Americans For Prosperity-Kansas Legislative Agenda For 2013

Diunggah oleh

Bob WeeksJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Americans For Prosperity-Kansas Legislative Agenda For 2013

Diunggah oleh

Bob WeeksHak Cipta:

Format Tersedia

2013 Kansas Legislative Agenda

A New Beginning

2013 Kansas Legislative Agenda

A New Beginning

BUDGET

Kansas spending and debt have skyrocketed over the past 60 years. Our state governments spending increased by 571% from 1960 to 2010 after adjusting for inflation. During the same time frame, state government debt increased by 335%. While increased population accounts for much of the need to increase spending, it has by far outpaced the 31% increase in population during the same time frame. From 1960 to 2010, per capita state government spending grew from $1,134 to $5,813 after adjusting for inflation. Thats $5,813 for each man, woman and child in Kansas. Fortunately, Kansas legislators are becoming aware of the damage overspending has caused our state and have hit reverse. Under Gov. Sam Brownbacks leadership, state expenditures have decreased by $2.2 billion over the last two years, with the latest $14.3 billion budget having been approved in June. Although these improvements should certainly be celebrated, Kansans should not mistake our states spending problems as being solved. We must continue to hold our elected officials accountable to a fiscally responsible rate of spending that is characteristic of any good government.

As if the cost of our state government isnt high enough, Kansans are also subject to the burdensome taxes and spending of the federal government. Federal expenditures have increased by 409% from 1960 to 2010 after adjusting for inflation, and debt HAS INCREASED by an incredible 532%. Like Topekas past spending addictions, these skyrocketing expenditures have dramatically

- 3 -

outpaced the countrys 10% growth in population during the same time frame. From 1960 to 2010, per capita federal spending grew from $2,413 to $11,194 after adjusting for inflation. Topekas and Washingtons spending costs every man, woman, and child $17,007 a year. Unfortunately, this skyrocketing spending is about to get much worse. Federal taxes are expected to soar in 2013 thanks to the expiration of many tax relief measures and the implementation of the Presidents health care law. Clearly if Kansas wants a competitive edge in the global economy, both Topeka and Washington should lower taxes and spending to attract greater commerce and thus greater prosperity. For the Fiscal Year 2014 budget (begins July 1, 2013), AFP supports an 8% reduction in spending. Spending reductions should be implemented in order to reconcile the projected budget shortfall while also keeping adequate reserves in the state budget. Enact legislation limiting any future spending increases to the sum of inflation and population growth. The following excerpt from our FY 2011 Commonsense Budget Proposal, explains the impact spending constraints would have had if enacted in 2004. With the expectation of significant increases of revenues to the state government, this passage serves as a good reminder of what defines the path to prosperity: a surplus of $340 million existed in FY 2004, but the growth in expenditures erased that surplus and led to a shortfall of $890 million in FY 2010. If Kansas had instituted a controlled spending approach as AFP advocated, the difference would have been pronounced for state government finances Instead of a deficit of $890 million, Kansas would have experienced a surplus of $554 million in state coffers for FY 2010. It should be noted this estimate is very likely well below what actually could be expected. With just six years of spending controls the cumulative amount of funds that could have been returned to taxpayers would have been in excess of $3.7 billion. This infusion of cash into the economy would have generated additional tax revenues for the state coffers while strengthening Kansas private sector economy to weather the recession. It is obvious that putting government growth and special interests ahead of fiscal prudence has created a problem that was easily avoidable. The question now is: will Kansas legislators ignore this lesson of the past or move forward with self imposed spending controls? Require local governments (cities, counties and school districts) to participate in the states transparency Web site with uniform budget reporting. Require every state agency to implement zero-based budgeting practices. State agencies should mirror a common practice amongst the private sector that is building their budgets from scratch. At a minimum an agency should do it once every four years. It is difficult for anyone to make claim that all wasteful and inefficient spending has been eliminated without building a budget from the ground up.

- 4 -

TAX POLICY

On May 22, 2012, Gov. Brownback signed HB 2117 into law, simplifying and reducing our state tax codes burden. The reform collapses its three income tax brackets into two and lowers their respective rates to 3.0% and 4.9%. A study by the Kansas Policy Institute projects that somewhere between 33,430 and 41,690 additional private sector jobs will be created because of the tax reforms through 2018, and annual gross wages will increase somewhere between $277 and $364. This anticipated increase in economic activity is expected to broaden Kansas tax base, as new residents and businesses set up shop in the Sunflower State. With such an increase in revenue, our state local governments will become less reliant on our high property, sales, and corporate taxes making room for future rate reductions. As of 2009, these three taxes combined cost every man, woman, and child in Kansas $2,533. In building on our states recent tax reform, AFP supports more rate reductions in the future, thus assuring that Kansas continues down the path to lower taxes and greater prosperity.

Additional tax agenda items: AFP supports a legislative super-majority in order to raise taxes. Currently 16 states, including three of our four neighboring states, require a super-majority to approve tax increases. AFP supports the Property Tax Transparency Act. This legislation will require property tax mill levies to be automatically reduced in correspondence to increase in property valuations. Local units of government that want to utilize their local taxing authority by increasing property tax revenues can do so with a majority of the body approving it. For too

- 5-

long, local units of government have benefited from stealth-like tax increases due to property valuation increases. This legislation would provide government transparency and accountability by requiring a vote for approving tax increases.

TA X P A Y E R-F U N D E D L OB BY IN G R E FOR M

Currently, more than 100 lobbyists with more than 60 government entities/associations have been hired by your tax dollars, lobbying for more and more of your money. Taxpayer funded lobbying propagates the cycle of more spending and more programs that call for more spending. Serious reform will help curb the culture of more is never enough in Topeka.

Require governments that hire lobbyists simply to report how much they are spending on these services. Require those individuals who represent state level government entities to register as a lobbyist, just like those who represent city and county government.

JUDICIAL REFORM

Supreme Court justices are selected primarily by an insider group of Kansas lawyers, and Kansas is the only state with lawyers completely dominating the selection process. AFP supports reforms that will open up the system, allow public input, and allow the appropriate questions to be asked before a judge is appointed, rather than later.

ENERGY MANDATEs AND GOvERNMENT AssIsTANCE

There is nothing wrong with investing in newer energy technologies like windmills. In fact, such investment when done by private individuals and companies spur the free enterprise system that drives prosperity. However when such investment is made by governments in the form of massive subsidies, it unfairly takes money out of the wallets of private citizens and companies to wage as a bet that some company will be profitable. Quite often, as with Solyndra, it is not. Kansas energy companies should stand on their own two feet without help from government. Over the last few years, Kansas has developed the Kansas Renewable Portfolio Standards

- 5-

mandates in an effort to prop up alternative renewable energy sources. This is nothing but government picking winners and losers and according to a July 2012 report released by the Kansas Policy Institute and The Beacon Hill Institute, the losers are Kansas taxpayers. The July report The Economic Impact of the Kansas Renewable Portfolio Standard concludes that Kansas electricity ratepayers will pay higher rates and face fewer employment opportunities. The report states: In 2020 renewable energy mandates will cost families an average of $660 per year; commercial businesses will spend an extra $3,915 per year; and industrial businesses will spend an extra $25,516 per year. Between 2012 and 2020, the average residential consumer can expect to pay $2,471 more for electricity. A commercial ratepayer would pay $14,663 more during the period, and the typical industrial user would pay $95,560 more. Its easy to conclude these mandates will have an adverse effect on the Kansas economy. AFP supports the Electricity Freedom Act which would repeal the state standards.

OBAMACARE EXChANGEs

On principle, conservatives could support health insurance exchanges. They harness the power of free market competition, transparency and value comparison to drive innovation, increase choice, and reduce costs. However, when a health plans participation in the exchange is conditioned on page after page of federal mandates and restrictions, exchanges can also be used as a tool to expand bureaucratic control and micromanage the market. Thats exactly what President Obama and HHS Secretary Kathleen Sebelius are trying to do by inviting states to partner with the federal government in creating Obamacare exchanges. Fortunately Gov. Brownback has rejected the invitation from the federal government. However attempts may be made during the 2013 legislative session to seek legislative approval to partner with the federal government on this matter. AFP will oppose any state effort to create the Obamacare exchange in Kansas.

q Yes!

q Contact my legislator when important legislation is being considered. q Help form a local AFP chapter in my area. q Participate in a local AFP chapter in my area. q Attend a statewide AFP conference/event.

I would be willing to help Americans for Prosperity in the following ways:

E-MAIL ADDRESS:

REFER A FRIEND

Do you have a friend that you would like to know about the work of AFP-Kansas? Send us their name and address and we will send them a packet of information on AFP and how they can get involved. We will only do this once. If they chose not to get involved with AFP will discontinue communication with them. _________________________________________________________________________________________

NAME

_________________________________________________________________________________________

ADDRESS

_________________________________________________________________________________________

CITY ST ZIP

_________________________________________________________________________________________

NAME

_________________________________________________________________________________________

ADDRESS

_________________________________________________________________________________________

CITY ST ZIP

_________________________________________________________________________________________

NAME

_________________________________________________________________________________________

ADDRESS

_________________________________________________________________________________________

CITY ST ZIP

Americans for Prosperity Kansas is a statewide organization of citizen leaders committed to advancing every individuals right to economic freedom and opportunity. AFP-KS educates and engages citizens in support of restraining state and federal government growth, and returning government to its constitutional limits.

2348 SW Topeka Blvd, Suite 201 Topeka, KS 66604 www.afpks.org

Visit our website today at www.afpks.org to learn more about our efforts today. @AFPKansas on Twitter www.facebook.com/AFPKansas

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Premier Processing Loan AgreementDokumen9 halamanPremier Processing Loan AgreementBob WeeksBelum ada peringkat

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Leadership Council Grow Primary Jobs: Update and DiscussionDokumen13 halamanLeadership Council Grow Primary Jobs: Update and DiscussionBob WeeksBelum ada peringkat

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Report of The K-12 Student Performance and Efficiency Commission To The 2015 Kansas LegislatureDokumen16 halamanReport of The K-12 Student Performance and Efficiency Commission To The 2015 Kansas LegislatureBob WeeksBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

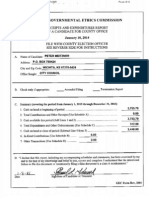

- Jeff Longwe Jeff Longwell Campaign Finance 2015-01-10 Mayorll Campaign Finance 2015-01-10 MayorDokumen8 halamanJeff Longwe Jeff Longwell Campaign Finance 2015-01-10 Mayorll Campaign Finance 2015-01-10 MayorBob WeeksBelum ada peringkat

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Wichita Old Town Cinema TIF Update September 19, 2014Dokumen6 halamanWichita Old Town Cinema TIF Update September 19, 2014Bob WeeksBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Five-Year Budget Plan For The State of KansasDokumen11 halamanFive-Year Budget Plan For The State of KansasBob WeeksBelum ada peringkat

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Wichita Sales Tax Vote, November 4, 2014Dokumen4 halamanWichita Sales Tax Vote, November 4, 2014Bob WeeksBelum ada peringkat

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Development Plan For Downtown WichitaDokumen121 halamanDevelopment Plan For Downtown WichitaBob WeeksBelum ada peringkat

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

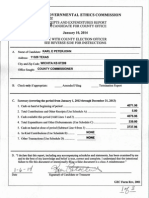

- Pete Meitzner Campaign Finance 2014-01-10Dokumen5 halamanPete Meitzner Campaign Finance 2014-01-10Bob WeeksBelum ada peringkat

- An Evaluation of The Kansas Affordable Airfares ProgramDokumen40 halamanAn Evaluation of The Kansas Affordable Airfares ProgramBob WeeksBelum ada peringkat

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- CEDBR Fiscal Model Presentation To Wichita City CouncilDokumen14 halamanCEDBR Fiscal Model Presentation To Wichita City CouncilBob WeeksBelum ada peringkat

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Affordable Airfares Funding Agreement With Sedgwick County 2014-08-12Dokumen15 halamanAffordable Airfares Funding Agreement With Sedgwick County 2014-08-12Bob WeeksBelum ada peringkat

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Resolution Considering The Establishment of The Union Station Redevelopment District (Tax Increment Financing)Dokumen115 halamanResolution Considering The Establishment of The Union Station Redevelopment District (Tax Increment Financing)Bob WeeksBelum ada peringkat

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Sedgwick County Economic Development Incentives 2013 Status ReportDokumen5 halamanSedgwick County Economic Development Incentives 2013 Status ReportBob WeeksBelum ada peringkat

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- TIF History and Performance Report, Wichita 2011Dokumen23 halamanTIF History and Performance Report, Wichita 2011Bob WeeksBelum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Kansas Legislative Briefing Book, 2014Dokumen411 halamanKansas Legislative Briefing Book, 2014Bob WeeksBelum ada peringkat

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- State of The City Address 2014Dokumen10 halamanState of The City Address 2014Bob WeeksBelum ada peringkat

- Tim Norton Campaign Finance 2014-01-10Dokumen6 halamanTim Norton Campaign Finance 2014-01-10Bob WeeksBelum ada peringkat

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

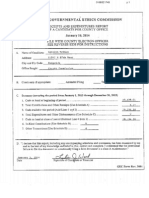

- Karl Peterjohn Campaign Finance 2014-01-10Dokumen3 halamanKarl Peterjohn Campaign Finance 2014-01-10Bob WeeksBelum ada peringkat

- Jeff Blubaugh Campaign Finance 2014-01-10Dokumen7 halamanJeff Blubaugh Campaign Finance 2014-01-10Bob WeeksBelum ada peringkat

- Dave Unruh Campaign Finance 2014-01-10Dokumen5 halamanDave Unruh Campaign Finance 2014-01-10Bob WeeksBelum ada peringkat

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Jim Howell Campaign Finance 2014-01-10Dokumen6 halamanJim Howell Campaign Finance 2014-01-10Bob WeeksBelum ada peringkat

- Jim Skelton Campaign Finance 2014-01-10Dokumen5 halamanJim Skelton Campaign Finance 2014-01-10Bob WeeksBelum ada peringkat

- Carolyn McGinn Campaign Finance 2014-01-10Dokumen2 halamanCarolyn McGinn Campaign Finance 2014-01-10Bob WeeksBelum ada peringkat

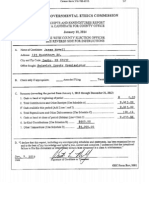

- James Clendenin Campaign Finance 2014-01-10Dokumen5 halamanJames Clendenin Campaign Finance 2014-01-10Bob WeeksBelum ada peringkat

- Clinton Coen Campaign Finance 2014-01-10Dokumen4 halamanClinton Coen Campaign Finance 2014-01-10Bob WeeksBelum ada peringkat

- Janet Miller Campaign Finance 2014-01-10Dokumen3 halamanJanet Miller Campaign Finance 2014-01-10Bob WeeksBelum ada peringkat

- Lavonta Williams Campaign Finance 2014-01-10Dokumen6 halamanLavonta Williams Campaign Finance 2014-01-10Bob WeeksBelum ada peringkat

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Joy Eakins Campaign Finance 2014-01-10Dokumen5 halamanJoy Eakins Campaign Finance 2014-01-10Bob WeeksBelum ada peringkat

- Jeff Longwell Campaign Finance 2014-01-10Dokumen2 halamanJeff Longwell Campaign Finance 2014-01-10Bob WeeksBelum ada peringkat

- Uco BankDokumen325 halamanUco Bankdoon devbhoomi realtorsBelum ada peringkat

- Anansit QP-DOC-01 Context of OrganizationDokumen5 halamanAnansit QP-DOC-01 Context of OrganizationTan Tok Hoi100% (2)

- Toronto PATH MapDokumen2 halamanToronto PATH Maptiffany_wong_clBelum ada peringkat

- 2242 3d Printronics GantryDokumen2 halaman2242 3d Printronics GantryRupen AryalBelum ada peringkat

- Royce Credit and Financial Services, Inc.: MemorandumDokumen11 halamanRoyce Credit and Financial Services, Inc.: MemorandumDPMC BANTAYBelum ada peringkat

- Tax Digests VATDokumen27 halamanTax Digests VATBer Sib JosBelum ada peringkat

- 2019 Q3 Housing Affordability IndexDokumen9 halaman2019 Q3 Housing Affordability IndexC.A.R. Research & Economics50% (2)

- Remote Controlled Mini Water Waste Collector, 2.0Dokumen6 halamanRemote Controlled Mini Water Waste Collector, 2.0Antonieta Gregorio DagoyBelum ada peringkat

- Spectrum Metro PricelistDokumen1 halamanSpectrum Metro PricelistParamveer SharmaBelum ada peringkat

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Appendix - I Taj Environmental Attitude Scale (Teas) : (English Version)Dokumen6 halamanAppendix - I Taj Environmental Attitude Scale (Teas) : (English Version)intan yunandaBelum ada peringkat

- Gyq2014543026 - NVC ChecklistDokumen5 halamanGyq2014543026 - NVC ChecklistDanilo TorresBelum ada peringkat

- Causes of The March Revolution 1917Dokumen2 halamanCauses of The March Revolution 1917nikolasBelum ada peringkat

- IMPDokumen6 halamanIMPAnonymous gXREIoKOWBelum ada peringkat

- Econometrics - SlidesDokumen264 halamanEconometrics - SlidesSamuel ObengBelum ada peringkat

- Special Economic Zone - WikipediaDokumen8 halamanSpecial Economic Zone - WikipediaDishaBelum ada peringkat

- DPI AutomotiveDokumen9 halamanDPI AutomotiveUnodostres Cinco Ocho TreceBelum ada peringkat

- BBFS IndividualDokumen1 halamanBBFS IndividualMuhammad IqbalBelum ada peringkat

- Describe Your Team and Background: Prateek JhaDokumen3 halamanDescribe Your Team and Background: Prateek JhaSree Arvind Harish SomasundaramBelum ada peringkat

- PIO List 2022Dokumen41 halamanPIO List 2022Bikki KumarBelum ada peringkat

- Reservation in IndiaDokumen2 halamanReservation in IndiaZuhair AntuleBelum ada peringkat

- Goods and Service TaxDokumen4 halamanGoods and Service TaxAranya GuvvalaBelum ada peringkat

- Ekkisavi Sadi Banam Ujjwal Bhavishya 2Dokumen57 halamanEkkisavi Sadi Banam Ujjwal Bhavishya 2Sudhir MaherwalBelum ada peringkat

- BillDokumen10 halamanBillAlok TiwariBelum ada peringkat

- PWC - Vietnam - Doing Business in Vietnam - 2020Dokumen96 halamanPWC - Vietnam - Doing Business in Vietnam - 2020Tien Manh Nguyen100% (1)

- CintholDokumen2 halamanCintholHardik MehtaBelum ada peringkat

- Jos Tech Academy (Lusaka, Zambia)Dokumen3 halamanJos Tech Academy (Lusaka, Zambia)Cristian RenatusBelum ada peringkat

- File 3 Category Analysis - Deep DiveDokumen21 halamanFile 3 Category Analysis - Deep Divem_vasilyevaBelum ada peringkat

- CH 3Dokumen31 halamanCH 3Hero Course100% (1)

- Pension Mathematics WinklevossDokumen368 halamanPension Mathematics Winklevossannisa uswahtulhaq100% (3)

- Pay SlipDokumen7 halamanPay Slipapi-3808900100% (1)

- The Courage to Be Free: Florida's Blueprint for America's RevivalDari EverandThe Courage to Be Free: Florida's Blueprint for America's RevivalBelum ada peringkat

- The Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpDari EverandThe Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpPenilaian: 4.5 dari 5 bintang4.5/5 (11)

- The Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteDari EverandThe Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VotePenilaian: 4.5 dari 5 bintang4.5/5 (16)

- Modern Warriors: Real Stories from Real HeroesDari EverandModern Warriors: Real Stories from Real HeroesPenilaian: 3.5 dari 5 bintang3.5/5 (3)

- Thomas Jefferson: Author of AmericaDari EverandThomas Jefferson: Author of AmericaPenilaian: 4 dari 5 bintang4/5 (107)

- Stonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonDari EverandStonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonPenilaian: 4.5 dari 5 bintang4.5/5 (21)

- Power Grab: The Liberal Scheme to Undermine Trump, the GOP, and Our RepublicDari EverandPower Grab: The Liberal Scheme to Undermine Trump, the GOP, and Our RepublicBelum ada peringkat

- The Last Republicans: Inside the Extraordinary Relationship Between George H.W. Bush and George W. BushDari EverandThe Last Republicans: Inside the Extraordinary Relationship Between George H.W. Bush and George W. BushPenilaian: 4 dari 5 bintang4/5 (6)