Scenario of Indian Credit Card Industry

Diunggah oleh

Ashish SharmaDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Scenario of Indian Credit Card Industry

Diunggah oleh

Ashish SharmaHak Cipta:

Format Tersedia

SCENARIO OF INDIAN CREDIT CARD INDUSTRY The number of credit cards issued by Indian banks has increased phenomenally

during the last few years. The provision of paying for an expensive commodity in easy installments is the basic advantage of using a credit card. Moreover, among the affluent population, credit card ownership in India is the lowest in the world. Industry sources estimate that just over 20% of the affluent people have credit cards in India compared to over 80% in the countries, such as the US, the UK and, even Hong Kong. With such low penetration levels, Indian credit card industry offers plethora of opportunities, realizing which numerous companies are planning to launch their credit card operations in India. Consequently, the number of credit cards issued by banks is forecasted to grow at a CAGR of nearly 13.2% during FY 2011-FY 2013, says new research report Indian Payment Card Market Forecast to 2012 We have taken credit card segment of retail banking and have done its STP and 4Ps for SBI, ICICI, AXIS and Regional bank (niche bank). SBI is the market leader in retail segment but in credit card segment it is not number one. SEGMENTATION SBI has segmented the credit card market as follows:

The segmentation of the card industry can be done on the basis of income and on the basis of motivation towards a common set of needs and wants. The Indian market reflects considerable diversities in income levels and lifestyles. There are large segments of people, whose income levels are significantly higher, growing faster and spurring a consumer revolution, a case in point being the rise of software and IT enabled services. Segments 1. Rich 2. Consuming Class 3. Climbers 4. Aspirants Income Group (Rs.) 6,00,000 + 4,00,000-6,00,000 2, 50,000-4,00,000 1,50,000-2,50,000

Segmentation according to perceived utility of credit cards:

Preliminary qualitative research by NCAER has identified certain motivators differentiated on the basis of the income segments. Segment Rich Consuming class Climbers Motivations: Convenience and acceptability, level of service, Credit limit. Prestige, convenience, charges, service level. Prestige, charges

Another segment is of frequently shopping customers

This is a segment of customers whose primary motive to buy credit card is to use for shopping. So SBI has tie with various shopping outlets and provides specialized shopping credit cards.

Another segment is frequently travelling customers

SBI has segmented a group of customers on the basis of their travelling needs and have tied with Indian railways and air carriers to come up with travel credit cards. TARGETING SBI is targeting all the segments mentioned above as it is the market leader and has the muscle power to enter into each segment. 1. Premium cards These cards are targeting Rich segment of the population. SBI has come up with two type of premium cards SBI Platinum Card SBI Platinum advantage Card

2. Classic cards These cards are aimed at consuming class and climbers. There are different types of classic cards available SBI Advantage Plus credit Card is targeting consuming class SBI Gold card and SBI advantage card are for climbers and aspirants.

3. Travel cards SBI targets this segment of customers with the following offerings. SBI railway card SBI spicejet card

4. Shopping cards These cards are targeting the people who shop frequently. The cards offered are SBI gold and more card SBI advantage gold and more card

POSITIONING SBI used different positioning strategies for different cards. Positioning on quality of service: SBI Platinum cards After convenience and acceptability of credit cards, the most important thing for customers is quality of service. This can be defined as prompt response in issuing the card, 24 hour customer service and quick complaint and grievance redressal. Positioning based on benefits and features: Both classic cards and premium cards. Positioning as a low cost card: SBI Gold card This has previously been disregarded as an option as the costs involved are higher and one cannot gain by competing on price and advantages can be gained only on the basis of service and innovative product features

Positioning on use: SBI shopping card, SBI travel card. Credit cards in India are most often used while making expensive purchases, traveling, online shopping and utility payments. This can be the main positioning plank because it would increase the credit card usage in each of the segments and hence exclusive cards can be introduced for the purpose the customers wants to or would benefit from using the card.

Positioning on security: Positioning as a card for transactions on the net With the impending boom in e-commerce in India, credit card issuers could position themselves as the best and safest medium for payment purposes..

NEW PRODUCT DEVELOPMENT SBI entered the credit card market after private players. So it developed NEW PRODUCT LINES. SBI launched its credit card in JV with GE. First it had launched a simple credit card but then it added products to its existing product lines. For example it added travel cards, shopping cards,etc SBI also started repositioning of its credit cards as most trustworthy and secure.

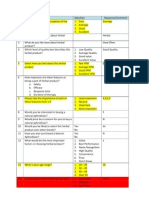

PRODUCT LIFE CYCLE AND 4PS SBI has launched different Credit Cards which are at their different life cycle stages. These Credit Cards are marketed all over the country which is the Place. The other Ps such as the Product, Price and Promotions are described in the table below along with their product life cycle stage. (Source: SBI Website) [Only the title of the promotional offers have been given here details can be found in the website]

Product Price Joining fee 2999 Annual fee 2999 Promotion Product Cycle Life

SBI Platinum Card SBI Advantage Platinum Card SBI Gold & More Card SBI Advantage Gold & More Card SBI Railway Card SBI Spicejet Card

True lifestyle, True Travel, True Value, True Priority True Lounge access, True lifestyle, True Travel, True Value, True Priority

Introduction

2999

2999

Introduction

499

499

499

499

Shopping extravaganza, Entertainment extravaganza, Dining extravaganzan, Travel extravaganza Shopping extravaganza, Entertainment extravaganza, Dining extravaganzan, Travel extravaganza Get back upto 10% of AC ticket fare, Railway Point0% Transaction Charges on tickets booked at irctc.co.in, Complementary Personal Rail Accident Insurance of Rs. 10 Lac Utility Bill Payment Facility, Balance Transfer on low interest rates, Flexipay

Growth stage

Maturity stage

500

300

Maturity stage

upto 2000

250

Maturity stage

SBI Gold Credit Card SBI Advantage Gold Card SBI Advantage Plus Card SBI Maruti Cards Tata Cards SBI Bank of Maharashtra Card SBI Dena Bank Secured Card SBI UBI Card SBI Vishal MegaMart Card SBI Bank of Maharashtra Platinum Card

299 299

299 299

Utility Bill Payment Facility Credit free period of upto 50 days and extended credit facility with very low interest rate of 1.99% p.m Credit free period of upto 50 days and extended credit facility with very low interest rate of 1.99% p.m 4% Value back, Joining Bonanza, Redemption of Auto Points Welcome Offers, Value Back in all Partner Company Store 2.5% Value Back, Complete Fuel Freedom, Welcome Offers A no income proof, low interest credit card for Dena Bank customers.

Maturity stage Maturity stage

500

500

Maturity stage

500 500 499

500 500 499

Growth stage Growth stage Maturity stage

NIL

250

Growth stage

5000 5000

1500 1500

Better Shopping offers Shopping Card with Mega Savings offers

Growth stage Growth stage

2999

2999

True Lounge access, True lifestyle, True Travel, True Value, True Priority

Introduction stage

ICICI Bank Ltd. SEGMENTATION Three Levels of Segmentation used by ICICI are as follows : Mass Marketing : The mass promoted credit cards offered by ICICI include ICICI Instant Gold Credit card and the ICICI Instant Platinum Credit card Segment Marketing: ICICI bank has been greatly successful in identifying groups within the population set looking for specific cards of utility. Eg. ICICI Bank HPCL Platinum Credit Card Niche Marketing: ICICI bank has tie-ups with 3 airlines, namely, Kingfisher Airlines, British Airways and Singapore Airlines to provide specialized service to frequent fliers who would prefer to use credit cards for convenience and added benefits/savings. Segmentation Variables Adopted Geographic Segmentation: National - ICICI bank has managed to cover the credit card market in the entire nation even though a select few credit cards are available only in some major cities. Demographic Segmentation: ICICI bank seems to have considered the following demographic factors when segmenting the credit card market :-

Age , Family life cycle stage, and family size this being the most basic of demographic considerations necessary to any sector Income Credit cards such as ICICI Platinum Identity card offer exclusivity to the high income group members by providing unique benefits Psychographic Segmentation: ICICI bank segments the market based on Lifestyle of the prospects. This is evident from the offering of ICICI bank VISA Signature credit card.

Behavioural Segmentation: Segmentation is done according to benefits sought and loyalty status & usage rate (airlines credit card range)

MARKET TARGETING Evaluation of Market Segment Market Attractiveness: There has been a great demand for convenience in banking services n India. With rising incomes and shrinking family sizes, the potential credit card market has grown exponentially over the last decade. Given the excessive competition in the banking sector, ICICI took the initiative and started targeting the segments aggressively. Companys Objectives and Resources: ICICI being the market challenger in the overall retail banking sector, had a great motivation towards investing time, money and marketing strength in credit card sales. Selecting the Market Segment (s) ICICI endeavours to achieve Market Specialization by catering to the various needs of the Indian Credit Market by providing them with an array of different products. Given below is a list of the different credit cards offered by ICICI and the sub groups it cater to: Name of Credit Card Coral Credit Card Visa Signature Credit Card Sub Groups Targeted Customers who want value for money Offered to high credit worthy customers who dont want a credit limit to be attached to their cards. British Airways Premium Card Offered to frequent flyers with British Airways. High cost of interest associated with the card Titanium Credit Card Offered to high net worth individuals who are frequent shoppers. Singapore Airlines Visa Platinum Credit For frequent flyers with Singapore Card Airlines. High interest rate associated with the card Platinum Identity Credit Card Super premium card in the lifestyle and leisure segment Ascent American Express The card is targeted at the High Income group. Provides access to privileges and offers given by American Express to its

cardholders Offered to customers who buy fuel at HPCL outlets. Surcharge deducted on fuel Instant Platinum Credit Card Super Premium Customers who want the most basic credit services Instant Gold Credit Card Premium Customers who want the most basic credit services. Entry level card HPCL Titanium Credit Card Offered to premium customers who buy fuel at HPCL outlets. Surcharge deducted on fuel Kingfisher Airlines MasterCard Titanium Offered to super premium frequent flyers Card with Kingfisher airlines Kingfisher Airlines MasterCard Platinum Offered to premium frequent flyers with Card Kingfisher airlines Kingfisher Airlines MasterCard World Entry level card offered to frequent flyers Credit Card with Kingfisher airlines HPCL Platinum Credit Card PRODUCT POSITIONING Performance Differentiators: Hardly any product differentiators exist in the credit card market Service Differentiators: ICICI through its vast network of retail banks is able to provide efficient service to credit card holders. ICICI ensures ordering ease through a hassle free registration process. It has efficient and widespread tie-ups with various market players in other sectors, the sales of whose products and services are encouraged through usage of specialised ICICI Credit cards which provide unique benefits and discounts on every purchase. Personnel Differentiation: ICICI has been the trend setter in this category. The employees are encouraged to maintain high levels of professionalism and etiquette. Work uniform culture was brought to the Indian banking environ by ICICI and it struck a good cord with the customers.

PRODUCT MIX AND PRICING: ICICI has a product mix comprising of 14 basic credit cards available in the country. The pricing decisions or the decisions related to interest and fee or commission charged by banks are found instrumental in motivating or influencing the target market. The joining fess and monthly interest rates of the various credit cards offered by ICICI Bank is given below: Sl. No. 1 2 3 Name of the Credit Card Coral Credit Card Visa Signature Credit Card British Airways Premium Card Joining Fee (Rs) 1000 25000 7000 Fee) Interest Rate (% per month) 3.40 3.40 (Annual 3.40

4 5 6 7 8 9 10 11 12 13 14

Titanium Credit Card Singapore Airlines Visa Platinum Credit Card Platinum Identity Credit Card Ascent American Express HPCL Platinum Credit Card Instant Platinum Credit Card Instant Gold Credit Card HPCL Titanium Credit Card Kingfisher Airlines MasterCard Titanium Credit Card Kingfisher Airlines MasterCard Platinum Credit Card Kingfisher Airlines MasterCard World Credit Card

500 Fee) 6000 Fee) 2000 4000 500 Fee) Nil Nil 500 Fee) 5000 Fee) 5000 Fee) 5000 fee)

(Annual 3.40 (Annual 3.40 3.40 3.40 (Annual 3.40 2.49 2.49 (Annual 3.40 (Annual 3.40 (Annual 3.40 (Annual 3.40

PLACE: Currently ICICI has 2553 branches across India. Almost all of them issue credit cards, however all credit cards are not available at every branch. On analysis we found that Instant Gold Credit Card and Instant Platinum Card are the most widely available cards, whereas cards such as Ascent American Express and British Airways Premium Card are available only in metros.

PROMOTION: The different components of promotion help bank professionals in promotion the banking business. ICICI Bank uses the following mediums to promote its credit cards: Advertising: Promotion through television, radio, movies, theatres etc. ICICI uses this medium of promotion with the aim of informing, sensing and persuading the customers. The advertising professionals bear the responsibility of making the appeals, slogans, messages more creative. Print media: Hoardings, newspaper, magazines. There are a number of devices to advertise, such as broadcast media, telecast media and the print media Publicity: road shows, campus visits, sandwich man, sponsorship Sales promotion: Gifts, discount, commission, incentives, etc. Personal selling: Cross-sale (selling at competitors place), personalized service. Personal selling is found instrumental in promoting the banking business. It is a process of communication in which an individual exercise his/her personal potentials, tact, skill and ability to influence the impulse buying of the customers. Telemarketing: ICICI also uses call centers to promote credit card sales.

In-film promotions: The film Baghban was used to promote ICICI credit cards as well. Co-Branding Initiatives: Alliance with Amway India for launch of the

international credit card. The card will enable Amway distributors to purchase Amway products and earn and redeem reward points.

NEW PRODUCT DEVELOPMENT We shall limit our focus to the latest credit card launched by ICICI Bank Ltd, namely The Coral Credit Card (It is an addition to the existing product line and has reached test marketing stage) The Card offers strengthened level of security to the card members against the possible misuse in form of counterfeiting and also skimming of embedded microchip, which consists of card member information in an encrypted format. Moreover, the Coral Credit Card, which is part of the exclusive 'Gemstone Collection' of ICICI Bank Credit Cards, is aimed at the value conscious sector. It offers cash rewards on all retail purchases. The rewards gets doubled on spends on dining and also groceries. The net proposition is hoping to deliver significant savings to card members. It is coupled with entertainment, dining and travel benefits. The eligibility criteria set are as follows:

Acquirer must be more than 23 years old, An Indian national Residing in any of the following cities - Mumbai, Delhi, Chennai, Kolkata, Bengaluru, Ahemdabad, Pune, Hyderabad, Baroda, Surat, Chandigarh, and Jaipur

Innovative additions in terms of benefits of using the card are:

Policy of Buy 1, Get 1 Movie Ticket Free through the week. Minimum 15% Saving at Participating restaurants.

As a never seen before introductory offer, ICICI is offering a complimentary Jet Airways ticket to a destination anywhere across India to the credit card subscriber. PRODUCT LIFE CYCLE The Credit card product line for ICICI has seen accelerated growth rate in the recent past and is now headed for the stage of decelerated growth. Early adopters and the early majority of the market have already accepted the product. His is evident by the fact that ICICI bank today is the largest player in the credit card market. Competition has risen rapidly with numerous regional and national banks introducing credit card services. The bank probably needs to prepare new strategies

to ensure continued growth. New strategies could include adding newer products to the line (like the new Coral card being introduced), increasing distribution coverage, entering newer market segments, improving upon the offerings of the existing credit cards etc.

AXIS BANK SEGMENTATION: A market segment consists of a group of customer who share a similar set of needs and wants. Bank has segmented its credit card market based on demographics variables like income, social class and psychographics variables like benefits, user-status, user rate and attitudes. Segments are as follows: Mass Marketing: They are targeting the entire marketing with one product. E.g. Easy Platinum/Gold Credit Card Niche Marketing: Niche is a more narrowly defined customer group seeking a distinctive mix of benefits. Niche is fairly small but high growth potential market. E.g. Shriram Credit Card, Trust Chemists Credit Card. Segment Marketing: They are segmenting the market based on different needs, wants, purchasing power, geographical locations and buying attitudes and habits. E.g. Titanium Smart Traveler Credit Card, Signature/Wealth Signature Credit Card. Individual Marketing: They provide with the customize services according to the need of the customers. E.g. Platinum Credit Card, Corporate Credit Card. TARGETING After evaluating different segments, company must decide which/how many segments to service/targets. Banks has targeted various segments as in: Single element concentration: Single product catering to single market group e.g. eShop Card. Selective Specialisation: Company selects a certain number of segments each of which are attractive and in line with companies mission. E.g. Trust Chemists Credit Card, Shriram Credit Card, Titanium Smart Traveler Credit Card. Product Specialisation: Company concentrate on making single product category that it sells to different segments. E.g. Gold Credit Card Full market coverage: Firms tries to serve all customers group with all products that they may need. E.g. Easy Platinum/Gold Credit Card

POSITIONING They have differentiated their products based on the forms and features, service differentiators like ordering ease and delivery etc. They have used different positioning strategy like: User Positioning: e.g. Titanium Smart Traveler Credit Card Benefit Positioning: e.g. Easy Platinum/Gold Credit Card, Silver Credit Card, Gold Credit Card Attribute Positioning: e.g. Platinum Credit Card Use/ Application Positioning: e.g. eShop Card Product Category Positioning: Trust Chemists Credit Card, Shriram Credit Card

4 PS OF MARKETING MIX PRODUCT: Axis credit card market is divided into different products on the basis of: Basic Product: Silver Credit Card Expected Product: Easy Platinum/Gold Credit Card Augmented Product: Platinum Credit Card, Signature/Wealth Signature Credit Card, Titanium Smart Traveler Credit Card, Prive Infinite Credit Card Potential Product: Corporate Credit Card, eShop Card, Trust Chemists Credit Card, Shriram Credit Card PRICE: The price of the product depends upon the services provided by the Bank on the respective product to the customers. Detailed pricing changes from time to time and the same can be found on the website of Axis bank. PLACE Place plays an important role in attracting customer and more so for a service sector. Quality of service is perceived by many customers in the form of place of delivery- locational appeal, interiors, ambience, etc. Providing excellent tangibles in the form of place or location and interiors is particularly important for appealing to the customers segment. AXIS Bank is providing very attractive tangibles in the form of their locations, exteriors and interiors. Moreover credit card has zero level channels, as it is directly supplied by a producer to its customer.

PROMOTION Promotions can be done in different forms:

Visualization: through hoardings, TV and print campaigns or advertisements Association with different outlets, like Pizza Hut, Provogue, Kimaya, Snapdeal, Converse, Loot etc, to provide unlimited offers.

Physical representation: Physical representation in services has a good promotional appeal to customers like use of colors to symbolize wealth and status.

Documentation: Service providers use documentation in their promotions in support of their claims for dependability, popularity and responsiveness

PRODUCT LIFE CYCLE PLC is typically divided into 4 stages Introduction Growth Maturity o o o Decline Growth Maturity Stable Maturity Decaying Maturity

Credit card segment is under maturity stage, therefore its marketing strategy could be: Market Modification: eShop Card, Trust Chemists Credit Card, Shriram Credit Card Product Modification: Platinum Credit Card, Signature/Wealth Signature Credit Card Marketing Mix Modification: Price, Distribution, Advertising, Sales Promotion, Personal Selling, Services.

Anda mungkin juga menyukai

- Harris Corporation DataDokumen16 halamanHarris Corporation DataAbhinav SinghBelum ada peringkat

- Case Study 1 - FaircentDokumen4 halamanCase Study 1 - FaircentSneha Banerjee100% (1)

- Bajaj Auto SM - PPTDokumen46 halamanBajaj Auto SM - PPTWaibhav KrishnaBelum ada peringkat

- CRM in Rilance FreshDokumen27 halamanCRM in Rilance FreshSuvashis Mahapatra67% (3)

- What Is Wholesale Banking ?Dokumen10 halamanWhat Is Wholesale Banking ?Anonymous So5qPSnBelum ada peringkat

- Swot Analysis of Canara BankDokumen6 halamanSwot Analysis of Canara Bankshwetachalke21100% (1)

- Cashing Out The Future of Cash in Israel - Group12Dokumen7 halamanCashing Out The Future of Cash in Israel - Group12Vimal JephBelum ada peringkat

- AFSA Certification Test - FinShiksha - SolutionDokumen20 halamanAFSA Certification Test - FinShiksha - SolutionAnil Kumar SharmaBelum ada peringkat

- Itc DiversificationDokumen22 halamanItc DiversificationEkta SoniBelum ada peringkat

- Market Structure of Indian IT Industry-InFOSYSDokumen20 halamanMarket Structure of Indian IT Industry-InFOSYSNitin ChidarBelum ada peringkat

- Shiva Tourist DhabaDokumen7 halamanShiva Tourist DhabaChaitanya JethaniBelum ada peringkat

- Meddeal Private Limited: Putting A Price Tag For The BusinessDokumen20 halamanMeddeal Private Limited: Putting A Price Tag For The BusinessShivani SinghBelum ada peringkat

- T8 RevivalDokumen6 halamanT8 RevivalSumit AggarwalBelum ada peringkat

- Measuring Brand Equity in <40 CharactersDokumen27 halamanMeasuring Brand Equity in <40 CharactersPadmanabhan Ns100% (1)

- STP PPT (Anubhav Bansal)Dokumen36 halamanSTP PPT (Anubhav Bansal)anubhav bansalBelum ada peringkat

- Compatitive Analysis On Consumer Durable Loans With Special Ref Through IDFC First BankDokumen19 halamanCompatitive Analysis On Consumer Durable Loans With Special Ref Through IDFC First BankMr. Umang Panchal50% (2)

- Case Analysis Questions PDFDokumen1 halamanCase Analysis Questions PDFSourav KumarBelum ada peringkat

- Reliance JioDokumen3 halamanReliance JioDynamic Levels100% (2)

- Naukri Employee Retention CaseDokumen13 halamanNaukri Employee Retention CaseBhanu NirwanBelum ada peringkat

- Segmenting Customer BaseDokumen9 halamanSegmenting Customer BaseSankalp Agarwal100% (1)

- Coffee Wars in India: How CCD Can Retain Market Leadership Against StarbucksDokumen3 halamanCoffee Wars in India: How CCD Can Retain Market Leadership Against StarbucksPulkit AggarwalBelum ada peringkat

- Multi-brand advantages over mono-brand retailDokumen4 halamanMulti-brand advantages over mono-brand retailtdarukaBelum ada peringkat

- A Study On Subprime Mortgage CrisisDokumen52 halamanA Study On Subprime Mortgage CrisisInstant Assignment HelpBelum ada peringkat

- College Canteen's Decreasing Sales: Analysis Dilemmas: Ref. No.: QM0001Dokumen4 halamanCollege Canteen's Decreasing Sales: Analysis Dilemmas: Ref. No.: QM0001Chintan MankodiBelum ada peringkat

- XYLYS: Exploring Consumer Perception About Premium Watches in The Indian ContextDokumen15 halamanXYLYS: Exploring Consumer Perception About Premium Watches in The Indian ContextZeynab AbrezBelum ada peringkat

- Striders: Running Away or Towards The Growth (Group 8)Dokumen1 halamanStriders: Running Away or Towards The Growth (Group 8)Rashi VajaniBelum ada peringkat

- Credit Card Marketing: Bank of AmericaDokumen3 halamanCredit Card Marketing: Bank of AmericaHamna ShahidBelum ada peringkat

- Online Marketing at Big Skinny: Submitted by Group - 6Dokumen2 halamanOnline Marketing at Big Skinny: Submitted by Group - 6Saumadeep GuharayBelum ada peringkat

- CRM of Shopper's StopDokumen5 halamanCRM of Shopper's StopSheik Nazaar0% (1)

- DMart Case Study - Group 06Dokumen3 halamanDMart Case Study - Group 06Siddhi GodeBelum ada peringkat

- Spencers Retail Case StudyDokumen10 halamanSpencers Retail Case StudyEina GuptaBelum ada peringkat

- LCBSL expand non-core revenueDokumen4 halamanLCBSL expand non-core revenueMuhammad Rafeeq100% (1)

- Case-A: Aditi Agro ChemicalsDokumen1 halamanCase-A: Aditi Agro ChemicalsDivya Punjabi50% (2)

- SDM Pre ReadDokumen16 halamanSDM Pre ReadArka BoseBelum ada peringkat

- Porter's Five Force Analysis of Industry: Rivalry Among Competitors - Attractiveness: HighDokumen5 halamanPorter's Five Force Analysis of Industry: Rivalry Among Competitors - Attractiveness: HighPrasanta MondalBelum ada peringkat

- Shopperstop Casestudy 120405045535 Phpapp01Dokumen3 halamanShopperstop Casestudy 120405045535 Phpapp01Vishal KumarBelum ada peringkat

- Fresh Meals in China: Flashfood.Shop's Self-Service Retailing ModelDokumen13 halamanFresh Meals in China: Flashfood.Shop's Self-Service Retailing ModelAkansha SaxenaBelum ada peringkat

- Maruti Suzuki India's Leading Car Manufacturer Market Share 52% 3 Manufacturing Plants 1.7 Million Annual CapacityDokumen3 halamanMaruti Suzuki India's Leading Car Manufacturer Market Share 52% 3 Manufacturing Plants 1.7 Million Annual CapacityPreetBelum ada peringkat

- More Vino Projected EarningsDokumen4 halamanMore Vino Projected EarningsTERESABelum ada peringkat

- Swot Analysis of Canara BankDokumen2 halamanSwot Analysis of Canara BankManjunath ShettyBelum ada peringkat

- Mi Summit 2020 PDFDokumen3 halamanMi Summit 2020 PDFKuber SoodBelum ada peringkat

- Titan EncircleDokumen8 halamanTitan EncircleAntara Debnath100% (1)

- Itc Diversification Case SolutionDokumen40 halamanItc Diversification Case SolutionDivya PujariBelum ada peringkat

- PolicyBazaar and KuveraDokumen18 halamanPolicyBazaar and KuveraBendi YashwanthBelum ada peringkat

- Business Model of Cork'dDokumen2 halamanBusiness Model of Cork'dPritish EkkaBelum ada peringkat

- Flipkart:Transitioning To Marketplace Model: Group 4Dokumen9 halamanFlipkart:Transitioning To Marketplace Model: Group 4asniBelum ada peringkat

- Chase Sapphire Creating A Millennial Cult BrandDokumen2 halamanChase Sapphire Creating A Millennial Cult Brandguntupalli manojBelum ada peringkat

- Group 9 - GirishDokumen23 halamanGroup 9 - GirishKostub GoyalBelum ada peringkat

- MARKETING MIX & 4P's OF RELIANCE JIODokumen13 halamanMARKETING MIX & 4P's OF RELIANCE JIOYash KarandeBelum ada peringkat

- Organisational Structure of V Guard in KeralaDokumen23 halamanOrganisational Structure of V Guard in Keralapratyush0501100% (1)

- Bajaj Auto LTD - Case Analysis PDFDokumen39 halamanBajaj Auto LTD - Case Analysis PDFpragadeeshwaranBelum ada peringkat

- BJP - GRP 7Dokumen39 halamanBJP - GRP 7Jaspartap Singh100% (1)

- Zomato's Way Forward to Address Key ChallengesDokumen4 halamanZomato's Way Forward to Address Key ChallengesShashwat MishraBelum ada peringkat

- Zerodha Vs EdelweissDokumen8 halamanZerodha Vs EdelweissAditya MukherjeeBelum ada peringkat

- Isme MM - Airtel Data AmbitionsDokumen6 halamanIsme MM - Airtel Data AmbitionsAkhilesh desaiBelum ada peringkat

- A Report ONDokumen68 halamanA Report ONYenkee Adarsh AroraBelum ada peringkat

- Winter PRJCT SynopsisDokumen15 halamanWinter PRJCT SynopsisNitu Saini100% (1)

- CK Kshitij CBR COUUNTRY ANALYSIS ECONOMICS - (22018)Dokumen18 halamanCK Kshitij CBR COUUNTRY ANALYSIS ECONOMICS - (22018)KshitijBelum ada peringkat

- Smer PDFDokumen50 halamanSmer PDFHarish DesalliBelum ada peringkat

- Sbi Read UpDokumen19 halamanSbi Read Upperfection1Belum ada peringkat

- E 2 LiteratureDokumen12 halamanE 2 LiteratureAshish SharmaBelum ada peringkat

- Synopsis of Advertising IndustryDokumen10 halamanSynopsis of Advertising IndustryAshish SharmaBelum ada peringkat

- Messi HistoryDokumen16 halamanMessi HistoryAshish SharmaBelum ada peringkat

- Tag LinesDokumen9 halamanTag LinesAshish SharmaBelum ada peringkat

- STP and NPD-SBIDokumen4 halamanSTP and NPD-SBIAshish SharmaBelum ada peringkat

- AdvertisingDokumen2 halamanAdvertisingdhiru12883Belum ada peringkat

- AnnexuresDokumen23 halamanAnnexuresAshish SharmaBelum ada peringkat

- QuestionnaireDokumen2 halamanQuestionnaireAshish SharmaBelum ada peringkat

- ECO FinalDokumen3 halamanECO FinalAshish SharmaBelum ada peringkat

- Transcript of Warren Buffett Interview With FCICDokumen23 halamanTranscript of Warren Buffett Interview With FCICSantangel's ReviewBelum ada peringkat

- Fa MB Brochure Actros 210x297mm (010416) Rev 02Dokumen6 halamanFa MB Brochure Actros 210x297mm (010416) Rev 02Hariyanto oknesBelum ada peringkat

- Session 2 CBA Valuing Benefit and Cost Primary MarketsDokumen21 halamanSession 2 CBA Valuing Benefit and Cost Primary MarketsShabahul ArafiBelum ada peringkat

- CPA Exam: Accelerated Depreciation Methods ReviewDokumen4 halamanCPA Exam: Accelerated Depreciation Methods ReviewIvan PachecoBelum ada peringkat

- Ocean Carriers Capesize Ship Project AnalysisDokumen10 halamanOcean Carriers Capesize Ship Project AnalysisScottMeltonBelum ada peringkat

- Soal MicroeconomyDokumen2 halamanSoal MicroeconomyDavid WijayaBelum ada peringkat

- Essays On The Indian Economy Competitive Pressure PDFDokumen111 halamanEssays On The Indian Economy Competitive Pressure PDFMerabi SabuluaBelum ada peringkat

- Brand Pruning RKDG2Dokumen25 halamanBrand Pruning RKDG2Derek Sherman100% (1)

- Supply Budget ControlDokumen16 halamanSupply Budget ControlFolegwe FolegweBelum ada peringkat

- R33 Residual Income ValuationDokumen34 halamanR33 Residual Income ValuationAftab SaadBelum ada peringkat

- Pricing strategies to maximize revenue and salesDokumen13 halamanPricing strategies to maximize revenue and salesgraceBelum ada peringkat

- Beauty and Personal Care in India - Analysis: Country Report - Jun 2020Dokumen5 halamanBeauty and Personal Care in India - Analysis: Country Report - Jun 2020aryaBelum ada peringkat

- Consumer buying behaviors and product types comparisonDokumen12 halamanConsumer buying behaviors and product types comparisonJoana Felicia L.Belum ada peringkat

- Accountancy Review Center (ARC) of The Philippines Inc.: Student HandoutsDokumen2 halamanAccountancy Review Center (ARC) of The Philippines Inc.: Student HandoutsBella IlaganBelum ada peringkat

- Deed of Assignment Sample - PhilippinesDokumen3 halamanDeed of Assignment Sample - PhilippinesClarissaBelum ada peringkat

- EY-Kazakhstan Oil and Gas Tax Guide 2014Dokumen24 halamanEY-Kazakhstan Oil and Gas Tax Guide 2014shankar_embaBelum ada peringkat

- Name: E-Mail: Cell Phone Number:: Balance Sheet Initial 1st MonthDokumen3 halamanName: E-Mail: Cell Phone Number:: Balance Sheet Initial 1st MonthEmiliano Mancilla SilvaBelum ada peringkat

- Sample For AssignmentDokumen16 halamanSample For AssignmentRiya AhujaBelum ada peringkat

- Titan Case StudyDokumen5 halamanTitan Case StudyKeerthivasa TBelum ada peringkat

- Corporate Governance and IPO Underpricing - 1Dokumen23 halamanCorporate Governance and IPO Underpricing - 1BIMOBelum ada peringkat

- Lecture2 MonopolyDokumen58 halamanLecture2 MonopolyGaurav JainBelum ada peringkat

- Present Value of AnnuitiesDokumen2 halamanPresent Value of AnnuitiesJai Prakash100% (1)

- Pricing Strategy Plan PDFDokumen6 halamanPricing Strategy Plan PDFJerwin Canteras100% (1)

- Gold and Silver Club EbookDokumen22 halamanGold and Silver Club Ebookmfaisalidreis100% (1)

- Act 202 Final Assignment (Part-1) Faculty (RKB)Dokumen2 halamanAct 202 Final Assignment (Part-1) Faculty (RKB)Dinha ChowdhuryBelum ada peringkat

- Marketing MIx StrategyDokumen8 halamanMarketing MIx StrategyGift SimauBelum ada peringkat

- Trap Ease (Case)Dokumen2 halamanTrap Ease (Case)Amr EidBelum ada peringkat

- Caps, Floors, SwapDokumen3 halamanCaps, Floors, SwapFransiskus Saut Sandean SinagaBelum ada peringkat

- ADXDokumen7 halamanADXsathish bethriBelum ada peringkat

- EPCM TheMisunderstoodContractDokumen6 halamanEPCM TheMisunderstoodContractmonikatickoo4412100% (2)