Financial Planing

Diunggah oleh

Abhishek PramanikJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Financial Planing

Diunggah oleh

Abhishek PramanikHak Cipta:

Format Tersedia

Client Data Collection Form

Important Notice to Customers The Corporations Law requires that a Financial Planner making financial product recommendations must have reasonable grounds for making those recommendations. This means that a Financial Planner must conduct appropriate investigations as to the financial objectives, situation and particular needs of the customer. The information requested in this form is necessary to enable recommendations to be made and will be used solely for that purpose. We accept no liability for any advice given on the basis of inaccurate or incomplete information. Privacy Statement This Client Data Collection Form is strictly confidential between you and AXIS Investment Centre Pty Ltd

PRIVATE AND CONFIDENTIAL Client Name:_________________________________________________ Financial Planner:____________________________________________ Date of initial interview: _______________________________________

Disclaimer The information contained in this document is for the exclusive use of Axis Investment Centre Pty Ltd. Any use or copying of this information is prohibited unless prior written consent has been provided by the management of Axis Investment Centre Pty Ltd. Copyright Coin Financial Software Australia 2004

Client Data Collection Form

Key Details

Item Date FSG Provided Date of First Appointment Reference Description

Personal Details

Client 1 Title Full Name Sex Marital Status Date of Birth Age To Retire Private Health Insurance Risk Profile Client 2

Contact Details

Client 1 Address Type Street Address Home / Business / Other Client 2 Home / Business / Other

Suburb State Postcode Phone (w) Phone (h) Phone (m) Fax Email (primary) Email (secondary)

Employment Details

Client 1 Occupation Type Employee Self Employed Client 2 Employee Self Employed

25/02/2008

Page 2 of 12

Client Data Collection Form Unemployed Retired Not Applicable Occupation Employer Date Commenced Current Employment Unemployed Retired Not Applicable

Child Details

Child's Name DOB Sex Financially Dependent Dependent Til Age Income

Male Female Male Female

Yes No Yes No

Estate Details

Client 1 Last Review Date Next Review Date Importance of Estate Planning? Low Medium High Yes No Yes No Low Medium High Yes No Yes No Client 2

Do you have a Will?

Is the Will current?

What is the date of the Will? Where is the Will located? Does the Will include provision for a testamentary trust? Yes No Yes No

Power of Attorney Entity Client 1 Client 2 Client 1 Client 2

Type of PoA Name of PoA Relationship Expiry Date Last Reviewed Location

25/02/2008

Page 3 of 12

Client Data Collection Form

Other Details

Client 1 Liquidity Requirement Retirement Income Requirement Health Good Average Poor Yes No Yes No Good Average Poor Yes No Yes No Client 2

Smoker

Australian Resident

No. years in Australia

Objectives

Tax Effective Wealth Accumulation Target Retirement Income of _____ pa after tax Consider Risk and Return Portfolio Liquidity of ____ Wealth Accumulation for Retirement Tax Effectiveness Investment Flexibility Target Retirement at Age of _____ Convenient Investment Management Portfolio Diversification Planned Capital Expenditure Retirement Investment Timeframe Achieve Capital Growth

Other Objectives

Entity Objective Description

25/02/2008

Page 4 of 12

Client Data Collection Form

Entities

Self Managed Super Fund Name Trustee Type Approved trustee All members are trustees Corporate trustee Investment Strategy Held Yes No Superfund Members

Company Name Company Purpose Business Consulting Investment Creditor Protection Other No. Employees Shareholders Include in Advice Yes No

Trust Name Trust Type Discretionary Testamentary Fixed Hybrid Other Trustee Beneficiaries Include in Advice Yes No

Professional Advisers

Professional Adviser Type Solicitor Accountant Insurance Adviser Other Name Company Address Phone

25/02/2008

Page 5 of 12

Client Data Collection Form Referral Source Type Solicitor Accountant Insurance Advisor Existing Client Other Name Company Address Phone

Comments

Comments

25/02/2008

Page 6 of 12

Client Data Collection Form

Financial Details

Investment Assets

Investment Assets - Non-Superannuation Current Value Owner Regular Investment / Withdrawals

Total

Investment Assets - Superannuation

Current Value

Owner

ESD

Components Contributions

Total

Lifestyle Assets

Lifestyle Asset Current Value Owner

Total

Loans

Liability Amount Owner Lender Interest Rate Repayment

Total

25/02/2008

Page 7 of 12

Client Data Collection Form

Cashflow

Annual Income & Expenses Client 1 Annual Income Employment income Other taxable income Other non-taxable income Centrelink/DVA Total Income Reportable fringe benefits Tax deductible expenses Annual Expenses Mortgage repayments/rent Vehicle lease/loan repayments Vehicle registration and insurance Fuel and servicing Council rates Electricity Gas Telephone/mobile/internet Childrens education Health insurance/other medical Home and contents insurance Life/income protection insurance Accounting/legal fees Groceries Clothing Entertainment Memberships/subscriptions Voluntary super contributions Donations Holidays Gifts Other Total Expenses Joint Client 2

25/02/2008

Page 8 of 12

Client Data Collection Form Other / Irregular Income Income Item Inheritance Part-time retirement income House downgrade Other________________ Entity Client Spouse Joint Date Received Frequency Amount Taxable Yes No

Other / Irregular Expense Expense Item Boat purchase Car purchase Education Holiday Home renovations Other _______________ Client Spouse Joint Entity Date Incurred Frequency Amount

Insurance

Policy Type Level of Cover Insured Premium

Annuities

Owner Product Purchase Date ESD RCV Reversion'y Yes No Current Balance Annuity Amount Indexation

Termination Payments

Annual Leave Owner Description ETP Date Amount Leave Type Normal Special

25/02/2008

Page 9 of 12

Client Data Collection Form Redundancy Owner Redundancy Type Redundancy Ex Gratia Golden Handshake Other ETP Date Eligible Service Date Amount

Long Service Leave Owner Description ETP Date Eligible Service Date Amount Leave Type Normal Special

Defined Benefits

Owner Description Accrued Multiple Accrual Rate Super Salary

25/02/2008

Page 10 of 12

Client Data Collection Form

Risk Profile Questionnaire

1. How long do you intend to invest your savings? a) short term (1-2 years) b) medium term (2-5 years) c) medium to long term (5-7 years) d) long term (more than 7 years) 2. Will you need to access these funds during the term of the investment? a) b) 3. Yes No (1 point) (2 points) (1 point) (2 points) (3 points) (4 points)

Inflation erodes the value of your savings. Growth investing can counter the eroding effect of inflation but will also expose you to the risk of short-term losses. a) b) c) I am comfortable with this trade off to beat inflation I am conscious of the risks inflation presents, but would prefer a middle ground Inflation may erode my savings but I have no tolerance for loss (3 points) (2 points) (1 point)

4.

Which of the following risk/return scenarios would you be most comfortable with? a) b) c) d) Low risk/return (maximum return 6% p.a, minimum return 3% p.a.) Moderate risk/return (maximum return 8% p.a, minimum return -5% p.a.) Above average risk/return (maximum return 12% p.a, minimum return -10% p.a.) High risk/return (maximum return 20% p.a, minimum return -25% p.a.) (1 point) (2 points) (3 points) (4 points)

5.

What would you do if your investment dropped in value by 15%? a) b) c) d) move the entire investment to cash move some of the investment to cash do nothing buy more of the investment (1 point) (2 points) (3 points) (4 points)

6.

What is the most aggressive investment you have ever made? a) b) c) d) e) Shares Managed Funds Investment property Own home Cash in the bank/Term deposit (5 points) (4 points) (3 points) (2 points) (1 point)

7.

If you were investing in a share portfolio, which of the following would suit you best? a) b) c) d) A portfolio of potentially high-returning shares whose value could rise or fall dramatically (4 points) A blue chip portfolio that pays regular dividends A mixture of the above two options I am not interested in shares. (3 points) (2 points) (1 point)

Total points:

__________

25/02/2008

Page 11 of 12

Client Data Collection Form Associated Risk Profile: Conservative (less than 10 points) Moderately Conservative (between 10 and 13 points) Balanced (between 14 and 17 points) Growth (between 18 and 21 points) High Growth (between 22 and 25 points)

Do you agree with this assessment of your risk profile? _________________________________

If not, what do you believe your risk profile should be? __________________________________

Client Acknowledgement

The information provided in this fact find and attachments is complete and accurate to the best of my knowledge. I/we understand that any investment made or policy purchased without the completion of this fact find, or following partial or inaccurate completion may not be appropriate to my/our needs. I/we appreciate that, in these circumstances I/we may lose the risk to seek compensation from Axis Investment Centre Pty Ltd for any loss suffered by me/us as a consequence of incomplete or inaccurate information being provided. I/we also acknowledge that personal circumstances can change and will contact the adviser when or if this occurs.

We understand that there will be a fee of $__________ incurred for the preparation of any such strategic financial plan.

CLIENT 1 SIGNATURE: _______________________________________________________

DATE: __________________

CLIENT 2 SIGNATURE: _______________________________________________________

DATE: __________________

25/02/2008

Page 12 of 12

Anda mungkin juga menyukai

- The C Unch: Economic IndicatorsDokumen9 halamanThe C Unch: Economic IndicatorsAbhishek PramanikBelum ada peringkat

- FAPDokumen12 halamanFAPAnokye AdamBelum ada peringkat

- Rural MarketingDokumen52 halamanRural MarketingAbhishek PramanikBelum ada peringkat

- Davesh NHPC Project FINALDokumen44 halamanDavesh NHPC Project FINALAbhishek PramanikBelum ada peringkat

- Colgate (Brand Management)Dokumen18 halamanColgate (Brand Management)Abhishek PramanikBelum ada peringkat

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Asset Management 2011-12 PDFDokumen36 halamanAsset Management 2011-12 PDFAbhishek PramanikBelum ada peringkat

- EDBM Workbook PDFDokumen59 halamanEDBM Workbook PDFsnehachandan91Belum ada peringkat

- 4 P's of MarketingDokumen12 halaman4 P's of MarketingAbhishek PramanikBelum ada peringkat

- Investment Management (Lupin LTD.)Dokumen17 halamanInvestment Management (Lupin LTD.)Abhishek PramanikBelum ada peringkat

- Hul Internet MarketingDokumen3 halamanHul Internet MarketingAbhishek PramanikBelum ada peringkat

- Strategic Information Systems: Group - 3Dokumen15 halamanStrategic Information Systems: Group - 3Abhishek PramanikBelum ada peringkat

- Project FinanceDokumen8 halamanProject FinanceAbhishek PramanikBelum ada peringkat

- Economic Optimization ProcessDokumen14 halamanEconomic Optimization ProcessAbhishek PramanikBelum ada peringkat

- Empowerment: Some Practical Questions & AnswersDokumen13 halamanEmpowerment: Some Practical Questions & AnswersAbhishek Pramanik100% (1)

- Performance AppraisalDokumen31 halamanPerformance AppraisalAbhishek PramanikBelum ada peringkat

- AccreditationDokumen20 halamanAccreditationAbhishek PramanikBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Take Private Profit Out of Medicine: Bethune Calls for Socialized HealthcareDokumen5 halamanTake Private Profit Out of Medicine: Bethune Calls for Socialized HealthcareDoroteo Jose Station100% (1)

- Model:: Powered by CUMMINSDokumen4 halamanModel:: Powered by CUMMINSСергейBelum ada peringkat

- SD Electrolux LT 4 Partisi 21082023Dokumen3 halamanSD Electrolux LT 4 Partisi 21082023hanifahBelum ada peringkat

- Arizona Supreme CT Order Dismisses Special ActionDokumen3 halamanArizona Supreme CT Order Dismisses Special Actionpaul weichBelum ada peringkat

- Leg Wri FInal ExamDokumen15 halamanLeg Wri FInal ExamGillian CalpitoBelum ada peringkat

- Elaspeed Cold Shrink Splices 2010Dokumen3 halamanElaspeed Cold Shrink Splices 2010moisesramosBelum ada peringkat

- Excavator Loading To Truck TrailerDokumen12 halamanExcavator Loading To Truck TrailerThy RonBelum ada peringkat

- Overhead Door Closers and Hardware GuideDokumen2 halamanOverhead Door Closers and Hardware GuideAndrea Joyce AngelesBelum ada peringkat

- Computers As Components 2nd Edi - Wayne WolfDokumen815 halamanComputers As Components 2nd Edi - Wayne WolfShubham RajBelum ada peringkat

- Account STMT XX0226 19122023Dokumen13 halamanAccount STMT XX0226 19122023rdineshyBelum ada peringkat

- Geneva IntrotoBankDebt172Dokumen66 halamanGeneva IntrotoBankDebt172satishlad1288Belum ada peringkat

- Circular 09/2014 (ISM) : SubjectDokumen7 halamanCircular 09/2014 (ISM) : SubjectDenise AhrendBelum ada peringkat

- Tyron Butson (Order #37627400)Dokumen74 halamanTyron Butson (Order #37627400)tyron100% (2)

- Quezon City Department of The Building OfficialDokumen2 halamanQuezon City Department of The Building OfficialBrightNotes86% (7)

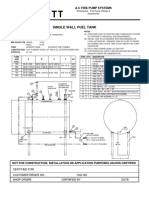

- Single Wall Fuel Tank: FP 2.7 A-C Fire Pump SystemsDokumen1 halamanSingle Wall Fuel Tank: FP 2.7 A-C Fire Pump Systemsricardo cardosoBelum ada peringkat

- MsgSpec v344 PDFDokumen119 halamanMsgSpec v344 PDFqweceBelum ada peringkat

- Complaint Handling Policy and ProceduresDokumen2 halamanComplaint Handling Policy and Proceduresjyoti singhBelum ada peringkat

- Lorilie Muring ResumeDokumen1 halamanLorilie Muring ResumeEzekiel Jake Del MundoBelum ada peringkat

- 50TS Operators Manual 1551000 Rev CDokumen184 halaman50TS Operators Manual 1551000 Rev CraymondBelum ada peringkat

- Course Syllabus: Aurora Pioneers Memorial CollegeDokumen9 halamanCourse Syllabus: Aurora Pioneers Memorial CollegeLorisa CenizaBelum ada peringkat

- Create A Gmail Account in Some Simple StepsDokumen9 halamanCreate A Gmail Account in Some Simple Stepsptjain02Belum ada peringkat

- Logistic Regression to Predict Airline Customer Satisfaction (LRCSDokumen20 halamanLogistic Regression to Predict Airline Customer Satisfaction (LRCSJenishBelum ada peringkat

- Social EnterpriseDokumen9 halamanSocial EnterpriseCarloBelum ada peringkat

- Chapter 6: Structured Query Language (SQL) : Customer Custid Custname OccupationDokumen16 halamanChapter 6: Structured Query Language (SQL) : Customer Custid Custname OccupationSarmila MahendranBelum ada peringkat

- Module 5Dokumen10 halamanModule 5kero keropiBelum ada peringkat

- CTS experiments comparisonDokumen2 halamanCTS experiments comparisonmanojkumarBelum ada peringkat

- 1st Exam Practice Scratch (Answer)Dokumen2 halaman1st Exam Practice Scratch (Answer)Tang Hing Yiu, SamuelBelum ada peringkat

- Dinsmore - Gantt ChartDokumen1 halamanDinsmore - Gantt Chartapi-592162739Belum ada peringkat

- BRD TemplateDokumen4 halamanBRD TemplateTrang Nguyen0% (1)

- Qatar Airways E-ticket Receipt for Travel from Baghdad to AthensDokumen1 halamanQatar Airways E-ticket Receipt for Travel from Baghdad to Athensمحمد الشريفي mohammed alshareefiBelum ada peringkat