In The United States Bankruptcy Court Eastern District of Michigan Southern Division

Diunggah oleh

Chapter 11 DocketsDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

In The United States Bankruptcy Court Eastern District of Michigan Southern Division

Diunggah oleh

Chapter 11 DocketsHak Cipta:

Format Tersedia

IN THE UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION In re: COLLINS & AIKMAN CORPORATION,

et al.1 Debtors. ) ) ) ) ) ) ) ) ) ) ) ) ) ) ) ) ) ) Chapter 11 Case No. 05-55927 (SWR) (Jointly Administered) (Tax Identification #13-3489233) Honorable Steven W. Rhodes Adversary No. _____________

COLLINS & AIKMAN CORPORATION, et al., Plaintiffs, v. NORTHERN TRUST BANK OF CALIFORNIA N. A., AS TRUSTEE, Defendant.

COMPLAINT FOR TURNOVER OF ESTATE ASSETS Plaintiffs Collins & Aikman et al., the above-captioned debtors (collectively, the Debtors or Collins & Aikman), allege for their Complaint, upon knowledge of their own acts and upon information and belief as to all other matters, as follows:

The Debtors in the jointly administered cases include: Collins & Aikman Corporation; Amco Convertible Fabrics, Inc., Case No. 05-55949; Becker Group, LLC (d/b/a/ Collins & Aikman Premier Mold), Case No. 05-55977; Brut Plastics, Inc., Case No. 05-55957; Collins & Aikman (Gibraltar) Limited, Case No. 05-55989; Collins & Aikman Accessory Mats, Inc. (f/k/a the Akro Corporation), Case No. 05-55952; Collins & Aikman Asset Services, Inc., Case No. 05-55959; Collins & Aikman Automotive (Argentina), Inc. (f/k/a Textron Automotive (Argentina), Inc.), Case No. 05-55965; Collins & Aikman Automotive (Asia), Inc. (f/k/a Textron Automotive (Asia), Inc.), Case No. 0555991; Collins & Aikman Automotive Exteriors, Inc. (f/k/a Textron Automotive Exteriors, Inc.), Case No. 05-55958; Collins & Aikman Automotive Interiors, Inc. (f/k/a Textron Automotive Interiors, Inc.), Case No. 05-55956; Collins & Aikman Automotive International, Inc., Case No. 05-55980; Collins & Aikman Automotive International Services, Inc. (f/k/a Textron Automotive International Services, Inc.), Case No. 05-55985; Collins & Aikman Automotive Mats, LLC, Case No. 05-55969; Collins & Aikman Automotive Overseas Investment, Inc. (f/k/a Textron Automotive Overseas Investment, Inc.), Case No. 05-55978; Collins & Aikman Automotive Services, LLC, Case No. 05-55981; Collins & Aikman Canada Domestic Holding Company, Case No. 05-55930; Collins & Aikman Carpet & Acoustics (MI), Inc., Case No. 05-55982; Collins & Aikman Carpet & Acoustics (TN), Inc., Case No. 05-55984; Collins & Aikman Development Company, Case No. 05-55943; Collins & Aikman Europe, Inc., Case No. 05-55971; Collins & Aikman Fabrics, Inc. (d/b/a Joan Automotive Industries, Inc.), Case No. 05-55963; Collins & Aikman Intellimold, Inc. (d/b/a M&C Advanced Processes, Inc.), Case No. 05-55976; Collins & Aikman Interiors, Inc., Case No. 05-55970; Collins & Aikman International Corporation, Case No. 05-55951; Collins & Aikman Plastics, Inc., Case No. 05-55960; Collins & Aikman Products Co., Case No. 05-55932; Collins & Aikman Properties, Inc., Case No. 0555964; Comet Acoustics, Inc., Case No. 05-55972; CW Management Corporation, Case No. 05-55979; Dura Convertible Systems, Inc., Case No. 05-55942; Gamble Development Company, Case No. 05-55974; JPS Automotive, Inc. (d/b/a PACJ, Inc.), Case No. 05-55935; New Baltimore Holdings, LLC, Case No. 05-55992; Owosso Thermal Forming, LLC, Case No. 05-55946; Southwest Laminates, Inc. (d/b/a Southwest Fabric Laminators Inc.), Case No. 05-55948; Wickes Asset Management, Inc., Case No. 05-55962; and Wickes Manufacturing Company, Case No. 05-55968.

K&E 10981007.6

0W[;&#'

0555927060307000000000008

(P

Introduction 1. Prior to the Petition Date (as defined below), the Debtors entered into an

agreement with Trust Services of America wherein the Debtors established a trust (the Wickes Rabbi Trust as defined in more detail below) for the purpose of paying supplemental retirement benefits to six former executives of Wickes Companies, Inc. (Wickes which is now operating as Collins & Aikman Products Co., a Debtor in the above-captioned chapter 11 cases). The Defendant, Northern Trust Bank of California N. A., subsequently became the successor trustee of the Wickes Rabbi Trust. Pursuant to the terms of the trust agreement controlling the Wickes Rabbi Trust (the Trust Agreement), attached hereto as Exhibit A, the trust assets held in the Wickes Rabbi Trust (the Trust Assets) are available for distribution to the Debtors creditors. 2. The Defendant has informed the Debtors that it will only transfer the Trust

Assets to the Debtors pursuant to an order by a court of competent jurisdiction to turnover such property. 3. As such, the Debtors file this Complaint seeking the entry of an order,

issued pursuant to Section 542 of title 11 of the United States Code, 11 U.S.C. 101-1330 (the Bankruptcy Code), requiring the Defendant to turnover the Trust Assets. Jurisdiction and Venue 4. On May 17, 2005 (the Petition Date), the Debtors filed their voluntary

petitions for relief under chapter 11 of the Bankruptcy Code. The Debtors continue to operate their businesses and manage their properties as debtors in possession pursuant to sections 1107(a) and 1108 of the Bankruptcy Code.

2

K&E 10981007.6

5. 28 U.S.C. 1334.

The Court has jurisdiction over this adversary proceeding pursuant to This adversary proceeding is a core proceeding within the meaning of

28 U.S.C. 157(b)(2). 6. 7. Bankruptcy Code. 8. This adversary proceeding has been instituted in accordance with Venue is proper pursuant to 28 U.S.C. 1408 and 1409. The statutory basis for the relief requested herein is section 542(a) of the

Rule 7001 of the Federal Rules of Bankruptcy Procedure. 9. any other court. Background I. The Parties 10. The Debtors and their non-debtor affiliates are leading global suppliers of No prior request for the relief requested herein has been made to this or

automotive components, systems and modules to all of the worlds largest vehicle manufacturers, including DaimlerChrysler AG, Ford Motor Company, General Motors Corporation, Honda Motor Company, Inc., Nissan Motor Company Unlimited, Porsche Cars GB, Renault Crateur DAutomobiles, Toyota SA and Volkswagen AG. 11. Defendant in this Adversary Proceeding is Northern Trust Bank of

California N. A. (Northern Trust), a subsidiary of Northern Trust Corporation and a national banking association. II. The Trust 12. On April 30, 1985, Wickes and Trust Services of America entered into the

Trust Agreement establishing the Wickes Rabbi Trust. The Wickes Rabbi Trust was created to hold assets for funding the Debtors liabilities, if any, for retirement benefits of certain of the Debtors former employees. 3

K&E 10981007.6

13. America. 14.

Northern Trust was appointed successor trustee to Trust Services of

Section 6.02 of the Trust Agreement provides:2

6.02 Claims of Creditors. Notwithstanding anything contained herein to the contrary, the assets of the Trust shall at all times be subject to the claims of the Companys creditors as if the assets herein were general assets of the Company; provided, however, that the Trustee shall have no power to make any such trust assets available to the general creditors of the Company unless and until the Responsible Officer or a court of competent jurisdiction (the Court) shall notify the Trustee in writing that the Company is unable to pay its debts as they mature or that the Company has or will imminently become subject, as a debtor, to a pending proceeding under the Bankruptcy Code. By such notice, the Responsible Officer or the Court shall direct the Trustee to, and the Trustee shall, deliver any and all Trust Assets only as the Court may direct to satisfy claims of the Companys creditors. Count I (Accounting and Turnover of Estate Assets -- 11 U.S.C. 542(a)) 15. The Debtors incorporate by reference each of the allegations contained in

paragraphs 1 through 14 of this Complaint as though fully stated herein. 16. Section 542(a) of the Bankruptcy Code provides, in relevant part:

Except as provided in subsection (c) or (d) of this section, an entity, other than a custodian, in possession, custody, or control, during the case, of property that the trustee may use, sell, or lease under section 363 of this title . . . shall deliver to the trustee, and account for, such property or the value of such property . . . . 11 U.S.C. 542(a). 17. Pursuant to the Trust Agreement and section 542 of the Bankruptcy Code,

the Trust Assets are property of the Debtors estates and the Defendant is required to deliver the Trust Assets to the Debtors.

Capitalized terms in this excerpt from the Trust Agreement are as defined in the agreement.

4

K&E 10981007.6

18.

Pursuant to section 542 of the Bankruptcy Code, the Defendant is required

to provide an accounting to the Debtors with respect to the Trust Assets. WHEREFORE, the Debtors respectfully request the entry of an order (a) requiring the Defendant to deliver the Trust Assets to the Debtors, (b) requiring the Defendant to provide an accounting of the Trust Assets and (c) granting such other further relief as is just and proper. Dated: March 7, 2006 KIRKLAND & ELLIS LLP /s/ Ray C. Schrock Richard M. Cieri (NY RC 6062) Citigroup Center 153 East 53rd Street New York, New York 10022 Telephone: (212) 446-4800 Facsimile: (212) 446-4900 -andDavid L. Eaton (IL 3122303) Ray C. Schrock (IL 6257005) Marc J. Carmel (IL 6272032) 200 East Randolph Drive Chicago, Illinois 60601 Telephone: (312) 861-2000 Facsimile: (312) 861-2200 -andCARSON FISCHER, P.L.C. Joseph M. Fischer (P13452) 4111 West Andover Road West - Second Floor Bloomfield Hills, Michigan 48302 Telephone: (248) 644-4840 Facsimile: (248) 644-1832 Co-Counsel for the Debtors

5

K&E 10981007.6

Anda mungkin juga menyukai

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen41 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen38 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In Re:) Chapter 11) Collins & Aikman Corporation, Et Al.1) Case No. 05-55927 (SWR) ) (Jointly Administered) Debtors.) ) (Tax Identification #13-3489233) ) ) Honorable Steven W. RhodesDokumen37 halamanIn Re:) Chapter 11) Collins & Aikman Corporation, Et Al.1) Case No. 05-55927 (SWR) ) (Jointly Administered) Debtors.) ) (Tax Identification #13-3489233) ) ) Honorable Steven W. RhodesChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen10 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen27 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen27 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen13 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen3 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen13 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Solvay Engineered Polymers, IncDokumen18 halamanDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To Solvay Engineered Polymers, IncChapter 11 DocketsBelum ada peringkat

- Hearing Date: March 12, 2007 at 2:00 P.M. Objection Deadline: March 12, 2007 at 12:00 P.MDokumen29 halamanHearing Date: March 12, 2007 at 2:00 P.M. Objection Deadline: March 12, 2007 at 12:00 P.MChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen17 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen3 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen7 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen15 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Nyx, IncorporatedDokumen18 halamanDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To Nyx, IncorporatedChapter 11 DocketsBelum ada peringkat

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To J.R. Wortman Co., IncDokumen18 halamanDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To J.R. Wortman Co., IncChapter 11 DocketsBelum ada peringkat

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To The Haartz CorporationDokumen19 halamanDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To The Haartz CorporationChapter 11 DocketsBelum ada peringkat

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Armada Rubber Manufacturing CoDokumen16 halamanDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To Armada Rubber Manufacturing CoChapter 11 DocketsBelum ada peringkat

- In Re:) Chapter 11) Collins & Aikman Corporation, Et Al.) Case No. 05-55927 (SWR) ) (Jointly Administered) Debtors.) ) (Tax Identification #13-3489233) ) ) Honorable Steven W. RhodesDokumen41 halamanIn Re:) Chapter 11) Collins & Aikman Corporation, Et Al.) Case No. 05-55927 (SWR) ) (Jointly Administered) Debtors.) ) (Tax Identification #13-3489233) ) ) Honorable Steven W. RhodesChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen15 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen14 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen6 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- Hearing Date: May 22, 2008 at 2:00 P.M. (If Necessary) Objection Deadline: May 12, 2008 at 4:00 P.MDokumen21 halamanHearing Date: May 22, 2008 at 2:00 P.M. (If Necessary) Objection Deadline: May 12, 2008 at 4:00 P.MChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen22 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen24 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen20 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Unique Fabricating, IncDokumen18 halamanDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To Unique Fabricating, IncChapter 11 DocketsBelum ada peringkat

- 10000024737Dokumen59 halaman10000024737Chapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen3 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen14 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen22 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Emhart Teknologies, IncDokumen19 halamanDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To Emhart Teknologies, IncChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen19 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Solo Products Co., LLCDokumen18 halamanDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To Solo Products Co., LLCChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen19 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- 10000027195Dokumen141 halaman10000027195Chapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen3 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen26 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen538 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen18 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen3 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen17 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen18 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen26 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen5 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen9 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen14 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen19 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen4 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen27 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen9 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen18 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen3 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen16 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen22 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen16 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen19 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen21 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- California Supreme Court Petition: S173448 – Denied Without OpinionDari EverandCalifornia Supreme Court Petition: S173448 – Denied Without OpinionPenilaian: 4 dari 5 bintang4/5 (1)

- SEC Vs MUSKDokumen23 halamanSEC Vs MUSKZerohedge100% (1)

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Dokumen28 halamanAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsBelum ada peringkat

- Wochos V Tesla OpinionDokumen13 halamanWochos V Tesla OpinionChapter 11 DocketsBelum ada peringkat

- National Bank of Anguilla DeclDokumen10 halamanNational Bank of Anguilla DeclChapter 11 DocketsBelum ada peringkat

- Zohar 2017 ComplaintDokumen84 halamanZohar 2017 ComplaintChapter 11 DocketsBelum ada peringkat

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Dokumen47 halamanAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsBelum ada peringkat

- PopExpert PetitionDokumen79 halamanPopExpert PetitionChapter 11 DocketsBelum ada peringkat

- Home JoyDokumen30 halamanHome JoyChapter 11 DocketsBelum ada peringkat

- Energy Future Interest OpinionDokumen38 halamanEnergy Future Interest OpinionChapter 11 DocketsBelum ada peringkat

- Kalobios Pharmaceuticals IncDokumen81 halamanKalobios Pharmaceuticals IncChapter 11 DocketsBelum ada peringkat

- Zohar AnswerDokumen18 halamanZohar AnswerChapter 11 DocketsBelum ada peringkat

- NQ LetterDokumen2 halamanNQ LetterChapter 11 DocketsBelum ada peringkat

- Quirky Auction NoticeDokumen2 halamanQuirky Auction NoticeChapter 11 DocketsBelum ada peringkat

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDokumen4 halamanUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsBelum ada peringkat

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDokumen5 halamanDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsBelum ada peringkat

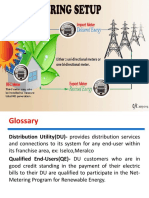

- Solar Net-Metering and Grid Tie SystemDokumen30 halamanSolar Net-Metering and Grid Tie SystemBilly Twaine Palma Fuerte100% (1)

- List of All CompaniesDokumen1.154 halamanList of All CompaniesMD ABUL KHAYER67% (6)

- Resort Operations Chapter 2Dokumen20 halamanResort Operations Chapter 2Aaron Black100% (2)

- 1Dokumen21 halaman1Joshua S MjinjaBelum ada peringkat

- Tax Revenue Performance in KenyaDokumen47 halamanTax Revenue Performance in KenyaMwangi MburuBelum ada peringkat

- FA3 CabreraDokumen139 halamanFA3 CabreraLaurenz Simon ManaliliBelum ada peringkat

- Data InterpretationDokumen44 halamanData InterpretationSwati Choudhary100% (2)

- Off Grid Industry Yearbook 2018Dokumen310 halamanOff Grid Industry Yearbook 2018birlainBelum ada peringkat

- Lin PrimerDokumen14 halamanLin PrimerPhil KaneBelum ada peringkat

- National Income Determination: (Three Sector Model)Dokumen12 halamanNational Income Determination: (Three Sector Model)Yash KumarBelum ada peringkat

- PartnershipDokumen5 halamanPartnershipHumaira ShafiqBelum ada peringkat

- On Types of BanksDokumen14 halamanOn Types of BanksRahulTikoo100% (1)

- Cash BudgetDokumen3 halamanCash Budgetmanoj kumarBelum ada peringkat

- Finmar Final Handouts 1 PDFDokumen3 halamanFinmar Final Handouts 1 PDFAcissejBelum ada peringkat

- 2014 Q3 Net Lease Research ReportDokumen3 halaman2014 Q3 Net Lease Research ReportnetleaseBelum ada peringkat

- In Do Solar DraftDokumen284 halamanIn Do Solar DraftSomraj DasguptaBelum ada peringkat

- Dissertation of Cash Flow RatiosDokumen309 halamanDissertation of Cash Flow Ratioszozo001100% (1)

- Arpita MAJOR RESEARCH PROJECTDokumen31 halamanArpita MAJOR RESEARCH PROJECTSukhvinder SinghBelum ada peringkat

- DeAngelo : The Irrelevance of The MM Dividend Irrelevance TheoremDokumen23 halamanDeAngelo : The Irrelevance of The MM Dividend Irrelevance TheoremAndreas WidhiBelum ada peringkat

- FM Project 1 - Textile IndustryDokumen13 halamanFM Project 1 - Textile IndustrySaharsh SaraogiBelum ada peringkat

- Principle of ManagementDokumen6 halamanPrinciple of ManagementWaqar AhmadBelum ada peringkat

- The Mechanics of AngelList Syndicates - by David E. WeeklyDokumen13 halamanThe Mechanics of AngelList Syndicates - by David E. WeeklyHaider RazaBelum ada peringkat

- SEC Vs Jonnie WilliamsDokumen8 halamanSEC Vs Jonnie WilliamsFuzzy PandaBelum ada peringkat

- Answers To Practice Questions: Capital Budgeting and RiskDokumen8 halamanAnswers To Practice Questions: Capital Budgeting and Risksharktale2828Belum ada peringkat

- TOPIC 6 Acquisitions, Corporate RestructuringDokumen29 halamanTOPIC 6 Acquisitions, Corporate RestructuringLeon MushiBelum ada peringkat

- MBFDokumen16 halamanMBFQaiser KhalilBelum ada peringkat

- Chapter 8 Part 1 (B)Dokumen88 halamanChapter 8 Part 1 (B)Nurul AsyilahBelum ada peringkat

- Contract of InsuranceDokumen3 halamanContract of InsuranceKirthana DarshayinieBelum ada peringkat

- Case StudyDokumen50 halamanCase StudyJaypee BallesterosBelum ada peringkat

- Eric Sorensen - The Salomon Smith BaDokumen188 halamanEric Sorensen - The Salomon Smith Bajbiddy789Belum ada peringkat