Divineguma Bill - Basic Guide Updated January 2013

Diunggah oleh

Sanjana HattotuwaDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Divineguma Bill - Basic Guide Updated January 2013

Diunggah oleh

Sanjana HattotuwaHak Cipta:

Format Tersedia

Note on theDivineguma Bill By Centre for Policy Alternatives January 2013

Media reports in December 2012 indicated that the Divineguma Bill (referred to here as the Bill) is to be taken upfor a vote by Parliament in January 2013. This note has been prepared by the Centre for Policy Alternatives (CPA),with the objective of raising key issues related to the Bill and their consequences, if the Bill is enacted in its present form. CPA raised these issues in 2012, in both petitions filed in the Supreme Court challenging the Bill and in awareness raising materialproduced in all three languages. Background to the Divineguma Bill The Government tabled the Bill in Parliament on 10 August 2012. CPA and its Executive Director challenged the provisions of the Bill in the Supreme Court (SC/SD 3/2012). Two other petitions were also filed in the Supreme Court.1 The petitions were taken up by the Supreme Court on 27 and 29 August and the determination on this matter was tabled in Parliament by the Speaker on 18 September 2012. In its determination the Supreme Court agrees with the submissions made by CPA and determines that Article 154(G) (3) of the Constitution needs to be complied with in respect of the subject matters referred to in the Provincial Council List and that it is mandatory for the Central Government to consult the Provincial Councils before placing such a Bill on the Order Paper of Parliament.2 The Bill was thereafter withdrawn from the order paper of Parliament on 21 September 2012 3 and was submitted for approval by each of the Provincial Councils. All eight Provincial Councils which

1SC/SD 2Please

01/2012 and SC/SD 02/2012

contact CPA if further documentation relevant to the petition is required.

3Adaderana.lk,

DiviNeguma bill to be withdrawn from orderpaper, 21 September 2012, available at http://www.adaderana.lk/news.php?nid=19750

have been constituted voted to approve the Bill4 and it was also reported that the Governor of the Northern Province had given his consent on behalf of the Northern Provincial Council. Thereafter the Bill was again placed on the order paper of Parliament on 9October 2012.5Upon being placed on the order paper of Parliament for the 2nd time the provisions of the Bill were challenged by several petitioners including yet again by CPA and its Executive Director. CPAs challenge was on the basis that -amongst other things- the Bill has not been properly placed on the order paper of Parliament in terms of Article 154(G) (3) of the Constitution. The Supreme Court in its determination in October 2012 stated that several clauses of the Bill were inconsistent with provisions of the Constitution and thus needed to be passed by a Special majority of Parliament.6 It further stated that Clause 8 (2) and Clauses 35 (1) (b), (C) and (d) of the Bill were inconsistent with Article 3 of the Constitution and hence needed to be passed by a Special Majority of Parliament and by the people at a referendum. The Supreme Court also suggested certain changes to Clause 8 (2) and Clauses 35 (1) (b), (C) and (d) which would remedy the inconsistency with Article 3. News reports quoting the Minister of Economic Development state that Clause 8 and 35 had been amended according to the directives given by the Supreme Court.7Other news reports state that the Bill is to be debated in Parliament on the 8 or 9 January 2013. 8The amended Bill was not publicly available at the time of producing this note and CPA is therefore unable to comment on any proposed amendments. In addition to the challenges in the Supreme Court in 2012, CPA conducted awareness raising campaigns across Sri Lanka on the issue. This was due to the limited information publicly available on the provisions contained in the Bill and lack of awareness among the public including officials and representatives of the people regarding implications if the Bill was to be enacted. CPA stated then and reiterates now that the multiple challenges to the Bill were not to prevent the alleviation of poverty. Nor is the challenge aimed at preventing employees of the Samurdhi Authority, the Southern Development Authority or the Udarata Development Authority from obtaining pension

4Ministry

of Economic Development website, Eastern PC approves DiviNeguma Bill, available at http://med.gov.lk/english/?p=13642; News Line, Provincial Councils endorse proposed DiviNeguma Bill, 4 October 2012, available at http://www.priu.gov.lk/news_update/Current_Affairs/ca201210/20121004provincial_councils_endorse_proposed_div i_neguma_bill.htm

5

Times online, Divineguma Bill re-introduced, 9 October 2012, Available at http://sundaytimes.lk/index.php?option=com_content&view=article&id=25305:divineguma-bill-re-introduced&catid=1:latest-news&Itemid=547

6Clause

5 (d); Clause 7; Clause 11; Clause 14; Clause 17 (m); Clause 18; Clause 19; Clause 25 (4); Clauses 29 (4); Clause

42.

7ShyamNuwanGanewatta,

Divineguma Bill amended according to Supreme Court ruling(Sinhala), Divaina, 18

December 2012.

8News.lk,

DiviNeguma Bill in Parliament on January 8, 31 December 2012, available athttp://www.news.lk/news/srilanka/4015-divi-neguma-bill-in-parliament-on-january-8 ; Ajantha Kumara Agalakada, Debate on impeachment motion next month, Daily mirror, 28 December 2012.

or other benefits as government servants. CPA recognises these are important issues that require attention and supports such processes if done in adherence to the Constitutional and legal framework in Sri Lanka. CPAs challenge was against the attempt to usurp powers of the Provincial Councils and the consolidation of powers with one Minister with limited checks and balances. CPA prepared a note in 2012 to provide a basic guide of the key provisions in the Bill and its impact if enacted. The present note is an update of the 2012 version, taking on board recent developments.While the Bill impact several different areas, this note will primarily address the concerns regarding its impact on devolution. CPA hopes that this note and other initiatives connected with the Bill will raise awareness among the public and relevant stakeholders on the scope of the Bill and how it can impact devolution, governance and the rights of individuals.

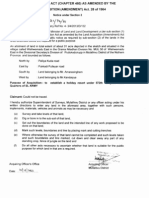

1. Structures that are to be established by the Bill The Bill attempts to establish several structures, which are explained in the graph found below. Key areas of concern are the objects, powers and functions of the Divineguma development department (Clause 4, 5 and 6), Divineguma district committees (Clause 20, 21 and 22), Divineguma regional organisations (Clause 16, 17 and 18) and Divineguma community based organisations (Clause 10, 11 and 12),which are broad in their scope and cover a large number of subjects.

The Minister

The Divineguma Development Department (Clause 4, 5 and 6)

Divineguma National Council (Clause 7 and 42)

Divineguma National Federation (Clause 23 & 24)

Divineguma District Committees (Clause 20, 21 and 22)

Divineguma Regional Organisations (Clause 16, 17 and 18)

Divineguma Community Based Organisations (Clause 10, 11 and 12)

Board of Management of Community based banks and banking societies (Clause 33)

Community based banking societies (Clause 30, 31 and 32)

Community based banks (Clause 26, 27 and 28)

2 Impact on Devolution As raised by the petitioners, the Bill includes a number of subjects contained in the Provincial Council List. This would result in the Central Government being able to take over subjects that are with the Provincial Councils as provided in the Thirteenth Amendment to the Constitution. The following table identifies various clauses of the Bill, which affect subjects devolved to the Provincial Councils.9

This table was part of the Written Submissions tendered in SC SD 03/2012 and was also reproduced in the determination of the Supreme Court which was read in Parliament on 18 September 2012.

Clause in Bill Clause 4(a) carrying out development activities as may be required to alleviate poverty and to bring about a society guaranteeing social equity (Divineguma Development Department) Clause 4(c) food security for each individual and family (Divineguma Development Department) Clause 4(f) physical and social infrastructure facilities for development of livelihoods (Divineguma Development Department)

Related item in Ninth Schedule List I of the Constitution (Provincial Council List) Item 2 Planning Implementation of provincial economic plans Item 10 Rural Development

Item 16 Food supply and distribution within the Province

Item 5:3 Construction activity in respect of any subject in the Provincial Council List Item 6 Roads and bridges and ferries within the Province Item 7:2 The Rehabilitation of destitute persons and families Item 7:3 Rehabilitation and welfare of physically, mentally and socially handicapped persons Item 7:4 Relief of the disabled and unemployable Item 15 Market fairs

Clause 4(i) social security network for those in need of social security (Divineguma Development Department)

Clause 5(c) centres for storage, marketing and processing products of Divineguma beneficiaries and to make available physical and financial resources for the said purpose (Divineguma Development Department) Clause 5(k) implement and operate programmes which will economically and socially uplift living standards of people and to develop infrastructure facilities (Divineguma Development Department)

Item 2 Planning Implementation of provincial economic plans Item 5:3 Construction activity in respect of any subject in the Provincial Council List Item 6 Roads and bridges and ferries thereon within the Province Item 10 Rural Development Item 17:1 Co-operative undertakings and the organisation, registration, supervision and audit of co-operative societies within the province Item 17:2 Co-operative development within the Province Item 28 Regulation of unincorporated trading, literary, scientific, religious and other societies and associations Item 2 Planning - Implementation of provincial economic plans.

Clause 9 Community based Organisations

Clause 11(k) to undertake and implement development programmes launched with the

labour contribution of the community (Community based Organisations)

Item 10 Rural Development

Clause 15(1) Divineguma regional organisations Item 17:1 Co-operative undertakings and the organisation, registration, supervision and audit of co-operative societies within the province Item 17:2 Co-operative development within the Province Item 28 Regulation of unincorporated trading, literary, scientific, religious and other societies and associations Clause 16(e) provide technical assistance and other services for the development of agricultural or any other products of its beneficiaries in the region (Divineguma regional organisations) Clause 16(f) maintain centres for the purchase, storage and marketing of products and rawmaterial and organise trading centres and shopping centres (Divineguma regional organisations) Clause 18(e) provide raw-material, technology and other related services for the development of products at regional level and provide facilities for marketing of the same (Divineguma regional organisations) Item 9:1 Agriculture, including, agricultural extension, promotion and education for provincial purposes and agricultural services

Item 15 Market fairs

Item 10 Rural Development Item 15 Market fairs Item 21 Subject to the formulation and implementation of National Policy in regard to development and planning, the power to promote, establish and engage in agricultural, industrial, commercial and trading enterprises and other income-generating projects, within the Province Item 7:3 Rehabilitation and welfare of physically, mentally and socially handicapped persons Item 7:4 Relief of the disabled and unemployable Item 35 The borrowing of money to the extent permitted by or under any law made by Parliament

Clause 18(f) provide assistance for the social security programme being implemented by the Divineguma community based organisations (Divineguma regional organisations)

Clause 26(d) provide credit facilities to Divineguma beneficiaries (Divineguma community based banks)

Clause 31(b) invest its funds, grant credit Item 35 The borrowing of money to the extent facilities and disburse profits permitted by or under any law made by (Divinegumacommunity based banking societies) Parliament

Considering that the objectives of the Bill and the Objects, Powers and Functions of various functionaries set up under the Bill are drafted in a broad manner and also considering the impact various clauses of the Bill have on subjects reserved for Provincial Councils there is a danger that the Bill will set up an alternative structure which will allow the Central Government to bypass Provincial Councils when engaging in activities which would otherwise be carried out through Provincial Councils and thereby reduce the ability of Provincial Councils to serve the people. This will curtail the role of Provincial Councils and possibly make them redundant in the future.

3. Powers vested in the Minister The Bill provides significant powers to the Minister which are briefly explained below: 1. The Minister has the power to appoint 6 of the 11 members appointed to the Divineguma National Council (DNC) (Clause 7(2)). The DNC shall have authority over matters relating to the policy and management of the Divineguma department [Clause 7(1) and 42 (1)]. The rules made by the DNC in relation to the Divineguma department will only come into operation after being approved by the Minister [Clause 42(2)].10 2.Make regulations relating to depositing and maintaining funds of Divineguma community based organisations in Divineguma community based banks (Clause 13). 3. The Minister has the power to prescribe the registration procedure of Divineguma community based banks and Divineguma community based banking societies and any other matter in relation to such procedures [Clause 25 (2) and 29 (2)]. 4. The Minister has the power to appoint a Board of Management of the Divineguma community based banks and banking societies. The Board of Management consists of 8 members of which 5 are ex- officio and 3 are appointed directly by the Minister. Out of the ex- officio members, several are closely associated to the Minister11. The Board of Management is in charge of regulating and supervising the financial activities of the Divineguma community based banks and banking societies subject to the regulations made by the Minister (Clause 33). 5. The Minister has the power to prescribe the purposes and the manner in which the Divineguma Development Fund may be utilized (Clause 35).

10

The written submissions in SC SD 01/2012 states: This provision creates a Department outside the recognised rules of the Public Service, a Department that is regulated by an exclusive entity called Divinaguma National Council. Generally, the Departments are regulated by the Cabinet decisions, Circulars issued by Cabinet, PSC and the Department of Management Services etc. Nothing prevents from this Department not following the Financial Regulations of the Government.

11Ex

officio members include the Director General of the Department, a representative of the Secretary to the Minister of Finance, Director in charge of the banking affairs of the Department, a representative appointed by the Governor of the Central Bank of Sri Lanka and the Secretary to the Minister

6. The Minister has the power to make regulations for purposes of the Act [Clause 41 (1)] without prejudice to this general power the Minister has the power to make regulations in the following areas: a. The Constitution of Divineguma community based organisations and Divineguma regional organisations and matters connected therewith [Clause 41(1) (a) and (b)]. b. Criterion in respect of selection of Divineguma beneficiaries [Clause 41 (1) (e)]. c. Criterion to be a member of Divineguma community based organisations and community based banks [Clause 41 (1) (f)]. d. Criterion in respect of supervision, regulation and evaluation of community based organisations, community based banks and banking societies [Clause 41 (1) (g)]. e. All matters connected with Divineguma development fund and Divineguma revolving fund [Clause 41 (1) (i)]. Regulations made by the Minister will come into operation on the date of which it is published in the Gazette and have to be approved by Parliament within 3 months. The various entities established by the Bill have broad powers but will be reliant on the Minister who has powers to issue regulations and appoint individuals to key positions. Although the structures may show there is decentralisation of powers, the overwhelming control over these entities by the Minister is problematic as it consolidates power with one individual.

4. General Provisions 1. All officers and servants of the Divineguma Department are required to sign a declaration of secrecy in respect of all matters connected with the workings of the department (Clause 38) and will not be compelled to disclose information unless by a court of law or written law, thereby raising concerns of transparency and accountability of public officials. 2. The Divineguma Department or any authorized officer has the power by notice in writing to require any person to provide information requested (Clause 39). This provision is drafted in such broad language that it could be interpreted to mean that any person would be compelled to give to the department any information. 3. Any person who violates the provisions of the Divineguma Act (after it has been passed by Parliament) is liable (after a summary trial) to be punished with imprisonment or a fine (Clause 40). This provision is particularly problematic in light of the broad and vague nature of Clause 39 (requirement to give information the department requires).

5. Protection of Employment of Employees of the Existing Authorities12 1. Clause 43(e) (i) gives an option for the employees to join the Department and they would thereby become public servants. However, there is no provision in the Bill to protect their salary status. Further, there is no information whether and how existing employees are integrated into the public service. 2. In terms of Clause 43(e) (ii), if the employees opt for voluntary retirement, they would be paid such remuneration as may be prescribed by the Minister who will decide arbitrarily without any guidelines. 6. Suggested Issues for the Debate on the Bill The above sections dealt with specific provisions in the Bill that were challenged by CPA in the Supreme Court in 2012. In light of the impending debate in January 2013, CPA has listed below key issues related to the Bill that should be considered by political parties, representatives of the people, policymakers and others. The issues raised below are not merely limited to the Bill but have broader implications for democracy and devolution in Sri Lanka.

1. What is the reasoning behind the attempt to centralise power in one Individual/ institution/ level of Government? 2. The Government claims that the Bill will alleviate poverty and achieve sustainable development but is it necessary to centralise power to achieve these goals? 3. Why is the Bill attempting to undermine the Thirteenth Amendment to the Constitution which grants limited powers to the Provincial Councils? This is contrary to the Governments own rhetoric of a political settlement based on the Thirteenth Amendment Plus. 4. Wide powers are provided to the Minister in the Bill but there is no rationale provided as towhy such powers are allocated to the Minister. 5. What are the safeguards in relation to the exercise of the Ministers powers (Cabinet approval, Audit etc) and are those safeguards adequate to prevent the abuse of power (i.e during elections) and public finance? 6. Is the institutional structure that governs the proposed Divineguma Community based banks adequate in order to protect the depositors? 7. What impact will the proposed Divineguma department have on the employment and other related benefits of the existing employees of the Samurdhi Authority, the Southern Development Authority or the Udarata Development Authority?

12

This section is based on the submissions made in SC SD 01/2012

10

8. Is the scope of the proposed secrecy clause (Clause 38) justifiable in light of its stated objective of protecting the privacy of Divineguma beneficiaries? 9. The Government has in recent weeks defended the concept of the supremacy of Parliament. Does this not extend to powers of Parliament as provided in the Constitution relating to public finances? The Bill if enacted in its present form undermines Parliaments full control over public finances.

Centre for Policy Alternatives The Centre for Policy Alternatives (CPA) is an independent, non-partisan organization thatfocuses primarily on issues of governance and conflict resolution. Formed in 1996 in the firmbelief that the vital contribution of civil society to the public policy debate is in need of strengthening, CPA is committed to programmes of research and advocacy through whichpublic policy is critiqued, alternatives identified and disseminated. Address: Telephone: Web Email 24/2 28th Lane, off Flower Road, Colombo 7 +94 (11) 2565304/5/6Fax: +94 (11) 4714460 www.cpalanka.org info@cpalanka.org

11

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5795)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Project of Tax LawDokumen20 halamanProject of Tax LawRam YadavBelum ada peringkat

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Jurisprudence NotesDokumen76 halamanJurisprudence NotesAli Wassan100% (1)

- Transcript of Ninoy Aquino - Los Angeles Speech 1981Dokumen15 halamanTranscript of Ninoy Aquino - Los Angeles Speech 1981Marielle Joie PinedaBelum ada peringkat

- DemocracyDokumen24 halamanDemocracyAarón Altamirano100% (1)

- The English Civil War and Glorious RevolutionDokumen39 halamanThe English Civil War and Glorious RevolutionkaushkBelum ada peringkat

- Government For Everybody Text PDFDokumen528 halamanGovernment For Everybody Text PDFAlMostafa83% (6)

- A Critique: HIV/AIDS and The Legal and Policy Framework in Sri LankaDokumen39 halamanA Critique: HIV/AIDS and The Legal and Policy Framework in Sri LankaSanjana Hattotuwa100% (1)

- December 2013: Outreach UnitDokumen8 halamanDecember 2013: Outreach UnitSanjana HattotuwaBelum ada peringkat

- Written Submission On Behalf of The PetitionersDokumen39 halamanWritten Submission On Behalf of The PetitionersSanjana HattotuwaBelum ada peringkat

- Final Report On Election Related Violence: Provincial Council Elections 2013, Northern ProvinceDokumen75 halamanFinal Report On Election Related Violence: Provincial Council Elections 2013, Northern ProvinceSanjana HattotuwaBelum ada peringkat

- Top Line Survey Results: Democracy in Post-War Sri LankaDokumen63 halamanTop Line Survey Results: Democracy in Post-War Sri LankaSanjana Hattotuwa100% (1)

- October 2013: Outreach UnitDokumen8 halamanOctober 2013: Outreach UnitSanjana HattotuwaBelum ada peringkat

- Northern Provincial Council Election 2013 - Communiqué No 1Dokumen9 halamanNorthern Provincial Council Election 2013 - Communiqué No 1Sanjana HattotuwaBelum ada peringkat

- Northern Provincial Council Elections: Pre-Election Survey ResultsDokumen3 halamanNorthern Provincial Council Elections: Pre-Election Survey ResultsSanjana HattotuwaBelum ada peringkat

- 2013 08 31 SL HC Final PDFDokumen6 halaman2013 08 31 SL HC Final PDFSanjana HattotuwaBelum ada peringkat

- Northern Provincial Council Elections: Pre-Election Survey Results (TAMIL)Dokumen3 halamanNorthern Provincial Council Elections: Pre-Election Survey Results (TAMIL)Sanjana HattotuwaBelum ada peringkat

- Basic Safety Tips and Security Guidelines For Facebook and Web Based Social Media (Sinhala Translation)Dokumen8 halamanBasic Safety Tips and Security Guidelines For Facebook and Web Based Social Media (Sinhala Translation)Sanjana HattotuwaBelum ada peringkat

- NPC Election Survey Report - SinhalaDokumen3 halamanNPC Election Survey Report - SinhalaSampath SamarakoonBelum ada peringkat

- Black JulyDokumen144 halamanBlack JulySanjana Hattotuwa100% (2)

- When The World's Media Has Moved OnDokumen22 halamanWhen The World's Media Has Moved OnSanjana HattotuwaBelum ada peringkat

- Statement Condemning The Attack On The Masjid Deenul Islam at Grandpass, ColomboDokumen9 halamanStatement Condemning The Attack On The Masjid Deenul Islam at Grandpass, ColomboSanjana HattotuwaBelum ada peringkat

- An Opinion Survey On The LLRC Report (Sinhala)Dokumen54 halamanAn Opinion Survey On The LLRC Report (Sinhala)Sanjana HattotuwaBelum ada peringkat

- Acquisition Notices in Kilinochi and MullaitivuDokumen16 halamanAcquisition Notices in Kilinochi and Mullaitivudirector2005Belum ada peringkat

- The Impeachment of The Chief Justice, The Independence of The Judiciary and The Rule of Law in Sri LankaDokumen31 halamanThe Impeachment of The Chief Justice, The Independence of The Judiciary and The Rule of Law in Sri LankaSanjana Hattotuwa50% (2)

- Night CitizenshipDokumen28 halamanNight CitizenshipBililign GeremewBelum ada peringkat

- Rules of BusnessDokumen120 halamanRules of Busnessmuhammad yasirBelum ada peringkat

- British ConstitutionDokumen64 halamanBritish ConstitutionLegend Sam MemonBelum ada peringkat

- The Rise and Decline of European ParliamentsDokumen63 halamanThe Rise and Decline of European ParliamentsLik_No1Belum ada peringkat

- English Legal System SBAQDokumen49 halamanEnglish Legal System SBAQsalonyk101Belum ada peringkat

- Constitution of Legislatures in StatesDokumen40 halamanConstitution of Legislatures in StatesuditiBelum ada peringkat

- Check and BalanceDokumen9 halamanCheck and Balancemodicam oloyaBelum ada peringkat

- Delegated Legislation and Emergency Rule-Making in AustraliaDokumen12 halamanDelegated Legislation and Emergency Rule-Making in AustraliaJackBelum ada peringkat

- Chapter 21 Section 2 and 5Dokumen24 halamanChapter 21 Section 2 and 5api-206809924Belum ada peringkat

- Rule by Ordinance': Critical Appraisal of The Oriancne Making Power of The Centre and The StateDokumen9 halamanRule by Ordinance': Critical Appraisal of The Oriancne Making Power of The Centre and The StateNavya BhandariBelum ada peringkat

- The UK Vs US ConstitutionDokumen4 halamanThe UK Vs US ConstitutionRaja Usaf100% (1)

- The Essence of DemocracyDokumen7 halamanThe Essence of DemocracyAung Kyaw MoeBelum ada peringkat

- The Political System of The PhilippinesDokumen3 halamanThe Political System of The PhilippinesJohn Vincent De JesusBelum ada peringkat

- Pad240 LegislatureDokumen5 halamanPad240 Legislatureasyraf0% (1)

- Absolutism ConstitutionalismDokumen5 halamanAbsolutism Constitutionalismapi-282463341Belum ada peringkat

- Student Parliament ConstitutionDokumen56 halamanStudent Parliament ConstitutionJloid AmarBelum ada peringkat

- The Shifting Dynamics of Centre-State RelationshipDokumen35 halamanThe Shifting Dynamics of Centre-State RelationshipYuseer AmanBelum ada peringkat

- 110302-Question For Retired Supreme Court Justice Is A Mr. David Ashton LewisDokumen2 halaman110302-Question For Retired Supreme Court Justice Is A Mr. David Ashton LewisGerrit Hendrik Schorel-HlavkaBelum ada peringkat

- The Debate: A Tudor Revolution in Government?Dokumen4 halamanThe Debate: A Tudor Revolution in Government?pritiBelum ada peringkat

- Cameroonian Political RegimeDokumen11 halamanCameroonian Political RegimeAh SamBelum ada peringkat

- What Are The Contents of The Draft Bangsamoro Basic Law?Dokumen12 halamanWhat Are The Contents of The Draft Bangsamoro Basic Law?Office of the Presidential Adviser on the Peace Process100% (1)

- Administrative Law in BangladeshDokumen2 halamanAdministrative Law in BangladeshRayhan Zaman KhanBelum ada peringkat

- Decline of The LegislatureDokumen7 halamanDecline of The LegislatureAnonymousBelum ada peringkat