18e Key Question Answers CH 11

Diunggah oleh

AbdullahMughalDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

18e Key Question Answers CH 11

Diunggah oleh

AbdullahMughalHak Cipta:

Format Tersedia

11-2

11-7

11-8

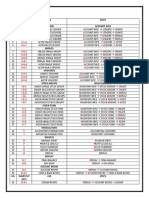

(Key Question) Compare the elasticity of the monopolistically competitors demand curve with that of a pure competitor and a pure monopolist. Assuming identical long-run costs, compare graphically the prices and output that would result in the long run under pure competition and under monopolistic competition. Contrast the two market structures in terms of productive and allocative efficiency. Explain: Monopolistically competitive industries are characterized by too many firms, each of which produces too little. The monopolistic competitors demand curve is less elastic than a pure competitor and more elastic than a pure monopolist. Your graphs should look like Figures 11.12 and 11.1 in the chapters. Price is higher and output lower for the monopolistic competitor. Pure competition: P = MC (allocative efficiency); P = minimum ATC (productive efficiency). Monopolistic competition: P > MC (allocative efficiency) and P > minimum ATC (productive inefficiency). Monopolistic competitors have excess capacity; meaning that fewer firms operating at capacity (where P = minimum ATC) could supply the industry output. (Key Question) Answer the following questions, which relate to measures of concentration: a. What is the meaning of a four-firm concentration ratio of 60 percent? 90 percent? What are the shortcomings of concentration ratios as measures of monopoly power? b. Suppose that the five firms in industry A have annual sales of 30, 30, 20, 10, and 10 percent of total industry sales. For the five firms in industry B, the figures are 60, 25, 5, 5, and 5 percent. Calculate the Herfindahl index for each industry and compare their likely competitiveness. A four-firm concentration ratio of 60 percent means the largest four firms in the industry account for 60 percent of sales; a four-firm concentration ratio of 90 percent means the largest four firms account for 90 percent of sales. Shortcomings: (1) they pertain to the nation as a whole, although relevant markets may be localized; (2) they do not account for interindustry competition; (3) the data are for U.S. productsimports are excluded; and (4) they dont reveal the dispersion of size among the top four firms. (Key Question) Explain the general meaning of the following profit payoff matrix for oligopolists C and D. All profit figures are in thousands. a. Use the payoff matrix to explain the mutual interdependence that characterizes oligopolistic industries. b. Assuming no collusion between C and D, what is the likely pricing outcome? c. In view of your answer to 8b, explain why price collusion is mutually profitable. Why might there be a temptation to cheat on the collusive agreement?

The matrix shows the four possible profit outcomes for each of two firms, depending on which of the two price strategies each follows. Example: If C sets price at $35 and D at $40, Cs profits will be $59,000, and Ds $55,000. (a) C and D are interdependent because their profits depend not just on their own price, but also on the other firms price.

(b) Likely outcome: Both firms will set price at $35. If either charged $40, it would be concerned the other would undercut the price and its profit by charging $35. At $35 for both; Cs profit is $55,000, Ds, $58,000. (c) Through price collusionagreeing to charge $40each firm would achieve higher profits (C = $57,000; D = $60,000). But once both firms agree on $40, each sees it can increase its profit even more by secretly charging $35 while its rival charges $40. 11-9 (Key Question) What assumptions about a rivals response to price changes underlie the kinked-demand curve for oligopolists? Why is there a gap in the oligopolists marginalrevenue curve? How does the kinked demand curve explain price rigidity in oligopoly? What are the shortcomings of the kinked-demand model? Assumptions: (1) Rivals will match price cuts: (2) Rivals will ignore price increases. The gap in the MR curve results from the abrupt change in the slope of the demand curve at the going price. Firms will not change their price because they fear that if they do their total revenue and profits will fall. Shortcomings of the model: (1) It does not explain how the going price evolved in the first place; (2) it does not allow for price leadership and other forms of collusion. 11-11 (Key Question) Why is there so much advertising in monopolistic competition and oligopoly? How does such advertising help consumers and promote efficiency? Why might it be excessive at times? Two ways for monopolistically competitive firms to maintain economic profits are through product development and advertising. Also, advertising will increase the demand for the firms product. The oligopolist would rather not compete on a basis of price. Oligopolists can increase their market share through advertising that is financed with economic profits from past advertising campaigns. Advertising can operate as a barrier to entry. Advertising provides information about new products and product improvements to the consumer. Advertising may result in an increase in competition by promoting new products and product improvements. It may also result in increased output for a firm, pushing it down its ATC curve and closer to productive efficiency (P = minimum ATC). Advertising may result in manipulation and persuasion rather than information. An increase in brand loyalty through advertising will increase the producers monopoly power. Excessive advertising may create barriers to entry into the industry.

Anda mungkin juga menyukai

- Quantitative MethodsDokumen26 halamanQuantitative MethodsAbdullahMughalBelum ada peringkat

- Quantitative MethodsDokumen26 halamanQuantitative MethodsAbdullahMughalBelum ada peringkat

- Quantitative Methods FOR Decision Making: Assignment No. 1Dokumen3 halamanQuantitative Methods FOR Decision Making: Assignment No. 1Arshad Baig MughalBelum ada peringkat

- 18e Key Question Answers CH 24Dokumen2 halaman18e Key Question Answers CH 24Harshwardhan Singh RathoreBelum ada peringkat

- 18e Key Question Answers CH 27Dokumen2 halaman18e Key Question Answers CH 27AbdullahMughalBelum ada peringkat

- Pay & Allowances 2001Dokumen30 halamanPay & Allowances 2001AbdullahMughalBelum ada peringkat

- 18e Key Question Answers CH 25Dokumen1 halaman18e Key Question Answers CH 25AbdullahMughalBelum ada peringkat

- 18e Key Question Answers CH 23Dokumen1 halaman18e Key Question Answers CH 23AbdullahMughalBelum ada peringkat

- 18e Key Question Answers CH 8Dokumen3 halaman18e Key Question Answers CH 8AbdullahMughalBelum ada peringkat

- 18e Key Question Answers CH 9Dokumen4 halaman18e Key Question Answers CH 9AbdullahMughalBelum ada peringkat

- Labor demand elasticity factorsDokumen3 halamanLabor demand elasticity factorsAbdullahMughalBelum ada peringkat

- 18e Key Question Answers CH 7Dokumen2 halaman18e Key Question Answers CH 7AbdullahMughalBelum ada peringkat

- 18e Key Question Answers CH 10Dokumen3 halaman18e Key Question Answers CH 10night2110Belum ada peringkat

- Graph demand data and calculate price elasticitiesDokumen3 halamanGraph demand data and calculate price elasticitiesaliabuelBelum ada peringkat

- 18e Key Question Answers CH 5Dokumen2 halaman18e Key Question Answers CH 5AbdullahMughalBelum ada peringkat

- Income Inequality and Business Organization Forms ComparedDokumen2 halamanIncome Inequality and Business Organization Forms ComparedAbdullahMughal100% (1)

- Ditrectorate of School Education Karachi Region KarachiDokumen1 halamanDitrectorate of School Education Karachi Region KarachiAbdullahMughalBelum ada peringkat

- Executive Mba Program Learning SheduleDokumen3 halamanExecutive Mba Program Learning SheduleAbdullahMughalBelum ada peringkat

- 18e Key Question Answers CH 3Dokumen3 halaman18e Key Question Answers CH 3AbdullahMughalBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- M CaffeineDokumen10 halamanM CaffeineKanishka KabadiBelum ada peringkat

- Group ProjectDokumen3 halamanGroup ProjectQuang MinhBelum ada peringkat

- What Is Content MarketingDokumen2 halamanWhat Is Content MarketingJimmy CyrusBelum ada peringkat

- Tradewind Brochure 11x17Dokumen2 halamanTradewind Brochure 11x17JAckBelum ada peringkat

- Absorption Costing For Decision Making - Zimmerman ApproachDokumen6 halamanAbsorption Costing For Decision Making - Zimmerman ApproachKEETARUTH OUMATEEBelum ada peringkat

- ACT-202 Group ProjectDokumen13 halamanACT-202 Group ProjectRomi SikderBelum ada peringkat

- Group Assignment 1 - Group 5Dokumen9 halamanGroup Assignment 1 - Group 5Suhaimi SuffianBelum ada peringkat

- Lazy Portfolios: Core and SatelliteDokumen2 halamanLazy Portfolios: Core and Satellitesan291076Belum ada peringkat

- Chapter 2 External EnvironmentDokumen34 halamanChapter 2 External EnvironmentcesartpBelum ada peringkat

- Essentials of Marketing ManagementDokumen76 halamanEssentials of Marketing ManagementYodhia Antariksa100% (2)

- Strategic AnalysisDokumen6 halamanStrategic AnalysisShrestha KishorBelum ada peringkat

- Marketing For DemographicDokumen7 halamanMarketing For DemographicSujit Kumar SahooBelum ada peringkat

- Business To Business Digital Content Marketing Marketers' Perceptions of Best PracticeDokumen25 halamanBusiness To Business Digital Content Marketing Marketers' Perceptions of Best PracticeAnonymous RPGElSBelum ada peringkat

- How To Define A Chart of Accounts in Oracle Apps R12: Month End ProcessDokumen18 halamanHow To Define A Chart of Accounts in Oracle Apps R12: Month End ProcessCGBelum ada peringkat

- Standard Operating Procedures Assessment of Accounting QualificationsDokumen14 halamanStandard Operating Procedures Assessment of Accounting QualificationschiaraferragniBelum ada peringkat

- FA - Abercrombie and Fitch Case StudyDokumen17 halamanFA - Abercrombie and Fitch Case Studyhaonanzhang100% (2)

- Inventory and Logistics Exam QuestionsDokumen10 halamanInventory and Logistics Exam Questionsطه احمدBelum ada peringkat

- Network Design Decisions in Supply Chain ManagementDokumen41 halamanNetwork Design Decisions in Supply Chain ManagementJanmejai BhargavaBelum ada peringkat

- A Presentation ON: Physical Distribution and LogisticsDokumen9 halamanA Presentation ON: Physical Distribution and LogisticssanadkumarBelum ada peringkat

- Case Study on Marketing Forces Faced by Kamdar GroupDokumen9 halamanCase Study on Marketing Forces Faced by Kamdar GroupNatasya SyafinaBelum ada peringkat

- ASICS: Chasing A 2020 Vision-Case Write Up Rallapalli Vishal Vijay PGP10239Dokumen1 halamanASICS: Chasing A 2020 Vision-Case Write Up Rallapalli Vishal Vijay PGP10239RALLAPALLI VISHAL VIJAYBelum ada peringkat

- Tally Shortcut Keys GuideDokumen2 halamanTally Shortcut Keys Guideradha ramaswamyBelum ada peringkat

- Issuance of Par Value ShareDokumen12 halamanIssuance of Par Value SharejudesamaiBelum ada peringkat

- Managing Brand OvertimeDokumen8 halamanManaging Brand Overtimedolevikas5163Belum ada peringkat

- BrochureDokumen5 halamanBrochureSumay Kumar FBelum ada peringkat

- Unit C RevisionDokumen1 halamanUnit C RevisionMaria Victoria Ferrer QuirogaBelum ada peringkat

- Service Leadership 19 08 2010Dokumen9 halamanService Leadership 19 08 2010Mohamed Shahul HameedBelum ada peringkat

- The Hershey Company: Abdullah, Esnaira A. Pantia, Patrik Oliver E. Pasaol, Devvie Mae ADokumen18 halamanThe Hershey Company: Abdullah, Esnaira A. Pantia, Patrik Oliver E. Pasaol, Devvie Mae APatrik Oliver PantiaBelum ada peringkat

- Customer Relationship ManagementDokumen10 halamanCustomer Relationship ManagementJay KrishnaBelum ada peringkat

- Marketing Chapter NineDokumen35 halamanMarketing Chapter Ninenupurk890% (1)