Solution:: Profit and Loss Account and Balance Sheet On 31st December, 1991

Diunggah oleh

suhel3Deskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Solution:: Profit and Loss Account and Balance Sheet On 31st December, 1991

Diunggah oleh

suhel3Hak Cipta:

Format Tersedia

From the following balances extracted from the books of X & Co.

, prepare a trading and profit and loss account and balance sheet on 31st December, 1991. $ 11,000 4,500 39,000 2,800 700 30,000 800 800 700 450 1,300 $ 500 200 1,000 500 4,750 1,100 1,450 60,000 3,000 19,650 17,900

Stock on 1st January Bills receivables Purchases Wages Insurance Sundry debtors Carriage inwards Commission (Dr.) Interest on capital Stationary Returns inwards

Returns outwards Trade expenses Office fixtures Cash in hand Cash at bank Tent and taxes Carriage outwards Sales Bills payable Creditors Capital

The stock on 21st December, 1991 was valued at $25,000.

Solution:

X & Co. Trading and Profit and Loss Account For the year ended 31st December, 1991 To Opening stock To Purchases Less returns o/w 39,000 500 38,500 To Carriage inwards To Wages To Gross profit c/d 800 2,800 30,600 83,700 To Stationary To Rent and rates To Carriage outwards To Insurance To Trade expenses To Commission To Interest on capital To Net profit transferred to capital a/c 450 1,100 1,450 700 200 800 700 25,200 11,000

|By

Sales Less | returns i/w

| | | | | | | | | | | | | | | | |

60,000 1,300 58,700

By Closing stock

25,000

83,700 By Gross profit b/d 30,600

30,600

| |

30,600

X & Co. Balance Sheet As at 31st December, 1991 Liabilities Creditors Bills payable Capital Add Net profit $ 19,650 3,000 17,900 25,200 43,100

| |

Assets Cash in hand | Cash at bank | Sundry debtors | Bill receivable | Stock | Office equipment

| | |

$ 500 4,750 30,000 4,500 25,000 1,000 65,750

65,750

Example 2:

The following trial balance was taken from the books of Habib-ur-Rehman on December 31, 19 .... Cash Sundry debtors Bill receivable Opening stock Building Furniture and fittings Investment (Temporary) Plant and Machinery Bills payable Sundry creditors Habib's capital Habib's drawings Sales Sales discount Purchases Freight in Purchase discount Sales salary expenses Advertising expenses Miscellaneous sales expenses Office salary expenses Misc. general expenses 13,000 10,000 8,500 45,000 50,000 10,000 5,000 15,500 9,000 20,000 78,200 1,000 100,000 400 30,000 1,000 500 5,000 4,000 500 8,000 1,000

Interest income Interest expenses

1,000 800 2,08,700 2,08,700

Closing stock on December 31, 19 ... was $10,000 Required: Prepare income statement/trading and profit and loss account and balance sheet from the above trial balance in report form.

Solution:

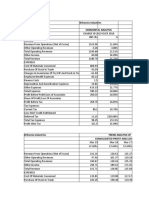

Habib-ur-Rehman Income Statement/Profit and Loss Account For the year ended December 31, 19..... Gross sales Less: Sales discount Net Sales Cost of Goods Sold: Opening stock Purchases Add: Freight in 100,000 400 99,600

45,000 30,000 1,000 31,000 500 30,500 75,500 10,000 65,500 34,100

Less purchase discount Net purchases Cost of goods available fort sale Less closing stock Cost of goods sold Gross profit Operating Expenses: Selling Expenses: Sales salary expenses Advertising expenses Misc. selling expenses General Expense: Office salaries expenses Misc. general expenses

5,000 4,000 500 9,500 8,000 1,000

9,000 Total operating expenses Net profit from operations Other Expenses and Incomes: Interest income Interest expenses Net increase Net income 18,500 15,600

1,000 800 200 15,800

Habib-ur-Rehman Balance Sheet As at December 31, 19..... ASSETS Current Assets: Cash Sundry debtors Bills receivable Stock on Dec. 31, 19 .. Investment Total Current Assets Fixed Assets: Buildings Plant and Machinery Furniture and fittings Total Fixed Assets Total Assets

13,000 10,000 8,500 10,000 5,000 46,500 50,000 15,500 10,000 75,500 122,000

LIABILITIES: Current Liabilities: Sundry creditors Bills payable Total Current Liabilities Fixed Liabilities: Habib's capital Net income for the year

20,000 9,000 29,000 78,200 15,800

Less: Drawings

94,000 1,000 93,000

Total Liabilities and Capital

122,000

Read more at http://accounting4management.com/examples_of_trading_and_profit_and_loss_account_and_ba lance_sheet.htm#SIZkVfKGMo9BCwFc.99

Anda mungkin juga menyukai

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionDari EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionBelum ada peringkat

- Adjust Final Accounts Chapter 8Dokumen11 halamanAdjust Final Accounts Chapter 8Bhavneet SachdevaBelum ada peringkat

- Trading and Profit and Loss Account and Balance Sheet - ExamplesDokumen4 halamanTrading and Profit and Loss Account and Balance Sheet - ExamplesSubrat Dhal56% (16)

- SBMA7000 Financial Management: Trial Balance, Trading Account, P&L Account & Balance SheetDokumen11 halamanSBMA7000 Financial Management: Trial Balance, Trading Account, P&L Account & Balance SheetPolireddy VennaBelum ada peringkat

- Exercise (Final Accounts)Dokumen14 halamanExercise (Final Accounts)Abhishek BansalBelum ada peringkat

- Exercises On Cash Flow StatementsDokumen3 halamanExercises On Cash Flow StatementsSam ChinthaBelum ada peringkat

- Review Questions Final Accounts For A Sole TraderDokumen3 halamanReview Questions Final Accounts For A Sole TraderdhanyasugukumarBelum ada peringkat

- Constructive Acctg. Report..... SINGLE ENTRY and ERROR CORRECTIONDokumen39 halamanConstructive Acctg. Report..... SINGLE ENTRY and ERROR CORRECTIONHoney LimBelum ada peringkat

- Introduction To Accounting - Fall 2011 Example - Merchandising Recording TransactionsDokumen4 halamanIntroduction To Accounting - Fall 2011 Example - Merchandising Recording Transactionsq0% (1)

- 20140217170246chapter 7 - InCOME STATEMENT-An IntroductionDokumen14 halaman20140217170246chapter 7 - InCOME STATEMENT-An IntroductionAlhana AwangBelum ada peringkat

- 11 Accountancy Notes Ch08 Financial Statements of Sole Proprietorship 02Dokumen9 halaman11 Accountancy Notes Ch08 Financial Statements of Sole Proprietorship 02Anonymous NSNpGa3T93100% (1)

- Final Account BBADokumen37 halamanFinal Account BBAgrivand100% (1)

- Sagitarrius Wash Service Financial Statement Analysis as of December 2009Dokumen17 halamanSagitarrius Wash Service Financial Statement Analysis as of December 2009janna777Belum ada peringkat

- AB Co. Ltd. Trial Balance StatementDokumen10 halamanAB Co. Ltd. Trial Balance StatementMd. Iqbal Hasan0% (1)

- Trabajo Zarate FinishDokumen17 halamanTrabajo Zarate FinishDavidFloresBelum ada peringkat

- Prep Trading - Profit-And-Loss-Ac Balance SheetDokumen25 halamanPrep Trading - Profit-And-Loss-Ac Balance Sheetfaltumail379100% (1)

- Cash and Accrual BasisDokumen36 halamanCash and Accrual BasisHoney LimBelum ada peringkat

- AccountDokumen2 halamanAccountnomaanahmadshahBelum ada peringkat

- Format For Financial StatementsDokumen2 halamanFormat For Financial StatementsMin ZenBelum ada peringkat

- 2012 Final Exam SolutionDokumen14 halaman2012 Final Exam SolutionOmar Ahmed ElkhalilBelum ada peringkat

- Income Statements 2010Dokumen10 halamanIncome Statements 2010Shivam GoelBelum ada peringkat

- Final Acc-Numerical 1Dokumen10 halamanFinal Acc-Numerical 1Rajshree BhardwajBelum ada peringkat

- Financial Accounting Fundamentals May 2011Dokumen6 halamanFinancial Accounting Fundamentals May 2011Kofi EwoenamBelum ada peringkat

- SciDokumen3 halamanSciJomar VillenaBelum ada peringkat

- SciDokumen3 halamanSciDonita BinayBelum ada peringkat

- Preparation of Final Accounts - With Regard To OrganisationDokumen24 halamanPreparation of Final Accounts - With Regard To OrganisationsureshBelum ada peringkat

- Cash Flow Statements IIDokumen7 halamanCash Flow Statements IIChris RessoBelum ada peringkat

- Accounting For Managers - FinalDokumen21 halamanAccounting For Managers - FinalAnuj SharmaBelum ada peringkat

- Mansa Building Balance Sheet As On 31st Dec, 1999Dokumen11 halamanMansa Building Balance Sheet As On 31st Dec, 1999Saurish JagdaleBelum ada peringkat

- Final AccountDokumen47 halamanFinal Accountsakshi tomarBelum ada peringkat

- Appendix 2 PR6-10ADokumen4 halamanAppendix 2 PR6-10APuput HapsariBelum ada peringkat

- Homework For Next ClassDokumen3 halamanHomework For Next ClassSimo El Kettani20% (5)

- Accounting Cycle IDokumen21 halamanAccounting Cycle IChristine PeregrinoBelum ada peringkat

- C02 Financial StatementsDokumen31 halamanC02 Financial StatementsJeya De GuzmanBelum ada peringkat

- Income Statement 1Dokumen4 halamanIncome Statement 1Mhaye Aguinaldo0% (1)

- MEFA 5 UnitDokumen30 halamanMEFA 5 UnitSuhasBelum ada peringkat

- AssignmentDokumen5 halamanAssignmentzahraBelum ada peringkat

- Review Financial Accounting Balance SheetDokumen3 halamanReview Financial Accounting Balance SheetLara Lewis Achilles100% (2)

- Financial StatementsDokumen7 halamanFinancial Statementsbim269Belum ada peringkat

- Hope College of Business, Science and Technology Faculty of Business Department of Accounting and Finance Advanced Accounting AssignmentDokumen6 halamanHope College of Business, Science and Technology Faculty of Business Department of Accounting and Finance Advanced Accounting AssignmentShumebeza BaylleBelum ada peringkat

- Financial Accounting ProjectDokumen9 halamanFinancial Accounting ProjectL.a. LadoresBelum ada peringkat

- Comprehensive Problems Solution Answer Key Mid TermDokumen5 halamanComprehensive Problems Solution Answer Key Mid TermGabriel Aaron DionneBelum ada peringkat

- Particulars AMT Particular: Profit and Loss Statement For The Year EndedDokumen10 halamanParticulars AMT Particular: Profit and Loss Statement For The Year EndedhitekshaBelum ada peringkat

- AP Problems 2015Dokumen20 halamanAP Problems 2015Rodette Adajar Pajanonot100% (1)

- Non Current AssetsDokumen44 halamanNon Current AssetsSandee Angeli Maceda Villarta100% (1)

- Fd2dbTraditional & Mordern Formats of Finanancial StatementsDokumen6 halamanFd2dbTraditional & Mordern Formats of Finanancial StatementsAmitesh PandeyBelum ada peringkat

- Financial and Management Accounting Practice Questions - Set 2Dokumen4 halamanFinancial and Management Accounting Practice Questions - Set 2Reena GoswamiBelum ada peringkat

- Audit - Examination IDokumen3 halamanAudit - Examination IOreo MaxBelum ada peringkat

- Karla Company P-WPS OfficeDokumen14 halamanKarla Company P-WPS OfficeKris Van HalenBelum ada peringkat

- Problems GeneralDokumen9 halamanProblems GeneralAmal BharaliBelum ada peringkat

- Seminar Solutions - Term 2Dokumen36 halamanSeminar Solutions - Term 2bontom333Belum ada peringkat

- Reconciliation of Cost and Financial AccountsDokumen4 halamanReconciliation of Cost and Financial AccountsQuestionscastle FriendBelum ada peringkat

- Accounting Cycle CompletedDokumen29 halamanAccounting Cycle CompletedMUHAMMAD HARIS PERVAIZBelum ada peringkat

- Fa 2 - Vertical Financial StatementsDokumen7 halamanFa 2 - Vertical Financial StatementsEduwiz Mänagemënt EdücatîonBelum ada peringkat

- Aert EgyDokumen90 halamanAert Egy65486sfasdkfhoBelum ada peringkat

- Income Statement & Balance Sheet-1Dokumen18 halamanIncome Statement & Balance Sheet-1Shreyasi RanjanBelum ada peringkat

- Finance for IT Decision Makers: A practical handbookDari EverandFinance for IT Decision Makers: A practical handbookBelum ada peringkat

- Britannia Industries Financial AnalysisDokumen4 halamanBritannia Industries Financial AnalysisSneha BhartiBelum ada peringkat

- Flinder Valves and Controls Inc. - WorksheetsDokumen22 halamanFlinder Valves and Controls Inc. - WorksheetsBach Cao50% (4)

- AE211 Final ExamDokumen10 halamanAE211 Final ExamMariette Alex AgbanlogBelum ada peringkat

- Case 6-1 BrowningDokumen7 halamanCase 6-1 BrowningPatrick HariramaniBelum ada peringkat

- M/S. Lavish Ceramics: The Project Cost 1 Cost of ProjectDokumen20 halamanM/S. Lavish Ceramics: The Project Cost 1 Cost of ProjectSabhaya ChiragBelum ada peringkat

- Texhong Textile GroupDokumen23 halamanTexhong Textile GroupHatcafe HatcafeBelum ada peringkat

- Indonesia Tax HighlightsDokumen10 halamanIndonesia Tax HighlightsMatus JakubikBelum ada peringkat

- Hilton7e SM CH9 MDokumen58 halamanHilton7e SM CH9 MVivekRaptorBelum ada peringkat

- LLH9e Ch03 SolutionsManual FINALDokumen68 halamanLLH9e Ch03 SolutionsManual FINALIgnjat100% (1)

- Acc501-Data Bank 2018Dokumen21 halamanAcc501-Data Bank 2018Fun NBelum ada peringkat

- Debit Relevant Expense A/c Credit Debit Credit Debit Bank Charges Account CreditDokumen27 halamanDebit Relevant Expense A/c Credit Debit Credit Debit Bank Charges Account CreditAsif AslamBelum ada peringkat

- Latihann Arus Kas & Jawaban (Indirect)Dokumen3 halamanLatihann Arus Kas & Jawaban (Indirect)Mona FitriaBelum ada peringkat

- Employee Cash Advance Request Form: The New SchoolDokumen1 halamanEmployee Cash Advance Request Form: The New SchoolcepjunBelum ada peringkat

- Business Expenses: Publication 535Dokumen50 halamanBusiness Expenses: Publication 535Birgitte SangermanoBelum ada peringkat

- Accounting GuideDokumen73 halamanAccounting GuideJoseph Habert100% (1)

- MGT NotesDokumen160 halamanMGT NotesMujtaba KhanBelum ada peringkat

- Financial Reporting 3rd Edition - (CHAPTER 12 Income Taxes)Dokumen52 halamanFinancial Reporting 3rd Edition - (CHAPTER 12 Income Taxes)gvfx48zc7xBelum ada peringkat

- Cash Management (Finance)Dokumen63 halamanCash Management (Finance)Rahul NishadBelum ada peringkat

- Most Important - Income TaxDokumen97 halamanMost Important - Income TaxAkhil BaijuBelum ada peringkat

- Dabur India LTD.: Standalone Balance SheetDokumen21 halamanDabur India LTD.: Standalone Balance SheetAniketBelum ada peringkat

- Ch2Premium LiabilityDokumen20 halamanCh2Premium LiabilityCrysta Lee100% (1)

- Chapter 1 - Financial StatementsDokumen21 halamanChapter 1 - Financial StatementsCông Hoàng ĐìnhBelum ada peringkat

- Ani Integrated Services Ltd. 624, Lodha Supremus II, Wagle Estate, Thane (W) - 400604 Salary Slip For The Month of DEC 2021Dokumen3 halamanAni Integrated Services Ltd. 624, Lodha Supremus II, Wagle Estate, Thane (W) - 400604 Salary Slip For The Month of DEC 2021tgytrBelum ada peringkat

- Chapter 13 Solutions ManualDokumen110 halamanChapter 13 Solutions Manualmarlon ventulan67% (3)

- Chart of AccountsDokumen19 halamanChart of AccountsAnnamaAnnama0% (1)

- Problem Solving (3 Points Each) .: Father Saturnino Urios UniversityDokumen3 halamanProblem Solving (3 Points Each) .: Father Saturnino Urios UniversityErykaBelum ada peringkat

- Exam and Question Tutorial Operational Case Study 2019 CIMA Professional QualificationDokumen61 halamanExam and Question Tutorial Operational Case Study 2019 CIMA Professional QualificationMyDustbin2010100% (1)

- Audit of Property, Plant and Equipment (Dokumen35 halamanAudit of Property, Plant and Equipment (Mohd Mirul86% (21)

- Arian Textile 2014 RimshaDokumen42 halamanArian Textile 2014 RimshaHaider SarwarBelum ada peringkat

- It Key Metrics Data 2018 Key 341745Dokumen43 halamanIt Key Metrics Data 2018 Key 341745ccfm0310100% (4)