Capital Budgeting Methods and Techniques Guide

Diunggah oleh

pratibha2031Deskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Capital Budgeting Methods and Techniques Guide

Diunggah oleh

pratibha2031Hak Cipta:

Format Tersedia

Capital budgeting

Capital budgeting (or investment appraisal) is the planning process used to determine whether an organization's long term investments such as new machinery, replacement machinery, new plants, new products, and research development projects are worth pursuing. It is budget for major capital, or investment, expenditures. Many formal methods are used in capital budgeting, including the techniques such as

Accounting rate of return Payback period Net present value Profitability index Internal rate of return Modified internal rate of return Equivalent annuity

These methods use the incremental cash flows from each potential investment, or project. Techniques based on accounting earnings and accounting rules are sometimes used - though economists consider this to be improper - such as the accounting rate of return, and "return on investment." Simplified and hybrid methods are used as well, such as payback period and discounted payback period.

Net present value

Each potential project's value should be estimated using a discounted cash flow (DCF) valuation, to find itsnet present value (NPV). (First applied to Corporate Finance by Joel Dean in 1951; see also Fisher separation theorem, John Burr Williams: Theory.) This valuation requires estimating the size and timing of all the incremental cash flows from the project. (These future cash highest NPV(GE).) The NPV is greatly affected by the discount rate, so selecting the proper rate - sometimes called the hurdle rate - is critical to making the right decision. The hurdle rate is the Minimum acceptable rate of return on an investment. This should reflect the riskiness of the investment, typically measured by the volatility of cash flows, and must take into account the financing mix. Managers may use models such as the CAPM or the APT to estimate a discount rate appropriate for each particular project, and use theweighted average cost of capital (WACC) to reflect the financing mix selected. A common practice in choosing a discount rate for a project is to apply a WACC that applies to the entire firm, but a higher discount rate may be more appropriate when a project's risk is higher than the risk of the firm as a whole.

Internal rate of return

The internal rate of return (IRR) is defined as the discount rate that gives a net present value (NPV) of zero. It is a commonly used measure of investment efficiency. The IRR method will result in the same decision as the NPV method for (non-mutually exclusive) projects in an unconstrained environment, in the usual cases where a negative cash flow occurs at the start of the project, followed by all positive cash flows. In most realistic cases, all independent projects that have an IRR higher than the hurdle rate should be accepted. Nevertheless, for mutually exclusive projects, the decision rule of taking the project with the highest IRR - which is often used - may select a project with a lower NPV. In some cases, several zero NPV discount rates may exist, so there is no unique IRR. The IRR exists and is unique if one or more years of net investment (negative cash flow) are followed by years of net revenues. But if the signs of the cash flows change more than once, there may be several IRRs. The IRR equation generally cannot be solved analytically but only via iterations. One shortcoming of the IRR method is that it is commonly misunderstood to convey the actual annual profitability of an investment. However, this is not the case because intermediate cash flows are almost never reinvested at the project's IRR; and, therefore, the actual rate of return is almost certainly going to be lower. Accordingly, a measure called Modified Internal Rate of Return (MIRR) is often used. Despite a strong academic preference for NPV, surveys indicate that executives prefer IRR over NPV[citation needed], although they should be used in concert. In a budgetconstrained environment, efficiency measures should be used to maximize the overall NPV of the firm. Some managers find it intuitively more appealing to evaluate investments in terms of percentage rates of return than dollars of NPV.

Equivalent annuity method

The equivalent annuity method expresses the NPV as an annualized cash flow by dividing it by the present value of the annuity factor. It is often used when assessing only the costs of specific projects that have the same cash inflows. In this form it is known as the equivalent annual cost (EAC) method and is the cost per year of owning and operating an asset over its entire lifespan. It is often used when comparing investment projects of unequal lifespans. For example if project A has an expected lifetime of 7 years, and project B has an expected lifetime of 11 years it would be improper to simply compare the net present values (NPVs) of the two projects, unless the projects could not be repeated. The use of the EAC method implies that the project will be replaced by an identical project.

Alternatively the chain method can be used with the NPV method under the assumption that the projects will be replaced with the same cash flows each time. To compare projects of unequal length, say 3 years and 4 years, the projects are chained together, i.e. four repetitions of the 3 year project are compare to three repetitions of the 4 year project. The chain method and the EAC method give mathematically equivalent answers. The assumption of the same cash flows for each link in the chain is essentially an assumption of zero inflation, so a real interest rate rather than a nominal interest rate is commonly used in the calculations.

Real options

Real options analysis has become important since the 1970s as option pricing models have gotten more sophisticated. The discounted cash flow methods essentially value projects as if they were risky bonds, with the promised cash flows known. But managers will have many choices of how to increase future cash inflows, or to decrease future cash outflows. In other words, managers get to manage the projects - not simply accept or reject them. Real options analysis try to value the choices - the option value that the managers will have in the future and adds these values to the NPV.

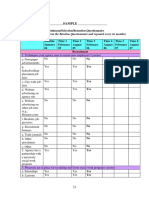

Ranked Projects

The real value of capital budgeting is to rank projects. Most organizations have many projects that could potentially be financially rewarding. Once it has been determined that a particular project has exceeded its hurdle, then it should be ranked against peer projects (e.g. - highestProfitability index to lowest Profitability index). The highest ranking projects should be implemented until the budgeted capital has been expended.

Funding Sources

When a corporation determines its capital budget, it must acquire said funds. Three methods are generally available to publicly traded corporations: corporate bonds, preferred stock, and common stock. The ideal mix of those funding sources is determined by the financial managers of the firm and is related to the amount of financial risk that corporation is willing to undertake. Corporate bonds entail the lowest financial risk and therefore generally have the lowest interest rate. Preferred stock have no financial risk but dividends, including all in arrears, must be paid to the preferred stockholders before any cash disbursements can be made to common stockholders; they generally have interest rates higher than those of corporate bonds. Finally, common stocks entail no financial risk but are the most expensive way to finance capital projects.The Internal Rate of Return is very important

Anda mungkin juga menyukai

- Capital Budgeting (Or Investment Appraisal) Is The Planning Process Used To Determine Whether A Firm'sDokumen4 halamanCapital Budgeting (Or Investment Appraisal) Is The Planning Process Used To Determine Whether A Firm'spavanbhatBelum ada peringkat

- Capital Budgeing ReviewDokumen20 halamanCapital Budgeing ReviewBalakrishna ChakaliBelum ada peringkat

- Mutual Fund Performance in Bangladesh - An Empirical StudyDokumen19 halamanMutual Fund Performance in Bangladesh - An Empirical Studysouthern.edu100% (1)

- Syed Althaf: Contact: +91 9849639797 E-Mail: ObjectiveDokumen4 halamanSyed Althaf: Contact: +91 9849639797 E-Mail: ObjectiveBharath Reddy KristipatiBelum ada peringkat

- Personality Prediction From CVResumeDokumen22 halamanPersonality Prediction From CVResumeSiddhuSelvaBelum ada peringkat

- HDFC ProjectDokumen111 halamanHDFC Projectsau98850% (1)

- New Inventory Management and Budgetary Control SystemDokumen5 halamanNew Inventory Management and Budgetary Control SystemVanshita GarudBelum ada peringkat

- Sreelekha T: Professional SummaryDokumen4 halamanSreelekha T: Professional SummaryChinmaya SahooBelum ada peringkat

- Resume: Secondary Education Board of Ajmer (Raj) Secondary Education Board of Ajmer (Raj)Dokumen2 halamanResume: Secondary Education Board of Ajmer (Raj) Secondary Education Board of Ajmer (Raj)Dhruv JainBelum ada peringkat

- Career Objective: Ankit Kumar ShrivastavaDokumen4 halamanCareer Objective: Ankit Kumar ShrivastavaashokBelum ada peringkat

- Fixed Assets NTPCDokumen59 halamanFixed Assets NTPCkshashankBelum ada peringkat

- Top Microsoft Word Shortcut KeysDokumen4 halamanTop Microsoft Word Shortcut Keyssanthu550Belum ada peringkat

- DeloitteDokumen2 halamanDeloitteIzZa RiveraBelum ada peringkat

- DD Icici UppalDokumen14 halamanDD Icici Uppalferoz khanBelum ada peringkat

- Security Analysis Project FinalDokumen37 halamanSecurity Analysis Project FinalDharodVarunBelum ada peringkat

- A Project Report On: Submitted in Partial Fulfilment For The Award of The Degree ofDokumen37 halamanA Project Report On: Submitted in Partial Fulfilment For The Award of The Degree ofpreetBelum ada peringkat

- NPV Rule and Capital Project Evaluation TechniquesDokumen16 halamanNPV Rule and Capital Project Evaluation TechniquesAbraham LinkonBelum ada peringkat

- Cross Cultural Issues in Hr-1Dokumen54 halamanCross Cultural Issues in Hr-1ANKIT MAANBelum ada peringkat

- Arvind Kumar: A/123 Vikas Nagar, (Old Plat No. 123, Post: Kanpur Univ. Kanpur-208024Dokumen2 halamanArvind Kumar: A/123 Vikas Nagar, (Old Plat No. 123, Post: Kanpur Univ. Kanpur-208024Anonymous ao827lnYGBelum ada peringkat

- Cryptocurrency Price Prediction and Analysis: Submitted To Prof. Vijayasherly V., SCOPEDokumen24 halamanCryptocurrency Price Prediction and Analysis: Submitted To Prof. Vijayasherly V., SCOPERSP VARUN 15BCE0388Belum ada peringkat

- Ravikiran TCS Project HRMDokumen38 halamanRavikiran TCS Project HRMRavikiran NarheBelum ada peringkat

- Capital Structure and Factors Affecting Capital Structure: Bhadrappa Haralayya, Jeelan Basha V, Nitesh S VibhuteDokumen32 halamanCapital Structure and Factors Affecting Capital Structure: Bhadrappa Haralayya, Jeelan Basha V, Nitesh S VibhuteDr Bhadrappa HaralayyaBelum ada peringkat

- Comparative Analysis of Saving AccountsDokumen89 halamanComparative Analysis of Saving AccountsAkhil AgarwalBelum ada peringkat

- MIS Executive PDFDokumen1 halamanMIS Executive PDFMedi Srikanth NethaBelum ada peringkat

- Internet Banking Project DocumentationDokumen23 halamanInternet Banking Project DocumentationDilip ChudasamaBelum ada peringkat

- Business Intelligence MINI PROJECTDokumen12 halamanBusiness Intelligence MINI PROJECTSachin S Katiyar 1827862Belum ada peringkat

- Project Report On Indian Banking SystemDokumen54 halamanProject Report On Indian Banking SystemParth prajapatiBelum ada peringkat

- Report On Kotak Mahindra BankDokumen23 halamanReport On Kotak Mahindra BankJayesh Bhandarkar100% (1)

- 0010 SAP TM Syllabus UCPL TechnologiesDokumen7 halaman0010 SAP TM Syllabus UCPL TechnologiesUCPL TrainingBelum ada peringkat

- Challenges For A HR Professional in BPODokumen4 halamanChallenges For A HR Professional in BPOsubbaramnaicker9379Belum ada peringkat

- Role of HR in Quality InitiativesDokumen22 halamanRole of HR in Quality InitiativesDeepesh SharmaBelum ada peringkat

- Kotak Mahindra BankDokumen4 halamanKotak Mahindra BankSanjeev GuptaBelum ada peringkat

- Influence of Organizational Climate On Employees CommitmentDokumen9 halamanInfluence of Organizational Climate On Employees CommitmentMoeez Shah100% (1)

- A Project Report On Employee Engagement KVGITDokumen51 halamanA Project Report On Employee Engagement KVGITganeshBelum ada peringkat

- A Winter Project Report: "Social Media Recruitment - A Study?"Dokumen20 halamanA Winter Project Report: "Social Media Recruitment - A Study?"Jagadeesh KumarBelum ada peringkat

- A Comprehensive Study On Financial Planning and ForecastingDokumen31 halamanA Comprehensive Study On Financial Planning and ForecastingInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- "Employee Absenteeism": A Research Report ONDokumen80 halaman"Employee Absenteeism": A Research Report ONDeepak SinghalBelum ada peringkat

- On Mutual FundsDokumen8 halamanOn Mutual FundsSushmita LandeBelum ada peringkat

- Part 2 GDokumen127 halamanPart 2 GMahesh BabuBelum ada peringkat

- 129 Project ReportDokumen75 halaman129 Project ReportNandan KumarBelum ada peringkat

- Working Capital Management in HCL InfosystemsDokumen105 halamanWorking Capital Management in HCL InfosystemsRupali BoradeBelum ada peringkat

- Analysis of Various Investment Products of Pms and Mutual FundsDokumen66 halamanAnalysis of Various Investment Products of Pms and Mutual FundsRamita SahniBelum ada peringkat

- A Study On Employee Engagement in It Sector: S. Praveena 1813422081028Dokumen14 halamanA Study On Employee Engagement in It Sector: S. Praveena 1813422081028NANDHINI PRIYABelum ada peringkat

- Budgetary Control SystemDokumen64 halamanBudgetary Control SystemKannan SBelum ada peringkat

- Recruitment Selection Retention QuestionnaireDokumen8 halamanRecruitment Selection Retention QuestionnaireVINIT SAXENABelum ada peringkat

- VenkateswaraReddy Sqldba 4.2 YrsDokumen4 halamanVenkateswaraReddy Sqldba 4.2 YrspraveenmpkBelum ada peringkat

- Asset and Liability ManagementDokumen17 halamanAsset and Liability ManagementkavyapbBelum ada peringkat

- Java 3.5 Years ResumeDokumen4 halamanJava 3.5 Years ResumeKishore MutcharlaBelum ada peringkat

- Reliance Industries Financial Report AnalysisDokumen52 halamanReliance Industries Financial Report Analysissagar029Belum ada peringkat

- Inventory Management ProjectDokumen87 halamanInventory Management ProjectPriyadarshan NairBelum ada peringkat

- KSRTC Financial AnalysisDokumen34 halamanKSRTC Financial AnalysisYoddhri DikshitBelum ada peringkat

- Darshan PPT 2Dokumen43 halamanDarshan PPT 2Sudarshan Reddy Y0% (1)

- Angel Broking Project Report Copy AviDokumen76 halamanAngel Broking Project Report Copy AviAvi Solanki100% (2)

- Illegal Parking Notification System Using Image Feature Extraction MethodDokumen22 halamanIllegal Parking Notification System Using Image Feature Extraction MethodShreya KowadkarBelum ada peringkat

- Working Jocil 06Dokumen83 halamanWorking Jocil 06Phani Deepika Koritala0% (1)

- Net Present Value: Capital Budgeting (Or Investment Appraisal) Is The Planning Process Used ToDokumen4 halamanNet Present Value: Capital Budgeting (Or Investment Appraisal) Is The Planning Process Used TorohitwinnerBelum ada peringkat

- Financial ManagementDokumen20 halamanFinancial ManagementGAURAV SHARMA100% (1)

- Capital Budgeting (Or Investment Appraisal) Is The Planning Process Used To Determine Whether A Firm's Long TermDokumen4 halamanCapital Budgeting (Or Investment Appraisal) Is The Planning Process Used To Determine Whether A Firm's Long TermAshish Kumar100% (2)

- Capital Budgeting at Birla CementDokumen61 halamanCapital Budgeting at Birla Cementrpsinghsikarwar0% (1)

- Republic Act No 9679 PAG IBIGDokumen17 halamanRepublic Act No 9679 PAG IBIGJnot VictoriknoxBelum ada peringkat

- Office of The City Engineer - Construction Services /8752 Mandate, Vision/Mission, Major Final Output, Performance Indicators and Targets Cy 2021Dokumen2 halamanOffice of The City Engineer - Construction Services /8752 Mandate, Vision/Mission, Major Final Output, Performance Indicators and Targets Cy 2021Charles D. FloresBelum ada peringkat

- Minimum-Distance Requirements Could Harm High-Performing Critical-Access Hospitals and Rural CommunitiesDokumen9 halamanMinimum-Distance Requirements Could Harm High-Performing Critical-Access Hospitals and Rural CommunitiesElay PedrosoBelum ada peringkat

- Jindal Steel EIC AnalysisDokumen5 halamanJindal Steel EIC AnalysisNavneet MakhariaBelum ada peringkat

- SK Annual BudgetDokumen4 halamanSK Annual BudgetBarangay CagangohanBelum ada peringkat

- Format For Computation of Income Under Income Tax ActDokumen3 halamanFormat For Computation of Income Under Income Tax ActAakash67% (3)

- MofedDokumen6 halamanMofedrachna357Belum ada peringkat

- An Example of Personal Finance Is Debating Whether or Not To Save Five DollarsDokumen3 halamanAn Example of Personal Finance Is Debating Whether or Not To Save Five DollarsBryan LluismaBelum ada peringkat

- Unit V BAP 2023 1700566379097Dokumen68 halamanUnit V BAP 2023 1700566379097kannandharani82Belum ada peringkat

- Union Budget Making Process ExplainedDokumen12 halamanUnion Budget Making Process ExplainedAnkush JadaunBelum ada peringkat

- Course Outline - FinanceDokumen2 halamanCourse Outline - FinanceAnnabelle BuenaflorBelum ada peringkat

- Valley Hot News Vol. 2 No.14Dokumen8 halamanValley Hot News Vol. 2 No.14Philtian MarianoBelum ada peringkat

- Office of The Sangguniang Kabataan: Budget MessageDokumen3 halamanOffice of The Sangguniang Kabataan: Budget MessageJennky Bulante100% (1)

- Balanced Scorecard ThesisDokumen58 halamanBalanced Scorecard ThesisJuswadji Sudiono100% (1)

- SPMDokumen15 halamanSPMValentinoBelum ada peringkat

- B. SAP IntegrationDokumen49 halamanB. SAP IntegrationOmole Wale100% (2)

- Fim 3A Main June Examination 2014 FinalDokumen11 halamanFim 3A Main June Examination 2014 FinalDolly VongweBelum ada peringkat

- FS - Kloha 2005 Developing - and - Testing - A - Composite - ModelDokumen12 halamanFS - Kloha 2005 Developing - and - Testing - A - Composite - ModelevanajaBelum ada peringkat

- Lecture 3 Public Finance in EthiopiaDokumen11 halamanLecture 3 Public Finance in Ethiopiadejenkibr100% (1)

- F2 Sample kbp2Dokumen8 halamanF2 Sample kbp2Philcas LiBelum ada peringkat

- QuestionnairesDokumen3 halamanQuestionnairesShobi DionelaBelum ada peringkat

- Tax Freeze Guidance DocumentDokumen20 halamanTax Freeze Guidance DocumentjspectorBelum ada peringkat

- Waterloo Region LRT Contract Report Mar 4 2014Dokumen70 halamanWaterloo Region LRT Contract Report Mar 4 2014WR_RecordBelum ada peringkat

- Problem On Flexible BudgtDokumen1 halamanProblem On Flexible BudgtRusheel ChavaBelum ada peringkat

- Apple Inc Financial StatementDokumen4 halamanApple Inc Financial StatementSaleh RehmanBelum ada peringkat

- Financial Planning Budgeting PDFDokumen4 halamanFinancial Planning Budgeting PDFMuhammadShoaibBelum ada peringkat

- Session 11 Cost ManagaamentDokumen23 halamanSession 11 Cost ManagaamentAbdul WahidBelum ada peringkat

- Alberta Budget 2020 Fiscal Plan 2020 23Dokumen234 halamanAlberta Budget 2020 Fiscal Plan 2020 23edmontonjournalBelum ada peringkat

- FHBM 1224 CH - 01Dokumen61 halamanFHBM 1224 CH - 01Yin LiuBelum ada peringkat

- MIS in Finanancial ManagementDokumen81 halamanMIS in Finanancial ManagementDipen Ashokkumar Kadam100% (2)