McNally V RPM FDCPA Receivables Performance Management Response To Plaintiff's Motion To Enforce Settlement and Request For Entry of Dismissal With Prejudice

Diunggah oleh

ghostgripDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

McNally V RPM FDCPA Receivables Performance Management Response To Plaintiff's Motion To Enforce Settlement and Request For Entry of Dismissal With Prejudice

Diunggah oleh

ghostgripHak Cipta:

Format Tersedia

1:11-cv-13393-TLL-CEB Doc # 19 Filed 08/13/12 Pg 1 of 6

Pg ID 68

UNITED STATES DISTRICT COURT IN THE EASTERN DISTRICT OF MICHIGAN NORTHERN DIVISION MARY MCNALLY, Plaintiff, v. RECEIVABLES PERFORMANCE MANAGEMENT, LLC Defendant. RONALD S. WEISS (P48762) WEISBERG & MEYERS, LLC Attorney for Plaintiff 7035 Orchard Lake Rd., Suite 600 West Bloomfield, MI 48322 888-595-9111 Ext. 230 Fax: 866-565-1327 rweiss@attorneysforconsumers.com CHARITY A. OLSON (P68295) OLSON LAW GROUP Attorneys for Defendant 106 E. Liberty, Suite 303 Ann Arbor, MI 48104 734-222-5179 Fax: 866-941-8712 colson@olsonlawpc.com Case No.: 1:11-cv-13393 Hon. Thomas L. Ludington

DEFENDANTS RESPONSE TO PLAINTIFFS MOTION TO ENFORCE SETTLEMENT AND REQUEST FOR ENTRY OF DISMISSAL WITH PREJUDICE Defendant, Receivables Performance Management, LLC (Defendant), through its counsel, Olson Law Group, for its Response to Plaintiffs Motion to Enforce Settlement and Request For Immediate Entry of an Order of Dismissal with Prejudice, states as follows: I. BACKGROUND Plaintiff correctly states that the parties reached a confidential agreement to settle Plaintiffs lawsuit. However, contrary to Plaintiffs assertions, otherwise, Defendant has made every effort to comply with the terms of the parties agreement and its respective obligations under the Internal Revenue Code (IRC), issuing the agreed upon payment less those amounts

1:11-cv-13393-TLL-CEB Doc # 19 Filed 08/13/12 Pg 2 of 6

Pg ID 69

that Defendant was required to withhold in the face of Plaintiffs refusal to provide Defendant with the requisite form W-9. Defendants obligation to properly report the settlement amount to the Internal Revenue Service (IRS) as to both Plaintiff and her attorney is not voluntary; indeed, Defendants failure to do so and/or to withhold taxes presumptively due to the IRS, thereunder, could subject Defendant to various penalties. For all of the reasons that follow, the Court should deny Plaintiffs motion and, instead, enter an order denying Plaintiffs motion and dismissing this action with prejudice consistent with the parties agreement. II. ARGUMENT A. Plaintiff Has Failed To Provide Defendant With The Requisite W-9 So Defendant Can Comply With The IRC And Corresponding Treasury Regulations

The IRC and associated Treasury Regulations require a party engaged in trade or business certain payments over $600 to report the transaction to the IRS through the issuance of one or more IRS form 1099s. IRC 6041(a); Treas. Reg. 1.6041-1. A party is engaged in a trade or business if, inter alia, the party performs activities for gain or profit. Id. Because Defendant is engaged in for profit activities, it must report all such payments constituting gross income. For purposes of 1099 reporting, the IRS broadly defines what constitutes gross income. Payment of a judgment or settlement by a business such as Defendant presumptively falls within the broad scope of taxable income and is, therefore, reportable. Johnson v. LPL Financial Services, 517 F. Supp. 2d 1231, 1234 (C.D. Cal. 2007), attached as Exhibit A; IRC 61(a). A partys failure to issue a form 1099 may result in penalties pursuant to IRC 6721.

1:11-cv-13393-TLL-CEB Doc # 19 Filed 08/13/12 Pg 3 of 6

Pg ID 70

In the case of a judgment or settlement payment, a defendants determination of whether a form 1099 should be issued to plaintiff, plaintiffs attorney or both turns on the specific circumstances of the case and, more specifically, who such settlement payment is payable to. Johnson at 1232-1233. As explained by the Court in Johnson: If some or all of the judgment or settlement payment is includable in Plaintiffs gross income, and the check is made payable to only Attorney, Defendant is required to provide a form 1099 to both Attorney and Plaintiff. This is because Defendant has separate obligations under the I.R.C. to provide Attorney and Plaintiff with form 1099s. Treas. Reg. 1.6045-5 states that Defendant must provide Attorney with a form 1099 for payments over $ 600 whether or not the attorney's services were performed for Defendant and whether or not Defendant is required to provide additional form 1099s. Treas. Reg. 1.6041-1 states that Defendant is also required to provide Plaintiff with a form 1099 for payments made over $ 600 if the payment is considered gross income to Plaintiff. Therefore, when a check is made out to only Attorney and the payment is considered gross income to Plaintiff, Defendant is required to provide form 1099s to Attorney and Plaintiff. Id., at 1235-1236. Here, there is no dispute that Plaintiff requested that the agreed upon settlement payment be made payable to her attorney, only. There is also no dispute that, notwithstanding repeated requests that she do so in advance of the payment due date, Plaintiff refused to provide Defendant with her W-9 so that Defendant could satisfy its respective reporting obligations. Plaintiffs provision of her attorneys W-9, only, is no more sufficient today than it was 2 months ago, nor does it somehow absolve Defendant from satisfying its tax reporting obligations in this instance. Indeed, the agreement expressly provides that [t]he Agreement is enforceable regardless of the taxability of the Settlement Amount or any portion thereof. Thus, Plaintiffs suggestion that such reporting obligations came as a surprise to Plaintiff and her counsel is without merit.

1:11-cv-13393-TLL-CEB Doc # 19 Filed 08/13/12 Pg 4 of 6

Pg ID 71

Equally unavailing is Plaintiffs suggestion that Defendant cannot comply with the IRC because the agreement did not expressly state that Defendant intended to properly report the payment to the IRS as required by law. See, e.g., McCormick v. Brezinski, 2010 U.S. Dist. LEXIS 36106, *10 (E.D. Mich. 2010) (rejecting plaintiffs contention that defendants demand for plaintiffs social security number for the purpose of dispatching defendants form 1099 reporting obligations was unenforceable). Defendant is plainly required to issue a form 1099 to both Plaintiff and her attorney as outlined above. Accordingly, Plaintiffs failure to do so is and remains without legal justification. If Plaintiff wishes to contest the applicable IRC provisions and/or the tax treatment of the agreed upon payment directly with the IRS, she is certainly free to do so. However, Defendant respectfully submits that neither the parties, nor this Court, are empowered to disregard the IRC in the course of properly reporting the agreed upon settlement payment. B. Faced With Plaintiffs Refusal to Duly Provide Her W-9, Defendant Properly Withheld Those Amounts Mandated by the IRS

Beyond the penalties associated with the failure to properly issue the requisite form 1099 in the first instance which Plaintiff seemingly glosses over a party that fails to withhold income tax on reportable payments can also be held liable for the payment of any back up withholding required to be deducted but not so withheld. IRC 3406. Such circumstances include, but are not limited to, instances where a payee fails to furnish a tax identification number in the manner required (i.e. by the provision of a form W-9). Id. This is precisely the same circumstance that Defendant finds itself in. Here, Plaintiffs refusal to furnish her W-9 does not excuse Defendants obligations under the IRC. In fact, the IRC expressly contemplates such a scenario, mandating that the payer take affirmative steps to deduct and withheld appropriate taxable amounts or run the risk of further penalty. 4

1:11-cv-13393-TLL-CEB Doc # 19 Filed 08/13/12 Pg 5 of 6

Pg ID 72

Plaintiffs problem is solely of her own making. By Plaintiffs own admission, Defendant expressly advised Plaintiffs counsel, in writing, that it would be forced to comply with the provisions of IRC 3406 should Plaintiffs W-9 not be forthcoming. Despite Defendants renewed plea for Plaintiffs W-9, Plaintiff and/or her counsel, again, ignored such notice and persisted with their refusal to provide the necessary documentation. Confronted with the looming settlement payment deadline and the specter of IRS penalties, Defendant properly and with full written notice to Plaintiff issued the agreed upon settlement payment less those amounts that Defendant was required to withhold pursuant to IRC 3406. The remaining amount, representing back up withholding, was made payable to the IRS. Plaintiff does not in any way dispute this sequence of events, nor does Plaintiff offer any reason whatsoever as to why the above-cited provisions do not apply to her. See, Dkt. 18, Plaintiffs Motion, 9. In fact, Plaintiff simply and rather unabashedly announces that she will not comply with the IRC, now or in the future. Such actions are wholly improper and are the sole reason for the continued delay in dismissal of this matter. C. The Court Should Enter an Order Dismissing this Matter With Prejudice and Awarding Defendant Its Fees and Costs

Despite Plaintiffs utter lack of cooperation, Defendant has complied with the parties agreement, issuing the settlement payment less required withholding amounts. Accordingly, Plaintiffs refusal to dismiss this matter, as required by the parties agreement, is without justification and constitutes a continuing breach of the settlement agreement, which mandates dismissal of this action in its entirety. III. CONCLUSION Because there is no longer a case or controversy between the parties, the Court can and should enter an order of dismissal with prejudice without further delay. Defendant has made the 5

1:11-cv-13393-TLL-CEB Doc # 19 Filed 08/13/12 Pg 6 of 6

Pg ID 73

agreed upon settlement payment less required withholding amounts. Plaintiff is entitled to nothing more. Defendant, on the other hand, bargained for dismissal of this matter with prejudice and should be granted nothing less. Defendant should also be awarded its attorneys fees and costs incurred in responding to Plaintiffs motion. Respectfully Submitted, /s/ Charity A. Olson Charity A. Olson (P68295) Olson Law Group Attorneys for Defendant 106 E. Liberty, Suite 303 Ann Arbor, MI 48104 734-222-5179 Fax: 866-941-8712 colson@olsonlawpc.com

Dated: August 13, 2012

PROOF OF SERVICE I, Charity A. Olson, hereby state that on August 13, 2012, I served a copy of the foregoing pleading upon all counsel of record via the Courts ECF system. /s/ Charity A. Olson CHARITY A. OLSON (P68295) Olson Law Group Attorneys for Defendant 106 E. Liberty, Suite 303 Ann Arbor, MI 48104 (734) 222- 5179 colson@olsonlawpc.com

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- Checklist ISO 20000-2018Dokumen113 halamanChecklist ISO 20000-2018roswan83% (6)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Scheffler V NCO Financial Systems Inc FDCPA ComplaintDokumen5 halamanScheffler V NCO Financial Systems Inc FDCPA ComplaintghostgripBelum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Sample Construction ContractDokumen7 halamanSample Construction ContractKim100% (1)

- Urspringer V Pizza Luce ADA Discrimination ComplaintDokumen10 halamanUrspringer V Pizza Luce ADA Discrimination ComplaintghostgripBelum ada peringkat

- Unilever Hellman's Survey Questions - Hampton CreekDokumen14 halamanUnilever Hellman's Survey Questions - Hampton CreekghostgripBelum ada peringkat

- Mitchell V Chase Receivables Inc FDCPADokumen5 halamanMitchell V Chase Receivables Inc FDCPAghostgripBelum ada peringkat

- Reflections of A Career Prosecutor James BackstromDokumen6 halamanReflections of A Career Prosecutor James BackstromghostgripBelum ada peringkat

- Presqriber V Practice Fusion Motion To DismissDokumen19 halamanPresqriber V Practice Fusion Motion To DismissghostgripBelum ada peringkat

- Acosta V Credit Bureau of Napa County Chase ReceivablesDokumen13 halamanAcosta V Credit Bureau of Napa County Chase ReceivablesghostgripBelum ada peringkat

- Presqriber LLC V Practice Fusion Inc Motion To DismissDokumen2 halamanPresqriber LLC V Practice Fusion Inc Motion To DismissghostgripBelum ada peringkat

- Nicolai V NCO Financial Systems Inc Rule 68 Offer of Judgment Erstad RiemerDokumen3 halamanNicolai V NCO Financial Systems Inc Rule 68 Offer of Judgment Erstad RiemerghostgripBelum ada peringkat

- Minneapolis Police Officers Federation Contract 2012Dokumen121 halamanMinneapolis Police Officers Federation Contract 2012ghostgrip100% (1)

- Pratt V NCO Financial Systems FDCPA Complaint MinnesotaDokumen6 halamanPratt V NCO Financial Systems FDCPA Complaint MinnesotaghostgripBelum ada peringkat

- Presqriber v. Medical Information Technology, Inc. D/b/a MeditechDokumen7 halamanPresqriber v. Medical Information Technology, Inc. D/b/a MeditechPriorSmartBelum ada peringkat

- Declaration of Ryu Yokoi Hellman's - Unilever V Hampton Creek Just MayoDokumen13 halamanDeclaration of Ryu Yokoi Hellman's - Unilever V Hampton Creek Just MayoghostgripBelum ada peringkat

- Dobson Chase Receivables Robert ArleoDokumen2 halamanDobson Chase Receivables Robert ArleoghostgripBelum ada peringkat

- Hellmans V Just Mayo - Declaration of Michael MazisDokumen14 halamanHellmans V Just Mayo - Declaration of Michael MazisghostgripBelum ada peringkat

- Chase Receivables Collection Agency NoticeDokumen2 halamanChase Receivables Collection Agency NoticeghostgripBelum ada peringkat

- Declaration of Michael J Wood Chase ReceivablesDokumen3 halamanDeclaration of Michael J Wood Chase ReceivablesghostgripBelum ada peringkat

- Motion For Class Certification Acosta V Credit Bureau of Napa CountyDokumen6 halamanMotion For Class Certification Acosta V Credit Bureau of Napa CountyghostgripBelum ada peringkat

- Chase Receivables Chase Payment CenterDokumen2 halamanChase Receivables Chase Payment CenterghostgripBelum ada peringkat

- Mitchell V Chase Receivables Inc FDCPADokumen5 halamanMitchell V Chase Receivables Inc FDCPAghostgripBelum ada peringkat

- Jay Clifton Kolls V City of Edina Withdrawal of CounselDokumen1 halamanJay Clifton Kolls V City of Edina Withdrawal of CounselghostgripBelum ada peringkat

- Conopco Unilever Hellman's V Hampton Creek Just Mayo ComplaintDokumen17 halamanConopco Unilever Hellman's V Hampton Creek Just Mayo ComplaintghostgripBelum ada peringkat

- Grazzini-Rucki V Knutson Amended Complaint ECF 17 13-CV-02477 Michelle MacDonald MinnesotaDokumen72 halamanGrazzini-Rucki V Knutson Amended Complaint ECF 17 13-CV-02477 Michelle MacDonald Minnesotaghostgrip100% (1)

- Jay Clifton Kolls DPPA ExhibitsDokumen14 halamanJay Clifton Kolls DPPA Exhibitsghostgrip100% (1)

- Bien V Stellar Recovery Inc Complaint Caller ID SpoofingDokumen15 halamanBien V Stellar Recovery Inc Complaint Caller ID SpoofingghostgripBelum ada peringkat

- Michelle MacDonald Complaint Criminal Contempt Dakota CountyDokumen3 halamanMichelle MacDonald Complaint Criminal Contempt Dakota CountyghostgripBelum ada peringkat

- Diabate V University of Minnesota ComplaintDokumen9 halamanDiabate V University of Minnesota ComplaintghostgripBelum ada peringkat

- Grazzini-Rucki V Knutson Amended Appendix ECF 17-2 13-CV-02477 Michelle MacDonald MinnesotaDokumen209 halamanGrazzini-Rucki V Knutson Amended Appendix ECF 17-2 13-CV-02477 Michelle MacDonald MinnesotaghostgripBelum ada peringkat

- Grazzini-Rucki V Knutson Order ECF 44 13-CV-02477 Michelle MacDonald MinnesotaDokumen34 halamanGrazzini-Rucki V Knutson Order ECF 44 13-CV-02477 Michelle MacDonald MinnesotaghostgripBelum ada peringkat

- Grazzini-Rucki V Knutson Feb 18 Letter ECF 43-1 13-CV-02477 Michelle MacDonald MinnesotaDokumen3 halamanGrazzini-Rucki V Knutson Feb 18 Letter ECF 43-1 13-CV-02477 Michelle MacDonald MinnesotaghostgripBelum ada peringkat

- Current Org StructureDokumen2 halamanCurrent Org StructureJuandelaCruzVIIIBelum ada peringkat

- Myths and Realities of Eminent Domain AbuseDokumen14 halamanMyths and Realities of Eminent Domain AbuseInstitute for JusticeBelum ada peringkat

- Armstrong April Quarterly 2022Dokumen108 halamanArmstrong April Quarterly 2022Rob PortBelum ada peringkat

- Sources of FinanceDokumen3 halamanSources of FinanceAero Vhing BucaoBelum ada peringkat

- IIP - Vs - PMI, DifferencesDokumen5 halamanIIP - Vs - PMI, DifferencesChetan GuptaBelum ada peringkat

- AE 5 Midterm TopicDokumen9 halamanAE 5 Midterm TopicMary Ann GurreaBelum ada peringkat

- RajasthanDokumen5 halamanRajasthanrahul srivastavaBelum ada peringkat

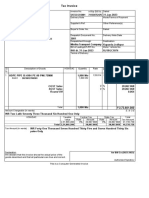

- Tax InvoiceDokumen1 halamanTax Invoicepiyush1809Belum ada peringkat

- Customer Master Data Views in CMDDokumen22 halamanCustomer Master Data Views in CMDVasand SundarrajanBelum ada peringkat

- Value Stream Mapping Case StudyDokumen12 halamanValue Stream Mapping Case StudySaikat GhoshBelum ada peringkat

- VhduwsDokumen3 halamanVhduwsVia Samantha de AustriaBelum ada peringkat

- BY Sr. Norjariah Arif Fakulti Pengurusan Teknologi Dan Perniagaan, Universiti Tun Hussein Onn Malaysia 2 December 2013Dokumen31 halamanBY Sr. Norjariah Arif Fakulti Pengurusan Teknologi Dan Perniagaan, Universiti Tun Hussein Onn Malaysia 2 December 2013Ili SyazwaniBelum ada peringkat

- December 2011Dokumen117 halamanDecember 2011Irfan AhmedBelum ada peringkat

- School of Agribusiness Management: (Acharya N G Ranga Agricultural University) Rajendranagar, Hyderabad-500030Dokumen25 halamanSchool of Agribusiness Management: (Acharya N G Ranga Agricultural University) Rajendranagar, Hyderabad-500030Donbor Shisha Pohsngap100% (1)

- DaewooDokumen18 halamanDaewooapoorva498Belum ada peringkat

- Compiled Midterm Study GuideDokumen9 halamanCompiled Midterm Study GuideHaseeb MalikBelum ada peringkat

- Oct 2022 Act BillDokumen2 halamanOct 2022 Act Billdurga prasadBelum ada peringkat

- OpTransactionHistoryTpr09 04 2019 PDFDokumen9 halamanOpTransactionHistoryTpr09 04 2019 PDFSAMEER AHMADBelum ada peringkat

- Ielts Writing Task 1-Type 2-ComparisonsDokumen10 halamanIelts Writing Task 1-Type 2-ComparisonsDung Nguyễn ThanhBelum ada peringkat

- Jansen H SinamoDokumen1 halamanJansen H SinamoIndoplaces100% (2)

- Eco Bank Power Industry AfricaDokumen11 halamanEco Bank Power Industry AfricaOribuyaku DamiBelum ada peringkat

- Business PeoplesDokumen2 halamanBusiness PeoplesPriya Selvaraj100% (1)

- Extra Oligopolio PDFDokumen17 halamanExtra Oligopolio PDFkako_1984Belum ada peringkat

- Report on Textiles & Jute Industry for 11th Five Year PlanDokumen409 halamanReport on Textiles & Jute Industry for 11th Five Year PlanAbhishek Kumar Singh100% (1)

- Lehman's Aggressive Repo 105 TransactionsDokumen19 halamanLehman's Aggressive Repo 105 Transactionsed_nycBelum ada peringkat

- Interpreting The Feelings of Other People Is Not Always EasyDokumen4 halamanInterpreting The Feelings of Other People Is Not Always EasyEs TrungdungBelum ada peringkat

- Bid Data SheetDokumen3 halamanBid Data SheetEdwin Cob GuriBelum ada peringkat

- Rajanpur Salary Sheet June 2020Dokumen18.379 halamanRajanpur Salary Sheet June 2020Zahid HussainBelum ada peringkat