Concept

Diunggah oleh

Bhavesh GoelDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Concept

Diunggah oleh

Bhavesh GoelHak Cipta:

Format Tersedia

International Business

INDIA

HERECOMETHE WAL-MART WANNABES

As Indiansflockto giant stores, the Big Bazaar chain is in the lead for now

is under the age of 30, and young India has an affinity for modem shopping. The country boasts 26 malls like Phoenix Mills, which will grow to 60 by December; the country's seven big retailers have 300 new stores under construcdon.

U-SHAPED AISLES

THE LEVEL OF COMPETITION will only

increase once the government eases restricdons on foreign investmentexpected to happen within the next two or three years. Pantaloon's Biyani is preparing a batde plan. The son of a family of Bombaybased textile traders, Biyani, 43, started with one store in Calcutta in 1997. Today he owns 52 stores in 19 cides with revenues projected at $250 nuUion for the year ending in Juneup 90% over last year. In any future batde with foreign compedtors such as Wal-Mart, Biyani thinks he has the advantage of knowing the Indian consumer. One trademark of his stores: vriding, U- and C-shaped aisles that create comers for families to consult about purchases. "Indians Uke to shop in groups and find straight aisles insipid," he says. Biyani now sells every variety of goods under three brands. His 13-oudet department-store chain is called Pantaloons. Then there is discoimt hypermarket Big Bazaar and supermarket chain Food Bazaar. By December, Biyani's stores will occupy 3 million square feet of retail space. Pantaloons' stock price has zoomed from $5 a year ago to $17 today. Skepdcal analysts worry that Biyani is expanding too fast. He's got strong local Stores Inc. or Carrefour here. Indian retau compeddon, too. The Tata Group's WestT'S A SUNDAY AFTERNOON AT the Phoenix MOls shopping center is sdll largely closed to foreign compa- side department store chain is growing as in Bombay, and the crowds are nies, so if s Biyani and his k who are fast as Pantaloon. Other compedtors incrushing. TTie former textile null is a profidng from the rapid growth of the clude Shoppers Stop and the RPG Group's chaodc sprawl of one- and two-sto- mall-hopping Indian consuming class Spencei^s. But Biyani dismisses the wonyry buudings that house 50-plus 105 mulion strong and swelling 10% a warts. A rough-hewn entrepreneur himstores. In the center's open-air year. Retau stores and malls like Big self, he has begun hiring experienced mancourtyard, vendors sell pizzas, popcorn, Bazaar are expected to be 9% of the mar- agers and accountants to drive expansion and rod bread from pushcarts. One estab- ket by 2010, with sales of $23 billion, up and manage inventory. There wiU be lots of new entrants to the business over the next lishment throbs witii more acdvity than from $6.4 bulion last year. two years, he says, but any other. Big Bazaar, the local version of There's plenty of "we vrl have made Wal-Mart, is the modem Indian family's room to grow. Accordmost of our mistakes favorite store. It stocks everything from ing to consultants KSA by then." It's sdll early peanuts and avocados to mops and crock- Technopak India, just days in fodia's retail ery. The ringing of the registers is constant. 3% of India's $180 bilMom-and-pop shops still dominate industry,, ;jid dovm in India, but sales at chain stores and Tlie crowds love it, as does Kishore Biyani, lion retail business is malls are growing fast. the road there is founder and chief execudve of Pantaloon based in shopping bound to be a shakeRetail (India) Ltd., which owns Big Bazaar centers and big stores, 2010 2004 out. Kut if s clearly goand is India's largest retailer. "The mall of vs. 20% in China and ing to be tough to today is Like the temple of yesterday, where 80% in the U.S. The push Kishore Biyani peopleflockedon Sundays," he explains. rest is fragmented, biilion billion The retail revoludon has finally hit In- with 12 million dny offthe top of the retau or 9% of total or 3% of total mountain. D dia, after decades of being rebuffed by its shops catering to the retail revenues retail revenues tradidonal mom-and-pop neighborhood needs of 1 billion Indi-ByManJeetKripalani ans. Yet 60% of India stores. But you won't find Wal-Mart m Bombay

Retail Runup

$6.4

$23

Data: KSA Technopak India

56 I BusinessWeek I April 4, 2005

Copyright of BusinessWeek is the property of Bloomberg, L.P. and its content may not be copied or emailed to multiple sites or posted to a listserv without the copyright holder's express written permission. However, users may print, download, or email articles for individual use.

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- DUMSSBDDDDokumen3 halamanDUMSSBDDDUBCREATIONZ 2019Belum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- (Case 10) Walmart and AmazonDokumen7 halaman(Case 10) Walmart and Amazonberliana setyawatiBelum ada peringkat

- Retail Structure, Types and RoleDokumen24 halamanRetail Structure, Types and RoleRishab Jain 2027203Belum ada peringkat

- Project Report Organised Retails in IndiaDokumen70 halamanProject Report Organised Retails in Indiabiswajit.hcl82% (11)

- Madura GarmentsDokumen41 halamanMadura GarmentsAnonymous 7xmMjaJA1Belum ada peringkat

- E Case h3 PDFDokumen3 halamanE Case h3 PDFaddisBelum ada peringkat

- Evolution of Retailing in INDIADokumen11 halamanEvolution of Retailing in INDIANivika Gupta0% (1)

- AR InvoiceDokumen3 halamanAR Invoicemouse.lenova mouseBelum ada peringkat

- Directorio de Tiendas EEUUDokumen17 halamanDirectorio de Tiendas EEUUBreisner Camacho DelgadoBelum ada peringkat

- Sajcs: A of Retaile T. AinericaDokumen3 halamanSajcs: A of Retaile T. AinericaMoeen AhmedBelum ada peringkat

- Mr. and Mrs. Dicarlo: Henry Esteban Roa FlorezDokumen3 halamanMr. and Mrs. Dicarlo: Henry Esteban Roa FlorezEsteban RoaBelum ada peringkat

- Reliance Fresh: Presentation OnDokumen17 halamanReliance Fresh: Presentation OnSanhoihpa KhaineuBelum ada peringkat

- Sam Walton: A Passion To LearnDokumen9 halamanSam Walton: A Passion To LearnGagan BathlaBelum ada peringkat

- Departmental StoresDokumen30 halamanDepartmental StoresAbdul HameedBelum ada peringkat

- DMartDokumen11 halamanDMartAshwin DholeBelum ada peringkat

- Entrep - National Book StoreDokumen11 halamanEntrep - National Book StoreAriaiza SanpiaBelum ada peringkat

- Chain Reaction CyclesDokumen2 halamanChain Reaction CyclesNida JamilBelum ada peringkat

- Market o Week 33 IrDokumen8 halamanMarket o Week 33 IrAndi ApriatnaBelum ada peringkat

- Types of RetailersDokumen31 halamanTypes of RetailersjunrexBelum ada peringkat

- Volt Magazine PreviewDokumen16 halamanVolt Magazine PreviewJose Juan Blanco HernándezBelum ada peringkat

- The Indian Retail SectorDokumen17 halamanThe Indian Retail SectorAdityaBelum ada peringkat

- Islam MLM by mufti-MASUM-billahDokumen61 halamanIslam MLM by mufti-MASUM-billahkazi yakub aliBelum ada peringkat

- Globus BrandDokumen7 halamanGlobus BrandAayushi PathakBelum ada peringkat

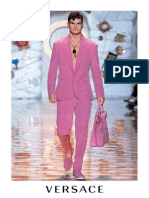

- Versace Men Collection SS 15Dokumen25 halamanVersace Men Collection SS 15SamuelBelum ada peringkat

- Retailer NagpurDokumen66 halamanRetailer NagpurRakesh PatleBelum ada peringkat

- Sales and OffersDokumen15 halamanSales and OfferspppppBelum ada peringkat

- Mexico City: Cushman & Wakefield Global Cities Retail GuideDokumen8 halamanMexico City: Cushman & Wakefield Global Cities Retail GuideBheemendra NarayanBelum ada peringkat

- Retail Management: Final Report On "Retail Management Project On Supermarket Chain "Dokumen12 halamanRetail Management: Final Report On "Retail Management Project On Supermarket Chain "Nilay NandekarBelum ada peringkat

- Readi NG ComprDokumen5 halamanReadi NG ComprHelen VivianaBelum ada peringkat

- Save 2Dokumen235 halamanSave 2Winny EducationBelum ada peringkat