TI

Diunggah oleh

Setiyo BirowoHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

TI

Diunggah oleh

Setiyo BirowoHak Cipta:

Format Tersedia

Chapter 1 3

Controls for Differentiated Strategies

597

Case 13-3

Texas Instruments and Hewlett-Packard

Texas Instruments (TI) and Hewlett-Packard (HP) developed, manufactured, and sold high-technology electric and electronic products. Texas Instruments had three main lines of business in 1984: components, which includ ed semi conductor integrated circuits, semiconductor subassemblies, and electronic control devices; digital products, which included minicomputers, personal com puters, scientific instruments, and calculators; and government electronics, which included radar systems, missile guidance and control system s, and in frared surveillance systems. The three businesses generated 46 percent, 19 percent, and 24 percent, respectively, of TIs sales in 1984. Hewle tt-Packard operated in two main lines of business: computer products, which included factory automation computers, engineering workstations, data termin als, per sonal computers, and calculators; and electronic test and measu rement sys tems, which included instruments that were used to evaluate the operation of electrical equipment against standards, instruments that would measu re and display electronic signals, voltmeters, and oscilloscopes. These busine sses gen erated 53 percent and 37 percent, respectively, of HPs 1984 sales. Summary financial information for each company is presented in Exhibit 1. Although Texas Instruments and Hewlett-Packard competed in similar industries, the strategies chosen by these two firms were very different. Exhibit 2 summarizes five major concepts related to the conten t of strategy for

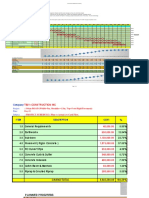

EXHIBIT 1 Summary Texas Instruments 1980

Assets Equity Sales

Financial

Information (S in Millions)

1981 $2,311 1,260 4,206 253 20.1%

1982 $2,631 1,361 4,327 236 17.3%

1983 $2,713 1,203 4,580 (288) n.a.

1984 $3,423 1,541 5,742 526 34.1%

$2,414 1,165 4,075 379 32.5%

Operating profit ROl Hewlett-Packard

1980

Assets Equity Sales

1981 $2,782 1,890 3,578 567 30.1%

1982 $3,470 2,349 4,254 676 28.8%

1983 $4,161 2,887 4,710 728 25.2%

1984 $5,153 3,545 6,044 860 24.2%

$2,337 1,547 3,099 523 33.8%

Operating profit ROl

Source: Steven C.Wheelright, Strategy Management, and Strategic Planning Approaches, interfaces, JanuaryFebruary 1984.

Reprinted by permission of Steven C. Wheelright, Strategy, Manag ement, and Strategic Planning Approaches, Interfaces, JanuaryFebruary 1984, pp. 1933. Copyright 1984 by the Operations Research Society of America and The Institute of Management Scienc es, 290 Westminster Street, Providence, Rhode Island 02903, USA.

598

Part Three

Variations in Management Control

EXHIBIT 2

Contrasting Strategies of TI and lIP Texas Instruments Business Strategy Competitive advantage for large, standard markets based on long-run cost position Competitive advantage for selected small markets based on unique, high-value/high-features products Functional Strategy Hewlett-Packard

Marketing: Manufacturing: R&D: Financial:

High volume/low price Rapid growth Standard products Scale economies and learning curve Vertical integration Large, low-cost locations Process and product Cost driven Design to cost Aggfessive Higher debt light ship

High value/high price Controlled growth Custom features Delivery and quality driven limited vertical integration Small, attractive locations Product only Features and quality driven Design to performance Conservative No debt Marg!n of safety (slack)

both Texas Instruments and Hewlett-Packard. Perhaps the most significant distinction between TI and HP was their generic business and functional strategies (Exhibit 2). They pursued very different approaches. TI preferred to pursue competitive advantage based on larger, more standard markets and a long-term, low-cost position. HP, on the other hand, sought competitive advan tage in selected smaller markets based on unique, high-value, high-feature products. The functional strategies used to support those desired competitive advantages also differed. With regard to the product life cycle (Exhibit 3), TI favored early entry fol lowed by expansion and consolidation of its position, resulting in a dominant market share when the product matured. HP, on the other hand, tended to cre ate new markets, but then exited (or introduced other new products) as costdriven competitors entered and the market matured. It is not surprising that the two firms viewed prices and costs, the third area, differently. TI empha sized continual price cuts to parallel cost reduction in order to build volume and take advantage of shared experience and learning. HP, on the other hand, put less emphasis on manufacturing cost reductions and held prices longer so that profit margins expanded during the initial periods. The early returns gen erated allowed early exit from the market with good returns on investment and provided funds for further product research and development. A fourth concept that highlights their differences in strategy is the product process matrix, which matches the product life cycle with its production coun terpart, the process life cycle. HP concentrated on more flexible production processes (such as job shop and batch operations) to meet the needs of its cus tom and low-volume markets, while TI concentrated on more capital-intensive and cost-effective production processes (assembly lines and continuous flow operations) to supply its more standard, high-volume markets.

Chapter 13 Controls for Differentiated Strategies

599

EXHIBIT 3

A

Differences in Strategy between Texas Instruments and Hewlett-Packard

TEXAS INSTRUMENTS

HEWLErF-PACKARD

Product life cycle

Time Time TI tended to enter early in a products life cycle, and stayed through maturity. HP tended to create a new product and then replaced it when it matured.

C Costs and Prices (Learning Curve)

Price Price Cost Cost

Cumulative volume Cumulative volume TI emphasized aggressive cost improvements, with equally aggressive price cuts. HP desired cost improvements, but sought higher margins and held prices longer.

E Product/Process Matrix

Custom Job shop Standard High volume

F

Custom Job

snup

Standard High volume

Continuous

Continuous

TI concentrated on more capital-intensive, cost-effective production processes to match high-volume standard product needs. HP concentrated on flexible production processes to match low-volume, more custom product needs. G Portfolio: Positioning and Resource Movement T-Jwh H (New unique products) A

A A

Annual growth rate

AA A

Annual growth rate

AA A A A A A A

High

Low Low Relative market share Relative market share TI sought a balanced portfolio of businesses where mature, large businesses provide resources for young, high-growth businesses. HP sought all high-growth, high-margin businesses that met their own resource needs, largely on an individual basis.

High

600

Part Three

Variations in Management Control

A fifth concept, portfolio analysis, further highlights differences in the firms strategies. TI looked for a portfolio that included low-growth businesses with dominant market shares to provide cash for a select group of high-growth

businesses with lower market shares but with the prospect of becoming domi nant, high-growth businesses, and eventually cash cows. HP, on the other hand, wanted all high-growth businesses with dominant market shares, and to reallocate major resources only to fund new businesses. In fact, the tradi tional solution to any profit problem at HP had been new products and new businesses.

Question

Given the differences in strategy between the two firms, what would you expect would be the differences between TI and HP in their planning and con trol systems: strategic planning systems; budgeting systems; reporting sys tems; performance evaluation systems; and incentive compensation systems?

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Micom P40 AgileDokumen386 halamanMicom P40 AgilesanthoshBelum ada peringkat

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- RAN3308: Flexi RFM 3T6R 2100Dokumen2 halamanRAN3308: Flexi RFM 3T6R 2100Reza BordbarBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Cubase 7 Quick Start GuideDokumen95 halamanCubase 7 Quick Start Guidenin_rufaBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Lesson 3 Electronic PortfolioDokumen4 halamanLesson 3 Electronic PortfolioFredDevillesValentinoBelum ada peringkat

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Nirala2018.pdf Springer PDFDokumen20 halamanNirala2018.pdf Springer PDFNigus TeklehaymanotBelum ada peringkat

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- PHP ReadmeDokumen3 halamanPHP ReadmeAdita Rini SusilowatiBelum ada peringkat

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Fis-Opf Ach PaymentsDokumen5 halamanFis-Opf Ach PaymentscrazytrainBelum ada peringkat

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Objective of MRP and MRP2 in Computer StudyDokumen14 halamanObjective of MRP and MRP2 in Computer StudyMostafa FawzyBelum ada peringkat

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- S4hana MorDokumen24 halamanS4hana MorARYAN SINHABelum ada peringkat

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- PLCDokumen936 halamanPLCjulio cidBelum ada peringkat

- DocumentDokumen10 halamanDocumentHafiz MuhammadBelum ada peringkat

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- EE 6351 - Electrical Drives and Controls (EDC) QBDokumen160 halamanEE 6351 - Electrical Drives and Controls (EDC) QBkannanchammyBelum ada peringkat

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Chapter 2 - The Origins of SoftwareDokumen26 halamanChapter 2 - The Origins of Softwareلوي وليدBelum ada peringkat

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- User Manual IDC20KDokumen12 halamanUser Manual IDC20KAnonymous m1cSnEavoBelum ada peringkat

- A Study of The Impact of Social Media On Consumer Buying Behaviour Submitted ToDokumen25 halamanA Study of The Impact of Social Media On Consumer Buying Behaviour Submitted ToAnanya GhoshBelum ada peringkat

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Britt Support Cat 9710Dokumen47 halamanBritt Support Cat 9710Jim SkoranskiBelum ada peringkat

- Wlguide PDFDokumen130 halamanWlguide PDFElaine MagcawasBelum ada peringkat

- Sample Consent FormDokumen1 halamanSample Consent FormMaira HassanBelum ada peringkat

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Engineering Graphics (EG)Dokumen8 halamanEngineering Graphics (EG)Sudalai MadanBelum ada peringkat

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Unit 1 Real Numbers - Activities 1 (4º ESO)Dokumen3 halamanUnit 1 Real Numbers - Activities 1 (4º ESO)lumaromartinBelum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Quiz 3Dokumen4 halamanQuiz 3Kereen Pearl PascuaBelum ada peringkat

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Training Asylum ApplicationDokumen2 halamanTraining Asylum Applicationec_eiucBelum ada peringkat

- Psi PopDokumen31 halamanPsi PopRebecca Monzon0% (1)

- Knowledge Management in Engineering Through ICT-2. DR K Dhamodharan Scopus PaperDokumen25 halamanKnowledge Management in Engineering Through ICT-2. DR K Dhamodharan Scopus PaperDR K DHAMODHARANBelum ada peringkat

- Rest Security by Example Frank KimDokumen62 halamanRest Security by Example Frank KimneroliangBelum ada peringkat

- What Are You Doing LiveworksheetDokumen18 halamanWhat Are You Doing LiveworksheetRizki Novela WatiBelum ada peringkat

- Lesson 23: HTML Interview QuestionsDokumen6 halamanLesson 23: HTML Interview QuestionssemibrevBelum ada peringkat

- Tc14.0.0.0 ActiveWorkspace6.2.2 READMEDokumen5 halamanTc14.0.0.0 ActiveWorkspace6.2.2 READMEgyuregabiBelum ada peringkat

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Clmd4a Ictg6Dokumen25 halamanClmd4a Ictg6Rose RamosBelum ada peringkat

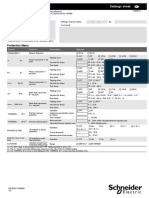

- VIP400 Settings Sheet NRJED311208ENDokumen2 halamanVIP400 Settings Sheet NRJED311208ENVăn NguyễnBelum ada peringkat

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)