Steel Industry Update #277

Diunggah oleh

Michael LockerHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Steel Industry Update #277

Diunggah oleh

Michael LockerHak Cipta:

Format Tersedia

Steel Industry Update/277

August 2012

Locker Associates, 225 Broadway, Suite 2625 New York NY 10007

Tel: 212-962-2980

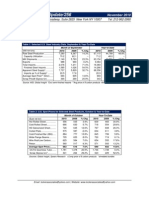

Table 1: Selected U.S. Steel Industry Data, June & Year-to-Date, 2012

Month of June

2012

2011

Raw Steel Production ........................7,979

7,987

(000 net tons)

% Chg

-0.1%

2012

50,918

Year-to-Date

2011

47,054

% Chg

8.2%

Capacity Utilization .......................... 74.8

76.2

--

78.8

74.4

--

Mill Shipments ...................................8,017

7,639

4.9%

50,117

44,780

11.9%

Exports ..............................................1,171

1,095

6.9%

7,277

6,408

13.6%

Total Imports......................................2,820

2,706

4.2%

17,632

14,645

20.4%

Finished Steel Imports .....................2,204

2,145

2.8%

13,605

11,092

22.7%

Apparent Steel Supply* ......................9,050

8,689

4.2%

56,445

49,464

14.1%

Imports as % of Supply*................... 24.4

24.7

--

24.1

22.4

--

Average Spot Price** ($/ton) ............... $744

$882

-15.6%

$800

$917

-12.7%

Scrap Price# ($/ton) ............................ $373

$440

-15.2%

$429

$440

-2.5%

Sources: AISI, SteelBenchmarker

*Excl semi-finished imports

**Avg price of 3 carbon products

#shredded scrap

Table 2: U.S. Spot Prices for Selected Steel Products, August & Year-to-Date, 2012

Hot Rolled Band....

Cold Rolled Coil........

Coiled Plate..................

Month of August

2012

2011

% Chg

$647

$664

-2.6%

751

778

-3.5%

796

1021

-22.0%

2012

$675

774

893

Average Spot Price....

$731

$821

-10.9%

$781

$898

OCTG*

$1,925

$1,963

-1.9%

$2,002

$1,859

7.7%

#1 Heavy Melt...

Shredded Scrap...

#1 Busheling.

$354

393

397

$406

436

481

-12.8%

-9.9%

-17.5%

$372

412

428

$404

440

475

-7.8%

-6.3%

-9.9%

($ per net ton)

Year-to-Date

2011

$794

889

1,011

Sources: World Steel Dynamics, Spears Research, 8/12; *OCTG data is July 2012

Email: lockerassociates@yahoo.com | Website: www.lockerassociates.com

% Chg

-15.0%

-12.9%

-11.7%

-13.1%

Steel Industry Update/277

Table 3: World Crude Steel Production, July & Year-to-Date, 2012

Month of July

Year-to-Date

(000 metric tons)

2012

2011

%

Chg

2012

2011

Region

European Union.

14,227

14,953

-4.9%

103,212

108,133

Other Europe.

3,261

3,070

6.2%

22,337

21,171

% Chg

-4.6%

5.5%

C.I.S.

9,515

9,278

2.6%

66,178

65,933

North America

10,235

10,108

1.3%

73,305

69,207

5.9%

South America...

4,010

4,269

-6.1%

27,770

28,738

-3.4%

0.4%

Africa/Middle East.....

2,689

2,726

-1.4%

20,094

20,228

-0.7%

Asia..

85,302

82,191

3.8%

580,695

570,364

1.8%

Oceania......

500

616

-18.8%

3,353

4,623

-27.5%

Total

129,738

127,210

2.0%

896,944

888,396

1.0%

China.......

Japan...

61,693

9,259

59,188

9,152

4.2%

1.2%

419,458

63,323

410,912

63,225

2.1%

0.2%

United States..

7,433

7,368

0.9%

53,625

50,055

7.1%

India(e).

6,590

6,252

5.4%

44,567

43,106

3.4%

Russia..

5,900

5,696

3.6%

41,556

40,437

2.8%

South Korea.......

5,911

5,660

4.4%

40,871

39,615

3.2%

Germany...

3,590

3,667

-2.1%

25,509

26,863

-5.0%

Turkey

3,135

2,858

9.7%

21,059

19,262

9.3%

Brazil...

3,001

3,129

-4.1%

20,404

20,957

-2.6%

Country

Ukraine(e)...

2,970

2,811

5.7%

20,146

20,513

-1.8%

All Others....

20,256

21,429

-5.5%

146,426

153,451

-4.6%

Source: World Steel Association, 8/12; e=estimate

Graph 1: World Crude Steel Production, July 2012

Source: World Steel Association, 8/12; in million metric tons

-2-

Steel Industry Update/277

Graph 2: World Steel Capacity Utilization, July 2012

Source: World Steel Association, 8/12

Table 4: Chinese Steel Exports, June 2012

June 12

781,104

May 12

889,435

Singapore

262,817

136,708

99,919

Vietnam

252,550

153,206

118,082

Thailand

214,275

206,065

177,714

India

187,689

210,974

121,652

Philippines

146,052

140,184

55,698

United States

123,898

125,324

124,739

Hong Kong

118,239

135,130

82,909

Indonesia

106,693

133,909

68,741

Russia

98,020

70,705

60,589

Brazil

54,089

99,813

121,847

Other

1,767,087

1,767,031

1,537,812

World Total

4,112,513

4,068,540

3,388,183

Country

South Korea

Source: American Metal Market, 7/30/12; in tonnes

-3-

June 11

818,481

Steel Industry Update/277

Table 5: South American Crude Steel Production, June & Year-to-Date, 2012

Argentina

Brazil

Chile

Colombia

Ecuador

Paraguay

Peru

Uruguay

Venezuela

2012

445

2,749

155

125

35

5

80

10

160

June

2011

470

3,004

139

113

50

3

81

8

261

% Chg

-5.3%

-8.5%

11.5%

10.6%

-30.0%

66.7%

-1.2%

25.0%

-38.7%

2012

2,726

17,390

887

708

210

19

481

59

1,143

Year-to-Date

2011

2,713

17,828

874

658

248

13

426

33

1,677

% Chg

0.5%

-2.5%

1.5%

7.6%

-15.3%

46.2%

12.9%

78.8%

-31.8%

South American Total

3,764

4,129

-8.8%

23,623

24,470

-3.5%

(in 000 tonnes)

Source: Worldsteel.org, 7/25/12

Table 6: Eurofer Economic and Steel Market Outlook, 2012e-2013f

%*

2011

q112

q212

q312

q412

2012

q113

q213

q313

q413

2013

Construction

27%

3.8

-5.5

-2.5

-0.6

-0.1

-2

2.7

1.9

2.3

2.2

Structural steelwork

11%

3.5

-2.7

-4.5

-2.7

-2.3

-3

-0.8

1.3

1.9

2.3

1.3

Mechanical engineering

14%

10.4

3.9

-0.5

-1.8

-1.7

-0.1

0.1

1.7

4.9

2.7

Automotive

16%

10.8

1.7

-2.1

-4.2

-4.3

-2.1

-2.8

0.8

3.4

6.3

1.8

Domestic appliances

4%

-5.6

-1

-3.1

-1.9

-0.2

-1.5

1.7

3.9

2.2

2.4

Shipyards

1%

-3.3

-0.4

-5

-5.8

-5.9

-4.1

-7.9

-3

0.5

2.6

-2.3

Tubes

12%

10.4

-3.8

-2.1

-3.8

-0.1

-2.5

1.5

1.1

3.6

3.7

2.4

Metal goods

12%

7.9

0.6

-0.8

-0.1

0.6

0.1

0.7

2.4

3.3

2.6

3%

0.6

-0.3

-1.1

0.1

1.4

0.9

1.8

4.1

4.9

2.9

100%

6.4

-1.2

-2.1

-1.9

-1.2

-1.6

0.3

1.6

2.9

3.8

2.2

Miscellaneous

Total

Source: Worldsteel.org, 7/25/12; *% in total consumption; e=estimate, f=forecast

Steel Industry Update (ISSN 1063-4339) published 12 times/year by Locker Associates, Inc. Copyright 2012 by Locker Associates, Inc. All

rights reserved. Reproduction in any form forbidden w/o permission. Locker Associates, Inc., 225 Broadway Suite 2625 New York NY 10007.

-4-

Steel Industry Update/277

Table 7: US Steel Consumption & Shipment Outlook, 1995-2013f

1995

2000

2005

2009

2010

2011

2012e

2013f

First quarter

24.9

28.6

27.1

13.3

20.5

22.5

25.0

25.5

Second quarter

24.4

28.5

25.6

13.5

21.7

22.3

24.5

26.0

Third quarter

24.0

27.3

25.7

16.8

20.8

23.7

24.0

25.5

Fourth quarter

24.2

24.7

26.6

18.6

20.4

23.4

24.5

25.1

Shipments

97.5

109.1

105.0

62.2

83.4

91.9

98.0

102.1

Plus: Imports

(million short tons)

24.4

38.0

32.1

16.2

23.9

28.5

31.5

33.0

Less: Imported semis converted to

finished products*

5.0

8.6

6.9

2.0

5.1

6.7

8.0

8.5

Less: Exports

7.1

6.5

9.4

9.3

12.0

13.5

13.5

14.0

109.8

131.9

120.8

67.1

90.2

100.3

108.0

112.6

Subtotal: Apparent steel demand

Less: Est. user/buyer inv. build

-2.0

-2.0

-6.4

-10.0

4.0

1.5

2.8

2.0

Equals: Actual steel consumption

111.8

133.9

127.2

77.1

86.2

98.8

105.3

110.6

% Change

2.0%

3.1%

2.8%

-32.9%

11.9%

14.5%

6.6%

5.1%

98.6

116.2

101.9

75.4

79.3

84.3

88.0

91.4

% Change

4.3%

5.8%

1.9%

-24.8%

5.2%

6.3%

4.3%

3.9%

Steel Consumption**

1.134

1.152

1.247

1.022

1.088

1.172

1.197

1.210

Index of activity (IDX) in 15 steel

consuming industries (2004 =100)

Source: World Steel Dynamics, 6/12; *AISI-reporting companies; **per point of activity index (million tons)

Table 8: World Steel Dynamics Mid-High Crude Steel Forecast, 2011-2013f

(in million metric tonnes)

Japan

Western Europe

United States

2011

108

148

2012e

108

142

2013f

113

150

% Chg

12e/13f

4.2

5.6

86

93

97

5.1

Small Cap

133

133

140

4.8

Advanced Countries

474

476

499

4.9

China

680

725

755

4.1

Africa

Brazil

7

35

7

35

7

38

0.0

6.8

113

115

118

2.6

Eastern Europe

13

13

13

2.7

Developing Asia

22

22

24

7.1

India

72

73

78

7.4

Latin America

33

33

35

6.1

Turkey

34

36

37

2.8

MENA

28

28

30

7.1

357

363

380

4.9

1,511

1,564

1,636

4.6

CIS

Developing World, ex-China

World Total

Source: World Steel Dynamics, June 2012; e=estimate, f=forecast

-5-

Steel Industry Update/277

Table 9: US Steel Financial Results, 2nd Quarter 2012

(in US$ millions, except per share amounts)

Net Sales

Segment income from flat rolled

Segment income from US Steel Europe

Segment income from tubular

Segment income from other businesses

Total reportable segment*

Postretirement benefit expense

Other items not allocated to segments

Income from operations

Net interest and other financial costs

Income tax provision

Net income attributable to US Steel

Per basic share

Per diluted share

Q2 '12

$5,017

177

34

103

16

330

-77

253

82

70

101

0.7

0.62

Q2 '11

$5,120

374

-18

31

9

396

-96

300

13

65

222

1.54

1.33

% Chg

-2.0%

-52.7%

-288.9%

232.3%

77.8%

-16.7%

-19.8%

Na

-15.7%

530.8%

7.7%

-54.5%

-54.5%

-53.4%

Q1 '12

$5,172

183

-34

129

17

295

-77

-291

-73

50

96

-219

-1.52

-1.52

% Chg

-3.0%

-3.3%

-200.0%

-20.2%

-5.9%

11.9%

0.0%

na

-446.6%

64.0%

-27.1%

-146.1%

-146.1%

-140.8%

Source: SteelGuru.com, 8/1/12; *and other businesses income from operations

Table 10: AK Steel Financial Results, 2nd Quarter 2012

Operating profit

Q2 '12

56.7

Q1 '12

4.1

% Chg

1,282.9%

Net income*

-724.2

-11.8

6,037.3%

(in US$ millions, except per share amounts)

Adjusted net income*

Earnings per diluted share, as reported

Adjusted earnings per diluted share

11.4

-11.8

-196.6%

-6.55

-0.11

5,854.5%

0.1

-0.11

-190.9%

% Chg

-10.5%

-28.2%

-51.1%

na

-37.5%

-37.4%

9.9%

17.1%

-6.6%

-2.3%

-26.6%

Q1 '12

$22,703

1,972

663

11

0.01

13.2

6.8

22.8

22.2

89

Source: SteelGuru.com, 7/25/12; *attributable to AK Steel Holding

Table 11: ArcelorMittal Financial Results, 2nd Quarter 2012

(in US$ millions unless otherwise shown)

Sales

EBITDA

Operating income

Income from discontinued operations

Net income

Basic earnings per share (USD)

Own iron ore production (mt)

Iron ore shipments at market price (mt)

Crude steel production (mt)

Steel shipments (mt)

EBITDA per tonne (US$/t)

Q2 '12

$22,478

2,449

1,101

959

0.62

14.4

8.2

22.8

21.7

113

Source: SteelGuru.com, 7/26/12

-6-

Q2 '11

$25,126

3,413

2,252

1,535

0.99

13.1

7

24.4

22.2

154

% Chg

-1.0%

24.2%

66.1%

na

8,618.2

6,100.0

9.1%

20.6%

0.0%

-2.3%

27.0%

Steel Industry Update/277

Table 12: Turkish Billet Exports, June 2012

June 12

215,910

25,779

June 11

33,478

27,304

1st H 12

850,813

94,121

1st H 11

325,388

154,573

1,241

21,574

64,247

106,568

na

6,500

50,085

105,040

Sudan

20,500

na

44,491

5,001

Bangladesh

40,000

na

40,000

47,846

UAE

2,194

41,330

26,974

124,388

Peru

25,928

na

25,928

53,875

Oman

15,600

na

25,096

na

Israel

7,798

2,379

23,861

17,937

Country

Saudi Arabia

Egypt

Iran

Morocco

Source: SteelOrbis.com, 8/9/12; in tonnes; na=not available

Table 13: Turkish Rebar Exports, June 2012

June 12

102,989

53,306

June 11

73,371

168,381

1st H 12

577,325

464,366

1st H 11

379,563

768,141

101,712

12,214

354,417

146,727

84,403

38,958

308,589

131,125

6,215

32,708

275,688

171,128

Israel

59,234

19,436

263,943

189,180

Yemen

26,500

21,748

238,335

107,701

Ethiopia

32,259

2,496

186,863

57,006

5,198

31,980

164,953

51,831

29,680

9,428

133,563

94,647

Country

Iraq

UAE

Saudi Arabia

Egypt

US

Libya

Canada

Source: SteelOrbis.com, 8/9/12; in tonnes

-7-

Steel Industry Update/277

Locker Associates Steel Track: Spot Prices

U.S. Flat-Rolled Prices

U.S. Scrap Prices

($ per ton)

500

1100

($ per ton)

#1 Busheling

Plate

1000

450

Shredded

Scrap

900

400

CR Coil

800

350

700

#1 Heavy Melt

Rebar

HR Band

300

600

250

500

400

200

'07 '08 '09 '10 1q

2q 3q

4q

'07 '08 '09 '10 1q

2q

3q

4q

Locker Associates Steel Track: Performance

U.S. Raw Steel Production

10.0

(mil net tons)

9.0

2012

80%

7.0

70%

6.0

60%

5.0

50%

4.0

40%

2011

90%

8.0

3.0

U.S. Capacity Utilization

100%

2012

2011

30%

2012 8.5 8.3 8.8 8.6 8.7 8.0

2012 78% 81% 80% 81% 79% 75%

2011 7.9 7.4 8.1 7.8 7.9 8.0

2011 73% 75% 75% 74% 73% 76%

Steel Mill Products: US Imports, June & Year-to-Date, 2012

Imports: Country of Origin

(000 net tons)

Canada..

Mexico

Other W. Hemisphere..

European Union

Other Europe*..

Asia.

Oceania.

Africa..

Total

Imports: Customs District

Atlantic Coast

Gulf Coast/Mexican Border

Pacific Coast.

Gr Lakes/Canadian Border

Off Shore

Month of June

2012

2011

% Chg

510

526

-3.0%

234

211

10.9%

433

268

61.6%

456

371

22.9%

230

368

-37.55

940

848

10.8%

14

86

-83.7%

3

27

-88.9%

2,820

2,705

4.3%

226

1,389

490

694

22

312

1,235

471

679

8

Source: AISI; *includes Russia

Update #277

-8-

-27.6%

12.5%

4.0%

2.2%

175.0%

2012

3,055

1,307

2,372

2,773

2,433

5,459

191

41

17,632

2,206

8,638

2,996

3,675

117

Year-to-Date

2011

3,108

1,615

1,519

2,201

1,499

4,075

533

96

14,645

1,874

6,238

2,831

3,597

105

% Chg

-1.7%

-19.1%

56.2%

26.0%

62.3%

34.0%

-64.2%

-57.3%

20.4%

17.7%

38.5%

5.8%

2.2%

11.4%

Locker Associates, Inc.

LOCKER ASSOCIATES is a business-consulting firm that specializes in enhancing the

competitiveness of businesses and industries on behalf of unions, corporate and government

clients. By combining expert business and financial analysis with a sensitivity to labor issues,

the firm is uniquely qualified to help clients manage change by:

leading joint labor/management business improvement initiatives;

facilitating ownership transitions to secure the long-term viability of a business;

conducting strategic industry studies to identify future challenges and opportunities;

representing unions in strategic planning, workplace reorganization and bankruptcy

formulating business plans for turnaround situations; and

performing due diligence for equity and debt investors.

Over the last 28 years, the firm has directed over 225 projects spanning manufacturing,

transportation, distribution and mining industries. Typical projects involve in-depth analysis of a

firms market, financial and operating performance on behalf of a cooperative labormanagement effort. Locker Associates also produces a widely read monthly newsletter, Steel

Industry Update that circulates throughout the U.S. and Canadian steel industry.

MAJOR CLIENTS

United Steelworkers

Bank of Boston

Congress Financial

Santander Investment Securities

AEIF-IAM/AK Steel Middletown

Prudential Securities

US Steel Joint Labor-Mgmt Comm

LTV Steel Joint Labor-Mgmt Committee

Intl Union of Electrical Workers

Bethlehem Joint Labor-Mgmt Comm

Inland Steel Joint Labor-Mgmt Comm

Northwestern Steel and Wire

Boilermakers

American Federation of Musicians

USS/KOBE

Sysco Food Services of San Francisco

International Brotherhood of Teamsters

Development Bank of South Africa

J&L Structural Steel

Air Line Pilots Association/Delta Air Lines MEC

Sharpsville Quality Products

IPSCO

International Association of Machinists

CSEA/AFSCME

United Auto Workers

Service Employees International Union

American Fed of Television & Radio Artists

Supervalu

United Mine Workers

Algoma Steel

North American Refractories

UNITE/HERE

AFL-CIO George Meany Center

Watermill Ventures

Wheeling-Pittsburgh Steel

Canadian Steel Trade & Employment Congress

Minn Gov's Task Force on Mining

Special Metals

RECENT PROJECTS

Metallic Lathers and Reinforcing Ironworkers (2010-Present): strategic industry research

and ongoing advisement on major industry trends and companies to help enhance the competitive

position of the unionized NYC construction industry

Building & Construction Trades Council of Greater NY (BCTC) (2011-present): analysis and

advisement regarding major trends in the New York City construction industry, including capital

market developments which affect BCTC members

Communication Workers of America (CWA) (2011-present): research and analysis to

prepare CWA for nationwide contract negotiations with AT&T

IBT-Supervalu (2010): assist union and management to identify major operational problems

impacting warehouse performance and provide recommendations for joint improvement

Metallurgical Coal Producer (2011): prepared a detailed study on the major trends in the

world metallurgical coal market for a large metallurgical coal producer

Email: lockerassociates@yahoo.com | Website: www.lockerassociates.com

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Consulting Club Case Series SetIII SolutionsDokumen7 halamanConsulting Club Case Series SetIII SolutionssheeljaitleyBelum ada peringkat

- PayslipSalary Slips - 9-2020 PDFDokumen1 halamanPayslipSalary Slips - 9-2020 PDFSukant ChampatiBelum ada peringkat

- Ch16 Beams10e TBDokumen23 halamanCh16 Beams10e TBLouie De La TorreBelum ada peringkat

- Compensation AdministrationDokumen4 halamanCompensation AdministrationKristine Collins Llorin YambaoBelum ada peringkat

- Daellenbach CH6 SolutionsDokumen10 halamanDaellenbach CH6 SolutionsTantowi Jauhari80% (5)

- Mineral Economics An IntroductionDokumen4 halamanMineral Economics An IntroductionFrancisco Javier Villaseca AhumadaBelum ada peringkat

- Product AvailabilityDokumen55 halamanProduct AvailabilityShagun Agarwal100% (1)

- Indian Fiscal PolicyDokumen2 halamanIndian Fiscal PolicyBhavya Choudhary100% (1)

- The Sustainable Business Case BookDokumen464 halamanThe Sustainable Business Case BookArmantoCepongBelum ada peringkat

- Steel Industry Update #282Dokumen9 halamanSteel Industry Update #282Michael LockerBelum ada peringkat

- Steel Industry Update #270Dokumen9 halamanSteel Industry Update #270Michael LockerBelum ada peringkat

- CWA-CVC Investor Briefing Presentation 4-15-13Dokumen20 halamanCWA-CVC Investor Briefing Presentation 4-15-13Michael LockerBelum ada peringkat

- Steel Industry Update 283Dokumen9 halamanSteel Industry Update 283Michael LockerBelum ada peringkat

- Steel Industry Update #268Dokumen13 halamanSteel Industry Update #268Michael LockerBelum ada peringkat

- Steel Industry Update #274Dokumen8 halamanSteel Industry Update #274Michael LockerBelum ada peringkat

- Steel Industry Update #279Dokumen8 halamanSteel Industry Update #279Michael LockerBelum ada peringkat

- Steel Industry Update #281Dokumen6 halamanSteel Industry Update #281Michael LockerBelum ada peringkat

- Steel Industry Update #280Dokumen10 halamanSteel Industry Update #280Michael LockerBelum ada peringkat

- Steel Industry Update #273Dokumen8 halamanSteel Industry Update #273Michael LockerBelum ada peringkat

- Steel Industry Update #276Dokumen7 halamanSteel Industry Update #276Michael LockerBelum ada peringkat

- Steel Industry Update #267Dokumen9 halamanSteel Industry Update #267Michael LockerBelum ada peringkat

- Steel Industry Update #278Dokumen9 halamanSteel Industry Update #278Michael LockerBelum ada peringkat

- Steel Industry Update #275Dokumen9 halamanSteel Industry Update #275Michael LockerBelum ada peringkat

- Steel Industry Update #272Dokumen7 halamanSteel Industry Update #272Michael LockerBelum ada peringkat

- Steel Industry Update #271Dokumen9 halamanSteel Industry Update #271Michael LockerBelum ada peringkat

- Locker RPA Transcript 6-9-11Dokumen2 halamanLocker RPA Transcript 6-9-11Michael LockerBelum ada peringkat

- Steel Industry Update #266Dokumen8 halamanSteel Industry Update #266Michael LockerBelum ada peringkat

- Steel Industry Update #264Dokumen10 halamanSteel Industry Update #264Michael LockerBelum ada peringkat

- Steel Industry Update #263Dokumen10 halamanSteel Industry Update #263Michael LockerBelum ada peringkat

- Steel Industry Update #269Dokumen8 halamanSteel Industry Update #269Michael LockerBelum ada peringkat

- Steel Industry Update #265Dokumen7 halamanSteel Industry Update #265Michael LockerBelum ada peringkat

- Steel Industry Update #262Dokumen7 halamanSteel Industry Update #262Michael LockerBelum ada peringkat

- Steel Industry Update #261Dokumen8 halamanSteel Industry Update #261Michael LockerBelum ada peringkat

- Steel Industry Update #260Dokumen6 halamanSteel Industry Update #260Michael LockerBelum ada peringkat

- Steel Industry Update #259Dokumen10 halamanSteel Industry Update #259Michael LockerBelum ada peringkat

- Steel Industry Update #258Dokumen8 halamanSteel Industry Update #258Michael LockerBelum ada peringkat

- Steel Industry Update #256Dokumen11 halamanSteel Industry Update #256Michael LockerBelum ada peringkat

- Steel Industry Update #257Dokumen8 halamanSteel Industry Update #257Michael LockerBelum ada peringkat

- Agamata Relevant Costing Chap 9 Short Term Decision PDFDokumen2 halamanAgamata Relevant Costing Chap 9 Short Term Decision PDFJaira MoradaBelum ada peringkat

- Chapter 12Dokumen57 halamanChapter 12Andhika Suhud Meliora SitumorangBelum ada peringkat

- The Journey of Bandhan - From Micro Finance To A BankDokumen10 halamanThe Journey of Bandhan - From Micro Finance To A BankDevishi SardaBelum ada peringkat

- Dividend Policy of Himalayan Bank LimitedDokumen42 halamanDividend Policy of Himalayan Bank LimitedSujan KhadkaBelum ada peringkat

- Financial Accounting MCQ 4Dokumen25 halamanFinancial Accounting MCQ 4Akash GangulyBelum ada peringkat

- Taxation UPDokumen28 halamanTaxation UPmarkbagzBelum ada peringkat

- The Sales Foundation Training Program OverviewDokumen1 halamanThe Sales Foundation Training Program OverviewJoão António VazBelum ada peringkat

- SWOT Analysis of BHEL EDNDokumen4 halamanSWOT Analysis of BHEL EDNggychaitraBelum ada peringkat

- Class - Xii - Macroeconomics - Worksheet No-01 - Value Added by A Firm - 2018-19Dokumen3 halamanClass - Xii - Macroeconomics - Worksheet No-01 - Value Added by A Firm - 2018-19Amit50% (2)

- DBBLDokumen17 halamanDBBLShaheen MahmudBelum ada peringkat

- CJH Development Corporation Vs Bureau of Internal Revenue Et AlDokumen6 halamanCJH Development Corporation Vs Bureau of Internal Revenue Et AlThe ChogsBelum ada peringkat

- Ford Strategic AnalysisDokumen32 halamanFord Strategic AnalysisFahad100% (5)

- Payslip 0213Dokumen1 halamanPayslip 0213sathiya moorthyBelum ada peringkat

- Chapter 4 Corporate Strategy and Corporate GovernanceDokumen10 halamanChapter 4 Corporate Strategy and Corporate GovernanceKaruna ShresthaBelum ada peringkat

- PROJECT PROFILE ON PRINTED JUTE BAG MANUFACTURINGDokumen9 halamanPROJECT PROFILE ON PRINTED JUTE BAG MANUFACTURINGafham84Belum ada peringkat

- Activities and AssessmentDokumen5 halamanActivities and AssessmentGiane Gayle CadionBelum ada peringkat

- Chapter 26.1Dokumen2 halamanChapter 26.1Nicki Lyn Dela CruzBelum ada peringkat

- International Valuation Application 1 Valuation For Financial Reporting (Revised 2005)Dokumen18 halamanInternational Valuation Application 1 Valuation For Financial Reporting (Revised 2005)KismetBelum ada peringkat

- Phuket CaseDokumen4 halamanPhuket Casejperez1980100% (1)

- MY Bank LTDDokumen83 halamanMY Bank LTDAiza RizviBelum ada peringkat

- Mba Project On Economic Value Added11Dokumen58 halamanMba Project On Economic Value Added11Avinash Bilagi50% (2)