IRS Publication Form 8594

Diunggah oleh

Francis Wolfgang UrbanHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

IRS Publication Form 8594

Diunggah oleh

Francis Wolfgang UrbanHak Cipta:

Format Tersedia

Form (Rev.

December 2012)

8594

Asset Acquisition Statement

Under Section 1060

Attach to your income tax return. Information about Form 8594 and its separate instructions is at www.irs.gov/form8594

OMB No. 1545-1021 Attachment Sequence No.

Department of the Treasury Internal Revenue Service

169

Name as shown on return

Identifying number as shown on return

Check the box that identifies you: Purchaser Seller

Part I

1

General Information

Other partys identifying number

Name of other party to the transaction

Address (number, street, and room or suite no.)

City or town, state, and ZIP code

Date of sale

3 Total sales price (consideration)

Part II

4 Class I Class II Class III Class IV Class V

Original Statement of Assets Transferred

Assets Aggregate fair market value (actual amount for Class I) Allocation of sales price

$ $ $ $ $ $

$ $ $ $ $ $

Class VI and VII

Total $ $ 5 Did the purchaser and seller provide for an allocation of the sales price in the sales contract or in another written document signed by both parties? . . . . . . . . . . . . . . . . . . . . . . If Yes, are the aggregate fair market values (FMV) listed for each of asset Classes I, II, III, IV, V, VI, and VII the amounts agreed upon in your sales contract or in a separate written document? . . . . . . . .

Yes

No

Yes

No

6 In the purchase of the group of assets (or stock), did the purchaser also purchase a license or a covenant not to compete, or enter into a lease agreement, employment contract, management contract, or similar arrangement with the seller (or managers, directors, owners, or employees of the seller)? . . . . . . If Yes, attach a statement that specifies (a) the type of agreement and (b) the maximum amount of consideration (not including interest) paid or to be paid under the agreement. See instructions. For Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 63768Z

Yes

No

Form 8594 (Rev. 12-2012)

Form 8594 (Rev. 12-2012)

Page

Part III Supplemental StatementComplete only if amending an original statement or previously filed supplemental statement because of an increase or decrease in consideration. See instructions.

7 Tax year and tax return form number with which the original Form 8594 and any supplemental statements were filed.

8 Class I Class II

Assets

Allocation of sales price as previously reported

Increase or (decrease)

Redetermined allocation of sales price

$ $ $ $ $ $

$ $ $ $ $ $

$ $ $ $ $ $ $

Class III Class IV Class V Class VI and VII

Total $ 9 Reason(s) for increase or decrease. Attach additional sheets if more space is needed.

Form 8594 (Rev. 12-2012)

Anda mungkin juga menyukai

- Construction Liens for the Pacific Northwest Alaska Idaho Oregon Washington Federal Public Works: A PrimerDari EverandConstruction Liens for the Pacific Northwest Alaska Idaho Oregon Washington Federal Public Works: A PrimerBelum ada peringkat

- US Internal Revenue Service: p4485Dokumen53 halamanUS Internal Revenue Service: p4485IRSBelum ada peringkat

- Client Request FormDokumen1 halamanClient Request FormDenald Paz100% (1)

- Lord Diplock in Att-Gen v. Times Newspapers Ltd. (1974) JusticeDokumen1 halamanLord Diplock in Att-Gen v. Times Newspapers Ltd. (1974) Justicecolin8790Belum ada peringkat

- IRS Publication Form 706 GSTDokumen3 halamanIRS Publication Form 706 GSTFrancis Wolfgang UrbanBelum ada peringkat

- US Internal Revenue Service: Irb04-43Dokumen27 halamanUS Internal Revenue Service: Irb04-43IRSBelum ada peringkat

- IRS Agents Can Get Cash Awards For Making Your Life A LIVING HELLDokumen41 halamanIRS Agents Can Get Cash Awards For Making Your Life A LIVING HELLBob HurtBelum ada peringkat

- Public Records Complaint Filed Against Perry TownshipDokumen19 halamanPublic Records Complaint Filed Against Perry TownshipFinney Law Firm, LLC100% (1)

- Our Qui Tam Lawsuit Against CVSDokumen3 halamanOur Qui Tam Lawsuit Against CVSBehn and Wyetzner, CharteredBelum ada peringkat

- Kermick Trammell, Sr. v. George Trammell, III, 3rd Cir. (2012)Dokumen4 halamanKermick Trammell, Sr. v. George Trammell, III, 3rd Cir. (2012)Scribd Government DocsBelum ada peringkat

- Fraudulent AssignmentDokumen2 halamanFraudulent AssignmentBrian KissingerBelum ada peringkat

- 6/3/19 Memorandum of Law in Support of Plaintiff's Opposition To Attorney General's Rule 12 (B) Motion To DismissDokumen36 halaman6/3/19 Memorandum of Law in Support of Plaintiff's Opposition To Attorney General's Rule 12 (B) Motion To DismissPaul MaraveliasBelum ada peringkat

- 2018-480 Notice 83827 E40BDokumen6 halaman2018-480 Notice 83827 E40BOneNationBelum ada peringkat

- Opposition To Motion To DismissDokumen11 halamanOpposition To Motion To DismissDavid T Saint AlbansBelum ada peringkat

- Unsworn Statement NLRC Case LawDokumen2 halamanUnsworn Statement NLRC Case Lawbatusay575Belum ada peringkat

- US District Court Complaint Against HSBC Mortgage CorporationDokumen58 halamanUS District Court Complaint Against HSBC Mortgage CorporationLishabi BriggsBelum ada peringkat

- California Attorney General's ComplaintDokumen19 halamanCalifornia Attorney General's Complaintjon_ortizBelum ada peringkat

- Lecates v. Barker, 10th Cir. (2000)Dokumen9 halamanLecates v. Barker, 10th Cir. (2000)Scribd Government DocsBelum ada peringkat

- Federacion de Maestr v. Junta de Relaciones, 410 F.3d 17, 1st Cir. (2005)Dokumen16 halamanFederacion de Maestr v. Junta de Relaciones, 410 F.3d 17, 1st Cir. (2005)Scribd Government DocsBelum ada peringkat

- Tooisgah v. United States, 186 F.2d 93, 10th Cir. (1950)Dokumen18 halamanTooisgah v. United States, 186 F.2d 93, 10th Cir. (1950)Scribd Government Docs100% (1)

- United States Court of Appeals, Tenth CircuitDokumen4 halamanUnited States Court of Appeals, Tenth CircuitScribd Government DocsBelum ada peringkat

- Pasulka ARDC ComplaintDokumen11 halamanPasulka ARDC ComplaintChris HackerBelum ada peringkat

- 55 - Gov - Uscourts.ord.124749.55.0Dokumen4 halaman55 - Gov - Uscourts.ord.124749.55.0Freeman LawyerBelum ada peringkat

- Chapter 4 Variation of TrustsDokumen3 halamanChapter 4 Variation of TrustsChan Yee ChoyBelum ada peringkat

- Monthly Tax Return For Wagers: (Section 4401 of The Internal Revenue Code)Dokumen4 halamanMonthly Tax Return For Wagers: (Section 4401 of The Internal Revenue Code)IRSBelum ada peringkat

- HON ANG: WordsDokumen45 halamanHON ANG: WordsakashBelum ada peringkat

- Notice To VacateDokumen3 halamanNotice To VacateChariseB2012Belum ada peringkat

- Court Book Index Defendants Solicitor PDFDokumen2 halamanCourt Book Index Defendants Solicitor PDFAnonymous ykCaKMhjWBelum ada peringkat

- Criminal Complaint Patrick LaloneDokumen7 halamanCriminal Complaint Patrick LaloneABC Action NewsBelum ada peringkat

- N1 Claim Form Against Swansea UniversityDokumen2 halamanN1 Claim Form Against Swansea UniversityJonathan BishopBelum ada peringkat

- Bradford Exchange Lien UccDokumen2 halamanBradford Exchange Lien Uccstephen williamsBelum ada peringkat

- Declaration of Abandonment of Declared Homestead: Recording Requested By: and When Recorded, Mail ToDokumen1 halamanDeclaration of Abandonment of Declared Homestead: Recording Requested By: and When Recorded, Mail TohramcorpBelum ada peringkat

- Emergency MotionDokumen11 halamanEmergency MotionGRANADAFRAUDBelum ada peringkat

- 11 11 10 Complaint Filed by Lee Momient Against Judges and ClerksDokumen11 halaman11 11 10 Complaint Filed by Lee Momient Against Judges and ClerksFlava Works100% (1)

- Complaint: Federal Trade Commission (FTC) : Complaints Against Sean Hannity, Freedom Concerts and Freedom Alliance: 3/29/10 - FTC Complaint CitationsDokumen254 halamanComplaint: Federal Trade Commission (FTC) : Complaints Against Sean Hannity, Freedom Concerts and Freedom Alliance: 3/29/10 - FTC Complaint CitationsCREWBelum ada peringkat

- Affidavit For Criminal Complaint Against Bank of America-8pgsDokumen8 halamanAffidavit For Criminal Complaint Against Bank of America-8pgsJOSHUA TASKBelum ada peringkat

- Attorney General On Quo WarrantoDokumen9 halamanAttorney General On Quo WarrantolegalmattersBelum ada peringkat

- J. Ranjan OrderDokumen37 halamanJ. Ranjan OrderLaw&Crime100% (1)

- What Is A MortgageDokumen6 halamanWhat Is A MortgagekrishnaBelum ada peringkat

- Tax Exempt PDFDokumen2 halamanTax Exempt PDFLj Perrier100% (1)

- Watchung Hills Regional High School District LawsuitDokumen40 halamanWatchung Hills Regional High School District LawsuitAlexis TarraziBelum ada peringkat

- Motion For Leave 1Dokumen6 halamanMotion For Leave 1Myers, Boebel and MacLeod L.L.P.Belum ada peringkat

- Not PrecedentialDokumen5 halamanNot PrecedentialScribd Government DocsBelum ada peringkat

- Supreme CRT Stilp v. KaneDokumen14 halamanSupreme CRT Stilp v. KanePennLiveBelum ada peringkat

- U.S. Customs Form: CBP Form 3485 - Lien NoticeDokumen1 halamanU.S. Customs Form: CBP Form 3485 - Lien NoticeCustoms FormsBelum ada peringkat

- "COMPANY NAME" Business Plan: (Tagline or Philosophy) Add A Photo or Personal Design (Optional)Dokumen12 halaman"COMPANY NAME" Business Plan: (Tagline or Philosophy) Add A Photo or Personal Design (Optional)moBelum ada peringkat

- Village of Goodfield Annexation ProcedureDokumen2 halamanVillage of Goodfield Annexation ProcedureHelpin HandBelum ada peringkat

- Streamlined Filing Compliance Procedures For Non-Resident, Non-Filer Taxpayers QuestionnaireDokumen2 halamanStreamlined Filing Compliance Procedures For Non-Resident, Non-Filer Taxpayers QuestionnaireTuan HoangBelum ada peringkat

- SLM Corp: Prospectus Filed Pursuant To Rule 424 (B) (5) Filed On 01/24/2012Dokumen70 halamanSLM Corp: Prospectus Filed Pursuant To Rule 424 (B) (5) Filed On 01/24/2012avico510100% (1)

- The Power of An Agent To Delegate His AuthorityDokumen27 halamanThe Power of An Agent To Delegate His Authoritybijuprasad100% (1)

- Court of Chancery of The State of DelawareDokumen13 halamanCourt of Chancery of The State of DelawareNate Tobik100% (1)

- John Doe Agency v. John Doe Corp., 493 U.S. 146 (1989)Dokumen16 halamanJohn Doe Agency v. John Doe Corp., 493 U.S. 146 (1989)Scribd Government DocsBelum ada peringkat

- NY FCA Complaint - ProposedDokumen14 halamanNY FCA Complaint - ProposedAvram100% (1)

- Innocent Owner Defense in Forfeiture Cases (Texas)Dokumen5 halamanInnocent Owner Defense in Forfeiture Cases (Texas)Charles B. "Brad" FryeBelum ada peringkat

- Miller Et Al V Homecomings FinDokumen22 halamanMiller Et Al V Homecomings FinA. CampbellBelum ada peringkat

- Stipulation and Protective Order (Qualcomm-Qorvo, Middle District of North Carolina)Dokumen8 halamanStipulation and Protective Order (Qualcomm-Qorvo, Middle District of North Carolina)Florian MuellerBelum ada peringkat

- Answer 3 Security Questions for ARC VerificationDokumen1 halamanAnswer 3 Security Questions for ARC VerificationTheLite WithinBelum ada peringkat

- Civil Government of Virginia: A Text-book for Schools Based Upon the Constitution of 1902 and Conforming to the Laws Enacted in Accordance TherewithDari EverandCivil Government of Virginia: A Text-book for Schools Based Upon the Constitution of 1902 and Conforming to the Laws Enacted in Accordance TherewithBelum ada peringkat

- Generally Accepted Auditing Standards A Complete Guide - 2020 EditionDari EverandGenerally Accepted Auditing Standards A Complete Guide - 2020 EditionBelum ada peringkat

- Shed Material List Part (1 of 9)Dokumen2 halamanShed Material List Part (1 of 9)nwright_besterBelum ada peringkat

- Shed PlansDokumen1 halamanShed PlansFrancis Wolfgang UrbanBelum ada peringkat

- Figure A Trusses: Inner (Common) Truss (9 Req'd)Dokumen1 halamanFigure A Trusses: Inner (Common) Truss (9 Req'd)Francis Wolfgang UrbanBelum ada peringkat

- 15 Foot SailDokumen4 halaman15 Foot SailjdogheadBelum ada peringkat

- Shed PlansDokumen1 halamanShed PlansFrancis Wolfgang Urban50% (2)

- 6 Inch Reflector PlansDokumen12 halaman6 Inch Reflector PlansSektordrBelum ada peringkat

- Shed PlansDokumen1 halamanShed PlansFrancis Wolfgang UrbanBelum ada peringkat

- Figure E Small Roof: 2x4 Nailers 2x4 Rafter 2x4 Subfascia 1x2 Fascia Trim 24" 32" 29-3/4"Dokumen1 halamanFigure E Small Roof: 2x4 Nailers 2x4 Rafter 2x4 Subfascia 1x2 Fascia Trim 24" 32" 29-3/4"Francis Wolfgang UrbanBelum ada peringkat

- Shed PlansDokumen1 halamanShed PlansFrancis Wolfgang UrbanBelum ada peringkat

- Shed PlansDokumen1 halamanShed PlansFrancis Wolfgang UrbanBelum ada peringkat

- 25 Foot CabinDokumen28 halaman25 Foot Cabinapi-3708365100% (1)

- Shed PlansDokumen16 halamanShed PlansFrancis Wolfgang Urban100% (7)

- Build and Use Small Electric MotorsDokumen5 halamanBuild and Use Small Electric MotorsdarkquinkBelum ada peringkat

- 10 Dollar Telescope PlansDokumen9 halaman10 Dollar Telescope Planssandhi88Belum ada peringkat

- 3inchrefractorDokumen6 halaman3inchrefractorGianluca SalvatoBelum ada peringkat

- 3 Wheel Dune BuggyDokumen5 halaman3 Wheel Dune BuggyyukitadaBelum ada peringkat

- IRS Publication Form Instructions w-2/w-3Dokumen13 halamanIRS Publication Form Instructions w-2/w-3Francis Wolfgang UrbanBelum ada peringkat

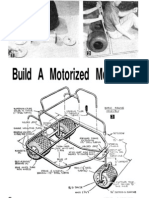

- Build a DIY Motorized Mountain BuggyDokumen5 halamanBuild a DIY Motorized Mountain Buggyjii_907001Belum ada peringkat

- IRS Publication Form Instructions 8941Dokumen10 halamanIRS Publication Form Instructions 8941Francis Wolfgang UrbanBelum ada peringkat

- IRS Publication Form Instructions 8867Dokumen2 halamanIRS Publication Form Instructions 8867Francis Wolfgang UrbanBelum ada peringkat

- IRS Publication Form Instructions 8283Dokumen7 halamanIRS Publication Form Instructions 8283Francis Wolfgang UrbanBelum ada peringkat

- Form 8853 InstructionsDokumen8 halamanForm 8853 InstructionsFrancis Wolfgang UrbanBelum ada peringkat

- IRS Publication Form Instructions 2106Dokumen8 halamanIRS Publication Form Instructions 2106Francis Wolfgang UrbanBelum ada peringkat

- IRS Publication Form Instructions 8829Dokumen4 halamanIRS Publication Form Instructions 8829Francis Wolfgang UrbanBelum ada peringkat

- IRS Publication Form Instructions 5405Dokumen6 halamanIRS Publication Form Instructions 5405Francis Wolfgang UrbanBelum ada peringkat

- IRS Publication Form Instructions SseDokumen6 halamanIRS Publication Form Instructions SseFrancis Wolfgang UrbanBelum ada peringkat

- IRS Publication Form Instructions 8594Dokumen3 halamanIRS Publication Form Instructions 8594Francis Wolfgang UrbanBelum ada peringkat

- IRS Publication Form Instructions 4797Dokumen10 halamanIRS Publication Form Instructions 4797Francis Wolfgang UrbanBelum ada peringkat

- IRS Publication Form Instructions 1120sDokumen42 halamanIRS Publication Form Instructions 1120sFrancis Wolfgang UrbanBelum ada peringkat

- Instructions for Form 1099-MISCDokumen10 halamanInstructions for Form 1099-MISCFrancis Wolfgang UrbanBelum ada peringkat

- Cost II CH 6 Pricing DecisionDokumen17 halamanCost II CH 6 Pricing DecisionAshuBelum ada peringkat

- Principles of Taxation For Business and Investment Planning 16Th Edition Jones Solutions Manual Full Chapter PDFDokumen39 halamanPrinciples of Taxation For Business and Investment Planning 16Th Edition Jones Solutions Manual Full Chapter PDFrosyseedorff100% (9)

- Bread Burn Bahasa Inggris 22Dokumen13 halamanBread Burn Bahasa Inggris 22adiastomoBelum ada peringkat

- Haushofer Shapiro UCT Online AppendixDokumen256 halamanHaushofer Shapiro UCT Online AppendixJ. Fernando G. R.Belum ada peringkat

- Revision ch3 1thDokumen18 halamanRevision ch3 1thYousefBelum ada peringkat

- Fundamental Analysis PresentationDokumen28 halamanFundamental Analysis Presentation354Prakriti SharmaBelum ada peringkat

- Income and Expenditureلبيان الصحفيDokumen11 halamanIncome and Expenditureلبيان الصحفيshabina921Belum ada peringkat

- Calculate Your Hourly Rate in 3 Easy StepsDokumen4 halamanCalculate Your Hourly Rate in 3 Easy StepsIna SarnoBelum ada peringkat

- Junior Philippine Institute of Accountants Income Statement For The Academic Year Ended May 31, 2021Dokumen5 halamanJunior Philippine Institute of Accountants Income Statement For The Academic Year Ended May 31, 2021Julliena BakersBelum ada peringkat

- TX 201Dokumen4 halamanTX 201Pau SantosBelum ada peringkat

- Valix 17 20 MCQ and Theory Emp Ben She PDFDokumen48 halamanValix 17 20 MCQ and Theory Emp Ben She PDFMitchie FaustinoBelum ada peringkat

- Accounting Cycle ProblemDokumen13 halamanAccounting Cycle Problemapi-300305341Belum ada peringkat

- Full Accounting Questions and AnswersDokumen7 halamanFull Accounting Questions and Answersdiane dildine100% (2)

- AFA 716 Chap 2 SolutionsDokumen40 halamanAFA 716 Chap 2 SolutionsMarc ColalilloBelum ada peringkat

- Trading and Profit Loss AccountDokumen8 halamanTrading and Profit Loss AccountOrange Noida100% (1)

- Emilio Aguinaldo College - Cavite Campus School of Business AdministrationDokumen9 halamanEmilio Aguinaldo College - Cavite Campus School of Business AdministrationKarlayaanBelum ada peringkat

- Ilovepdf MergedDokumen3 halamanIlovepdf Mergedarafath.aliBelum ada peringkat

- Module 2Dokumen15 halamanModule 2Calvin Rivero BrownBelum ada peringkat

- Safe Strategies For Financial FreedomDokumen3 halamanSafe Strategies For Financial Freedomnafulabeatrice1980Belum ada peringkat

- Itr Pankaj 2022-23Dokumen1 halamanItr Pankaj 2022-23gafoh81124Belum ada peringkat

- Karl DeutschDokumen23 halamanKarl Deutschsupersrbin20065023Belum ada peringkat

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDokumen2 halaman1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsJohn Lesther PabiloniaBelum ada peringkat

- Dusseldorf TableDokumen5 halamanDusseldorf TableMRABelum ada peringkat

- FFIEC031 202212 FDokumen91 halamanFFIEC031 202212 FBatmanBelum ada peringkat

- Fundamentals of Taxation 2018 by Ana M. Cruz Et Al. (Z-Lib - Org) - 4Dokumen1.252 halamanFundamentals of Taxation 2018 by Ana M. Cruz Et Al. (Z-Lib - Org) - 4VidoushiBelum ada peringkat

- Attachment AccountingDokumen6 halamanAttachment Accountingtaylor swiftyyyBelum ada peringkat

- Financial Statement AnalysisDokumen87 halamanFinancial Statement AnalysisShreyaSinglaBelum ada peringkat

- BUSINESS ECONOMICS II SEM III ENG mARATHIDokumen83 halamanBUSINESS ECONOMICS II SEM III ENG mARATHIKiran TakaleBelum ada peringkat

- IAS 20 Government GrantsDokumen1 halamanIAS 20 Government Grantsm2mlckBelum ada peringkat

- Anhs Scabaa 2019Dokumen17 halamanAnhs Scabaa 2019Sim BelsondraBelum ada peringkat