Daily Technical Report 26th Dec

Diunggah oleh

Angel BrokingHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Daily Technical Report 26th Dec

Diunggah oleh

Angel BrokingHak Cipta:

Format Tersedia

Daily Technical Report

December 26, 2012

Sensex (19255) / NIFTY (5856)

The week began on a quite note on Monday where our benchmark indices remained flat throughout the day to close with marginal gains. Trading volumes declined as traders turned cautious ahead of the Christmas holidays. On sectoral front, Metal, Oil & Gas and Consumer Durables counters remained under pressure. However, Teck, Realty and IT provided support to the markets. The advance to decline ratio was marginally in favor of advancing counters (A=1448 D=1431) (Source www.bseindia.com).

Exhibit 1: Nifty Daily Chart

Formation

The 20-day EMA and the 20-week EMA are placed at 19212 / 5845 and 18552 / 5636 levels, respectively. On the weekly chart, we are witnessing a breakout from Downward Sloping Trend Line joining two significant swing highs of 19811 / 5944 (April 2011) and 19137 / 5815 (Oct 2012) at 19050 / 5800 level. The 38.20% and 50% Fibonacci retracement levels of the rise from 18255 / 5548 (low on November 20, 2012) to 19612 / 5965 (high on December 11, 2012) are at 19100 18930 / 5806 5755, respectively. The daily RSI oscillator, 3 & 8 day EMA and the daily ADX (9) indicator are negatively poised.

Source: Falcon:

Actionable points:

View for the day Expected Targets Support Levels Bullish above 5875 5926 5965 5823 - 5806

Trading strategy:

The weak session on Friday was followed by a quiet trading session on Monday, in-line with muted global cues. Lack of participation prior to a long Christmas break resulted in significant fall in volumes. Hence, there is no major change in the chart structure and thus we reiterate our view that only if indices sustain below last weeks low of 19149 / 5823, we may witness a downward corrective move towards 19100 18930 / 5806 5755. These levels are the 38.20% and 50% Fibonacci retracement levels of the rise from 18255 / 5548 (low on November 20, 2012) to 19612 / 5965 (high on December 11, 2012), respectively. On the flipside, last weeks high of 19612 / 5965 would act as a strong resistance in the coming trading sessions.

www.angelbroking.com

Daily Technical Report

December 26, 2012

Bank Nifty Outlook - (12318)

On Monday, Bank Nifty opened on a flat note and in line with our benchmark indices traded in a narrow range throughout the session. In line with the benchmark indices, banking stocks too showed a decline in trading volumes and there is no major change in the chart structure on the daily chart. Going forward, the index is likely to trade in the range of 12568 12197 level. Within the mentioned range 12366 12410 levels are likely to act as resistance and 12238 12197 are likely to act as support for the day.

Exhibit 2: Bank Nifty Daily Chart

Actionable points:

View for the day Resistance Levels Support Levels Neutral 12366 12410 12238 - 12197 Source: Falcon:

www.angelbroking.com

Daily Technical Report

December 26, 2012

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS SENSEX NIFTY BANKNIFTY ACC AMBUJACEM ASIANPAINT AXISBANK BAJAJ-AUTO BANKBARODA BHARTIARTL BHEL BPCL CAIRN CIPLA COALINDIA DLF DRREDDY GAIL GRASIM HCLTECH HDFC HDFCBANK HEROMOTOCO HINDALCO HINDUNILVR ICICIBANK IDFC INFY ITC JINDALSTEL JPASSOCIAT KOTAKBANK LT LUPIN M&M MARUTI NTPC ONGC PNB POWERGRID RANBAXY RELIANCE RELINFRA SBIN SESAGOA SIEMENS SUNPHARMA TATAMOTORS TATAPOWER TATASTEEL TCS ULTRACEMCO WIPRO S2 19,170 5,830 12,216 1,385 196 4,310 1,314 2,059 827 300 224 335 307 410 349 218 1,795 345 3,112 621 815 668 1,852 126 519 1,106 166 2,306 284 433 93 635 1,556 596 927 1,460 152 253 817 113 498 809 508 2,304 188 653 717 292 105 421 1,255 1,911 378 S1 19,212 5,843 12,267 1,398 198 4,336 1,328 2,083 838 304 226 341 310 415 352 221 1,809 349 3,142 629 822 672 1,869 128 525 1,114 168 2,314 285 439 95 641 1,571 601 932 1,469 153 255 825 114 501 815 512 2,318 190 657 729 299 106 425 1,261 1,934 382 PIVOT 19,280 5,857 12,317 1,407 200 4,360 1,337 2,104 846 308 228 346 314 419 354 222 1,824 351 3,188 635 832 676 1,893 129 531 1,122 170 2,321 288 450 96 648 1,587 605 940 1,485 154 257 833 115 504 821 516 2,338 194 663 737 305 107 430 1,266 1,964 384 R1 19,323 5,870 12,367 1,419 202 4,386 1,351 2,128 857 312 230 352 318 424 356 225 1,838 355 3,218 643 838 680 1,911 131 537 1,130 172 2,329 290 456 97 653 1,602 611 946 1,495 155 258 841 116 507 827 521 2,352 196 667 749 313 108 434 1,272 1,987 389 R2 19,390 5,885 12,417 1,428 204 4,410 1,360 2,149 865 316 232 358 322 428 358 227 1,853 357 3,264 649 848 684 1,935 133 543 1,138 173 2,337 292 466 99 660 1,619 615 953 1,511 156 260 849 117 510 833 525 2,372 199 672 757 318 109 439 1,277 2,017 391

www.angelbroking.com

Daily Technical Report

December 26, 2012

Research Team Tel: 022 - 39357800 E-mail: research@angelbroking.com Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni Sameet Chavan Sacchitanand Uttekar Mehul Kothari Ankur Lakhotia Head Technicals Technical Analyst Technical Analyst Technical Analyst Technical Analyst

For any Queries, Suggestions and Feedback kindly mail to sameet.chavan@angelbroking.com

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 3952 6600

Sebi Registration No: INB 010996539

www.angelbroking.com 4

Anda mungkin juga menyukai

- WPIInflation August2013Dokumen5 halamanWPIInflation August2013Angel BrokingBelum ada peringkat

- Technical & Derivative Analysis Weekly-14092013Dokumen6 halamanTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Special Technical Report On NCDEX Oct SoyabeanDokumen2 halamanSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingBelum ada peringkat

- Daily Agri Tech Report September 16 2013Dokumen2 halamanDaily Agri Tech Report September 16 2013Angel BrokingBelum ada peringkat

- Commodities Weekly Outlook 16-09-13 To 20-09-13Dokumen6 halamanCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingBelum ada peringkat

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDokumen4 halamanRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingBelum ada peringkat

- Oilseeds and Edible Oil UpdateDokumen9 halamanOilseeds and Edible Oil UpdateAngel BrokingBelum ada peringkat

- Daily Agri Tech Report September 14 2013Dokumen2 halamanDaily Agri Tech Report September 14 2013Angel BrokingBelum ada peringkat

- Metal and Energy Tech Report November 12Dokumen2 halamanMetal and Energy Tech Report November 12Angel BrokingBelum ada peringkat

- International Commodities Evening Update September 16 2013Dokumen3 halamanInternational Commodities Evening Update September 16 2013Angel BrokingBelum ada peringkat

- Daily Metals and Energy Report September 16 2013Dokumen6 halamanDaily Metals and Energy Report September 16 2013Angel BrokingBelum ada peringkat

- Daily Agri Report September 16 2013Dokumen9 halamanDaily Agri Report September 16 2013Angel BrokingBelum ada peringkat

- Technical Report 13.09.2013Dokumen4 halamanTechnical Report 13.09.2013Angel BrokingBelum ada peringkat

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Dokumen4 halamanDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingBelum ada peringkat

- Currency Daily Report September 16 2013Dokumen4 halamanCurrency Daily Report September 16 2013Angel BrokingBelum ada peringkat

- Metal and Energy Tech Report Sept 13Dokumen2 halamanMetal and Energy Tech Report Sept 13Angel BrokingBelum ada peringkat

- Commodities Weekly Tracker 16th Sept 2013Dokumen23 halamanCommodities Weekly Tracker 16th Sept 2013Angel BrokingBelum ada peringkat

- Market Outlook: Dealer's DiaryDokumen13 halamanMarket Outlook: Dealer's DiaryAngel BrokingBelum ada peringkat

- TechMahindra CompanyUpdateDokumen4 halamanTechMahindra CompanyUpdateAngel BrokingBelum ada peringkat

- Sugar Update Sepetmber 2013Dokumen7 halamanSugar Update Sepetmber 2013Angel BrokingBelum ada peringkat

- Market Outlook 13-09-2013Dokumen12 halamanMarket Outlook 13-09-2013Angel BrokingBelum ada peringkat

- Derivatives Report 16 Sept 2013Dokumen3 halamanDerivatives Report 16 Sept 2013Angel BrokingBelum ada peringkat

- Derivatives Report 8th JanDokumen3 halamanDerivatives Report 8th JanAngel BrokingBelum ada peringkat

- MetalSectorUpdate September2013Dokumen10 halamanMetalSectorUpdate September2013Angel BrokingBelum ada peringkat

- IIP CPIDataReleaseDokumen5 halamanIIP CPIDataReleaseAngel BrokingBelum ada peringkat

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDokumen6 halamanTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingBelum ada peringkat

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDokumen1 halamanPress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingBelum ada peringkat

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDokumen4 halamanJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingBelum ada peringkat

- MarketStrategy September2013Dokumen4 halamanMarketStrategy September2013Angel BrokingBelum ada peringkat

- Daily Agri Tech Report September 06 2013Dokumen2 halamanDaily Agri Tech Report September 06 2013Angel BrokingBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- SEO Design ExamplesDokumen10 halamanSEO Design ExamplesAnonymous YDwBCtsBelum ada peringkat

- 2007 Bomet District Paper 2Dokumen16 halaman2007 Bomet District Paper 2Ednah WambuiBelum ada peringkat

- NGPDU For BS SelectDokumen14 halamanNGPDU For BS SelectMario RamosBelum ada peringkat

- Oblicon SampleDokumen1 halamanOblicon SamplelazylawatudentBelum ada peringkat

- Extensive Reading Involves Learners Reading Texts For Enjoyment and To Develop General Reading SkillsDokumen18 halamanExtensive Reading Involves Learners Reading Texts For Enjoyment and To Develop General Reading SkillsG Andrilyn AlcantaraBelum ada peringkat

- TLE8 Q4 Week 8 As Food ProcessingDokumen4 halamanTLE8 Q4 Week 8 As Food ProcessingROSELLE CASELABelum ada peringkat

- PCSE_WorkbookDokumen70 halamanPCSE_WorkbookWilliam Ribeiro da SilvaBelum ada peringkat

- Computer Portfolio (Aashi Singh)Dokumen18 halamanComputer Portfolio (Aashi Singh)aashisingh9315Belum ada peringkat

- Operation Manual: Auto Lensmeter Plm-8000Dokumen39 halamanOperation Manual: Auto Lensmeter Plm-8000Wilson CepedaBelum ada peringkat

- The Sound Collector - The Prepared Piano of John CageDokumen12 halamanThe Sound Collector - The Prepared Piano of John CageLuigie VazquezBelum ada peringkat

- Time Table For Winter 2023 Theory ExaminationDokumen1 halamanTime Table For Winter 2023 Theory ExaminationSushant kakadeBelum ada peringkat

- APC Smart-UPS 1500VA LCD 230V: Part Number: SMT1500IDokumen3 halamanAPC Smart-UPS 1500VA LCD 230V: Part Number: SMT1500IDesigan SannasyBelum ada peringkat

- Embryo If Embryonic Period PDFDokumen12 halamanEmbryo If Embryonic Period PDFRyna Miguel MasaBelum ada peringkat

- National Advisory Committee For AeronauticsDokumen36 halamanNational Advisory Committee For AeronauticsSamuel ChristioBelum ada peringkat

- PC November 2012Dokumen50 halamanPC November 2012bartekdidBelum ada peringkat

- April 2017 Jacksonville ReviewDokumen40 halamanApril 2017 Jacksonville ReviewThe Jacksonville ReviewBelum ada peringkat

- Supplier GPO Q TM 0001 02 SPDCR TemplateDokumen6 halamanSupplier GPO Q TM 0001 02 SPDCR TemplateMahe RonaldoBelum ada peringkat

- 00 CCSA TestDokumen276 halaman00 CCSA TestPedro CubillaBelum ada peringkat

- Radio Theory: Frequency or AmplitudeDokumen11 halamanRadio Theory: Frequency or AmplitudeMoslem GrimaldiBelum ada peringkat

- A General Guide To Camera Trapping Large Mammals in Tropical Rainforests With Particula PDFDokumen37 halamanA General Guide To Camera Trapping Large Mammals in Tropical Rainforests With Particula PDFDiego JesusBelum ada peringkat

- Weekly Choice - Section B - February 16, 2012Dokumen10 halamanWeekly Choice - Section B - February 16, 2012Baragrey DaveBelum ada peringkat

- Tender Notice and Invitation To TenderDokumen1 halamanTender Notice and Invitation To TenderWina George MuyundaBelum ada peringkat

- Corn MillingDokumen4 halamanCorn Millingonetwoone s50% (1)

- Microsoft Word 2000 IntroductionDokumen72 halamanMicrosoft Word 2000 IntroductionYsmech SalazarBelum ada peringkat

- Postnatal Assessment: Name Date: Age: D.O.A: Sex: Hospital: Marital Status: IP .NoDokumen11 halamanPostnatal Assessment: Name Date: Age: D.O.A: Sex: Hospital: Marital Status: IP .NoRadha SriBelum ada peringkat

- For Coin & Blood (2nd Edition) - SicknessDokumen16 halamanFor Coin & Blood (2nd Edition) - SicknessMyriam Poveda50% (2)

- Translation EquivalenceDokumen6 halamanTranslation EquivalenceJamal Anwar TahaBelum ada peringkat

- PW CDokumen4 halamanPW CAnonymous DduElf20OBelum ada peringkat

- Practical Research 2: Self-Learning PackageDokumen3 halamanPractical Research 2: Self-Learning PackagePrinces BaccayBelum ada peringkat

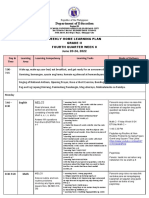

- Department of Education: Weekly Home Learning Plan Grade Ii Fourth Quarter Week 8Dokumen8 halamanDepartment of Education: Weekly Home Learning Plan Grade Ii Fourth Quarter Week 8Evelyn DEL ROSARIOBelum ada peringkat