10000019617

Diunggah oleh

Chapter 11 DocketsDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

10000019617

Diunggah oleh

Chapter 11 DocketsHak Cipta:

Format Tersedia

11-22820-rdd

Doc 51

Filed 07/18/11

Entered 07/18/11 17:58:18 Pg 1 of 4

Main Document

TARTER KRINSKY & DROGIN LLP Attorneys for The Christian Brothers Institute, et al. Debtors and Debtors-in-Possession 1350 Broadway, 11th Floor New York, New York 10018 (212) 216-8000 Scott S. Markowitz, Esq. Marilyn Simon, Esq. UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK ------------------------------------------------------------------- x In re: : : THE CHRISTIAN BROTHERS INSTITUTE, et al. : : Debtors. : ------------------------------------------------------------------- x

Chapter 11 Case No.: 11-22820 (RDD) (Jointly Administered)

APPLICATION IN SUPPORT OF RETENTION OF ACCOUNTANTS TO: THE HONORABLE ROBERT D. DRAIN UNITED STATES BANKRUPTCY JUDGE The Christian Brothers Institute, debtor and debtor-in-possession (the Debtor), respectfully sets forth and alleges: SUMMARY OF RELIEF REQUESTED 1. By this application (the Application), the Debtor seeks authority to retain

Sperduto Spector & Company P.C. (SS) to audit the Debtors statement of position as of June 30, 2011 and the related statements of activities and cash flows for the year then ended. The fee for the services to be rendered by SS is estimated not to exceed $30,000, plus expenses, as set forth in the Affidavit of Joseph R. Sperduto (the Sperduto Affidavit), annexed as Exhibit A hereto.

{Client\001718\BANK376\00379210.DOC;2}

11-22820-rdd

Doc 51

Filed 07/18/11

Entered 07/18/11 17:58:18 Pg 2 of 4

Main Document

JURISDICTION, VENUE AND STATUTORY BASES FOR REQUESTED RELIEF 2. This Court has jurisdiction to consider this Application under 28 U.S.C. 157

and 1334, and the order of reference, dated July 10, 1984 (Ward, C.J.). This matter is a core proceeding within the meaning of 28 U.S.C. 157(b). 3. 4. Venue is proper before this Court under 28 U.S.C. 1408 and 1409. The statutory bases for the relief requested herein are 327 and 328 of Title 11

of the United States Code (the Bankruptcy Code) and Rules 2014 and 2016 of the Federal Rules of Bankruptcy Procedure (the Bankruptcy Rules). RELEVANT BACKGROUND 5. On April 28, 2011 (the Petition Date), the Debtor filed a voluntary petition for

reorganization under Title 11, Chapter 11, 301 of the United States Bankruptcy Code (the Bankruptcy Code) and has been authorized to continue in the operation of its business as a debtor-in-possession pursuant to 1107 and 1108 of the Bankruptcy Code. 6. The United States Trustee has appointed a committee of unsecured creditors (the

Committee), which has retained counsel. 7. The Debtor is a domestic not-for-profit 501(c)(3) corporation organized under

102(a)(5) of the New York Not-for-Profit Corporation Law. The Debtor was formed in 1903 pursuant to Section 57 of the then existing New York Membership Law. The purpose for which the Debtor was, and continues to be, formed was to establish, conduct and support Catholic elementary and secondary schools, principally throughout New York State. As a not-for-profit corporation, the assets, and/or income are not distributable to, and do not inure to the benefit of its directors, or officers. The Debtor depends upon grants and donations to fund a portion of its operating expenses.

{Client\001718\BANK376\00379210.DOC;2}

11-22820-rdd

Doc 51

Filed 07/18/11

Entered 07/18/11 17:58:18 Pg 3 of 4

Main Document

RELIEF REQUESTED AND BASIS THEREFOR 8. As the affidavit of Joseph R. Sperduto, CPA, a principal of SS, indicates, SS is

not related to and has no business relationship or association with any affiliates, members, management of the Debtor, its attorneys or any other party to this case and represents no adverse interest to the creditors. Although SS provided accounting services to the Debtor prior to the Debtors Chapter 11 filing, SS is not owed any monies on account of pre-bankruptcy services. Since SS has been Debtors accountant for the ten (10) years prior to the Chapter 11 filing, and is therefore, fully familiar with the Debtors books and records, the Debtor believes it is in its best interest to retain SS as its accountant in this case to perform yearly audits. 1 It would be very expensive, disruptive and time consuming to replace accounting firms during this critical time. 9. As set forth in in the Sperduto Affidavit, SS is a disinterested person as that term

is defined in the Bankruptcy Code. 10. SS has conferred with management in order to ascertain the involvment that

would be necessary in order to meet the Debtors requirements for the services to be rendered, which include: (a) 30, 2011, and (b) ended June 30, 2011. 11. SS has advised the Debtor of its hourly rates as set forth in the Sperduto Affidavit Auditing the related statements of acticities and cash flows the the year Auditing the statement of position of the Debtor as at the year ended June

and has agreed to record its time on .1 increments. SS estimates that its charges will be not

1

Pursuant to loan documents between the Debtor and Country Bank, the Debtor is obligated to supply yearly audited financial statements.

{Client\001718\BANK376\00379210.DOC;2}

11-22820-rdd

Doc 51

Filed 07/18/11

Entered 07/18/11 17:58:18 Pg 4 of 4

Main Document

exceed $30,000 plus reimbursement of out-of-pocket costs, based upon its past experience with the Debtor. SS will bill the Debtor on a regularly basis and make periodic applications for allowance as required by 327 and 328 of the Bankruptcy Code, the Federal Rules of Bankruptcy Procedure and the Local rules of this Court. 12. As set forth in paragraph 8 hereof and in the Sperduto Affidavit the Debtor

submits that SS is a disinterested person and, therefore, may be retained as accountant to the Debtor. The Debtor is of the opinion and belief that SSs retention to render the accounting services described herein to the Debtor would be in the best interests of the estate. WHEREFORE, the Debtor respectfully requests that the Court authorize SSs retention, and grant such other and further relief as the Court deems just and proper, for which no other application has been made to this or any other Court. Dated: New York, New York July 16, 2011 THE CHRISTIAN BROTHERS INSTITUTE

By:

/s/ Brother Kevin Griffith Brother Kevin Griffith Vice-President

{Client\001718\BANK376\00379210.DOC;2}

11-22820-rdd

Doc 51-1

Filed 07/18/11 Entered 07/18/11 17:58:18 Affidavit in Support Pg 1 of 4

Exhibit A -

EXHIBIT A

11-22820-rdd

Doc 51-1

Filed 07/18/11 Entered 07/18/11 17:58:18 Affidavit in Support Pg 2 of 4

Exhibit A -

TARTER KRINSKY & DROGIN LLP Attorneys for The Christian Brothers Institute, et al. Debtors and Debtors-in-Possession 1350 Broadway, 11th Floor New York, New York 10018 (212) 216-8000 Scott S. Markowitz, Esq. Marilyn Simon, Esq. UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK ------------------------------------------------------------------- x In re: : : THE CHRISTIAN BROTHERS INSTITUTE, et al. : : Debtors. : ------------------------------------------------------------------- x

Chapter 11 Case No.: 11-22820 (RDD) (Jointly Administered)

AFFIDAVIT OF JOSEPH R. SPERDUTO

STATE OF NEW YORK

) ss.: COUNTY OF WESTCHESTER )

JOSEPH R. SPERDUITO, CPA, being duly sworn, deposes and says: 1. I am a certified public accountant and a partner in the accounting firm of Sperduto

Spector & Company P.C. (SS) with offices located at 15 Chester Avenue, White Plains, New York 10601. 2. SS is not related to The Christian Brothers Institute, debtor and debtor-in-

possession (the Debtor) or its affiliates, members, management, attorneys, or any other party in this case and represents no adverse interest to the creditors. 3. SS has rendered accounting services to the Debtor for the ten (10) years prior to

the Chapter 11 filing. SS is not owed any monies on account of pre-petition accounting services.

{Client\001718\BANK376\00379211.DOC;1}

11-22820-rdd

Doc 51-1

Filed 07/18/11 Entered 07/18/11 17:58:18 Affidavit in Support Pg 3 of 4

Exhibit A -

4.

SS seeks to be retained to audit the Statement of Position of the Debtor as of June

30, 2011 and the related Statements of Activities and Cash Flows for the year ended June 30, 2011. Deponent is familiar with the books and records of the Debtor and has fairly and

consistently performed the work for which retention is sought for the past ten (10) years. 5. At this time, it is not possible to accurately determine the amount of time which

will be required to perform the services referred to herein, but the firm estimates that its fees should not exceed $30,000. 6. SS will calculate its fees for professional services by reference to its standard

hourly rates for these services, which are currently as follows: Joseph R. Sperduto Robert B. Nuccio Andrew Piccinini Paul Sarlo Michael Trapp $200/hr $200/hr $120/hr $115/hr $95/hr Partner Partner Audit Staff Audit Staff Audit Staff

7.

SS is aware of the issues presently facing the Debtor and will make every effort to

perform all required services in an efficient and cost effective manner. 8. 9. SS is a disinterested person as that term is defined in the Bankruptcy Code. SS will seek compensation by making periodic applications to the Court in

accordance with the provisions of the Bankruptcy Code and the local rules of this Court unless otherwise ordered by the Court in a monthly fee order. SS will keep its time records in tenths of an hour as is required by this Courts general orders, the United States Trustee Guidelines, the Bankruptcy Code, and the Bankruptcy Rules. 10. Deponent has been advised of the mandatory guidelines for fees and

disbursements for professionals in the Southern District of New York bankruptcy cases dated June 20, 1991, as amended.

{Client\001718\BANK376\00379211.DOC;1}

11-22820-rdd

Doc 51-1

Filed 07/18/11 Entered 07/18/11 17:58:18 Affidavit in Support Pg 4 of 4

Exhibit A -

WHEREFORE, Deponent respectfully requests that an order be entered herein authorizing the Debtor to retain SS to perform the above-mentioned services at the hourly rates described above.

/s/ Joseph R. Sperduto Joseph R. Sperduto Sworn to before me this 24th day of June, 2011 /s/ Robert G. Sperduto Robert G. Sperduto Notary Public, State of New York No. 01SP6139299 Qualified in Westchester County My Commission Expires Jan. 3, 2014

{Client\001718\BANK376\00379211.DOC;1}

Anda mungkin juga menyukai

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Dokumen47 halamanAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsBelum ada peringkat

- Republic Late Filed Rejection Damages OpinionDokumen13 halamanRepublic Late Filed Rejection Damages OpinionChapter 11 Dockets100% (1)

- SEC Vs MUSKDokumen23 halamanSEC Vs MUSKZerohedge100% (1)

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Dokumen28 halamanAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsBelum ada peringkat

- Appellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Dokumen69 halamanAppellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsBelum ada peringkat

- Wochos V Tesla OpinionDokumen13 halamanWochos V Tesla OpinionChapter 11 DocketsBelum ada peringkat

- Ultra Resources, Inc. Opinion Regarding Make Whole PremiumDokumen22 halamanUltra Resources, Inc. Opinion Regarding Make Whole PremiumChapter 11 DocketsBelum ada peringkat

- Roman Catholic Bishop of Great Falls MTDokumen57 halamanRoman Catholic Bishop of Great Falls MTChapter 11 DocketsBelum ada peringkat

- Zohar 2017 ComplaintDokumen84 halamanZohar 2017 ComplaintChapter 11 DocketsBelum ada peringkat

- Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Dokumen38 halamanAppellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsBelum ada peringkat

- PopExpert PetitionDokumen79 halamanPopExpert PetitionChapter 11 DocketsBelum ada peringkat

- Quirky Auction NoticeDokumen2 halamanQuirky Auction NoticeChapter 11 DocketsBelum ada peringkat

- Energy Future Interest OpinionDokumen38 halamanEnergy Future Interest OpinionChapter 11 DocketsBelum ada peringkat

- NQ Letter 1Dokumen3 halamanNQ Letter 1Chapter 11 DocketsBelum ada peringkat

- Kalobios Pharmaceuticals IncDokumen81 halamanKalobios Pharmaceuticals IncChapter 11 DocketsBelum ada peringkat

- National Bank of Anguilla DeclDokumen10 halamanNational Bank of Anguilla DeclChapter 11 DocketsBelum ada peringkat

- City Sports GIft Card Claim Priority OpinionDokumen25 halamanCity Sports GIft Card Claim Priority OpinionChapter 11 DocketsBelum ada peringkat

- Home JoyDokumen30 halamanHome JoyChapter 11 DocketsBelum ada peringkat

- NQ LetterDokumen2 halamanNQ LetterChapter 11 DocketsBelum ada peringkat

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDokumen5 halamanDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsBelum ada peringkat

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDokumen4 halamanUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsBelum ada peringkat

- Zohar AnswerDokumen18 halamanZohar AnswerChapter 11 DocketsBelum ada peringkat

- APP CredDokumen7 halamanAPP CredChapter 11 DocketsBelum ada peringkat

- APP ResDokumen7 halamanAPP ResChapter 11 DocketsBelum ada peringkat

- GT Advanced KEIP Denial OpinionDokumen24 halamanGT Advanced KEIP Denial OpinionChapter 11 DocketsBelum ada peringkat

- Special Report On Retailer Creditor Recoveries in Large Chapter 11 CasesDokumen1 halamanSpecial Report On Retailer Creditor Recoveries in Large Chapter 11 CasesChapter 11 DocketsBelum ada peringkat

- Licking River Mining Employment OpinionDokumen22 halamanLicking River Mining Employment OpinionChapter 11 DocketsBelum ada peringkat

- Fletcher Appeal of Disgorgement DenialDokumen21 halamanFletcher Appeal of Disgorgement DenialChapter 11 DocketsBelum ada peringkat

- Farb PetitionDokumen12 halamanFarb PetitionChapter 11 DocketsBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- BHI SEC Cert & Amended Articles of Incorporation PDFDokumen9 halamanBHI SEC Cert & Amended Articles of Incorporation PDFkimberly_uymatiaoBelum ada peringkat

- For IMMEDIATE RELEASE-Ennia Group Announces Senior Management PromotionsDokumen2 halamanFor IMMEDIATE RELEASE-Ennia Group Announces Senior Management PromotionsLondonguyBelum ada peringkat

- Introduction of Unilever: These Main Target and Objectives AreDokumen2 halamanIntroduction of Unilever: These Main Target and Objectives AresanameharBelum ada peringkat

- CRD Foods PVT LTDDokumen15 halamanCRD Foods PVT LTDsanju kumarBelum ada peringkat

- The Top 200 International Design FirmsDokumen6 halamanThe Top 200 International Design FirmsSambhav PoddarBelum ada peringkat

- Secretary HandbookDokumen166 halamanSecretary HandbookShanShan Stella C100% (1)

- CILDokumen31 halamanCILHemant GaurkarBelum ada peringkat

- Annual Report - 2015Dokumen158 halamanAnnual Report - 2015Anonymous oWCnglbYgBelum ada peringkat

- ACCA F3 Provisions & Contingencies Question PaperDokumen6 halamanACCA F3 Provisions & Contingencies Question PaperG. DhanyaBelum ada peringkat

- Intermed Acc 1 PPT Ch02Dokumen55 halamanIntermed Acc 1 PPT Ch02Rose McMahonBelum ada peringkat

- SKS MicrofinanceDokumen9 halamanSKS MicrofinanceVarchas BansalBelum ada peringkat

- Wheelan 14e ch04Dokumen40 halamanWheelan 14e ch04Sozia TanBelum ada peringkat

- The Value in Outsourcing Legacy Insurance ProductsDokumen4 halamanThe Value in Outsourcing Legacy Insurance ProductsbillpetrrieBelum ada peringkat

- An Analysis of The Strategic ChallengesDokumen34 halamanAn Analysis of The Strategic ChallengesBenny HendartoBelum ada peringkat

- Cash Conversion ModelsDokumen34 halamanCash Conversion ModelsRanShibasaki0% (1)

- Small Business Development AssignmentDokumen12 halamanSmall Business Development AssignmentSadaqat Khan75% (4)

- OverheadsDokumen5 halamanOverheadsorangzeb mangiBelum ada peringkat

- National Development Corporation v. Court of AppealsDokumen1 halamanNational Development Corporation v. Court of AppealsReth GuevarraBelum ada peringkat

- 2nd Edition of Why RussianWhy Russians Don't Smile A Guide To Doing Business in Russia CISs Don't Smile A Guide To Doing Business in Russia CIS by Luc Jones Antal Russia (November 2015)Dokumen122 halaman2nd Edition of Why RussianWhy Russians Don't Smile A Guide To Doing Business in Russia CISs Don't Smile A Guide To Doing Business in Russia CIS by Luc Jones Antal Russia (November 2015)Maria GusevaBelum ada peringkat

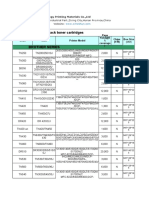

- Product List From Heshun-Lynn 2017Dokumen226 halamanProduct List From Heshun-Lynn 2017kswongBelum ada peringkat

- VNA IPO-Prospectus ENG 26Sept14-FinalDokumen116 halamanVNA IPO-Prospectus ENG 26Sept14-FinalYanLeBelum ada peringkat

- ACCA Presentation On Ethics IIDokumen25 halamanACCA Presentation On Ethics IIKingston Nkansah Kwadwo Emmanuel100% (1)

- Honda Disc 83521-BDokumen7 halamanHonda Disc 83521-BSumeet RatheeBelum ada peringkat

- Chapter 2 Accounting For PartnershipsDokumen102 halamanChapter 2 Accounting For PartnershipsVon Lloyd Ledesma Loren100% (1)

- Assignment SI and CI PDFDokumen2 halamanAssignment SI and CI PDFPrashant SinghBelum ada peringkat

- TransDokumen502 halamanTranssandeepBelum ada peringkat

- Santiago Cua, Jr. Et. Al. v. Miguel Ocampo Tan, Et. Al.Dokumen4 halamanSantiago Cua, Jr. Et. Al. v. Miguel Ocampo Tan, Et. Al.Cessy Ciar KimBelum ada peringkat

- Asha Mohan TDSDokumen5 halamanAsha Mohan TDSDalwinder SinghBelum ada peringkat

- 1 IbcDokumen32 halaman1 IbcChandreshBelum ada peringkat

- Paytm Postpaid Statement-February 2019Dokumen2 halamanPaytm Postpaid Statement-February 2019Amol WaghadeBelum ada peringkat