L Account For The Year Ended 31.3.16 Particulars Amount AmountflamerydersBelum ada peringkat