Language of Business - AIM MBA

Diunggah oleh

Leomard SilverJoseph Centron LimHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Language of Business - AIM MBA

Diunggah oleh

Leomard SilverJoseph Centron LimHak Cipta:

Format Tersedia

LANGUAGE OF BUSINESS (LOB)

M ASTER IN B USINESS A DMINISTRATION C O U R S E S Y L L A B U S

Course Code: Faculty : Sessions:

LOB Prof. Hilario G. Tan First Semester, 15 sessions

Course Objectives: To equip the students with a working knowledge and skills in financial accounting. To provide students with the basic tools and techniques needed for financial management course. For those interested to pursue a CFA Charter, to cover most of the preliminary topics for Financial Statement Analysis indicated in the CFA Level I Learning Objectives.

Course Description The Language of Business (LOB) course is designed to equip the students with a working knowledge of financial accounting. LOB is part of the Financial Management and Control module of the MBA course. Sufficient knowledge of financial accounting principles and concepts and the mastery of financial accounting analytical skills is a prerequisite for future financial management courses. Also, for those students interested to pursue a CFA Charter, the LOB course is designed to cover most of the preliminary topics for Financial Statement Analysis indicated in the CFA Level I Learning Outcomes. Learning Methodologies and Approaches Used This course will use the following learning methods and approaches: a. Lecture This will be used during the pre-MBA LOB module as bulk of the learning objectives are knowledge and skill based at this early stage. b. Case Analysis - This will be an important method as the objectives of this course focus on honing the use of financial accounting concepts, tools and techniques in the development of analysis for decision-making and policy formulation. c. Examinations Examinations take two forms. First, regular quizzes will be given primarily to evaluate the students understanding of various concepts and formulas. Second, case analysis examinations will be given to measure the ability of students to analyze business situations and to formulate recommendations which integrate all of the concepts discussed during the course.

Evaluation and Feedback Systems Students are evaluated on the following basis: a. Can Group Participation This measures the contribution of a student in collaborative learning in a can group setting in terms of qualitative performance and attitude/behavior. (20%) b. Class Participation - This measures the quality of students' insight during case analysis and lecture-discussion sessions (30%). b. Quizzes- These are given to measure the performance of students with regard to understanding stand alone topics (30%). c. Final Examination - Case analysis exam will be given to gauge the ability of the students in integrating the various concepts taken up in the course (20%).

Primary Textbooks a. Accounting: Text and Cases, 12th Edition, Robert N. Anthony, David F. Hawkins and Kenneth A. Merchant b. International Financial Statement Analysis, by Robinson, Greuning, Henry & Broihahn c. Other assigned reading which will be distributed as part of the students' casepack.

References: The Analysis and Use of Financial Statements, 3rd Ed., Gerald 1. White, Ashwinpaul C. Sondhi, and Dov Fried Course Outline Session Cases, Readings and Exercises Part 1: Introduction to LOB and the Accounting Cycle 1 Topic: Overview of LOB and the Accounting Spectrum Read: 1. Chap. 1: Anthony, Hawkins and Merchant, 12th Ed.

Learning Mode: Case 1-1: Ribbons an Bows, Inc. TEACHING PURPOSE: To get the students to start thinking like accountants and users of accounting information, without knowledge of any of the techniques. To illustrate the basic accounting concepts without naming them. 2 Topic: Overview of LOB and the Accounting Spectrum Read: 1. Chap. 1: Anthony, Hawkins and Merchant, 12th Ed.

Session

Cases, Readings and Exercises Learning Mode: Case 1-3: Baron Coburg TEACHING PURPOSE: To get the students to start thinking like accountants and users of accounting information, without knowledge of any of the techniques. To illustrate the basic accounting concepts without naming them.

Topic: Understanding the Balance Sheet & the Income Statement Read: 1. Chap. 2: Anthony, Hawkins and Merchant, 12th ed. 2. Chap. 3: Anthony , Hawkins and Merchant, 12th ed.

Learning Mode: Case 2-3: Lone Pine Caf (A) Case 3-2: Lone Pine Caf (B) TEACHING PURPOSE: To introduce the Balance Sheet and the Income Statement, with emphasis on understanding the basic concepts that guide balance sheet and income statement construction, the format and terminology used in a balance sheet and income statement and the type of information the balance sheet and income statement offers. 4 Topic: The Accounting Cycle Read: Chap. 4: Anthony, Hawkins and Merchant, 12th Ed.

Learning Mode: Case 4-4: Waltham Oil and Lube Center, Inc. TEACHING PURPOSE: To explain how financial statements are constructed from a list of business transactions. Part 2: Analysis of Accounts 5-6 Topic: Revenue and Monetary Assets Read: 1. Chap. 5: Anthony, et.al

Learning Mode: Case 5-2: Grennell Farm Case 5-4: Bausch & Lomb, Inc. TEACHING PURPOSE: To delve into the issues surrounding revenue recognition and to analyze the measurement of short-term monetary assets. To give students the opportunity to consider the importance of materiality in accounting. To highlight issues that are important to consider for revenue recognition decisions. To demonstrate the degree of discretion and managerial analysis required in making accounting decisions. To provide a context for discussing how regulators such as the SEC influence the financial reporting process. 7 Topic: Cost of Sales and Inventories Read: 1. Chap. 6: Anthony, 11th ed. *

Session

Cases, Readings and Exercises Learning Mode: Monterrey Manufacturing Company TEACHING PURPOSE: To introduce the difference betweens between the inventory accounting for a merchandising or service firm and a manufacturing firm.

Topic: Long Lived Assets Read: 1. Chap. 7: Anthony, et.al.

Learning Mode: Case 7-3: Stafford Press TEACHING PURPOSE: To illustrate issues of asset valuation, disposal gains and losses, and expense vs. capitalization of certain items. 9 Topic: Long Lived Assets Read: 1. Chap. 7: Anthony, et.al.

Learning Mode: Depreciation at Delta Air Lines & Singapore Airlines (A) TEACHING PURPOSE: To illustrate how the use of different depreciation methods affects the balance sheet and income statement accounts as well as the financial ratios. 10 Topic: Liabilities Read: 1. Chap. 8: Anthony, et.al.

Learning Mode: HBS Laurinberg Precision Engineering TEACHING PURPOSE: To give the students insight (1) into the relationship between bond terms and the market price for a given bond and (2) the implications of the bond terms on the financial statements and the cash flows. Topic: Liabilities Read: 1. Chap. 8: Anthony, et.al.

11

Learning Mode: HBS Depreciation at Delta Air Lines and Singapore Airlines (B) TEACHING PURPOSE: To give the students insight (1) into the effect of the accounting for leases on the balance sheet, income statement, cash flows and financial ratios. Topic: Stockholder's Equity Read: Chap. 9: Anthony, et.al. Introduction to Owners' Equity

12-13

Learning Mode: Case 9-2 Innovative Engineering HBS Nutra Foods

Session

14

Cases, Readings and Exercises TEACHING PURPOSE: To provide practice in accounting for capital transactions, both debt and owners equity transactions. To show the effect on income and on capital structure of various financing alternatives. Topic: Net Income and Earnings per Share Read: 1. Chapter 9: Anthony, et al. 2. Earnings per share Learning Mode: Lectures and Exercises TEACHING PURPOSE: To understand the concept of earnings per share.

Part 3: Integration 15 Topic: Other Items that Affect Net Income and Owners Equity Read: 1. Chap. 6 & 10: Anthony, et.al. 2. Expense Reporting

Learning Mode: Case 10-1 Norman Corporation (B) TEACHING PURPOSE: 16-17 To discuss various problems in expense recognition.

Topic: The Cash Flow Statement Read: 1. Chap. 11: Anthony, etal. 2. Solving the Puzzle of the Cash Flow Statement Learning Mode: HBS Crystal Meadows of Tahoe, Inc. HBS Statement of Cash Flows Three Examples TEACHING PURPOSE: To illustrate preparation of the cash flow statement from the other two statements and supplemental information.

18-20

Topic: Financial Statement Analysis Read: Chap. 13 Anthony, et.al. Chap. 14 Anthony, et. Al.

Learning Mode: Case 13-7 Sears, Roebuck & Co. vs. Walmart Stores, Inc. Case 14-2 Porter Lumber Co., Inc. (11th ed.) UVA Krispy Kreme TEACHING PURPOSE: To show how the integrated analysis of ratios can be used to evaluate corporate performance. FINAL EXAM: Coverage: Parts 2 and 3 of LOB

Knowledge, Competencies, Skills, Values, and Attitudes Sought Session 1-2 Knowledge Understand the following: Objectives of financial statements Assumptions of financial accounting Desired characteristics of financial accounting information Basic accounting principles Constraints of financial accounting Understand the following: Basic concepts that guide the construction of the balance sheet. The definition of the various balance sheet account terminology. The organization and format of the balance sheet. To understand the fundamental equation of the balance sheet (Assets = Liabilities + Equity) Understanding the following: Basic concepts that guide the construction of the income statement. The definition of the various income statement account terminology. The organization and format of the income statement. To understand the fundamental equation of the income statement (Revenues Expenses = Net Income). Understand the practice and the mechanisms used to collect, organize and present financial accounting information. 5-6 Understand the conditions under which revenue can be recognized. Understand the various revenue recognition methods. Understand the concepts behind the calculation of accounts receivable and bad debt. Understand the criteria used to Skills and Competencies Values and Attitudes Appreciate the importance of financial accounting information in day-to-day corporate decision-making.

Identify the various types of information needed to aid in corporate decisionmaking.

Understand the effects of various business transactions on the balance sheet.

All business transactions has a financial impact, some of which are measured in the balance sheet

Understand the effects of various business transactions on the balance sheet.

All business transactions have a financial impact, some of which are measured in the balance sheet

Journalize business transactions. Set-up T-Accounts to determine ending account balances. Prepare the various financial statements. Calculate recognized revenue using different recognition methods. Calculate allowances for doubtful accounts and bad debt expense.

Useful financial statements are developed only from the proper analysis and organization of business transaction information.

The methods used to calculate revenue and bad debt may lead to numbers with different meanings.

Session

Knowledge account for cash, cash equivalents and short-term investments. Understand the various inventory valuation methods (specific, average, first-in, first-out (FIFO), and last-in, first-out (LIFO). Understand quality issues in relation of the valuation of inventories.

Skills and Competencies

Values and Attitudes

7 Calculate the value of inventory and cost of goods sold using the different valuation methods.

Corporate managers have latitude in choosing which inventory valuation method to use. To correctly assess a firms balance sheet, analysts must understand why and under what conditions managers may choose a specific method. Depreciation accounting has a significant impact on the analysis of quality of earnings over time and assets deployed by a firm.

8-9

10-11

Understand how the depreciation for PPE is estimated using various methods. Understand the economic, tax and financial implications of each method. Understand how other assets are amortized or depleted. Understand the nature of various liabilities and contingencies Understand how liabilities are measured. Understand difference between term loans, bond liabilities, and capital leases. Understand the definition of off balance sheet debt and the issues surrounding its use and analysis.

Determine the cost of fixed assets, its useful life, and salvage value. Estimate depreciation expense using the various methods. Calculate trade payables, various types of accrued expenses, unearned revenues, etc. Calculate the liability due to a term loan. Calculate the liability due to a bond floatation. Calculate the payment schedule and liability due to a capital lease.

Liability analysis is critical in assessing risks and exposures. The long-term liabilities has a major impact on the financial risk profile of a firm and thus careful analysis and understanding of these accounts is necessary in assessing a firms financial health. The choice of where equity is sourced has an impact on the risk profile of the firm as well as on the returns of equity earned by the various owners. EPS and EPS growth play a major role in the valuation of corporate stock. It is critical to understand how EPS is calculated and reported and how analysts should react to a

10-11

12-13

14

Understand the various classes of owners in a firm and their economic rights and responsibilities. Understand the impact of share sales, share and cash dividends, stock splits and share repurchases on the calculation of owners equity Understand the relevance of EPS to financial statement analysis and determine how EPS is calculated. Understand how operating expenses, non-operating expenses, extraordinary items and

Calculate the effect of share sales, share and cash dividends, stock splits and share repurchases on owners' equity.

Calculate EPS in a situation where a firm has either a simple or complex equity structure.

Session

Knowledge other adjustments to equity affect the calculation of net income and earnings per share.

Skills and Competencies

Values and Attitudes particular EPS calculation.

15

Understand the various issues related to expense recognition

Apply the criteria for expense recognition in measuring income

Appreciate the use of a classified income statement in analyzing a companys profitability Understand the major items in the income statement and how it is measured gives insight into the companys cost structure and profitability.

16-17

18-20

Understand the basic concepts that guide the construction of the cash flow statement. Understand how business transactions affect the cash flow statement. Understand the analytical power of the cash flow statement in assessing a firms liquidity, solvency and overall financial health. Understand the different parts of the cash flow statement (operations, investing and financing). Differentiate between the direct and indirect method of reporting cash flows from operations. Understand the following concepts: purpose, use and limitations of ratios the use of common-size statements measures of operating and financial leverage integrated analysis of ratios Understand the right balance between appreciating the value of accounting information and recognizing its limitations.

Construct the cash flow statement (using both the direct and indirect methods) from existing balance sheets and income statements. Be able to reconcile net income and net cash using the direct method.

The cash flow statement is perhaps the most powerful tool in assessing a firm's financial health. Understanding how net income (calculated using accrual accounting) and net cash is reconciled gives significant insight into the firm's current condition and may be used to forecast future performance.

Compute and analyze ratios Interpret common-size statements Use integrated analysis of ratios to evaluate corporate performance Identify the uses and limitations of financial statements in decision making

Appreciate the importance of financial ratio analysis as an effective tool in business decision making Appreciate the uses and limitations of financial statements in decision making

Anda mungkin juga menyukai

- Supreme Court Rules in Favor of Driver in Collision CaseDokumen10 halamanSupreme Court Rules in Favor of Driver in Collision CaseLeomard SilverJoseph Centron LimBelum ada peringkat

- CC Event TemplateDokumen12 halamanCC Event TemplateLeomard SilverJoseph Centron LimBelum ada peringkat

- G.R. No. 75885Dokumen26 halamanG.R. No. 75885Leomard SilverJoseph Centron LimBelum ada peringkat

- Principles of Constitutional ConstructionDokumen11 halamanPrinciples of Constitutional ConstructionLeomard SilverJoseph Centron LimBelum ada peringkat

- Torts Compilation - Standard of ConductDokumen143 halamanTorts Compilation - Standard of ConductLeomard SilverJoseph Centron LimBelum ada peringkat

- IRR A Amended v2006Dokumen12 halamanIRR A Amended v2006Leomard SilverJoseph Centron LimBelum ada peringkat

- IRR A Amended v2006Dokumen12 halamanIRR A Amended v2006Leomard SilverJoseph Centron LimBelum ada peringkat

- Two Schools of Thought On The Bangsamoro BillDokumen6 halamanTwo Schools of Thought On The Bangsamoro BillLeomard SilverJoseph Centron LimBelum ada peringkat

- 2016 Revised IRR Clean Format and Annexes 26 August 2016 PDFDokumen149 halaman2016 Revised IRR Clean Format and Annexes 26 August 2016 PDFRyan JD LimBelum ada peringkat

- Implementing Rules RegulationsDokumen125 halamanImplementing Rules RegulationsDennis TolentinoBelum ada peringkat

- HB 00248Dokumen4 halamanHB 00248Leomard SilverJoseph Centron LimBelum ada peringkat

- BBL Needs Charter Change, Says Senate ReportDokumen3 halamanBBL Needs Charter Change, Says Senate ReportLeomard SilverJoseph Centron LimBelum ada peringkat

- GST AnswersDokumen2 halamanGST AnswersLeomard SilverJoseph Centron LimBelum ada peringkat

- Red Notes: Mercantile LawDokumen36 halamanRed Notes: Mercantile Lawjojitus100% (2)

- MotEx Addl FormDokumen3 halamanMotEx Addl FormLeomard SilverJoseph Centron LimBelum ada peringkat

- Icj 7Dokumen19 halamanIcj 7Leomard SilverJoseph Centron LimBelum ada peringkat

- Barons Marketing Vs - CaDokumen4 halamanBarons Marketing Vs - CaLeomard SilverJoseph Centron LimBelum ada peringkat

- JURIS FE physician consent dialysis benefitsDokumen2 halamanJURIS FE physician consent dialysis benefitsLeomard SilverJoseph Centron Lim100% (1)

- For SribdDokumen1 halamanFor SribdLeomard SilverJoseph Centron LimBelum ada peringkat

- Tax CasesDokumen12 halamanTax CasesLeomard SilverJoseph Centron LimBelum ada peringkat

- 14-027032 NoaDokumen1 halaman14-027032 NoaLeomard SilverJoseph Centron LimBelum ada peringkat

- History of BangsamoroDokumen1 halamanHistory of BangsamoroLeomard SilverJoseph Centron LimBelum ada peringkat

- For Sribd3Dokumen1 halamanFor Sribd3Leomard SilverJoseph Centron LimBelum ada peringkat

- Recruitment ProcessDokumen1 halamanRecruitment ProcessLeomard SilverJoseph Centron LimBelum ada peringkat

- For Sribd2Dokumen1 halamanFor Sribd2Leomard SilverJoseph Centron LimBelum ada peringkat

- Icj 7Dokumen19 halamanIcj 7Leomard SilverJoseph Centron LimBelum ada peringkat

- For SribdDokumen1 halamanFor SribdLeomard SilverJoseph Centron LimBelum ada peringkat

- Icj 7Dokumen19 halamanIcj 7Leomard SilverJoseph Centron LimBelum ada peringkat

- Icj 7Dokumen19 halamanIcj 7Leomard SilverJoseph Centron LimBelum ada peringkat

- International Court of Justice3Dokumen12 halamanInternational Court of Justice3Leomard SilverJoseph Centron LimBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Littlefield Technologies Final Report RedesvouzDokumen10 halamanLittlefield Technologies Final Report RedesvouzLuis MonteroBelum ada peringkat

- Arizona Tax Rates TableDokumen18 halamanArizona Tax Rates TableKaryll Trinidad AyangcoBelum ada peringkat

- MANAGEMENT ACCOUNTING RATIO ANALYSIS QUESTIONSDokumen10 halamanMANAGEMENT ACCOUNTING RATIO ANALYSIS QUESTIONSNaveen ReddyBelum ada peringkat

- Labangan Calamansi PlantationDokumen38 halamanLabangan Calamansi PlantationLorisa CenizaBelum ada peringkat

- Complete Exhibit 3. Provide The Answers in A Table FormatDokumen5 halamanComplete Exhibit 3. Provide The Answers in A Table FormatSajan Jose100% (2)

- Indian Aviation Industry - Indigo AirlinesDokumen13 halamanIndian Aviation Industry - Indigo AirlinesArjun Pratap SinghBelum ada peringkat

- Mcdonalds Final Supply ChainDokumen34 halamanMcdonalds Final Supply ChainAmmar Imtiaz100% (1)

- Asian Paints Limited Consolidated Balance SheetDokumen40 halamanAsian Paints Limited Consolidated Balance SheetSehajpal SanghuBelum ada peringkat

- Netherlands Totalization Agreement ExplainedDokumen11 halamanNetherlands Totalization Agreement ExplainedfdarteeBelum ada peringkat

- N Retail Full Mock T4-1Dokumen6 halamanN Retail Full Mock T4-1Josiah MwashitaBelum ada peringkat

- Ravi ResumeDokumen3 halamanRavi ResumeKeerthanaBelum ada peringkat

- Principles of Accounting I (ACFN 211)Dokumen65 halamanPrinciples of Accounting I (ACFN 211)Habibuna Mohammed100% (5)

- Statement of Defence of Stronach Consulting Corp.Dokumen31 halamanStatement of Defence of Stronach Consulting Corp.CTV News100% (1)

- May 20, 2015 Tribune Record GleanerDokumen20 halamanMay 20, 2015 Tribune Record GleanercwmediaBelum ada peringkat

- Body of The ReportDokumen26 halamanBody of The Reportahmed_zavedBelum ada peringkat

- Tax On Individuals Quiz - ProblemsDokumen3 halamanTax On Individuals Quiz - ProblemsJP Mirafuentes100% (1)

- Practical Accounting Problem 1Dokumen19 halamanPractical Accounting Problem 1Christine Nicole BacoBelum ada peringkat

- The Expenditure Cycle Part II: Payroll Processing and Fixed Asset ProceduresDokumen30 halamanThe Expenditure Cycle Part II: Payroll Processing and Fixed Asset ProceduresabmyonisBelum ada peringkat

- Characteristics of Fortune Global 500 - Assignment-2 - Akhil and NamuunDokumen53 halamanCharacteristics of Fortune Global 500 - Assignment-2 - Akhil and NamuunAkhil Agarwal100% (1)

- Nestlé Audit Committee OversightDokumen2 halamanNestlé Audit Committee OversightDisha ShekarBelum ada peringkat

- BDokumen4 halamanBsakuraBelum ada peringkat

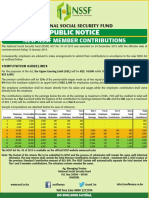

- Public Notice: New NSSF Member ContributionsDokumen1 halamanPublic Notice: New NSSF Member ContributionsDiana Dekatrinah KatrineBelum ada peringkat

- TCS Profit Up 50%, Declares 1:1 Bonus, 1,350% DividendDokumen6 halamanTCS Profit Up 50%, Declares 1:1 Bonus, 1,350% DividendBhaskar NiraulaBelum ada peringkat

- Management Accounting: Level 3Dokumen18 halamanManagement Accounting: Level 3Hein Linn KyawBelum ada peringkat

- Student Proposal 2Dokumen6 halamanStudent Proposal 2aman_lallyBelum ada peringkat

- 12th Biology Important 235 Mark Questions English Medium PDF DownloadDokumen6 halaman12th Biology Important 235 Mark Questions English Medium PDF DownloadNandhakumarBelum ada peringkat

- Norwich Manufacturing Inc Provided You With The Following Comparative BalanceDokumen1 halamanNorwich Manufacturing Inc Provided You With The Following Comparative BalanceFreelance WorkerBelum ada peringkat

- Tax Accounting: Tax On Profit of Juridical PersonsDokumen42 halamanTax Accounting: Tax On Profit of Juridical PersonsBasma MohamedBelum ada peringkat

- Conceptual Framework Purpose Assist Standards Developed IFRSDokumen6 halamanConceptual Framework Purpose Assist Standards Developed IFRSKyleZapantaBelum ada peringkat

- Shuttle Cock Manufacturing Project ProfileDokumen5 halamanShuttle Cock Manufacturing Project Profilepradip_kumarBelum ada peringkat