In The United States Bankruptcy Court Eastern District of Michigan Southern Division

Diunggah oleh

Chapter 11 DocketsDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

In The United States Bankruptcy Court Eastern District of Michigan Southern Division

Diunggah oleh

Chapter 11 DocketsHak Cipta:

Format Tersedia

IN THE UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION In re: ) ) COLLINS & AIKMAN CORPORATION,

et al.1 ) ) Debtors. ) ) ) ) ) ) _________________________________________) Chapter 11 Case No. 05-55927 (SWR) (Jointly Administered) (Tax Identification #13-3489233) Honorable Steven W. Rhodes

THE COLLINS & AIKMAN LITIGATION TRUSTS FIFTY-FIFTH OMNIBUS OBJECTION TO CLAIMS (LATE-FILED CLAIMS) The Collins & Aikman Litigation Trust (the Trust), as successor to the above-captioned Debtors (collectively, the Debtors) pursuant to the First Amended Joint Plan of Reorganization of Collins & Aikman Corporation and its Debtor Subsidiaries as confirmed by order of the Bankruptcy Court, hereby files this omnibus objection (the Fifty-Fifth Omnibus Objection) to the claims listed on Exhibit B as Late-Filed Claims and request the entry of an order, substantially in the form of Exhibit A, disallowing the Late-Filed Claims that are listed on

The Debtors in the jointly administered cases include: Collins & Aikman Corporation; Amco Convertible Fabrics, Inc., Case No. 05-55949; Becker Group, LLC (d/b/a/ Collins & Aikman Premier Mold), Case No. 05-55977; Brut Plastics, Inc., Case No. 05-55957; Collins & Aikman (Gibraltar) Limited, Case No. 05-55989; Collins & Aikman Accessory Mats, Inc. (f/k/a the Akro Corporation), Case No. 05-55952; Collins & Aikman Asset Services, Inc., Case No. 05-55959; Collins & Aikman Automotive (Argentina), Inc. (f/k/a Textron Automotive (Argentina), Inc.), Case No. 05-55965; Collins & Aikman Automotive (Asia), Inc. (f/k/a Textron Automotive (Asia), Inc.), Case No. 0555991; Collins & Aikman Automotive Exteriors, Inc. (f/k/a Textron Automotive Exteriors, Inc.), Case No. 05-55958; Collins & Aikman Automotive Interiors, Inc. (f/k/a Textron Automotive Interiors, Inc.), Case No. 05-55956; Collins & Aikman Automotive International, Inc., Case No. 05-55980; Collins & Aikman Automotive International Services, Inc. (f/k/a Textron Automotive International Services, Inc.), Case No. 05-55985; Collins & Aikman Automotive Mats, LLC, Case No. 05-55969; Collins & Aikman Automotive Overseas Investment, Inc. (f/k/a Textron Automotive Overseas Investment, Inc.), Case No. 05-55978; Collins & Aikman Automotive Services, LLC, Case No. 05-55981; Collins & Aikman Canada Domestic Holding Company, Case No. 05-55930; Collins & Aikman Carpet & Acoustics (MI), Inc., Case No. 05-55982; Collins & Aikman Carpet & Acoustics (TN), Inc., Case No. 05-55984; Collins & Aikman Development Company, Case No. 05-55943; Collins & Aikman Europe, Inc., Case No. 05-55971; Collins & Aikman Fabrics, Inc. (d/b/a Joan Automotive Industries, Inc.), Case No. 05-55963; Collins & Aikman Intellimold, Inc. (d/b/a M&C Advanced Processes, Inc.), Case No. 05-55976; Collins & Aikman Interiors, Inc., Case No. 05-55970; Collins & Aikman International Corporation, Case No. 05-55951; Collins & Aikman Plastics, Inc., Case No. 05-55960; Collins & Aikman Products Co., Case No. 05-55932; Collins & Aikman Properties, Inc., Case No. 0555964; Comet Acoustics, Inc., Case No. 05-55972; CW Management Corporation, Case No. 05-55979; Dura Convertible Systems, Inc., Case No. 05-55942; Gamble Development Company, Case No. 05-55974; JPS Automotive, Inc. (d/b/a PACJ, Inc.), Case No. 05-55935; New Baltimore Holdings, LLC, Case No. 05-55992; Owosso Thermal Forming, LLC, Case No. 05-55946; Southwest Laminates, Inc. (d/b/a Southwest Fabric Laminators Inc.), Case No. 05-55948; Wickes Asset Management, Inc., Case No. 05-55962; and Wickes Manufacturing Company, Case No. 05-55968.

0W[;(&;

(C

0555927080627000000000008

Exhibit B.

Pursuant to Rule 3007(e)(1) of the Federal Rules of Bankruptcy Procedure,

Claimants receiving this Fifty-Fifth Omnibus Objection should locate their names and claims in the objection and the attached exhibits. In support of the Fifty-Fifth Omnibus Objection, the Trust respectfully represents as follows: Jurisdiction 1. The Court has subject matter jurisdiction to consider and determine the Fifty-Fifth

Omnibus Objection pursuant to Paragraph 41(a) of the Order Confirming First Amended Joint Plan of Collins & Aikman Corporation And Its Debtor Subsidiaries (the Order). 2. 3. Venue is proper before the Court pursuant to 28 U.S.C. 1408 and 1409. The statutory basis for the relief requested by the Fifty-Fifth Omnibus Objection

is section 502 of the Bankruptcy Code, 11 U.S.C. 101-1330 and Rule 3007 of the Federal Rules of Bankruptcy Procedure. Background 4. On November 22, 2005, this Court entered the Order Establishing A Bar Date for

Filing Proofs of Claim and Approving the Manner and Notice Thereof (the Bar Date Order). 5. The Bar Date Order established January 11, 2006 as the deadline by which all

creditors, subject to certain stated exceptions, were required to file their proofs of claim in the Debtors chapter 11 cases (the Bar Date). In accordance with the Bar Date Order, the Debtors mailed written notice of the Bar Date to, among others, all creditors listed on the Schedules. This notice was also published in certain local and national newspapers. Such service and publication provided adequate notice of the Bar Date to all parties in interest.

6.

On January 9, 2007, Debtors filed its Twelfth Omnibus Objection to Claims (Late

Filed Claims). This Omnibus Objection addressed claims filed after the Bar Date. Debtors Twelfth Omnibus Objection to Claims was resolved by order of this Court on February 14, 2007. 7. Since the filing of the Twelfth Omnibus Objection to Claims (Late Filed Claims),

other claims have been filed, obviously well-past the Bar Date. A list of these claims is attached as Exhibit B. Objection to Late Filed Claims 8. The Trust objects to the Late Filed Claims listed on Exhibit B because such

claims were not timely filed before the Bar Date. As indicated above, on November 22, 2005, the Court entered the Bar Date Order, setting the Bar Date for all claims as January 11, 2006. The Bar Date Order further ordered that any entity that failed to file a proof of claim by the Bar Date shall be forever barred, estopped and enjoined from, among other things, asserting such claim against the Debtors. 9. Claimants filing the Late Filed Claims listed on Exhibit B filed such claims after

the Bar Date. Therefore, pursuant to the Bar Date Order, such Late Filed Claims are barred and should be disallowed and expunged for all purposes. 10. Pursuant to Article VII.A.1 of the Plan, the Fifty-Fifth Omnibus Objection (with

exhibits) and a notice thereof will be served upon the Holders of Such Claims and the United States Trustee. A Copy of the Fifty-Fifth Omnibus Objection has also been filed with the CM/ECF system which will serve a copy of this pleading on all attorneys registered to receive such filings. 11. No prior request for the relief sought in the Fifty-Fifth Omnibus Objection has

been made to this or any other court regarding the claims addressed herein.

WHEREFORE, the Trust respectfully requests the entry of an order, substantially in the form attached to this Fifty-Fifth Omnibus Objection as Exhibit A, (a) disallowing and expunging the Late Filed Claims identified on Exhibit B and (b) granting such other and further relief as is just and proper. Respectfully submitted, BOYLE BURDETT By:s/H. William Burdett, Jr. Eugene H. Boyle, Jr. (P42023) H. William Burdett, Jr. (P63185) 14950 East Jefferson, Suite 200 Grosse Pointe Park, Michigan 48230 (313) 344-4000 (313) 344-4001 (facsimile) burdett@boyleburdett.com Attorneys for the Collins & Aikman Litigation Trust

Dated: June 27, 2008

IN THE UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION In re: ) ) COLLINS & AIKMAN CORPORATION, et al.1 ) ) Debtors. ) ) ) ) ) ) _________________________________________) Chapter 11 Case No. 05-55927 (SWR) (Jointly Administered) (Tax Identification #13-3489233) Honorable Steven W. Rhodes

NOTICE AND OPPORTUNITY TO RESPOND TO THE COLLINS & AIKMAN LITIGATION TRUSTS FIFTY-FIFTH OMNIBUS OBJECTION TO CLAIMS (INSUFFICIENT BOOKS AND RECORDS) PLEASE TAKE NOTICE THAT the Collins & Aikman Litigation Trust (the Trust), as successor to the above-captioned Debtors (collectively, the Debtors) pursuant to the First Amended Joint Plan of Reorganization of Collins & Aikman Corporation and its Debtor Subsidiaries as confirmed by the order of the Bankruptcy Court, have filed its Fifty-Fifth Omnibus Objection to Claims (Insufficient Books and Records) (the Fifty-Fifth Omnibus Objection).

1

The Debtors in the jointly administered cases include: Collins & Aikman Corporation; Amco Convertible Fabrics, Inc., Case No. 05-55949; Becker Group, LLC (d/b/a/ Collins & Aikman Premier Mold), Case No. 05-55977; Brut Plastics, Inc., Case No. 05-55957; Collins & Aikman (Gibraltar) Limited, Case No. 05-55989; Collins & Aikman Accessory Mats, Inc. (f/k/a the Akro Corporation), Case No. 05-55952; Collins & Aikman Asset Services, Inc., Case No. 05-55959; Collins & Aikman Automotive (Argentina), Inc. (f/k/a Textron Automotive (Argentina), Inc.), Case No. 05-55965; Collins & Aikman Automotive (Asia), Inc. (f/k/a Textron Automotive (Asia), Inc.), Case No. 0555991; Collins & Aikman Automotive Exteriors, Inc. (f/k/a Textron Automotive Exteriors, Inc.), Case No. 05-55958; Collins & Aikman Automotive Interiors, Inc. (f/k/a Textron Automotive Interiors, Inc.), Case No. 05-55956; Collins & Aikman Automotive International, Inc., Case No. 05-55980; Collins & Aikman Automotive International Services, Inc. (f/k/a Textron Automotive International Services, Inc.), Case No. 05-55985; Collins & Aikman Automotive Mats, LLC, Case No. 05-55969; Collins & Aikman Automotive Overseas Investment, Inc. (f/k/a Textron Automotive Overseas Investment, Inc.), Case No. 05-55978; Collins & Aikman Automotive Services, LLC, Case No. 05-55981; Collins & Aikman Canada Domestic Holding Company, Case No. 05-55930; Collins & Aikman Carpet & Acoustics (MI), Inc., Case No. 05-55982; Collins & Aikman Carpet & Acoustics (TN), Inc., Case No. 05-55984; Collins & Aikman Development Company, Case No. 05-55943; Collins & Aikman Europe, Inc., Case No. 05-55971; Collins & Aikman Fabrics, Inc. (d/b/a Joan Automotive Industries, Inc.), Case No. 05-55963; Collins & Aikman Intellimold, Inc. (d/b/a M&C Advanced Processes, Inc.), Case No. 05-55976; Collins & Aikman Interiors, Inc., Case No. 05-55970; Collins & Aikman International Corporation, Case No. 05-55951; Collins & Aikman Plastics, Inc., Case No. 05-55960; Collins & Aikman Products Co., Case No. 05-55932; Collins & Aikman Properties, Inc., Case No. 0555964; Comet Acoustics, Inc., Case No. 05-55972; CW Management Corporation, Case No. 05-55979; Dura Convertible Systems, Inc., Case No. 05-55942; Gamble Development Company, Case No. 05-55974; JPS Automotive, Inc. (d/b/a PACJ, Inc.), Case No. 05-55935; New Baltimore Holdings, LLC, Case No. 05-55992; Owosso Thermal Forming, LLC, Case No. 05-55946; Southwest Laminates, Inc. (d/b/a Southwest Fabric Laminators Inc.), Case No. 05-55948; Wickes Asset Management, Inc., Case No. 05-55962; and Wickes Manufacturing Company, Case No. 05-55968.

PLEASE TAKE FURTHER NOTICE THAT your rights may be affected. Pursuant to Rule 3007(e)(1) of the Federal Rules of Bankruptcy Procedure, Claimants receiving this FiftyFifth Omnibus Objection should locate their names and claims in the objection and the attached exhibits. You may wish to review the Objection and discuss it with your attorney, if you have one in these cases. If you do not have an attorney, you may wish to consult one. PLEASE TAKE FURTHER NOTICE THAT if you wish to object to the Court granting the relief sought in the Fifty-Fifth Omnibus Objection, or if you want the Court to otherwise consider your views on the Objection, no later than July 21, 2008, or such shorter time as the Court may order and of which you may receive subsequent notices, you or your attorney must file with the Court a written response explaining your position at: United States Bankruptcy Court 211 West Fort Street, Suite 2100 Detroit, Michigan 48226 PLEASE TAKE FURTHER NOTICE THAT if you mail your response to the Court for filing, you must mail it early enough so the Court will receive it on or before the date above. PLEASE TAKE FURTHER NOTICE THAT you must also serve your response so that it is received on or before July 21, 2008 by the undersigned attorney.

PLEASE TAKE FURTHER NOTICE THAT if no response to the Objection is timely filed and served, the Court may grant the Objection and enter the order without a hearing as set forth in Rule 9014-1 of the Local Rules for the United States Bankruptcy Court for the Eastern District of Michigan. Respectfully submitted, BOYLE BURDETT By:s/H. William Burdett, Jr. Eugene H. Boyle, Jr. (P42023) H. William Burdett, Jr. (P63185) 14950 East Jefferson, Suite 200 Grosse Pointe Park, Michigan 48230 (313) 344-4000 (313) 344-4001 (facsimile) burdett@boyleburdett.com Attorneys for the Collins & Aikman Litigation Trust

Dated: June 27, 2008

IN THE UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION In re: ) ) COLLINS & AIKMAN CORPORATION, et al.1 ) ) Debtors. ) ) ) ) ) ) _________________________________________) Chapter 11 Case No. 05-55927 (SWR) (Jointly Administered) (Tax Identification #13-3489233) Honorable Steven W. Rhodes

NOTICE OF HEARING PLEASE TAKE NOTICE that a hearing on The Collins & Aikman Litigation Trusts (the Trust) Fifty-Fifth Omnibus Objection to Claims (the Fifty-Fifth Omnibus Objection) is scheduled to be heard before the Honorable Steven W. Rhodes on July 31, 2008 at 2:00 p.m., or as soon thereafter as counsel may be heard, in his courtroom in the United States Bankruptcy Court, 211 West Fort Street, Detroit, Michigan 48226. PLEASE TAKE FURTHER NOTICE that the July 31, 2008 hearing (the Hearing) may be adjourned thereafter from time to time without further notice to claimants and other parties in

1

The Debtors in the jointly administered cases include: Collins & Aikman Corporation; Amco Convertible Fabrics, Inc., Case No. 05-55949; Becker Group, LLC (d/b/a/ Collins & Aikman Premier Mold), Case No. 05-55977; Brut Plastics, Inc., Case No. 05-55957; Collins & Aikman (Gibraltar) Limited, Case No. 05-55989; Collins & Aikman Accessory Mats, Inc. (f/k/a the Akro Corporation), Case No. 05-55952; Collins & Aikman Asset Services, Inc., Case No. 05-55959; Collins & Aikman Automotive (Argentina), Inc. (f/k/a Textron Automotive (Argentina), Inc.), Case No. 05-55965; Collins & Aikman Automotive (Asia), Inc. (f/k/a Textron Automotive (Asia), Inc.), Case No. 0555991; Collins & Aikman Automotive Exteriors, Inc. (f/k/a Textron Automotive Exteriors, Inc.), Case No. 05-55958; Collins & Aikman Automotive Interiors, Inc. (f/k/a Textron Automotive Interiors, Inc.), Case No. 05-55956; Collins & Aikman Automotive International, Inc., Case No. 05-55980; Collins & Aikman Automotive International Services, Inc. (f/k/a Textron Automotive International Services, Inc.), Case No. 05-55985; Collins & Aikman Automotive Mats, LLC, Case No. 05-55969; Collins & Aikman Automotive Overseas Investment, Inc. (f/k/a Textron Automotive Overseas Investment, Inc.), Case No. 05-55978; Collins & Aikman Automotive Services, LLC, Case No. 05-55981; Collins & Aikman Canada Domestic Holding Company, Case No. 05-55930; Collins & Aikman Carpet & Acoustics (MI), Inc., Case No. 05-55982; Collins & Aikman Carpet & Acoustics (TN), Inc., Case No. 05-55984; Collins & Aikman Development Company, Case No. 05-55943; Collins & Aikman Europe, Inc., Case No. 05-55971; Collins & Aikman Fabrics, Inc. (d/b/a Joan Automotive Industries, Inc.), Case No. 05-55963; Collins & Aikman Intellimold, Inc. (d/b/a M&C Advanced Processes, Inc.), Case No. 05-55976; Collins & Aikman Interiors, Inc., Case No. 05-55970; Collins & Aikman International Corporation, Case No. 05-55951; Collins & Aikman Plastics, Inc., Case No. 05-55960; Collins & Aikman Products Co., Case No. 05-55932; Collins & Aikman Properties, Inc., Case No. 0555964; Comet Acoustics, Inc., Case No. 05-55972; CW Management Corporation, Case No. 05-55979; Dura Convertible Systems, Inc., Case No. 05-55942; Gamble Development Company, Case No. 05-55974; JPS Automotive, Inc. (d/b/a PACJ, Inc.), Case No. 05-55935; New Baltimore Holdings, LLC, Case No. 05-55992; Owosso Thermal Forming, LLC, Case No. 05-55946; Southwest Laminates, Inc. (d/b/a Southwest Fabric Laminators Inc.), Case No. 05-55948; Wickes Asset Management, Inc., Case No. 05-55962; and Wickes Manufacturing Company, Case No. 05-55968.

interest other than the announcement of the adjourned date at the Hearing or any other hearing thereafter. PLEASE TAKE FURTHER NOTICE that you need not appear at the Hearing if you do not object to the relief requested in the Fifty-Fifth Omnibus Objection. PLEASE TAKE FURTHER NOTICE that if no responses to the Fifty-Fifth Omnibus Objection are timely filed and served, the Court may grant the Fifty-Fifth Omnibus Objection and enter the order without a hearing as set forth in Rule 9014-1 of the Local Rules for the United States Bankruptcy Court for the Eastern District of Michigan. Respectfully submitted, BOYLE BURDETT By:s/H. William Burdett, Jr. Eugene H. Boyle, Jr. (P42023) H. William Burdett, Jr. (P63185) 14950 East Jefferson, Suite 200 Grosse Pointe Park, Michigan 48230 (313) 344-4000 (313) 344-4001 (facsimile) burdett@boyleburdett.com Attorneys for the Collins & Aikman Litigation Trust

Dated: June 27, 2008

EXHIBIT A

IN THE UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION In re: ) ) COLLINS & AIKMAN CORPORATION, et al.1 ) ) Debtors. ) ) ) ) ) ) _________________________________________) Chapter 11 Case No. 05-55927 (SWR) (Jointly Administered) (Tax Identification #13-3489233) Honorable Steven W. Rhodes

ORDER GRANTING THE COLLINS & AIKMAN LITIGATION TRUSTS FIFTY-FIFTH OMNIBUS OBJECTION TO CLAIMS Upon the Collins & Aikman Litigation Trusts (the Trust) Fifty-Fifth Omnibus Objection, dated June 27, 2008; and upon consideration of the supporting papers and the files and records in these cases and upon the arguments and testimony presented at a hearing before the Court; and any responses to the Fifty-Fifth Omnibus Objection having been withdrawn or overruled on the merits; and it appearing that the Court has jurisdiction over the subject matter of the Fifty-Fifth Omnibus Objection and the relief requested therein; and it appearing that notice of

The Debtors in the jointly administered cases include: Collins & Aikman Corporation; Amco Convertible Fabrics, Inc., Case No. 05-55949; Becker Group, LLC (d/b/a/ Collins & Aikman Premier Mold), Case No. 05-55977; Brut Plastics, Inc., Case No. 05-55957; Collins & Aikman (Gibraltar) Limited, Case No. 05-55989; Collins & Aikman Accessory Mats, Inc. (f/k/a the Akro Corporation), Case No. 05-55952; Collins & Aikman Asset Services, Inc., Case No. 05-55959; Collins & Aikman Automotive (Argentina), Inc. (f/k/a Textron Automotive (Argentina), Inc.), Case No. 05-55965; Collins & Aikman Automotive (Asia), Inc. (f/k/a Textron Automotive (Asia), Inc.), Case No. 0555991; Collins & Aikman Automotive Exteriors, Inc. (f/k/a Textron Automotive Exteriors, Inc.), Case No. 05-55958; Collins & Aikman Automotive Interiors, Inc. (f/k/a Textron Automotive Interiors, Inc.), Case No. 05-55956; Collins & Aikman Automotive International, Inc., Case No. 05-55980; Collins & Aikman Automotive International Services, Inc. (f/k/a Textron Automotive International Services, Inc.), Case No. 05-55985; Collins & Aikman Automotive Mats, LLC, Case No. 05-55969; Collins & Aikman Automotive Overseas Investment, Inc. (f/k/a Textron Automotive Overseas Investment, Inc.), Case No. 05-55978; Collins & Aikman Automotive Services, LLC, Case No. 05-55981; Collins & Aikman Canada Domestic Holding Company, Case No. 05-55930; Collins & Aikman Carpet & Acoustics (MI), Inc., Case No. 05-55982; Collins & Aikman Carpet & Acoustics (TN), Inc., Case No. 05-55984; Collins & Aikman Development Company, Case No. 05-55943; Collins & Aikman Europe, Inc., Case No. 05-55971; Collins & Aikman Fabrics, Inc. (d/b/a Joan Automotive Industries, Inc.), Case No. 05-55963; Collins & Aikman Intellimold, Inc. (d/b/a M&C Advanced Processes, Inc.), Case No. 05-55976; Collins & Aikman Interiors, Inc., Case No. 05-55970; Collins & Aikman International Corporation, Case No. 05-55951; Collins & Aikman Plastics, Inc., Case No. 05-55960; Collins & Aikman Products Co., Case No. 05-55932; Collins & Aikman Properties, Inc., Case No. 0555964; Comet Acoustics, Inc., Case No. 05-55972; CW Management Corporation, Case No. 05-55979; Dura Convertible Systems, Inc., Case No. 05-55942; Gamble Development Company, Case No. 05-55974; JPS Automotive, Inc. (d/b/a PACJ, Inc.), Case No. 05-55935; New Baltimore Holdings, LLC, Case No. 05-55992; Owosso Thermal Forming, LLC, Case No. 05-55946; Southwest Laminates, Inc. (d/b/a Southwest Fabric Laminators Inc.), Case No. 05-55948; Wickes Asset Management, Inc., Case No. 05-55962; and Wickes Manufacturing Company, Case No. 05-55968.

the Fifty-Fifth Omnibus Objection was sufficient and no other or further notice need be provided; and after due deliberation and sufficient cause appearing therefore, it is ORDERED: 1. 2. The Fifty-Fifth Omnibus Objection is granted in its entirety. The Claims identified on Exhibit B to the Fifty-Fifth Omnibus Objection are

disallowed and expunged for all purposes. 3. 4. This Order is effective without further action of the Debtors and the claimants. The Debtors, the Trust, and Kurtzman Carson Consultants, LLC are authorized to

take all actions necessary to effectuate the relief granted pursuant to this Order in accordance with the Fifty-Fifth Omnibus Objection. 5. The terms and conditions of this Order shall be immediately effective and

enforceable upon its entry. 6. The Court retains jurisdiction with respect to all matters arising from or relating to

the implementation of this Order.

EXHIBIT B

Claim No. 8857 Daniel Detkowski

Name

Claim Amount $1,500,000.00

Anda mungkin juga menyukai

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen14 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen16 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen16 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen22 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen17 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen19 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen17 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen19 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen20 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen18 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen17 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen19 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen19 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen16 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen18 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen19 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen19 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen19 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen19 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen18 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen15 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen18 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen18 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen19 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen17 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen20 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen14 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen19 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen20 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen17 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen19 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen18 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen18 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen17 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen19 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen14 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen19 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen14 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen19 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen17 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen14 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen21 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen19 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen14 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen19 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen19 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen27 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen14 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen27 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen15 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen16 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen17 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen14 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen14 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen14 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen14 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen18 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen18 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokumen14 halamanIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsBelum ada peringkat

- Supreme Court Eminent Domain Case 09-381 Denied Without OpinionDari EverandSupreme Court Eminent Domain Case 09-381 Denied Without OpinionBelum ada peringkat

- SEC Vs MUSKDokumen23 halamanSEC Vs MUSKZerohedge100% (1)

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Dokumen28 halamanAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsBelum ada peringkat

- Wochos V Tesla OpinionDokumen13 halamanWochos V Tesla OpinionChapter 11 DocketsBelum ada peringkat

- National Bank of Anguilla DeclDokumen10 halamanNational Bank of Anguilla DeclChapter 11 DocketsBelum ada peringkat

- Zohar 2017 ComplaintDokumen84 halamanZohar 2017 ComplaintChapter 11 DocketsBelum ada peringkat

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Dokumen47 halamanAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsBelum ada peringkat

- PopExpert PetitionDokumen79 halamanPopExpert PetitionChapter 11 DocketsBelum ada peringkat

- Home JoyDokumen30 halamanHome JoyChapter 11 DocketsBelum ada peringkat

- Energy Future Interest OpinionDokumen38 halamanEnergy Future Interest OpinionChapter 11 DocketsBelum ada peringkat

- Kalobios Pharmaceuticals IncDokumen81 halamanKalobios Pharmaceuticals IncChapter 11 DocketsBelum ada peringkat

- Zohar AnswerDokumen18 halamanZohar AnswerChapter 11 DocketsBelum ada peringkat

- NQ LetterDokumen2 halamanNQ LetterChapter 11 DocketsBelum ada peringkat

- Quirky Auction NoticeDokumen2 halamanQuirky Auction NoticeChapter 11 DocketsBelum ada peringkat

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDokumen4 halamanUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsBelum ada peringkat

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDokumen5 halamanDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsBelum ada peringkat

- Secured Transactions Outline JDDokumen176 halamanSecured Transactions Outline JDJesse Danoff92% (13)

- Dallas Police and Fire Pension BriefingDokumen85 halamanDallas Police and Fire Pension BriefingTristan HallmanBelum ada peringkat

- Metrobank V SLGT HoldingsDokumen19 halamanMetrobank V SLGT HoldingsNeil BorjaBelum ada peringkat

- NokScoot - L19 - Application For Repayment of Debts - T+EDokumen14 halamanNokScoot - L19 - Application For Repayment of Debts - T+ESaratchai Gonchan OngprasertBelum ada peringkat

- Appleyard v. Douglass, 1st Cir. (1999)Dokumen16 halamanAppleyard v. Douglass, 1st Cir. (1999)Scribd Government DocsBelum ada peringkat

- Guaranty and SuretyDokumen9 halamanGuaranty and SuretyCaren DumaliliBelum ada peringkat

- Expert Witness Testimony Example - Neil Garfield Living LiesDokumen16 halamanExpert Witness Testimony Example - Neil Garfield Living LiesForeclosure FraudBelum ada peringkat

- Statutory ConstructionDokumen18 halamanStatutory ConstructionMichelle Vale CruzBelum ada peringkat

- 2017 08 02 18 49 30 PW2b FINAL DRAFT 010113 - 109 - 109Dokumen56 halaman2017 08 02 18 49 30 PW2b FINAL DRAFT 010113 - 109 - 109sharif uddinBelum ada peringkat

- Crystal Vs Bpi DigestDokumen5 halamanCrystal Vs Bpi DigestAmelyn Albitos-Ylagan MoteBelum ada peringkat

- 4SSpl1 FRIA-DigestDokumen48 halaman4SSpl1 FRIA-DigestEdmart VicedoBelum ada peringkat

- Rudd DiamondDokumen2 halamanRudd DiamondMy-Acts Of-SeditionBelum ada peringkat

- 10000018256Dokumen3 halaman10000018256Chapter 11 DocketsBelum ada peringkat

- Modes of Winding Up and The Courts' JurisdictionDokumen3 halamanModes of Winding Up and The Courts' JurisdictionBhuvaneshwar RaiBelum ada peringkat

- ContractDokumen41 halamanContractPaul KwongBelum ada peringkat

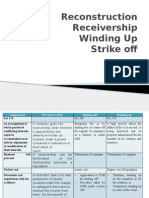

- Reconstruction Receivership Winding Up Strike OffDokumen71 halamanReconstruction Receivership Winding Up Strike OffMohammad Hasrul AkmalBelum ada peringkat

- Paper PresentationDokumen11 halamanPaper PresentationAmit PandeyBelum ada peringkat

- Distribution Agreement - Lending Services Andromeda.1Dokumen4 halamanDistribution Agreement - Lending Services Andromeda.1Santosh DasBelum ada peringkat

- Jennifer Buchan ThesisDokumen368 halamanJennifer Buchan ThesisMj SoguilonBelum ada peringkat

- Single Member LLC Operating Agreement TemplateDokumen8 halamanSingle Member LLC Operating Agreement Templatemacphersonsml100% (4)

- Uncontested Probate Procedure in CaliforniaDokumen3 halamanUncontested Probate Procedure in CaliforniaStan BurmanBelum ada peringkat

- Control AccountsDokumen8 halamanControl AccountsAejaz MohamedBelum ada peringkat

- {9AAD8CAC-1234-46DD-BB5B-E372619EA2EC}Dokumen28 halaman{9AAD8CAC-1234-46DD-BB5B-E372619EA2EC}sunyahnilBelum ada peringkat

- Extinguishing An Obligations Payment and CompensationDokumen28 halamanExtinguishing An Obligations Payment and CompensationAnonymous dvDBzOcJCBelum ada peringkat

- 8 Self Balancing LedgerDokumen22 halaman8 Self Balancing LedgerkautiBelum ada peringkat

- Membership Interest Pledge AgreementDokumen6 halamanMembership Interest Pledge AgreementKnowledge Guru100% (1)

- Living Temple Class NotesDokumen73 halamanLiving Temple Class NotesMichael Haskins100% (7)

- Serrano v. Central Bank of The PhilippinesDokumen2 halamanSerrano v. Central Bank of The PhilippinesErick Jay InokBelum ada peringkat

- S&P Global Ratings Definitions: AUGUST 18, 2016 1Dokumen45 halamanS&P Global Ratings Definitions: AUGUST 18, 2016 1Sonal AggarwalBelum ada peringkat

- 2012 - Chapter 14 - Geberit Appendix Sanitary CatalogueDokumen8 halaman2012 - Chapter 14 - Geberit Appendix Sanitary CatalogueCatalin FrincuBelum ada peringkat