App 00 A

Diunggah oleh

dbjnDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

App 00 A

Diunggah oleh

dbjnHak Cipta:

Format Tersedia

Appendix A - Derivatives

Appendix A Questions

A-2 Reflective thinking Derivatives A-3 A-4 A-5 A-6 A-7 A-1 A-2 A-3 A-4 A-5 A-6 Analytic Reflective thinking Reflective thinking Reflective thinking Reflective thinking Reflective thinking Analytic Analytic Analytic Analytic Analytic Analytic Analytic, Communications Analytic A-1 Reflective thinking

Exercises

Problems

A-1 A-2 A-3

Cases

A-1 A-2 A-3 A-4

QUESTIONS FOR REVIEW OF KEY TOPICS

index.

Question A-1

These instruments derive their values or contractually required cash flows from some other security or

Question A-2

The FASB has taken the position that the income effects of the hedge instrument and the income effects of the item being hedged should be recognized at the same time.

Question A-3

If interest rates change, the change in the debts fair value will be less than the change in the swaps fair value. The gain or loss on the $500,000 notional difference will not be offset by a corresponding loss or gain on debt. Any increase or decrease in income resulting from a hedging arrangement would be a result of hedge ineffectiveness such as this.

Question A-4

A futures contract is an agreement between a seller and a buyer that calls for the seller to deliver a certain commodity (such as wheat, silver, or Treasury bond) at a specific future date, at a predetermined price. Such contracts are actively traded on regulated futures exchanges. If the

AppA-1

Appendix A - Derivatives

commodity is a financial instrument, such as a Treasury bill, commercial paper, or a CD, the contract is called a financial futures agreement.

Question A-5

An interest rate swap exchanges fixed interest payments for floating rate payments, or vice versa, without exchanging the underlying notional amount.

Question A-6

All derivatives, without exception, are reported on the balance sheet as either assets or liabilities at fair (or market) value. The rationale is that (a) derivatives create either rights or obligations that meet the FASBs definition of assets or liabilities and (b) fair value is the most meaningful measurement.

Question A-7

A gain or loss from a cash flow hedge is deferred as other comprehensive income until it can be recognized in earnings along with the earnings effect of the item being hedged.

AppA-2

Appendix A - Derivatives

EXERCISES

Exercise A-1

Indicate (by abbreviation) the type of hedge each activity described below would represent. Hedge Type FV Fair value hedge CF Cash flow hedge FC Foreign currency hedge N Would not qualify as a hedge Activity FV 1. An options contract to hedge possible future price changes of inventory. CF 2. A futures contract to hedge exposure to interest rate changes prior to replacing bank notes when they mature. CF 3. An interest rate swap to synthetically convert floating rate debt into fixed rate debt. FV 4. An interest rate swap to synthetically convert fixed rate debt into floating rate debt. FV 5. A futures contract to hedge possible future price changes of timber covered by a firm commitment to sell. CF 6. A futures contract to hedge possible future price changes of a forecasted sale of tin. FC 7. ExxonMobils net investment in a Kuwait oil field. CF 8. An interest rate swap to synthetically convert floating rate interest on a stock investment into fixed rate interest. N 9. An interest rate swap to synthetically convert fixed rate interest on a held-tomaturity debt investment into floating rate interest. CF 10. An interest rate swap to synthetically convert floating rate interest on a heldto-maturity debt investment into fixed rate interest. FV 11. An interest rate swap to synthetically convert fixed rate interest on a stock investment into floating rate interest.

AppA-3

Appendix A - Derivatives

Exercise A-2

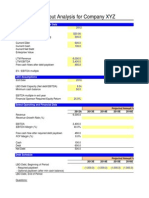

Requirement 1 January 1 Fair value of interest rate swap Fair value of note payable Fixed rate Floating rate Fixed interest receipts Floating payments Net interest receipts (payments) 10% 10% 0 $200,000 March 31 $6,472 $206,472 10% 8% $5,000 4,000 $1,000 June 30 $11,394 $211,394 10% 6% $5,000 3,000 $2,000

AppA-4

Appendix A - Derivatives

Exercise A-2 (concluded)

Requirement 2 January 1 Cash Notes payable To record the issuance of the note March 31 Interest expense ([10% x ] x $200,000) Cash To record interest Cash ($5,000 ([8% x ] x $200,000)) Interest expense To record the net cash settlement Interest rate swap [asset] ($6,472 0) Holding gain interest rate swap To record change in fair value of the derivative Holding loss - hedged note Note payable ($206,472 200,000) To record change in fair value of the note June 30 Interest expense ([10% x ] x $200,000) Cash To record interest Cash ($5,000 ([6% x ] x $200,000)) Interest expense To record the net cash settlement Interest rate swap [asset] ($11,394 6,472) Holding gain interest rate swap To record change in fair value of the derivative Holding loss - hedged note Note payable ($211,394 206,472)

200,000 200,000

5,000 5,000 1,000 1,000 6,472 6,472 6,472 6,472

5,000 5,000 2,000 2,000 4,922 4,922 4,922 4,922

AppA-5

Appendix A - Derivatives

To record change in fair value of the note

AppA-6

Appendix A - Derivatives

Exercise A-3

Requirement 1 January 1 Fair value of interest rate swap Fair value of investment Fixed rate Floating rate Fixed interest payments Floating interest receipts Net interest payments 10% 10% 0 $200,000 March 31 $6,472 $206,472 10% 8% $5,000 (4,000) $1,000 June 30 $11,394 $211,394 10% 6% $5,000 (3,000) $2,000

AppA-7

Appendix A - Derivatives

Exercise A-3 (concluded) Requirement 2 January 1 Investment in notes Cash To record the investment of the note March 31 Cash Interest revenue ([10% x ] x 200,000) To record interest Interest revenue Cash ($5,000 ([8% x ] x $200,000)) To record the net cash settlement Holding loss interest rate swap Interest rate swap [liability] ($6,472 0) To record change in fair value of the derivative Investment in notes ($206,472 200,000) Holding gain - hedged investment To record change in fair value of the investment June 30 Cash Interest revenue ([10% x ] x $200,000) To record interest Interest revenue Cash ($5,000 ([6% x ] x $200,000)) To record the net cash settlement 200,000 200,000

5,000 5,000

1,000 1,000

6,472 6,472 6,472 6,472

5,000 5,000

2,000 2,000

Holding loss interest rate swap

4,922

AppA-8

Appendix A - Derivatives

Interest rate swap [liability] ($11,394 $6,472) To record change in fair value of the derivative Investment in notes ($211,394 206,472) Holding gain - hedged investment To record change in fair value of the investment 4,922

4,922

4,922

AppA-9

Appendix A - Derivatives

Exercise A-4

Requirement 1 June 30 Fair value of interest rate swap Fair value of note payable Fixed rate Floating rate Fixed receipts Floating payments Net interest receipts (payments) $11,394 $220,000 10% 6% $5,000 ([10% x ] x $200,000) (3,000) $2,000 ([6% x ] x $200,000)

AppA-10

Appendix A - Derivatives

Exercise A-4 (concluded) Requirement 2 Your entries would be the same whether there was or was not an additional rise in the fair value of the note (higher than that of the swap) on June 30 due to investors perceptions that the creditworthiness of LLB was improving. When a notes fair value changes by an amount different from that of a designated hedge instrument for reasons unrelated to interest rates, we ignore those changes. We recognize only the fair value changes in the hedged item that we can attribute to the risk being hedged (interest rate risk in this case). The entries would be: June 30 Interest expense ([10% x ] x $200,000) Cash To record interest Cash ($5,000 ([6% x ] x $200,000)) Interest expense To record the net cash settlement Interest rate swap [asset] ($11,394 6,472) Holding gain interest rate swap To record change in fair value of the derivative Holding loss - hedged note Note payable ($211,394 206,472) To record change in fair value of the note due to interest 5,000 5,000 2,000 2,000 4,922 4,922 4,922 4,922

AppA-11

Appendix A - Derivatives

Exercise A-5

January 1 Cash Notes payable To record the issuance of the note March 31 Interest expense ([10% x ] x $200,000) Cash To record interest Cash ($5,000 ([8% x ] x $200,000)) Interest rate swap ($6,472 - 0) Interest revenue ([10% x ] x $0) Holding gain - interest rate swap (to balance) To record the net cash settlement, accrued interest on the swap, and change in fair value of the derivative Holding loss - hedged note Notes payable ($206,472 200,000) To record change in fair value of the note due to interest June 30 Interest expense ([8% x ] x $206,472) Notes payable (difference) Cash ([10% x ] x $200,000) To record interest 200,000 200,000

5,000 5,000 1,000 6,472 0 7,472

6,472 6,472

4,129 871 5,000

AppA-12

Appendix A - Derivatives

Cash ($5,000 ([6% x ] x $200,000)) Interest rate swap ($11,394 6,472) Interest revenue ([8% x ] x $6,472) Holding gain - interest rate swap (to balance) To record the net cash settlement, accrued interest on the swap, and change in fair value of the derivative Holding loss - hedged note Notes payable ($211,394 206,472 + 871) To record change in fair value of the note due to interest

2,000 4,922 129 6,793

5,793 5,793

AppA-13

Appendix A - Derivatives

Exercise A-6

Requirement 1 June 30 Fair value of interest rate swap Fair value of note payable Fixed rate Floating rate Fixed receipts Floating payments Net interest receipts (payments) $11,394 $220,000 10% 6% $5,000 ([10% x ] x 200,000) (3,000) ([6% x ] x 200,000) $2,000

AppA-14

Appendix A - Derivatives

Exercise A-6 (concluded) Requirement 2 Your entries would be the same whether there was or was not an additional rise in the fair value of the note (higher than that of the swap) on June 30 due to investors perceptions that the creditworthiness of LLB was improving. When a notes fair value changes by an amount different from that of a designated hedge instrument for reasons unrelated to interest rates, we ignore those changes. We recognize only the fair value changes in the hedged item that we can attribute to the risk being hedged (interest rate risk in this case). The entries would be: June 30 Interest expense ([8% x ] x $206,472) Notes payable (difference) Cash ([10% x ] x $200,000) To record interest Cash ($5,000 ([6% x ] x $200,000)) Interest rate swap ($11,394 6,472) Interest revenue ([8% x ] x $6,472) Holding gain - interest rate swap (to balance) To record the net cash settlement, accrued interest on the swap, and change in fair value of the derivative Holding loss - hedged note Notes payable ($211,394 206,472 + 871) To record change in fair value of the note due to interest

4,129 871 5,000 2,000 4,922 129 6,793

5,793 5,793

AppA-15

Appendix A - Derivatives

PROBLEMS

Problem A-1

Requirement 1 January 1 2011 Fixed rate Floating rate Fixed receipts Floating payments Net interest receipts (payments) Requirement 2 January 1, 2011 Cash Notes payable To record the issuance of the note December 31, 2011 Interest expense (8% x $100,000) Cash To record interest Interest expense Cash ($8,000 [9% x $100,000]) 100,000 100,000 8% 8% 2011 8% 9% $ 8,000 9,000 $(1,000) December 31 2012 8% 7% $8,000 7,000 $1,000 2013 8% 7% $8,000 7,000 $ 1,000

8,000 8,000 1,000 1,000

AppA-16

Appendix A - Derivatives

To record the net cash settlement Holding lossinterest rate swap (to balance) Interest rate swap (0 $1,759) To record the change in fair value of the derivative Notes payable ($98,241 100,000) Holding gainhedged note To record change in fair value of the note 1,759 1,759 1,759 1,759

AppA-17

Appendix A - Derivatives

Problem A-1 (continued) Requirement 3 December 31, 2012 Interest expense (8% x $100,000) Cash To record interest Cash ($8,000 [7% x $100,000]) Interest expense To record the net cash settlement Interest rate swap ($935 [1,759]) Holding gaininterest rate swap (to balance) To record the change in fair value of the derivative Holding losshedged note ($100,935 98,241) Notes payable (to balance) To record change in fair value of the note due to interest 8,000 8,000 1,000 1,000 2,694 2,694 2,694 2,694

AppA-18

Appendix A - Derivatives

Problem A-1 (continued) Requirement 4 December 31, 2013 Interest expense (8% x $100,000) Cash To record interest Cash ($8,000 [7% x $100,000]) Interest expense To record the net cash settlement Holding loss - interest rate swap (to balance) Interest rate swap (0 $935) To record the change in fair value of the derivative Notes payable ($100,000 100,935) Holding gain - hedged note To record change in fair value of the note due to interest Note payable Cash To repay the loan 8,000 8,000 1,000 1,000 935 935 935 935 100,000 100,000

AppA-19

Appendix A - Derivatives

Problem A-1 (continued) Requirement 5 Swap Jan. 1, 2011 Dec. 31, 2011 Balance Dec. 31, 2012 Balance Dec. 31, 2013 Balance 0 2,694 935 935 935 100,000 0 2,694 100,935 1,759 1,759 Note 100,000 1,759 98,241

AppA-20

Appendix A - Derivatives

Problem A-1 (continued) Requirement 6 Income Statement + () 2011 (8,000) (1,000) (1,759) 1,759 (9,000) (8,000) 1,000 2,694 (2,694) (7,000) (8,000) 1,000 (935) 935 (7,000) Interest expense Interest expense Holding loss interest rate swap Holding gain hedged note Net effect same as floating interest payment on swap Interest expense Interest expense Holding gain interest rate swap Holding loss hedged note Net effect same as floating interest payment on swap Interest expense Interest expense Holding loss interest rate swap Holding gain hedged note Net effect same as floating interest payment on swap

2012

2013

AppA-21

Appendix A - Derivatives

Problem A-1 (concluded) Requirement 7 Your entries would not be affected. When a notes fair value changes by an amount different from that of a designated hedge instrument for reasons unrelated to interest rates, we ignore those changes. We recognize only the fair value changes in the hedged item that we can attribute to the risk being hedged (interest rate risk in this case). The entries still would be: Interest expense (8% x $100,000) Cash To record interest Interest expense Cash ($8,000 [9% x $100,000]) To record the net cash settlement Holding lossinterest rate swap (to balance) Interest rate swap (0 $1,759) To record the change in fair value of the derivative Notes payable ($98,241 100,000) Holding gainhedged note To record change in fair value of the note 8,000 8,000 1,000 1,000 1,759 1,759 1,759 1,759

AppA-22

Appendix A - Derivatives

Problem A-2

Requirement 1 CMOS has an unrealized gain due to the increase in the value of the derivative (not necessarily the same amount). Because interest rates declined, the swap will enable CMOS to pay the lower floating rate (receive cash on the net settlement of interest). The value of the swap (an asset) represents the present value of expected future net cash receipts. That amount has increased, as has the swaps fair value, creating the unrealized gain. There is an offsetting loss on the bonds (a liability) because the fair value of the companys debt has increased. Because the loss on the bonds exactly offsets the gain on the swap, earnings will neither increase nor decrease due to the hedging arrangement. Requirement 2 CMOS would have an unrealized loss due to the decrease in the value of the derivative. Because interest rates increased, the swap will cause CMOS to pay the higher floating rate (pay cash on the net settlement of interest). The value of the swap (an asset) represents the present value of expected future net cash receipts. That amount has decreased, as has the swaps fair value, creating the unrealized loss. There is an offsetting gain on the bonds (a liability) because the fair value of the companys debt has decreased. Because the gain on the bonds exactly offsets the loss on the swap, earnings will neither increase nor decrease due to the hedging arrangement.

AppA-23

Appendix A - Derivatives

Problem A-2 (continued) Requirement 3 The unrealized gain on the swap and loss on the bonds would not be affected. When a hedged debts fair value changes by an amount different from that of a designated hedge instrument for reasons unrelated to interest rates, we ignore those changes. We recognize only the fair value changes in the hedged item that we can attribute to the risk being hedged (due to interest rate risk in this case). Because the loss on the bonds exactly offsets the gain on the swap, earnings will neither increase nor decrease due to the hedging arrangement. Requirement 4 There would be an unrealized gain due to the increase in the value of the derivative. There is an unrealized loss on the bonds (a liability). However, the gain on the derivative would be $20,000 more than the loss on the bonds. Because the loss on the bonds is less than the gain on the swap, earnings will increase by $20,000 (ignoring taxes) due to the hedging arrangement, an effect resulting from hedge ineffectiveness. This is an intended effect of hedge accounting. To the extent that a hedge is effective, the earnings effect of a derivative cancels out the earnings effect of the item being hedged. All ineffectiveness of a hedge is recognized currently in earnings.

AppA-24

Appendix A - Derivatives

Problem A-2 (concluded) Requirement 5 There would be an unrealized loss due to a decrease in the value of the derivative, a liability to BIOS. Because interest rates declined, the swap would cause BIOS to receive the lower floating rate (pay cash on the net settlement of interest). The value of the swap represents the present value of expected future net cash payments. That amount has increased, as has the swaps fair value, creating the unrealized loss. There would be an offsetting gain, though, on the bond investment because the fair value of the companys investment has increased. Because the gain on the bonds exactly offsets the loss on the swap (a liability), earnings will neither increase nor decrease due to the hedging arrangement.

AppA-25

Appendix A - Derivatives

Problem A-3

Requirement 1

AppA-26

Appendix A - Derivatives

January 1 2011 Fixed rate Floating rate Fixed payments Floating payments Net interest receipts (payments) Requirement 2 January 1, 2011 Cash Notes payable To record the issuance of the note December 31, 2011 Interest expense (8% x $100,000) Cash To record interest Interest expense (8% x $0) Holding lossinterest rate swap (to balance) Interest rate swap (0 $1,759) Cash ($8,000 [9% x $100,000]) To record the net cash settlement, accrued interest on the swap, and change in fair value of the derivative Notes payable ($98,241 100,000) Holding gainhedged note To record change in fair value of the note due to interest 8% 8% 2011 8% 9% $ 8,000 9,000 $(1,000)

December 31 2012 8% 7% $8,000 7,000 $1,000 2013 8% 7% $8,000 7,000 $ 1,000

100,000 100,000

8,000 8,000 0 2,759 1,759 1,000

1,759 1,759

AppA-27

Appendix A - Derivatives

Problem A-3 (continued) Requirement 3 December 31, 2012 Interest expense (9% x $98,241) Notes payable (difference) Cash (8% x $100,000) To record interest Cash ($8,000 [7% x $100,000]) Interest rate swap ($935 [ 1,759]) Interest expense (9% x $1,759) Holding gaininterest rate swap (to balance) To record the net cash settlement, accrued interest on the swap, and change in fair value of the derivative Holding losshedged note ($100,935 98,241 842) Notes payable (to balance) To record change in fair value of the note due to interest 8,842 842 8,000 1,000 2,694 158 3,852

1,852 1,852

AppA-28

Appendix A - Derivatives

Problem A-3 (continued) Requirement 4 December 31, 2013 Interest expense (7% x $100,935) Notes payable (difference) Cash (8% x $100,000) To record interest 7,065 935 8,000

Cash ($8,000 [7% x $100,000]) 1,000 Holding lossinterest rate swap (to balance) 0 Interest rate swap (0 $935) Interest revenue (7% x $935) To record the net cash settlement, accrued interest on the swap, and change in fair value of the derivative Notes payable ($100,000 100,935 + 935) Holding gainhedged note To record change in fair value of the note due to interest Note payable Cash To repay the loan 0

935 65

0 100,000 100,000

AppA-29

Appendix A - Derivatives

Problem A-3 (continued) Requirement 5 Swap Jan. 1, 2011 Dec. 31, 2011 Balance Dec. 31, 2012 Balance Dec. 31, 2013 Balance 0 2,694 935 935 935 100,000 0 1,759 1,759 Note 100,000 1,759 98,241 842 1,852 100,935

AppA-30

Appendix A - Derivatives

Problem A-3 (continued) Requirement 6 Income Statement + () 2011 (8,000) (2,759) 1,759 (9,000) (8,842) (158) 3,852 (1,852) (7,000) (7,065) 65 (0) 0 (7,000) Interest expense Holding loss interest rate swap Holding gain hedged note Net effect same as floating interest payment on swap Interest expense Interest expense Holding gain interest rate swap Holding loss hedged note Net effect same as floating interest payment on swap Interest expense Interest revenue Holding loss interest rate swap Holding gain hedged note Net effect same as floating interest payment on swap

2012

2013

AppA-31

Appendix A - Derivatives

Problem A-3 (concluded) Requirement 7 Your entries would not be affected. When a notes fair value changes by an amount different from that of a designated hedge instrument for reasons unrelated to interest rates, we ignore those changes. We recognize only the fair value changes in the hedged item that we can attribute to the risk being hedged (interest rate risk in this case). The entries still would be: Interest expense (8% x $100,000) Cash To record interest Interest expense (8% x $0) Holding lossinterest rate swap (to balance) Interest rate swap (0 $1,759) Cash ($8,000 [9% x $100,000]) To record the net cash settlement, accrued interest on the swap, and change in fair value of the derivative Notes payable ($98,241 100,000) Holding gainhedged note 8,000 8,000 0 2,759 1,759 1,000

1,759 1,759

AppA-32

Appendix A - Derivatives

CASES

Real World Case A-1

Requirement 1 When Johnson & Johnson indicates that it expects that substantially all of the balance of deferred net gains on derivatives will be reclassified into earnings over the next 12 months as a result of transactions that are expected to occur over that period, it is saying that these as-yet-unrecognized net gains will be included in net income. A gain or loss from certain hedges is deferred as other comprehensive income until it can be recognized in earnings along with the earnings effect of the item being hedged. Requirement 2 A gain or loss from a fair value hedge is recognized immediately in earnings along with the loss or gain from the item being hedged. On the other hand, a gain or loss from a cash flow hedge is deferred in the manner described by Johnson & Johnson until it can be recognized in earnings along with the earnings effect of the item being hedged. The hedging transactions referred to by Johnson & Johnson might also include foreign currency hedges used to hedge foreign currency exposure to a forecasted transaction because they are treated as a cash flow hedge.

AppA-33

Appendix A - Derivatives

Communication Case A-2

Depending on the assumptions made, different views can be convincingly defended. The process of developing and synthesizing the arguments will likely be more beneficial than any single solution. Each student should benefit from participating in the process, interacting first with his or her partner, then with the class as a whole. It is important that each student actively participate in the process. Domination by one or two individuals should be discouraged. Hedging means taking an action that is expected to produce exposure to a particular type of risk thats precisely the opposite of an actual risk to which the company already is exposed. Under existing hedge accounting, if the contract meets specified hedging criteria, the income effects of the hedge instrument and the income effects of the item being hedged should be recognized at the same time. Arguments raised may focus on a variety of issues including: Which hedges should qualify for special accounting? Hedges of risk of loss? Hedges that reduce the variability of outcomes? Should treatment be different for fair value hedges and cash flow hedges? Should only risk exposures arising from existing assets or liabilities qualify for special accounting? Should anticipated transactions be included also? To what extent if any must there be correlation between the gains and losses on the hedge instrument and the item being hedged? How should any deferred gain or loss be classified prior to recognition?

AppA-34

Appendix A - Derivatives

Real World Case A-3

The following is a copy of the 13-Week U.S. Treasury Bill Futures: Settlement Prices as of September 21, 2009:

Daily Settlements for 13-Week U.S.Treasury Bill Futures (PRELIMINARY)Trade Date: 09/21/2009

Month Open High Low Last Change Settle Volume OCT 09 NOV 09 DEC 09 MAR 10 JUN 10 SEP 10

Total

Open Interest -

UNCH UNCH UNCH UNCH UNCH UNCH

99.51 99.47 99.47 99.37 99.27 99.27

AppA-35

Appendix A - Derivatives

Research Case A-4

[Note: This case requires the student to reference a journal article.]

Requirement 1 According to the authors, the primary problems or issues the FASB was attempting to address with the standard are the following:

Previous accounting guidance for derivatives and hedging was incomplete. Only a few types of derivatives used today were specifically addressed in accounting standards. SFAS No. 52, Foreign Currency Translation, addresses forward foreign exchange contracts, and SFAS No. 80, Accounting for Futures Contracts, addresses exchange-traded futures contracts. Similarly, those two standards were the only ones that specifically provided for hedge accounting. The Emerging Issues Task Force (EITF) addressed the accounting for some derivatives and for some hedging activities not covered in Statements 52 or 80; however, that effort was on an ad hoc basis. Large gaps remained in the authoritative accounting guidance. Accounting practice had filled some of those gaps on issues such as "synthetic instrument accounting" without any commonly understood limitations on their appropriate use. The result of this accounting hodgepodge was that a) many derivative instruments were carried "off balance sheet" regardless of whether they are part of a hedging strategy, b) practices were inconsistent among entities and for similar instruments held by the same entity, and c) users of financial reports were confused or even misled. Previous accounting guidance for derivatives and hedging was inconsistent. Under the previous accounting guidance (FASB standards and EITF consensuses), the required accounting treatment may have differed depending on the type of instrument used in hedging and the type of risk being hedged. For example, an anticipated transaction could qualify as a hedged item only if the hedging instrument was a nonforeign currency futures contract or a nonforeign currency purchased option. Additionally, derivatives were measured differently under the previous accounting standards--futures contracts were reported at fair value, foreign currency forward contracts at amounts that reflect changes in foreign exchange rates but not other value changes, and other derivatives unrecognized or reported at nominal amounts that were a small fraction of the value of their potential cash flows. Other hedge accounting inconsistencies related to level of risk assessment (transaction-based versus entity-wide) and measurement of hedge effectiveness.

AppA-36

Appendix A - Derivatives

Case A-4 (concluded) Previous accounting guidance for derivatives and hedging was complex. The lack of a single, comprehensive approach to accounting for derivatives and hedging made the accounting guidance very complex. The incompleteness of the FASB statements on derivatives and hedging forced entities to look to a variety of different sources, including the numerous EITF issues and nonauthoritative literature, to determine how to account for specific instruments or transactions. Because there was often nothing directly on point, entities were forced to analogize to existing guidance. Because different sources of analogy often conflict, a wide range of answers could often be supported, and no answer was safe from later challenge. Effects of derivatives were not apparent. Under the previous varied practices, derivatives may or may not have been recognized in the financial statements. If recognized in the financial statements, realized and unrealized gains and losses on derivatives may have been deferred from earnings recognition and reported as part of the carrying amount (or basis) of a related item or as if they are freestanding assets or liabilities. As a result, users of financial statements found it difficult to determine what an entity has or has not done with derivatives and what the related effects were. It was difficult to understand how financial statements could purport to present financial position without reporting the material benefits and obligations associated with derivative instruments. Requirement 2 In considering the issues, the FASB made four fundamental decisions that became the cornerstones of the proposed statement. According to the article, those fundamental decisions were: Derivatives are assets or liabilities and should be reported in the financial statements.

Fair value is the most relevant measure for financial instruments and the only relevant measure for derivatives. Only items that are assets or liabilities should be reported as such in the financial statements. A derivative loss should not be reported as an asset because it has no future economic benefit associated with it. Hedge accounting should be provided for only qualifying transactions, and one aspect of qualification should be an assessment of offsetting changes in fair values or cash flows.

AppA-37

Anda mungkin juga menyukai

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Risk-Neutral Skewness - Evidence From Stock OptionsDokumen24 halamanRisk-Neutral Skewness - Evidence From Stock OptionsdbjnBelum ada peringkat

- Smiles, Bid-Ask Spreads and Option PricingDokumen24 halamanSmiles, Bid-Ask Spreads and Option PricingdbjnBelum ada peringkat

- Extra Credit Fall '12Dokumen4 halamanExtra Credit Fall '12dbjnBelum ada peringkat

- Option Hapiness and LiquidityDokumen53 halamanOption Hapiness and LiquiditydbjnBelum ada peringkat

- Introduction To Variance SwapsDokumen6 halamanIntroduction To Variance Swapsdbjn100% (1)

- Dynamics of Implied Volatility SurfacesDokumen16 halamanDynamics of Implied Volatility SurfacesdbjnBelum ada peringkat

- Quick LBO ModelDokumen10 halamanQuick LBO ModeldbjnBelum ada peringkat

- Final Exam Fall '12Dokumen7 halamanFinal Exam Fall '12dbjnBelum ada peringkat

- Brealey. Myers. Allen Chapter 17 TestDokumen13 halamanBrealey. Myers. Allen Chapter 17 TestMarcelo Birolli100% (2)

- Chap 006Dokumen95 halamanChap 006dbjnBelum ada peringkat

- Of Smiles and SmirksDokumen30 halamanOf Smiles and SmirksdbjnBelum ada peringkat

- Chap 002Dokumen75 halamanChap 002dbjnBelum ada peringkat

- BMA 20 8eDokumen11 halamanBMA 20 8edbjnBelum ada peringkat

- BMA TB 33 8eDokumen8 halamanBMA TB 33 8edbjnBelum ada peringkat

- On The Properties of Equally-Weighted Risk Contributions PortfoliosDokumen23 halamanOn The Properties of Equally-Weighted Risk Contributions PortfoliosdbjnBelum ada peringkat

- Chap 011Dokumen81 halamanChap 011dbjnBelum ada peringkat

- Annual Report 2011 Current OPECDokumen65 halamanAnnual Report 2011 Current OPECdbjnBelum ada peringkat

- 2013 World Economic Situation and ProspectsDokumen37 halaman2013 World Economic Situation and ProspectsdbjnBelum ada peringkat

- Chap 021Dokumen122 halamanChap 021dbjnBelum ada peringkat

- Answer Key QuizDokumen4 halamanAnswer Key QuizdbjnBelum ada peringkat

- Bloomberg ExcelDokumen52 halamanBloomberg Exceldbjn100% (2)

- Erc SlidesDokumen56 halamanErc SlidesdbjnBelum ada peringkat

- Excel Short CutsDokumen42 halamanExcel Short CutsdbjnBelum ada peringkat

- Acadian Portfolio RiskDokumen14 halamanAcadian Portfolio RiskdbjnBelum ada peringkat

- Chap 019Dokumen11 halamanChap 019dbjnBelum ada peringkat

- Chap 018Dokumen19 halamanChap 018dbjnBelum ada peringkat

- Spiceland IA 6e Excel GuideDokumen31 halamanSpiceland IA 6e Excel Guidemondew99Belum ada peringkat

- Chap 020Dokumen10 halamanChap 020dbjnBelum ada peringkat

- Chap 021Dokumen18 halamanChap 021dbjnBelum ada peringkat

- Chap 013Dokumen8 halamanChap 013dbjnBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- United Wholesale Mortgage, Llc's Motion To Dismiss America's Moneyline, Inc.'s Amended CounterclaimDokumen79 halamanUnited Wholesale Mortgage, Llc's Motion To Dismiss America's Moneyline, Inc.'s Amended CounterclaimMatias SmithBelum ada peringkat

- CV Kleber HerreraDokumen10 halamanCV Kleber HerreraGaby Vaca PitaBelum ada peringkat

- Certificate Cum Policy Schedule: MOTOR 2 WHEELER (PACKAGE POLICY) - UIN NO. IRDAN137RP0017V01200809 - SAC Code. 997134Dokumen1 halamanCertificate Cum Policy Schedule: MOTOR 2 WHEELER (PACKAGE POLICY) - UIN NO. IRDAN137RP0017V01200809 - SAC Code. 997134Rohit YadavBelum ada peringkat

- Universitas Bina Nusantara: Catering)Dokumen2 halamanUniversitas Bina Nusantara: Catering)Aldo PutraBelum ada peringkat

- India Discovers $410 Billion Lithium DepositDokumen9 halamanIndia Discovers $410 Billion Lithium DepositELC2024-ABelum ada peringkat

- The Role of Law in Business DevelopmentDokumen4 halamanThe Role of Law in Business DevelopmentPsy GannavaramBelum ada peringkat

- Module 7: Making The System WorkDokumen18 halamanModule 7: Making The System WorkshukkurBelum ada peringkat

- Chatting Format 1Dokumen13 halamanChatting Format 1Wilfred Freddy100% (4)

- Business Law and Practice (Skills) : Workshop 9 Task 1 - ExemplarDokumen2 halamanBusiness Law and Practice (Skills) : Workshop 9 Task 1 - ExemplarRo LondonBelum ada peringkat

- Questionnaire of A SurveyDokumen3 halamanQuestionnaire of A Surveynur naher muktaBelum ada peringkat

- HNB Report-2Dokumen37 halamanHNB Report-2Samith GurusingheBelum ada peringkat

- Application of Demand and SupplyDokumen4 halamanApplication of Demand and SupplyFahad RadiamodaBelum ada peringkat

- Analisis Pengaruh Atribut Produk Terhadap Keputusan Pembelian Motor Suzuki Smash Di Kota Semarang Part-1Dokumen10 halamanAnalisis Pengaruh Atribut Produk Terhadap Keputusan Pembelian Motor Suzuki Smash Di Kota Semarang Part-1Aji SetyobudiBelum ada peringkat

- Behavioral FinanceDokumen184 halamanBehavioral FinanceSatya ReddyBelum ada peringkat

- MAF Mixed and Yield Variances (Eng)Dokumen8 halamanMAF Mixed and Yield Variances (Eng)BirukBelum ada peringkat

- General Conditions: Insurance CancellationDokumen5 halamanGeneral Conditions: Insurance CancellationCodruta HiripanBelum ada peringkat

- Restaurant Marketing StrategyDokumen19 halamanRestaurant Marketing StrategyEmily MathewBelum ada peringkat

- Masterclass 3.2Dokumen6 halamanMasterclass 3.2Amit PrasadBelum ada peringkat

- ABSLI Multiplier FundDokumen1 halamanABSLI Multiplier FundTanveer AhmadBelum ada peringkat

- JLPT Application Form Method-July 2024Dokumen4 halamanJLPT Application Form Method-July 2024Sanjyot KolekarBelum ada peringkat

- SAG 23 Heavy-Duty Vehicle Weight Restrictions in The EUDokumen28 halamanSAG 23 Heavy-Duty Vehicle Weight Restrictions in The EUAliBelum ada peringkat

- Global SME Finance Facility Progress Report 2012 2015Dokumen42 halamanGlobal SME Finance Facility Progress Report 2012 2015Aarajita ParinBelum ada peringkat

- TPA Refund ProcessDokumen3 halamanTPA Refund ProcessYuan TianBelum ada peringkat

- Warehouse and Inventory Management: UNIT-1Dokumen29 halamanWarehouse and Inventory Management: UNIT-1Amitrajeet kumarBelum ada peringkat

- Berzanski Indeksi U Realnom Sektoru EkonomijeDokumen131 halamanBerzanski Indeksi U Realnom Sektoru EkonomijeMasal MiroslavBelum ada peringkat

- Monsoon Sim Data Presentation and AnalysisDokumen16 halamanMonsoon Sim Data Presentation and AnalysisMa. Eunice CajesBelum ada peringkat

- Module 2 - Audit Planning Risk-Based AuditDokumen10 halamanModule 2 - Audit Planning Risk-Based AuditCha DumpyBelum ada peringkat

- Global Migration: Amayna, Arabello, Basilio, Gabio, Marco, RonquilloDokumen15 halamanGlobal Migration: Amayna, Arabello, Basilio, Gabio, Marco, RonquilloBrian Angelo Montalvo BasilioBelum ada peringkat

- Tradersworld: Don't Let Faulty Assumptions Sabotage Your Trading CareerDokumen117 halamanTradersworld: Don't Let Faulty Assumptions Sabotage Your Trading CareerMichael RomeroBelum ada peringkat

- Evaluating The Identity of Purchasing Amp Supply - 2021 - Journal of PurchasiDokumen12 halamanEvaluating The Identity of Purchasing Amp Supply - 2021 - Journal of PurchasiRoshanBelum ada peringkat