Defining International Banking

Diunggah oleh

Songs Punjabi ShareDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Defining International Banking

Diunggah oleh

Songs Punjabi ShareHak Cipta:

Format Tersedia

Defining International Banking

International banks typically have headquarters located in an area reknowned for financial operations. Fundamentally, their structure can be defined by business divisions, premises, interests and affiliates. International banking typically aims to provide services brokered by the company on a global scale.

Structure of Services

An international banking corporation will strive to provide its services first and foremost in order to increase its profits. Consequently, it is not always necessary for an international bank to structure its business around locating premises in different countries; affiliation with native businesses can often prove more beneficial.

Brokering Services

An international bank may find brokering services through a native business or company to be more beneficial. This can allow the bank to avoid costs required in building infrastructure in a new location and may utilize important local knowledge. Crucially, it also encourages compliance with legislation that governs international banking.

International Banking When a bank undertakes activities in other countries then that bank is said to be an international bank. Not all banks are or want to be international banks due to the risks attached in doing international banking. The emphasis is on the theory and practice of international banking, because of its critical importance in the modern banking framework. In this topic we understand the difference between Indian banking and international. International banking helps us to know how important international banking for the progress of India and also for the counter. It is one of the most important factors responsible for economic growth of the nation. Banks in many nations have internationalized their operation since 1970. The quantum of operation has increased in such a manner that the concept evolved into a subject in itself. The term multinational banking signifies the presence of banking facilities in more than one country. Aiber defines International banking as a subset of commercial banking transactions and activity having a cross border or cross currency element. Domestic operation such as the currency of denomination of the transaction, the residence of the bank customer and location of the banking office the range of transactions comprised by International banking can be easily distinguished. A deposit or a loan transacted in local currency between a bank in its home country and a resident of that same country is termed as pure domestic banking. History The origin of international banking dates back to the 2nd century BC when Babylonian temples safeguarded the idle funds and extended loans to merchants to finance the

movements of goods. The loans extended by the Florentine banking houses were the first instance of international lending. During the nineteenth century many innovations were witnessed in the international lending, leading to trade financing and investment banking. Trade financing started as short term lending. Of the two investments banking accounted further great bulk of the international lending and financial companies acted as agents or underwriters for the placement of funds. By 1920, American banking institutions dominated international lending, and the European nations were the major borrowers. There was perfect international banking system existing till the time of First World War. The Bretton system had installed a secured financial framework and revolutionized the economic life by creating a global shopping center. International banking speeded up after the first oil crisis in 1973. Progress in the telecommunications sector across the world supplemented the growth of international banking. TOP Reasons for the Growth of International Banking There are number of explanations or theories provided to support the growth in international banking operations. International banking theories explain the reasons behind the banks choice of a particular location for their banking facilities, maintaining a particular organizational structure, and the underlying causes of international banking. Certain theories are as such:

Follow the leader, explanations suggests that banks expand across national borders to continue to serve customers by establishing branches or subsidiaries abroad. Expansion abroad has a pervasive effect on competition. Banks use management technology and marketing knowhow developed countries for domestic uses at very marginal cost abroad. Banks can take ownership-specific and location-specific advantages while operating abroad. Market imperfections due to domestic rules, regulations and taxations along with the drastic reduction in the cost of communications prompt the banks to set up operations abroad. Inter-country differences in the cost of capital attract banks to set up their operations in different countries. The multi-lateral system of payments came into existence after the creation of the IMF and the World Bank. Resources were new raised through financial markets for financing the development projects in member countries. Effectively it

was the commercial banks which mobilized savings and channelized them to these institutions for development use.

With the introduction of the flexible exchange rate system, exchange rates were determined by market demand- supply forces. Since all transactions went through the banking system involved with International Banking were ideally placed to establish the demand supply equilibrium. The role of establishing exchange rate was therefore transferred from central banks to commercial banks. TOP

Characteristics and Dimensions Though international banking concept is quite old, it has acquired certain new characteristics and dimensions. The maturities have risen considerably and now the average maturities are about ten years. Banks have started diversifying their sources of funds along with the assets. Apart from the above, two kinds of overseas bank operations characterized international bank expansion in the late 1960s and 1970s.

A multinational consortium bank, was created by several established by parent banks, and; The shell branch, which is not really a bank but a device to get around the domestic government regulation, was created.

Features of International Banking International banks are organized in various formal and informal ways from simply holding account with each other to holding common ownership.

CORRESPONDENT BANKING This represents an informal linkage between banks and its customers in different countries. The linkage is setup when banks maintain correspondent accounts with each other and facilitates international payments and collections for customers. BANK AGENCIES The agencies mostly deal in the local currency markets and in the foreign exchange markets, arrange loans and clears cheques. FOREIGN BRANCHES These are operating banks and are subject to local banking rules and the rules at home. These branches most of the time offer quality services and safety that are provided by a large bank to the customers in small countries. TOP

Recent Trends

In the past two decades, people around the world have come across complex developments in the financial sector which have evolved gradually. The increasing domination of securities of markets by financial institutions managed by professional bankers has led to the institutionalization of markets. Globalization has affected the financial markets in the world almost entirely. Foremost among the global trends in the worlds financial industry are consolidation and convergence. These two encompass financially driven mergers within domestic market. TOP

International Monetary System TOP The Gold and Gold Bullion Standards The gold standard was the first modern international monetary system. The gold standard facilitated the free circulation between nations of gold coins of standard specification. Under this system, gold was the only standard of value. One of the major advantages of the system was in its stabilizing influence. Gold was received in payment in balance by those countries that exported more than it imported. As a result of such an injection of gold raised prices, and thus lowered the value of the domestic currency. Further, higher prices resulted in decreasing the demand for exports, a depletion of gold to pay for the relatively cheap imports, and eventually return to the original price level. This system was not free from defects. It lacked liquidity since the world's supply of money would be limited by the world's supply of gold. Moreover, any unusual increase in the supply of gold, like the discovery of a rich deposit of gold, would cause prices to rise suddenly. Then eventually, in 1914, the international gold standard broke down. Later during the 1920s the gold bullion standard took the place of gold standard. Under the gold bullion nations no longer issued gold coins but backed their currencies with gold bullion and agreed to buy and sell the bullion at a fixed price. But this system too couldnt see the day-light and was abandoned in the 1930s. TOP The Gold-Exchange System This system came into existence after World War II. Under such a system, nations peg the value of their currencies some foreign currency instead of gold, which is in turn fixed to and redeemable in gold. Many nations fixed their currencies against U.S. dollar and preserved dollar reserves in the United States, which was known as the key currency country. At the Bretton Woods international conference in 1944, a system of fixed exchange rates was adopted, and the International Monetary Fund (IMF) was created for the task of maintaining stable exchange rates on a global level.

TOP The Two-Tier System The 1960s saw the fall of the gold-exchange system because the U.S. commitments abroad drew gold reserves from the nation, confidence in the dollar diluted, causing some dollar-holding countries and speculators to exchange their dollars for gold. As a result gold reserves in U.S. started depleting and in order to correct the situation, the two-tier system was created in 1968. In this system there were two tiers:

The official tier, consisting of central bank gold traders, the value of gold was set at $35 an ounce, and gold payments to non-central bankers were prohibited. In the free-market tier, gold was completely demonetized, with its price set by supply and demand.

Gold and the U.S. dollar remained the major reserve assets for the world's central banks, although Special Drawing Rights were created as a new reserve currency. In spite of such measures, the drain on U.S. gold reserves continued and eventually in 1971 the United States was forced to abandon gold convertibility. TOP Floating Exchange Rates and Recent Developments After the fall of the gold convertibility the IMF was compelled to agree on a system of floating exchange rates. By this method the gold standard became obsolete and the values of various currencies were to be determined by the market forces. In the late 20th century, the Japanese Yen and the German Deutschmark strengthened and became increasingly important in international financial markets, whereas the U.S. dollar weakened with respect to them and diminished in importance. Moreover, the Euro was introduced in financial markets in 1999 as replacement for the currencies of 11 countries belonging to the European Union (EU). The euro replaced the European Currency Unit, which had become the second most commonly used currency after the dollar in the primary international bond market. TOP European Monetary System It is an arrangement by which most nations of the European Union (EU) associated their currencies in order to prevent fluctuations relative to one another. It came into existence in 1979 to stabilize foreign exchange and counter inflation among members. In the early 1990s this system was stressed due to the differing economic policies and conditions of its members. In 1994 the European Monetary Institute was formed as intermediary in establishing the European Central Bank (ECB) and a common currency. The ECB is responsible for setting a single monetary policy and interest rate for the adopting nations, in line with their national central banks.

At the beginning of 1999, the same EU members adopted a single currency called the Euro. It was regarded as a major step toward European political unity. A common economic policy helped the nations to put a constraint on excessive public spending, reduce debt, and make a strong attempt at soaring inflation. However, many members of the Union violated the ceilings established on the budget and deficit ceilings in part because of national government measures to stimulate economic growth. In 2003, EU finance ministers, faced with the fact that economic downturns had put France and Germany in violation of the ceilings, temporarily suspended the pact. The European Commission challenged that move, however, and the EU high court annulled the finance ministers' decision in 2004. Euro coins and notes began circulating in Jan., 2002, and local currencies were no longer accepted as legal tender two months later. The European Currency Unit (ECU), which was established in 1979, was the forerunner of the euro. Derived from a basket of varying amounts of the currencies of the EU nations, the ECU was a unit of accounting used to determine exchange rates among the national currencies. Of the European Union members, Denmark, Great Britain, and Sweden did not adopt the euro when it was introduced. Britain is the most notable, which continues to regard itself as separate from Europe. In all three nations there has been strong public anxiety that dropping their respective national currencies would give up too much independence. TOP Bretton Woods System The Bretton Woods system of monetary management established the rules for commercial and financial relations among the world's major industrial states in the mid 20th century. The Bretton Woods system was the first example of a fully negotiated monetary order intended to govern monetary relations among independent nation-states. Preparing to rebuild the international economic system as World War II was still raging, 730 delegates from all 44 Allied nations gathered at the Mount Washington Hotel in Bretton Woods, New Hampshire, United States, for the United Nations Monetary and Financial Conference. The delegates deliberated upon and signed the Bretton Woods Agreements during the first three weeks of July 1944. Setting up a system of rules, institutions, and procedures to regulate the international monetary system, the planners at Bretton Woods established the International Monetary Fund (IMF) and the International Bank for Reconstruction and Development (IBRD), which today is part of the World Bank Group. These organizations became operational in 1945 after a sufficient number of countries had ratified the agreement. The chief features of the Bretton Woods system were an obligation for each country to adopt a monetary policy that maintained the exchange rate of its currency within a fixed valueplus or minus one percentin terms of gold and the ability of the IMF to bridge temporary imbalances of payments. In the face of increasing financial strain, the system collapsed in 1971, after the United States unilaterally terminated convertibility of the dollars to gold. This action caused considerable financial stress in the world economy

and created the unique situation whereby the United States dollar became the "reserve currency" for the states which had signed the agreement. After World War I most countries wanted to return to the old financial security and stable situation of pre-war times as soon as possible. Discussions about a return to the gold standard began and by 1926 all leading economies had re-established the system, according to which every nations circulating money had to be backed by reserves of gold and foreign currencies to a certain extent. But several mistakes in implementing the gold standard (mainly that a weakened Great Britain had to take the leading part and that a number of main currencies where over- or undervalued) led to a collapse of the economic and financial relations, peaking in the Great Depression in 1929. Every single country tried to increase the competitiveness of its export products in order to reduce its payment balance deficit by deflating its currency. This strategy only led to success as long as a country was deflating faster and more strongly than all other nations. This fact resulted in an international deflation competition that caused mass unemployment, bankruptcy of enterprises and the failing of credit institutions. In the 1930s several conferences dealing with the world monetary problems caused by the Great Depression had ended in failure. But after World War II the need for a stabilizing system that avoided the mistakes, which had been made earlier, became evident. Plans were made for an innovative monetary system and a supervising institution to monitor all actions. TOP Crisis of The System In the 1960s and 1970s enduring imbalances of payments between the Western industrialized countries weakened the system of Bretton Woods. One substantial problem was that one national currency (the U.S. dollar) had to be an international reserve currency at the same time. This made the national monetary and fiscal policy of the United States free from external economic pressures, while heavily influencing those external economies. To ensure international liquidity the USA was forced to run deficits in their balance of payments, otherwise world inflation would have been caused. However, in the 1960s they ran a very inflationary policy and limited the convertibility of the U.S. dollar because the reserves were insufficient to meet the demand for their currency. The other member countries were not willing to accept the high inflation rates that the par value system would have caused and the dollar ended up being weak and unwanted, just as predicted by Greshams law: Bad money drives out good money. The system of Bretton Woods collapsed. Another fundamental problem was the delayed adjustment of the parities to changes in the economic environment of the countries. It was always a great political risk for a government to adjust the parity and each change in the par value of a major currency tended to become a crisis for the whole system. This led to a lack of trust and destabilizing speculations.

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- DHAKA - Dwayne Smith Smashed 72 Off 43 Balls Before Spinner Samuel Badree Claimed 4-15Dokumen2 halamanDHAKA - Dwayne Smith Smashed 72 Off 43 Balls Before Spinner Samuel Badree Claimed 4-15Songs Punjabi ShareBelum ada peringkat

- Bank Vs NBFCDokumen2 halamanBank Vs NBFCSongs Punjabi ShareBelum ada peringkat

- BFSI TeamDokumen1 halamanBFSI TeamSongs Punjabi ShareBelum ada peringkat

- BluestarDokumen3 halamanBluestarSongs Punjabi ShareBelum ada peringkat

- Office & Showroom SCF - 27, First Floor, DLF Industrial Area, Phase - 1, Faridabad, Haryana (121003) +91 - 129 4052525, 9582492353Dokumen1 halamanOffice & Showroom SCF - 27, First Floor, DLF Industrial Area, Phase - 1, Faridabad, Haryana (121003) +91 - 129 4052525, 9582492353Songs Punjabi ShareBelum ada peringkat

- Office & Showroom SCF - 27, First Floor, DLF Industrial Area, Phase - 1, Faridabad, Haryana (121003) +91 - 129 4052525, 9582492353Dokumen1 halamanOffice & Showroom SCF - 27, First Floor, DLF Industrial Area, Phase - 1, Faridabad, Haryana (121003) +91 - 129 4052525, 9582492353Songs Punjabi ShareBelum ada peringkat

- BluestarDokumen3 halamanBluestarSongs Punjabi ShareBelum ada peringkat

- Swot Analysis of Tata MotorsDokumen21 halamanSwot Analysis of Tata MotorsSunil SoniBelum ada peringkat

- Tata SuppliersDokumen1 halamanTata SuppliersSongs Punjabi ShareBelum ada peringkat

- Academics: 1. Don't Be Afraid of NumbersDokumen16 halamanAcademics: 1. Don't Be Afraid of NumbersSongs Punjabi ShareBelum ada peringkat

- 9 Questions Asked in The Personal InterviewDokumen2 halaman9 Questions Asked in The Personal InterviewSongs Punjabi ShareBelum ada peringkat

- EntryDokumen17 halamanEntrySongs Punjabi ShareBelum ada peringkat

- Definition of Marketing by Philip KotlerDokumen8 halamanDefinition of Marketing by Philip KotlerSongs Punjabi ShareBelum ada peringkat

- Customer Satisfaction Hyundai MotorsDokumen73 halamanCustomer Satisfaction Hyundai MotorsRajesh Kumar Bajaj80% (20)

- HTML CodesDokumen35 halamanHTML CodesSongs Punjabi ShareBelum ada peringkat

- Multinational AssignmentsDokumen4 halamanMultinational AssignmentsSongs Punjabi ShareBelum ada peringkat

- Strategies For Managing Risk in Multinational CorporationsDokumen5 halamanStrategies For Managing Risk in Multinational CorporationsSongs Punjabi ShareBelum ada peringkat

- Business StudiesDokumen20 halamanBusiness StudiesSongs Punjabi ShareBelum ada peringkat

- MBA 405: Talent Management: Faculty Name: Ms. Neetu Deptt. of MGMT StudiesDokumen264 halamanMBA 405: Talent Management: Faculty Name: Ms. Neetu Deptt. of MGMT StudiesSongs Punjabi Share100% (6)

- International MarketingDokumen3 halamanInternational MarketingAbinash TripathyBelum ada peringkat

- Electronic Payment SystemDokumen23 halamanElectronic Payment SystemSongs Punjabi ShareBelum ada peringkat

- HR AL PG ADM F 06101 Supplier Profile Form1Dokumen3 halamanHR AL PG ADM F 06101 Supplier Profile Form1Songs Punjabi ShareBelum ada peringkat

- Bba Bvusde Project GuidelinesDokumen9 halamanBba Bvusde Project GuidelinesSongs Punjabi ShareBelum ada peringkat

- Britannia - Project ReportDokumen32 halamanBritannia - Project ReportHelpdesk77% (44)

- Challenges Faced by International AdvertisingDokumen28 halamanChallenges Faced by International AdvertisingSongs Punjabi Share75% (4)

- Supply Chain MangemenrDokumen1 halamanSupply Chain MangemenrSongs Punjabi ShareBelum ada peringkat

- Prof. DG JHADokumen13 halamanProf. DG JHAnikvysBelum ada peringkat

- Chapter 2: GLOBALISATION: Q.1.Globalisation of Indian BusinessDokumen5 halamanChapter 2: GLOBALISATION: Q.1.Globalisation of Indian BusinessdigvijaymisalBelum ada peringkat

- Business Policy Strategic AnalysisDokumen31 halamanBusiness Policy Strategic AnalysisSongs Punjabi ShareBelum ada peringkat

- Integrated Live Project On Bharti Airtel "Study On Brand Positioning of Airtel"Dokumen54 halamanIntegrated Live Project On Bharti Airtel "Study On Brand Positioning of Airtel"Dipika Daryani100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Jcsgo Christian Academy: Senior High School DepartmentDokumen4 halamanJcsgo Christian Academy: Senior High School DepartmentFredinel Malsi ArellanoBelum ada peringkat

- Modigliani & Miller Capital Structure TheoryDokumen2 halamanModigliani & Miller Capital Structure TheoryJoao Mariares de VasconcelosBelum ada peringkat

- Analysis of Section 139 A IT Act 1961Dokumen13 halamanAnalysis of Section 139 A IT Act 1961padam jainBelum ada peringkat

- Modes of Extinguishment of ObligationDokumen20 halamanModes of Extinguishment of ObligationJohn Kayle BorjaBelum ada peringkat

- Sardar Patel Shikshan Samiti and Ors Vs State of UPDokumen7 halamanSardar Patel Shikshan Samiti and Ors Vs State of UPAbhay GuptaBelum ada peringkat

- Jan 2012Dokumen120 halamanJan 2012tejpalBelum ada peringkat

- MCQ On Accounting Concept and PrincipalDokumen6 halamanMCQ On Accounting Concept and Principalmohit pandeyBelum ada peringkat

- Report - Solar Power Plant - Financial Modeling PrimerDokumen48 halamanReport - Solar Power Plant - Financial Modeling Primeranimeshsaxena83100% (3)

- Types of Dividend PolicyDokumen7 halamanTypes of Dividend PolicyRakibul Islam JonyBelum ada peringkat

- Chapter 9 Project Cash FlowsDokumen28 halamanChapter 9 Project Cash FlowsGovinda AgrawalBelum ada peringkat

- B40Dokumen7 halamanB40ambujg0% (1)

- 203 Final Fall 2010 Answers POSTDokumen15 halaman203 Final Fall 2010 Answers POSTJonathan RuizBelum ada peringkat

- Namma Kalvi 12th Commerce Study Material em 215328Dokumen74 halamanNamma Kalvi 12th Commerce Study Material em 215328Aakaash C.K.100% (2)

- How Much Commission Mutual Fund Agent GetsDokumen19 halamanHow Much Commission Mutual Fund Agent GetsjvmuruganBelum ada peringkat

- Cash and Cash Equivalent LatestDokumen53 halamanCash and Cash Equivalent LatestxagocipBelum ada peringkat

- Assignment QuestionsDokumen12 halamanAssignment QuestionsyogendradilwalaBelum ada peringkat

- Inside JobDokumen4 halamanInside JobAvinash ChandraBelum ada peringkat

- How To Buy CryptocurrenciesDokumen2 halamanHow To Buy CryptocurrenciesObinna ObiefuleBelum ada peringkat

- DLN Acquisitions 67 2015-03-LibreDokumen34 halamanDLN Acquisitions 67 2015-03-LibreMuntean GabrielaBelum ada peringkat

- Year 1 2 3 4 Sales Volume (Units/year) 350,000 380,000 400,000 400,000Dokumen13 halamanYear 1 2 3 4 Sales Volume (Units/year) 350,000 380,000 400,000 400,000সৈকত হাবীবBelum ada peringkat

- Inventory ManagementDokumen109 halamanInventory ManagementsreevardhanBelum ada peringkat

- Forward Rate Agreement NotesDokumen4 halamanForward Rate Agreement NotesSangram PandaBelum ada peringkat

- Fi 19Dokumen9 halamanFi 19priyanshu.goel1710Belum ada peringkat

- Chapter Eight Interest Rate Risk I: Chapter Outline The Level and Movement of Interest Rates The Repricing ModelDokumen27 halamanChapter Eight Interest Rate Risk I: Chapter Outline The Level and Movement of Interest Rates The Repricing ModelMuhammad Uzair ShahBelum ada peringkat

- Banking Amendment Act 2012Dokumen26 halamanBanking Amendment Act 2012jaspreet444Belum ada peringkat

- SecuritizationDokumen15 halamanSecuritizationAnkit LakhotiaBelum ada peringkat

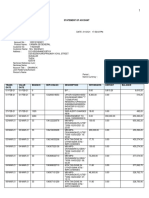

- Statement of AccountDokumen5 halamanStatement of Accountmutaia pandian100% (1)

- 1 30 2012 4Dokumen546 halaman1 30 2012 4Dante FilhoBelum ada peringkat

- The HistoricalEvolutionofCentral BankingDokumen25 halamanThe HistoricalEvolutionofCentral Bankingmansavi bihaniBelum ada peringkat

- External Users of AccountingDokumen3 halamanExternal Users of AccountingMarko Zero FourBelum ada peringkat