Candela Corporation

Diunggah oleh

Anastasia LittsiouDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Candela Corporation

Diunggah oleh

Anastasia LittsiouHak Cipta:

Format Tersedia

Candela Corporation 1

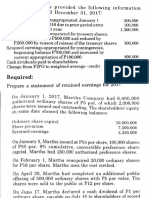

Common size financial statements

June 30, 2007 July 1, 2006 Amount Percent Amount Percent Balance Sheet Assets Current Assets Cash and cash equivalents Marketable securities Accounts receivable, net Notes Receivable Inventories, net Other current assets Total current assets Property & equipment, net Deffered tax assets, long term 106,957 3,479 6,146 71,2 2,3 4,1 125,326 3,302 5,294 83,7 2.2 3,6 $ 27,152 11,773 38,455 1,025 21,368 7,136 18 7,8 25,6 0,7 14,2 4,8 $ 40,194 27,332 34,273 1,611 16,666 5,084 26,9 18,3 22,9 1,1 11,1 3,4

Goodwill Acquired intangible assets, net of amortization Marketable securities, long term

10,997 8,151

7,3 5,4

-----------

--------

12,260

8,2

11,953

Candela Corporation 2

2,240 Other assets $150,230 Total assets Liabilities and Stockholders' Equity Current Liabilities Accounts payable Accrued payroll and related expenses Accrued warranty costs, current ------Income taxes payable 1,161 Sales tax payable 459 Royalties payable 9,554 Other accrued liabilities 10,000 Deferred revenue, current 1,257 Current liabilities of discontinued operations Total current liabilities Deferred tax liability, long-term Accrued warranty costs, longterm 40,183 2,659 2,127 $ 6,922 5,344

1,5 100.0

3,781 $149,656

2,5 100.0

4,6 3,5

$ 15,968 5,728

10,6 3,8

5,486

3,7

5,868

3,9

-----0,8 0,3 6,3 6,7 0,8

933 854 764 3,672 8,342 1,287

0,6 0,6 0,5 2,5 5,6 0,9

26,7 1,8 1,4

43,416 480 3,761

29 0,3 2,5

Candela Corporation 3

Deferred revenue, long-term Total Stockholders' equity

3,751 101,510 $150,230

2,5 67,6 100.0

1,987 100,012 $149,656

1,4 66,8 100.0

Total liabilities and stockholders' equity

2007 Income Statement Total revenue Amount Percent 100,0 148,557 149,466 Amount

2006 Percent 100,0

2005 Amount 123,901 Percent 100,0

49,8 Total cost of sales 73,949 75,617

50,6

67,982

54,9

67,982 Gross profit Total operating expenses 8,091 Income from operations Interest income 8,658 Income from continuing 9,799 operations before income taxes 3,543 Provision for income taxes 6,6 22,402 15 3,355 2,719 2,3 1,8 20,673 1,748 13,8 1,2 640 75,063 71,708 50,5 48,3 75,617 53,176 49 35,6 47,828

45,1 38,6

6,5 0,5 7

2,4

7,468

2,194

1,8

Candela Corporation 4

$ 6,256 Net income

4,2

$14,934

10

$7,323

5,9

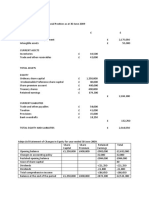

Ratio analysis Liquidity 2007 Current ratio = 2006 Current ratio = = times = times

2007 Quick test = 2006 Quick test = = = times

2007 Average collection period= 2006 Average collection period= 2007 Cash flow liquidity= = 2006 times = = =

Candela Corporation 5

Cash flow liquidity= = 2007 Days inventory held = 2006 Days inventory held = 2007 Days payable outstanding = 2006 Days payable outstanding = 2007 Net trade cycle= average collection period +days inventory held-days payable outstanding = 94+105-34= 165 days 2006 Net trade cycle= average collection period +days inventory held-days payable outstanding = 84+80-77= 87 days = = = = times

Activity 2007 Accounts receivable turnover = 2006 Accounts receivable turnover = = times = times

2007 Inventory turnover = = times

Candela Corporation 6

2006 Inventory turnover = = times

2007 Total asset turnover = 2006 Total asset turnover = = times = times

2007 Payables turnover = 2006 Payables turnover = = times = times

2007 Fixed asset turnover = 2006 Fixed asset turnover = = times = times

Leverage 2007 Debt ratio = 2006 Debt ratio = = =

Candela Corporation 7

2007 Debt to equity = 2006 Debt to equity = = times = times

2007 Times interest earned = 2006 Times interest earned = = times = times

2007 Long term debt to total capitalization = times 2006 Long term debt to total capitalization = times 2007 Cash interest coverage = times = = =

2006 Cash interest coverage = times =

Candela Corporation 8

2007 Fixed charge coverage = = times

2006 Fixed charge coverage = = times

Profitability 2007 Gross profit margin = 2006 Gross profit margin = = =

2007 Operating profit margin = 2006 Operating profit margin = = =

2007 Net profit margin = 2006 Net profit margin = = =

2007

Candela Corporation 9

Return on total assets = 2006 Return on total assets =

2007 Return on equity = 2006 Return on equity = = =

2007 Cash flow margin= 2006 Cash flow margin= = =

2007 Cash return on assets = 2006 Cash return on assets = = =

Market 2007

Candela Corporation 10

Earnings per common share = 2006 Earnings per common share =

2007 Dividend payout = 2006 Dividend payout = 2007 Price to earnings = 2006 Price to earnings= = = = 5,2 = 4,6

Qurent ratio and quick test including equity turnover ratio are good indicators of short term solvency of the company. Short term solvency can also be calculated as: income before fixed charges x 100 / sales revenue = 6,456 x 100 / 148,557= 4,35% for year 2007, 14,934 x 100/ 149,466 = 9,99% for year 2006 and 7,323 x 100/ 123,901 = 5,9% for year 2005.

Reasons to invest in Candela Corporation As we can see from the analysis Candela Corporation for both years 2006 and 2007 has a good ability to meet her short term debts with short term assets as for year 2006 the company could meet her short term debt with short term assets 2,9 times. During year 2007 the companys ability to meet short term debt with short term assets is a little less, 2,7 times, but only because the company reduced for that year both her current assets and her current liabilities. The same good picture is seen in the quick test analysis in which the numbers are 2,5 times in year 2007 and 2,8 times in year 2006.

Candela Corporation 11

Anda mungkin juga menyukai

- Noon Sugar Mills Financial Analysis (2005-2007Dokumen12 halamanNoon Sugar Mills Financial Analysis (2005-2007Sherdil MahmoodBelum ada peringkat

- NestleDokumen25 halamanNestleShafali PrabhakarBelum ada peringkat

- Chapter 2 - Basic Financial StatementsDokumen12 halamanChapter 2 - Basic Financial StatementsParas AbbiBelum ada peringkat

- ICI Pakistan AnalysisDokumen19 halamanICI Pakistan AnalysisAffan AnwarBelum ada peringkat

- 2010 SixyearhighlightsDokumen1 halaman2010 SixyearhighlightsSalman AshrafBelum ada peringkat

- FM Ratio Analysis UnileverDokumen14 halamanFM Ratio Analysis UnileverZohaib IrshadBelum ada peringkat

- Financial Statement Analysis: Presenter's Name Presenter's Title DD Month YyyyDokumen30 halamanFinancial Statement Analysis: Presenter's Name Presenter's Title DD Month YyyyDammika MadusankaBelum ada peringkat

- Afs Assignment Profitability RatiosDokumen9 halamanAfs Assignment Profitability RatiosMohsin AzizBelum ada peringkat

- Financial PlanDokumen15 halamanFinancial PlanIshaan YadavBelum ada peringkat

- KUANGLU RESTAURANT , BUSINESS PLANDokumen10 halamanKUANGLU RESTAURANT , BUSINESS PLANDonjulie HoveBelum ada peringkat

- Excel Spreadsheet For Mergers and Acquisitions ValuationDokumen6 halamanExcel Spreadsheet For Mergers and Acquisitions ValuationRenold DarmasyahBelum ada peringkat

- Inter Company AnalysisDokumen32 halamanInter Company AnalysisWaqas Ali BabarBelum ada peringkat

- MBA Financial Statement Analysis of Target Corporation (2007-2009Dokumen12 halamanMBA Financial Statement Analysis of Target Corporation (2007-2009Fernanda CugolaBelum ada peringkat

- Corporate Finance:: School of Economics and ManagementDokumen13 halamanCorporate Finance:: School of Economics and ManagementNgouem LudovicBelum ada peringkat

- BWFF2013 - Exp of AssgDokumen22 halamanBWFF2013 - Exp of AssgHoo LMinBelum ada peringkat

- Oman Oil Balance SheetDokumen27 halamanOman Oil Balance Sheeta.hasan670100% (1)

- Write Your Answer For Part A HereDokumen9 halamanWrite Your Answer For Part A HereMATHEW JACOBBelum ada peringkat

- DocxDokumen16 halamanDocxbelloyinka42Belum ada peringkat

- Executive SummaryDokumen12 halamanExecutive SummaryShehbaz HameedBelum ada peringkat

- Financial Statement Analysis: Chavez, Michellee Marie B. Diokno, Renee Angela P. Guballa, Czarina Mae CDokumen10 halamanFinancial Statement Analysis: Chavez, Michellee Marie B. Diokno, Renee Angela P. Guballa, Czarina Mae Cemchavez07Belum ada peringkat

- Financial Modeling-A Valuation Model of Boeing Co.Dokumen49 halamanFinancial Modeling-A Valuation Model of Boeing Co.Shahid AliBelum ada peringkat

- USD $ in MillionsDokumen8 halamanUSD $ in MillionsAnkita ShettyBelum ada peringkat

- 2012 Annual Financial ReportDokumen76 halaman2012 Annual Financial ReportNguyễn Tiến HưngBelum ada peringkat

- EDGR Audited Results For The 52 Weeks To 04 Jan 14Dokumen1 halamanEDGR Audited Results For The 52 Weeks To 04 Jan 14Business Daily ZimbabweBelum ada peringkat

- Ceres Gardening Company Submission PriyanshuChaturvedi PDFDokumen6 halamanCeres Gardening Company Submission PriyanshuChaturvedi PDFPriyanshu ChaturvediBelum ada peringkat

- Consolidated Profit and Loss Account For The Year Ended December 31, 2008Dokumen16 halamanConsolidated Profit and Loss Account For The Year Ended December 31, 2008madihaijazBelum ada peringkat

- Ratio Analysis: Presented By: Ajay BankaDokumen16 halamanRatio Analysis: Presented By: Ajay Bankaajay070188Belum ada peringkat

- Ratios PrblmsDokumen13 halamanRatios PrblmsAbraz KhanBelum ada peringkat

- EVA ExampleDokumen27 halamanEVA Examplewelcome2jungleBelum ada peringkat

- PRIMO BENZINA Financial Ratios 2006-2009Dokumen13 halamanPRIMO BENZINA Financial Ratios 2006-2009P3 Powers100% (1)

- Google+Gap FR ChangeDokumen2 halamanGoogle+Gap FR ChangeShahid JavaidBelum ada peringkat

- Financial Statement AnalysisDokumen28 halamanFinancial Statement AnalysissanyaBelum ada peringkat

- Lecture Common Size and Comparative AnalysisDokumen28 halamanLecture Common Size and Comparative AnalysissumitsgagreelBelum ada peringkat

- Coco Cola Ratio Analysis Final IIDokumen10 halamanCoco Cola Ratio Analysis Final IITalha KhanBelum ada peringkat

- Summit Bank Annual Report 2012Dokumen200 halamanSummit Bank Annual Report 2012AAqsam0% (1)

- Case SolutionsDokumen106 halamanCase SolutionsRichard Henry100% (5)

- Yahoo, Microsoft and Google Financial AnalysisDokumen62 halamanYahoo, Microsoft and Google Financial AnalysisAnjana GummadivalliBelum ada peringkat

- SGT Cash Flow Ratio AnalysisDokumen16 halamanSGT Cash Flow Ratio AnalysisHa LinhBelum ada peringkat

- Key Financial Ratios and Analysis of Company PerformanceDokumen10 halamanKey Financial Ratios and Analysis of Company PerformanceCatcha AllBelum ada peringkat

- 2003 2004 2005 2006 Answer Reason Decreasing CFO 2019 838 250 226 Trend Increase in Account ReceivableDokumen44 halaman2003 2004 2005 2006 Answer Reason Decreasing CFO 2019 838 250 226 Trend Increase in Account Receivablebabu senBelum ada peringkat

- Return On Assets (ROA) : ROA Is An Indicator of How Profitable A Company Is Relative To ItsDokumen4 halamanReturn On Assets (ROA) : ROA Is An Indicator of How Profitable A Company Is Relative To ItsTanya RahmanBelum ada peringkat

- EVA ExampleDokumen14 halamanEVA ExampleKhouseyn IslamovBelum ada peringkat

- Singer Bangladesh's financial performance over 3 yearsDokumen16 halamanSinger Bangladesh's financial performance over 3 yearsMahbubur RahmanBelum ada peringkat

- Airline AnalysisDokumen20 halamanAirline Analysisapi-314693711Belum ada peringkat

- MeharVerma IMT Ceres 240110 163643Dokumen9 halamanMeharVerma IMT Ceres 240110 163643Mehar VermaBelum ada peringkat

- Investment VI FINC 404 Company ValuationDokumen52 halamanInvestment VI FINC 404 Company ValuationMohamed MadyBelum ada peringkat

- Valuation: Future Growth and Cash FlowsDokumen12 halamanValuation: Future Growth and Cash FlowsAnshik BansalBelum ada peringkat

- Mrs. Bella LlegoDokumen182 halamanMrs. Bella Llegototo titiBelum ada peringkat

- PNB Ratio AnalysisDokumen15 halamanPNB Ratio AnalysisNiraj SharmaBelum ada peringkat

- Coca Cola Financial Statements 2008Dokumen75 halamanCoca Cola Financial Statements 2008James KentBelum ada peringkat

- Balance Sheet of Reliance IndustriesDokumen10 halamanBalance Sheet of Reliance IndustriesSatyajeet ChauhanBelum ada peringkat

- Ch11 P11 Build A ModelDokumen6 halamanCh11 P11 Build A ModelJDOLL1100% (2)

- (5414) Specialized Design Services Sales Class: $500,000 - $999,999Dokumen15 halaman(5414) Specialized Design Services Sales Class: $500,000 - $999,999Christyne841Belum ada peringkat

- IMT CeresDokumen11 halamanIMT CeresShivam GuptaBelum ada peringkat

- Avon Powerpoint PresentationDokumen22 halamanAvon Powerpoint PresentationOana TrutaBelum ada peringkat

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosDari EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosBelum ada peringkat

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosDari EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosBelum ada peringkat

- Applied Corporate Finance. What is a Company worth?Dari EverandApplied Corporate Finance. What is a Company worth?Penilaian: 3 dari 5 bintang3/5 (2)

- Getting Funding or Finaning 02062023 083302amDokumen30 halamanGetting Funding or Finaning 02062023 083302amIslamic DuniyaBelum ada peringkat

- Accounting FinalDokumen208 halamanAccounting Finalabdul abdulBelum ada peringkat

- REVIEWERDokumen10 halamanREVIEWERRhyna Vergara SumaoyBelum ada peringkat

- Establish and Maintain Cash Based Accounting SystemDokumen31 halamanEstablish and Maintain Cash Based Accounting SystemTegene Tesfaye100% (1)

- IAS 21 - Foreign Currency TransactionsDokumen1 halamanIAS 21 - Foreign Currency TransactionsDawar Hussain (WT)Belum ada peringkat

- Pearson LCCI Certificate in Accounting (VRQ) Level 3Dokumen22 halamanPearson LCCI Certificate in Accounting (VRQ) Level 3Aung Zaw HtweBelum ada peringkat

- Chapter 9 2019 EditionDokumen26 halamanChapter 9 2019 EditionAngelica Faye DuroBelum ada peringkat

- Financial Ratios MGT657Dokumen8 halamanFinancial Ratios MGT657Iman NadzirahBelum ada peringkat

- Inkel Limited: KakkanadDokumen10 halamanInkel Limited: KakkanadNareshkumarBelum ada peringkat

- III) Notice of Meeting of Growers and Explanatory Memorandum & Appendices, Golden Palm GrowersDokumen48 halamanIII) Notice of Meeting of Growers and Explanatory Memorandum & Appendices, Golden Palm GrowersGolden Palm GrowersBelum ada peringkat

- Others 1667194749455Dokumen17 halamanOthers 1667194749455Techboy RahulBelum ada peringkat

- Problems 1st PartDokumen17 halamanProblems 1st PartMelyssa Ayala0% (1)

- Exam paper for financial accountingDokumen7 halamanExam paper for financial accountingSuppy PBelum ada peringkat

- PArtDokumen6 halamanPArtMay DabuBelum ada peringkat

- Capital Structure Decision: An Overview: Kennedy Prince ModuguDokumen14 halamanCapital Structure Decision: An Overview: Kennedy Prince ModuguChaitanya PrasadBelum ada peringkat

- Debt PolicyDokumen30 halamanDebt PolicyMai Phạm100% (1)

- Alliance Concrete CaseDokumen16 halamanAlliance Concrete Caseguest8900% (1)

- MCQs of AccountingDokumen29 halamanMCQs of AccountingImran Arshad33% (3)

- Banking - Citi - Original File1Dokumen16 halamanBanking - Citi - Original File1Xiaochen TangBelum ada peringkat

- Indian Railways (HBL Timken)Dokumen22 halamanIndian Railways (HBL Timken)YogeshTiwariBelum ada peringkat

- 12 Investment in AssociateDokumen3 halaman12 Investment in AssociateLara Jane Dela CruzBelum ada peringkat

- Let's Analyze: Pacalna, Anifah BDokumen2 halamanLet's Analyze: Pacalna, Anifah BAnifahchannie PacalnaBelum ada peringkat

- Quiz 2 - Statement of Changes in Equity-CompressedDokumen4 halamanQuiz 2 - Statement of Changes in Equity-CompressedJm BalessBelum ada peringkat

- CBLM Bookkeeping NCIIIDokumen52 halamanCBLM Bookkeeping NCIIILovely Rose Bacolcol75% (4)

- Scope and exclusions of IAS 39Dokumen11 halamanScope and exclusions of IAS 39Muhammad Qasim FareedBelum ada peringkat

- Chapter 1 - Question 1Dokumen4 halamanChapter 1 - Question 1Sophie ChopraBelum ada peringkat

- Coffee Shop Business Plan ProjectDokumen27 halamanCoffee Shop Business Plan ProjectSadafYaseen71% (14)

- Balance Sheet Financial Statement AnalysisDokumen5 halamanBalance Sheet Financial Statement AnalysisOld School Value100% (4)

- Warren Buffett and Wall StreetDokumen4 halamanWarren Buffett and Wall StreetcoolchadsBelum ada peringkat

- Turner V Lorenzo ShippingDokumen2 halamanTurner V Lorenzo ShippingChic Pabalan67% (3)