L R L¡ V-C (Ó: Attchd Attch D

Diunggah oleh

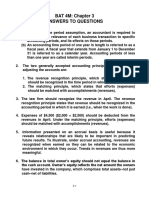

Chapter 11 DocketsDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

L R L¡ V-C (Ó: Attchd Attch D

Diunggah oleh

Chapter 11 DocketsHak Cipta:

Format Tersedia

UNITD STATES BANKRUPTCY COURT

DISTRICT OF DELA WARE

In re: Cameros Acauisition Com. Debior

Case No. 09-10788

Reponing Period: Aoril2009

MONTHLY OPERATING REPORT

RE(jUIREDDOCUMS

Schedule of Cash Receipts and Disburements

Schedule of Professional Fees Paid

CODies of bank statements

Docent

.....

Form No.

MOR-I MOR-Ia MOR-Ib

.."

Attched

0/ 0/ 0/

Bank Reconcilaiion (or cODies of debior's ban reconciliations)

~.

Cash disbursements journals

N/A N/A

0/ 0/ 0/

Slaiemenl of OperatIons

Balance Sheei

Siatus of PostotItion Taxes Conies ofIRS Form 6123 or Dayment receipt

CODies of tax returs fied during renoning Deriod

MOR-2 MOR-3 MOR-4

.......

......

N/A N/A

0/

Summar of Unpaid Postpeiiiion Debts Lisiinl! of ailed accounts payable

Accounts Receivable Reconcilation and Aging

Debior Questionnaire

MOR-4 MOR-4 MOR-S MOR-S

0/ 0/ 0/

'iation AfdaviUSupplement e e N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A

Attchd Attch d

I declare under penaliy of perjury (28 U.S.C. Section 1746) ihat this report and the attached documents are true and correct 10 the best of my knowledge and belief.

Signature of Debtor

Dale

Date

"of (?!o .

l;r l V- c(

Title of Authorized Individual

AuUionzed individual must be an offcer, director or sholder if debtor is a corporation: a panner if debtor

is a parnership; a manager or member if debtor is a limited liabilty company.

MOR

(lJ107)

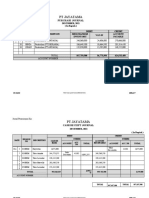

In re: Cameros ACCllisition Com.

Case No. 09-10788

Debtor

Reponing Period:_ApriJ 2009_

SCHEDULE OF CASH RECEIPS AND DISBURSEMENTS

BAN ACCOUN opa PA ROLL TAX 011ER

CASIl BEGING OF.M0N11

RECEI1

I I II

II

I I I II

ACTAL PROJE

II

CUNT MONT

CtiTI FILING TO DATE

ACTAL PROJ

Cameros AcqUisition Corp. aoes not malnlaln any cash accounts.

TOTAL RECElP

I ....

Disll .

I=,,-=-~

Ilfl'!- . .1

i i I I II I

THE FOLLOWING SECTION MUST BE COMPLETED

II

II

II

DisnuRsEiiiiEN FOR :di nNGU.s. riuST fUARTEIlLv FE:

TOTAL DISBURSEMENTS

LESS: TRANSFES TO DEBTOR IN POSSESSION ACCOUNTS

CFillMcuMON'IACnAI.COLUMNl

. SO.OO SO.OO SO.OO

PLUS: ESATE DISBURSEMENTS MADE BY OUTSIDE SOURCES (Le. froinescw nccounls)

TOTAL DISBUREMENTS FOR CALCULATIG u.s. TRUSTEE QUARTERLY FEES

$0.00

RlRM Mon-1

(()m)

In re: Camero~ Acqui~iiion Corn.

Case No. 09-10788

Debtor

Repornng Pcriod:_ApriI2009_

BANK RECONCILIATIONS

CouUnualoD Sheet tor MOR-!

OiI'ing

I~ALANCE PER BOOKS

BANK BALANCE

1#

I ; .~"' "". '/.."

dlat11

1#

I I

Tax

1#

I

Other

1#

I I

(+) DEPSITS IN TRANSIT (ATTACH US1

(0) OUTSTANDING CHECKS (ATTACH Usn

Cameros Acquisiton Corp. does not mafntalnany cash accounts.

ADJUSTD BANK BALCE .

. Adjusted bank balance must ciual

balance pcr boks

..

~

FORM MOR.14 (04101)

In re: Cameros Acquisition Corp. Debtor

Case No. 09-10788

Reporting Period:_April 2009_

SCHEDULE OF PROFESSIONAL FEES AND EXPENSES PAID

..'

,...c'

..:;;d/,....

Payee

.'..

..,;

k/

."

/ 1.....0':,,(. ....

F

,,'

F.....,payor ',.

Fes

Check Number Date':'.

': '.,Affl1rPid FeeS . Exoenses

Year;.To:iate

Expenses

No profesional fees were paid post-petition.

rDRM MOR-lb

(04107)

In re: Cameros Acquisition Com. Debtor

Case No. 09-10788

Reporting Period:_ApriI2009_

STATEMENT OF OPERATIONS

(Income Statement)

l . REVENU

...

M tb on

S

Cumulative

.

Fil Date Gnt()

-

Oil and l!as Droduction revenue Rovaltv DavmenlS Net Revenue

OPERTIGEXPENSESr

Reoairs and maintenance

.,.....,

..'

.,;

. ..d ..

.....

...

....

..... ....

....

Salares/commssionsfees

TransDortation exoense Utilities Insurance Emolovee benefit Droimms

Taxes - Droduction

Inveniory change Rent and lease expense

Travcl and entertainment

.

-

SUDoles

General and administrativc

Denreciation. depletion and amrtzation Net Profit (Lss) Before Other Income & Expenses

.......':I'...',. . ..

.....7...,;(...

" ...

..'..,..,....

....

-

......'.

...,

.'..

-

Accretion of discounts and amortzation of defcrrcdfinancinl! costs Interest expense- non-cash - paid in kind Stock cortoensation expense Interest and dividends

Realized gainl(loss) on derivatives

Interestexoense. cash Oiher revenue General exploration expense Nct Profit (Loss) Beforc Reomalzation Items

REORGANATION ITEMS

Professional Fees Reorgalzation Interest Net Profit (Loss)

Note: The income statcments above reflect the Company's activiiy for thc entire month of March.

FORM MOR-2

(04107)

In rc: Carneros ACCllisition Com.

Cas No. 09-10788

Debtor

Reporting Penod:_April2009_

BALANCE SHEET

. .B()()KYAltIATEN'Ol' ,

.

....

ct REPORTIG MOl\'T

..

S

Unrestricted Cah and Equivalents

Restncied Cash and Cash EouivalenlS

Accounts Receivnble (Nell (nventories

Preoaid Exoenses Professional Retaners OOler Current Assets (See Attached Schedule)

S

,

TOTAL CURREN ASSETS

'PROPERTY,ANEQUIME...,

Asset Retirement COSIS

;."

,..

,../,-c,/ -

.,...

....

..

1,840.096 1,840.096

'"

.,:

Proved Prooerties Ineludin~ Leas and Well Eouinment

.'

In Procss Develonmcnt Unprnved Prooerties Office Equipment aDd Software Vehicles Other Eouioment und Leasehold ImprovemenlS Pioeline Eouioment Less Accumulate Denreciution

.

S

..

TOTAL PROPERTY & EQUIPMEN " '..

. .

s

e

on

S

..

-

Secured Debt Priority Debt

Unscure Debt

Intercompany Payables TOTAL PRE.PETITION UABIUTIES

"

..",

'c'

5,099,434 5,099,434

.hd.,...., .. "0.."'",,' ..', '.

S

,/ ...,..:,.'

.,

,.,..

S

..,

Shae Clnital Contributed Surplus

100

'-

WarDIS

Additionul Paid In Cloital Accumulated Oiler ComDrehensivc La.. Panners' Cuoital Account Owner's Equiiy Account

ReUlined Eainl! - Pre-Petition

6,124,900

(9.384.338)

S

.. ..

Retained Eain~s - Postoeiition Adiustment to owner Eouitv (niwch schedule)

Posiieition Contnbutions (Distnbutions (Drws) (aiweh schedule)

NET SHAREHOLDERS' EQUITY

.

..

(3,259,338)

.

T()TALUAi:AN'.Ovv'.:iQUI

1,840.96

roRM MOR.) ro,'U7

In re: Cameros Acquisition Com. Debtor

Case No. 09. I 0788

Reportng Period:_April 2009_

BALANCE SHEET. continuation sheet

BOOK VALUE AT

END OF

ASSETS

CURT REP()RnNG MONT

,...,.,

Other Cunt Assets

Intercompany Receivables

Deri vati ve Assets

1,840,096

-

Advances Other Receivables

.

~.

Tolal Other Curent Assets

1,840,096

FORM MOR-3 CONT

(Ol/07)

In re: Cameros Acquisition Corp. Debtor

Case No. 09-10788

Reporting Period:_April 20m

STA TUS OF POSTPETITION TAXES

Ending

Aoiouiit

Pad

Date Paid

CheckN. or. EFT

Tii

Liabilty

Not Applicable

Withholding Sales Excise UnemDlovment

Real ProDeriv

Not Applicable

Personal Property

Toial State and Local

I I

I I

i I

I I

I I

Total Taxes

SUMMARY OF UNAID POSTPETITION DEBTS

Niimber of Days

Pas Due

-

Cureiit

Accounts Payable

Waiies Payable

I

0-30

I

3160 6190 Over

I

90

i I

Tota

Taxes Payable

Rent/Leases-Building ReniJLeases-EouiDment Secured DebiJ Adequate Protection Payments

Professional Fees

Not Applicable

Total Postpetition Debts

I -,

I I

I I

i I

I I

FORM MOR"

(041071

In re: Cameros ACQuisition Com.

Case No. 09-10788

Debtor

Reporting Period:_April 2(

ACCOUNTS RECEIVABLE RECONCILIATION AND AGING

AccountS .RceeivbleReconcilation

Total Accounts Receivable at the beginning of the reporting period + Amounts biled during the perod - Amounts collected during the period Total Accounts Receivable at the end of the reporting period

. Accounts'ReceivableAgmg

Amuit

I

Not Applicable

.-

Amount

I

o - 30 days old 31 - 60 days old 61 - 90 days old 91+ days old Total Accounts Receivable

Accounts Receivable (Net)

Not Applicable

DEBTOR QUESTIONNAIRE

Mst be completed eaCh month:

,. ; , .

eslNo

No

No

1. Have any assets been sold or iransferrcd outside the norr course of busincss this rcporting period? If ycs, provide an explanation below.

2. Have any funds bcen disbursed from any account oier than a debtor in possession

account this reportng period? If ycs, provide an cxplanation below.

3. Have all postpetition tax returns been timely fied? If no, provide an explanation

below.

4. Arc workcrs compcnsation, general

N/A

Yes

liabilty and othcr neccssar insurancc covcrages in effect? If no, provide an explanation below.

5. Has any bank account becn opcncd during the reporting period? If yes, provide documentation idcntifying thc opencd account(s). If an invcstmcnt account has been opened provide ie rcquired documetation puruant to the Delaware Local Rule 4001-3.

No

FORM MOR.5

(04107)

Anda mungkin juga menyukai

- N, Il ¡ /-Y¡: Requid DocumntsDokumen9 halamanN, Il ¡ /-Y¡: Requid DocumntsChapter 11 DocketsBelum ada peringkat

- Date (L I: 5 (Vi R-C (ÓDokumen9 halamanDate (L I: 5 (Vi R-C (ÓChapter 11 DocketsBelum ada peringkat

- VT ¡Cfõ: Requidí) OcusDokumen9 halamanVT ¡Cfõ: Requidí) OcusChapter 11 DocketsBelum ada peringkat

- United States Bankruptcy Court District of Delaware: MOR (041W)Dokumen9 halamanUnited States Bankruptcy Court District of Delaware: MOR (041W)Chapter 11 DocketsBelum ada peringkat

- Documentexplanation Affida%Itjsuppiexuviii Rf:U1Red Docume Is Form No. Att Ichcd Attached CiiedDokumen9 halamanDocumentexplanation Affida%Itjsuppiexuviii Rf:U1Red Docume Is Form No. Att Ichcd Attached CiiedChapter 11 DocketsBelum ada peringkat

- At Eli.y: I 'Foio A AebdDokumen9 halamanAt Eli.y: I 'Foio A AebdChapter 11 DocketsBelum ada peringkat

- Requid Documnts Attched Attched: DocentDokumen9 halamanRequid Documnts Attched Attched: DocentChapter 11 DocketsBelum ada peringkat

- Reouired Do (Ijmfn Is Form No T1iachclDokumen9 halamanReouired Do (Ijmfn Is Form No T1iachclChapter 11 DocketsBelum ada peringkat

- Si ,,LL: I/l HfoDokumen9 halamanSi ,,LL: I/l HfoChapter 11 DocketsBelum ada peringkat

- Debtor: I I I IDokumen9 halamanDebtor: I I I IChapter 11 DocketsBelum ada peringkat

- Debtor: Unjted States Bankruptcy Court District of DelawareDokumen9 halamanDebtor: Unjted States Bankruptcy Court District of DelawareChapter 11 DocketsBelum ada peringkat

- In Re: Petrocal Acquisition Corp.: If Is Is CompanyDokumen9 halamanIn Re: Petrocal Acquisition Corp.: If Is Is CompanyChapter 11 DocketsBelum ada peringkat

- United States Bankruptcy Court District of DelawareDokumen9 halamanUnited States Bankruptcy Court District of DelawareChapter 11 DocketsBelum ada peringkat

- United States Bankruptcy Court: RN Re: Pacific Energy Alaska Holdings. Inc. Reporting Period: Mav 2009Dokumen9 halamanUnited States Bankruptcy Court: RN Re: Pacific Energy Alaska Holdings. Inc. Reporting Period: Mav 2009Chapter 11 DocketsBelum ada peringkat

- Doeunpnt Explaiation Afiudavit/Suppieniqnt !uequired DocumentsDokumen9 halamanDoeunpnt Explaiation Afiudavit/Suppieniqnt !uequired DocumentsChapter 11 DocketsBelum ada peringkat

- Mor-3 VDokumen9 halamanMor-3 VChapter 11 DocketsBelum ada peringkat

- .7 Imor 4: Ui - CH Irfd I1 ('IDokumen9 halaman.7 Imor 4: Ui - CH Irfd I1 ('IChapter 11 DocketsBelum ada peringkat

- Reqi'Ireh Docl..Men Is Form Attached Ktraehc, 1: 1N1'FEI)Dokumen9 halamanReqi'Ireh Docl..Men Is Form Attached Ktraehc, 1: 1N1'FEI)Chapter 11 DocketsBelum ada peringkat

- United States Bankrupt (:Y Court District of Delaware: An Is A orDokumen9 halamanUnited States Bankrupt (:Y Court District of Delaware: An Is A orChapter 11 DocketsBelum ada peringkat

- Monthly Operating ReportDokumen9 halamanMonthly Operating ReportChapter 11 DocketsBelum ada peringkat

- R!Iet Qrocumnts.. Sinq: 1Hcd N/ADokumen9 halamanR!Iet Qrocumnts.. Sinq: 1Hcd N/AChapter 11 DocketsBelum ada peringkat

- N/A N/A: T'DwonluisDokumen9 halamanN/A N/A: T'DwonluisChapter 11 DocketsBelum ada peringkat

- .¡ N/a N/a .¡ N/a N/a .¡ N/a N/a .¡ N/a N/a .¡ N/a N/a .¡ N/a N/a .¡ N/a N/a .¡ N/a N/a .¡ N/a N/a .¡ N/a N/aDokumen9 halaman.¡ N/a N/a .¡ N/a N/a .¡ N/a N/a .¡ N/a N/a .¡ N/a N/a .¡ N/a N/a .¡ N/a N/a .¡ N/a N/a .¡ N/a N/a .¡ N/a N/aChapter 11 DocketsBelum ada peringkat

- United States Bankruptcy Court District of Delaware: or Isa A If Isa A IsaDokumen9 halamanUnited States Bankruptcy Court District of Delaware: or Isa A If Isa A IsaChapter 11 DocketsBelum ada peringkat

- Debtor: ReturnsDokumen9 halamanDebtor: ReturnsChapter 11 DocketsBelum ada peringkat

- R'Loljilfld Documems Forr No Affached Attiched Attached: - 1) Quit I XPL Affldqv - Yppcn, IpntDokumen9 halamanR'Loljilfld Documems Forr No Affached Attiched Attached: - 1) Quit I XPL Affldqv - Yppcn, IpntChapter 11 DocketsBelum ada peringkat

- 10000016855Dokumen9 halaman10000016855Chapter 11 DocketsBelum ada peringkat

- Transactions Related To Revenue and Cash Receipts Completed by ADokumen1 halamanTransactions Related To Revenue and Cash Receipts Completed by AM Bilal SaleemBelum ada peringkat

- Status: Schedule and Disbursements MOR-1 N/A Bank Copies Bank N/ADokumen9 halamanStatus: Schedule and Disbursements MOR-1 N/A Bank Copies Bank N/AChapter 11 DocketsBelum ada peringkat

- Required) Ocuments: I Na EhDokumen11 halamanRequired) Ocuments: I Na EhChapter 11 DocketsBelum ada peringkat

- Appendix 26 - Instructions - RCDDokumen2 halamanAppendix 26 - Instructions - RCDthessa_starBelum ada peringkat

- Mstrict of Uela Ware: Attached AttachedDokumen11 halamanMstrict of Uela Ware: Attached AttachedChapter 11 DocketsBelum ada peringkat

- Exp!Nn (In MF - Daviusuppicrnent Required Documents:: Oeqt.Dokumen12 halamanExp!Nn (In MF - Daviusuppicrnent Required Documents:: Oeqt.Chapter 11 DocketsBelum ada peringkat

- Steven Meldahl Operating Report 10-31-13Dokumen11 halamanSteven Meldahl Operating Report 10-31-13CamdenCanaryBelum ada peringkat

- $"'y-B/?' Sa /Ð-, Y: United States SSankruptcy CourtDokumen9 halaman$"'y-B/?' Sa /Ð-, Y: United States SSankruptcy CourtChapter 11 DocketsBelum ada peringkat

- Qocumeqt Expjna (Icn Tffidvit/$Qpplemnt: Rpflij1Tili) Nneilmi'NiqDokumen11 halamanQocumeqt Expjna (Icn Tffidvit/$Qpplemnt: Rpflij1Tili) Nneilmi'NiqChapter 11 DocketsBelum ada peringkat

- Ggiii X : Authori D Is Partnership A or Member If Debtor Is Limited Liability CompanyDokumen14 halamanGgiii X : Authori D Is Partnership A or Member If Debtor Is Limited Liability CompanyChapter 11 DocketsBelum ada peringkat

- Monthly Operating ReportDokumen12 halamanMonthly Operating ReportChapter 11 DocketsBelum ada peringkat

- 1 The Accounting Equation Accounting Cycle Steps 1 4Dokumen6 halaman1 The Accounting Equation Accounting Cycle Steps 1 4Jerric CristobalBelum ada peringkat

- Monthly Operating Report: N/A N/ADokumen12 halamanMonthly Operating Report: N/A N/AChapter 11 DocketsBelum ada peringkat

- Rmo No.45-2019Dokumen2 halamanRmo No.45-2019Earl PatrickBelum ada peringkat

- Basic Accounting - Midterm 2010Dokumen6 halamanBasic Accounting - Midterm 2010Trixia Floie GalimbaBelum ada peringkat

- Cash Disbursements Register (Cdreg) : InstructionsDokumen1 halamanCash Disbursements Register (Cdreg) : InstructionsLyka Mae Palarca IrangBelum ada peringkat

- The Accounting Equation & The Accounting Cycle: Steps 1 - 4: Acct 1A&BDokumen5 halamanThe Accounting Equation & The Accounting Cycle: Steps 1 - 4: Acct 1A&BKenneth Christian WilburBelum ada peringkat

- Group-Government AccountingDokumen125 halamanGroup-Government AccountingaceBelum ada peringkat

- Handout TopFormDokumen10 halamanHandout TopFormshnappsshubhBelum ada peringkat

- Process Financial Transactions and Extract Interim Reports - 025735Dokumen37 halamanProcess Financial Transactions and Extract Interim Reports - 025735l2557206Belum ada peringkat

- Chapter 3 Answers To QuestionsDokumen34 halamanChapter 3 Answers To QuestionsjheyfteeBelum ada peringkat

- Audit Report On Collection and Reporting of Revenues by The Board of Standards and AppealsDokumen14 halamanAudit Report On Collection and Reporting of Revenues by The Board of Standards and AppealslanderBelum ada peringkat

- Acc 103 Quiz ReviewerDokumen7 halamanAcc 103 Quiz Reviewerfernandezmaekyla1330Belum ada peringkat

- 518 Assignment FinalDokumen12 halaman518 Assignment FinalCarmel ThereseBelum ada peringkat

- March 2010 Part 1 InsightDokumen63 halamanMarch 2010 Part 1 InsightSony AxleBelum ada peringkat

- Report of Disbursement - 1st QuarterDokumen2 halamanReport of Disbursement - 1st Quartertesdaro12Belum ada peringkat

- The Accounting Cycle Preparing An Annual Report. Accounting For Merchandising Activities. Financial Assets.Dokumen8 halamanThe Accounting Cycle Preparing An Annual Report. Accounting For Merchandising Activities. Financial Assets.Talha Khan0% (1)

- Annex D Summary Report of Disbursements: ParticularsDokumen2 halamanAnnex D Summary Report of Disbursements: ParticularsJeremiah TrinidadBelum ada peringkat

- Date - /: United States Bankrupcy CourtDokumen9 halamanDate - /: United States Bankrupcy CourtChapter 11 DocketsBelum ada peringkat

- Insight Sep2010 Part2Dokumen89 halamanInsight Sep2010 Part2Legogie Moses AnoghenaBelum ada peringkat

- Mail To Sana SB - Final QuerriesDokumen2 halamanMail To Sana SB - Final QuerriesMuhammad Ammar KhanBelum ada peringkat

- ..P,.4.Ffykp:P) Ein:Ent Fqulrd Docum Is FormDokumen11 halaman..P,.4.Ffykp:P) Ein:Ent Fqulrd Docum Is FormChapter 11 DocketsBelum ada peringkat

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeDari Everand1040 Exam Prep Module III: Items Excluded from Gross IncomePenilaian: 1 dari 5 bintang1/5 (1)

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Dokumen28 halamanAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsBelum ada peringkat

- Ultra Resources, Inc. Opinion Regarding Make Whole PremiumDokumen22 halamanUltra Resources, Inc. Opinion Regarding Make Whole PremiumChapter 11 DocketsBelum ada peringkat

- Appellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Dokumen69 halamanAppellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsBelum ada peringkat

- SEC Vs MUSKDokumen23 halamanSEC Vs MUSKZerohedge100% (1)

- Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Dokumen38 halamanAppellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsBelum ada peringkat

- Republic Late Filed Rejection Damages OpinionDokumen13 halamanRepublic Late Filed Rejection Damages OpinionChapter 11 Dockets100% (1)

- Wochos V Tesla OpinionDokumen13 halamanWochos V Tesla OpinionChapter 11 DocketsBelum ada peringkat

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Dokumen47 halamanAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsBelum ada peringkat

- National Bank of Anguilla DeclDokumen10 halamanNational Bank of Anguilla DeclChapter 11 DocketsBelum ada peringkat

- City Sports GIft Card Claim Priority OpinionDokumen25 halamanCity Sports GIft Card Claim Priority OpinionChapter 11 DocketsBelum ada peringkat

- Zohar 2017 ComplaintDokumen84 halamanZohar 2017 ComplaintChapter 11 DocketsBelum ada peringkat

- Roman Catholic Bishop of Great Falls MTDokumen57 halamanRoman Catholic Bishop of Great Falls MTChapter 11 DocketsBelum ada peringkat

- Energy Future Interest OpinionDokumen38 halamanEnergy Future Interest OpinionChapter 11 DocketsBelum ada peringkat

- PopExpert PetitionDokumen79 halamanPopExpert PetitionChapter 11 DocketsBelum ada peringkat

- Zohar AnswerDokumen18 halamanZohar AnswerChapter 11 DocketsBelum ada peringkat

- Quirky Auction NoticeDokumen2 halamanQuirky Auction NoticeChapter 11 DocketsBelum ada peringkat

- Kalobios Pharmaceuticals IncDokumen81 halamanKalobios Pharmaceuticals IncChapter 11 DocketsBelum ada peringkat

- NQ Letter 1Dokumen3 halamanNQ Letter 1Chapter 11 DocketsBelum ada peringkat

- NQ LetterDokumen2 halamanNQ LetterChapter 11 DocketsBelum ada peringkat

- Home JoyDokumen30 halamanHome JoyChapter 11 DocketsBelum ada peringkat

- APP CredDokumen7 halamanAPP CredChapter 11 DocketsBelum ada peringkat

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDokumen4 halamanUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsBelum ada peringkat

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDokumen5 halamanDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsBelum ada peringkat

- GT Advanced KEIP Denial OpinionDokumen24 halamanGT Advanced KEIP Denial OpinionChapter 11 DocketsBelum ada peringkat

- Licking River Mining Employment OpinionDokumen22 halamanLicking River Mining Employment OpinionChapter 11 DocketsBelum ada peringkat

- APP ResDokumen7 halamanAPP ResChapter 11 DocketsBelum ada peringkat

- Farb PetitionDokumen12 halamanFarb PetitionChapter 11 DocketsBelum ada peringkat

- Fletcher Appeal of Disgorgement DenialDokumen21 halamanFletcher Appeal of Disgorgement DenialChapter 11 DocketsBelum ada peringkat

- Special Report On Retailer Creditor Recoveries in Large Chapter 11 CasesDokumen1 halamanSpecial Report On Retailer Creditor Recoveries in Large Chapter 11 CasesChapter 11 DocketsBelum ada peringkat

- Advance AssigmentDokumen3 halamanAdvance AssigmentAdugna MegenasaBelum ada peringkat

- Record The Following Transactions On Page 2 of The Journal:: InstructionsDokumen3 halamanRecord The Following Transactions On Page 2 of The Journal:: InstructionsItsF2bleAP 37100% (1)

- SALWA Business PlanDokumen62 halamanSALWA Business Planسلوئ اءزواني عبدالله سحىمىBelum ada peringkat

- HKICPA QP Exam (Module A) Feb2008 AnswerDokumen10 halamanHKICPA QP Exam (Module A) Feb2008 Answercynthia tsui100% (1)

- Pelenio - Abm 12-ADokumen2 halamanPelenio - Abm 12-AAAAAABelum ada peringkat

- Full Pfrs Vs Pfrs For Smes PDFDokumen21 halamanFull Pfrs Vs Pfrs For Smes PDFPaula Merriles100% (2)

- Hikkaduwa Beach Resorts PLC and Waskaduwa Beach Resorts PLCDokumen17 halamanHikkaduwa Beach Resorts PLC and Waskaduwa Beach Resorts PLCreshadBelum ada peringkat

- Cost of CapitalDokumen38 halamanCost of CapitalSandip KumarBelum ada peringkat

- Management Accounting: Amity Business SchoolDokumen24 halamanManagement Accounting: Amity Business Schoolprateek agalBelum ada peringkat

- Advanced Financial Accounting-Part 2Dokumen4 halamanAdvanced Financial Accounting-Part 2gundapola83% (6)

- Cost 2 Finals Quiz 1 2Dokumen15 halamanCost 2 Finals Quiz 1 2Jp Combis0% (1)

- Answer Key Prelim ExamDokumen11 halamanAnswer Key Prelim ExamJerald Jardeliza100% (1)

- Capital Reduction MergedDokumen33 halamanCapital Reduction MergedWhalienBelum ada peringkat

- Statement of Cash Flow: Rafhan Oil & Maize ProductsDokumen5 halamanStatement of Cash Flow: Rafhan Oil & Maize ProductsAdeena AmirBelum ada peringkat

- Chapter 5 MCQDokumen6 halamanChapter 5 MCQnurul amiraBelum ada peringkat

- What Is The Overall Weighted Average Cost of Capital (WACC) ?Dokumen3 halamanWhat Is The Overall Weighted Average Cost of Capital (WACC) ?JIAXUAN WANGBelum ada peringkat

- Illustrative Audit Case: Keystone Computers & Networks, IncDokumen6 halamanIllustrative Audit Case: Keystone Computers & Networks, Incvaratvai0% (3)

- Lecture 01 - Cost AccountingDokumen56 halamanLecture 01 - Cost Accountingdia_890Belum ada peringkat

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDokumen80 halamanIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeReinch ClossBelum ada peringkat

- CHAPTER 12 Liquidation Partnership (Depreciation)Dokumen6 halamanCHAPTER 12 Liquidation Partnership (Depreciation)nashBelum ada peringkat

- Differences Gaap - IfrsDokumen7 halamanDifferences Gaap - IfrsAlexander BoshraBelum ada peringkat

- Jawaban Siklus Manual Ukk 2022Dokumen7 halamanJawaban Siklus Manual Ukk 2022irma nurmayantiBelum ada peringkat

- Mid Term Exam 20-10-2017 SolutionsDokumen28 halamanMid Term Exam 20-10-2017 SolutionsfabriBelum ada peringkat

- CostDokumen3 halamanCostmitaaaBelum ada peringkat

- Name Kausar HanifDokumen43 halamanName Kausar HanifIqra HanifBelum ada peringkat

- 4 GPFS Reports of 18 Local Governments 2018 Accounts Ojuolape FileDokumen13 halaman4 GPFS Reports of 18 Local Governments 2018 Accounts Ojuolape FileSeyon HunpeganBelum ada peringkat

- Chapter 11 - Ho Branch - MillanDokumen34 halamanChapter 11 - Ho Branch - MillanAngelica Cerio100% (1)

- CA Assignment 2Dokumen13 halamanCA Assignment 2Methly MorenoBelum ada peringkat

- Earthware Case 3-1 To 3-5Dokumen10 halamanEarthware Case 3-1 To 3-5Stephanie Slaughter80% (5)

- Kumpulan SoalDokumen22 halamanKumpulan Soalmariko1234Belum ada peringkat