(A) Pure Banking:: Advantages

Diunggah oleh

Arihant JainDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

(A) Pure Banking:: Advantages

Diunggah oleh

Arihant JainHak Cipta:

Format Tersedia

(a) Pure Banking: Under pure Banking, the commercial banks give only short-term loans to industry, trade

and commerce. They specialise in short-term finance only. This type of banking is popular in U.K. In U.K., Special institutions like investment houses, finance corporations were established for providing long-term finance. Hence, it is argued that commercial banks should provide only short-term loans. It is stressed on the lines of safety and liquidity. (b) Mixed Banking: Mixed banking is that system of banking under which the commercial banks perform the dual function of commercial banking and investment banking, i.e., it combines deposit and lending activity with investment banking. Commercial banks usually offer both short-term as well as medium term loans. The German banking system is the best example of mixed Banking where banks are permitted besides, lending activity, investment functioning also. In India, Banks are permitted to undertake limited investment activity. In USA commercial or credit banks are not permitted to undertake investment activity. Banks in Switzerland, Denmark, Japan also provide long-term loans. Advantages Mixed Banking has the following advantages: (i) Credit requirements are fully satisfied. (ii) Banking resources are utilized for industrial development. (iii) Industries can mobilize greater finance resources through these banks. (iv) Investment guidance to general public. (v) Expert guidance and advice to industries. (vi) Direct contact with industries. (vii) Promote rapid industrial development through investment banking. Disadvantages (i) Threat to stability of Banks- the stability of the bank may be affected if the prices of Securities in which banks have invested depreciate. (ii) Liquidity of banks may be affected, if the securities are not traded in the market. (iii) Possibility of engaging in speculative business (iv) Scope for over lending. After the Second World War, underdeveloped countries began to show much interest on mixed banking. In recent years, there has been a favourable trend towards mixed banking in India because of the following reasons: (a) Increase in the volume of deposits. (b) Increase in time deposits than demand deposits.

(c) RBI initiative to strengthen the banking system. (d) After nationalisation, the Government encouraged the public sector banks to grant long-term loans to small scale industries and entrepreneurs. It, is made on the grounds of rapid industrialisation in the country. (e) A realisation that overall growth depends upon development of capital market also.

Group Banking is the system in which two or more independently incorporated banks are brought under the control of a holding company. The holding company may or may not be a banking company. Under group banking, the individual banks may be unit banks, or banks operating branches or a combination of the two. Participating banks retain their own boards of directors which are responsible to the supervising and regulatory authority and depositors for the proper operation of the bank. That is, each bank in the group has got a separate entity. This system has developed in United States in 1900. It was popular and extensively developed in 1920's. Advantages of Group Banking The following are the advantages of the Group Banking System: (i) Centralized Administration: The participating banks enjoy the benefits of centralized administration. (ii) Enhancement of operational efficiency: Because of Group banking system, the operational efficiency of participant banks is enhanced through shared knowledge and experience. (iii) Broader market: Group Banking offers broader market to the small banks for their excess resources. Thus, their earning capacity and network improved. (iv) -Mobility and transfer of resources: In the case of crisis, the funds are transferred among participating banks. This helps them to face the financial crisis if any, more effectively (v) Large scale operation: Group banking paves the way for large scale operation. The member banks can get the economies of large scale operation.

(vi) Other Benefits: The holding company offers the following services to the participating banks: (i) Guidance of experts (ii) Auditing (iii) Investment counseling (iv) Combined Purchase of stationery and office equipments (v)Insurance cover on deposits (vi) Advertising and publicity (vii) Tax guidance (viii) Other advisory services. Disadvantages The disadvantages of the Group Banking System are as follows: (i) Lack of effective management and control: Under Group banking system the control and management is not effective because the control is indirect and more flexible. It cannot offer specialised management. (ii) Inefficiency of member banks protected: The inefficiency of one participating bank affects the other participating banks. (iii) Less facilities: This system cannot provide all the facilities offered by branch banking. (iv) Cannot mobilize funds: Group banking does not have the capacity to mobilise funds as in the case with branch banking. Hence, it cannot offer the same economy of operations as are offered by branch banking.

Anda mungkin juga menyukai

- Director AssignmentDokumen16 halamanDirector AssignmentUma VermaBelum ada peringkat

- Functions of Commercial Banks of IndiaDokumen5 halamanFunctions of Commercial Banks of Indiajunaid sayyedBelum ada peringkat

- Banking Structure in India - The Way Forward CONTENTSDokumen29 halamanBanking Structure in India - The Way Forward CONTENTSPrathamesh PawarBelum ada peringkat

- Commercial Bank PDFDokumen22 halamanCommercial Bank PDFA ThakurBelum ada peringkat

- Transformation of Financial Institutions Into Universal BanksDokumen10 halamanTransformation of Financial Institutions Into Universal BanksYashwanth KalepuBelum ada peringkat

- International Banking and FinanceDokumen7 halamanInternational Banking and FinanceravikungwaniBelum ada peringkat

- Banking SystemDokumen10 halamanBanking SystemVaishnavi JhaBelum ada peringkat

- Meaning and Definition of Universal BankingDokumen20 halamanMeaning and Definition of Universal BankingGags Deep0% (1)

- Universal Banking - Unit Iii: Lecture Notes SeriesDokumen11 halamanUniversal Banking - Unit Iii: Lecture Notes SeriesGame ProfileBelum ada peringkat

- Universal Banking: A Paradigm Shift in Indian Banking SystemDokumen10 halamanUniversal Banking: A Paradigm Shift in Indian Banking SystemvkfzrBelum ada peringkat

- Banking System Unit-I 1. Definition of Bank?Dokumen9 halamanBanking System Unit-I 1. Definition of Bank?shakuttiBelum ada peringkat

- Banking Sector in IndiaDokumen88 halamanBanking Sector in IndiaRahul DelBelum ada peringkat

- Universal Banking FINALDokumen45 halamanUniversal Banking FINALVrujresh VedBelum ada peringkat

- Mixed Banking:: System Refers To That Banking System Under Which TheDokumen7 halamanMixed Banking:: System Refers To That Banking System Under Which TheLOKESH RAMBelum ada peringkat

- Types of BankingDokumen3 halamanTypes of BankingSunni ZaraBelum ada peringkat

- The Concept of Universal BankingDokumen13 halamanThe Concept of Universal BankingRicha VermaBelum ada peringkat

- Commercial Banking System and Role of RBI PG QP JUNE 2024 PDFDokumen4 halamanCommercial Banking System and Role of RBI PG QP JUNE 2024 PDFBalamuralikrishna YadavBelum ada peringkat

- Studying The Different Sources of Finance in BANKING INDUSTRIESDokumen23 halamanStudying The Different Sources of Finance in BANKING INDUSTRIESManas GuptaBelum ada peringkat

- Merchant BankingDokumen4 halamanMerchant BankingSUNIL DUGANWABelum ada peringkat

- Nakil Investment Banking FinalDokumen52 halamanNakil Investment Banking Finalnakil_parkar7880100% (1)

- Chapter-3 Financial Ins and MKTDokumen24 halamanChapter-3 Financial Ins and MKTwubeBelum ada peringkat

- Chapter 1Dokumen9 halamanChapter 1AliansBelum ada peringkat

- Acknowledgement: Sunil Kumar Tyagi Under Whose Guidance and Supervision Project ReportDokumen75 halamanAcknowledgement: Sunil Kumar Tyagi Under Whose Guidance and Supervision Project Reportsheery_ank007899Belum ada peringkat

- By:-Nirmal Joshi Mayuresh Kumbhar Pallavi Indurkar Niranjan Tiwari Manali Suryavanshi Minu PareekDokumen15 halamanBy:-Nirmal Joshi Mayuresh Kumbhar Pallavi Indurkar Niranjan Tiwari Manali Suryavanshi Minu PareekVinayak PatilBelum ada peringkat

- Universal BankingDokumen30 halamanUniversal Bankingdarshan71219892205100% (1)

- Lesson 10 Expanding The Boundaries of BankingDokumen29 halamanLesson 10 Expanding The Boundaries of Bankingshai291321Belum ada peringkat

- 2nd ChapterDokumen30 halaman2nd ChapterAnantha KrishnaBelum ada peringkat

- Universal Banks in IndiaDokumen33 halamanUniversal Banks in Indianamita patharkarBelum ada peringkat

- Fsbi NotesDokumen74 halamanFsbi Notessanthoshkalpavally5164100% (11)

- International BankingDokumen9 halamanInternational Bankingshahd naserBelum ada peringkat

- Financial Hand Out 22-2Dokumen13 halamanFinancial Hand Out 22-2Hace AdisBelum ada peringkat

- PobDokumen24 halamanPobgillyhicksBelum ada peringkat

- Universal Banking in IndiaDokumen6 halamanUniversal Banking in IndiaashwanidusadhBelum ada peringkat

- Role of Commercial Banks in Financing SmallDokumen19 halamanRole of Commercial Banks in Financing SmallGowtham RaajBelum ada peringkat

- Important Questions BankingDokumen21 halamanImportant Questions BankingAshutosh AgalBelum ada peringkat

- Types of Banking Organisation and StructuresDokumen4 halamanTypes of Banking Organisation and Structuresaakash patilBelum ada peringkat

- Commercial BankingDokumen14 halamanCommercial BankingSudheer Kumar SBelum ada peringkat

- Full Notes-CfDokumen107 halamanFull Notes-CfBalaji SahBelum ada peringkat

- Introduction of Bank and BankingDokumen12 halamanIntroduction of Bank and BankingAtia IbnatBelum ada peringkat

- Lecture 4Dokumen28 halamanLecture 4Devyansh GuptaBelum ada peringkat

- Fmi Unit 3&4Dokumen6 halamanFmi Unit 3&4aarwi3851Belum ada peringkat

- Banking System in IndiaDokumen9 halamanBanking System in IndiaBhavesh LimaniBelum ada peringkat

- Merchant BankingDokumen38 halamanMerchant BankingBhargavKevadiyaBelum ada peringkat

- Financial Intermediation BusinessDokumen96 halamanFinancial Intermediation BusinessRoba AbeyuBelum ada peringkat

- MBAD511 Term PaperDokumen3 halamanMBAD511 Term PaperelizabethBelum ada peringkat

- Universal BKG IndiaDokumen28 halamanUniversal BKG IndiarajrnairBelum ada peringkat

- Assignments - Fin Derivatives and InstrumentsDokumen19 halamanAssignments - Fin Derivatives and InstrumentsNaveed AnsariBelum ada peringkat

- Aditya Institute of Management Studies and Research: Banking & InsuranceDokumen14 halamanAditya Institute of Management Studies and Research: Banking & InsuranceAnkita TrivediBelum ada peringkat

- Universal Banking-Chp - 01Dokumen27 halamanUniversal Banking-Chp - 01raneeshajmera27Belum ada peringkat

- Merchant Banking I M ComDokumen18 halamanMerchant Banking I M Comselvam sBelum ada peringkat

- Difference Between Bank and Financial InstituteDokumen2 halamanDifference Between Bank and Financial InstituteKrishan Kant PartiharBelum ada peringkat

- Universal Banking LatestDokumen189 halamanUniversal Banking LatestSony Bhagchandani50% (2)

- 9 Nationalisation of Banks Pros & ConsDokumen6 halaman9 Nationalisation of Banks Pros & ConsAastha PrakashBelum ada peringkat

- Innovative Financial Instrument - FinalDokumen6 halamanInnovative Financial Instrument - FinalRinse JohnBelum ada peringkat

- Industry - Fundamental AnalysisDokumen13 halamanIndustry - Fundamental AnalysisJerin JoyBelum ada peringkat

- Banking Law PYQDokumen11 halamanBanking Law PYQxakij19914Belum ada peringkat

- Bank Fundamentals: An Introduction to the World of Finance and BankingDari EverandBank Fundamentals: An Introduction to the World of Finance and BankingPenilaian: 4.5 dari 5 bintang4.5/5 (4)

- Understand Banks & Financial Markets: An Introduction to the International World of Money & FinanceDari EverandUnderstand Banks & Financial Markets: An Introduction to the International World of Money & FinancePenilaian: 4 dari 5 bintang4/5 (9)

- Financial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingDari EverandFinancial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingBelum ada peringkat

- Syndicated Lending 7th edition: Practice and DocumentationDari EverandSyndicated Lending 7th edition: Practice and DocumentationBelum ada peringkat

- Soriano V Bautista Sales Case DigestDokumen2 halamanSoriano V Bautista Sales Case DigestattycertfiedpublicaccountantBelum ada peringkat

- Citystate Savings Bank V TobiasDokumen2 halamanCitystate Savings Bank V TobiasBurnok SupolBelum ada peringkat

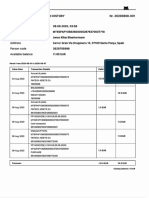

- Account Overview: View History For Transaction History PeriodDokumen6 halamanAccount Overview: View History For Transaction History PeriodNara WangsaBelum ada peringkat

- Retail LoansDokumen3 halamanRetail LoansMonisha Bhatia0% (1)

- Report On Motor InsuranceDokumen59 halamanReport On Motor InsuranceMangesh SarjeBelum ada peringkat

- Audit of The Inventory and Warehousing Cycle: Chapter 2DDokumen34 halamanAudit of The Inventory and Warehousing Cycle: Chapter 2DCyndi SyifaaBelum ada peringkat

- Contract Type: Lottery/inheritance/ Undelivered Lottery FundDokumen2 halamanContract Type: Lottery/inheritance/ Undelivered Lottery FundLoveofyouth ReddyBelum ada peringkat

- FI504 Case Study 1 The Complete Accounting CycleDokumen16 halamanFI504 Case Study 1 The Complete Accounting CycleElizabeth Hurtado-Rivera0% (1)

- Working GroupDokumen16 halamanWorking GrouppvaibhyBelum ada peringkat

- 4DCA - FELTUSvUSBANK - Lost Note - Fraud Affidavit - Rule 1.190 (A)Dokumen6 halaman4DCA - FELTUSvUSBANK - Lost Note - Fraud Affidavit - Rule 1.190 (A)winstons2311Belum ada peringkat

- Asset Revaluation ProcessDokumen3 halamanAsset Revaluation Processrajiwani50% (2)

- SURVEY QUESTIONNAIRE On CSCMDokumen6 halamanSURVEY QUESTIONNAIRE On CSCMavie71% (7)

- Food HistoryDokumen19 halamanFood HistoryImran MjBelum ada peringkat

- List of All SWIFT-ISO MessagesDokumen47 halamanList of All SWIFT-ISO Messagessanjayjogs50% (2)

- National Bank of PakistanDokumen44 halamanNational Bank of Pakistanmadnansajid8765Belum ada peringkat

- BlackDokumen2 halamanBlacksaxvdx100% (1)

- Insurance Investment AuditDokumen53 halamanInsurance Investment AuditshankerscribdBelum ada peringkat

- A Critical Review of Insurance Claims Management: A Study of Selected Insurance Companies in NigeriaDokumen17 halamanA Critical Review of Insurance Claims Management: A Study of Selected Insurance Companies in NigeriadhaiwatBelum ada peringkat

- Brief History of PayPalDokumen2 halamanBrief History of PayPalMamun Or Rashid RumonBelum ada peringkat

- IC38 Model Question Paper # 4Dokumen8 halamanIC38 Model Question Paper # 4Gokul100% (1)

- Angel ProjectDokumen108 halamanAngel Projectnarendra89npBelum ada peringkat

- Accounting Grade 10 Lesson and TasksDokumen4 halamanAccounting Grade 10 Lesson and Tasksnashi04Belum ada peringkat

- List+No 347+update+Available+BGs, MTNS, CDs+&+BONDsDokumen15 halamanList+No 347+update+Available+BGs, MTNS, CDs+&+BONDsJuan Pablo ArangoBelum ada peringkat

- US Bank of Washington - Executive SummaryDokumen5 halamanUS Bank of Washington - Executive SummaryJoshua Sullivan100% (2)

- Prelim Compre Quiz - Cash Answer KeyDokumen5 halamanPrelim Compre Quiz - Cash Answer KeyLedesma Ken Rembrandt83% (6)

- Name of MFI StateDokumen12 halamanName of MFI StateAmit ChanchalBelum ada peringkat

- Analyzing Transactions and Double EntryDokumen40 halamanAnalyzing Transactions and Double EntrySuba ChaluBelum ada peringkat

- Tijara CaseDokumen5 halamanTijara CaseHammad Ahmad0% (1)

- RVC Tuition Fee Payment and Refund Policy 2014Dokumen10 halamanRVC Tuition Fee Payment and Refund Policy 2014Senitha MindulaBelum ada peringkat

- ISIN ListDokumen32 halamanISIN ListMirza Haseeb Ahsan100% (1)