SWIFT FIN Payment Format Guide For European Accts

Diunggah oleh

destinysandeepJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

SWIFT FIN Payment Format Guide For European Accts

Diunggah oleh

destinysandeepHak Cipta:

Format Tersedia

TREASURY SERVICES

SWIFT FIN Payment Formatting Guide for Financial Institutions with Accounts in Europe

Version 7.0 Last Updated: 20 January 2010

2009 JPMorgan Chase & Co. All Rights Reserved. JPMorgan Chase Bank, N.A. Member FDIC. All services are subject to applicable laws and regulations and service terms. Not all products and services are available in all geographic areas. J.P.Morgan is a marketing name for the treasury services businesses of J.P.Morgan Chase Bank, National Association and its subsidiaries worldwide. In Germany, J.P. Morgan AG is authorised and regulated by the Bundesanstalt fr Finanzdienstleistungsaufsicht. In the United Kingdom, JPMorgan Chase Bank, N.A., London branch and J.P. Morgan Europe Limited are authorised and regulated by the Financial Services Authority.

SWIFT FIN CASH FORMATTING GUIDE EUROPEAN ACCOUNTS

TABLE OF CONTENTS

General principles applying to all message types.................................. 2 MT103 Customer Transfer message .......... 2 MT103+ (when used for Regulated Euro Payments)........................4 MT202 Financial Institution Payments.................................6 MT202 COV Cover Payments ..................... 7 SWIFT for Corporates (MT101) Payments .....................................9 Bankers Draft ......................................... 12 AUTO FX .................................................. 13

Example 1 Example 2 Formatting an MT103 for AutoFX

The purpose of this document is to provide a non-legally binding description of our guidelines for cash payment instructions delivered via SWIFT FIN across accounts in EMEA. It is designed to assist clients to improve their straight through processing rates. The document is intended to be used in conjunction with the standards detailed in the SWIFT User Handbook and only used when formatting SWIFT messages sent to J.P. Morgan. Regional variation may occur for accounts outside of this region and therefore the relevant guide should be consulted (where available). Intra EU/EEA payments refers to payments where the ordering institution (first bank) and account with institution (last bank) in the payment chain are located within the EU/EEA. As we expand our network new branches may be added which may require regional variations. We will endeavour to update this guide as appropriate. To ensure that you have the most up to date version of the guide, or if you wish to clarify whether this guide applies to your account or for any other questions relating to this guide, please contact your J.P. Morgan Customer Service Representative. For information on the SWIFT organisation please refer to www.swift.com.

Appendix A: Field 72 Codewords ............. 17

1) Euro RTGS request 2) Secure Payment Confirmation 3) J.P. Morgan priority payments 4) Timed Payments 5) Euro Priority Payments 6) Beneficiary information /BNF/ 7) INS

Appendix B: Field 23 Codewords ............. 18

For more information, please contact your J.P. Morgan Treasury Services representative or visit jpmorgan.com/ts

2009 JPMorgan Chase & Co. All Rights Reserved. JPMorgan Chase Bank, N.A. Member FDIC.

SWIFT FIN CASH FORMATTING GUIDE EUROPEAN ACCOUNTS

General principles applying to all message types

Use of an 8 digit BIC is recommended, for the Sender BIC and fields 50 59 in preference to

an 11 digit BIC, unless you are routing the payment to a specific branch of the BIC owning entity where an 11 digit BIC has to be used.

If you have multiple accounts in the same currency with same branch of J.P. Morgan, (linked

to the same SWIFT BIC address), an account number should be quoted in Field 53 to determine the correct account to debit.

MT103 Customer Transfer message

An MT103 is sent by a financial institution on behalf of itself or its ordering customer directly or via intermediary banks, to the final beneficiarys financial institution. The ordering customer or beneficiary customer, or both, are non-financial institutions from the perspective of the Ordering Institution. The MT103 message can also be used in combination with an MT202 cover [MT202 COV]1 message to advise the beneficiary institution directly of a future receipt of funds.

Status M Tag 20 Field Name Senders transaction reference number O M O O M 13C 23B 23E 26T 32A Time Indication Bank Operation Code Instruction Code Transaction Type Code Value Date, Currency Code and Amount Use value dates which are not in the past for STP processing. A value date which falls on a weekend will be adjusted to the following business day. The value date should not fall on a bank holiday in the country/currency you are paying, otherwise a repair would be required. O 33B Currency and Instructed Amount O M 36 50a Exchange Rate Ordering Customer For payments intra EU/EEA- include the Ordering Customers account number. For payments destined for accounts outside the EU/EEA- include complete Ordering Customer information including the name, address and account number of the Ordering Customer. Note: If the Ordering Customer holds their account with J.P. Morgan, J.P. Morgan will (where possible) add the address, linked to the account number in the first line of your message, on our records to the message. If the Sender is also the Ordering Customer, the BIC address in field 50 should match the SWIFT BIC of the Sender. We recommend the use of IBAN (International Bank Account Numbers) where available.2 O 51A Sending Institution Use A Tag if not blank CRED recommended Please refer to options in Appendix B J.P. Morgan STP Guidance

MT202 COV replaces MT202 messages for cover payments from November 2009 For more details on Ordering Customer information requirements and BIC/IBAN see: Treasury Services Client Clearing Information Website

2

2009 JPMorgan Chase & Co. All Rights Reserved. JPMorgan Chase Bank, N.A. Member FDIC.

SWIFT FIN CASH FORMATTING GUIDE EUROPEAN ACCOUNTS

Status O

Tag 52a

Field Name Ordering Institution

J.P. Morgan STP Guidance Option A is the preferred option if populated. If left blank the Sender is assumed to be the Ordering Institution (some exceptions apply).

53a

Sender's Correspondent

Options A or B are the preferred options if populated. If left blank our system will debit the account linked to the currency and Sender SWIFT BIC. If you have multiple accounts in the same currency, linked to the same SWIFT BIC address, an account number should be quoted in this field to ensure that the correct account is debited.

54a

Receiver's Correspondent

This field should be left blank

55a

Third Reimbursement Institution

This field should be left blank

56a

Intermediary Institution

Option A is the preferred option and we would recommend populating this field where possible. If this field is left blank, and the Account with Institution is not directly reachable, our system will attempt to derive the correspondent details.

57a

Account With Institution

Option A is the preferred option and must be populated unless the Beneficiary customer also has their account with the same branch of J.P. Morgan. The use of a valid SWIFT BIC in this field (using the A tag option) is becoming increasingly standard throughout the EEA. Therefore it is highly recommended for STP. For domestic Sterling payments: Include key word //SC followed by the 6 consecutive numbers of the Sort Code and the SWIFT BIC Code of the bank where available.

59a

Beneficiary Customer

Must contain the account number or the BIC/BEI of the final beneficiary. For intra EEA payments in Euro or Swedish kronor of 50K or less in value and covered by Regulation 924/2009 an IBAN account number should be quoted in this field. IBAN should also be used where required/available in other IBAN countries and currencies.3 For all other currency payments into the EU/EEA the use of the IBAN account number in Field 59 is highly recommended.

70

Remittance Information

This field should only contain information for the Beneficiary Customer. It should not be populated with routing or credit party information.

For more details on Ordering Customer information requirements and BIC/IBAN see: Treasury Services Client Clearing Information Website

2009 JPMorgan Chase & Co. All Rights Reserved. JPMorgan Chase Bank, N.A. Member FDIC.

SWIFT FIN CASH FORMATTING GUIDE EUROPEAN ACCOUNTS

Status M

Tag 71A

Field Name Charges option

J.P. Morgan STP Guidance BEN charges to be borne by the beneficiary customer though deductions to the principal amount. OUR charges to be borne by the remitting customer. SHA charges on the Senders side to be borne by the ordering customer; transaction charges on the receivers side are to be borne by the beneficiary customer. Note: For intra EEA payments in Euro or Swedish kronor of 50K or less in value and covered by Regulation 924/2009 or in EEA currency and regulated by the Payment Services Directive SHA is the recommended charges option. J.P. Morgan will change the charging indicator to SHA on any payment we identify as regulated.

O O O

71F 71G 72

Sender's Charges Receiver's Charges Sender to Receiver Information This field should be left blank Blank or see Appendix A for recognised keywords. This field should not be used to identify routing/credit party information. Note: Use of /REC/ will prevent STP.

O O

77B 77T

Regulatory Reporting Envelope Contents Not supported

M = Mandatory, O = Optional

MT103+

(when used for Regulated Payments)

An MT103+ is an MT103 message with a restricted set of fields and format options which support straight through processing of regulated payments . Regulated payments are generally payments in euro or Swedish kronor between two accounts in the European Economic Area (EEA), which are under 50,000 in value and exempt from interbank charges under EU Regulation 924/2009. STP is a necessary precondition for ensuring the payment is charged at the same rate as a domestic transfer and free of interbank charges and deductions. Note: MT 103+ format validation is triggered by the inclusion of the code STP in the validation flag field 119 ({3:{119: STP}}) of the user header of the message (block 3).

Status M Tag 20 Field Name Senders Transaction Reference Number O M O O M 13C 23B 23E 26T 32A Time Indication Bank Operation Code Instruction Code Transaction Type Code Value Date, Currency Code and Amount CRED recommended Restricted to SDVA, INTC and CORT (see Appendix B). Should not be used Use value dates which are not in the past for STP processing. A value date which falls on a weekend will be adjusted to the following business day. The value date should not fall on a bank holiday in the country/currency you are paying, otherwise a repair would be required. J.P. Morgan/SWIFT standard

2009 JPMorgan Chase & Co. All Rights Reserved. JPMorgan Chase Bank, N.A. Member FDIC.

SWIFT FIN CASH FORMATTING GUIDE EUROPEAN ACCOUNTS

Status O

Tag 33B

Field Name Currency and Instructed Amount

J.P. Morgan/SWIFT standard

O M

36 50a

Exchange Rate Ordering Customer For payments intra EU/EEA- include the Ordering Customers account number. For payments destined for accounts outside the EU/EEA- include complete Ordering Customer information including the name, address and account number of the Ordering Customer. Note: If the Ordering Customer holds their account with J.P. Morgan, J.P. Morgan will (where possible) add the address, linked to the account number in the first line of your message, on our records to the message. If the Sender is also the Ordering Customer, the BIC address in field 50 should match the SWIFT BIC of the Sender. We recommend the use of IBAN (International Bank Account Numbers) where available.4

52A

Ordering Institution

Option A is the only option allowed if populated. If left blank the Sender is assumed to be the Ordering Institution (some exceptions apply).

53a

Sender's Correspondent

Options A or B are the only options allowed if populated. If left blank our system will debit the account linked to the currency and Sender SWIFT BIC. If you have multiple accounts in the same currency, linked to the same SWIFT BIC address, an account number should be quoted in this field to ensure that the correct account is debited.

54A

Receiver's Correspondent

This field should be left blank

55A

Third Reimbursement Institution

This field should be left blank

56A

Intermediary Institution

Option A is the only option allowed and we would recommend populating this field where possible. If this field is left blank, and the Account with Institution is not directly reachable, our system will attempt to derive the correspondent details.

57A

Account With Institution

Option A is the only option allowed and must be populated unless the Beneficiary customer also has their account with the same branch of J.P. Morgan. For domestic Sterling payments: Include key word //SC followed by the 6 consecutive numbers of the Sort Code and the SWIFT BIC Code of the bank where available.

4 For more details on Ordering Customer information requirements and BIC/IBAN see: Treasury Services Client Clearing Information Website

2009 JPMorgan Chase & Co. All Rights Reserved. JPMorgan Chase Bank, N.A. Member FDIC.

SWIFT FIN CASH FORMATTING GUIDE EUROPEAN ACCOUNTS

Status M

Tag 59a

Field Name Beneficiary Customer

J.P. Morgan/SWIFT standard Should contain the IBAN5 or BIC/BEI of the final beneficiary.

70

Remittance Information

This field should only contain information for the Beneficiary Customer it should not be populated with routing or credit party information.

71A

Charges Option

For intra EEA payments in Euro or Swedish kronor of 50K or less in value and covered by Regulation 924/2009 or in EEA currency and regulated by the Payment Services Directive SHA is the recommended charges option. J.P. Morgan will change the charging indicator to SHA on any payment we identify as regulated.

O O O

71F 71G 72

Sender's Charges Receiver's Charges Sender to Receiver Information This field should be left blank Blank or see Appendix A for recognised keywords This field should not be used to identify routing/credit party information. Must not include ERI information. INS, if used, must be followed by a valid BIC. Note: Use of /REC/ will prevent STP.

77B

Regulatory Reporting

M = Mandatory, O = Optional

MT202 Financial Institution Payments

The MT202 is sent by a financial institution directly or via intermediary banks to the final beneficiary institution. An MT202COV message (see below) should be used instead of an MT202 when sent in combination with an MT103. This message may also be sent to a financial institution servicing multiple accounts for the Sender to transfer funds between these accounts. In addition it can be sent to a financial institution to debit an account of the Sender serviced by the Receiver and to credit an account, owned by the Sender at an institution specified in field 57A.

Status M Tag 20 Field Name Senders Transaction Reference Number M O M 21 13C 32A Related Reference Time Indication Value Date, Currency Code and Amount Use value dates which are not in the past for STP processing. A value date which falls on a weekend will be adjusted to the following business day. The value date should not fall on a bank holiday in the country/currency you are paying, otherwise a repair would be required. O 52a Ordering Institution Option A is the preferred option if populated. If left blank the Sender is assumed to be the Ordering Institution (some exceptions apply). J.P. Morgan/SWIFT standard

5 For more details on Ordering Customer information requirements and BIC/IBAN see: Treasury Services Client Clearing Information Website

2009 JPMorgan Chase & Co. All Rights Reserved. JPMorgan Chase Bank, N.A. Member FDIC.

SWIFT FIN CASH FORMATTING GUIDE EUROPEAN ACCOUNTS

Status O

Tag 53a

Field Name Sender's Correspondent

J.P. Morgan/SWIFT standard Options A or B are the preferred options if populated. If left blank our system will debit the account linked to the currency and Sender SWIFT BIC. If you have multiple accounts in the same currency, linked to the same SWIFT BIC address, an account number should be quoted in this field to ensure that the correct account is debited.

54a

Receiver's Correspondent

Use A tag and a valid SWIFT BIC if not blank.

56a

Intermediary

Option A is the preferred option and we would recommend populating this field where possible. If this field is left blank, and the Account with Institution is not directly reachable, our system will attempt to derive the correspondent details.

57a

Account With Institution

Option A is the preferred option and must be populated unless the Beneficiary customer also has their account with the same branch of J.P. Morgan. The use of a valid SWIFT BIC in this field (using the A tag option) is becoming increasingly standard throughout the EEA. Therefore it is highly recommended for STP. For domestic Sterling payments: Include key word //SC followed by the 6 consecutive numbers of the Sort Code and the SWIFT BIC Code of the bank where available.

58a

Beneficiary Institution

Option A is the preferred option and must be populated.

72

Sender to Receiver Information

Blank or see Appendix A for recognised keywords. This field should not be used to identify routing/credit party information. Note: Use of /REC/ will prevent STP.

M = Mandatory, O = Optional

MT202 COV Cover Payments

Sent in combination with a direct advice to the beneficiary bank, where the ordering customer or beneficiary customer, or both, are non-financial institutions from the perspective of the Ordering Institution. The MT202COV cover message is sent by a financial institution to, or through intermediary banks to, the final beneficiary institution. The MT202 COV, which replaced the MT202 in November 2009 for the purposes of cover payments, must contain ordering customer and beneficiary customer information (from the associated MT103) in Sequence B, where the beneficiary and originating customer information are required by the intermediary banks for sanctions screening/Anti Money laundering checks. MT 202 COV format validation is triggered by the inclusion of the code COV in the validation flag field 119 ({3:{119: COV}}) of the user header of the message (block 3).

Status M Tag 20 Field Name Senders Transaction Reference Number M 21 Related Reference The COV message related reference must be the same as the Tag20 of the related MT103 direct message. J.P. Morgan/SWIFT standard

2009 JPMorgan Chase & Co. All Rights Reserved. JPMorgan Chase Bank, N.A. Member FDIC.

SWIFT FIN CASH FORMATTING GUIDE EUROPEAN ACCOUNTS

Status O M

Tag 13C 32A

Field Name Time Indication Value Date, Currency Code and Amount

J.P. Morgan/SWIFT standard

Use value dates which are not in the past for STP processing. A value date which falls on a weekend will be adjusted to the following business day. The value date should not fall on a bank holiday in the country/currency you are paying, otherwise a repair would be required.

52a

Ordering Institution

Option A is the preferred option if populated. If left blank the Sender is assumed to be the Ordering Institution (some exceptions apply).

53a

Sender's Correspondent

Options A or B are the preferred options if populated. If left blank our system will debit the account linked to the currency and Sender SWIFT BIC. If you have multiple accounts in the same currency, linked to the same SWIFT BIC address, an account number should be quoted in this field to ensure that the correct account is debited.

54a

Receiver's Correspondent

Use A tag if not blank. Must contain a valid BIC.

56a

Intermediary

Option A is the preferred option and we would recommend populating this field where possible. If this field is left blank, and the Account with Institution is not directly reachable, our system will attempt to derive the correspondent details.

57a

Account With Institution

Option A is the preferred option and must be populated unless the Beneficiary customer also has their account with the same branch of J.P. Morgan. The use of a valid SWIFT BIC in this field (using the A tag option) is becoming increasingly standard throughout the EEA. Therefore it is highly recommended for STP. For domestic Sterling payments: Include key word //SC followed by the 6 consecutive numbers of the Sort Code and the SWIFT BIC Code of the bank where available.

58a

Beneficiary Institution

Option A is the preferred option and must be populated.

72

Sender to Receiver Information

Blank or see Appendix A for recognised keywords. This field should not be used to identify routing/credit party information. Note: Use of /REC/ will prevent STP. Sequence B

50a

Ordering Customer

Should match the information and formatting of the supporting MT103.

52a

Ordering Institution

Should match the information and formatting of the supporting MT103.

2009 JPMorgan Chase & Co. All Rights Reserved. JPMorgan Chase Bank, N.A. Member FDIC.

SWIFT FIN CASH FORMATTING GUIDE EUROPEAN ACCOUNTS

Status O

Tag 56a

Field Name Intermediary Institution

J.P. Morgan/SWIFT standard Should match the information and formatting of the supporting MT103. Should match the information and formatting of the supporting MT103. Should match the information and formatting of the supporting MT103.

57a

Account With Institution

59a

Beneficiary Customer

70

Remittance Information

Should match the information and formatting of the supporting MT103. Should match the information and formatting of the Sender to Receiver Information above. Should match the information and formatting of the supporting MT103.

72

Sender to Receiver Information

33B

Currency and Instructed Amount

M = Mandatory, O = Optional

SWIFT for Corporates (MT101) Payments

The following describes the format which can be used by a Corporate client, initiating a payment from an account with J.P. Morgan using an MT101 message.

Status M O Tag 20 21R Field Name Sender's Reference Customer Specified Reference M 28D Message Index/Total J.P. Morgan only accepts one occurrence of Sequence B with each occurrence of Sequence A. Tag 28D must always contain 1/1. O O 50a 50a Instructing Party Ordering Customer H Option only accepted. Line 1: debit account at J.P. Morgan prefixed by a /. Line 2 4: Name and address information of the ordering party. Note: if the Ordering Customers account is with J.P. Morgan lines 2 4 are overwritten by the address on our records. O 52a Account Servicing Institution O M 51A 30 Sending Institution Requested Execution Date Use value dates which are not in the past for STP processing. A value date which falls on a weekend will be adjusted to the following business day. The value date should not fall on a bank holiday in the country/currency you are paying, otherwise a repair would be required. O M O O 25 21 21F 23E Authorisation Transaction Reference F/X Deal Reference Instruction Code See Appendix B for J.P. Morgan value added service codes that can be used in this field. Option A is the preferred option if populated J.P. Morgan/SWIFT standard

2009 JPMorgan Chase & Co. All Rights Reserved. JPMorgan Chase Bank, N.A. Member FDIC.

SWIFT FIN CASH FORMATTING GUIDE EUROPEAN ACCOUNTS

Status

Tag

Field Name

J.P. Morgan/SWIFT standard

32B

Currency/Transaction Amount

O O

50a 50a

Instructing Party Ordering Customer For payments intra EU/EEA- include the Ordering Customers account number. For payments destined for accounts outside the EU/EEA- include complete Ordering Customer information including the name, address and account number of the Ordering Customer. Note: If the Ordering Customer holds their account with J.P. Morgan, J.P. Morgan will (where possible) add the address, linked to the account number in the first line of your message, on our records to the message. If the Sender is also the Ordering Customer, the BIC address in field 50 should match the SWIFT BIC of the Sender. We recommend the use of IBAN (International Bank Account Numbers) where available.6

52a

Account Servicing Institution

Option A is the preferred option if populated. If left blank the Sender is assumed to be the Ordering Institution (some exceptions apply).

56a

Intermediary

Option A is the preferred option and we would recommend populating this field where possible. If this field is left blank, and the Account with Institution is not directly reachable, our system will attempt to derive the correspondent details.

57a

Account With Institution

Option A is the preferred option and must be populated unless the Beneficiary customer also has their account with the same branch of J.P. Morgan. The use of a valid SWIFT BIC in this field (using the A tag option) is becoming increasingly standard throughout the EEA. Therefore it is highly recommended for STP. For domestic Sterling payments: Include key word //SC followed by the 6 consecutive numbers of the Sort Code and the SWIFT BIC Code of the bank where available.

For more details on Ordering Customer information requirements and BIC/IBAN see: Treasury Services Client Clearing Information Website

2009 JPMorgan Chase & Co. All Rights Reserved. JPMorgan Chase Bank, N.A. Member FDIC.

10

SWIFT FIN CASH FORMATTING GUIDE EUROPEAN ACCOUNTS

Status M

Tag 59a

Field Name Beneficiary

J.P. Morgan/SWIFT standard The ultimate beneficiary of the transaction. For intra EEA payments in Euro or Swedish kronor of 50K or less in value and covered by Regulation 924/2009 an IBAN account number should be quoted in this field. IBAN should also be used where required/available in other IBAN countries and currencies.7 For all other currency payments into the EU/EEA the use of the IBAN account number in Field 59 is highly recommended. Option A Line 1 IBAN/Account number prefixed with a /, Line 2 should be a valid SWIFT BIC or BEI address. No letter option Line 1 IBAN/Account number prefixed with a /, Line 2 4 can be used to supply an address.

70

Remittance Information

This field should only contain information for the Beneficiary Customer. It should not be populated with routing or credit party information.

O O

77B 33B

Regulatory Reporting Currency/Original Ordered Amount Used only in combination with keyword EQUI in Tag23E BEN charges to be borne by the beneficiary customer. OUR charges to be borne by the remitting customer. SHA charges on the Senders side to be borne by the ordering customer; transaction charges on the receivers side are to be borne by the beneficiary customer. Note: For intra EEA payments in Euro or Swedish kronor of 50K or less in value and covered by Regulation 924/2009 or in EEA currency and regulated by the Payment Services Directive SHA is the recommended charges option. J.P. Morgan will change the charging indicator to SHA on any payment we identify as regulated.

71A

Details of Charges

O O

25A 36

Charges Account Exchange Rate Used only in combination with keyword EQUI in Tag23E.

M = Mandatory, O = Optional

7 For more details on Ordering Customer information requirements and BIC/IBAN see: Treasury Services Client Clearing Information Website

2009 JPMorgan Chase & Co. All Rights Reserved. JPMorgan Chase Bank, N.A. Member FDIC.

11

SWIFT FIN CASH FORMATTING GUIDE EUROPEAN ACCOUNTS

Bankers Draft

The MT103 message type must be used when requesting J.P. Morgan to issue a Draft on your behalf.

The Payee name and address must be quoted in Field 59.

The Payee name to be quoted on the draft should be populated in the first line ONLY. The remaining lines should be populated with the address to which the draft should be mailed.

/CHEQUE/ must be quoted in Field 72 so that our payment system will derive the

appropriate payment method requested.

Status M Tag 20 Field Name Senders Transaction Reference Number O M O 13C 23B 23E Time Indication Bank Operation Code Instruction Code CRED recommended See Appendix B for J.P. Morgan value added service codes that can be used in this field (note: not all of the codes that can be used will be relevant to this service). O M 26T 32A Transaction Type Code Value Date, Currency Code and Amount Use value dates which are not in the past for STP processing. A value date which falls on a weekend will be adjusted to the following business day. The value date should not fall on a bank holiday in the country/currency you are paying, otherwise a repair would be required. O 33B Currency and Instructed Amount O M 36 50a Exchange Rate Ordering Customer For payments intra EU/EEA- include the Ordering Customers account number. For payments destined for accounts outside the EU/EEA-include complete Ordering Customer information including the name, address and account number of the Ordering Customer. Note: If the Ordering Customer holds their account with J.P. Morgan, J.P. Morgan will (where possible) add the address, linked to the account number in the first line of your message, on our records to the message. If the Sender is also the Ordering Customer, the BIC address in field 50 should match the SWIFT BIC of the Sender. We recommend the use of IBAN (International Bank Account Numbers) where available.8 O O 51A 52A Sending Institution Ordering Institution Use A Tag if not blank Option A is the preferred option if populated. If left blank the Sender is assumed to be the Ordering Institution (some exceptions apply). J.P. Morgan/SWIFT standard

For more details on Ordering Customer information requirements and BIC/IBAN see: Treasury Services Client Clearing Information Website

2009 JPMorgan Chase & Co. All Rights Reserved. JPMorgan Chase Bank, N.A. Member FDIC.

12

SWIFT FIN CASH FORMATTING GUIDE EUROPEAN ACCOUNTS

Status O

Tag 53a

Field Name Sender's Correspondent

J.P. Morgan/SWIFT standard Options A or B are the preferred options if populated. If left blank our system will debit the account linked to the currency and Sender SWIFT BIC. If you have multiple accounts in the same currency, linked to the same SWIFT BIC address, an account number should be quoted in this field to ensure that the correct account is debited.

54a

Receiver's Correspondent

This field should be left blank

55A

Third Reimbursement Institution

This field should be left blank

56A

Intermediary Institution

This field should be left blank

57A

Account With Institution

This field should be left blank

59a

Beneficiary Customer

Payee name to be quoted on the draft should be quoted in the first line of this field. The remaining lines should be used for the mailing address.

70

Remittance Information

This field should only contain information for the Beneficiary Customer. It should not be populated with routing or credit party information.

71A

Charges Option

BEN charges to be borne by the beneficiary customer though deductions to the principal amount OUR charges to be borne by the remitting customer SHA charges on the Senders side to be borne by the ordering customer; transaction charges on the receivers side are to be borne by the beneficiary customer.

O O O

71F 71G 72

Sender's Charges Receiver's Charges Sender to Receiver Information This field should be left blank /CHEQUE/ must be quoted

77B

Regulatory Reporting

M = Mandatory, O = Optional

AUTO FX

J.P. Morgan systems enable clients to debit an account in one currency but pay away in another, e.g. paying Hong Kong dollars from a euro denominated account. Where such instructions are received, a foreign exchange transaction is initiated at J.P. Morgan. Referred to as Auto FX (as the currency conversion is processed automatically), these transactions are processed via a direct link to the J.P. Morgan FX dealing room and according to the market rates for the transaction. The currency being paid must be different to that being debited. There are two types of foreign exchange, which can be effected. 1. Where the pay amount is known and the debit amount is not. 2. Where the debit amount is known but the pay amount is not (an FX equivalent transaction)

2009 JPMorgan Chase & Co. All Rights Reserved. JPMorgan Chase Bank, N.A. Member FDIC.

13

SWIFT FIN CASH FORMATTING GUIDE EUROPEAN ACCOUNTS

Example 1 where the pay amount is known

Where a specific amount of a currency is to be paid, the details are entered using either the message type MT103 or MT202. The amount debited will only be known after the foreign exchange transaction has been completed and the amount reported via normal transaction reporting methods. E.g. Debit a Euro account to pay HKD 120,000.00. The amount of Euros debited will not be known until it is reported upon completion of FX. 32A 030505 53B 12345678 HKD 120000,

(EURO A/C)

56A (correspondent BIC if required) 57A (beneficiary / pay bank BIC) 59 12463987 (Ultimate beneficiary a/c and name) 70 Reference details

Example 2 where the debit amount is known.

It is possible to specify an equivalent rate transaction where a currency amount equivalent to the debit currency is being sought. E.g. where a client wishes to pay away Hong Kong dollars to the equivalent of 45,000.00 Euros. In the example below, account 12345678 (Euro account) is debited an amount of 45,000 Euros. The amount paid will not be known until the transaction is received by the back office and the FX transaction completed, details of which, including the FX rate, are reported in the normal manner. The keyword FXEQUIV must be entered into Field 72 in order to initiate this kind of processing. Omitting this keyword will cause the transaction to be processed as example 1 above. 32A 030505 53B 12345678 HKD 45000,

(EURO A/C)

56A (correspondent BIC if required) 57A (beneficiary / pay bank BIC) 59 12463987 (Ultimate beneficiary a/c and name) 70 Reference details 72 /FXEQUIV/

Formatting an MT103 for AutoFX

Status M Tag 20 Field Name Senders transaction reference number O M O O 13C 23B 23E 26T Time Indication Bank Operation Code Instruction Code Transaction Type Code CRED recommended Please refer to options in Appendix B J.P. Morgan STP Guidance

2009 JPMorgan Chase & Co. All Rights Reserved. JPMorgan Chase Bank, N.A. Member FDIC.

14

SWIFT FIN CASH FORMATTING GUIDE EUROPEAN ACCOUNTS

Status M

Tag 32A

Field Name Value Date, Currency Code and Amount

J.P. Morgan STP Guidance Use value dates which are not in the past for STP processing. A value date which falls on a weekend will be adjusted to the following business day. The value date should not fall on a bank holiday in the country/currency you are paying, otherwise a repair would be required.

33B

Currency and Instructed Amount

O M

36 50a

Exchange Rate Ordering Customer For payments intra EU/EEA- include the Ordering Customers account number. For payments destined for accounts outside the EU/EEA-include complete Ordering Customer information including the name, address and account number of the Ordering Customer. Note: If the Ordering Customer holds their account with J.P. Morgan, J.P. Morgan will (where possible) add the address, linked to the account number in the first line of your message, on our records to the message. If the Sender is also the Ordering Customer, the BIC address in field 50 should match the SWIFT BIC of the Sender. We recommend the use of IBAN (International Bank Account Numbers) where available.9

O O

51A 52a

Sending Institution Ordering Institution

Use A Tag if not blank Option A is the preferred option if populated. If left blank the Sender is assumed to be the Ordering Institution (some exceptions apply).

53a

Sender's Correspondent

Options A or B are the preferred options if populated. If left blank our system will debit the account linked to the currency and Sender SWIFT BIC. If you have multiple accounts in the same currency, linked to the same SWIFT BIC address, an account number should be quoted in this field to ensure that the correct account is debited.

54a

Receiver's Correspondent

This field should be left blank

55a

Third Reimbursement Institution

This field should be left blank

56a

Intermediary Institution

Option A is the preferred option and we would recommend populating this field where possible. If this field is left blank, and the Account with Institution is not directly reachable, our system will attempt to derive the correspondent details.

For more details on Ordering Customer information requirements and BIC/IBAN see: Treasury Services Client Clearing Information Website

2009 JPMorgan Chase & Co. All Rights Reserved. JPMorgan Chase Bank, N.A. Member FDIC.

15

SWIFT FIN CASH FORMATTING GUIDE EUROPEAN ACCOUNTS

Status O

Tag 57a

Field Name Account With Institution

J.P. Morgan STP Guidance Option A is the preferred option and must be populated unless the Beneficiary customer also has their account with the same branch of J.P. Morgan. The use of a valid SWIFT BIC in this field (using the A tag option) is becoming increasingly standard throughout the EEA. Therefore it is highly recommended for STP. For domestic Sterling payments: Include key word //SC followed by the 6 consecutive numbers of the Sort Code and the SWIFT BIC Code of the bank where available.

59a

Beneficiary Customer

Must contain the account number or the BIC/BEI of the final beneficiary. For intra EEA payments in Euro or Swedish kronor of 50K or less in value and covered by Regulation 924/2009 an IBAN account number should be quoted in this field. IBAN should also be used where required/available in other IBAN countries and currencies.10 For all other currency payments into the EU/EEA the use of the IBAN account number in Field 59 is highly recommended.

70

Remittance Information

This field should only contain information for the Beneficiary Customer. It should not be populated with routing or credit party information.

71A

Charges option

BEN charges to be borne by the beneficiary customer though deductions to the principal amount OUR charges to be borne by the remitting customer SHA charges on the Senders side to be borne by the ordering customer; transaction charges on the receivers side are to be borne by the beneficiary customer.

O O O

71F 71G 72

Sender's Charges Receiver's Charges Sender to Receiver Information This field should be left blank Use /FXEQUIV/ when the Debit amount and sell currency amount is known. See Appendix A for recognised keywords. This field should not be used to identify routing/credit party information. Note: Use of /REC/ will prevent STP

O O

77B 77T

Regulatory Reporting Envelope Contents Not supported

M = Mandatory, O = Optional

10

For more details on Ordering Customer information requirements and BIC/IBAN see: Treasury Services Client Clearing Information Website

2009 JPMorgan Chase & Co. All Rights Reserved. JPMorgan Chase Bank, N.A. Member FDIC.

16

SWIFT FIN CASH FORMATTING GUIDE EUROPEAN ACCOUNTS

Appendix A: Field 72 Codewords

The following is additional formatting details for a number of value added services. These codewords should be used in combination with the formatting guidelines above, where the service is required. Note: these services may be subject to additional charges and specific terms and conditions governing their usage. Please request details of the service from your J.P. Morgan Relationship Managers before using these code words otherwise they may not be acted upon or processed on an STP basis.

1) Euro RTGS Request

To request payment via an RTGS system (Target2) for a Euro payment.

Status O Tag 72 Field Name Sender to Receiver Information J.P. Morgan/SWIFT standard /RTGS/

Alternatively use //RT in field 56A (if present) or if blank used in field 57A. Note the following priority services are subject to the Terms and Conditions for J.P. Morgan Prioritised Payment, Priority Payments Scheme for Euros and TIMED Payments.

2) Secure Payment Confirmation

Can be used to initiate euro payments from Frankfurt accounts only. The service incorporates payment via an RTGS system combined with an additional confirmation that the payment was settled in the clearing system. The confirmation is included on your same day reporting messages.

Status O Tag 72 Field Name Sender to Receiver Information J.P. Morgan/SWIFT standard /SNR/

3) J.P. Morgan Priority Payments

Prioritise specific payment instructions above other payment instructions received from your organisation that are in a pending state. This service is available for same-day payments initiated in euro from an account with J.P.Morgan AG, Frankfurt and in any currency offered from an account with J.P.Morgan Chase Bank, N.A., London Branch.

Status O Tag 72 Field Name Sender to Receiver Information J.P. Morgan/SWIFT standard /PRIORITY/

4) Timed Payments

This service is available for payments initiated in euro from an account with J.P.Morgan AG, Frankfurt and in euro, GB pound, US dollar and Swiss franc from an account with J.P.Morgan Chase Bank, N.A., London Branch.

Status O Tag 72 Field Name Sender to Receiver Information J.P. Morgan/SWIFT standard /TIMED/HHMM

HHMM in CET

5) Euro Priority Payments

This service is available for payments initiated in euro from an account with J.P.Morgan AG, Frankfurt and J.P.Morgan Chase Bank, N.A., London Branchin MT103/103+ format. For four hour end to end prioritised payments in euros, under the conditions of the EBA Euro Priority Payments Scheme. Note: Additional scheme conditions should be met by banks

2009 JPMorgan Chase & Co. All Rights Reserved. JPMorgan Chase Bank, N.A. Member FDIC.

17

SWIFT FIN CASH FORMATTING GUIDE EUROPEAN ACCOUNTS

wishing to accept or pay funds using this scheme on behalf of their customers. These conditions include registration prior to use.

Status O Tag 72 Field Name Sender to Receiver Information J.P. Morgan/SWIFT standard /SPRI/ (MT103 only)

6) Beneficiary Information /BNF/

Status O Tag 72 Field Name Sender to Receiver Information J.P. Morgan/SWIFT standard /BNF/ (MT202 only)

7) INS

Status O Tag 72 Field Name Sender to Receiver Information J.P. Morgan/SWIFT standard /INS/

Note: Other codes may be accepted, or specified by J.P. Morgan, please refer to your J.P. Morgan representative for guidance before using non-specified codes.

Appendix B: Field 23 Codewords

The following is additional formatting details for a number of value added services. These codewords should be used in combination with the formatting guidelines above, where the service is required. Note: these services may be subject to additional charges and specific terms and conditions governing their usage. Please request details of the service from your J.P. Morgan Relationship Managers before using these codewords otherwise they may not be acted upon or processed on an STP basis.

Status O Tag 23 Field Name Instruction Code J.P. Morgan/SWIFT standard CHQB Cheque processed and mailed to beneficiary full addressee details required in T59 O O O 23 23 23 Instruction Code Instruction Code Instruction Code CORT F/X. Copied to outbound MT103 INTC Intra Company Payment RTGS to request payment via an RTGS system (Target2) for a euro payment. O 23 Instruction Code MT101 Only OTHR/PRIORITY J.P. Morgan Priority see service description in Appendix A O 23 Instruction Code MT101 Only OTHR/SPRI (MT101/103 only) Euro Priority Payment see service description in Appendix A O 23 Instruction Code MT101 Only OTHR/SNR Secure payment confirmation see service description in Appendix A O 23 Instruction Code MT101 Only OTHR/TIMED/HHMM Timed Payment see service description in Appendix A O 23 Instruction Code MT101 Only EQUI F/X payment specifying the amount in the debit currency

2009 JPMorgan Chase & Co. All Rights Reserved. JPMorgan Chase Bank, N.A. Member FDIC.

18

Anda mungkin juga menyukai

- Fullz, CVV shops review legitimacyDokumen1 halamanFullz, CVV shops review legitimacyKenneth Richardson80% (5)

- Send Domestic and International Wires Securely OnlineDokumen2 halamanSend Domestic and International Wires Securely OnlineAshwanth RamasubbuBelum ada peringkat

- Stamp Duty PaymentDokumen3 halamanStamp Duty Paymentmiriam chewBelum ada peringkat

- 20b Avan New Update MP2112Dokumen5 halaman20b Avan New Update MP2112pezhmanbayat924Belum ada peringkat

- SwiftDokumen96 halamanSwiftVenkat Baliga86% (7)

- Standing Order FormDokumen3 halamanStanding Order FormMaissa Hassan100% (1)

- BCL Swift User GuideDokumen191 halamanBCL Swift User GuideM.Medina100% (1)

- Repos A Deep Dive in The Collateral PoolDokumen7 halamanRepos A Deep Dive in The Collateral PoolppateBelum ada peringkat

- Swift Block Info and FormatDokumen5 halamanSwift Block Info and FormatnishantvshahBelum ada peringkat

- Send International Payments Securely with SWIFTDokumen23 halamanSend International Payments Securely with SWIFTDharanya VBelum ada peringkat

- SWIFT BASICS: Learn the FundamentalsDokumen96 halamanSWIFT BASICS: Learn the FundamentalsPushkar Anand100% (1)

- SWIFT Certified Application: Label Criteria 2019Dokumen24 halamanSWIFT Certified Application: Label Criteria 2019Rimpa SenapatiBelum ada peringkat

- SwiftDokumen28 halamanSwiftShailendra SenBelum ada peringkat

- Standards MT Release 2018 Webinar: Mandatory Changes in Category 1 and Category 2Dokumen20 halamanStandards MT Release 2018 Webinar: Mandatory Changes in Category 1 and Category 2Anonymous 9kIXZjGSfNBelum ada peringkat

- Swift PaymentsDokumen3 halamanSwift PaymentsShruti GuptaBelum ada peringkat

- SWIFT FIN Payment Format Guide For European AcctsDokumen19 halamanSWIFT FIN Payment Format Guide For European AcctsShivaji ManeBelum ada peringkat

- 5 Lease of Bank Instrument - Bank Statement As Pof 005aDokumen1 halaman5 Lease of Bank Instrument - Bank Statement As Pof 005aapi-255857738Belum ada peringkat

- Deutsche Bank MT940/942 Format Specifi CationsDokumen18 halamanDeutsche Bank MT940/942 Format Specifi CationsfcfarabiBelum ada peringkat

- Minimizing Risks of Financial InstitutionsDokumen2 halamanMinimizing Risks of Financial InstitutionsSalim MattarBelum ada peringkat

- Swift Gpi Business Case EbookDokumen14 halamanSwift Gpi Business Case EbookBeniamin KohanBelum ada peringkat

- SBLC Purchase BPU-799 Pre-Advice - Prepayment Procedures-ALFDokumen3 halamanSBLC Purchase BPU-799 Pre-Advice - Prepayment Procedures-ALFSharonBelum ada peringkat

- MT 103202Dokumen5 halamanMT 103202uink wow100% (1)

- MT94042 enDokumen18 halamanMT94042 enAjeesh SudevanBelum ada peringkat

- Syllabus Negotiable InstrumentsDokumen7 halamanSyllabus Negotiable InstrumentsMagnolia Masangcay-Dalire100% (1)

- HSBC's guide to achieving straight-through processing (STP) standardsDokumen8 halamanHSBC's guide to achieving straight-through processing (STP) standardsVi ZaBelum ada peringkat

- Sample 1 PDFDokumen45 halamanSample 1 PDFChicagoCitizens EmpowermentGroupBelum ada peringkat

- Formaatbeschrijving MT103 SWIFT FIN PDFDokumen9 halamanFormaatbeschrijving MT103 SWIFT FIN PDFAnonymous 9NgJRDVHMMBelum ada peringkat

- Kinpro - Contract (Doa)Dokumen23 halamanKinpro - Contract (Doa)boncodeBelum ada peringkat

- Swift MT734Dokumen1 halamanSwift MT734Muhammad Ashifur RahmanBelum ada peringkat

- Adopt SWIFT gpi in 2018 to Future-Proof Payment OperationsDokumen28 halamanAdopt SWIFT gpi in 2018 to Future-Proof Payment Operationsandres torresBelum ada peringkat

- MT100Dokumen349 halamanMT100Hari NBelum ada peringkat

- MT 103 FAQ'sDokumen20 halamanMT 103 FAQ'sja_mufc_scribd0% (1)

- SWIFT Procurement Compliance PDFDokumen18 halamanSWIFT Procurement Compliance PDFMasoud DastgerdiBelum ada peringkat

- Experian Credit Report: 0 Late AccountsDokumen18 halamanExperian Credit Report: 0 Late Accountsmary hunterBelum ada peringkat

- SEPA and SWIFT Money Transfers - What Is The DIFFERENCE?: SWIFT - The Global Provider of Secure Financial Messaging?Dokumen2 halamanSEPA and SWIFT Money Transfers - What Is The DIFFERENCE?: SWIFT - The Global Provider of Secure Financial Messaging?Lalu Ahmad GunawanBelum ada peringkat

- Anggibni-Usd5m BarclaysDokumen1 halamanAnggibni-Usd5m BarclaysJaswani SAPBelum ada peringkat

- International funds transfer notificationDokumen1 halamanInternational funds transfer notificationLENINCMBelum ada peringkat

- Financial Services Authority: Final NoticeDokumen44 halamanFinancial Services Authority: Final Noticeannawitkowski88Belum ada peringkat

- CrvswiDokumen588 halamanCrvswiPrasad NayakBelum ada peringkat

- GEORGE NOVARO TARIGAN and 95 others personal dataDokumen66 halamanGEORGE NOVARO TARIGAN and 95 others personal dataWahidun HtnBelum ada peringkat

- STP Quick Guide Usd Mt103Dokumen3 halamanSTP Quick Guide Usd Mt103Ni Kadek SuastiniBelum ada peringkat

- RPT CPSPM 6816030 21848Dokumen8 halamanRPT CPSPM 6816030 21848Poornima AcharyaBelum ada peringkat

- Alpari Uk Bank DetailsDokumen3 halamanAlpari Uk Bank DetailsreniestessBelum ada peringkat

- Your Route To ISO 20022 and The CBPR+ GuidelinesDokumen2 halamanYour Route To ISO 20022 and The CBPR+ GuidelinesBalaji NatarajanBelum ada peringkat

- Reprint From MFA Documentary Credit NotificationDokumen4 halamanReprint From MFA Documentary Credit NotificationMd.Sakib- Ul-GoniBelum ada peringkat

- Swift Mt202 CovDokumen16 halamanSwift Mt202 CovAshish Sharma100% (2)

- Agreement 103 manual чист.Dokumen15 halamanAgreement 103 manual чист.Emanuel BarkanBelum ada peringkat

- Funds Goncarovova 2022.06.27Dokumen1 halamanFunds Goncarovova 2022.06.27Miroslav MathersBelum ada peringkat

- Letter Credit Swift Message Types & The FieldsDokumen54 halamanLetter Credit Swift Message Types & The FieldsAnonymous SuefhnBelum ada peringkat

- MT 199 Free Format Message: Click Here To Get FileDokumen2 halamanMT 199 Free Format Message: Click Here To Get FileFaNToMツNailBelum ada peringkat

- Swift MT799Dokumen1 halamanSwift MT799Muhammad Ashifur RahmanBelum ada peringkat

- NatWest Current Account Application Form Non UK EU ResDokumen17 halamanNatWest Current Account Application Form Non UK EU ResL mBelum ada peringkat

- 2 Sample SBLC 2023Dokumen2 halaman2 Sample SBLC 2023SANG HOANG THANH100% (1)

- MT103 Ubs PDFDokumen8 halamanMT103 Ubs PDFHoàng Trần HữuBelum ada peringkat

- 1 Lease of Bank Instrument - Pof Icbpo 001aDokumen1 halaman1 Lease of Bank Instrument - Pof Icbpo 001aapi-255857738Belum ada peringkat

- MT103Dokumen6 halamanMT103wisnu ipasarBelum ada peringkat

- Get Ready For: Universal Payment ConfirmationsDokumen4 halamanGet Ready For: Universal Payment Confirmationsswift adminBelum ada peringkat

- SWIFT - PresentationVisit Us at Management - Umakant.infoDokumen50 halamanSWIFT - PresentationVisit Us at Management - Umakant.infowelcome2jungleBelum ada peringkat

- MessagingDokumen9 halamanMessagingHEMANT SARVANKARBelum ada peringkat

- ISO 20022 Payments Initiation - Maintenance 2019 - 2020 Message Definition Report - Part 2Dokumen287 halamanISO 20022 Payments Initiation - Maintenance 2019 - 2020 Message Definition Report - Part 2kafihBelum ada peringkat

- Register of European Account NumbersDokumen174 halamanRegister of European Account NumbersCliffton PereiraBelum ada peringkat

- Transferring Funds : International Personal BankDokumen4 halamanTransferring Funds : International Personal BankGarbo BentleyBelum ada peringkat

- MT 760 Bank InstrumentsDokumen1 halamanMT 760 Bank InstrumentskdelaozBelum ada peringkat

- Swift - MT List 2013Dokumen10 halamanSwift - MT List 2013John HBelum ada peringkat

- Very Easy Money Transfer: E-ChequeDokumen15 halamanVery Easy Money Transfer: E-ChequeKartheek AldiBelum ada peringkat

- 4-Detail of Procedure GPI-1Dokumen1 halaman4-Detail of Procedure GPI-1uink wowBelum ada peringkat

- RUB MT 103/202: S.W.I.F.T. Payment Orders Filling-In Rules (Banks Non-Residents)Dokumen12 halamanRUB MT 103/202: S.W.I.F.T. Payment Orders Filling-In Rules (Banks Non-Residents)swift adminBelum ada peringkat

- International Securities Association For Institutional Trade CommunicationDokumen8 halamanInternational Securities Association For Institutional Trade Communicationmc080202962Belum ada peringkat

- Pacs.009 FV IBDokumen6 halamanPacs.009 FV IBchugorenerBelum ada peringkat

- Payment SystemsDokumen14 halamanPayment SystemsdestinysandeepBelum ada peringkat

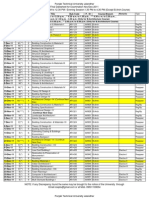

- Final Datesheet As On 2.10.11Dokumen47 halamanFinal Datesheet As On 2.10.11destinysandeepBelum ada peringkat

- PTU Online Counselling Details for B.Tech, B.Pharm, B.Arch AdmissionsDokumen1 halamanPTU Online Counselling Details for B.Tech, B.Pharm, B.Arch AdmissionsdestinysandeepBelum ada peringkat

- CET Slip Counselling CETDokumen1 halamanCET Slip Counselling CETdestinysandeepBelum ada peringkat

- Re: Registration of Second Amendment To The Real Estate Mortgage of Sps. Lilian B. and Filamer Amado P. BulaoDokumen2 halamanRe: Registration of Second Amendment To The Real Estate Mortgage of Sps. Lilian B. and Filamer Amado P. BulaoAl MarvinBelum ada peringkat

- 2012 UCPB Annual ReportDokumen81 halaman2012 UCPB Annual ReportPat Dela CruzBelum ada peringkat

- Acbl Internship ReportDokumen78 halamanAcbl Internship Reportmianshahzabalee1685100% (1)

- Banking & Economy PDF - November 2019 by AffairsCloudDokumen51 halamanBanking & Economy PDF - November 2019 by AffairsCloudSurbhi KulkarniBelum ada peringkat

- The Quran & Sunnah Society of Canada: Toronto Prayer Times (2016)Dokumen2 halamanThe Quran & Sunnah Society of Canada: Toronto Prayer Times (2016)Brush LeeBelum ada peringkat

- Kedududkan Ekonomi Chettiar Di Tanah Melayu, 1945-1957: Ummadevi Suppiah Sivachandralingam Sundara RajaDokumen23 halamanKedududkan Ekonomi Chettiar Di Tanah Melayu, 1945-1957: Ummadevi Suppiah Sivachandralingam Sundara RajaDyan AedyBelum ada peringkat

- Services Overseas Filipino ServicesDokumen2 halamanServices Overseas Filipino ServicesFlorie Ann AguilarBelum ada peringkat

- Q1 Module 5-Week 5-Loan Requirements of Different Banks and Non Bank InstitutionsDokumen24 halamanQ1 Module 5-Week 5-Loan Requirements of Different Banks and Non Bank InstitutionsJusie ApiladoBelum ada peringkat

- INTERACTIVE: Navigate Your Online Bank Account (Simulation) : NGPF Activity Bank Checking #9Dokumen42 halamanINTERACTIVE: Navigate Your Online Bank Account (Simulation) : NGPF Activity Bank Checking #9Alison GaliciaBelum ada peringkat

- Banking Related GamesDokumen5 halamanBanking Related GamesSoru Granale BalingbingBelum ada peringkat

- Cash Book ObjectivesDokumen5 halamanCash Book ObjectivestarabhaiBelum ada peringkat

- User Manual Rabo Internet BankingDokumen19 halamanUser Manual Rabo Internet BankingBach GalahadBelum ada peringkat

- Mortgage Backed SecuritiesDokumen13 halamanMortgage Backed SecuritiessaranBelum ada peringkat

- Fee Deposit SlipDokumen1 halamanFee Deposit Slipsachingoel19825509Belum ada peringkat

- Father - Guardian Name Correction Form PDFDokumen4 halamanFather - Guardian Name Correction Form PDFAdeel RazaBelum ada peringkat

- Report on MERCHANT BANKINGDokumen6 halamanReport on MERCHANT BANKINGNirbhay AroraBelum ada peringkat

- Effect of Electronic Banking On The Economic Growth of Nigeria (2009-2018)Dokumen24 halamanEffect of Electronic Banking On The Economic Growth of Nigeria (2009-2018)The IjbmtBelum ada peringkat

- Harmonised Framework For Impact Reporting Green Bonds - June 2022 280622Dokumen75 halamanHarmonised Framework For Impact Reporting Green Bonds - June 2022 280622Preetham BharadwajBelum ada peringkat

- FINA3010 Summary For Lecture 1,2Dokumen9 halamanFINA3010 Summary For Lecture 1,2Koon Sing ChanBelum ada peringkat

- Bankers Lien 3Dokumen9 halamanBankers Lien 3NishiBelum ada peringkat

- Payment HistoryDokumen1 halamanPayment HistoryRam KumarBelum ada peringkat